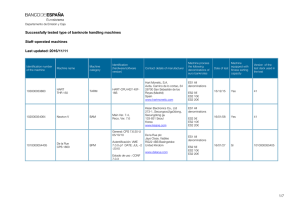

Caja Madrid, Bancaja, La Caja de Canarias, Caja of Ávila, Caixa

Laietana, Caja Segovia and Caja Rioja

The savings banks transfer retail business

assets and liabilities to Banco Financiero

The savings banks will continue to maintain their naturality as credit

institutions, as Banco Financiero y de Ahorros delegates the

management of retailer business to them, within their respective

territories of influence

This agreement forms part of the integration model developed by the

Group, to unify the financial and business policies of the savings banks

that constitute the Group, and pool 100% of all profits

January 28, 2011.- The Boards of Directors of the savings banks that integrate

Banco Financiero y de Ahorros S.A. have approved, within the integration

framework, the transference of assets and liabilities of retail business banking to

Banco Financiero y de Ahorros. At the same time, the Bank yields the

management of their assets and liabilities to the savings banks, therefore

maintaining their naturality as credit entities. In this way, clients of the seven

savings banks will be able to continue with their regular operations. The

respective companies will continue to manage their retail banking activities,

under their own brand, and within their territories of influence.

The territories in which each of the seven savings banks will manage the

corporate retail banking of the Group are distributed as follows: Caja Madrid

(Autonomous Community of Madrid and Castile-La Mancha); Bancaja (Valencia

and the Balearic Islands); La Caja de Canarias (the Canary Islands); Caja de

Ávila (Province of Ávila); Caixa Laietana (Province of Girona and Barcelona,

except the Municipality of Barcelona); Caja Segovia (Province of Segovia); and

Caja Rioja (Community of La Rioja). Equally, Caja de Ávila will retain

responsibility in the management of Salamanca and Caja Segovia of Valladolid.

On the other hand, in the municipality of Barcelona, Caja Madrid, Bancaja and

Caixa Laietana keep their own trademarks.

This integration model will reinforce the solvency of the Group, making the

acquired solvency commitment more real and efficient, contributing thus to

restoring the investor confidence in markets, and the Spanish economy as a

whole.

The transfer of assets and liabilities to Banco Financiero y de Ahorros is framed

within the integration model developed by the Group, through which the seven

savings banks unify their financial and corporate business policies, thus pooling

100% of profits.

1

In this way, the new Group functions as one company, the third largest bank in

Spain; with 340,000 million euros in assets, and the leading bank in terms of

volume of corporate and retail banking in Spain.

The Company has a website, www.bancofinancieroydeahorros.com, where you

can access all legal, financial and institutional information, relevant facts,

introductions to investors, corporate documentation and the Press Office, along

with additional content.

2