Measuring risk when expected losses are unbounded

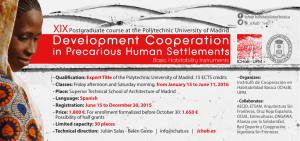

Anuncio

Measuring risk when expected losses are unbounded Alejandro Balbás (1) Iván Blanco (1) and José Garrido (2) (1) University Carlos III of Madrid. C/ Madrid, 126. 28903 Getafe (Madrid, Spain). [email protected] and [email protected] (2) Concordia University. Department of Mathematics and Statistics. 1455 de Maisonneuve Blvd. West, LB-901, Montreal, Quebec, Canada H3G 1M8. [email protected] Abstract This paper proposes a new method in order to introduce coherent risk measures applying for risks with infinite expectations, such as those characterized by some Pareto distributions. Some examples are given, such as extensions of the Conditional Value at Risk and the Weighted Conditional Value at Risk. Actuarial applications are analyzed, such as new approaches in Operational Risk and extensions of the Expected Value Premium Principle when expected losses are unbounded.