English - Banco de Chile

Anuncio

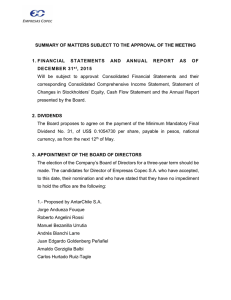

PROPOSITIONS FROM BANCO DE CHILE’S BOARD OF DIRECTORS TO THE ORDINARY AND EXTRAODINARY SHAREHOLDERS MEETINGS TO BE HELD ON MARCH 24, 2016. PROPOSITIONS FROM BANCO DE CHILE’S BOARD OF DIRECTORS TO THE ORDINARY SHAREHOLDERS MEETING TO BE HELD ON MARCH 24, 2016. APPROVAL OF THE CONSOLIDATED FINANCIAL STATEMENTS AND DISTRIBUTION OF THE DISTRIBUTABLE NET INCOME FOR THE FISCAL YEAR 2015 The Board of Directors (the “Board”) during its meeting N° BCH 2,832 held on January 28, 2016 agreed to summon to an Ordinary Shareholders Meeting to be held on March 24, 2016 in order to obtain the approval of the Annual Report, Balance Sheet, Financial Statements and Report of external auditors of Banco de Chile for the year 2015. In addition, the Board agreed to propose to the Ordinary Shareholders Meeting the distribution of the distributable net income for the year ended December 31, 2015 and the approval of Dividend number 204 of $3.37534954173 per every “Banco de Chile” share corresponding to such distributable net income. DEFINITIVE APPOINTMENT OF DIRECTORS The Board during meeting N° BCH 2,832 held on January 28, 2016, agreed in accordance to Article 8 of Banco de Chile’s bylaws, to propose the definitive appointment of Mrs. Jane Fraser and Mr. Samuel Libnic as Directors of Banco de Chile. 2 DIRECTOR’S REMUNERATION The Board in Meeting N° BCH 2,833 held on February 25, 2016, agreed to propose for 2016 the following system of remuneration, fees and incentives: a) Each member of the Board shall receive as a monthly remuneration an amount equivalent to UF 180. The Chairman and the Vice Chairman will receive an amount equivalent UF 540 as a monthly remuneration. In addition, the Chairman will receive an incentive of UF 14,180 for the fiscal year 2016, subject to a condition consisting on the achievement by Banco de Chile of the forecasted earnings for said year. The Directors and Audit Committee shall determine whether the above mentioned condition was achieved. b) Each member of the Board shall receive an amount equivalent to UF 45 as a fee for each board meeting attended. The Chairman or the director surrogating him will receive said amount doubled. c) Each director appointed by the Board to integrate a Committee shall receive an amount equivalent to UF 45 as a fee for each ordinary meeting attended, with a limit of one remunerated meeting per month. However, said limit will not apply to the Credit Committee. The director chairing each Committee will receive double the 3 above mentioned amount, to the extent that the Committee is integrated by more than one director. The director who surrogates another director will receive the same fee entitled to the surrogated director. This proposal will apply as of its approval date until the next Ordinary Shareholders Meeting agrees a new remuneration system. DIRECTORS AND AUDIT COMMITTEE´S REMUNERATION AND THE APPROVAL OF ITS BUDGET During its meeting N° BCH 2.834 held on March 10, 2016, the Board agreed to propose to the Ordinary Shareholders Meeting for 2016, a remuneration equivalent to UF 60 for each Director member of the Directors and Audit Committee, as a fee for each ordinary meeting attended, with a limit of one remunerated meeting per month. Nonetheless, no more than six extraordinary meetings will be remunerated, during the validity of the present agreement. The Director chairing such Committee will receive double said amount. 4 Additionally, in accordance to Article 50 bis of the Chilean Corporations Law, the Ordinary Shareholders Meeting must determine the budget of the Directors Committee. Hence, the Board agreed to propose an amount equivalent to UF 4,000 as budget for the operations and expenses of the Directors and Audit Committee and its advisors, for the fiscal year 2016. NOMINATION OF EXTERNAL AUDITOR According to Article 16 of the General Banking Law, consolidated financial statements as of and for each year ended December 31, must be informed by an external auditor firm. Moreover, according to Article 52 of the Chilean Corporations Law, the ordinary annual shareholders’ meeting must appoint an external auditor firm ruled by Chapter 28 of the Law 18,045 (“Ley de Mercado de Valores”), in order then to examine the accounting, inventory, balance and other financial statements of Banco de Chile, being obliged to inform, in writing, to the next ordinary shareholders meeting, on the implementation of its mandate. The board of directors approved the rules for the private bid for external auditors and encouraged Deloitte Auditores y Consultores Limitada; KPMG Auditores Consultores Limitada; PricewaterhouseCoopers Consultores, Auditores y Compañía 5 Limitada; and Ernst & Young Servicios Profesionales de Auditorias y Asesorías Limitada to be part of the process. After having this firms presenting to the board of directors, the Directors/Audit Committee recommended the nomination for year 2016 of Ernst & Young Servicios Profesionales de Auditorias y Asesorías Limitada based on its economic offer. The board of directors, in Session N° 2.834 of March 10, 2016, agreed to propose to the shareholder meeting the nomination of Ernst & Young Servicios Profesionales de Auditorias y Asesorías Limitada as external auditor. RATING AGENCIES The Board, in Session N° 2.834 of March 10, 2016, in accordance to Chapter 191 of the Regulations of the Superintendency of Banks and Financial Institutions, agreed on the nomination of Fitch Chile Clasificadora de Riesgo Limitada and Feller-Rate, Clasificadora de Riesgo Limitada as rating agencies for the year 2016 for Banco de Chile and the publicly offered securities issued by it. Likewise, the Board agreed to inform and to ratify this nomination in the ordinary shareholders’ meeting. 6 PROPOSITION OF BANCO DE CHILE’S BOARD OF DIRECTORS TO THE EXTRAORDINARY SHAREHOLDERS MEETING TO BE HELD ON MARCH 24, 2016. CAPITALIZATION OF NET INCOME AND AMENDMENTS TO THE BYLAWS The Board of Directors, in Session N° 2.832, held on January 28th, 2016, agreed to summon an Extraordinary Shareholders Meeting to be held on the same date and place than the Ordinary Shareholders Meeting and immediately after such Ordinary Shareholder Meeting in order to address the following matters: o Increase the Bank’s capital through the capitalization of 30% of the distributable net income obtained during the fiscal year 2015, through the issuance of fully paid-in shares, of no par value, with a value of Ch$ 64.79 per share which will be distributed among the shareholders in the proportion of 0.02232718590 fully paid-in shares for each share, and to adopt the agreements that are necessary in this regard, subject to the exercise of the options established in article 31 of Law 19,396. o Amend the Fifth Article of the bylaws, related to the capital and shares of the Bank and the First Transitory Article of the bylaws. o Adopt the agreements necessary to legalize and execute the agreed upon amendments of the bylaws. 7 8