Leading independent investment bank in the Iberian

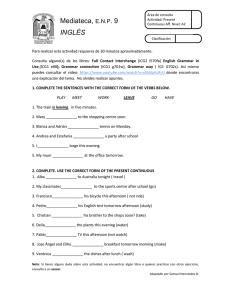

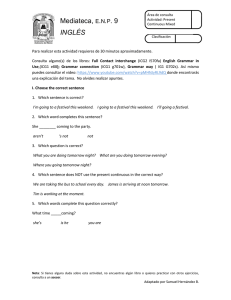

Anuncio

Leading independent investment bank in the Iberian Peninsula CORPORATE PRESENTATION MADRID BARCELONA VALENCIA LISBON MIAMI NEW YORK A T A G L A N CE • Founded in 1991 • More than 300 transactions closed • Long term relationships • Over 60 professionals • Multifamily office • Transparency H I S T O RY Foundation of GBS Finanzas Start of Venture Capital’s activity Start of Real Estate’s activity Start of Alternative Investments’ activity Incorporation of GBS Finanzas as registered adviser in the Mercado Alternativo Bursatil (MAB) 1991 1998 2002 2006 2010 1994 Signature of agreement with US investment bank Bear Stearns & Co 2000 Constitution of Marco Polo Investments, a venture capital company promoted by GBS Finanzas 2003 Start of Family Office’s activity 2008 2011 Founding of the broker, GBS Finanzas Investcapital AV Office opening in Lisbon Office opening in New York: GBS Finance LLC 2012 2015 Office opening in Miami A WA RD S Continental Independent Corporate Finance House of the Year 2005 Iberian M&A Adviser of the Year 2008 Mid-Market Deal of the Year (Pepe Jeans) M&A Adviser of the Year 2011 Corporate Finance House of the Year 2011 Continental Independent Corporate Finance House of the Year 2011 Deal Maker of the Year 2013 GBS FINANZAS | 1 LEADING IND EP EN D EN T I N VESTMEN T B AN K With 25 years of experience, GBS Finanzas is a leader in corporate advisory and asset management BUSINESS LI N ES Founded in 1991, the Partners and most of our professionals have had previous experience in top-ranked institutions such as Credit Suisse, First Boston, UBS Warburg, Goldman Sachs, Deutsche Bank, Bank of America, 3i and also leading audit and law firms. Our clients include listed companies, multinationals with operations in Spain, family-owned companies, and Spanish and foreign private equity funds. FAMILY OFFICE CORPORATE FINANCE • Independent wealth advisory • Mergers and acquisitions • Broker registered with the CNMV • Debt services • No depository services • Capital MarketsStrategic advice • Cost control of depository banks • Open architecture GBS FINANZAS | 2 LEADING IND EP EN D EN T I N VESTMEN T B AN K The values that govern GBS Finanzas are always linked to its long-term client vocation VALUES 1 EXPERIENCE GBS Finanzas is a reference in the Iberian Peninsula, with accumulated experience of more than 300 transactions completed by its professional team. 2 INDEPENDENCE We are an independent entity specialized in advising on mergers and acquisitions. We focus all our efforts on maximizing the value delivered to our clients, avoiding the generation of conflicts of interest. 3 ABILITY TO EXECUTE • Market knowledge • Direct access through our international network of investment banks to any investor or source of national or international financing. • Experienced team in investment banking and private equity. 4 CREATIVITY Much of the work of GBS Finanzas is based on the contribution of new ideas to our clients, in investment proposals, divestitures or mergers, and the subsequent execution of such operations. 5 CONFIDENTIALITY With the maximum confidentiality, GBS Finanzas takes advantage of all of its previous experiences to make each new project unique. GBS FINANZAS | 3 S O C I A L RES P O N S I B I L I TY I N GBS FINANZ AS Our business activities are always guided by ethical and socially responsible criteria The management of Corporate Social Responsibility of GBS Finanzas aims to align our economic and social interests. Therefore, in addition to strict compliance with moral, ethical and legal obligations, we voluntarily collaborate with companies that promote the social, cultural and scientific development of society. • The entities with which GBS Finanzas regularly collaborates are: Fundación Princesa de Asturias, Asociación Española Contra el Cáncer (AECC), Unicef, Ayuda en Acción, Invest for Children, Asociación de Antiguos Alumnos de los Colegios de la Guardia Civil, Just Giving, Fundación Humanitaria A.G.H., Fundación IE. Since 2015, GBS Finanzas is a signatory member of The United Nations Global Compact. GBS Finanzas, among other activities: • Has developed internal training programs for its employees. • Makes donations to NGOs. • Supports organizations that favor medical research. • Promotes cultural activities. GBS FINANZAS | 4 ST RAT EGIC ALLI AN C ES GBS Finanzas is a member of an international network of investment banks formed by premier institutions ensuring global coverage for our clients O U R N ETWO RK’S A D D ED VALUE • Sector intelligence from around the world. • Exchange of ideas and investment opportunities. • Access to the leading foreign groups and investors in each country. GBS FINANZAS | 5 S T RA T E G I C A L L I A N CES O U R I N T E RNA TI O N A L P A RT NERS BANK WEB FOUNDATION YEAR BUSINESS LINES PRESENCE ADDITIONAL CONSIDERATIONS www.viabcp.com 1889 Commercial Banking, Corporate Banking, Asset Management Peru and South American countries Main financial institution in the country www.degroof.be 1871 Private Banking, Institutional Management, Financial Markets, Corporate Finance, Credit & Structured Finance Belgium, France, Luxembourg, Spain, Switzerland, and Hong Kong Belgium’s premier independent private and investment bank www.correval.com 1987 Investment Banking, Corporate Finance, Project Finance, Capital Markets Colombia One of the leading investment banks in the country www.icf-rothschild.com 1953 Private Banking, Asset Management, Private Equity, Institutional & Fund Services, Corporate Finance America (Bahamas, Chile and Uruguay), Europe, Israel, China, Japan, United Arab Emirates, Taiwan 2,900 professionals worldwide. Private Banking and Asset Management have over 150 billion Swiss francs in assets under management www.handelsbanken.es 1871 Commercial Banking, Capital Markets and Corporate Finance Sweden, UK, Denmark, Finland, Norway and the Netherlands Over 11,000 employees working in a total of 24 countries www.icicibank.com 1955 Personal Banking, Investment Banking, Life and General Insurance, Venture Capital and Asset Management 19 countries,such as India, Singapore, Bahrain, Hong Kong, Sri Lanka, Qatar, United Arab Emirates India's second-largest bank with total assets of Rs. 4,736.47 billion (US$ 93 billion) www.imtrust.cl 1985 Corporate finance, Asset Management and Capital Market Chile, Peru and Colombia Main financial institution in the country www.isinvestment.com 1996 Brokerage, Corporate Finance, Institutional Services, Asset Management Turkey and 13 other countries, most notably Germany, Russia and North Cyprus It is part of İşbank. İş Group is the largest fund management group in Turkey www.metzler.com 1674 Asset Management, Corporate Finance, Equities, Capital Markets, Private Banking Germany, USA, Japan, China and Ireland Is the oldest German private bank with an unbroken tradition of family ownership www.pcm.co.il 1990 Investment Banking, Private Equity and Capital Markets Israel, China, India and the U.S. Subsidiary of Bank Hapoalim, is the Israel's largest financial group www.vitaleeassociati.com 2001 Corporate Finance and Capital Markets Italy One of the main independent companies specialized in the middle market. Founded by the investment bank Lazard’s team in Italy GBS FINANZAS | 6 Corporate Finance BUSINESS LINES: C O R P O R ATE FI N AN C E Over 300 transactions successfully closed since 1991 MAIN ACT IV I TI ES MERGERS & ACQUISITIONS • Divestments and company acquisitions • Leveraged transactions (LBOs, MBOs, MBIs) • Mergers / joint ventures • Equity restructuring & Spin-offs DEBT SERVICE Advise and negotiate independent debt funding solutions in relation to corporate finance transactions: •Acquisition financing or re-financing (buy side) •Staple financing (sell side) •Alternative stand alone financing: DL funds, sovereign funds, insurance companies, private placements •Refinancing CAPITAL MARKETS STRATEGIC FINANCIAL ADVICE • Preparation of companies entering the stock market • Strategic alliances • Capital increases • Selective sale of business operations, equity and assets • Fairness opinions • Structuring acquired stakes in companies • Registered advisor of MAB • Takeover defense GBS FINANZAS | 8 M A I N CL I ENTS B Y I ND U S TRY Clients of GBS Finanzas include many publicly listed Spanish companies as well as familyowned business and multinationals with a presence in Spain FOOD TOURISM MEDIA ENERGY BEVERAGES FINANCIAL HEALTHCARE RESTAURANTS CONSUMPTION INDUSTRIAL IT&TELECOM REAL ESTATE CONSTRUCTION SERVICES TRANSPORT PRIVATE EQUITY GBS FINANZAS | 9 M A I N RECE NTL Y A D VI S ED TRANSACT IONS Sale of Novaire, OHL’s subsidiary to SARquavitae Artá Capital acquires a stake in In Store Media Group Sale of a stake in Marqués de Atrio to Changyu Consor6um by Bright Food and CIC for the acquisi6on of 100% of Miquel Alimentació Grup Fairness opinion of the exclusion takeover bid of Ahorro Familiar Financial advisor dto seller Asesor financiero el the vendedor Financial advisor dto buyer Asesor financiero el the vendedor Financial advisor dto buyer Asesor financiero el the vendedor Financial advisor dto buyer Asesor financiero el the vendedor dvisor Asesor fiFinancial nanciero ad el vendedor Acquisi2on of the Canalejas parking to Empark Sale of the company to Saica Acquisi6on of 22.2% of the French real estate company SFL owned by Cacip, Unibail and Orion Sale of 100% to Schneider Barceló acquires 42% of Occidental Hoteles from minor shareholders dvisor Asesor fiFinancial nanciero ad el vendedor Financial advisor dto seller Asesor financiero el the vendedor Financial advisor dto buyer Asesor financiero el the vendedor Financial advisor dto seller Asesor financiero el the vendedor dvisor Asesor fiFinancial nanciero ad el vendedor Acquisi6on of office water solu6ons ac6vi6es from Grupo Leche Pascual Sale of UBK Correduría de Seguros y Reaseguros to Howden Iberia Correduría de Seguros Sale of 100% stake in Centro de Infer+lidad y Reproducción Humana (CIRH), S.L. to Clínica Eugin Acquisi6on of 8.78% of Colonial Sale of its subsidiary of water in Portugal to the Japanese Corpora=on Marubeni Financial advisor dto buyer Asesor financiero el the vendedor Financial advisor dto seller Asesor financiero el the vendedor Financial advisor dto seller Asesor financiero el the vendedor Financial advisor dto buyer Asesor financiero el the vendedor Financial advisor dto seller Asesor financiero el the vendedor GBS FINANZAS | 10 G B S F I NA NZA S CO RP O RA TE FINANCE - T EAM P E D R O G Ó M EZ D E B A E ZA C H AI RM A N • Doctorate in Industrial Engineering from the University of Madrid and an MBA from the Wharton School of Finance. • Previous experience: Managing Director of S.G. Warburg Spain, Board member of the S.G. Warburg & Co Bank in London, Managing Director at The First Boston Corporation (New York) and JP Morgan (New York). • Member of the Board of Directors at Biosearch Life and GBS Finanzas Investcapital AV,SA. Chairman of La Amarilla de Ronda and founding Partner of Círculo Fortuny. P A B LO D Í A Z L L A D Ó PARTNER JUAN ANTONIO SAMARANCH CEO AND F O UND I NG PARTNER • Industrial Engineering from the University of Barcelona and an MBA from New York University. • Vice President of S.G. Warburg Spain, Senior Associate at The First Boston Corporation (New York) and Account Manager at International Flavors & Fragrances. • Member of the Management Board at PortAventura and of the Executive Board at the International Olympic Committee, Vice-President at Real Automóvil Club of Catalonia (RACC) and President of Caldas Golf Club, and Special Olympics Spain. KEVIN W O O D S PARTNER P AB LO G O MEZ D E P AB LO S M ANAGI NG P ARTNER • Degree in Economics and Business Administration from CUNEF in Madrid. • Previous experience: Senior Associate at Arthur Andersen & Co. • Member of Círculo de Empresarios and of the Board of Directors at BeRuby.com and IplusF. J AVI ER HER R ER O P ART NER • Degree in Economics and Business Administration from CUNEF in Madrid. • B.A. from Manhattan College and an M.A. from The Johns Hopkins University. • Degree in Law and Economics from ICADE (Universidad Pontificia Comillas). • Previous experience: financial analyst at Grupo Moneda, a brokerage firm based in Mexico City. • Previous experience: Managing Director and Head of Corporate Finance at Bank of America in Madrid and held various positions in the Corporate Office of Bank of America NT&SA in New York. Previously, he worked for The Chase Manhattan Bank in New York and Milan. • Previous experience: Uria & Menéndez executing M&A deals, international financing and IPO´s. GBS FINANZAS | 11 G B S F I NA NZA S CO RP O RA TE FINANCE - T EAM M I KE L B I L B A O PARTNER • Degree in Law, Economics and Management from ICADE (Universidad Pontifica Comillas). • Previous experience: Chief Investment Officer at Cofir, Managing Director at BNP Structured Finance and head of 3i’s portfolio of Spanish firms at the British private equity firm. • Currently a board member at Imaginarium, Hoss Intropia, Grupo Royo and Bodybell. ANA LACASA PARTNER • Degree in Law and Management from ICADE (Universidad Pontificia Comillas) and an MBA from the Stern School of Business . • Previous experience: Spencer Stuart, S.G. Warburg, First Boston and Dresdner Kleinwort Wasserstein. G O N Z ALO R O D ÉS P RES I D ENT O F GB S F I NANZAS C AT AL UNYA • Degree in Law from Universidad de Barcelona. • Previous experience: International tax department of Cuatrecasas Gonçalves Pereira and founding partner of Rodés & Sala Abogados. Partner of Gómez-Acebo &Pombo in charge of Business Development. • Vice President of Fundación Príncep de Girona and Barcelona Global, member of the boards at Accesogroup, Meridia Capital Partners and Member of the Executive Committee of Asepeyo. GBS FINANZAS | 12 Family Office BUSINESS LINES: FAMI LY O FFI C E GBS Finanzas Family Office offers global wealth management for high net worth clients ABOUT US The GBS Finanzas Family Office division was founded in 2003, and offers management and advisory services to high net worth clients. The business model of GBS Finanzas Family Office is clear, simple, transparent and global. Fundamentally, its aim is to preserve capital and to optimize the structure of the investment portfo- lios of its clients, regardless of the institutions in which their investments are deposited. Our company is fully owned by the partners, who are professionals with many years of experience in prestigious financial institutions. GBS Finanzas is registered with regulators in those countries where it operates: Spain – GBS Finanzas Investcapital A.V., S.A. – regulated by the Spanish Stock Exchange Commission (CNMV), and registered as “Empresas de Servicios de Inversión” USA – GBS Finance LLC – regulated by the SEC GBS FINANZAS | 14 G B S F I N ANZA S F A M I L Y O F F ICE A professional team specialized in finding solutions to family wealth management, centralizing relationship with custodians and consolidating information BUSINESS MODEL OPEN ARCHITECTURE: Our “100% open architecture” enables us to have a broader view and optimize the profitability of the investment portfolio. We have full access to any institution in its sector, allowing us to work with the best managers without conflicts of interest EFFICIENCY: GBS Finanzas consolidates all information regarding investments and compiles a tailor-made report for each client. This full and clear vision of each portfolio is the basis to control profitability, optimize the portfolio and better monitor the risk. WITHOUT ANY DEPOSITARY RISK: GBS Finanzas does not offer depositary services. This means that the client will continue to have its funds deposited at the bank of his/her choice and continue to receive all of the information of those entities. GBS Finanzas will be his/her interlocutor, offering them a comfortable and unified management with a global reach. COST CONTROL: Our goal is to reduce costs to a minimum. The client is the only person who will pay us our fees. Any savings or rebates obtained from the product providers or custodians are returned in full to our clients. This scheme breaks with the conflict of interest that banks and other financial institutions have of receiving commissions based on products or rotation of the portfolio. GBS FINANZAS | 15 B U S I N E SS L I NE S : F A M I L Y O FFICE We offer a comprehensive and highly individualized approach to every client S E RV I CES O F F E RE D SERVICES FAMILY GROUP FOLLOW UP • Strategic and Estate Planning • Wealth Management • Protocols • Portfolio optimization • Orientation and training of legal structures, tax and inheritance • Information • Costs • Tax optimization: VAT, Income Tax, Corporation Tax, Heritage and Inheritance FINANCIAL INVESTMENTS • Traditional • Alternatives • Structured REAL ESTATE INVESTMENTS • Search, analysis and selection of national and international real estate assets • Consulting and introduction of new products and markets PRIVATE EQUITY ALTERNATIVE INVESTMENTS • Advising on the acquisition of shares in companies • Art • Search, analysis and selection of companies • Forest / Water • Alternative energy • Raw materials GBS FINANZAS | 16 G B S F I N ANZA S F A M I L Y O F F ICE On the basis of preserving the wealth of our clients, we seek to increase it in line with a personalized and controlled risk PORTFOLIO MANAGEMENT PROCESS 1. Analysis and optimization of the banking structure. The first step is to conduct a comprehensive analysis of the client’s portfolio, consolidating all investments in a single tailor-made report. This overall vision is the basis to obtain and optimize the overall profitability of the portfolio, and also to monitor the risk. 2. Generate a more efficient platform. We work with the most efficient banks for each type of investment, renegotiating the terms / current costs of the portfolio. We can obtain favorable terms thanks to our volume and synergies of the Multifamily Office: 3. Define with the client an investment strategy, based on the optimization of risk-return trade-off. i. Product selection through thorough independent analysis. ii. Optimize cash and fixed income across different entities which offer attractive interest rates and that have recognized solvency. 4. Tax and financial optimization. Tax planning is integrated into our management process. i. SICAV: Conditions of management and custodial services ii. Brokerage costs, transaction, custody, best execution ... Rebates and incentives obtained are returned in full to the client, avoiding potential conflicts of interest. GBS FINANZAS | 17 G B S F I NA NZA S F A M I L Y O F FICE – T EAM JAIME ALONSO P A R T N E R G BS FIN A N ZA S I N V E S TCA PITA L A V • Bachelor of Science in Finance from the Wharton School of Business in the United States. • Over 20 years of experience in asset management and capital markets. • Previous experience: he worked at Credit Agricole Indosuez and was a part of the founding team at Credit Suisse in Spain. • He also managed the implementation and operation of two operating branches for Banesto. JUAN ESQUER RUFILANCHAS PARTNER GB S F I NANZAS INV ESTCA P I TAL AV SANTIAGO HAGERMAN ARNUS P ART NER GB S F I NANZAS I NV ES T C AP I T AL AV • Doctorate in Finance from the Universidad Autónoma in Madrid and an International MBA from the Instituto de Empresa. • Bachelor of Science in Economics from New York University and a MBA from INSEAD (France). • Juan has 20 years of experience in private banking, asset management and capital markets. • Over 20 years of experience in private banking, asset management and capital markets. • Previous experience: he worked at Guggenheim Partners in Madrid and Geneva as Managing Director. Managed Deutsche bank’s fixed income portfolio and became Manager of the investment portfolio at Deutsche Bank in London. He has also been responsible for investments at Banesto (Grupo SCH) and Argentaria (Grupo BBVA). • Previous experience: he worked at Guggenheim Partners in Madrid and Geneva as Director of Investment Management in Europe. He was part of the mergers and acquisitions team at Goldman Sachs and has worked at Salomon Brothers and Deutsche Bank in New York, managing equity portfolios in emerging markets. IVAN DOLZ DE ESPEJO P A R T N E R G BS FIN A N ZA S I N V E S TCA PITA L A V • Degree in Business Administration from CUNEF (Madrid) and was number one in his class in the Superior Programme of Portfolio Management of Instituto de Empresa (IE). • Over 14 years of experience in private banking, asset management and capital markets. • Previous experience: he worked in the Equity Sales department for Latin America and EMEA of Salomon Smith Barney, and also at Deutsche Bank. GBS FINANZAS | 18 CO N T A C T MADRID Velázquez, 53 28001 Madrid (Spain) T. +34 91 576 76 06 BARCELONA Francesc Macià 6 08021 Barcelona (Spain) T. +34 93 368 56 37 VALENCIA Universidad, 4 46002 Valencia (Spain) T. +34 96 342 72 20 LISBOA Rua Castilho, 75 1250-068 Lisboa (Portugal) T. +35 914 807 085 www.gbsfinanzas.es NEW YORK East 57th, 135 10022 New York (U.S.A.) T. +1 646 571 0513 MIAMI 801 Brickell Avenue, Suite 925 - Miami, FLA 33131 (U.S.A.) T. +1 786 375 5094 Main recently advised transactions by sector GBS FINANZAS | 20 FOOD Consor6um by Bright Food, JIC and DHT for the acquisi6on of 100% of Miquel Alimentació Grup Sale of a stake in Marqués de Atrio to Changyu Strategic analysis of the wine sector in La Rioja Sale of the company to Iberian Beverages Group Advisor to Ibersuizas y Torreal in the sale of Oscar Mayer’s 24,9% Financial advisor dto buyer Asesor financiero el the vendedor Financial advisor dto buyer Asesor financiero el the vendedor dvisor Asesor fiFinancial nanciero ad el vendedor Financial advisor dto seller Asesor financiero el the vendedor Financial advisor dto seller Asesor financiero el the vendedor Joint venture to create Rioja wines Sale of the company to Berberana Private placement for 56% of Arco Bodegas Unidas Sale of its subsidiary in Spain, Leaf Iberica (Caramelos Damel) to Coopera, S.G.E.C.R. Acquisi6on of Bodegas Campo Burgo dvisor Asesor fiFinancial nanciero ad el vendedor Financial advisor dto seller Asesor financiero el the vendedor dvisor Asesor fiFinancial nanciero ad el vendedor Financial advisor dto seller Asesor financiero el the vendedor Financial advisor dto buyer Asesor financiero el the vendedor Sale of the company to Clesa Advisor to Saint Louis Sucre in the merger between Azucarera Ebro Agrícolas and Puleva Acquisi6on of 100% of Vasco Da Gama by Produtos Alimentares Antonio & Henrique Serrano, S.A. Sale of its stake in Tauste Ganadera Sale of 50% in Proaliment Jesus Navarro SA to the founding shareholders of the company Financial advisor dto seller Asesor financiero el the vendedor dvisor Asesor fiFinancial nanciero ad el vendedor Financial advisor dto buyer Asesor financiero el the vendedor Financial advisor dto seller Asesor financiero el the vendedor Financial advisor dto seller Asesor financiero el the vendedor GBS FINANZAS | 21 FOOD Acquisi6on through a public tender offer of 100% of the U.S. company Riviana Sale of the company to Nutrinveste Sale of Compañía Agrícola de Tenerife, S.A. (subsidiary of Ebro Agrícolas) to Aguas de Barcelona Acquisi6on of 100% of Conservas Pincha, S.L. Shareholders restructuring of the company Financial advisor dto buyer Asesor financiero el the vendedor Financial advisor dto seller Asesor financiero el the vendedor Financial advisor dto seller Asesor financiero el the vendedor Financial advisor dto buyer Asesor financiero el the vendedor dvisor Asesor fiFinancial nanciero ad el vendedor Reorganiza3on of the company’s shareholding structure Shareholders agreement with Bodegas Príncipe Alfonso de Hohenlohe Sale 3% of Puleva Biotech to private investors Sale of its produc6ve ac6vity to Sovena, subsidiary of Nutrinveste Valua2on of Olcesa for the priva2za2on process dvisor Asesor fiFinancial nanciero ad el vendedor dvisor Asesor fiFinancial nanciero ad el vendedor Financial advisor dto seller Asesor financiero el the vendedor Financial advisor dto seller Asesor financiero el the vendedor dvisor Asesor fiFinancial nanciero ad el vendedor Valua2on for the priva2za2on process Acquisi6on of office water solu6ons ac6vi6es from Grupo Leche Pascual dvisor Asesor fiFinancial nanciero ad el vendedor Financial advisor dto buyer Asesor financiero el the vendedor GBS FINANZAS | 22 CONCESSIONS Sale of its stake in Puerto depor*vo Nau*c Palamós Sale of four underground parkings in Chile to Aber%s Shareholders restructuring of the group Acquisi6on of the parking division of Urbas Acquisi6on of a stake in Emparque Financial advisor dto seller Asesor financiero el the vendedor Financial advisor dto buyer Asesor financiero el the vendedor dvisor Asesor fiFinancial nanciero ad el vendedor Financial advisor dto buyer Asesor financiero el the vendedor Financial advisor dto buyer Asesor financiero el the vendedor Priva1za1on through its sale to a consor1um formed by DST , ABB Reorganiza3on of its shareholding structure Sale of its 50% in Estacionamientos del Pilar, SA to Vinci Park Crea1on and capital raising of Concessia Sale of its parking to Vinci Park dvisor Asesor fiFinancial nanciero ad el vendedor dvisor Asesor fiFinancial nanciero ad el vendedor Financial advisor dto seller Asesor financiero el the vendedor dvisor Asesor fiFinancial nanciero ad el vendedor Financial advisor dto seller Asesor financiero el the vendedor Sale of its stake in Abra Terminales Marí/mas Sale of a minority stake in Italinpa SPA to Autostrade Sale of its stake in Abra Terminales Marí/mas Independent valua4on of the company Valua2on for Aurea and Dragados of the Aeropuerto Inter. de Bogotá company Financial advisor dto seller Asesor financiero el the vendedor Financial advisor dto seller Asesor financiero el the vendedor Financial advisor dto seller Asesor financiero el the vendedor dvisor Asesor fiFinancial nanciero ad el vendedor dvisor Asesor fiFinancial nanciero ad el vendedor GBS FINANZAS | 23 CONCESSIONS Sale of two parkings in Seville and Tenerife to Ipgessa Estacionamientos Reorganiza3on and transfer of assets to Abra Terminales Marí/mas Fairness opinion of the company Fairness opinion of Autopistas de León (Aulesa) Management Buy Out and sale of other OHL assets Financial advisor dto seller Asesor financiero el the vendedor dvisor Asesor fiFinancial nanciero ad el vendedor dvisor Asesor fiFinancial nanciero ad el vendedor dvisor Asesor fiFinancial nanciero ad el vendedor dvisor Asesor fiFinancial nanciero ad el vendedor Sale of its subsidiary of water in Portugal to the Japanese Corpora=on Marubeni Sale of its stake in Aguas de Alcalá to Aqualia Acquisi2on of the Canalejas parking to Empark Acquis6on of 30,3% of CaixaBank by Calabuig family Par3al dives3ture of its sports division Angels Capital Financial advisor dto seller Asesor financiero el the vendedor Financial advisor dto seller Asesor financiero el the vendedor dvisor Asesor fiFinancial nanciero ad el vendedor Financial advisor dto buyer Asesor financiero el the vendedor Financial advisor dto seller Asesor financiero el the vendedor Sale of the environment division of OHL Group to GS E&C Financial advisor dto seller Asesor financiero el the vendedor GBS FINANZAS | 24 CONSULTING AND SERVICES Sale of a stake to Prosegur Sale of a majority stake to ECA Integra3on of their companies in a sole group Acquisi6on of the media planning company Presscut Entrance of new shareholders through a capital increase Financial advisor dto seller Asesor financiero el the vendedor Financial advisor dto seller Asesor financiero el the vendedor dvisor Asesor fiFinancial nanciero ad el vendedor Financial advisor dto buyer Asesor financiero el the vendedor Financial advisor dto seller Asesor financiero el the vendedor Volja, S.A. Acquisi4on of the Spanish subsidiary of Asnef Equifax Acquisi6on of the facility management company Ingesan Acquisi6on of a 22% stake of Applus Joint venture for the parking development business in Spain Sale of its maintenance subsidiary Pronatur to Rentokil Ini/al Financial advisor dto seller Asesor financiero el the vendedor Financial advisor dto buyer Asesor financiero el the vendedor Financial advisor dto buyer Asesor financiero el the vendedor dvisor Asesor fiFinancial nanciero ad el vendedor Financial advisor dto seller Asesor financiero el the vendedor Environmental International Engineering Sale of the company to Mutuapesca Sale of the subsidiary company of Grupo Nor(a to Trust Risk Group Capital increase for the development of new regasifica8on projects Acquisi6on of 80% of GDS Acquisi6on of Incresa; Vía Ejecu/va; Seido, y Diodi. Financial advisor dto seller Asesor financiero el the vendedor Financial advisor dto seller Asesor financiero el the vendedor dvisor Asesor fiFinancial nanciero ad el vendedor Financial advisor dto buyer Asesor financiero el the vendedor Financial advisor dto buyer Asesor financiero el the vendedor GBS FINANZAS | 25 DISTRIBUTIONAND CONSULTING ANDSERVICES RETAIL Asesor financiero del vendedor Acquisi6on of Silita assets, owned by ABN AMRO Independent valua4on of the subsidiary of Estratel, GSE Acquisi4on of group cer4fica4on Applus Sale of UBK Correduría de Seguros y Reaseguros to Howden Iberia Correduría de Seguros Financial advisor to the buyer dvisor Asesor fiFinancial nanciero ad el vendedor Financial advisor dto seller Asesor financiero el the vendedor Financial advisor dto seller Asesor financiero el the vendedor Sale of 25% of Alfaro Supermarkets to private investors Acquisi4on of the Portuguese chain Computer World Acquisi6on of Vivavoce Sale of 100% of Grelar, SA, holding of Supermarkets “El Árbol" to Unigro Strategic alliance for the Spanish expansion of Roberto Torre)a Financial advisor dto seller Asesor financiero el the vendedor Financial advisor dto seller Asesor financiero el the vendedor Financial advisor dto buyer Asesor financiero el the vendedor dvisor Asesor fiFinancial nanciero ad el vendedor dvisor Asesor fiFinancial nanciero ad el vendedor Capital increase for the entrance of a new group of investors Restructuring of its shareholders structure Sale of 28% stake to Artá Capital, L Capital dvisor Asesor fiFinancial nanciero ad el vendedor dvisor Asesor fiFinancial nanciero ad el vendedor Financial advisor dto seller Asesor financiero el the vendedor DISTRIBUTION AND RETAIL GBS FINANZAS | 26 ENERGY Placement of the American sec7on of the company Book Runner” in the US$ 1,250,000,000 Global Bond Sale of its renewables subsidiary in Portugal to Cavalum Placement of the American sec7on of the company Sale of its subsidiaries Aguas de la Janda and Aguas de Herrera to Aygesa Co-­‐manager Asesor financiero del vendedor -­‐ Financial dael dvisor Asesor Co financiero vendedor Financial advisor dto seller Asesor financiero el the vendedor Co-­‐manager Asesor financiero del vendedor Financial advisor dto seller Asesor financiero el the vendedor Sale of its stake in Interagua, Inc. to Grupo Agbar Merger of companies Sale of a solar photovoltaic plant to DIF Independent valua4on of its subsidiary in Canada Valua2on of its subsidiary Nueva Nuinsa, S.A. Financial advisor dto seller Asesor financiero el the vendedor dvisor Asesor fiFinancial nanciero ad el vendedor Financial advisor dto seller Asesor financiero el the vendedor dvisor Asesor fiFinancial nanciero ad el vendedor dvisor Asesor fiFinancial nanciero ad el vendedor Sale of several photovoltaic plants Sale of its por5olio of mini-­‐hydro to a private equity Sale of the company to E.ON Financial advisor dto seller Asesor financiero el the vendedor Financial advisor dto seller Asesor financiero el the vendedor Financial advisor dto seller Asesor financiero el the vendedor GBS FINANZAS | 27 HOTELS Debt restructuring of Hotel Palacio Casa de Carmona Capital increase for the entrance of Invercartera, Reig Patrimonia S.A. Sale of Hotel "The Lodge" to a private group of investors Management contract of two hotels Wes$n and Sheraton with Xeresa Golf Strategic alliance with a private group for the development of projects in Spain dvisor Asesor fiFinancial nanciero ad el vendedor dvisor Asesor fiFinancial nanciero ad el vendedor Financial advisor dto seller Asesor financiero el the vendedor dvisor Asesor fiFinancial nanciero ad el vendedor dvisor Asesor fiFinancial nanciero ad el vendedor Sale of hotel in Oviedo to funds managed by Proac&va Asset Management Merger between the hotel management companies Refinancing €75m in bank debt Merger with the hotel chain Krasnapolsky Barceló acquires 42% of Occidental Hoteles from minor shareholders Financial advisor dto seller Asesor financiero el the vendedor dvisor Asesor fiFinancial nanciero ad el vendedor dvisor Asesor fiFinancial nanciero ad el vendedor dvisor Asesor Co-­‐Financial financiero dael vendedor dvisor Asesor fiFinancial nanciero ad el vendedor Strategic analysis regarding future poten7al investments in Spain Sale to a private group of investors “Fairness opinion" regarding a poten5al alliance with Cement Invest Investment in a new air-­‐ condi5oning factory in Catalonia Sale of the components manufacturer, Aritex, to the Austrian group VA Tech dvisor Asesor fiFinancial nanciero ad el vendedor Financial advisor dto seller Asesor financiero el the vendedor dvisor Asesor fiFinancial nanciero ad el vendedor dvisor Asesor fiFinancial nanciero ad el vendedor Financial advisor dto seller Asesor financiero el the vendedor INDUSTRY GBS FINANZAS | 28 INDUSTRY Acquisi6on of Porcelana)o Sale of the company to a group of private investors Sale of 33% of the company's other founders of the group Through its subsidiary Sidlaw Packaging Spain SA, has acquired 100% of Tobepal , Tobefil Sale of the mannequins company to Miura Private Equity Financial advisor dto buyer Asesor financiero el the vendedor Financial advisor dto seller Asesor financiero el the vendedor Financial advisor dto seller Asesor financiero el the vendedor Financial advisor dto seller Asesor financiero el the vendedor Financial advisor dto seller Asesor financiero el the vendedor Acquisi6on of renewable energy subsidiary of Endesa Made Independent valua4on of the watches and accessories company Sale of its Finnish subsidiary to Evry Sale of the company to the manufacturer of measuring equipment Circutor Independent valua4on of Unión Resinera Financial advisor dto buyer Asesor financiero el the vendedor dvisor Asesor fiFinancial nanciero ad el vendedor Financial advisor dto seller Asesor financiero el the vendedor Financial advisor dto seller Asesor financiero el the vendedor dvisor Asesor fiFinancial nanciero ad el vendedor Sale of 100% to Schneider Sale of its Portuguese subsidiary to the management team BISCHOF+KLEIN GmbH & Co.KG sold Hueco Pack to Onena Bolsas de Papel, S.A. Sale of the company to Saica Financial advisor dto seller Asesor financiero el the vendedor Financial advisor dto seller Asesor financiero el the vendedor Financial advisor dto seller Asesor financiero el the vendedor Financial advisor dto seller Asesor financiero el the vendedor GBS FINANZAS | 29 REAL ESTATE Acquisi6on of a 63% stake in Inmobiliaria Colonial Acquisi6on of real estate assets of Grupo Prasur Acquisi6on of several office buildings in Madrid Realia cons0tuted a joint venture with Amorim to jointly invest in projects in Spain and Portugal Acquisi6on of 20% in Cevasa Financial advisor dto buyer Asesor financiero el the vendedor Financial advisor dto buyer Asesor financiero el the vendedor Financial advisor dto buyer Asesor financiero el the vendedor dvisor Asesor fiFinancial nanciero ad el vendedor Financial advisor dto buyer Asesor financiero el the vendedor Atlético de Madrid Sale of a minority stake in its real estate fund, Imopólis to Fonditel Sale of a building in Lisbon to Blackstone Acquired a group of buildings in Madrid and Barcelona to Monteverde Grupo Inmobiliario Acquisi2on through a public tender offer, the realtor company listed Parquesol Capital increase for the entrance of a group of investors in its real estate subsidiary Financial advisor dto seller Asesor financiero el the vendedor Financial advisor dto buyer Asesor financiero el the vendedor Financial advisor dto buyer Asesor financiero el the vendedor dvisor Asesor fiFinancial nanciero ad el vendedor dvisor Asesor fiFinancial nanciero ad el vendedor Grupo Martin Criado Cartera Meridional Completed control of Parquesol Inmobiliaria Sale of its subsidiary Técnicas de Administración y Mantenimiento Inmobiliario, S.A. to Grupo Aldesa Debt refinancing of the company Refinancing €200m in bank debt Acquisi2on of a stake in Mar$nsa Fadesa dvisor Asesor fiFinancial nanciero ad el vendedor Financial advisor dto seller Asesor financiero el the vendedor dvisor Asesor fiFinancial nanciero ad el vendedor dvisor Asesor fiFinancial nanciero ad el vendedor dvisor Asesor fiFinancial nanciero ad el vendedor GBS FINANZAS | 30 REAL ESTATE Capital increase of €1263m Acquisi6on of 8.78% of Colonial Acquisi6on of 22.2% of the French real estate company SFL owned by Cacip, Unibail and Orion Joint acquisi7on of land in Lisbon for promo7on Capital increase for the entrance of private investors in Fonrestaura Financial advisor to dtel he vcendedor ompany Asesor financiero Financial advisor dto buyer Asesor financiero el the vendedor Financial advisor dto buyer Asesor financiero el the vendedor Financial advisor dto buyer Asesor financiero el the vendedor dvisor Asesor fiFinancial nanciero ad el vendedor Fairness opinion of the exclusion takeover bid of Ahorro Familiar Sale of a development of publicly subsidized housing units for rent to Cevasa Sale of diverse real estate assets Acciona Fund raising of €100m for the entrance in Colonial dvisor Asesor fiFinancial nanciero ad el vendedor Financial advisor dto seller Asesor financiero el the vendedor Financial advisor dto seller Asesor financiero el the vendedor Financial advisor dto buyer Asesor financiero el the vendedor Sale of 35% of the Spanish subsidiary to Corporación Financiera Reunida, S.A. Merger of the interna5onal ac5vity of the two brokers Sale of the company to Sabadell Bond issue to securi5ze credits for a total amount of €150m Bond issue to securi5ze credits for a total amount of €600m Financial advisor dto seller Asesor financiero el the vendedor dvisor Asesor fiFinancial nanciero ad el vendedor Financial advisors dtel o tvhe seller Asesor financiero endedor Financial dael dvisor Asesor Co-­‐ financiero vendedor Financial dael dvisor Asesor Co-­‐ financiero vendedor FINANCIAL INSTITUTIONS GBS FINANZAS | 31 FINANCIAL INSTITUTIONS Acquisi6on of Benito y Monjardín S.V.B. and GESBM S.G.I.I.C. Sale of 51% of the bank to Banque Degroof Sale of its stake in Inversiones Ibersuizas to private investors Financial advisor to the buyer Banco Alcalá Acquisi6on of the fund management division of Liberbank Ges,ón Financial advisor dto buyer Asesor financiero el the vendedor Financial advisor dto seller Asesor financiero el the vendedor Financial advisor dto seller Asesor financiero el the vendedor Financial advisor dto buyer Asesor financiero el the vendedor Financial advisor dto buyer Asesor financiero el the vendedor Artá Capital acquires a stake in In Store Media Group Sale of 40% to Verlagsgruppe Passau Valua2on of the radio for SEPI Acquisi6on of 50% stake of Economica SGPS to the Portuguese company Media Capital Merger with media division of Havas Media Financial advisor dto buyer Asesor financiero el the vendedor Financial advisor dto seller Asesor financiero el the vendedor dvisor Asesor fiFinancial nanciero ad el vendedor Financial advisor dto buyer Asesor financiero el the vendedor dvisor Asesor fiFinancial nanciero ad el vendedor Sale of 10% to Inversiones GB Balboa S.A. Financial advisor dto seller Asesor financiero el the vendedor MEDIA Y CONTENT GBS FINANZAS | 32 MEDIA Y CONTENT Capital increase for the entrance of an Italian private group of investors Acquisi6on of 6.9% in Vía Digital Sale of a stake to Ola Internet Sale of the company, Ce#sa Publishers, SA, to Grupo Tecnipublicaciones Has taken a financial stake in La Netro Zed dvisor Asesor fiFinancial nanciero ad el vendedor Financial advisor dto buyer Asesor financiero el the vendedor Financial advisor dto seller Asesor financiero el the vendedor dvisor Asesor fiFinancial nanciero ad el vendedor dvisor Asesor fiFinancial nanciero ad el vendedor Capital increase for the entrance of private investors Capital increase for the entrance of a group of investors Acquisi6on of 49.99% of the company of Audiovisual Services Vér$ce 360 Sale of 100% to HighCo dvisor Asesor fiFinancial nanciero ad el vendedor dvisor Asesor fiFinancial nanciero ad el vendedor Financial advisor dto buyer Asesor financiero el the vendedor Financial advisor dto seller Asesor financiero el the vendedor RESTAURANTS Rescot Acquisi6on of 25% from the holding company of Boca%a Acquisi6on of the restaurant chain The Wok Acquisi6on of several Italian restaurants chains: La Tagliatella, Pas-ficio, Il Trastevere Pans & Company merger agreement with Boca.a Acquisi6on to Alcodra Group and other individual shareholders of Rescot Financial advisor dto buyer Asesor financiero el the vendedor Financial advisor dto buyer Asesor financiero el the vendedor Financial advisor dto buyer Asesor financiero el the vendedor dvisor Asesor fiFinancial nanciero ad el vendedor Financial advisor dto buyer Asesor financiero el the vendedor GBS FINANZAS | 33 HEALTHCARE Calmante Vitaminado Sale of Novaire, OHL’s subsidiary to SARquavitae Acquisi6on of a stake in CV Dynamics Inc. Merger of the companies Acquisi6on of USP Hospital Santa Teresa Acquisi6on of the 85% of USP United Surgical Partners Financial advisor dto seller Asesor financiero el the vendedor Financial advisor dto buyer Asesor financiero el the vendedor dvisor Asesor fiFinancial nanciero ad el vendedor Financial advisor dto buyer Asesor financiero el the vendedor Financial advisor dto buyer Asesor financiero el the vendedor Acquisi6on of Hospital Nuestra Señora de la Esperanza Acquisi6on of USP Clínica Sagrado Corazón Acquisi4on of Alpha Quirúrgica Advice to the management team in the cons4tu4on of USPE Capital increase of the company Financial advisor dto buyer Asesor financiero el the vendedor Financial advisor dto buyer Asesor financiero el the vendedor Financial advisor dto seller Asesor financiero el the vendedor dvisor Asesor fiFinancial nanciero ad el vendedor dvisor Asesor fiFinancial nanciero ad el vendedor Acquisi6on of a stake in the group of teleradiology Telemedicine Clinic Acquisi6on of a majority stake of Servirecord Independent valua4on of the group Sale of 65% to Cinven Sale of 5% to Ibersuizas Financial advisor dto buyer Asesor financiero el the vendedor Financial advisor dto buyer Asesor financiero el the vendedor dvisor Asesor fiFinancial nanciero ad el vendedor Financial advisor dto seller Asesor financiero el the vendedor Financial advisor dto seller Asesor financiero el the vendedor GBS FINANZAS | 34 HEALTHCARE Capital increase of the company Sale of its subsidiary, An#bió#cos, SA to Enerthi Sale of its Spanish division to Faes Farma Acquisi6on of Hospital San Camilo Sale of the company to DSM dvisor Asesor fiFinancial nanciero ad el vendedor Financial advisor dto seller Asesor financiero el the vendedor Financial advisor dto seller Asesor financiero el the vendedor Financial advisor dto buyer Asesor financiero el the vendedor Financial advisor dto seller Asesor financiero el the vendedor Sale of 100% stake in Centro de Infer+lidad y Reproducción Humana (CIRH), S.L. to Clínica Eugin Financial advisor dto seller Asesor financiero el the vendedor IT Exchange of 36.56% of Indra SSI for 9.4% of Amper Coordina1on of due diligence in the acquisi1on of Olé Sale of a majority stake to Geocapital Capital increase of the company Valua2on of the company Computer Technology Associates dvisor Asesor fiFinancial nanciero ad el vendedor dvisor Asesor fiFinancial nanciero ad el vendedor Financial advisor dto seller Asesor financiero el the vendedor dvisor Asesor fiFinancial nanciero ad el vendedor dvisor Asesor fiFinancial nanciero ad el vendedor GBS FINANZAS | 35 IT Sale of the company to Finnma&ca, SpA Capital increase for the entrance of Brience Sale of a stake to Ola Internet Sale of the company to Ola Internet Acquisi6on of 98% of ZAZ to RBS Administraçao Ltda (Brasil) Financial advisor dto seller Asesor financiero el the vendedor dvisor Asesor fiFinancial nanciero ad el vendedor Financial advisor dto seller Asesor financiero el the vendedor Financial advisor dto seller Asesor financiero el the vendedor Financial advisor dto buyer Asesor financiero el the vendedor Sale of the manufacturing ac7vity to Grupo Odeco Sale of components distribu8on to Diode Capital increase subscribed by a group of investors Capital increase of the company Smartmission Capital increase of the company Financial advisor dto seller Asesor financiero el the vendedor Financial advisor dto seller Asesor financiero el the vendedor dvisor Asesor fiFinancial nanciero ad el vendedor dvisor Asesor fiFinancial nanciero ad el vendedor dvisor Asesor fiFinancial nanciero ad el vendedor Independent valua3on of the company Sale of the 4cke4ng ac4vity to Indra Acquisi6on of the company of Informa6on Technology Azer%a Sale of 40% to private investors and to Caja de Ahorros El Monte Entrance of new private investors through a capital increase dvisor Asesor fiFinancial nanciero ad el vendedor Financial advisor dto seller Asesor financiero el the vendedor Financial advisor dto buyer Asesor financiero el the vendedor Financial advisor dto seller Asesor financiero el the vendedor dvisor Asesor fiFinancial nanciero ad el vendedor GBS FINANZAS | 36 IT Sale of its stake in IA So& to Oesía Tecnología Sinfónica Financial advisor dto seller Asesor financiero el the vendedor TELECOM Concession of UMTS licenses in Italy and Germany Sale of the company to Gestmin Riverside Capital increase of the VOIP operator Sale of 60% of Ola Internet to the management team Exchange of 4.3% stake in COINTEL for 20% of ENTEL, a subsidiary of Telefónica Internacional, SA dvisor Asesor fiFinancial nanciero ad el vendedor Financial advisor dto seller Asesor financiero el the vendedor dvisor Asesor fiFinancial nanciero ad el vendedor Financial advisor dto seller Asesor financiero el the vendedor dvisor Asesor fiFinancial nanciero ad el vendedor Sale of a subsidiary of TDF to An&n Infrastructure Partners Acquisi6on of 48% of Euskaltel Gran1ng of an equity line of €30m to Ezen%s Sale of15% of Entel, a subsidiary of Telefónica Internacional, SA to Samsung Joint venture between Telefónica Sistemas and Ulipicsa Financial advisor dto seller Asesor financiero el the vendedor Financial advisor dto buyer Asesor financiero el the vendedor dvisor Asesor fiFinancial nanciero ad el vendedor Financial advisor dto seller Asesor financiero el the vendedor dvisor Asesor fiFinancial nanciero ad el vendedor GBS FINANZAS | 37 TELECOM Sale of its 7.7% of Euskaltel to BBK Placement of the American sec7on of the company Concession of an LMDS license Financial advisor dto seller Asesor financiero el the vendedor Co-­‐manager Asesor financiero del v endedor dvisor Asesor fiFinancial nanciero ad el vendedor TRANSPORT AND LOGISTICS R.Benet, S.A. Placement of 7.9% of capital to BBK, Vital y Kutxa Sale of a majority stake in Record Rent a Car to Mercapital Sale of the car dealer group to Layna Investments, a company owned by Grupo Salvador Caetano Sale of the company to TransUnion Capital increase of the subsidiary of Globalia for the entrance of Ibericar dvisor Asesor fiFinancial nanciero ad el vendedor Financial advisor dto seller Asesor financiero el the vendedor Financial advisor dto seller Asesor financiero el the vendedor Financial advisor dto seller Asesor financiero el the vendedor Financial advisor dto seller Asesor financiero el the vendedor Eduardo Velasco Sale of the shareholding of Andaluza de Inversiones, S.A. and Inversión Corpora=va, S.A. in Tecsa to Indalo Valua2on of the company for SEPI in the priva2za2on process Sale of its 50% in Logipoint to Grupo Empresarial Transcoma Sale of Record Rent a Car SA to Northgate Sale of the car dealer to Nayox Financial advisor dto seller Asesor financiero el the vendedor dvisor Asesor fiFinancial nanciero ad el vendedor Financial advisor dto seller Asesor financiero el the vendedor Financial advisor dto seller Asesor financiero el the vendedor Financial advisor dto seller Asesor financiero el the vendedor GBS FINANZAS | 38 TRANSPORT AND LOGISTICS Acquisi2on of a stake in Grupo Trapsa Sale of a Peugeot car dealer to Grupo Comercial Autotractor Sale of the subsidiary of Suardíaz, Pecovasa, to Renfe Fairness Opinion of the company Design of the Corporate Strategy of the company dvisor Asesor fiFinancial nanciero ad el vendedor Financial advisor dto seller Asesor financiero el the vendedor Financial advisor dto seller Asesor financiero el the vendedor Financial advisor to dtel he vvendedor alua3on Asesor financiero Financial advisor to the strategy Asesor financiero dG el roup´s vendedor Sale of 100% to Gowaii Financial advisor dto seller Asesor financiero el the vendedor GBS FINANZAS | 39