archivos de economía - DNP Departamento Nacional de Planeación

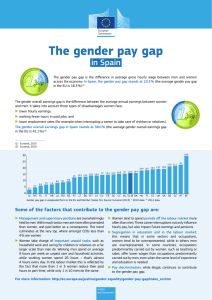

Anuncio