Distribuidora Internacional de Alimentación, S.A. and Subsidiaries

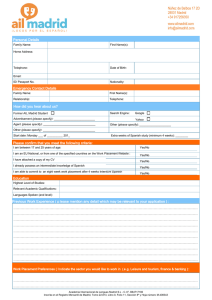

Anuncio