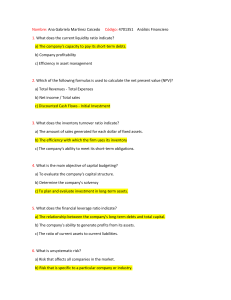

ACC 230 Dr. Tish Bates Transferred to Bottling Department (60,000 gallons)............................. _______ January charges: Direct material (61,000 gallons)............................................................. 152,500 Direct labor…………………………………………………………………… Manufacturing overhead……………………………………………………. 73,600 48,800 January 31 inventory (_________ gallons, 70% processed).................. _______ Required Assuming Godfrey uses the weighted average method in process costing, calculate the following amounts for the Blending Department: • Number of units in the January 31 inventory. • Equivalent units for materials and conversion costs. • January costs per equivalent unit for materials and conversion costs. • Costs of the units transferred to the Bottling Department. • Costs of the incomplete units in the January 31 inventory. Equivalent Units Units % work done Direct materials % work done Conversion costs Completed/Transferred 60,000 100% 60,000 100% 60,000 Ending inventory 6,000* 100% 6,000 70% 4,200 (6,000x70%) Total (b) 66,000 66,000 64,200 Note: (a) Ending inventory* (in units) = Beginning inventory + Purchases - transferred = 5,000 + 61,000 - 60,000 = 6,000 units Thus, the number of units in January 31 inventory is 6,000 units. Product cost report Direct materials($) Conversion costs($) Total ($) Beginning inventory 12,000 5,900 17,900 Current 152,500 122,400 274,900 Total 164,500 128,300 292,800 Divide: Equivalent Units 66,000 64,200 Average costs / Equivalent Units (c) 2.4924 1.9984 Completed/Transferred: Amounts ($) Direct materials 149,545 (60,000x2.4924) Conversion costs 119,907(60,000x1.9984) Cost of goods manufactured (d) 269,452 Ending inventory: Direct materials 14,955 (6,000x2.4924) Conversion costs 8,393 (4,200x1.9984) Cost of ending inventory (e) 23,348 Total cost allocated 292,800