Certificate of Payments and Withholdings to Non-residents

Anuncio

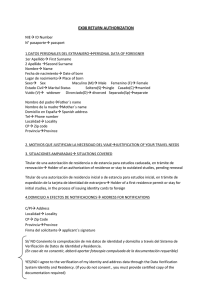

CERTIFICATE OF PAYMENTS AND WITHHOLDINGS TO NON-RESIDENTS FRONT 2016 PAGE NUMBER 1 __________ PAYMENT PERIOD: BEGINNING MONTH ________ ENDING MONTH ______ YEAR _______ IDENTIFICATION INFORMATION OF THE NON-RESIDENT NAME OR NAME OF LEGAL ENTITY OR CORPORATE NAME __________________________________________________________________________________ ADDRESS OF THE NON-RESIDENT (STREET, STREET NUMBER, __ ________________________________________________ POSTAL CODE, CITY, TELEPHONE NUMBER) TAX IDENTIFICATION NUMBER (see instruction 2) ____ _______________________________________ CODE OF THE COUNTRY OF RESIDENCE _________ __________ (see instruction 3) 2 DESCRIPTION OF PAYMENTS MADE A. CODE OF THE RECEIVER OF THE INCOME _________________ B. SURNAME(S) AND GIVEN NAME(S) OR CORPORTE NAME OR NAME OF THE LEGAL ENTITY __ OF THE BENEFICIARY OF THE PAYMENTS C. CODE OF THE COUNTRY OF RESIDENCE OF THE EFFECTIVE BENEFICIARYOF THE PAYMENTS _____ _______ (see instruction 5) D. TAX IDENTIFICATION NUMBER OF THE EFFECTIVE BENEFICIARY____ ____ OF THE PAYMENTS E. CODE OF THE RELATED PARTY___ (see instruction 6) F. PAYMENT CODE ______________________ (see instruction 7) K. INCOME TAX WITHHELD _______ _________________ (see instruction 12) G. SPECIFY ________________________________ (Only when code 40 “Others” is chosen) L. VALUE-ADDED TAX WITHHELD __________________________ (see instruction 13) H. AMOUNT OF PAYMENT _________ (see instruction 9) M. EXEMPTION CODE _____________________________________ I. WITHHOLDING RATE ____________ % (see instruction 10) N. PLACE AN “X” IF A TAX RATE PROVIDED ___________________ BY A DOUBLE TAX TREATY WAS USED (see instruction 14) J. COST OF THE OPERATION _________________ (see instruction 11) 3 INSTRUCTIONS 1. Except in the spaces where it requests information in percentages, the values and amounts required in this form should be expressed in Mexican Pesos (including the balance of loans), currency conversions should be made in accordance with the provisions of the Federal Tax Code. IDENTIFICATION INFORMATION OF THE NON-RESIDENT 2. TAX IDENTIFICATION NUMBER. Note the number or tax identification code of the non-resident in its country of residence for the non-resident that had Mexican source income and where, in case that election is made to generate the certificate, it will be valid. 3. CODE OF THE COUNTRY OF RESIDENCE. This refers to the country of residence of the foreign individual or entity to which payment was made. The country of residence indicated should not necessarily coincide with the country of residence of the effective beneficiary of the income. Write the code of the country of residence in accordance with the list published on the webpage of the Tax Administration Service (SAT). 6. CODE OF THE RELATED PARTY. Write the code that corresponds accordance to the relationship that exists between the taxpayer and the non-resident that has obtained Mexican source income in accordance with the following: A None. B Holding Company. One who has permanent investments, which are understood to be investments made in representative titles of the share capital of other entities with the intention of maintaining those investments for an undefined period. C Controller. One that controls one or more subsidiaries. D Subsidiary. This is the entity that is controlled by another entity, known as the controller. E Associated. This is an entity in which the holding company has significant influence in its administration but without having control. F Affiliate. Those companies that have common shareholders or significant common administration. 12 13 14 15 16 17 18 19 20 21 22 23 24 25 7. PAYMENT CODE. Write the code in accordance to the following: 26 DESCRIPTION OF PAYMENTS MADE 01 4. CODE OF THE RECEIVER OF THE INCOME. Write the code which corresponds to the following: 01 02 03 04 05 06 07 15 20 Artists, athletes and performers Other individuals Entity Trust Joint venture International Organization or Government Exempt organizations Paying agents Others 5. CODE OF THE COUNTRY OF RESIDENCE OF THE EFFECTIVE BENEFICIARY OF THE PAYMENTS. This refers to the country of residence of the individual or entity of the non-resident that is the effective beneficiary of the income. Write the code of the country of residence in accordance with the list published on the webpage of the Tax Administrative Service (SAT). 02 03 04 05 06 07 08 09 10 11 Salaries and wages (except for government services) Independent personal services (except fees to board members and for government services) Fees to board members Interest (Art. 195, fraction I income Tax Act Interest (Art. 195, fraction II Income Tax Act) Interest (Art. 195, fraction III Income Tax Act) Interest (Art. 195, fraction IV, Income Tax Act) Interest (Others) Dividends paid to entities that are the owners of more than 10% of the shares representing the share capital Dividends paid to other persons Royalties for the use or temporary enjoyment of railcars (Art. 200, fraction I Income Tax Act) 27 28 29 30 31 32 40 Royalties (different than the ones in fraction I except technical assistance of Art. 200, fraction II Income Tax Act) Other royalties Technical assistance (Art. 200 fraction II Income Tax Act) Capital gains (alienation of immovable property) Capital gains (alienation of shares or titles of value) Capital gains (others) Remuneration for government services (salaries and wages) Remuneration for government services (pensions) Remuneration for government services (others) Child support Artists, athletes and performers Immovable property (agriculture) Immovable property (royalties for the use of natural resources) Immovable property (use or temporary enjoyment) Immovable property (destined for accommodation or lodging) Immovable property (others) Construction, installation, maintenance and assembly Commissions Income derived from contracts for time-sharing tourist services Income for premiums paid or ceded to reinsurers Income for premiums paid or ceded to captive reinsurers Others 8. The codes corresponding to the income that the nonresident receives may also be applicable when the benefits of an international tax treaty are used. 9. AMOUNT OF PAYMENT. Write the gross amount of the payment to the non-resident that comes from Mexican sources. 10. Write the whole quantities in the field on the left and the fractions up to the ten thousandth in the field on the right without omitting a digit even when the amount is zero. Example: Interest rate equal to 8.09 should be written as: 8 . 0900 BACK 2015 4 FOREIGN FINANCING (see instruction 15) TYPE OF FINANCING ___________ (see instruction 16) DENOMINATION OF ____________________________ THE BASE RATE (1) APPLICABLE INTEREST RATE _____ . ________ % (see instruction 10) A. DATE OF OPENING OF THE _____ _____ _____ FINANCING OPERATION (day, month, year) D. DATE OR FREQUENCY OF CALLABILITY ______________________________ OF THE INTEREST (see instruction 18) B. DATE OF EXPIRY OR DUE DATE _____ _____ ______ OF FINANCING OPERATION (day, month, year) E. PORCENTAGE OF GUARANTEED ________ . ___________ % FINANCING (see instruction 10) C. UNPAID BALANCE AS AT 31 DECEMBER ___________________________ OF THE YEAR, OF THE LOANS THAT HAVE BEEN GRANTED F. REGISTRY NUMBER OF THE ENTITY ________________________________ G. NAME OF THE ENTITY THAT _____________________________________ _____________________________________________________________________________ GUARANTEED THE CREDIT H. ADDRESS OF THE ENTITY THAT _______________________________________________________________________________________________________________ GUARANTEED THE CREDIT (Street, street number, postal code, city, country telephone number) I. CODE FOR THE COUNTRY OF RESIDENCE OF ________________________ THE ENTITY THAT GUARANTEED THE CREDIT K. TOTAL AMOUNT OF ______________________________________________ DEDUCTIBLE INTEREST J. CODE FOR THE COUNTRY OF TAX RESIDENCE _______________________ OF THE EFFECTIVE BENEFICIARY L. NUMBER OF OFFICE OF AUTHORIZATION ___________________________ OF THE NATIONAL BANKING AND SECURITIES COMMISSION OF THE FOREIGN PUBLIC OFFER OF THE SECURITIES ISSUED IN MEXICO 5 INFORMATION ON THE WITHHOLDER FEDERAL TAXPAYERS’ IDENTIFICATION NUMBER _______________ ______________ UNIQUE POPULATION REGISTRY CODE _______________________________ PATERNAL SURNAME, MATERNAL SURNAME ________________________________._____________________________________________________________________ AND NAME(S) OR LEGAL ENTITY NAME OR CORPORATE NAME LEGAL REPRESENTATIVE INFORMATION FEDERAL TAXPAYERS’ IDENTIFICATION ________________ PATERNAL SURNAME, MATERNAL SURNAME ______ _____________________________________________________ AND NAME(S) _______________________________________ SIGNATURE OF THE WITHHOLDER OR LEGAL REPRESENTATIVE 3 UNIQUE POPULATION REGISTRY CODE ______________________ _______________________________________ STAMP OF WITHHOLDER (IF APPLICABLE) ______________________________________________ SIGNATURE OF RECEIPT FOR THE NON-RESIDENT INSTRUCTIONS (Continued) 11. COST OF THE OPERATION. Write the tax cost of the operation for those transactions where the tax was remitted on a net basis (alienation of shares and alienation of immovable property). 12. INCOME TAX WITHHELD. Write the amount of income tax withheld or the income tax remitted by the legal representative of the non-resident. 13. VALUE-ADDED TAX WITHHELD. Write the amount of VAT that was withheld from the non-resident which does not have a permanent establishment nor a fixed base. 14. EXEMPTION CODE. Write the exemption code in accordance with the following: 1 Exemption in accordance with the Income Tax Act. 2 The income was not from a source in Mexico, but does come from Mexico. 3 Exempt in accordance with an international tax treaty. 4 Others. FOREIGN FINANCING 15. This area is compulsory when the field PAYMENT CODE shows code 04, 05, 06, 07 or 08. 16. TYPE OF FINANCING. Write the code that corresponds to the type of financing used in the operation in accordance with the following: a. Bank acceptances b. Letters of credit c. Bridge loan d. Direct e. Asset loan f. Mortgage g. Global line of credit h. Secured loan i. Protocols j. Commercial loan k. Fixed asset loan l. Revolving loan m. Syndicated credit n. Others. 17. REGISTRY NUMBER OF THE ENTITY. Write the corresponding number that in accordance to the Registry of Banks, Financing Entities, Pension and Retirement Funds and Foreign Investment Funds, published in the Official Gazette of the Federation. 18. DATE OR FREQUENCY OF CALLABILITY OF THE INTEREST. Write the date specifying the day, month and year o if applicable, period: monthly, bimonthly, etc. ( 1 ) Example: Libor rate, prime rate, fixed, among others.