Sol4

Anuncio

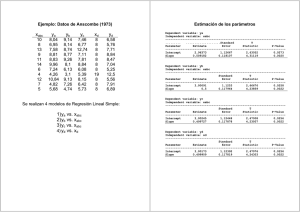

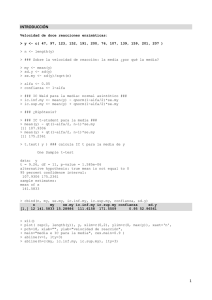

EJERCICIOS 4 1) a) Diagrama de dispersión: DIAGRAMA DE DISPERSION INGRESOS 10 8 6 4 2 0 0 5 10 15 20 25 30 PRACTICA c) Dada la recta de regresión, ninguna de las rectas estimadas en b) es adecuada. d) Coeficiente de correlación: 0.8588. Correlations INGRESOS PRACTICA -------------------------------------------------------------INGRESOS 0.8588 ( 10) 0.0015 PRACTICA 0.8588 ( 10) 0.0015 -------------------------------------------------------------Correlation (Sample Size) P-Value 1 2) Diagrama de dispersión: DIAGRAMA DE DISPERSION DISTANCIA 40 30 20 10 0 3.1 5.1 7.1 9.1 11.1 CARGA b) Recta de regresión: β̂1 = donde cov(x, y) = cov(x, y) = 3,5441, Sx2 n n 1X 1X (xi − x̄)(yi − ȳ) y Sx2 = (xi − x̄)2 . n i=1 n i=1 β̂0 = ȳ − x̄β̂1 = −3,6878 Regression Analysis - Linear model: Y = a + b*X ----------------------------------------------------------------------------Dependent variable: DISTANCIA Independent variable: CARGA ----------------------------------------------------------------------------Standard Parameter Estimate Error T Statistic P-Value ----------------------------------------------------------------------------Intercept -3.6878 4.65993 -0.791386 0.4515 Slope 3.54412 0.623294 5.68611 0.0005 ----------------------------------------------------------------------------- 2 Analysis of Variance ----------------------------------------------------------------------------Source Sum of Squares Df Mean Square F-Ratio P-Value ----------------------------------------------------------------------------Model 706.782 1 706.782 Residual 174.882 8 21.8602 32.33 0.0005 ----------------------------------------------------------------------------Total (Corr.) 881.664 9 Correlation Coefficient = 0.895347 R-squared = 80.1646 percent R-squared (adjusted for d.f.) = 77.6852 percent Standard Error of Est. = 4.67549 c) En la tabla siguiente tenemos Yi (CARGA), Ŷi (PREDICCION), Yi −Ŷi (RESIDUOS) y (Yi − Ŷi )2 (RESIDUOS2 ). Los cálculos pueden comprobarse mediante n X (Yi − Ŷi ) = 0. i=1 --------------------------------------------------------DISTANCIA CARGA PREDICCION RESIDUOS RESIDUOS2 22.4 6.8 20.4122 1.9878 3.9513 36.8 10.5 33.5254 3.2746 10.7227 14.4 4.0 10.4887 3.9113 15.2985 27.2 7.9 24.3107 2.8893 8.3478 16.0 8.1 25.0196 -9.0196 81.3525 35.2 9.5 29.9813 5.2187 27.2345 8.0 3.1 7.2990 0.7010 0.4914 19.2 7.2 21.8299 -2.6298 6.9161 9.6 4.5 12.2607 -2.6607 7.0795 25.6 9.3 29.2725 -3.6725 13.4873 --------------------------------------------------------- RECTA DE REGRESION DISTANCIA 40 30 20 10 0 3.1 5.1 7.1 CARGA 3 9.1 11.1 3) a) Recta de regresión: Y = 7,9398 + 0,4419 · X Regression Analysis - Linear model: Y = a + b*X ----------------------------------------------------------------------------Dependent variable: TIEMPO Independent variable: PASAJEROS ----------------------------------------------------------------------------Standard Parameter Estimate T Error Statistic P-Value ----------------------------------------------------------------------------Intercept Slope 7.93978 6.70688 1.18383 0.2577 0.441876 0.0206224 21.427 0.0000 ----------------------------------------------------------------------------- Analysis of Variance ----------------------------------------------------------------------------Source Sum of Squares Df Mean Square F-Ratio P-Value ----------------------------------------------------------------------------Model 71665.7 1 71665.7 Residual 2029.23 13 156.095 459.12 0.0000 ----------------------------------------------------------------------------Total (Corr.) 73694.9 14 Correlation Coefficient = 0.986136 R-squared = 97.2464 percent R-squared (adjusted for d.f.) = 97.0346 percent Standard Error of Est. = 12.4938 b) Residuos: Yi − Ŷi , con Ŷi = 7,9398 + 0,4419 · Xi 1 2 3 4 5 6 7 8 9 10 11 12 13 14 15 RESIDUOS -10.3368 -19.7384 7.86798 16.2134 -10.7588 10.8244 0.357416 -19.2238 7.8442 8.54434 1.75704 8.5001 1.19826 12.4294 -15.4788 4 q 73694,933 14 = 72,5529; √ Desviación tı́pica residual = 156,0946 = 12,4938 c) Desviación tı́pica de Y = d) Coeficiente de correlación = 0,9861 4) a) DIAGRAMA DE DISPERSION 66 TIEMPO 61 56 51 46 41 36 6 9 12 15 18 21 DEFECTOS b) Recta de regresión: Y = 31 + 1,4167 · X RECTA DE REGRESION 66 TIEMPO 61 56 51 46 41 36 6 9 12 15 DEFECTOS 5 18 21 Regression Analysis - Linear model: Y = a + b*X ----------------------------------------------------------------------------Dependent variable: TIEMPO Independent variable: DEFECTOS ----------------------------------------------------------------------------Standard Parameter Estimate T Error Statistic P-Value ----------------------------------------------------------------------------Intercept Slope 31,0 4,92293 6,29706 0,0002 1,41667 0,383948 3,68973 0,0061 ----------------------------------------------------------------------------- Analysis of Variance ----------------------------------------------------------------------------Source Sum of Squares Df Mean Square F-Ratio P-Value ----------------------------------------------------------------------------Model 409,417 1 409,417 Residual 240,583 8 30,0729 13,61 0,0061 ----------------------------------------------------------------------------Total (Corr.) 650,0 9 Correlation Coefficient = 0,793645 R-squared = 62,9872 percent Standard Error of Est. = 5,48388 c) Residuos: 1 2 3 4 5 6 7 8 9 10 -7.08333 3.83333 6.25000 4.16667 -5.00000 6.50000 -4.91667 -2.91667 2.66667 -3.50000 r 650 = 8,4984 9 √ Desviación tı́pica residual = 30,07292 = 5,4839 d) Desviación tı́pica de Y = 6 5) Coeficiente de correlación = 0,7911 Correlations FAMILIA UNIDADES -------------------------------------------------------FAMILIA 0,7911 ( 10) 0,0064 UNIDADES 0,7911 ( 10) 0,0064 -------------------------------------------------------- Correlation (Sample Size) P-Value 6) Coeficiente de correlación = 0,7608 Correlations INVENTARIO GANANCIAS ----------------------------------------------------------INVENTARIO 0,7608 ( 5) 0,1353 GANANCIAS 0,7608 ( 5) 0,1353 ----------------------------------------------------------Correlation (Sample Size) P-Value 7 7) a) Regression Analysis - Linear model: Y = a + b*X ----------------------------------------------------------------------------Dependent variable: GASOLINA Independent variable: PETROLEO ----------------------------------------------------------------------------Standard Parameter Estimate T Error Statistic P-Value ----------------------------------------------------------------------------Intercept 35,5054 6,30403 5,63218 0,0001 Slope 2,90637 0,296128 9,81458 0,0000 ----------------------------------------------------------------------------- Analysis of Variance ----------------------------------------------------------------------------Source Sum of Squares Df Mean Square F-Ratio P-Value ----------------------------------------------------------------------------Model 7375,54 1 7375,54 Residual 995,392 13 76,5686 96,33 0,0000 ----------------------------------------------------------------------------Total (Corr.) 8370,93 14 Correlation Coefficient = 0,938664 R-squared = 88,109 percent Standard Error of Est. = 8,75035 Recta de regresión: Y = 35,5054 + 2,9064 · X b) RECTA DE REGRESION GASOLINA 137 117 97 77 57 10 15 20 25 30 35 40 PETROLEO La recta de regresión estimada parece apropiada para explicar la relación entre las dos variables. 8 c) Predicción: Ŷ0 = 35,5054 + 2,9064 · X0 = 79,1014, donde X0 = 15 8) a) Diagrama de dispersión y recta de regresión: DIAGRAMA DE DISPERSION VENTAS 72 62 52 42 32 1400 1700 2000 2300 2600 2900 INDICE D.J. Regression Analysis - Linear model: Y = a + b*X ----------------------------------------------------------------------------Dependent variable: VENTAS Independent variable: INDICE D.J. ----------------------------------------------------------------------------Standard Parameter Estimate T Error Statistic P-Value ----------------------------------------------------------------------------Intercept Slope 4,71478 11,4398 0,412137 0,6889 0,0224277 0,00558354 4,01675 0,0025 ----------------------------------------------------------------------------- Analysis of Variance ----------------------------------------------------------------------------Source Sum of Squares Df Mean Square F-Ratio P-Value ----------------------------------------------------------------------------Model Residual 846,47 1 846,47 524,639 10 52,4639 16,13 0,0025 ----------------------------------------------------------------------------Total (Corr.) 1371,11 11 Correlation Coefficient = 0,785723 R-squared = 61,7361 percent Standard Error of Est. = 7,2432 b) Como vemos, la variabilidad explicada por la regresión es R2 = 61,74 %, con lo cual podemos concluir que existe relación entre las ventas y el ı́ndice Dow Jones. 9