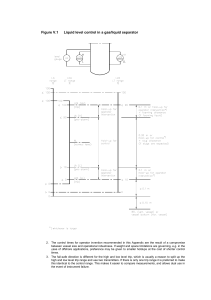

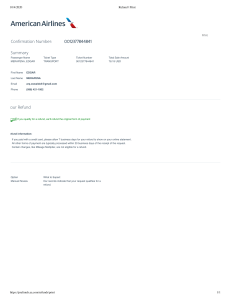

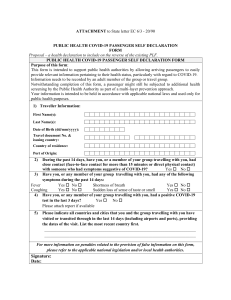

7P PROCESS 7P PROCESS • DESCRIPTION • BENEFITS • DAY CALCULATION • DOCUMENT JUSTIFICATION • EXCEPTIONS • FINAL LIQUIDATION DESCRIPTION • 7p article from the Spanish Personal Income Tax Law. • The liquidation amount can be up to 60.100€. • The company financing the project has to be based abroad. • The country where the project is based has to have a tax system similar to ours, and can’t be a tax haven. BENEFITS • The passenger can ask for a tax refund up to 60.100€. DAY CALCULATION • The trip days travelling abroad and coming back count for the process only if the departure time is earlier than 12p.m. and the landing time coming back is after 18 p.m. DOCUMENT JUSTIFICATION • The justifying documents of each trip are: • Boarding passes • Hotel invoice EXCEPTIONS • Trainings (ZXXXXX charge codes), depending on the code, they can be authorised. • Missing documents. • Charge code changes Corrected Payroll with tax refund DIAGRAM Passenger Financial department IB Payroll Confirmation and extra data Email with summary Issues GBT