Trinomial Trees in Derivative Pricing: A Financial Analysis

Anuncio

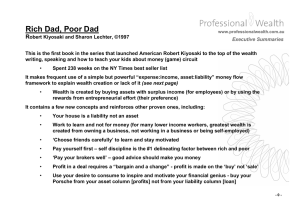

Using trinomial trees in derivative pricing Fernando Jáuregui, Christian Jurado and Julián Sánchez* Abstract A useful and very popular technique for pricing an option involves constructing a trinomial tree. This is a diagram representing different possible paths that might be followed by the stock price over the life of an option. The underlying assumption is that the stock price follows a random walk. In each time step, it has a certain probability of moving up, a certain probability of moving down and a certain probability of keep its value. In this paper we will take a first look at trinomial trees. We show they can be used to value options using no-arbitrage arguments and a principle known as risk-neutral valuation. Keywords: JEL Classification: Trinomial Trees, Derivatives, Arbitrage G12, G13 The views expressed in this paper are those of the authors and do not reflect necessarily the position of the Universidad Carlos III de Madrid. *Students of Executive Master in Financial Analysis of the Universidad Carlos III de Madrid. 1. Tree Methods as an approximation to Black-Scholes The generalized Cox-Ross-Rubinstein (CRR)1 model has an interest on his own as a basic model of stochastic discrete-time process for the underlying asset of a financial derivative. One of its main attractive feature is the easiness of standard option pricing by backward induction which relies on the possibility of performing a perfect hedge at every node of the tree (cf. The Generalized CRR Model). In fact the original motivation of Cox, Ross and Rubinstein was to approximate the BlackScholes price of an option. 2. From Binomial trees to trinomial trees It is well known to use binomial trees to model the evolution of the price of the underlying asset in the process of calculating the price of financial derivatives. The model assumes that based on the current price of the underlying asset, can have only two possible prices in the next period. Under this assumption can always determine a portfolio composed of a certain quantity of the underlying asset along with a bonus, which exactly replicates the payment that would result from the derivative, for each of the two possible underlying asset prices, portfolio value matches the corresponding payoff of the derivative. Thus, the price of the derivative is determined by the current value of the portfolio, since both provide the same payment at the end. Additionally, under certain assumptions, which are always satisfied when the market is in equilibrium, we can estimate the risk-neutral probability call, which can be used to calculate the expected value of the derivative payments whose present value is just the price of same, which is an alternative method for calculation. Abandoning the assumption of only two values for the underlying asset price, and allowing three trinomial trees are obtained. The ideal situation binomial model and not preserved: it is not possible to obtain a portfolio (with only two instruments) that replicates the derivative payments, nor can calculate the risk-neutral probability. 3. Trinomial trees The trinomial tree proposed by Rubinstein (1985) and by Derman, E., Kani, I., and Chriss, N. (1996) is very similar to the binomial method. Since each node, now born three branches, the central one being the only one that does not change. That is, if in the future the binomial tree had two alternatives: the rise or fall of the underlying asset, in the trinomial trees we add a third alternative: the asset does not move. 1 Cox-Ross-Rubinstein were the first in talk about tree methods. Trinomial trees provide an effective method of numerical calculation of option prices within Black Scholes share pricing model. Trinomial trees can be built in a similar way to the binomial tree. To create the jump sizes u and d and the transition probabilities pu and pd in a binomial model we aim to match these parameters to the first two moments of the distribution of our geometric Brownian motion2 . The same can be done for our trinomial tree for u , d , pu , pd , pm . We will use a trinomial tree model defined by: S (t )u S (t t ) S (t ) S (t )d with prob pu with prob pm 1 pu pd with prob pd and we can match the first two moments of our models distribution according to the no arbitrage condition, (1) E S (ti 1 ) S (ti ) ert S (ti ) (2) Var S (ti 1 ) S (ti ) tS (ti ) 2 2 (t ) where we have assumed that the volatility of the underlying asset is constant and the asset price follows geometric Brownian motion; r is the rate of risk-free investment. Now, because of the fact the no-arbitrage condition is not central to the derivation of most trinomial tree pararnerisations, there has been somewhat of a crisis of identity associated with this methodology. How could one be sure that it is "right"?, what reason could be forwarded for its right to existence ? The answer normally given, is that it can be shown that this methodology is consistent with the explicit finite difference solution of the Black and Scholes partial differential equation. In other words, it is not strictly speaking a tree based method, but rather something in between. 2 The term "Brownian motion" can refer to the mathematical model used to describe such random movements, which is often called a particle theory. Brownian motion is among the simplest of the continuous-time stochastic processes, and it is a limit of both simpler and more compli cated stochastic processes (random walk and Donsker's theorem). Another issue of concern is that many trinomial parameterizations do not return arbitrage free derivatives prices, whilst numerical instability is also quite often a feature of these models: this being related to risk neutral probabilities becoming negative for some parameter choices (like volatility and the risk free returns). Trinomial Tree Parameter Set Condition (1) is a standard equilibrium or no arbitrage condition: it states that the average return from the asset should be equal to the risk free-return. It can be re-written in the following explicit form: 1 pu pd pu u pd d ert Conditions (1, 2) impose two constraints on 4 parameters of the tree. An extra constraint comes from the requirement that the size of the upward jump is the reciprocal of the size of the downward jump, (3) ud 1 While this condition is not always used for a trinomial tree construction, it greatly simplifies the complexity of the numerical scheme: it leads to a recombining tree, which has the number of nodes growing polynomially with the number of levels rather than exponentially. We have imposed three constraints (1, 2, 3) on four parameters u, d , pu and pm . As a result there exists a family of trinomial tree models. In the project we consider the following popular representative of the family: its jump sizes are (4) u e Its transition probabilities are given by 2 t , d e 2 t 2 t r t e 2 e 2 (5) pu t t e 2 e 2 r t t e 2 e 2 (6) pd t t e 2 e 2 (7) pm 1 pu pd 2 Example: Using the trinomial tree we will calculate the price of a call option, at the money when the price of an underlying asset is at 10 euros, the volatility is 20%, and the interest rate is 3%. The maturity is two months and take monthly periods. In this case: 2 t ue d e e 2 t 30 (20%) 2 365 e 1.0845 30 (20%) 2 365 0.9221 With these data we can construct the trinomial tree of underlying asset Step 1 10 10.845 10 9.221 Step 2 11.761 10.845 10 9.221 8.503 Now, we can calculate the odds 2 (3%) 30 (20%) 30 365 365 2 e 2 e 0.2551 pu 30 30 (20%) 2365 (20%) 2365 e e 2 (20%) 30 365 (3%) 30 365 2 e e 2 0.2450 pd 30 30 (20%) 2365 (20%) 2365 e e pm 1 0.2551 0.2450 0.4999 We ended up doing the trinomial tree of the share price. At the expiration propose the maximum of the difference between the price of the underlying asset and the strike price and zero. Max(11.761 10;0) 1.761 Max(10.845 10;0) 1.845 Max(10 10;0) 0 Max(9.221 10;0) 0 Max(8.503 10;0) 0 Each node is calculated using the calculated probabilities. Thus the node in step 2 were calculated as follows 1.761(0.2551) 0.845(0.4999) 0(0.2450) e 30 (3%) 365 0.869 The next lower node is: 0.845(0.2551) 0(0.4999) 0(0.2450) e 30 (3%) 365 0.215 Hence, the price of the option is: 0.869(0.2551) 0.215(0.4999) 0(0.2450) e 30 (3%) 365 Finally we get the following trinomial tree: 0.328 Step 1 0.869 0.215 0.000 0.328 Step 2 1.761 0.845 0.000 0.000 0.000 4. Alternative Trinomial tree The above tree was a CRR 3 -equivalent trinomial tree. As already indicated, there is an unlimited number of sample spaces and corresponding probability parameters that can be used to consistently price an option. Following is another popular set of parameters often used in the literature: (8) pu 1 2 t r 6 2 12 2 (9) pd 1 2 t r 6 2 12 2 (10) pm 2 3 This implementation yields a negative up probability pu if: 2r 2 2 1 6r t 3t 3t and a negative down probability pd if: 2r 2 2 1 6r t 3t 3t The up probability pu becomes larger than unity if: 2r and similarly for the down probability when 3 Cox-Ross-Rubinstein Model 50 10 25 6r t 3t 3t 2r 50 10 25 6r t 3t 3t For example, interest rate is 20%, 20 time steps, and one year to maturity results in a negative down probability if the volatility is below 7.63%. This is a realistic scenario, although not a frequently occurring one. To avoid negative probabilities with this set of parameters, we can set the number of time steps n equal to or higher than: r 2 Integer 3rT 1 2 1 4 r 5. Relation between Binomial and Trinomial trees Rubinstein with "On the Relation between Binomial and trinomial Option Pricing Models" (2000), provided a solution to the identity dilemma of trinomial tree procedures. He showed that these (under very loose conditions) are in fact binomial trees but regarded at every second time node only; the figure below further illustrates this 4 : Mathematically the equivalence can be shown as: Theorem: Define a binomial price scheme as follows: S (t )u S (t t ) S (t )d 4 with prob p with prob (1 p) The circles and vectors represent the trinomial tree overlay. Rd so as to be consistent with the no-arbitrage condition. Were one ud to further define 'u u 2 , 'm ud and 'd d 2 , with the risk neutral probabilities set equal to: pu p 2 , pm 2 p(1 p ) and pd (1 p)2 , then the a binomial consistent trinomial tree could be defined as: Where p S (t ) ' u S (t 2t ) S (t ) ' m S (t ) ' d with prob pu with prob pm with prob pd The above definition is very powerful in that it compresses all the information contained in a binomial scheme into a scheme comprising half the number of nodes, otherwise said: the trinomial tree will determine derivatives prices with the accuracy given by a binomial lattice but requiring only half the number of time steps. Furthermore, in contrast to many other trinomial parameterizations extant, the above definition inherits the qualities of the binomial one: arbitrage bee derivatives prices as well as numerical stability (if it applies). It should be added that Tian5 , makes mention of the improved convergence properties of the trinomial tree, although he never offers an explanation for it. 5 "A Trinomial Option Pricing Model Dependent on Skewness and Kurtosis", International Review of Economics and Finance, (1998). References Cox, J. C., A. Ross, and M. Rubinstein, “Option Pricing: A Simplified Approach”, Journal of Financial Economics 7 (October 1979): 229-64 Hull J. ”Options, Futures and Other Derivatives”, Person Prentice Hall, Seventh Edition, (2009). Rubinstein M. E., "On the Relation between Binomial and Trinomial Option Pricing Models", UC Berkley, Research Program in Finance (Working Paper FPF-292), (2000). Tian Y., "A Modified Lattice Approach to Option Pricing", Journal of Futures Markets, Val. 13, No. 5 (1993) 563-577. Tian Y.S., "A Trinomial Option Pricing Model Dependent on Skewness and Kurtosis", International Review of Economics and Finance, (1998).