Highlights

The renovation/modification cost estimate will include the costs associated with preparing the site for opening

business.

Start−up

Start−up Plan

Start−up Expenses

Legal

Brochures

Consultants

Insurance

Rent

4−group Automatic Coffee

Machine

Coffee Grinder

Computer Systems (x2)

Cooker

Fridge

Freezer

Fume−fan

Communication Lines

Fixtures / Re−model

Other

Total Start−up Expense

£500

£600

£2,000

£700

£1,445

£10,000

£795

£1500

£800

£600

£700

£200

£140

£20,000

£0

£40,480

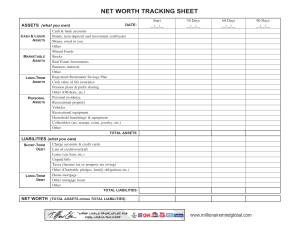

Start−up Assets Needed

Cash Requirements

Start−up inventory

Other Short−term Assets

Total Short−term Assets

£24,000

£2,000

£0

£26,000

Long−term Assets

Total Assets

£0

£26,000

Total Start−up Requirements: £66,480

Left to finance:

£24,000

Start−up Funding Plan

Investment

Owners

Investors

Other

Total investment

£13,000

£18,000

£0

£31,000

Short−term Liabilities

1

Unpaid Expenses

Short−term Loans

Interest−free Short−term

Loans

Subtotal Short−term

Liabilities

Long−term Liabilities

Total Liabilities

£0

£9,290

Loss at Start−up

Total Capital

Total Capital and Liabilities

Check−line

(£38,290)

(£7,290)

£26,000

£0

£0

£9,290

£24,000

£33,290

Market Analysis (Pie)

Market Analysis

Potential Customers

University Students

Office Workers

Seniors

Teenagers

Other

Total

Growth

4%

3%

5%

2%

0%

2.68%

1999

15,000

25,000

18,500

12,500

25,000

96,000

2000

15,600

25,750

19,425

12,750

25,000

98,525

2001

16,224

26,523

20,396

13,005

25,000

101,148

2002

16,873

27,319

21,416

13,265

25,000

103,873

2003

17,548

28,139

22,487

13,530

25,000

106,704

CAGR

4.00%

3.00%

5.00%

2.00%

0.00%

2.68%

5.4.1 Sales Forecast

2

Sales Monthly

Sales Forecast

Unit Sales

2003

Coffee (based on average)

12,015

Speciality Beverages (based on

6,654

average)

Baked Goods (based on

32,673

average)

Other

0

Total Unit Sales

51,342

Unit Prices

2003

Coffee (based on average)

£1.00

Speciality Beverages (based on

£3.00

average)

Baked Goods (based on

£1.25

average)

Other

£0.00

Milestones

Milestone

Business Plan

Secure Start−up

Funding

Site Selection

Architect Designs

Designer Proposal

Year 1 Plan

Personnel Plan

Accounting Plan

Licensing

Totals

2004

14,068

2005

15,475

7,913

8,705

42,150

46,365

0

64,135

0

70,544

2004

£1.00

2005

£1.00

£3.00

£3.00

£1.25

£1.25

£0.00

£0.00

Start Date

1/1/00

End Date

2/1/00

Budget

£1,000

Manager

Owners

Department

Admin

2/15/00

3/1/00

£1,000

Owners

Admin

3/1/00

4/1/00

4/1/00

6/1/00

7/1/00

7/1/00

9/1/00

3/15/00

5/1/00

4/15/00

6/5/00

7/10/00

7/5/00

9/15/00

£1,000

£1,000

£1,000

£1,000

£1,000

£1,000

£1,000

£10,000

Owners

Owners

Owners

Owners

Owners

Owners

Owners

Admin

Admin

Admin

Admin

Admin

Admin

Admin

Expenditures on staff

Personnel Plan

Personnel

Owner

Part Time 1

Part Time 2

Part Time 3

Part Time 4

Part Time 5

Part Time 6

2003

£24,000

£7,920

£7,920

£7,920

£7,920

£3,960

£7,920

2004

£26,400

£7,920

£7,920

£7,920

£7,920

£7,920

£7,920

2005

£29,040

£7,920

£7,920

£7,920

£7,920

£7,920

£7,920

3

Manager

Other

Total Payroll

£4,000

£0

£71,72

£24,000

£0

£97,94

£26,400

£0

£102,98

Total Headcount

Payroll Burden

Total Payroll

Expenditures

0

£13,994

0

£18,274

0

£19,388

£85,71

£116,21

£122,37

7.1 Important Assumptions

General Assumptions

Short−term Interest Rate %

Long−term Interest Rate %

Payment Days Estimator

Inventory Turnover Estimator

Tax Rate %

Expenses in Cash %

Personnel Burden %

2003

10.00%

10.00%

30

48.00

25.00%

10.00%

15.00%

2004

10.00%

10.00%

30

48.00

25.00%

10.00%

15.00%

2005

10.00%

10.00%

30

48.00

25.00%

10.00%

15.00%

7.2 Key Financial Indicators

Profit Monthly

7.3 Break−even Analysis

Break Even Analysis:

Monthly Units Break−even

Monthly Sales Break−even

20,000

£20,000

Assumptions:

Average Per−Unit Revenue

Average Per−Unit Variable Cost

Estimated Monthly Fixed Cost

£1.00

£0.50

£10,000

Break−Even Analysis

Units break−even point = where Total costs intersects with Sales revenue

7.4 Projected Profit and Loss

Profit and Loss (Income Statement)

Sales

Direct Cost of Sales

Other

2003

£248,878

£62,220

£0

−−−−−−−−−−−−

2004

£303,549

£75,887

£0

−−−−−−−−−−−−

2005

£333,904

£83,476

£0

−−−−−−−−−−−−

4

Total Cost of Sales

Gross Margin

Gross Margin %

Operating expenses:

Advertising/Promotion

Travel

Miscellaneous

Payroll Expense

Payroll Burden

Depreciation

Utilities

Insurance

Rent

Contract/Consultants

Total Operating Expenses

Profit Before Interest and Taxes

Interest Expense Short−term

Interest Expense Long−term

Taxes Incurred

Net Profit

Net Profit/Sales

£62,220

£186,659

75.00%

£75,887

£227,662

75.00%

£83,476

£250,428

75.00%

£25,000

£750

£12,000

£93,291

£13,994

£0

£18,000

£6,000

£24,000

£6,000

−−−−−−−−−−−−

£199,034

(£12,376)

£439

£1,880

(£3,674)

(£11,021)

−4.43%

£25,000

£0

£12,000

£121,824

£18,274

£0

£18,000

£6,000

£24,000

£3,000

−−−−−−−−−−−−

£228,097

(£436)

£0

£1,190

(£406)

(£1,219)

−0.40%

£28,000

£0

£12,000

£129,254

£19,388

£0

£18,000

£6,000

£24,000

£3,000

−−−−−−−−−−−−

£239,642

£10,785

£0

£700

£2,521

£7,564

2.27%

7.5 Projected Cash Flow

Cash

Pro−Forma Cash Flow

Net Profit

Plus:

Depreciation

Change in Accounts Payable

Current Borrowing (repayment)

Increase (decrease) Other Liabilities

Long−term Borrowing (repayment)

Capital Input

Subtotal

Less:

Change in Inventory

Change in Other Short−term Assets

Capital Expenditure

Dividends

Subtotal

2003

(£11,021)

2004

(£1,219)

2005

£7,564

£0

£12,433

(£9,290)

£0

(£9,600)

£0

(£17,478)

2003

(£255)

£0

£0

£0

(£255)

£0

£1,036

£0

£0

(£5,000)

£0

(£5,184)

2004

£383

£0

£0

£0

£383

£0

£1,049

£0

£0

(£4,800)

£0

£3,813

2005

£213

£0

£0

£0

£213

5

Net Cash Flow

Cash Balance

(£17,224)

£6,776

(£5,567)

£1,209

£3,600

£4,809

7.6 Projected Balance Sheet

Pro−forma Balance Sheet

Assets

Short−term Assets

Cash

Inventory

Other Short−term Assets

Total Short−term Assets

Long−term Assets

Capital Assets

Accumulated Depreciation

Total Long−term Assets

Total Assets

2003

£6,776

£1,745

£0

£8,522

2004

£1,209

£2,129

£0

£3,338

2005

£4,809

£2,342

£0

£7,151

£0

£0

£0

£8,522

£0

£0

£0

£3,338

£0

£0

£0

£7,151

Accounts Payable

Short−term Notes

Other Short−term Liabilities

Subtotal Short−term Liabilities

2003

£12,433

£0

£0

£12,433

2004

£13,469

£0

£0

£13,469

2005

£14,518

£0

£0

£14,518

Long−term Liabilities

Total Liabilities

£14,400

£26,833

£9,400

£22,869

£4,600

£19,118

Paid in Capital

Retained Earnings

Earnings

Total Capital

Total Liabilities and Capital

Net Worth

£31,000

(£38,290)

(£11,021)

(£18,311)

£8,522

(£18,311)

£31,000

(£49,311)

(£1,219)

(£19,531)

£3,338

(£19,531)

£31,000

(£50,531)

£7,564

(£11,967)

£7,151

(£11,967)

Liabilities and Capital

7

6

30

25

20

15

10

5

0

£

7

0

0

0

s

Months

8

9