Result report 2009 - CorpBanca Inversiones

Anuncio

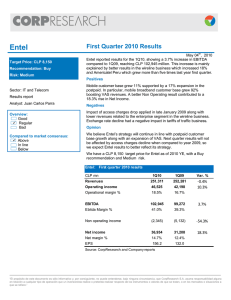

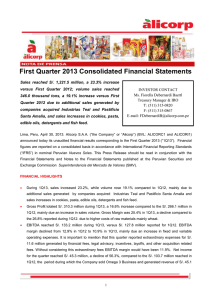

Results as of the fourth quarter 2009 Parauco Target price: CLP 730 Recommendation: Buy Risk: Low Sector: Retail & Real Estate Full year results reported a 15.9% increase in revenues, 21.3% in Ebitda and net income almost tripled. Positives Analyst: Cristina Acle At the operating level: better revenues; lower costs; important Ebitda increase; and better margins. Overview: 9 Good Regular Bad Compared to our expectations: 9 Above In line Below Compared to market consensus: 9 Above In line Below Results FY 2009 CLP mn Revenues Ebitda Ebitda margin Net income Net margin EPS CLP February 26, 2010 Parque Arauco reported very good results for the fourth quarter 2009, with a 15.5% increase in Ebitda and twice the net income. The Ebitda margin increased almost seven percentage points. The operating figures were above our expectations, with a reported Ebitda 18.9% better than expected. Net income was in line with our expectations and net margin doubled. 2009 63,569 45,920 72.2% 29,253 46.0% 48.16 At the non-operating level: higher profits from related companies, which include the operations in Argentina, Viña and Curico. The improvement coming from Argentinean operations. Additionally, the losses due to price level restatement that the company reported as of the 4Q08 diminished to almost 1/10 as of the 4Q09. Negatives Higher taxes. Opinion Parauco’s good results reaffirm the company’s positive perspectives and we confirm our target price in CLP 730 per share and our Buy recommendation. Additionally, we consider that the risk of the share is Low. In the future, the good results would be higher when the new malls and the enlargements included in the capital expenditures plan begin to operate. Parauco Results for the fourth quarter 2009 2008 Dif % 54,850 15.9% 37,862 21.3% 69.0% 10,851 170% 19.8% 17.87 170% CLP mn Revenues Costs Operating result Operating margin Fourth Actual 18,947 (7,756) 11,191 59.1% quarter 2009 Estim. Dif % 16,042 18.1% (6,330) 22.5% 9,713 15.2% 60.5% 4Q08 Dif % 18,056 4.9% (8,098) -4.2% 9,958 12.4% 55.2% Ebitda Ebitda margin 14,184 74.9% 11,934 18.9% 74.4% 12,277 15.5% 68.0% Non operating result Result before taxes Net income Net margin EPS CLP (466) 10,725 7,787 41.1% 12.8 n.m. (1,447) 8,266 29.8% 7,930 -1.8% 49.4% 13.1 -1.8% (5,142) 4,816 3,740 20.7% 6.2 n.m. 123% 108% 108% Source: Company reports and CorpResearch “El propósito de este documento es sólo informativo y, por consiguiente, no puede entenderse, bajo ninguna circunstancia, que CorpResearch S.A. asuma responsabilidad alguna en relación a cualquier tipo de operación que un inversionista realice o pretenda realizar respecto de los instrumentos o valores de que se tratan, o en los mercados o situaciones a que se refiere.” Glossary Term Definition / Translation Calculation EBITDA Earnings Before Interests, Taxes, Depreciation and Amortization Operational Income plus Depreciation and Amortization EBITDAR Earnings Before Interests, Taxes, Depreciation, Amortization and Rents EV Enterprise Value EV/EBITDA Valuation multiple. While greater it is, more expensive it is the stock Operational Income plus Depreciation and Amortization plus rent of fixed assets. It is used the at transport industries to reverse the rent of airplanes or ships. Market capitalization plus Net Financial Debt plus Minority Interest EV divided by Ebitda FCF Free Cash Flow Operational Income plus Depreciation and Amortization minus tax minus capital expenditures plus (minus) working capital variation. Free-float Percentage of stocks that can be freely traded in the market Percentage of stock that does not belong to controller’s shareholders. Margin Operational Ebitda Net Percentage of sales P/E Price / Earnings Market Price divided by EPS P/B Price to Book value ratio Market price divided by the accounting value of the stock. Dividend Yield The return in terms of dividends of investing in equities Dividends distributed in a year divided by the market price. FCF yield Free Cash Flow Return. FCF / Market Price ROA Return on Assets Net Income / Total Assets ROE Return on Equity Net Income / Accounting capitalization EPS Earnings Per Share Net Income / Shares outstanding YtD Year to Date Percentage variation year to date x Times Operational Income / Revenue Ebitda / Revenue Net Income / Revenue Stocks recommendations: these are established according to the stock yield relative to the IPSA. We define a yield to be “In line with the IPSA” when it is within a range whose scope is equivalent to a third of the variation expected for the index, with a minimum of 5%. Once that is settled, we recommend Hold, when we expect the share to have a yield in line with the IPSA; Buy, when the yield expected for the share is above to that expected for the IPSA; and Sell, when the yield expected for the share is below to that expected for the IPSA. 2 “El propósito de este documento es sólo informativo y, por consiguiente, no puede entenderse, bajo ninguna circunstancia, que CorpResearch S.A. asuma responsabilidad alguna en relación a cualquier tipo de operación que un inversionista realice o pretenda realizar respecto de los instrumentos o valores de que se tratan, o en los mercados o situaciones a que se refiere.” CorpResearch Álvaro Donoso CorpResearch Director [email protected] Economic Research Sebastián Cerda Economic Studies Director [email protected] Juan José Donoso Economic Analyst [email protected] Nicolas Birkner Economic Analyst [email protected] Equities Research Cristina Acle Head of Equities Research. Sectors: Forestry and Transport [email protected] Matías Brodsky Analyst. Sector: Banks [email protected] Juan Carlos Parra Analyst. Sector: Mining, Foods, IT and Telecom [email protected] Rosario Letelier Analyst. Sector: Energy and Construction [email protected] Gutenberg Martínez Analyst. Sector: Retail [email protected] Communications Antonia de la Maza Communications Editor [email protected] Rosario Norte 660 Floor 17, Las Condes, Santiago, Chile. Telephone: (562) 660 2295 Bloomberg: CORG <GO> 3 “El propósito de este documento es sólo informativo y, por consiguiente, no puede entenderse, bajo ninguna circunstancia, que CorpResearch S.A. asuma responsabilidad alguna en relación a cualquier tipo de operación que un inversionista realice o pretenda realizar respecto de los instrumentos o valores de que se tratan, o en los mercados o situaciones a que se refiere.”