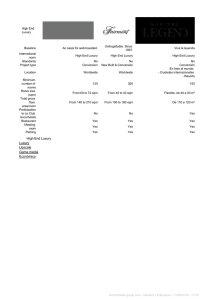

2019 True-Luxury Global Consumer Insight 6 th E d i t i o n Milano, April 17 th 2019 BCG-Altagamma True-Luxury Global Consumer Insight 2019 study: 6th Edition 12,000+ Respondents1 Sixth Ed. 2019 Fifth Ed. 2018 12,000+ • • +1,000 in China +1,000 in US Fourth Ed. 2017 12,000+ • • +1,000 in China +1,000 in US ~€39K Average spend2 10 Largest worldwide luxury Markets1 covering ~85% of Total luxury sales value ~€37K Average spend ~€36K Average spend 1. Begun monitoring Indian consumers (1,000) 2. Includes personal and experiential luxury, excluding cars, yachts, smartphones and smartwatches Source: BCG-Altagamma True-Luxury Global Consumer Insight Survey Dec 18/Jan 19 (12K+ respondents in 10 countries) 1 TRUE LUXURY GLOBAL CONSUMER INSIGHT Copyright © 2019 by Boston Consulting Group. All rights reserved. BCG expert partner network ready to discuss in every large market the outcomes of True-Luxury Global Consumer Insight 2019 Christine Barton Jeffrey Shaddix Nicola Pianon Filippo Bianchi Olivier Abtan Joan Sol Sebastian Boger Jessica Distler Guillaume Charlin Javier Seara Olof Darpö Christina Synnergren Robbin Mitchell Drake Watten Sarah Willersdorf Europe North America APAC Bharat Khandelwal Miki Tsusaka Vincent Lui Hemant Kalbag Holger Gottstein Abheek Singhi 2 TRUE LUXURY GLOBAL CONSUMER INSIGHT Copyright © 2019 by Boston Consulting Group. All rights reserved. Luxury market has reached ~920 B€ in 2018, with 4-5% annual expected growth until 2025 Category Personal luxury reached 330 B€ in 2018 expected to grow in 2018-2025 at ~3%, driven by accessories and cosmetics Experiential luxury reached 590 B€ in 2018, expected to grow faster at ~5% Generation Nationality True-Luxury Consumers Millennials predicted to grow from ~32% to ~50% of personal luxury market by 2025. 130% of 2018-25 market growth expected to come from Millennials China continues to be the driving force, making up ~33% of the market and expected to rise to ~40% by 2025 True-Luxury consumers, the focus of BCG-Altagamma study, generate ~30% of global luxury market, or 278 B€ and expected to reach 395 B€ by 2025 75% of the 2018-25 market growth expected to come from Chinese True-Luxury consumers Largest contribution to growth coming from Status Seeker, Little Prince and Fashionista segments, seeking extravagance, fun and new form of creativity in products & brands Gen Z represents today only ~4% of personal luxury, but have a clearly different set of behaviors & values that brands should better monitor and understand (i.e. Buy > collaborations, > influenced by sustainability, …) Source: BCG Luxury Market Model Megacitiers, expression of the global millennial tribe, continue to grow 3 TRUE LUXURY GLOBAL CONSUMER INSIGHT Copyright © 2019 by Boston Consulting Group. All rights reserved. Purchase collaborations Gen Z have a unique set of behaviors and values, and brands should start understanding them better Growth lever for 2nd-hand Influenced by sustainability High social media interaction Embrace mix & match Copyright © 2019 by Boston Consulting Group. All rights reserved. 67% purchase items from collaborations • vs. 60% Millennials • vs. 50% overall True-Luxury consumers 57% consider resale value when purchasing luxury goods • vs. 50% Millennials • vs. 44% overall True-Luxury consumers 64% influenced by sustainability when making purchases • vs. 64% Millennials • vs. 59% overall True-Luxury consumers 95% use social media to interact with luxury brands, bloggers or social media peers regarding luxury brands and products • vs. 92 % Millennials • vs. 81% overall True-Luxury consumers 56% have partially shifted spending from traditional luxury brands to premium, fast fashion, niche or sports brands • vs. 52% Millennials • vs. 46% overall True-Luxury consumers Source: BCG-Altagamma True-Luxury Global Consumer Insight Survey Dec 18/Jan 19 4 TRUE LUXURY GLOBAL CONSUMER INSIGHT Today's True-Luxury consumers characterized by 12 behavioral segments, with greatest growth in #Littleprince, Status Seeker and Fashionista Growth in segment value (%) True-Luxury consumers seeking extravagance, fun and new creativity (newwave luxury values) showing the highest growth, driven by Chinese + Status Seeker #Littleprince Fashionista The Global, millennial tribe continues to grow, sharing their behaviors across mega cities Megacitier Social Wearer Rich Upstarter Timeless Proper 0 Luxe Immune Experiencer Omni-gifter Absolute Luxurer In emerging markets, TrueLuxury consumers becoming less unsure and more sophisticated, reflected by a shrinking Classpirational segment Classpirational Segment value Source: BCG-Altagamma True-Luxury Global Consumer Insight Survey Dec 18/Jan 19 (12K+ respondents in 10 countries) Copyright © 2019 by Boston Consulting Group. All rights reserved. 5 TRUE LUXURY GLOBAL CONSUMER INSIGHT True-Luxury Global Consumer Insight 2019 Edition: the 12 key trends New and Emerging Keeps Growing Stabilizing 1 Collaborations 2 Second-hand 3 Sustainability 4 Luxury Casualwear 5 Influencers 6 Social Media 7 Online 8 Omnichannel 9 Mono-Brand Stores 10 Made-in 11 Mix & Match 12 Customization 6 TRUE LUXURY GLOBAL CONSUMER INSIGHT Copyright © 2019 by Boston Consulting Group. All rights reserved. True-Luxury Global Consumer Insight 2019 Edition: the 12 key trends New and Emerging Keeps Growing Stabilizing 1 Collaborations 2 Second-hand 3 Sustainability 4 Luxury Casualwear 5 Influencers 6 Social Media 7 Online 8 Omnichannel 9 Mono-Brand Stores 10 Made-in 11 Mix & Match 12 Customization Awareness reaches ~90%, 50% of True-Luxury consumers purchasing collaborations and special editions, driven by Chinese (62%) and younger generations (67% Gen. Z, 60% Millennials) 7 TRUE LUXURY GLOBAL CONSUMER INSIGHT Copyright © 2019 by Boston Consulting Group. All rights reserved. True-Luxury Global Consumer Insight 2019 Edition: the 12 key trends New and Emerging Keeps Growing Stabilizing 1 Collaborations 2 Second-hand 3 Sustainability 4 Luxury Casualwear 5 Influencers 6 Social Media 7 Online 8 Omnichannel 9 Mono-Brand Stores 10 Made-in 11 Mix & Match 12 Customization Reached 7% of personal luxury market value and is growing 12% per year Out of True-Luxury consumers, 34% sell 2nd-hand products, while 26% buy 80% of 2nd-hand market participants use online channels to get informed and to trade 8 TRUE LUXURY GLOBAL CONSUMER INSIGHT Copyright © 2019 by Boston Consulting Group. All rights reserved. True-Luxury Global Consumer Insight 2019 Edition: the 12 key trends New and Emerging Keeps Growing Stabilizing 1 Collaborations 2 Second-hand 3 Sustainability 4 Luxury Casualwear 5 Influencers 6 Social Media 7 Online 8 Omnichannel 9 Mono-Brand Stores 10 Made-in 11 Mix & Match 12 Customization Influences purchase behavior of ~60% of True-Luxury consumers (+12pp vs 2013), driven by environmental, animal and ethical manufacturing concerns 9 TRUE LUXURY GLOBAL CONSUMER INSIGHT Copyright © 2019 by Boston Consulting Group. All rights reserved. True-Luxury Global Consumer Insight 2019 Edition: the 12 key trends New and Emerging Keeps Growing Stabilizing 1 Collaborations 2 Second-hand 3 Sustainability 4 Luxury Casualwear 5 Influencers 6 Social Media 7 Online 8 Omnichannel 9 Mono-Brand Stores 10 Made-in 11 Mix & Match 12 Customization Casual approach to social and professional occasions continues to grow, now affecting 74% of True-Luxury consumers, with still further expected growth in spending (driven by sneakers and jeans) 10 TRUE LUXURY GLOBAL CONSUMER INSIGHT Copyright © 2019 by Boston Consulting Group. All rights reserved. True-Luxury Global Consumer Insight 2019 Edition: the 12 key trends New and Emerging Keeps Growing Stabilizing 1 Collaborations 2 Second-hand 3 Sustainability 4 Luxury Casualwear 5 Influencers 6 Social Media 7 Online 8 Omnichannel 9 Mono-Brand Stores 10 Made-in 11 Mix & Match 12 Customization Their relevance in shaping consumer purchase decisions continues to increase, affecting ~2x as many TrueLuxury consumers in China than in Europe and US 11 TRUE LUXURY GLOBAL CONSUMER INSIGHT Copyright © 2019 by Boston Consulting Group. All rights reserved. True-Luxury Global Consumer Insight 2019 Edition: the 12 key trends New and Emerging Keeps Growing Stabilizing 1 Collaborations 2 Second-hand 3 Sustainability 4 Luxury Casualwear 5 Influencers 6 Social Media 7 Online 8 Omnichannel 9 Mono-Brand Stores 10 Made-in 11 Mix & Match 12 Customization Keep growing in all geographies, by far greatest influence lever in China, soon to overtake magazines in Europe and US 12 TRUE LUXURY GLOBAL CONSUMER INSIGHT Copyright © 2019 by Boston Consulting Group. All rights reserved. True-Luxury Global Consumer Insight 2019 Edition: the 12 key trends New and Emerging Keeps Growing Stabilizing 1 Collaborations 2 Second-hand 3 Sustainability 4 Luxury Casualwear 5 Influencers 6 Social Media 7 Online 8 Omnichannel 9 Mono-Brand Stores 10 Made-in 11 Mix & Match 12 Customization Continues to grow, with over 20% of last purchase occasions online, and contributes to overall market growth more than cannibalizing (~60% in addition to physical, vs 40% ~cannibalization) 13 TRUE LUXURY GLOBAL CONSUMER INSIGHT Copyright © 2019 by Boston Consulting Group. All rights reserved. True-Luxury Global Consumer Insight 2019 Edition: the 12 key trends New and Emerging Keeps Growing Stabilizing 1 Collaborations 2 Second-hand 3 Sustainability 4 Luxury Casualwear 5 Influencers 6 Social Media 7 Online 8 Omnichannel 9 Mono-Brand Stores 10 Made-in 11 Mix & Match 12 Customization Omnichannel – Accounts for 50% overall, with substantial variation by geography (64% China, 42% EU) Mono-Brand Stores – Appear to have stabilized in TrueLuxury consumers' minds, no longer decreasing in a significant way, except for China Made-in – Made-in Italy continues to strengthen its global lead among True-Luxury consumers and among Millennials, and reconquered leadership among Chinese vs Made-in France. Made-in China growing among Chinese (+11pp vs 2014) Mix & Match – Luxury niche and sports brands driving greater shift. Exclusivity and perception of better value are driving consumers to niche brands, whereas comfort and active lifestyle to sportswear brands Customization – Demand stabilized (at high level). Product configuration, made to measure and bespoke products most desired 14 TRUE LUXURY GLOBAL CONSUMER INSIGHT Copyright © 2019 by Boston Consulting Group. All rights reserved. Collaborations Collaborations Collaborations' importance confirmed, with awareness reaching ~90% of True-Luxury consumers Thinking about special editions realized in collaboration with different brands / artists, which of the following statements best apply to you? If you don't know about them select "I am not aware" Overall True-Luxury consumers Driven by younger generations… Gen. Z Not aware 11% 12% 5% Millennials 5% Gen. X 88% 4% 30% 89% 95% 94% 95% 13% 18% 87% 82% 43% 96% 87% 70% 2017 Silvers 13% +1pp Aware Baby Boomers …and Chinese 57% 2018 Note: Limited responses available for Silvers Source: BCG-Altagamma True-Luxury Global Consumer Insight Survey Dec 18/Jan 19 (12K+ respondents in 10 countries) 16 TRUE LUXURY GLOBAL CONSUMER INSIGHT Copyright © 2019 by Boston Consulting Group. All rights reserved. Collaborations Half of True-Luxury consumers have purchased special editions, again driven by younger generations and Chinese Have you ever purchased special editions created by brands in collaboration with different artists/brands? Overall True-Luxury consumers By generation Gen. Z 33% No 50% Millennials By nationality Gen. X Baby Boomers 38% 40% 60% 80% 67% Yes 50% Silvers 55% 47% 45% 86% 62% 60% 40% 20% 53% 14% 2018 Note: Limited responses available for Silvers Source: BCG-Altagamma True-Luxury Global Consumer Insight Survey Dec 18/Jan 19 (12K+ respondents in 10 countries) 17 TRUE LUXURY GLOBAL CONSUMER INSIGHT Copyright © 2019 by Boston Consulting Group. All rights reserved. Collaborations Chinese consumers strongly attracted to collaborations, as they seek cool and different styles Thinking about special editions realized in collaboration with different brands / artists, which of the following statements best apply to you? Overall True-Luxury consumers 89% % of respondents aware of collaboration Cool, new different styles 46% 22% 23% Something new without changing identity Negative impact 96% 34% Special and unique collections Indifferent By nationality 9% 4% 2% 2% 82% 28% 31% 24% 14% 15% 87% 22% 16% 15% 11% 5% 15% 3% Note: First-ranked responses shown Source: BCG-Altagamma True-Luxury Global Consumer Insight Survey Dec 18/Jan 19 (12K+ respondents in 10 countries) 18 TRUE LUXURY GLOBAL CONSUMER INSIGHT Copyright © 2019 by Boston Consulting Group. All rights reserved. Collaborations Handbags and sneakers dominate collaborations and special edition purchases Thinking about special editions created by brands in collaboration with different artists/brands, which category have you ever purchased? Top-purchased product categories among collaborations and special editions 1. Handbags 28% 47% 19% 2. Sneakers 16% 33% 17% 3. Formal shoes 10% 21% 11% 4. Backpacks 9% 20% 11% 5. T-shirts 9% 18% 9% % of special edtion's buyers Source: BCG-Altagamma True-Luxury Global Consumer Insight Survey Dec 18/Jan 19 (12K+ respondents in 10 countries) Female Male 19 TRUE LUXURY GLOBAL CONSUMER INSIGHT Copyright © 2019 by Boston Consulting Group. All rights reserved. Collaborations Top-purchased collaborations relatively consistent across geographies Thinking about special editions created by brands in collaboration with different artistis/brands, which collection did you ever purchased? Top-purchased collaborations Overall By nationality #1 Louis Vuitton & Supreme #1 Louis Vuitton & Supreme #1 Louis Vuitton & Supreme #1 Louis Vuitton & Supreme #2 Adidas & Yeezy #2 Chanel & Pharrell #2 Chanel & Pharrell #2 Adidas & Yeezy #3 Chanel & Pharrell #3 Adidas & Yeezy #3 Gucci & Dapper Dan #3 Fendi & Fila #4 Nike & Off-white #4 Nike & Off-white #4 Adidas & Yeezy #4 Gucci & Gucci Ghost #5 Fendi & Fila #5 LV & Jeff Koons #5 Fendi & Fila #5 Moschino & H&M #6 Louis Vuitton & J. Koons #6 #6 #6 Burberry & G. Rubchinskiy Gucci & Gucci Ghost Chanel & Pharrell Not in global top 6 Source: BCG-Altagamma True-Luxury Global Consumer Insight Survey Dec 18/Jan 19 (12K+ respondents in 10 countries) 20 TRUE LUXURY GLOBAL CONSUMER INSIGHT Copyright © 2019 by Boston Consulting Group. All rights reserved. Fendi & Fila LV & Supreme Burberrry & Rubchinskiy Adidas & Yeezy LV & Jeff Koons Nike & Off-white Gucci & Gucci Ghost Collaborations Chanel & Pharrel Gucci & Dapper Dan Some examples of the most purchased collaborations among True-Luxury consumers 21 TRUE LUXURY GLOBAL CONSUMER INSIGHT Copyright © 2019 by Boston Consulting Group. All rights reserved. Second-hand luxury Second-hand luxury Luxury 2nd-hand market estimated at 22 B€ and growing faster than overall personal luxury... Total personal luxury market size (B€) 2nd-hand luxury market size (B€) +3% +12% 330 361 22 2018E 2021F Share of total personal luxury market1 1. Second-hand personal luxury sales as share of total personal luxury market size Source: BCG True-Luxury Market Model; Analyst reports; Expert interviews; BCG analysis 31 2018E 2021F 7% 9% Note: On the most penetrated categories, and most successful brands, this can rise to 15-20% 23 TRUE LUXURY GLOBAL CONSUMER INSIGHT Copyright © 2019 by Boston Consulting Group. All rights reserved. Second-hand luxury …fueled by four drivers Professionalization of the trade channels Consumer preferences for shorter ownership and sustainability Broader access to iconic, scarce products Access to luxury products at better price/quality ratio Digital platforms replacing consignment shops, and now providing seamless end-to-end experience that guarantees authenticity and quality Luxury consumers exposed to constant flux of styles through social media, not willing to own products forever, and more concerned about sustainability than ever before Scarce luxury products, both iconic products or special capsules, can be readily located on 2ndhand digital marketplaces, which benefit from a far wider reach of suppliers than bricks-and-mortar consignment shops Participation in the 2nd-hand market provides lower purchase prices along with an income opportunity. Younger consumers spending less on products and more on experiences. Source: BCG-Altagamma True-Luxury Global Consumer Insight 2019; Analyst reports; Expert interviews; BCG analysis 24 TRUE LUXURY GLOBAL CONSUMER INSIGHT Copyright © 2019 by Boston Consulting Group. All rights reserved. Second-hand luxury Buying Selling Second-hand luxury Buying Selling Second-hand luxury Most True-Luxury consumers interested in purchasing luxury 2nd-hand products Have you ever purchased second hand / pre-owned luxury items? 60% are interested in purchasing pre-owned luxury items Interested Not interested Driven by 32% Perceived price-quality ratio 19% Look for sold out/ limited edition/ vintage items 17% Thanks to online platforms, there is more transparency on price and authenticity of 2nd-hand market 35% Not interested / would never buy pre-owned 34% Do not trust resellers and afraid of counterfeit goods 13% Afraid of buying products in bad condition 60% 40% 2018 Note: Selected most important answers Source: BCG-Altagamma True-Luxury Global Consumer Insight Survey Dec 18/Jan 19 (12K+ respondents in 10 countries) 27 TRUE LUXURY GLOBAL CONSUMER INSIGHT Copyright © 2019 by Boston Consulting Group. All rights reserved. Second-hand luxury Online the king of 2nd-hand purchase channels Where do you purchase second-hand luxury goods? Which online platforms do you use? 80% purchase pre-owned luxury items online Purchased Have not, but would 26% Online only 37% 34% 43% 40% Offline only 2018 20% Leading platforms by geography 16% Vestiaire Collective Both online and offline Never purchased Most commonly used specialist online platforms 14% Vinted Instant Lux 11% Le Bon Coin 11% Vide Dressing 11% Depop 8% Hardly ever worn it 8% TheRealReal 8% Vite en Vogue 8% 2018 Note: Selected highest-ranked platforms, percentage is number of responses per platform as fraction of total online platform users Source: BCG-Altagamma True-Luxury Global Consumer Insight Survey Dec 18/Jan 19 (12K+ respondents in 10 countries) 28 TRUE LUXURY GLOBAL CONSUMER INSIGHT Copyright © 2019 by Boston Consulting Group. All rights reserved. Second-hand luxury Handbags the queen among True-Luxury second-hand purchases, APAC countries developing an appetite also for SLG and watches You told us that you buy second-hand luxury goods, which category do you mostly purchase? 40% of all pre-owned purchases were handbags… …followed by clothing, with the exception of China and Japan 4% 7% 3% 7% 3% 8% 2% 9% Shoes 9% 7% 8% 7% Watches 10% 8% 6% 9% Jewelry Accessories Small leather goods Clothing 11% 13% 21% 13% 11% 9% 9% 15% 12% 9% 16% 3% 20% 3% 13% 8% 9% 4% 7% 9% 4% 8% 4% 13% 10% 21% 13% 12% 14% 8% 1% 5% 7% 8% 6% 9% 12% 14% 8% 7% 14% 12% 18% 16% 16% 10% 17% 18% 20% 11% 53% Handbags 40% 2018 Brazil 45% China 39% 32% 41% France Germany Italy Note: Category purchased most often is shown (ranked #1 by respondent) Source: BCG-Altagamma True-Luxury Global Consumer Insight Survey Dec 18/Jan 19 (12K+ respondents in 10 countries) 43% 44% Russia South Korea 34% 31% Japan UK 40% US 29 TRUE LUXURY GLOBAL CONSUMER INSIGHT Copyright © 2019 by Boston Consulting Group. All rights reserved. Second-hand luxury Popularity of brands in 2nd-hand market disproportionate to share of 1st-hand sales You told us that you buy second-hand luxury goods, which brand(s) do you usually purchase in second-hand 1 Alexander McQueen greatest score in 2nd-hand index 2 Number of second-hand purchases 3 4 5 Bulgari Chloé Givenchy Bally Omega Mulberry Miu Miu Marc Jacobs Fendi Bottega Veneta Celine Ralph Lauren Tiffany Giorgio Armani Saint Laurent Valentino Cartier Dolce & Gabbana Versace Rolex Hermes Prada Alexander McQueen Balenciaga Dior Burberry Gucci Louis Vuitton Chanel Second-hand index1 1. Share of 2nd-hand purchases divided by brand's share of estimated revenues, for brands with most 2 nd-hand purchases Source: BCG-Altagamma True-Luxury Global Consumer Insight Survey Dec 18/Jan 19 (12K+ respondents in 10 countries) 30 TRUE LUXURY GLOBAL CONSUMER INSIGHT Copyright © 2019 by Boston Consulting Group. All rights reserved. Second-hand luxury Buying Selling Second-hand luxury One-third of True-Luxury respondents sell luxury items, to primarily empty wardrobe and finance new luxury purchases Have you ever sold on / through second-hand platforms? 34% have previously sold luxury items through 2nd-hand platforms Reasons why 44% To empty my wardrobe 21% To finance new Luxury purchases No 66% I find it amusing Yes 34% 17% This is truly sustainable behavior 9% Unhappy with a gift I received 5% Don’t find the item trendy anymore 5% 2018 Source: BCG-Altagamma True-Luxury Global Consumer Insight Survey Dec 18/Jan 19 (12K+ respondents in 10 countries) 32 TRUE LUXURY GLOBAL CONSUMER INSIGHT Copyright © 2019 by Boston Consulting Group. All rights reserved. Second-hand luxury True-Luxury younger generations very interested in potential resale value when purchasing new luxury items During your luxury purchases, do you ever think about / take into consideration in your purchasing behavior the resell value of the goods you are about to buy 44% consider resale value when purchasing luxury Do not consider Consider resale value Gen. Z 43% 56% 44% Attention to resale value decreases with age Millennial Gen. X 57% Silver 76% 78% 24% 22% 50% 65% vs. 34% that actually sell, suggesting potential for segment growth Baby Boomer 50% 35% 2018 Note: Limited responses available for Silvers Source: BCG-Altagamma True-Luxury Global Consumer Insight Survey Dec 18/Jan 19 (12K+ respondents in 10 countries) 33 TRUE LUXURY GLOBAL CONSUMER INSIGHT Copyright © 2019 by Boston Consulting Group. All rights reserved. Second-hand luxury Buying & Selling Second-hand luxury Younger True-Luxury consumers largest participants in 2nd-hand, with supply driven by younger generations and demand driven by older 45% of True-Luxury consumers participate in 2nd-hand market Younger generations bigger sellers, older generations bigger buyers Gen. Z Does not participate Millennial Gen. X 52% 19% 65% 45% participation in 2nd-hand market 15% Purchase only 11% 59% 24% 21% Sell and purchase Silver 46% 55% 62% Sell only Baby Boomer 10% 15% 11% 13% 21% 9% 18% 9% 11% 12% 8% 17% 18% 2018 Source: BCG-Altagamma True-Luxury Global Consumer Insight Survey Dec 18/Jan 19 (12K+ respondents in 10 countries) 35 TRUE LUXURY GLOBAL CONSUMER INSIGHT Copyright © 2019 by Boston Consulting Group. All rights reserved. Second-hand luxury Chinese True-Luxury consumers biased to selling 2nd-hand luxury, while US biased to purchasing 50% Does not participate 57% 57% 11% 15% Sell only 26% 21% 15% Sell and purchase Purchase only 12% 12% 18% 5% Source: BCG-Altagamma True-Luxury Global Consumer Insight Survey Dec 18/Jan 19 (12K+ respondents in 10 countries) 36 TRUE LUXURY GLOBAL CONSUMER INSIGHT Copyright © 2019 by Boston Consulting Group. All rights reserved. Second-hand luxury A marketing & consumer understanding tool A new recruiting channel for consumers and advocates Mainly for brands: Why could certified 2nd-hand be relevant for luxury players? A way to monitor and mitigate brand reputational risk Mainly for retailers: A new profitable source of business 37 TRUE LUXURY GLOBAL CONSUMER INSIGHT Copyright © 2019 by Boston Consulting Group. All rights reserved. Sustainability in luxury Sustainability continues to be a hot topic in luxury 39 TRUE LUXURY GLOBAL CONSUMER INSIGHT Copyright © 2019 by Boston Consulting Group. All rights reserved. Sustainability Influences purchasing behavior Several aspects of True-Luxury consumer behaviors impacted by Sustainability Increases 2nd-hand buying Drives shift toward niche brands Re-defining luxury values Copyright © 2019 by Boston Consulting Group. All rights reserved. 59% of True-Luxury consumers' purchasing behaviors are influenced by sustainability 17% of True-Luxury consumers in the 2ndhand market purchase pre-owned because it is 'truly sustainable behavior' 13% of True-Luxury consumers that shifted spending from traditional to niche luxury brands attributed their shift to sustainability 10% of True-Luxury consumers consider Sustainability a top 3 value when asked to define luxury (+ 1 pp vs 2017) Source: BCG-Altagamma True-Luxury Global Consumer Insight Survey Dec 18/Jan 19 40 TRUE LUXURY GLOBAL CONSUMER INSIGHT Sustainability Consumers increasingly informed about Sustainability, resulting in greater influence over purchase decisions… 56% of consumers investigate a brand's social responsibility For the same product I would choose a brand that supports sustainability rather than a brand that does not I try to get informed whether the brand I buy is socially responsible Completely disagree Disagree 7% 6% 15% 11% 4% 7% 6% 10% 33% Completely agree 12% 2013 36% 56% 20% 2018 12% 26% 32% +12pp Agree 5% 8% 6% 35% 33% +11pp Knowing that a brand cares about sustainability can make a difference to me in choosing it 26% 28% Indifferent For a given item, over 60% would purchase from the more sustainable brand 62% 38% 12% 2013 +10pp 39% 23% 2018 38% 37% 14% 2013 61% 23% 2018 Source: BCG-Altagamma True-Luxury Global Consumer Insight Survey Dec 18/Jan 19 (12K+ respondents in 10 countries) 41 TRUE LUXURY GLOBAL CONSUMER INSIGHT Copyright © 2019 by Boston Consulting Group. All rights reserved. Sustainability …greatest influence on younger generations, and substantial variation across nationalities Does the Sustainability topic influence your purchasing behavior? ~60% influenced by sustainability, reaching 64% of younger generations… All Gen. Z Millennial Gen. X Baby Boomer …and from 81% of South Koreans to less than 50% of UK and US Silver 19% No 41% 36% 36% 44% 54% 59% 64% 64% 56% 46% 34% 34% 38% 46% 63% 81% Yes 30% 70% 66% 37% 66% 62% 54% 55% 55% 57% 45% 45% 43% 2018 Note: Limited responses available for Silver generation Source: BCG-Altagamma True-Luxury Global Consumer Insight Survey Dec 18/Jan 19 (12K+ respondents in 10 countries) 42 TRUE LUXURY GLOBAL CONSUMER INSIGHT Copyright © 2019 by Boston Consulting Group. All rights reserved. Sustainability Sustainable approach to life responsible for 42% of sustainable purchase behaviors… Why is sustainability important to you when it comes to luxury goods? 42% 14% 10% 5% Care about sustainability in my life generally Care about the planet and next generations 5% 4% Trust a Demand more Value highCare about company in transparency quality where /how favor of products that luxury goods sustainability last years) are made 2% Take corporate responsibility seriously Note: Selected responses shown Source: BCG-Altagamma True-Luxury Global Consumer Insight Survey Dec 18/Jan 19 (12K+ respondents in 10 countries) 43 TRUE LUXURY GLOBAL CONSUMER INSIGHT Copyright © 2019 by Boston Consulting Group. All rights reserved. Sustainability …with Environmental and Animal criteria most valued when purchasing luxury goods, driven by younger generations Which sustainability criteria do you value when it comes to purchasing luxury goods? Environment and Animal concerns dominate sustainability criteria… 15% 21% 27% …driven by younger generations, while ethics and materials more important to older consumers 100% Transparency of materials 12% 14% Ethical manufacturing 18% 18% 22% 23% 32% Animal care 36% 25% 23% Environmental care Ethical Transparency manufact. of materials 35% Gen. Z 19% 27% 26% 37% Environmental Animal care care 18% 42% Millennial 34% Gen. X 27% 23% 26% Baby Boomer Silver Note: 12 personal sustainability criteria grouped into above four categories. Limited responses available for Silver which may affect generational trend Source: BCG-Altagamma True-Luxury Global Consumer Insight Survey Dec 18/Jan 19 (12K+ respondents in 10 countries) 44 TRUE LUXURY GLOBAL CONSUMER INSIGHT Copyright © 2019 by Boston Consulting Group. All rights reserved. Made-in Made-In Made-in Italy strengthens its overall lead driven by apparel, handbags and shoes Which country of manufacturing do you consider the best for luxury brands? Overall preferences for made-in1 (%) 29% 21% 12% 2 9% Δ 2014–2018 (pp) +11 +3 +4 -1 7% -4 6% 0 5% 0 Apparel +15 pp 19% 2014 34% 2018 +2 pp Handbags & shoes +18 pp 20% 2014 38% 2018 +2 pp 14% 16% 16% 18% 2014 2018 2014 2018 +3 pp +3 pp Cosmetics & perfumes Jewelry +2 pp -1 pp 15% 17% 21% 20% 2014 2018 2014 2018 +5 pp 35% 40% 2014 2018 = 16% 16% 2014 2018 +3 pp +5 pp 10% 13% 8% 11% 8% 11% 11% 16% 2014 2018 2014 2018 2014 2018 2014 2018 1. Focus on personal luxury (excluding cars, luxury yachts, design and lighting) 2. 57% of True-Luxury consumers show preference for watches made-in Switzerland Source: BCG-Altagamma True-Luxury Global Consumer Insight Survey Dec 18/Jan 19 (12K+ respondents in 10 countries) 46 TRUE LUXURY GLOBAL CONSUMER INSIGHT Copyright © 2019 by Boston Consulting Group. All rights reserved. Made-In Made-in Italy increasingly valued by True-Luxury consumers, improving appreciation among Millennial and Chinese consumers Increasing the gap vs. Made-in France among Millennials 30% Made-in Italy Made-in France 20% Made-in US 10% Striking back to leadership on Chinese 30% Made-in Italy 20% Made-in France 10% Made-in US 2014 2017 2018 2014 2017 2018 Note: Focus on personal luxury (excluding cars, luxury yachts, design and lighting) Source: BCG-Altagamma True-Luxury Global Consumer Insight Survey Dec 18/Jan 19 (12K+ respondents in 10 countries) 47 TRUE LUXURY GLOBAL CONSUMER INSIGHT Copyright © 2019 by Boston Consulting Group. All rights reserved. THANK YOU