question reply

Anuncio

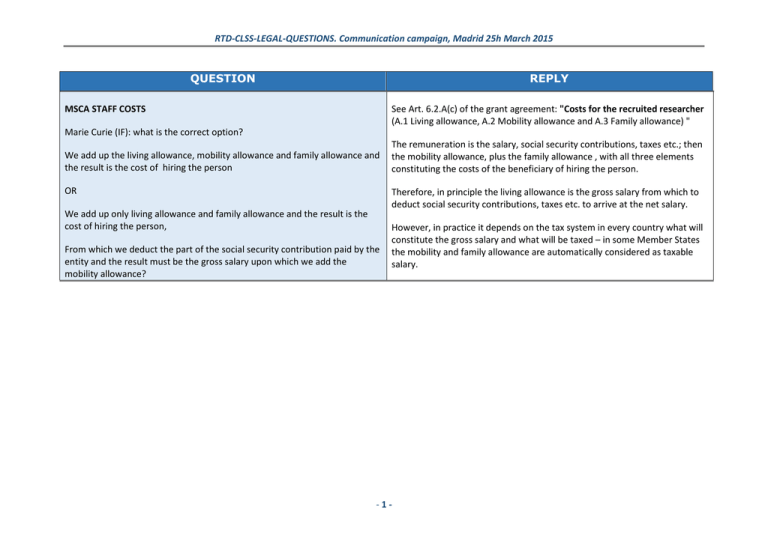

RTD-CLSS-LEGAL-QUESTIONS. Communication campaign, Madrid 25h March 2015 QUESTION REPLY MSCA STAFF COSTS See Art. 6.2.A(c) of the grant agreement: "Costs for the recruited researcher (A.1 Living allowance, A.2 Mobility allowance and A.3 Family allowance) " Marie Curie (IF): what is the correct option? We add up the living allowance, mobility allowance and family allowance and the result is the cost of hiring the person OR The remuneration is the salary, social security contributions, taxes etc.; then the mobility allowance, plus the family allowance , with all three elements constituting the costs of the beneficiary of hiring the person. Therefore, in principle the living allowance is the gross salary from which to deduct social security contributions, taxes etc. to arrive at the net salary. We add up only living allowance and family allowance and the result is the cost of hiring the person, From which we deduct the part of the social security contribution paid by the entity and the result must be the gross salary upon which we add the mobility allowance? However, in practice it depends on the tax system in every country what will constitute the gross salary and what will be taxed – in some Member States the mobility and family allowance are automatically considered as taxable salary. -1- RTD-CLSS-LEGAL-QUESTIONS. Communication campaign, Madrid 25h March 2015 QUESTION REPLY MSCA STAFF COSTS The family allowance is an entitlement of the researcher, consequently beneficiaries have to pay the full amount of the allowance to all researchers eligible for family allowance. We coordinate an ITN MSC. In the proposal we calculated the family allowance by using half of the amount to be paid to the fellow. Can the consortium re-allocate the funding depending on the family status of the fellows which are eventually hired? If so, how this should be reported in the financial statement? Can we ask 100 % of the allowance although in theory was not indicated in the budget of the individual beneficiary? The estimated budget breakdown is an estimation therefore if the family situation of the fellows change the consortium can adjust the estimated budget breakdown by transfers of amounts between beneficiaries (Art. 4.2 MSC TN GA) according to the number of MSC researchers with family recruited by each beneficiary. Regarding the financial statement, each beneficiary should claim the family allowance that they paid to each fellow and each beneficiary should report according to the implemented person-months. The beneficiaries may re-distribute person-months between them (as compared with the original planning set out in Annex 2). This re-distribution can be done without requesting an amendment provided that it does not imply a substantial change to the action as described in Annex 1. Taking this into account the individual beneficiary can ask for 100% of the allowance, since beneficiaries may reallocate the budget in such a way as to account for the number of fellow months they have to pay. -2- RTD-CLSS-LEGAL-QUESTIONS. Communication campaign, Madrid 25h March 2015 QUESTION REPLY MSCA STAFF COSTS According the Annex 3 for Marie Curie Actions: Criteria of eligibility: Duration The ESR can be involved under the project to benefit from the initial training activities for a duration at least 3 months up to a maximum of 36 months This does not mean that he/she could not leave the project within a month, is not it? And if we have ok of officer we could proceed with the new recruitment for the rest of month, are not we? All costs are elegible, are not? Yes, if the researcher leaves the project before the 3 months (e.g. the researcher resigns), these costs are still eligible if the intention of the beneficiary had been to recruit him/her for a longer period of time provided the costs are eligibility in accordance with Article 6 of the GA. Please have a look at the Annotated Grant Agreement (i.e. page 377): http://ec.europa.eu/research/participants/data/ref/h2020/grants_manual/a mga/h2020-amga_en.pdf In this case the beneficiary can then proceed with the recruitment of a new researcher. -3- RTD-CLSS-LEGAL-QUESTIONS. Communication campaign, Madrid 25h March 2015 QUESTION REPLY MSCA STAFF COSTS According to the grant agreement (Art. 6.2.A), the beneficiary is responsible for recruiting the researcher under a contract including social security coverage that also covers the period of secondment to a partner organisation abroad: Dear Mr/Ms I would like to clarify the following regarding the 24 months Outgoing Phase of the Individual Fellowships. Art. 6.2.A: Even though the beneficiary of the Member State/Associated Country is the one that employs the researcher during the whole fellowship duration (2412 months), it is not clear to me who has to pay the Social Security costs while the fellow is in the Third Country (e.g. USA). Could you please clarify what is the most common scenario? It is quite common that the fellow needs to pay medical insurance in USA in order to be covered there (Spanish social security does not cover USA). What would be the best scenario for the fellow taking this into account? Thank you. …(b) the recruited researcher complies with the following conditions: (i) be recruited by the beneficiary under an employment contract (or other direct contract with equivalent benefits, including social security coverage) or — if not otherwise possible under national law — under a fixed-amount-fellowship agreement with minimum social security coverage, including for a period of secondment to a ‘partner organisation’. Therefore, the beneficiary will need to ensure that the researcher is covered by social security also for the outgoing phase abroad. If additional social security costs are incurred during the outgoing phase, these should be covered in principle by the "mobility allowance". However, where appropriate due to the high healthcare contributions requested by the country of the outgoing host, the interested parties (beneficiary, host organisation and the fellow) may also agree to use the contribution for "management and indirect costs" to cover (in part or in full) these additional costs. For this purpose, the beneficiary can either transfer the required funds to the outgoing host or directly to the fellow. The REA proposes and strongly recommends that this issue is resolved between the partners and the fellow in advance while negotiating their internal arrangements to implement the action. In addition, regarding the often very high costs of social security coverage in the USA, some Member States have bilateral social security agreements with the USA. It may be worth checking in each specific case if such an arrangement exists as it might remove the need to pay into the health insurance schemes of both countries. -4- RTD-CLSS-LEGAL-QUESTIONS. Communication campaign, Madrid 25h March 2015 QUESTION REPLY MSCA & THIRD PARTIES Please specify the nature of a CEI in order to be able to provide a substantiated reply. MCSA: in the frame of the participation of a CEI (Campus de excelencia internacional?) in a MSC action, could it be the proposer the CEI and hire the researcher considering that the work will be carried out in the premises of the Universities participating in the CEI. MSCA: Networking Action costs The rules for MSC actions indicate that in the consortium agreement we can agree on re-allocation of the funding for management and training (B.1 an B.2) differently from the distribution indicated in the budget In this context we wonder how the costs are to be justified in these actions. Let´s imaging that it is decided that the coordinator will receive 90% of the management costs although he will just host 20 researchers/month. What management cots has to declare each beneficiary in its financial statement? Those corresponding to the number of researchers/month that they hosted or rather those according to the agreement in the consortium agreement? In the example above; what the coordinator has to declare in its financial statement? (90 % of the management costs as agreed in the CA or what corresponds to the researcher/month that it hosted? In the MSC actions, the beneficiary (the specific legal entity carrying out the action; “participant” according to Art.2(15) RfP) needs to recruit, host and train the researchers. In H2020 MSC actions all the costs are reimbursed on the basis of unit costs, and the unit costs are only eligible if: “the number of units declared corresponds to the actual number of months spent by the person on the project activities”. Beneficiaries have to their own costs in accordance with the provisions of the grant agreement (i.e. for the person-months hosted), and are reimbursed in accordance with their cost claims. However, the consortium agreement may provide for a distribution of the funding which is different from the costs claimed. In these actions therefore beneficiaries have to justify the costs not with regard to what is agreed in the consortium agreement, but with regard to the number of researchers/months that they have hosted. -5- RTD-CLSS-LEGAL-QUESTIONS. Communication campaign, Madrid 25h March 2015 QUESTION MSCA: Networking Action costs What is meant by "networking costs". Is durable equipment eligible under networking costs? REPLY In MSC actions beneficiaries must declare the costs in the form of unit costs under "costs for recruited researchers" and as "institutional costs". The "institutional costs" are defined in the MSCA Unit Cost Decision C(2013) 8194: "Costs related to the training and research expenses of researchers as well as to the costs related to the transfer of knowledge and networking". The "networking costs" are therefore part of the costs that the beneficiary can claim under the institutional unit costs. In accordance with the MSC Work Programme "networking activities" are linked to workshops, seminars, conferences and similar events incurred by the beneficiaries to facilitate sharing of knowledge, new skills acquisition and the career development of researchers or for research and innovation staff members. See MSC MSC Work Programme can be found at: http://ec.europa.eu/research/participants/data/ref/h2020/wp/2014_2015/ main/h2020-wp1415-msca_en.pdf The objective of these funds allocated to "networking" is therefore to fund these activities in which of the researchers or staff members participate. It is not excluded to buy with these funds equipment which is needed for research, but it needs to be clear that such equipment is necessary for the research needs of the researchers. The purchase of such equipment cannot impair the foreseen research, training and networking activities. Therefore, it is best to specifically discuss this with the PO responsible for the specific project in order to see if this is possible, and if this was not foreseen in the beginning, if an amendment to the grant agreement would be needed -6- RTD-CLSS-LEGAL-QUESTIONS. Communication campaign, Madrid 25h March 2015 QUESTION REPLY H2020 General: Staff Costs Una entidad que participa en proyectos europeos tiene 1 person/month para tareas administrativas del proyecto aunque NO es coordinador. ¿Pueden cargarse horas del personal del departamento de administración de la entidad? H2020 General: Staff Costs Una entidad que participa en proyectos europeos tiene 1 person/month para tareas administrativas del proyecto aunque NO es coordinador. ¿Pueden cargarse horas del personal del departamento de administración de la entidad? Administrative costs, particularly those not related to the specific tasks of the coordinator, are typically considered as indirect costs. As such, they are covered by the 25 % indirect costs flat rate. Only exceptionally can those costs be declared as direct costs for the action. That may be the case if the usual cost accounting practice of the beneficiary is to consider (part of) the administrative staff as direct costs and provided that they keep reliable time records for the hours dedicated by that staff for the Horizon 2020 action. In any other cases the administrative costs are to be covered by the 25 % flat rate. Administrative costs, particularly those not related to the specific tasks of the coordinator, are typically considered as indirect costs. As such, they are covered by the 25 % indirect costs flat rate. Only exceptionally can those costs be declared as direct costs for the action. That may be the case if the usual cost accounting practice of the beneficiary is to consider (part of) the administrative staff as direct costs and provided that they keep reliable time records for the hours dedicated by that staff for the Horizon 2020 action. In any other cases the administrative costs are to be covered by the 25 % flat rate. -7- RTD-CLSS-LEGAL-QUESTIONS. Communication campaign, Madrid 25h March 2015 QUESTION REPLY H2020 Other Costs: Clinical Trials In the case of Clinical Studies in collaborative projects: In cases where there are many centres which will provide patients recruitment (for instance 40) ¿is it okay if they all become full beneficiary Yes. It is up to the consortium to assess if this is the best solution. In cases where not all of them cannot become full beneficiary or linked third party (Art. 14), two options remain: 1) Use of in-kind contributions provided by third parties against payment (Art. 11 Model Grant Agreement), 2) Subcontractor (Art. 13 Model Grant Agreement). Is it possible in any of these cases not to include in the submitted proposal what exact centres will participate in the Action? Finally, if we want to use the Agreed Reimbursement payment mode: 1) do we have to follow Art 11 or 13?, 2) how do these costs have to be demonstrated and justified in the proposal? In the proposal it is not strictly necessary to include the names of the third parties but it has to be done at the latest during the grant preparation, when the description of the action becomes Annex 1 of the Grant. The name of the subcontractors is no required neither in the proposal nor in the Grant Agreement, only the description of the tasks that must be subcontracted and the estimation of the costs. The selection of the subcontractors must be done according to the rules of best value for money and avoiding any conflict of interest. The reimbursement of the costs by the EC to the beneficiary will be always based on the eligible costs that are declared (actual costs or unit costs according to the rules). If the entity participates as a third party providing in-kind contributions (Article 11), then the third party must report to the beneficiary either its real costs by providing an invoice detailing the actual time spent, the purchased consumables, etc. or the use of unit cost if requested and agreed with EC. Those would be the eligible costs for the beneficiary. However the payment by the beneficiary to the third party may be as they particularly agree (total, partial, or a fixed amount). In the case of subcontracting the price is fixed in the subcontract by the parties. -8- RTD-CLSS-LEGAL-QUESTIONS. Communication campaign, Madrid 25h March 2015 QUESTION REPLY H2020 GENERAL SUBCONTRACTING AND THIRD PARTIES En el Anexo 5 (MODEL FOR THE CERTIFICATE ON THE FINANCIAL STATEMENTS) se dice explícitamente que los beneficiarios deben disponer de 3 ofertas para la compra de bienes y servicios (Art. 10) y el auditor, según los procedimientos, debe verificar este hecho y en caso de no existir, reportarlo como excepción en su informe. ¿Realmente deben obtenerse 3 ofertas para cualquier compra de bienes o servicios con independencia de su importe? ¿deben los auditores reportar excepciones para cada uno de estos casos, incluso la compra de un tornillo de 0,50€ por ejemplo? As explained in page 128 of the AGA (see http://ec.europa.eu/research/participants/data/ref/h2020/grants_manual/a mga/h2020-amga_en.pdf ) competitive selection procedures are not required in all cases; i.e. the best value-for-money principle does not require competitive selection procedures in all cases. However, if a beneficiary did not request several offers it must demonstrate how best value-for-money was ensured (as explained right afterwards in the AGA). The Commission needs, therefore, to obtain additional information to assess how best-value for money was ensured when there are no different offers. This is one of the objectives of the related procedures in the CFS and the main purpose of reporting an exception. Below you may see the actual wording of the conditions and the instructions provided to the auditor in the Certificate 'when different offers were not collected'. COSTS OF OTHER GOODS AND SERVICES (see D.3 of the form) 58. Procurement rules, principles and guides were followed. There were documents of requests to different providers, different offers and assessment of the offers before selection of the provider in line with internal procedures and procurement rules. The purchases were made in accordance with the principle of best value for money. (When different offers were not collected the Auditor explains the reasons provided by the Beneficiary under the caption “Exceptions” of the Report. The Commission will analyse this information to evaluate whether these costs might be accepted as eligible) -9- RTD-CLSS-LEGAL-QUESTIONS. Communication campaign, Madrid 25h March 2015 QUESTION REPLY COSTS OF SUBCONTRACTING (see B of the form) 39. There were documents of requests to different providers, different offers and assessment of the offers before selection of the provider in line with internal procedures and procurement rules. Subcontracts were awarded in accordance with the principle of best value for money. (When different offers were not collected the Auditor explains the reasons provided by the Beneficiary under the caption “Exceptions” of the Report. The Commission will analyse this information to evaluate whether these costs might be accepted as eligible) In your question you stated that ' En el Anexo 5 (MODEL FOR THE CERTIFICATE ON THE FINANCIAL STATEMENTS) se dice explicitamente que los beneficiarios deben disponer de 3 ofertas para la compra de bienes y servicios' . However, as you can see above the model the CFS does not imply such obligation. In contrast, in order for the Commission to be able to conclude on the eligibility of the related costs it needs to obtain the explanations requested from the auditor in the model CFS. The Commission assess the findings reported by the auditor, considers the representations made by the beneficiary, evaluates any other relevant information (e.g. the explanations provided in the exception) to finally draw conclusions regarding the eligibility of the costs claimed. In this sense, the meaning of an exception in the report is often misunderstood. It has to be noted that an exception in the report does not automatically mean non-compliance/ineligibility of the costs. It actually indicates a deviation from the standard situation. In the specific case the standard situation is that of having different offers for the provision of goods and services and for subcontracts. - 10 - RTD-CLSS-LEGAL-QUESTIONS. Communication campaign, Madrid 25h March 2015 QUESTION REPLY H2020 – Indirect Cost Under Horizon 2020 an internal invoice can only refer to the use/dedication of specific resources for the project (e.g. a researcher, a piece of equipment, etc.). The use and the usage (number of hours) of those resources for the action must be specifically recorded and mentioned in the invoice. The costs must be declared under the budget category that corresponds to the invoiced resource (e.g. personnel, equipment, consumable, etc.) and must fulfil the eligibility criteria set out in Article 6.1 and 6.2. They may not include indirect costs elements or profit margin or mark-up. It is therefore not possible to calculate an all-in average cost of internally invoiced equipment including, for instance, allocated indirect costs (e.g. maintenance). More information on internally invoiced costs for H2020 can be found on pages 8182 of the Annotated Model Grant Agreement (http://ec.europa.eu/research/participants/data/ref/h2020/grants_manual/a mga/h2020-amga_en.pdf). In the Annotated Model Grant Agreement (article 6.D.3) foresees the justification of certain services with internal invoices. I clearly understand that this situation only can be used in those cases where the beneficiary is able to prove that the rates used to issue the internal invoice are properly calculated and they not include neither overhead cost nor mark-up. For example, if a beneficiary, following its internal rules, has calculated one microscope hourly rate using actual direct cost (that includes, for example, personnel, depreciation, direct electricity cost and maintenance) and this rate has been multiplied by the number of hours devoted to the project, I understand that this internal invoice could be declared in an H2020 project. Could you confirm that my interpretation is correct? What category of expenses should be declared? H2020 General: Indirect Costs Respecto a la subcontratación, las empresas, en especial las PYMES, no tienen el conocimiento ni las herramientas para determinar el best value for money (a menudo tiene más valor la confianza y la experiencia previa que lo que pueden ofrecer otros). ¿Que herramientas utilizan los auditores para evaluar este punto? ¿Podrían hacerse disponibles al público en general? Por otro lado, el subcontractor aplica un precio comercial por un trabajo realizado. ¿Qué tipo de auditoría se realizaría? ¿El subcontractor está obligado a presentar timesheets y justificar un determinado número de horas? The beneficiaries must base their purchases and subcontracts on the ‘best value-for-money’ considering the quality of the service, good or works proposed (also called ‘best price-quality ratio’) or on the lowest price. This requirement is the mere application of the general cost eligibility condition set out in Article 6.1(a)(vii) (i.e. that costs must be reasonable and comply with the principle of sound financial management) to the costs of the purchase of goods, works or services, as well as for subcontracting. The best value-for-money principle does not require competitive selection procedures in all cases. However, where a beneficiary did not even request several offers it must demonstrate how best value-for-money was nevertheless ensured. In case of audit on the beneficiary the auditor will request the supporting documents showing how the entity selected the provider/subcontractor (e.g. offers received, basis on which the choice was made, etc). Regarding a possible audit on the subcontractor, this audit would not be aimed at reviewing the actual costs for the subcontractor since, as you advance in your query, the service is rendered against a commercial price. - 11 - RTD-CLSS-LEGAL-QUESTIONS. Communication campaign, Madrid 25h March 2015 QUESTION REPLY Thus, the subcontractor does not have to keep time-records unless the price agreed is based on a number of working hours (e.g. X € per hour of engineering). Typically the audits on subcontractors would chiefly address the technical aspects of the subcontracted task. Legal and financial helpdesk Disclaimer: the answer or information contained in this message is based on the information provided by you, which may not be sufficiently detailed or complete to provide a full and correct answer or response to your question. The Commission is committed to providing accurate information through the enquiry services, however, the information provided has no binding nature. The Commission cannot be held liable for any use made of this information or for its accuracy. - 12 -