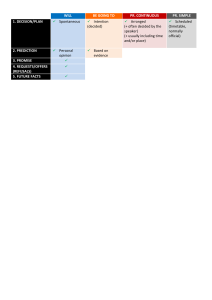

CONSIDERATION IN LAW OF CONTRACTS There is so much talk about paying money or exchanging something for a consideration for the engagement and performance of a contract and or an agreement. You hear many people talking about upfront fees or engagement costs. Should you pay/receive something or not when you are offered to contract? What does the Law say? What Is Consideration? Consideration is the benefit that each party gets or expects to get from the contractual agreement -- for example, Victoria's Secret gets your money; you get the cashmere robe. In order for consideration to provide a valid basis for a contract -- and remember that every valid contract must have consideration -- each party must make a change in their "position." Consideration is usually either the result of: a promise to do something you're not legally obligated to do, or a promise not to do something you have the right to do (often, this means a promise not to file a lawsuit). Sometimes this change in position is also called a "bargained-for detriment." How does consideration work in the real world? Let's say you backed into your neighbor's golf cart and damaged it. Your neighbor is legally permitted to sue you for the damage but instead agrees not to sue you if you pay him $1,000. This agreement provides adequate consideration for the contract, because each party is giving up something in the exchange -- you're giving up some of your money while your neighbor is giving up the right to sue you. When a Contract Lacks Consideration Courts will step in and declare that a contract is unenforceable because it lacks consideration. Let's look at some of these scenarios. Under basic principles of contract law, consideration is the answer to the question, "Why are you entering this contract?" or "What are you receiving for being a party to this contract?" In order for any agreement to be deemed legally binding, it must include consideration on the part of every person or company that enters the contract. This article covers the basics of the consideration requirement, including real-world examples of consideration. (To learn more about what else goes into a legally binding contract, check out Nolo's article Contracts: The Basics.) FULL ARTICLE: http://www.nolo.com/legal-encyclopedia/consideration-everycontract-needs-33361.html Keeping it Simple: http://study.com/academy/lesson/what-is-acceptance-in-contractlaw-definition-rules-examples.html More detail: http://study.com/academy/lesson/rules-of-consideration-in-contract-lawelements-case-examples.html In contract law consideration is concerned with the bargain of the contract. A contract is based on an exchange of promises. Each party to a contract must be both a promisor and a promisee. They must each receive a benefit and each suffer a detriment. This benefit or detriment is referred to as consideration. Consideration must be something of value in the eyes of the law - (Thomas v Thomas) (1842) 2 QB 851. This excludes promises of love and affection, gaming and betting etc. A one sided promise which is not supported by consideration is a gift. The law does not enforce gifts unless they are made by deed. Whilst the common law strictly adheres to the requirement of consideration (although in some instances the courts seem to go to some lengths to invent consideration eg Ward v Byham [1956] 1 WLR 496, Williams v Roffey Bros [1990] 2 WLR 1153) equity will, in some instances, uphold promises which are not supported by consideration through the doctrine of promissory estoppel. Consideration must be sufficient but need not be adequate: There is no requirement that the consideration must be market value, providing something of value is given eg £1 given in exchange for a house would be valid. The courts are not concerned with whether the parties have made a good or bad bargain: Chappell v Nestle [1960] AC 87 Case summary Consideration must move from the promisee If a person other than the promisee is to provide the consideration, the promisee can not enforce the agreement: Tweddle v Atkinson [1861] EWHC QB J57 Case summary Exceptions to the rule in Pinnel's case: Where part payment is made by a third party: Hirachand Punamchand v Temple [1911] 2 KB 330 Case summary DEFINITION OF CONTRACT CONSIDERATION LAW Lush J. in Currie v Misa (1875) LR 10 Exch 153 referred to consideration as consisting of a detriment to the promisee or a benefit to the promisor: "... some right, interest, profit or benefit accruing to one party, or some forbearance, detriment, loss or responsibility given, suffered or undertaken by the other." The definition given by Sir Frederick Pollock, approved by Lord Dunedin in Dunlop v Selfridge Ltd [1915] AC 847, is as follows: "An act or forbearance of one party, or the promise thereof, is the price for which the promise of the other is bought, and the promise thus given for value is enforceable." Read more at Law Teacher: http://www.lawteacher.net/lecture-notes/contractlaw/consideration-lecture.php#ixzz3pkIfBo7p n. 1) payment or money. 2) a vital element in the law of contracts, consideration is a benefit which must be bargained for between the parties, and is the essential reason for a party entering into a contract. Consideration must be of value (at least to the parties), and is exchanged for the performance or promise of performance by the other party (such performance itself is consideration). In a contract, one consideration (thing given) is exchanged for another consideration. Not doing an act (forbearance) can be consideration, such as "I will pay you $1,000 not to build a road next to my fence." Sometimes consideration is "nominal," meaning it is stated for form only, such as "$10 as consideration for conveyance of title," which is used to hide the true amount being paid. Contracts may become unenforceable or rescindable (undone by rescission) for "failure of consideration" when the intended consideration is found to worth less than expected, is damaged or destroyed, or performance is not made properly (as when the mechanic does not make the car run properly). Acts which are illegal or so immoral that they are against established public policy cannot serve as consideration for enforceable contracts. Examples: prostitution, gambling where outlawed, hiring someone to break a skater's knee or inducing someone to breach an agreement (talk someone into backing out of a promise.) (See: contract) What kinds of contracts might not hold up in court? Unenforceable Contracts: What to Watch Out For Since a contract is a legally binding agreement, in the typical scenario, once you enter into a contract with another person or business, you and the other party are both expected to fulfill the terms of the contract. But it's possible for an otherwise valid contract to be found unenforceable in the eyes of the law, and this article looks at some common situations where that might be the case. Lack of Capacity It's expected that both (or all) parties to a contract have the ability to understand exactly what it is they are agreeing to. If it appears that one side did not have this reasoning capacity, the contract may be held unenforceable against that person. The issue of capacity to contract usually comes up when one party of the agreement is too young or does not have the mental wherewithal to completely understand the agreement and its implications. The general idea here is to prevent an unscrupulous person from taking advantage of someone who lacks the ability to make a reasoned decision. To learn more, check out Nolo's article Who Lacks the Capacity to Contract? Duress Duress, or coercion, will invalidate a contract when someone was threatened into making the agreement. In an often cited case involving duress, a shipper (Company A) agreed to transport a certain amount of Company B's materials, which would be used in a major development project. After Company B's project was underway and Company A's ship was en route with the materials, Company A refused to complete the trip unless Company B agreed to pay a higher price. Company B was forced to pay the jacked-up rate because there was no other way to get the material, and not completing the job would lead to unsustainable losses. The court ultimately found that this agreement to raise the price was not enforceable, because it came about through duress. Another common example of duress is blackmail. Undue Influence If Person B forced Person A to enter into an agreement by taking advantage of a special or particularly persuasive relationship that Person B had with Person A, the resulting contract might be found unenforceable on grounds of undue influence. In general, to prove undue influence, Person A would have to show that Person B used excessive pressure against Person A during the bargaining process, and that for whatever reason Person A was overly susceptible to the pressure tactics -- or that Person B exploited a confidential relationship to exert pressure on Person A. Misrepresentation If fraud or misrepresentation occurred during the negotiation process, any resulting contract will probably be held unenforceable. The idea here is to encourage honest, good faith bargaining and transactions. Misrepresentations commonly occur when a party says something false (telling a potential buyer that a house is termite-free when it is not) or, in some other way, conceals or misrepresents a state of affairs (concealing evidence of structural damage in a house's foundation with paint or a particular placement of furniture). Nondisclosure Nondisclosure is essentially misrepresentation through silence -- when someone neglects to disclose an important fact about the deal. Courts look at various issues to decide whether a party had a duty to disclose the information, but courts will also consider whether the other party could or should have easily been able to access the same information. It should be noted that parties have a duty to disclose only material facts. But if Party A specifically asks Party B about a fact (material or non-material), then Party B has a duty to disclose the truth. When contract disputes involve fraudulent dealings like misrepresentation or nondisclosure, and one side of the agreement has already suffered financial losses as a result, a lawsuit for breach of contract might be filed over the matter. Learn more in Nolo's article Breach of Contract: Material Breach. Unconscionability Unconscionability means that a term in the contract or something inherent in or about the agreement was so shockingly unfair that the contract simply cannot be allowed to stand as is. The idea here again is to ensure fairness, so a court will consider: whether one side has grossly unequal bargaining power whether one side had difficulty understanding the terms of the agreement (due to language or literacy issues, for example), or whether the terms themselves were unfair (like sky-high arbitration costs; read more in Nolo's article Arbitration Clauses in Contracts). If a court does find a contract unconscionable, it has options other than just voiding the agreement altogether. It may instead choose to enforce the conscionable parts of the contract and rewrite the unconscionable term or clause, for example. Public Policy Contracts can be found unenforceable on grounds of public policy not only to protect one of the parties involved, but also because what the contract represents could pose harm to society as a whole. For example, a court will never enforce a contract promoting something already against state or federal law (you can never enforce a contract for an illegal marijuana sale) or an agreement that offends the "public sensibilities" (contracts involving some sort of sexual immorality, for example). Other examples of contracts (or contracts clauses) that are against public policy and therefore unenforceable include: an employer forcing an employee to sign a contract that forbids workers from joining a union an employer forcing an employee to sign a contract forbidding medical leave a landlord forcing a tenant to sign a contract forbidding medically necessary companion animals such as seeing eye dogs, and contracts for child custody are invalid in California if their terms are not in line with the child's best interest. Mistake Sometimes a contract is unenforceable not because of purposeful bad faith by one party, but due to a mistake on the part of one party (called a "unilateral mistake") or both parties (called a "mutual mistake"). In either case, the mistake must have been about something important related to the contract, and it must have had a material (significant) effect on the exchange or bargaining process. Impossibility In some cases, a contract is deemed unenforceable because it would be impossible or impracticable to carry out its terms -- too difficult or too expensive, for example. To claim impossibility, you would need to show that: you can't complete performance under the contract because of some unexpected event that's not your fault the contract didn't make the risk of the unexpected event something you needed to shoulder, and performing the contract will be much more difficult or expensive now. For example, if Company A contracts to sell 20 barrels of its flour to Company B and a natural disaster wipes out Company A's entire stock of flour before the sale can be completed, Company A might be able to have the contract ruled unenforceable on grounds of impossibility. For more information on contracts, read Nolo's new book Contracts: The Essential Business Desk Reference, by attorney Rich Stim (Nolo). Who Lacks the Capacity to Contract? Certain people lack the legal ability to enter into a binding contract. When it comes to legally binding agreements, certain people are always considered to lack the legal ability (or "capacity") to contract. As a legal matter, basically they are presumed not to know what they're doing. These people--legal minors and the mentally ill, for example--are placed into a special category. If they enter into a contract, the agreement is considered "voidable" by them (as the person who lacked capacity to enter the agreement in the first place). Voidable means that the person who lacked capacity to enter the contact can either end the contract or permit it to go ahead as agreed on. This protects the party who lacks capacity from being forced to go through with a deal that takes advantage of his or her lack of savvy. Let's look at some situations in which a person might lack the legal capacity to enter into a legally binding contract. Minors Have No Capacity to Contract Minors (those under the age of 18, in most states) lack the capacity to make a contract. So a minor who signs a contract can either honor the deal or void the contract. There are a few exceptions, however. For example, in most states, a minor cannot void a contract for necessities like food, clothing, and lodging. Also, a minor can void a contract for lack of capacity only while still under the age of majority. In most states, if a minor turns 18 and hasn't done anything to void the contract, then the contract can no longer be voided. EXAMPLE Sean, 17, a snowboarder, signs a long-term endorsement agreement for sportswear. He endorses the products and deposits his compensation for the endorsements for several years. At age 19, he decides he wants to void the agreement to take a better endorsement deal. He claims he lacked capacity when he signed the deal at 17. A court probably will not permit Sean to now void the agreement. For another example of minors entering into contracts, see Nolo's Q&A Is a 15-yearold's contract with a cell phone service valid? Mental Incapacity A person who lacks mental capacity can void, or have a guardian void, most contracts (except contracts for necessities). In most states, the standard for mental capacity is whether the party understood the meaning and effect of the words comprising the contract or transaction. This is called the "cognitive" test. Some states use what's called the "affective" test: a contract can be voided if one party is unable to act in a reasonable manner and the other party has reason to know of the condition. And some states use a third measure, called the "motivational" test. Courts in these states measure capacity by the person's ability to judge whether or not to enter into the agreement. These tests may produce varying results when applied to mental conditions such as bipolar disorder. EXAMPLE Mr. Smalley contracted to sell an invention, and then later claimed that the contract was void because he lacked capacity. Smalley had been diagnosed as manic-depressive and had been in and out of mental hospitals. His doctor stated that Mr. Smalley was not capable of evaluating business deals when he was in a "manic" state. A California Court of Appeals refused to terminate the contract and stated that Smalley, in his manic state, was capable of contracting. "The manic phase of the illness under discussion is not, however, a weakness of mind rendering a person incompetent to contract." In other words, the Court's view of manic-depression was cognitive--that the condition may have impaired Smalley's judgment but not his understanding. Alcohol and Drugs People who are intoxicated by drugs or alcohol are usually not considered to lack capacity to contract. Courts generally rule that those who are voluntarily intoxicated shouldn't be allowed to avoid their contractual obligations, but should instead have to take responsibility for the results of their self-induced altered state of mind. However, if a party is so far gone as to be unable to understand even the nature and consequences of the agreement, and the other (sober) party takes advantage of the person's condition, then the contract may be voidable by the inebriated party. EXAMPLE In the late 19th century, Mr. Thackrah, a Utah resident and owner of $80,000 worth of mining stock, went on a three-month bender. Mr. T's fondness for alcohol was well known, and a local bank hired Mr. Haas to contract with the inebriated Thackrah. Haas did the deal, getting Thackrah to agree to accept $1,200 for his mining stock. When he sobered up (a month later), Thackrah learned that Haas had turned over the mining shares to a local bank (apparently the real culprits in the scheme). Thackrah sued Haas. The case went all the way to the U.S. Supreme Court, which ruled that the agreement was void because the bank and Hass knew that Thackrah had no idea what he was doing when he entered the contract. The bank had to return the shares to Thackrah, less the $1,200 he had already been paid.