ALICORP S

Anuncio

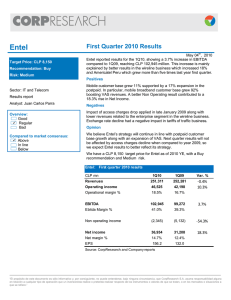

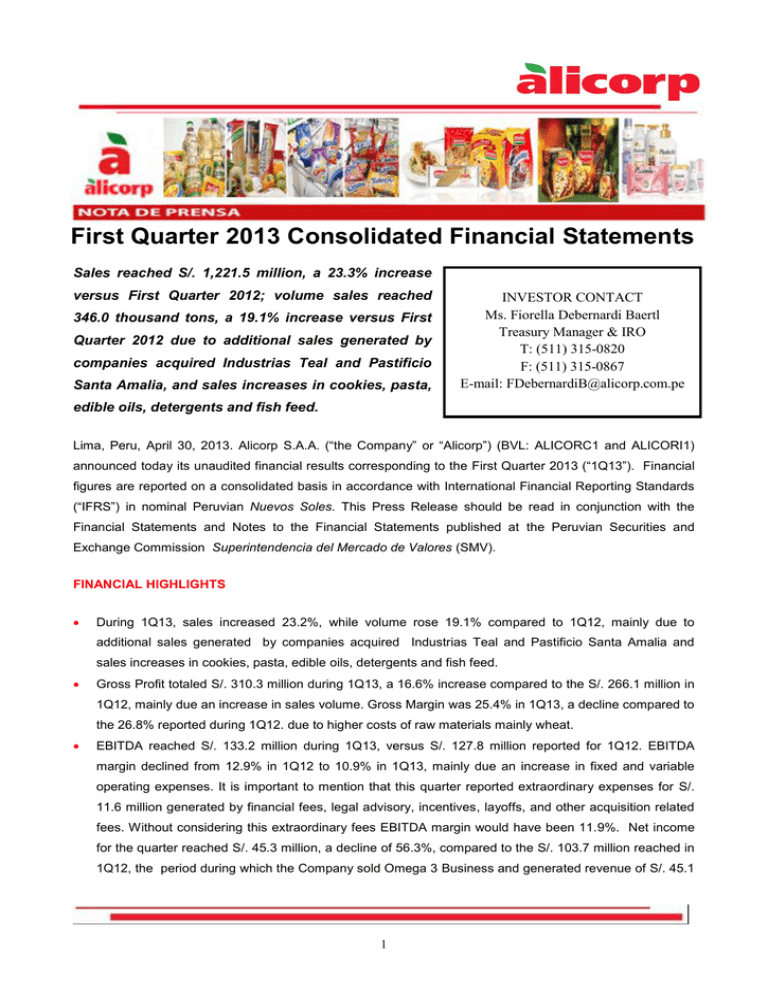

First Quarter 2013 Consolidated Financial Statements Sales reached S/. 1,221.5 million, a 23.3% increase versus First Quarter 2012; volume sales reached 346.0 thousand tons, a 19.1% increase versus First Quarter 2012 due to additional sales generated by companies acquired Industrias Teal and Pastificio Santa Amalia, and sales increases in cookies, pasta, INVESTOR CONTACT Ms. Fiorella Debernardi Baertl Treasury Manager & IRO T: (511) 315-0820 F: (511) 315-0867 E-mail: [email protected] edible oils, detergents and fish feed. Lima, Peru, April 30, 2013. Alicorp S.A.A. (“the Company” or “Alicorp”) (BVL: ALICORC1 and ALICORI1) announced today its unaudited financial results corresponding to the First Quarter 2013 (“1Q13”). Financial figures are reported on a consolidated basis in accordance with International Financial Reporting Standards (“IFRS”) in nominal Peruvian Nuevos Soles. This Press Release should be read in conjunction with the Financial Statements and Notes to the Financial Statements published at the Peruvian Securities and Exchange Commission Superintendencia del Mercado de Valores (SMV). FINANCIAL HIGHLIGHTS During 1Q13, sales increased 23.2%, while volume rose 19.1% compared to 1Q12, mainly due to additional sales generated by companies acquired Industrias Teal and Pastificio Santa Amalia and sales increases in cookies, pasta, edible oils, detergents and fish feed. Gross Profit totaled S/. 310.3 million during 1Q13, a 16.6% increase compared to the S/. 266.1 million in 1Q12, mainly due an increase in sales volume. Gross Margin was 25.4% in 1Q13, a decline compared to the 26.8% reported during 1Q12. due to higher costs of raw materials mainly wheat. EBITDA reached S/. 133.2 million during 1Q13, versus S/. 127.8 million reported for 1Q12. EBITDA margin declined from 12.9% in 1Q12 to 10.9% in 1Q13, mainly due an increase in fixed and variable operating expenses. It is important to mention that this quarter reported extraordinary expenses for S/. 11.6 million generated by financial fees, legal advisory, incentives, layoffs, and other acquisition related fees. Without considering this extraordinary fees EBITDA margin would have been 11.9%. Net income for the quarter reached S/. 45.3 million, a decline of 56.3%, compared to the S/. 103.7 million reached in 1Q12, the period during which the Company sold Omega 3 Business and generated revenue of S/. 45.1 1 million. Without considering revenues of Omega 3, Net margin for 1Q12 would be 5.9% vs 1Q13 3.7%. These results were affected by higher financial expenses and exchange rate loss. During 1T13, Alicorp was active in innovation, launching 3 new products (a new presentation of Plusbelle Effect line, a new Obekon cookie, and new variety of Panisuave shortenings), and re-launching 2 products (Zorro and Cristal dish detergents). On January 4, 2013, Alicorp acquired for S/. 413.9 million, 99.11% of the common stock and 93.68% investment stock of Industrias Teal S.A., (“Teal”) Teal manufactures and markets panettones, chocolates, candies, flour, pastas and cookies under the Sayon brand. On February 6, 2013, Alicorp purchased, via its Brazilian subsidiary Alicorp do Brasil, a 100% stake in Pastificio Santa Amália S.A. (“Santa Amalia”), a Brazilian company dedicated to the manufacture and marketing of food consumer goods such as pastas, jelly, chocolate powder, cookies, panettones, sauces, among others, and distributes personal and home care products for third-parties. Santa Amalia has over 50 years of experience in the Brazilian market and is a leading pasta player in Brazil and the number one pasta company in the state of Minas Gerais. On March 15, 2013, Alicorp successfully issued US$ 450 million in senior unsecured bonds in the international market. Alicorp received investment grade with ‘stable perspective’ from the international risk rating agencies Fitch Ratings (“BBB”) and Moody’s (“Baa2”). On March 26, 2013, the Company inaugurated its new balanced food production plant (Nicovita Brand) in Ecuador. FINANCIAL INFORMATION FINANCIAL HIGHLIGHTS (In millions of Peruvian Nuevos Soles) 1Q2013 1Q2012 YoY 4Q2012 QoQ 1,221.5 991.4 23.2% 1,233.5 Gross Profit 310.3 266.1 16.6% 335.2 Operating Profit 109.0 106.8 2.1% 132.8 EBITDA 133.2 127.8 4.3% 153.7 45.3 103.6 -56.3% 82.6 0.053 0.121 -56.3% 0.097 -0.98% -7.4% -17.9% -13.3% -45.2% -45.2% 2,177.8 1,384.3 3,446.7 793.5 163.0 1,969.8 436.1 1,533.8 2,076.6 1,556.7 751.1 1,389.9 805.6 181.4 608.9 79.1 529.8 1,898.8 39.9% 84.3% 148.0% -1.5% -10.2% 223.5% 451.3% 189.5% 9.4% 2,234.2 1,270.6 2,175.2 963.6 496.1 1,328.8 581.1 747.7 2,129.6 -2.5% 8.9% 58.5% -17.7% -67.1% 48.2% -25.0% 105.1% -2.5% 25.4% 8.9% 10.9% 1.57 3.48 1.66 14.5% 26.8% 10.8% 12.9% 2.07 1.12 0.73 18.8% Net Sales Net Earnings for the Period/Year Earnings per Share (Commun Shares) Current Assets Current Liabilities Total Liabilities Working Capital Cash and Cash Equivalents Total Financial Debt Bank Loans Long-Term Debt Shareholders' Equity RATIOS Gross Margin Operating Margin EBITDA Margin Current Ratio Gross Debt to EBITDA Leverage Ratio Return on Equity 1. Net Debt to EBITDA is defined as total financial debt divided by EBITDA for the last twelve months. This EBITDA does not consider EBITDA generated by acquired companies. If this EBITDA is considered, last twelve months EBITDA shall be S/. 611 million with a Gross Debt / EBITDA ratio of 3.20x 2. Leverage Ratio is defined as Total Liabilities divided by Shareholders’ Equity 3. ROE is defined as last twelve months Net Profit divided by Average Shareholders’ Equity for the last twelve months 2 INCOME STATEMENT Sales Sales and Gross Margin (Millons Soles) Sales totaled S/. 1,222.5 million In 1Q13, a 23.2% Ventas increase YoY. Domestic sales increased 10.8% YOY, Margen Bruto 80% 1,190 while international sales increased 58.3% YoY. During the quarter, international sales represented 33.2% of Total 1,234 1,221 70% 991 1,058 60% 50% Sales, primarily due to increased sales in Brazil, Chile and 40% 26.8% 27.5% 27.5% 27.2% 25.4% Argentina. 30% 20% 10% 0% 1T12 Main contributors to sales growth in 1Q13 were the sales cookies, detergents and edible and bulk oils. Also contributing to sales were the fish feed category in Chile, 3T12 Others Haiti 9% Colombia 2% 4% Brasil 6% following the acquisition of Salmofood, as well as shrimp feed in Ecuador. 4T12 1T13 International Sales (Last 12M to March 31) generated by companies acquired Industrias Teal and Pastificio Santa Amalia and the following categories: 2T12 Argentina 40% Chile 17% Volume in 1Q13 increased 19.1% compared to 1Q12, mainly due to additional sales generated by companies Ecuador 23% acquired Industrias Teal and Pastificio Santa Amalia and growth in the categories of: cookies, pasta, edible oils in Peru; dish detergent and detergent in Argentina as well as fish feed in Ecuador. Gross Profit Gross Profit totaled S/. 310.3 million during 1Q13, a 16.6% increase compared to 1Q12, mainly explained by additional sales generated by companies acquired Industrias Teal and Pastificio Santa Amalia, and growth in sales volume. Gross Margin decreased slightly from 26.8% to 25.4% YoY due to higher cost of raw materials, mainly wheat. 3 Alicorp is well-positioned to offset the volatility of commodity prices due to the following: 1) a raw material purchasing strategy that allows pricing flexibility, 2) consistent cost and expense efficiency management to improve Alicorp’s competitiveness and 3) diversification of the product portfolio to include higher value-added products, Operating Profit and EBITDA Operating Profit totaled S/. 109.0 million (8.9% of net sales) in 1Q13, a 2.0% increase compared to 1Q12. Earnings before interest, tax, depreciation and amortization (EBITDA) was S/. 133.2 million during 1Q13, higher than the S/. 127.8 million obtained in 1Q12. EBITDA increased mainly due: 1) higher Gross Profit compared to 1Q12, 2) higher extraordinary expenses for S/. 11.6 million and 3) an increase in operating expenses during 1Q13. As a result, EBITDA margin reached 10.9% in 1Q13 compared to 12.9% in 1Q12. Without considering extraordinary expenses of S/. 11.6 million, EBITDA margin shall be 11.9% Net Financial Expenses Net Financial Expenses increased by S/. 15.8 million in 1Q13 YoY, mainly due to higher interest costs due to higher indebtment as well as higher exchange rate differences. Net Income Net Income in 1Q13 reached S/. 45.3 million (3.7% of Total Sales), mainly due to higher operating expenses and higher net financial expenses. The drop of 56.3% in 1Q13, compared to the S/.103.7 million reached in 1Q12 is explained by the Omega3 business divestment, which generated a S/.45.1 million profit. Without considering Omega3 profit, net margin for 1Q12 shall be 5.9%. This result was influenced by higher financial expenses and exchange rate differences. 4 During 1Q13, Earnings per Share were S/. 0.053, lower than the S/. 0.121 reported in 1Q12 due to the higher Net Income explained by the Omega 3 divestment. BALANCE SHEET Assets As of March 31, 2013, Total Assets increased S/. 1,274 million, or 29.7%, mainly as a result of an increase of S/. 1,330.0 million in the Non-Current Assets. The increase in Non-Current Assets was explained mainly by higher goodwill levels from the acquisitions of Santa Amália and Teal, among other financial assets. Cash and Cash Equivalents decreased from S/. 496.1 million as of December2012 to S/. 162.9 million as of March 2013. Accounts Receivables increased from S/. 751.1 million as of December 2012 to S/. 798.3 million as of March 2013. Collections were made in an average 47.1 days in 1Q13 compared to 26.1days in 4Q13. Inventories increased from S/. 755.2 million as of December 2012 to S/. 880.1 million as of March 2013, mainly due to an increase in raw materials purchases as a result of commodity purchasing strategies. Inventory turnover increased from 82.4 to 88.4 days from 4Q12 to 1Q13, respectively. Prepaid Expenses increased from S/. 38.4 million as of December2012 to S/. 71.8 million as of March 31, 2013, mainly due to an increase in commissions and loan interest. Property, Plant and Equipment, increased S/. 172.3 million, from S/. 1,326.8 million as of December 2012 to S/. 1,499.1 million as of March 2013, mainly due to:1) the construction of the new detergent plant in Lima, which the Company estimates will be operational during 2013 and 2) the purchase of land in Lima, where the Company plans to build a new distribution center that is currently in development stage. Additionally, the acquisitions of Industrias Teal and Santa Amalia also contributed to the increase. Liabilities As of March 31,2013, Total Liabilities increased by S/. 1,306.3 million, or 60%. This growth was mainly due to a S/. 113.6 million increase in total Current Liabilities, and a S/. 1,192.7 million increase in Non-Current Liabilities. The variation in Current Liabilities was primarily due to Other Accounts Payable, which increased by S/. 165.7 million (S/. 102.5 million due to Dividends payable, S/ 31.3 million due to a residue payable for the purchase of the stake of Teal), an increase of S/. 133.1 million in Accounts, a decrease of S/. 145.0 million in Other Financial Liabilities, as a result of lower imports financing and a decline of 5 S/. 43.8 million in Provisions for Employee Profit Sharing. Accounts Payable turnover decreased from 43.6 days in 4Q12 to 49.2 days in 1Q13. Non-Current Liabilities increased mainly due to Other Financial Liabilities, which rose S/. 786.1 million, as a result of: 1) the issuance of international senior unsecured bonds for US$ 450 million, which destined to reassess the overall risk profile of short and medium-term existing debt, 2) taxes due related to the acquisition of Santa Amalia for S/. 400.4 million, and 3) a US$ 40.0 million payment to assess the overall risk profile of Salmofood’s medium-term debt. Total Short-Term Debt as of March 31, 2013 totaled S/. 436.1million. The Company operates with revolving credit lines for import financing and working capital requirements. Total Financial Long-Term Debt as of March 2013 totaled S/. 1,533.8 million, representing 77.9% of Total Debt. The currency mix was: 12% in Peruvian Nuevos Soles, 67% in U.S. Dollars, 16% in Brazilian Reals, with the remaining 4% in Argentine Pesos. The duration of debt averaged 6.9 years (not including short-term debt). During 1Q13, Alicorp undertook 4 foreign exchange forward agreements in Peru and a total of 4 interest hedges operations. Currently, the majority of bank financings are fixed-rate, either direct or through derivative transactions. The average rate in 1Q13 for loans in USD was 3.66%. Equity Shareholders’ Equity decreased S/. 32.3 million, or 1.5%, from S/. 2,108.9 million as of December 2012 to S/. 2,076.6 million as of March 2013, mainly due to transfers from Retained Earnings to Other Accounts Payable for a total of S/. 102.5 million, related to the Dividends Payable and Net Profit for S./ 45.3 million. As of March 2013, ROE reached 14.5% (this ratio considers the average Shareholders’ Equity and Net Earnings for the last twelve months). If we include acquisitions equity in our analysis, ROE would reach 15.6% if we consider Net Income and average Equity of the last 12 months. CASH FLOW STATEMENTS Operating Activities During 1Q13, cash flow from operations was S/. 52 million compared to S/. -28.6 million obtained during 1Q12. The Company´s cash position totaled S/. 163 million at March 2013. 6 Investing Activities Cash flow from investing activities for the first three months of 2013 totaled S/. -697.7 million compared to S/. 0.8 million for the same period in 2012. Net cash flow during the period was mainly from 1) acquisition outflows for S/. 571.1 million and 2) CAPEX investments for S/. 118.1 million (mainly explained by the acquisition of land in Chilca, improvements in detergent, pasta and sauces plants , as well as the expansion of the distribution center in Arequipa). Financing Activities Cash flow from financing activities for the January to March 2013 period was S/. 312.6 million, compared to S/. 98.6 million for the same period of 2012 as a result of higher long-term financing activities such as the issuance of the international senior unsecured bonds as well as the remaining debts pertaining to the companies acquired. Existing financing are subject to certain debt restrictions, liquidity, profitability and a minimum Shareholders’ Equity. Alicorp is fully compliant with the existing credit requirements, which allows the Company to take on additional debt, if necessary. Liquidity and Leverage Ratios The Company’s liquidity ratio decreased from 1.76x as of December 2012 to 1.57x as of March 2013, mainly due to a cash decrease. The leverage ratio increased from 1.00x as of December 2012 to 1.68x as of March, 2013 due to higher financial debt. In terms of the Gross Debt / EBITDA ratio, this ratio rose from 2.30x as of December 2012 to 3.5x as of March 2013 also due to higher financial obligations. The Company reported a last 12 months EBITDA figure of S/. 565.8 million (without considering the EBITDA generated by acquired companies Teal and Santa Amalia). Considering EBITDA generated by acquired companies during the last 12 months Gross Debt/EBITDA ratio is 3.20x 7 OTHER IMPORTANT EVENTS Industrias Teal Acquisition On January 4, 2013, Alicorp acquired a 99.11% stake of the common stock and 93.68% investment stock in Industrias Teal S.A for S/. 413.9 Million. Industrias Teal is one of the leading players in the Peruvian market for consumer good products. Industrias Teal’s portfolio includes: industrial flours, pastas, chocolates, and confitery. The company covers a large part of the domestic territory and exports 10% of sales, mostly throughout Latin America. It has a production facility, and administrative offices and warehouses property.Its main brands in the cookies category are Margaritas, Soda Sayon, Zoológico and Vainilla; in industrial flours it has Harina Industrial, Harina Industrial Sayon . The acquired brands from Industrias Teal will allow the Company to enter to the confitery, chocolate and panettones market, and develop synergies and economies of scale in the categories in which Alicorp already operates, such as industrial flours, pasta and cookies, in which Sayon has an strong positioning in both, mid income and low income segments Pastificio Santa Amalia On February 6, 2013, Alicorp acquired via its subsidiary Alicorp do Brasil, a 100% stake in Pastificio Santa Amalia S.A. in Brazil for R$190 million (approximately US$ 95.8 million), with the objective to become a leading player in the pasta market in Latin America. Santa Amalia is located in Minas Gerais, with a population of over 29 million, representing 8.9% of Brazil’s GDP and one of the most important economies in the country. Santa Amália is a main player within the Brazilian pasta market with expected gross sales of R$ 573 million (approximately US$ 286 million) in 2012. The company operates in two business segments: 1) a diversified product portfolio of consumer food goods, which includes pastas, jellies, chocolates, juice powder, panettones, sauces, cookies, among others and 2) and distributes personal care and home products for third-parties. The company is the leading pasta player in Minas Gerais, and the second-largest in the industry in the Brazilian Southeastern Region. 8 International senior unsecured bonds issue On March 15, 2013, Alicorp successfully issued international senior unsecured bonds for US$ 450 million in the international market under the Rule 144A and the Regulation S of the United States Securities 1933 Act. Alicorp obtained investment grade, with ‘stable perspective’, from the international risk rating agencies Fitch Ratings (“BBB”) and Moody’s (“Baa2”). The risk rating agencies agreed that Alicorp has a stable business model, based on a solid and diversified product portfolio with leading market brands. The amount raised from this issue was intended to pay the existing financing debt and to finance future fixed assets investments. Inbalnor facility inauguration On March 26, 2013, we inaugurated our new Nicovita balanced food brand production facility in Ecuador. Our facility is one of the most modern facilities in the balanced feed manufacturing for the global aquaculture industry and has an annual production capacity of 100,000 balanced feed tons. New Product Launches and Re-launches During the quarter we have launched and re-launched products related to the consumer goods business and in the industrial products business. The launches and re launches corresponding to 1Q13 were: On January 2013, we launched a new 200mL presentation of the Plusbelle Effect line for hair care in the Argentine market. The new presentations include: Reparación Total (Total Recovery), Extra Brillo (Extra Shine) and Color Brillante (Brilliant Color). The objective of this strategy is to continue creating brand value for Plusbelle through the consolidation in the personal care and beauty industry. 9 On March 2013, a new cookie was launched in Argentina under the Okebon brand, mainly focused on kids market.. The cookies have a new formula, containing additional milk and calcium strengthening customer’s perception of a healthier and nutritive product, coupled with a playful and funny packaging. In Argentina, the Company also had two re-launches in March in the dish detergent category with the Zorro and Cristal brands. This strategy seeks to expand the market share by better differentiating these two brands, which previously were packaged in the same container and received a similar perception in terms of product quality. In this manner, we could direct them to 2 different segments. Zorro: For greater value to the Zorro brand, changing the bottle, improving the label quality and changing varieties in both versions: creamy and crystalline. Crystal: It plays a value for money role for the low-income segment with crystalline and creamy varieties. 10 In February 2013, for the Business to Business Branded Products projects platform, we launched a new variety in the Shortenings segment by extending the Panisuave Plus line, in order to strengthen its position and increase competitiveness. The product, as well as being the lowest priced, will enable savings of up to 50% in terms of sugar consumption in basic bread baking recipe, generating double savings Finally, in the same category, we re-launched the Famosa brand in order to offer clients better results in the production processes, offering the same recognized quality while renewing its image. The product now shows a more modern package that includes recipes and practical advice for succeeding in the bread baking business. In addition, now Famosa is healthier, having0% trans-fat (TFA). 11 About Alicorp Alicorp is a leading consumer goods company headquartered in Peru, with operations in other Latin American countries, such as Argentina, Brasil, Colombia, Chile, Ecuador, and exports to 23 other countries. The Company is focused in three core businesses: (1) Consumer Product Goods (food, personal and home care products), in Peru, the Mercosur and Andean & Central America regions, (2) Industrial Food Products (industrial flour, industrial lard, pre-mix and food service products, mainly in Peru), and (3) Animal Nutrition (fish and shrimp feeding along LATAM). Alicorp employs more than 6,400 employees at its operations in Peru and international subsidiaries. The Company´s common and investment shares are listed on the Lima Stock Market under the symbol ALICORC1 and ALICORI1, respectively. Disclaimer This Press Release may contain forward-looking statements concerning recent acquisitions, its financial and business impact, management’s beliefs and objectives with respect thereto, and management’s current expectations for future operating and financial performance, based on assumptions currently believed to be valid. Forward-looking statements are all statements other than statements of historical facts. The words “anticipates,” “may,” “can,” “plans,” “believes,” “estimates,” “expects,” “projects,” “intends,” “likely,” “will,” “should,” “to be,” and any similar expressions or other words of similar meaning are intended to identify those assertions as forward-looking statements. It is uncertain whether the events anticipated will transpire, or if they do occur what impact they will have on the results of operations and financial condition of Alicorp or of the consolidated company. Alicorp does not undertake any obligation to update the forward-looking statements included in this press release to reflect subsequent events or circumstances. Please refer to the Company’s Management Discussion & Analysis for the years ended December 31, 2012, 2011 and 2010, as well as other public filings for a description of operations and factors that could impact the Company’s financial results. 12

![mayo a octubre [may to october] atención: el bus que realiza este](http://s2.studylib.es/store/data/005070024_1-543eada77f6f2052d3fe7a1827244407-300x300.png)