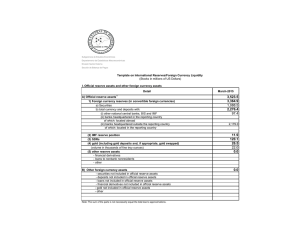

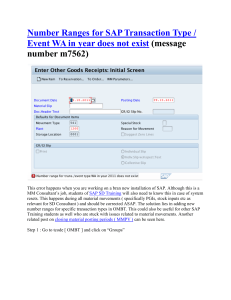

Tema 1: International Macroeconomics. Introductions. ● What is economic slowdown? It is a recession. This happens when the economic activity of a country decreases. We can measure GDP in absolute or relative measures: Absolut measures: Consumption + Investment + Government Spending+ Net exports. This is the market value of products and services produced within a year. But we care about the relative measure, that is in terms of percentage. ((GDP1-GDP0)/GDP0)=%. We need to look the percentage to know the economic cycle we are going through. Also, it is important to know the value of real GDP, not nominal. For example, if quantity of goods sold remains for 1 year but we have an increase, that does not mean we have growth. We need to have a base price to compare, nominal GDP is misleading. GDP forgets about different things, like environmental problems and standards of living, life expectancy… Also hidden economy (Problems with unfair competition) ● What is inflation? It is a sustain increase in the level of prices. It causes loses in the purchase power, because the value of money is less. We are poorer, it is like a tax over citizen. This is translated in problems to retirees, creditors, savers… We use the Consumer Price Index to calculate inflations, but inflation is reflected in the variation of the price indexes. ● Differences between real and nominal returns: Real returns are corrected to the inflation rate, while nominal are not. ● Unemployment: Definition, measures and facts of unempkoyment: Unemployment is the level of non-working people in a country. We measure it with the rate of unemployment (Spain is about 16%). Some facts, lower GDP, lower standards of life… The registered unemployment is the number of unemployed divided by the labor force. (We talk about labor force in terms of people seeking for jobs). We have cyclical (It depends on economic cycles), structural (Differences between supply and demand of employments and problems with skills) and frictional (Due to imperfections of the labor market). ● Name of the institution that says interest rates in Spain. European Central Bank. Christina Lagarde presides it. The interest rate in the EU is 0%. ● Name of the institution that says interest rates in the USA: The Fed. Jerome Powell presides it. The interest rate in the Fed is around 2%. ● Monetary policy target in Europe: Control of inflation. There are another side implication, but this is the most important mandate. ● Monetary policy target in the USA: Reducing unemployment at the expense of rises in inflation. Also, GDP ● What is quantitative easing? A program to buy public debt. ● Name of financial assets that fund governments: Bonds (Principal + Interests, called bonds). Unique alternative to fund debt. ● What is public deficit? Public deficit is the difference between tax issues (Income) and expenses (Government Spending). The public deficit in Spain is 2.83% of the GDP. We can talk about public deficit, public surplus or fiscal equilibrium. It is more relevant than public debt, because it is measured annually. ● What is public debt? Public debt is the amount of debt that a country has. A country can issue debt by bonds, this is the way to fund the public deficit. It is a way to measure the economic growth in terms of GDP. If we make (Public debt/GDP)*100% we know the percentage of public debt. There is a certain point where you cannot invest yourself because nobody is going to trust you. In that case, you need to get rescued and decrease the Government Spending. ● Rating agencies: (Agencias de calificación crediticia). They issue a mark on credit instruments, i.e. bonds. Not stocks, not equity, just credit instruments. Moody’s or S&P are rating agencies. Changes in califications have economic effect. ● Risk premium: (Prima de riesgo). It is a rating. The extra amount of money you pay the investor that holds the risk. It is measured by differences between countries (i.e. how much is Germany coupon and how much is Spanish coupon) Chapter 2: National accounts and the balance of payments. The balance of payments is a statement that summarizes the economic transactions between residents and nonresidents during a specific time period. It is elaborated by the Bank of Spain following the directions of the BMP6 of the International Monetary Fund in order to compare with other countries. General accounting principles: - Dual accountability: (In Spanish, Todo movimiento en haber tiene su movimiento en el debe) We need to incorpórate twice the same transactions. Accrual principle: (In Spanish, Principio de Devengo). Every payment or every move we have to do belongs to the year is done. Transactions are recorded upon economic agreement regardless the period of the payment. Main accounts and important concepts: - Current account: Current and very often transactions. Capital account: Transactions of capital. Financial account: Financial transactions between our country and the rest of the world and the monetary ide of current and capital accounts. Credits: Exports of goods and service, income receivable, reduction in assets or increase in liabilities. Debits: Imports of goods and services, income payable, increase in assets or reduction in liabilities. Balance: Differences between credits and debits. Could be surplus or deficit. Financial transactions: It consists on three columns: net assetss, net liabilities and balance. Net assets: Vs. the rest of the world. It equals a net outflow. - Net liabilities: Vs. the rest of the world. It equals a net inflow. Current account (CA) It shows flows of goods, services, primary income and secondary income between residents and nonresidents. - - - Goods: The sales are exports, in the column of credits. The purchases are imports, in the column of debit. The balance is for insights. We register secondhand transactions also. Services: Like tourism. i.e. We receive tourists; it is a credit (Revenue for me). When we go abroad it is a debit (It is a payment for another country). Primary income: We register income from labor (wages) and financial investments. The primary income for labor presents problem with frontiers. i.e. if a French citizen works in Spain it gets it wage here, but it spends it in France. The primary income for financial investments is the revenue or the expenses form financial investments. i.e. We buy a German bond and we get a coupon. (And the other way round) Secondary income: Unilateral transfers without a quid pro quo. Emergency funds or charity. Also remittances. The different between imports and exports of goods is sometimes called the balance of merchandise trade, but it is not a good measure, because services are not into it. A current account surplus means exports of goods, services, primary or secondary income. A current account deficit means imports of one of these accounts. If we incur into deficit we must finance the deficit by borrowing money to the rest of the world. Capital accounts (KA) The capital account in the international accounts shows capital transfers receivable and payable between residents and nonresidents and the acquisition and disposal of nonproduced, nonfinancial assets between residents and nonresidents. - - Capital transfers receivable: Debt forgiveness, investment grants… It is not the same as transfers in the secondary income. Also unilateral transfers, wether we receive or we give the money. The aim is the formation of capital. An example are EU Funds FEDER, we were given the money but we were obliged to build infrastructure, roads… Acquisition or Disposal of non-produced non-financial assets: Transactions related to: Tangible assets: Natural resources (land, mineral rights, air space…) Intangible assets: Contracts, leases, licenses, marketing assets and goodwill. There is an additional line we need to consider: The Net Lending Capacity (NLC) or the Net Borrowing Situation (NBS). If the figure is positive, we are in NLC (We are earning money, so we have an extra funding capacity to lend money). If we are in NBS, the figure is negative. Financial accounts: The financial accounts (FA) records transactions that involve financial assets and liabilities and that take place between residents and nonresidents. It is so easy: Domestic ownership of foreign assets vs. Foreign ownership of domestic assets. Entries in the financial account can be corresponding entries to goods, services, income, capital account or other financial account entries. i.e. The corresponding entry for an export of goods is usually an increase in financial assets, such as currency and deposits or trade credit. Financial accounts deal with money related to foreign reserves and private investments in business. It is represented under two separate columns: - - Capital inflows (net incurrence of liabilities or net changes in liabilities) from abroad are registered as a credit. A positive sign in the column of net changes in liabilities implies an increase of liabilities with nonresidents. A negative sign decreases it. It is capital that goes into for the purpose of investing. Capital outflows (Net acquisition of financial assets or Net changes in financial assets) are registered as a debit, such that a positive sign in the column of net changes in financial assets implies an increase of assets with nonresidents. A negative sign decreases it. It is capital that goes outside for the purpose of investing. Accounts: - Direct investments: An investor resident in one economy makes an investment that gives control or a significant degree of influence on the management of an enterprise that is resident in another economy. We have different types: Shares: Acquisition of shares (assets) if the control of the firm is equal or higher than 10% of the firm’s equity. Investment in affiliated enterprises. Housing investment: Housing or Real Estate investment is also recorded as a direct investment. - Portfolio investment: Crossborder transactions and positions involving debt or equity securities, other than those included in direct investment or reserve assets. Buying or selling assets in the stock market: Shares that seeks rentability, but not control. (The acquisition must be less than the 10% of the social capital). Debt titles, bonds, fixed income… Money market assets. Employee stock options and others. - - Other investments: Financial and commercial loans (including those from IMF), trade credit and advances and deposits in financial institutions. Financial Derivatives: Financial contracts based on underlying assets such as forward contracts and forward interest rates transactions swaps over benchmarks, market prices or any other financial assets. Reserve assets: External assets that are readily available to and controlled by monetary authorities for meeting balance of payments financing needs, for intervention in exchange markets to affect the currency exchange rate, and for other related purposes. Reserve assets situate the country as a lender with respect the rest of the world. They are registered in the column of Net changes in financial assets. The overall balance on the financial account is called net lending or net borrowing. Net lending means that economy supplies funds to the rest of the world, while net borrowing means borrowing money from the rest of the world. Net errors and omissions: Although the balance of payments accounts are balanced, imbalances result in practice from imperfections in source data and compilation. This imbalance is labeled net errors and omissions and should be identified separately in published data. It should not be included indistinguishably in other items. Net errors and omissions are derived residually as net lending or net borrowing and can be derived from the financial account minus the same item derived from the current and capital accounts. Net errors and omissions = CF – CC – CK. Overall look of the Balance of Payments. GOODS SERVICES PRIMARY INCOME SECUNDARY INCOME CURRENT ACCOUNT Balance CAPITAL TRANSFERS NON-PRODUCED and NON-FINANCIAL ASSETS CAPITAL ACCOUNT Balance Direct Inv. Portfolio Inv. Other invest. Derivatives Reserves FINANCIAL AC. CREDITS Exports Exports Inflows DEBITS Imports Imports Outflows Inflows Outflows BALANCE M= C + F + I + L Inflows Outflows Inflows Outflows T= P+S NET LIABILITIES NET ASSETS BALANCE Equilibrium in the Balance of Payments: Accounting equilibrium: Due to the double-entry principle, the balance of the BoP is always 0, and therefore it is always under equilibrium. Economic equilibrium: The Balance of Payments is always in equilibrium. When the surplus or the deficit is mentioned we refer to the different accounts of the balance. Chapter 3: Currencies and Exchange Rates. An exchange rate is the price of a currency against another currency. This is too important: We cannot talk about exchange rates without referring to 2 different currencies. (Example: Exchange rate of the € vs. the $). Illustration of interest rates: - The indirect exchange rate refers to the price of local currency expressed in units of foreign currency. (The price of 1 € in terms of dollars) The direct exchange rate refers to the price of a foreign currency expressed in units of local currency. (The price of $1 in terms of euros) It is the same thing. We ca use the indirect exchange rate to get to the direct one and vice versa. Systems: - Flexible system: (Sistema de fluctuación flexible). The price of the € vs. the $ depends on market forces (Supply and demand). The Balance iin the foreign exchange market and the BoP equilibrium is achieved without government intervention and the economy is protected against external impacts. The Foreign Exchange Market (Forex) is a global decentralized market which encompasses people, institutions, and mechanisms for the trading of currencies. It is divided into trading and financial transactions, where the financial transactions fulfill the 90% of the transactions. The Forex depends on what is happening in financial markets: If I want to buy Apple Stock or an American Bond, I need to buy it with a different currency. The unique problem is that the dynamics of market adjustments does not always work perfectly. - Fixed system: (Sistema de fluctuación fija) The price of a currency expressed in terms of another currency depends on political decisions, not market fluctuations. (There is certain among investors) This system is more stable because the political decisions are not much frequent. It is less volatile than the flexible system. But there are many important contras: ● We need greater volumes of foreign exchange reserves. ● We lose autonomy on monetary policy. This is very though. Let’s see it through an example: If we are in a expansionary monetary policy, the national interests are lower so there are outflows of capital of people seeking higher profitability. The euro will depreciate against another currency. There is an intervention using reserves to buy euros. The monetary base is diminished and consequently, there is an increasing of interest rates. Appreciation vs. Devaluation: An appreciation happens when a currency strengthens vs. another currency. A depreciation happens when a currency weakens vs. another currency. The exchange rates get appreciated or depreciated vs. another exchange rates, they never go up or down. Devaluation vs. Revaluation: A devaluation is a reduction in the value of a currency as a decision by the monetary authorities. A depreciation of the currency of a country decreases the relative value of its exports and increases the relative value of the imports. For example, if the € depreciates, our exports become cheaper, while imports are more expensive for us. A revaluation is an increase in the value of a currency as a decision by the monetary authorities. A revaluation of the currency of a country increases the relative price of its exports and reduces the relative price of the imports. For example, if the € appreciates, our exports become more expensive, while imports are cheaper for us. One of the reasons to devaluate our currency is related to the increase in competitiveness. One of the ways to increase the GDP is devaluating the currency in order to have cheaper exports and increasing competitiveness. The side effect on devaluating the currency is related to the inflation. Every government intervention has his side effects. REAL Exchange Rates: We use real exchange rates when we want to compare the price of the products. The Real exchange rate are exchange rates adjusted for international differences in aggregate price levels. It is denominated by an Epsilon. The real exchange rate is a measure of competitiveness because it depends on the price of the product (nationally and internationally) and the nominal exchange rate. If the NER increases (and there is ceteris paribus), our Epsilon increases ad the competitiveness increases in prices. When the international prices go up, we gain competitiveness. When domestic prices go down, we gain competitiveness. The gain of competitiveness using revaluation or devaluation methods has side effects. The best option is a sustained competitiveness increasing productivity (Reduction of costs, investments in capital…) There are different theories to forecast exchange rates: - Exchange rates: (PPP) The prices of products go up and down in different countries. The exchange rates will fluctuate to compensate the differences in markets along prices. It has to be exactly the same to buy a product in the USA and in Spain, because exchange rates will compensate the difference. The theory is: Exchange rates * Price = International price. The problem this is not accurate. If we are in a country with inflation, the exchange rate will depreciate the price to compensate the difference. (The other way around in countries with deflation). The problem of the theory is we are not looking at financial markets, so we have no idea about interest rates. There is an index to use this theory in real life: The Big Mac index. It is a quite limited index due to the different markets and strategies carried out in the market. This index tells us about the undervaluation or overvaluation of a currency. - Financial arbitrage: The arbitrage is known as the buy and purchase of an asset in order to receive benefits from the differences in prices. There are other problems here. Let’s imagine we have an interest rate of 5% in Australia and 0.5% in Europe. Investors will invest in Australia due to higher returns. The problem we have is that we need Australian dollars to invest in Australia. So the Australian dollar will appreciate against the Euro. This will make the Australian dollar not profitable anymore. Exchange rates will depend on interest rates diferentials. The limitations are that it doesn’t take into account inflation, no we need to trade with real exchange rates regimes. Bands system. (Sistema de bandas) It’s a mixture between the flexible and the fixed systems. The Central Bank implements two bands. It all depends on the distance between the bands. If we are between the 2 bands, we are in a flexible system. Wider bands are more like a flexible regime. If we are out the bands, we are in a fixed system. In this moment the is an intervention, which is typical of the fixed exchange rates regimes. The intervention is known as the buy or sale of the domestic currency in the market. The purpose of the intervention is maintaining the exchange rates stable. This is the mostly used regime in transitions between different regimes. It’s about buying or selling the own currency. What happens if the demand for a currency increase? The currency demand takes place in a market whose characteristics are similar to those of any other market. When does a currency get demanded? (Example: The €) - - Importers of EU products. (If someone wants to buy a European product, he needs to buy it in €) EU recipients of primary income from residents in the US. (We have to sell dollars to buy euros). (A European investment that pays me dividends in dollars and I need to convert it into euros) EU recipients of secondary income from residents in the US. Direct and portfolio investors in the EU. - Loans and other investments to nonresidents in the EU. These types of increases in demand have consequences on the Balance of Payments: The demand of euros depends on the foreign level of income, the real exchange rates and the domestic and international interest rates. - Current account: Let’s suppose we are a net importer country that belongs to the EU. If someone wants to buy a product, he needs to buy it using euros. The imports depend on the Real Exchange Rate (Nominal Exchange Rate, international prices and national prices) and the economic situation or level of income situation from my country. - Financial account: The domestic financial assets of my country are valuated in euros. For example, if an international investor buys Telefonica, he needs to buy it in euros. When we implement financial decisions we look at interest rates. We have to look at the differences between domestic interest rates vs. international interest rates. For example, if a lot of investors are deciding to invest in my country, may our interest rates are higher. Chapter 4: International Trade. Production Possibilities Frontier: (Frontera de posibilidades de producción). Business: It is a curve that illustrates the variations in the amounts that can be produced of two products if both depend upon the same finite resource for their manufacture. Macroeconomics: The point at which a country’s economy is most efficiently producing its various goods and services and allocating its resources in the best way possible. (enough car factories producing cars, enough bread makers producing bread…) If there are more people producing more or less of the quantities indicated by the PPF, resources are being managed inefficiently and the nation’s economic stability will deteriorate. There should be a limit on production issues. If an economy wants to achieve the efficiency, the governors (or the economy or the market factors) should decide the combination of goods and services that could be produced. The PPF answers the question: What is our maximum capacity of production? The maximum capacity of production means creating as many jobs as possible using as many resources as possible. (It is an ideal state). Example: Bread producers and meat producers. If we have a limited number of workers and a limited amount of resources, we will have to make a decision related to producing bread, meat or both. Every point under the grey line means an inefficient use of resources (Or the country is not producing at expected levels given those resources). Every point upon the grey line means an impossible goal with the actual level of resources. If there is an improvement in resources (land, for example), the PPF shifts upwards, meaning that economy is growing. This is also used in international macroeconomics 🡪 Country A: Lots of pigs, cows… Country B 🡪 Lots of flour and iron to make ovens. The opportunity costs for Country A is enormous (due to there isn’t iron or flour) and the other way around. If countries A and B are in autarky periods they only have their own PPF. The logic decision: Specializing in your product 🡪 Exporting it. Absolute advantage: The absolute advantage is the ability of a country to produce a greater quantity of a good or service with the same quantity of inputs (Labor, capital and natural resources) per unit of time. (Or producing the same quantity per unit of time using less inputs). Absolute advantage 🡪 Lower absolute costs per unit 🡪 Higher efficiency. The countries with absolute advantage can decide to specialize in a production of a good or a service, exporting it and funding themselves to purchase another goods and services. By Smith’s argument, if countries specialize in their products and gain absolute advantage, they will be better since every country would be specializing in their own product. Example: Country number 1 produces iron and country number two produces eggs. Every country needs per year 6 pieces of iron and six eggs. The Country 1 can produce 6 pieces of iron and 12 eggs, and Country 2 can produce 12 pieces of iron and 6 eggs. They fulfill their needs, but they could have trouble if the production of eggs or pieces of iron fail. However, both countries have absolute advantage in producing one of the products. (Country 1 🡪 Eggs, Country 2 🡪 Iron). If they specialize in their products, they can divide the labor between them, while they get benefits from the trade. Comparative Advantage: (Trade pattern based on the comparative advantage) The comparative advantage is an economy’s ability to produce a particular good or service at lower opportunity cost that its trading partners. Therefore, a lower opportunity costs leads to lower prices and higher margins. Opportunity costs are important factors of analysis. The opportunity costs are potential benefits that people lose when they select one option over another. The countries will engage in trade with one another, exporting the goods that they have a relative advantage in. It’s different of absolute advantage. The relative advantage refers to the ability of producing at a lower cost of opportunity, not at a greater volume or quality. Example that Ricardo saw: England manufacturing clothes and Portugal producing wine. There would be a moment that they realized that they could produce one of the things at lower costs and then they could export the rest. Indeed, as time went on, England stopped producing wine and Portugal stopped manufacturing clothes. The comparative advantage is related with free trade. Disadvantages: Rent seeking 🡪 One group organizes and lobbies the government to protect its interest. (Interest could be negatively impacted by cheaper makers) 🡪 Aranceles. (customs duty). Comparing comparative advantage, we don’t have to forget absolute advantage. If we have an absolute advantage on a product, we need to calculate the comparative advantage. For example. In United Kingdom, the opportunity cost of producing one unit of wheat is producing 2 units of cloth instead of 6 units The Neoclassical model. (Heckscher-Ohlin) Assumptions: It’s a 2x2x2 model: 2 countries, 2 sectors and 2 factors of production. It is based in a perfect competition market, with same technology for those countries but with differences in factor allocation. The advantage or (source of trade; trade pattern) is the difference between countries in factor endowments. We know it seeing the prices. If a factor is abundant compared to other country, the price of that factor will be cheaper. Let’s see it with an example: 2x2x2. - Productive factors: Labour (L), Natural Resources (N). Products: Cloths (Intensive in L), Food (Intensive in N). Countries: Country A (Abundant in L), Country B (Abundant in N). Source of trade: - Country A: It is abundant in labor, export clothes. Country B: It is abundant in natural resources, export food. There is a partial specialization, as opposed to the Smith’s and Ricardo’s theories. (Where there is a complete specialization). 1. Trade pattern determination. Different products are associated with various factor endowments at different intensity. A country has a competitive advantage in producing those goods that require the productive factor that the country holds in abundancy. The trade pattern is determined by prices. If a productive force is abundant in a country, it will be cheaper, because of the abundance. In this sense, each country exports that good that has been built up with that abundant factor of production. Everybody gains from this trade. The terms if trade of both countries improved, both countries have gains in the trade. 2. Factor Price Equalization Theorem. If the relative prices of goods and services under an autarky period are different, factor prices would also be different. When we are under free market and the prices are equalized between countries, the prices of the factors of production will also be equalized between countries. The international trade has distributional effects on income levels because of this reason. The relative prices of goods and services converge among countries. If relative prices of G&S converge, the relative prices of factors of production also do. This change cause variation in the return of income. There are winners and losers. The Global Value chain. This is a theory that says that every product is composed by a global supplier chain. It is determined by globalization, technological progress, reduction in transportation costs and free trade. The different stages of the production process are located across different countries. Chapter 5: Influences of economic policies in an open economy context. In this chapter we are going to talk about fiscal, monetary and commercial policies. In economy, we have different economic cycles. The government intervens to soften that economic cylce. The government has different goals: - General goals: Sustained development, justice, equality, equity… Social and economic goals: It needs to be adequated to the Public Sector and the Budgeting. Price stability, unemployment, inflation, economic development, etc. Economic policies: Fiscal, monetary, financial and commercial policies. (There are commercial policies because there are market failures, like monopolies.) The GDP is supposed to increase while economic cycles go upward and backward. We cannot avoid economic cycles, but we can smooth the effects of economic cycles with interventions. - Restrictive policies: Contraction in the evolution of the GDP. Expansionary policies: Expansion in the evolution of the GDP. Fiscal policy: It is about government expenditure, transfers (Money that governments give to individuals in exchange of NOTHING) and taxes. - - - Publig budget: Evolution of the government expenditure and taxes over a year. There could be a public surplus or a public deficit. The public deficit needs to be funded with public debt (as a % of the GDP) Taxation: It is a proportion of your income. If we want to increase the revenue out of taxes a bad decision is doing it by increasin the % on the income that you pay. The Laffer curve explains it perfectly. You can increase the taxes until a certain level. Upon that level, the higher the %, the lower the increase in the collection, because taxes discourage the activity. Tax revenues are completely cyclical. (Companies that close down, companies that go abroad…) Another option is thinking about a fiscal union. Super complicated issue. Fiscal depends on revenues, taxes and expenditure, and you need to agree about the three points, and every country have different needs. Transfers: The money that governments give us in exchange of absolutely nothing. Monetary policy. The monetary policy is about money supply and interest rates. It is very related to financial policies. The monetary policy is about changes in the money in circulation to alter the interest rates and affect the level of overall spending. We have different instruments in the monetary policy: The open market operations, the discount rate and the reserve requirements. Comercial policy: It is about how easy is to trade with the rest of the world. It depends on tariffs (custom duty). Tariffs are te taxes we pay in the frontier, increaing the price of the product. Tariffs protect national products artificially. There are also another non-tariffs issues that make trade harder: - Import quotas: It limits the quantity of an item imported into a nation. It tends to drive up the price. Subsidies: It reduces the prices of national products. Administrative barriers. - Currency devaluation: If there is a reduction of national currency, exports to other countries will be cheaper, while imports will be more expensive. Chapter 6: The goods and service markets in open economies. Introduction. The introduction is about assumptions about the last year. We are going to talk about an equilibrium between supply and demand. The supply is the production, while demand is the addition of consumption, investment, government expenditure and net exports. - Consumption: It is the demand by individuals. It is about 70% in developed economies. According to Keynes, the consumption depends on the autonomous consumption, the disposable income and the MPC. The autonomues consumption is the expenditures that consumers make when they haven’t got disposable income. It is fundend by savings. The disposable income is the amount of income available after paying taxes and receiving transfers. It is necessary to know about the taxation system we are in and the transfer we receive. Taxation systems can be fixed (Everybody pay the same amount of money) or proportional (It is a proportion of yout income). The MPC is a relationship between savings and consumption. It is about how much we consume with an extra € of income. If MPC=0.8, I am going to consume the 80% of a marginal unit and save 0.2. - Investment: The investment formula is: I = Ia + a*Y – b*r It is the demand by businesess. The productive investment refers to companies that buy items to produce other goods and services. The variables that determine investment are interest rates, economic cycles, autonomous investment and 2 parameters. (B i.e. is the responsiveness of investment spending to the interest rate) Most companies tend to use debt to invest. This is called financial leverage, and it is like a balance. (We cannot incur into much debt because we will go bankruptcy). Also, if we use cash to invest, we will have oportunity costs. If interest is low, it is worth to invest because the cost of funding is low. On the other hand, if interest are high we can invest at that interest rates. The interest rates are super important. There is an inverse relationship between investment and interest rates. If we have higher interest rates, we have higher cost of funding. The autonomous investment is the amount of investment regardless any other variables. It is always a positive number. - Government expenditure: It just depends on government decisions; it is about fiscal policy. - Net exports: Exports – Imports. Exports are valuated in €, while imports aren’t. We need to use the RER. The level of net exports depend on the national income, the international income and the RER. If national income is higher, we have a deficit in the trade balance, and the other way around. Also, there is a Marginal Propensity to Import (MPI). It shows what happens to the overall level of imports after an increase in the overall level of production. The MPC is always higher than the MPI (We are going to call it “q”) because we assume that consumption in internal products will exceed the consumption of external products. (In a good economic cycle, we are going to consume both internal and external products, so the MPC is going to be affected) NX = X – q*Y. (Epsylon is also added in this formula, but only if it isn’t 0) IS Curve. Investment and savings curve. It represents the equilibrium in the goods and services markets and the effect of the fiscal policy (Government expenditures, Taxes and Transfers). The equation of the IS curve is Supply = C + I + G +NX. We can know the impact of the fiscal policy by using the IS curve. The axis are Y (Overal level of production) and interest rates. The curve represents the equilibrium in the goods and services market. The slope in closed economies is less steeper than in open economies. Types of fiscal policies: - Expansionary fiscal policy: The expansionary fiscal policy increases the GDP. It could be increasing the government spending, decreasing taxes, or increasing transfers. This means a shift to the right of the IS curve. (There is a shift because the change is in variables not represented in the axis. If the change would have been in variables in the axis, there is a movement across the same line). The IS curve shifts to the right. Implications: The public deficit increases, so the public debt also does. (The public deficit is funded issuing public debt) There is an increase in the cost of funding. The coupon paid by the Government is higher (differences with the risk premium). Now, if we are a private company and we want to get funded, we can follow the same path as the government using corporate bonds. But the Government usually is more trustable than private companies, because private companies can go bankrupt. Furthermore, Telefonica is not the only one in the market that wants funds. So, Telefonica needs to compete with competitors in the price of the coupon. This is known as the crowd out effect. Another example of the crowd out effect is about large countries increasing its borrowing. The scale of the borrowing can lead to increasing the interest rate, therefore the cost of funding is higher. There is a decrease in net exports. We have a higher level of income, so we buy more products inside and outside (The imports increase because our income has increased) the country. The growth gets decreased. The Expansionary Fiscal Policy tends to the twin deficit: Public deficit + Trade deficit. Fiscal multipliers. Governments can take an expansionary fiscal policy. (The best tool to expand the growth is government expenditure). If we increase the Govern expenditure by a hundred it will take a multiplier effect. Business will see there is an improve in economic activities, so they are going to invest. If they invest, they will engage more people, more labor and so on. There is an additional effect on income. The overall in the final Y is higher than 100. We calculate it with multipliers. mG=1/(1-c) Y Variation = mG*G Variation We can apply it to every fiscal policy, so we have different multipliers. The multiplier allows us to calculate the effectiveness of every policy tool. The taxes multiplier is less effective than the Government expenditure multiplier. Changes in G affect to Y directly, while changes in Taxes will also be conditioned to the MPC. As we can see, the higher the MPC , the higher the multiplier. The multiplier for transfers is the same as multiplier for taxation, but we have different signs. Also, we have different multipliers in open economies. The MPI is in here. The multiplier is smaller, so the effectiveness is decreased: - Mathematical reason: We introduce another factor in the denominator Economic reason: Part of the effects of the policy are felt in foreign countries due to import growth. Chapter 7: Monetary policy. It is about money supply and demand. Money supply. (Creation of money) Not only the Fed or the ECB create money, but also the private and commercial banks: We talk about fiduciary money. This means the overall system is based on faith, because the value of a note or a coin is nothing. We assume that the piece of paper worth X. We are right now in a currency system: This is the balance sheet of a central bank, and we can extrapolate it to the balance sheet. The liabilities change a little bit (We can find here loans received by the CB, i.e.), but assets are almost the same. We can find here loans to clients, portfolio of investments, bonds (The reason why the EU saved Greece during the economic crisis) or Real Estate. Banks need to have different assets to diversify their risk. Also, there is a minimum part you need to hold as cash to meet people needs. This is called the reserve requirement. K =Cash Reserves / Deposits. In the European Union, k=1%. The lower the reserve requirements, the more the money you can lend. Process of money creation: Fractional reserve system. Lets imagine the monetary base is 100, and the MRR is 1%. This means we have 99€ to lend and 1€ that goes to the bank reserves. The bank has 99€ to lend to another user right now and so on. The CB want to control the money creation, and they use this tool. If they want to stop the money creation, they increase the MRR and the money creation gets reduced, because banks need to have that higher % as reserves, so there is less money to lend. Chapter 9: The Mundell-Fleming Model. The Mundell-Fleming model wants to show us how fiscal policies, monetary policies and different conditions of capital mobility can be used as instruments to achieve internal and external goals. It is an integration of the BoP within the IS-LM model under fixed prices assumptions. According to the approach the monetary markets reach their equilibriums based on variations of international reserves. The CB intervenes in the foreign exchange markets to defend the fixed exchange rate. In this manner, it meets the excess of currency demand or avoids the excess of currency supply in the foreign exchange markets. Perfect capital mobility and contractionary monetary policies. At the initial point, we have an IS=LM=BP condition. If we carry out a contractionary monetary policy (Selling bonds, increasing interest rates of standing facilities or increasing the MRR) we have a new equilibrium where IS=LM’. This means we have an internal equilibrium, but not an external one. So, we have a trade deficit or surplus (We will know it knowing at the graphs.) If the point is on the BP graph, we will have a trade surplus, if it is in the other way around, it is a trade deficit. In this example national interest rates are higher than internationals, wo we have capital inflows and a surplus in the Financial Account. As a consequence, our currency appreciates due to the higher profitability, and the ECB needs to intervene the economy. It sells domestic the domestic currency and buys another one, increasing the assets and therefore the monetary base. As a consequence, the money supply, the consumption, the investment and the income are increased. This is not a monetary policy carried out by the Central Bank. The CB just intervened in the FOREX market. We return to the initial point, so the monetary policy is ineffective. Perfect capital mobility and expansionary fiscal policies. We have an initial point of equilibrium where IS=LM=BP. An expansionary policy is carried out, so we have a shift in the IS curve upwards. We have now a second point of equilibrium where IS’=LM. At this moment, there is an internal equilibrium, but not external. Due to the expansion of the fiscal policy, the public deficit increases, and the public debt also does. This means an increasing in the cost of funding. As the interest rates are higher, there are capital inflows, and our own currency gets appreciated. The CB needs to intervene in the economy selling € and buying foreign currency. The assets of the CB increase, so the MB also does. Therefore, we have an increase of the money supply and the LM curve shifts upwards. The effect is doubled. Imperfect capital mobility (high sensitivity) and expansionary monetary policies. We have an initial point IS=LM=BP. We carry out an expansionary monetary policy (Decreasing r, quantitative easing or lowering the MRR) and we have a new point of internal equilibrium (IS=LM’), but not the external one. At this point we have an external deficit: - The income increases and imports also do. Therefore, net exports fall. There is a decrease in interest rates, there are capital outflows and the financial account decreases. Due to the capital outflows there is a depreciation against other currencies. The CB intervenes buying domestic currencies and selling foreign ones. The is a decrease in assets and therefore in the monetary base. The money supply is reduced, and interest rates are going high again, so there are not effects at all because we go back to the beginning point. Imperfect capital mobility (low sensitivity) and expansionary monetary policies. We have the similar effects as in the case of high sensitivity to R. We don’t care about the degree of imperfect capital mobility. We return to the beginning point. Imperfect capital mobility (high sensitivity) and expansionary fiscal policies. We have an initial equilibrium point where IS=LM=BP. We carry out an expansionary fiscal policy (Increasing Government expenditure, increasing Transfers or decreasing Taxes) and we have a new point of equilibrium (IS’=LM) were the internal sector is balanced but the external sector isn’t. We have now an external surplus. Despite net exports fall (Due to the higher imports because of the expansionary fiscal policy), there are capital inflows due to the higher interest rates. The Financial Account is stronger than the Current Account because of the high sensitivity to interest rates here. Due to the capital inflows there is an appreciation of the domesic currency against the foreign currencies. The ECB intervenes buying foreign currencies and selling domestic currencies. The assets of the CB increases, therefore the MB also does. The money supply is higher and we have a new point of equilibrium E2. Imperfect capital mobility (low sensitivity) and expansionary fiscal policies. We have an initial point IS=LM=BP where we are at equilibrium. We carry out a fiscal policy (decreasing Taxes, increasing the Government Expenditure or increasing Transfers) and we have a new point of equilibrium (IS’=LM ) where the internal sector is balanced but the external sector is not. We have an external deficit, despite the graph tells us something different: - Interest rates are higher, but there is an imperfect capital mobility with low sensitivity, so the effects on the Financial Account are barely seen. As effect of the expansionary fiscal policy, the income increases and the imports also do, so the net exports fall. There are capital outflows to buy foreign products and services because of the increase in imports. The domestic currency gets depreciated and the CB needs to intervene. The CB buys domestic currency and sells foreign currencies. The assets of the CB get diminished and the MB also does. The money supply is reduced and interest rates go up.