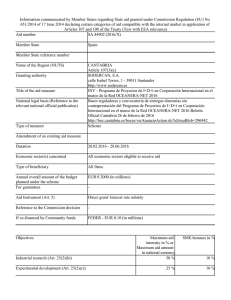

I G I TA L N E W S P R O J E C T D I G I TA L N E W S P R O J E C T D I G I TA L N E W S P R O J E C T D I G I TA L N E W S Reuters Institute for the Study of Journalism PRIVATE SECTOR MEDIA AND DIGITAL NEWS ALESSIO CORNIA, ANNIKA SEHL, AND RASMUS KLEIS NIELSEN 2016 CONTENTS About the Authors Acknowledgements Executive Summary 1. 2. 3. 4. 5. 6. 7. Introduction The Search for New Business Models New Sources of Digital Revenue Approaches to Social Media Approaches to Mobile Approaches to Online Video Conclusion References List of interviewees 5 6 7 11 15 27 35 43 47 53 57 59 PRIvATE SECTOR MEDIA AND DIGITAL NEWS About the Authors Alessio Cornia is a Research Fellow at the Reuters Institute for the Study of Journalism. His research interest is comparative research on journalism, with a focus on news industry developments, digital news, EU journalism, political communication, and risk communication. He comes from a position at the Department of Political Science at the University of Perugia, where he has taught courses on online communication campaigns and digital media studies, and where he was involved in several EU-funded research projects (e.g. ANTICORRP, OPTI-ALERT, and AIM). In 2009 he completed a Ph.D. in Social and Political Theory and Research (University of Perugia). He has published a monograph on EU journalists in Brussels and several articles in academic journals including Media, Culture and Society, the European Journal of Communication, Journalism, Journalism Studies, and Journal of Risk Research. Annika Sehl is a Research Fellow at the Reuters Institute for the Study of Journalism. Her research interests are mainly journalism and comparative research. She comes from a position as post-doctoral researcher at the Institute of Journalism at TU Dortmund University, where she also completed her doctorate, and has been a visiting professor of communication studies at the University of Hamburg. Her teaching has focused mainly on journalism, audience research, and research methods at different institutions in Germany and abroad. She co-authored a book on digital journalism in Germany and has published in a range of academic outlets including First Monday and Media Perspektiven. In addition to her academic experience, she was trained as a journalist with the news broadcaster N24 in Berlin, Hamburg, and Munich. Rasmus Kleis Nielsen is Director of Research at the Reuters Institute for the Study of Journalism and serves as editor-in-chief of the International Journal of Press/Politics. His work focuses on changes in the news media, on political communication, and the role of digital technologies in both. He has done extensive research on journalism, American politics, and various forms of activism, and a significant amount of comparative work in Western Europe and beyond. Recent books include The Changing Business of Journalism and its Implications for Democracy (2010, edited with David A. L. Levy), Ground Wars: Personalized Communication in Political Campaigns (2012), and Political Journalism in Transition: Western Europe in a Comparative Perspective (2014, edited with Raymond Kuhn). 5 PRIvATE SECTOR MEDIA AND DIGITAL NEWS Acknowledgements We would like to thank first and foremost our 54 interviewees for taking the time to share their insights into how private sector legacy news organisations are adapting to a changing media environment. Without their expertise and their willingness to share their thoughts not only on what works, but also what does not (yet) work, this report would not have been possible. We have also benefited from background information from a wider range of interviews conducted by colleagues at the Reuters Institute with editors and strategists at various news organisations, as well as confidential off-the-record conversations with people in similar positions, which has helped us contextualise and interpret the interviews done specifically for this report. Some quotes do not carry names or organisations, generally at the request of those interviewed. We also would like to thank Dr Frank Lobigs, Professor of Media Economics at TU Dortmund University, for a background interview on current business challenges for media organisations, and George Brock, Professor of Journalism at City University London, for his input on the interview questionnaire. Finally, we are grateful for input and support from the team at the Reuters Institute for the Study of Journalism including Antonis Kalogeropoulos, Federica Cherubini, Nic Newman, and Richard Fletcher – as well as Alex Reid, Rebecca Edwards, and Hannah Marsh. Shira Naomi Bick did an excellent job as research assistant. David Levy deserves special mention as he has offered extensive constructive criticism on the entire manuscript. Published by the Reuters Institute for the Study of Journalism with the support of Google and the Digital News Initiative. 6 PRIvATE SECTOR MEDIA AND DIGITAL NEWS Executive Summary In this report, we examine how private sector legacy news organisations like newspapers and broadcasters in six European countries (Finland, France, Germany, Italy, Poland, and the United Kingdom) are adapting to an evolving digital media environment. The analysis is based on 54 interviews conducted between April and July 2016 primarily with executives, senior managers, and editors from a strategic sample of 25 newspapers and commercial broadcasters across Europe, as well as on survey data from the Reuters Institute Digital News Report and secondary sources. We show that: • Newspapers and broadcasters, sometimes criticised for their conservatism, are investing in a wide variety of new digital initiatives to reach new audiences and generate new revenues. All the organisations covered see audiences moving from offline media to online media – quickly in the case of print to digital, and (thus far) more slowly in the case of television to digital. All aim to make a similar move to retain the audience connection upon which both their editorial impact and their business models depend. • In all the countries covered, private sector legacy news organisations reach more people with news than public service media, and more people get news online from newspapers and commercial broadcasters than get news via social media. • Despite their growing online reach, our interviews suggest 80 to 90% of revenues in most newspapers still come from print – even after years of decline in print advertising and circulation and almost 20 years of investment in digital media. Broadcasters generally have an even smaller share of digital revenues, primarily because their legacy operations have not yet been affected by the rise of online media to the same extent, but also because they have often been less focused on building a business around digital news. • As revenues from legacy operations are generally declining (print) or at best stable (broadcast) and digital revenues still limited, the resources for investments in digital initiatives generally continue to come from cross-subsidies and/or cost-cutting elsewhere in each organisation. • In terms of the business of digital news, interviewees highlight the following challenges when it comes to advertising: o the dominant role of large technology companies like Google and Facebook that attract a large share of online advertising; o the low average revenues per user, especially on the mobile web; o the growing number of people who use ad-blockers. • The challenges around advertising mean that more and more newspapers are moving to various forms of pay models, with the exception of a few high-profile titles with very large audiences. Only a minority of online news users have been willing to pay so far, but interviewees are cautiously optimistic that the number will grow. 7 PRIvATE SECTOR MEDIA AND DIGITAL NEWS • Commercial broadcasters are generally seeking to replicate the television model of advertisingsupported content free at the point of consumption in their approach to digital media. For many, news is a very small part of their overall business. • Beyond the turn to pay models, private sector legacy news organisations (especially newspapers) are exploring other alternative sources of revenue to supplement display advertising and subscription, including: o the launch of new verticals (content offerings beyond the organisations’ main brands), repackaged content products, and sections aimed at cultivating specific audiences more effectively; o investment in native advertising and branded content activities that are more effectively differentiated from generic display advertising; o diversification with a move into e-commerce, business-to-business services, and offline activities including events and merchandising. • Social media enable news organisations to reach a wider public, in particular younger people and other audiences who do not normally come direct to their sites or apps, but also imply a number of challenges related to editorial control, brand recognition, audience data, audience loyalty, and monetisation. • Many news organisations covered here are experimenting with distributed content formats (e.g. Facebook Instant Articles and Snapchat Discover), and see potential for synergy between publishers and platforms. Most selectively engage but want to evaluate the first results in term of reach and revenue before they decide how much to engage and with what. Other news organisations, in particular in France and Germany, have been more reluctant so far to distribute their content through third-party platforms and aim to be more self-reliant. • News organisations are addressing the growth of smartphone use by adapting their content to mobile devices, creating dedicated teams, adopting mobile-first approaches and focusing on the development of their news apps. However, the mobile advertising market is still much less developed than the desktop advertising market, and this represents a central challenge for the business of mobile news. • Online video advertising is growing fast and several news organisations are therefore investing in online video production and curation, strengthening their online video teams, experimenting with new formats and technologies (e.g. virtual reality, 360-degree, and social video), and seeking new ways to monetise online video news. • All our interviewees expect to see audiences and advertising continue to move from offline to online media, and expect to see the digital media environment itself continue to change, driven by evolving forms of use, new technologies, and initiatives from large technology companies. Individual organisations are adapting to this with varying degrees of success, but no clear generally applicable model(s) for sustainable digital news production have been developed so far. Every organisation examined is experimenting and forging its own path, seeking a balance between exploiting legacy operations, building digital operations, and exploring the opportunities ahead. Experimentation and exploration are an uncertain business, but encouraging in themselves – it is because of their decision to invest in the future that newspapers and commercial broadcasters continue to be central to an increasingly digital media environment. 8 PRIvATE SECTOR MEDIA AND DIGITAL NEWS This report is the first of a series of annual reports that will focus specifically on how European private sector legacy news organisations are adapting to the rise of digital media. 9 PRIvATE SECTOR MEDIA AND DIGITAL NEWS 1. Introduction The continued development and use of digital media technology present private sector media with a range of evolving challenges and opportunities. How they deal with them is important not only for their own development, but also for news production and distribution more broadly. Private sector legacy news organisations – newspapers and broadcasters – have significant audience reach across their offline and online platforms and invest more in news production than anyone else, including public service media and digital-born news operations. Data from the 2016 Reuters Institute Digital News Report show that newspapers and commercial broadcasters together reach more people with news online than public service media, and that more people say they get news online from private sector legacy news organisations than get it via social media (Newman et al. 2016). One relatively recent analysis from the UK suggests the newspapers alone account for 68% of all editorial investment there, and commercial broadcasters a further 10% (Mediatique 2012). Clearly, private sector legacy news organisations continue to be of central importance to our media environment (Nielsen 2012). In this report, we focus on how a sample of 25 different private sector legacy news organisations in six European countries are adapting to an evolving digital media environment, especially in terms of dealing with the business of digital news, the rise of social media, the move from desktop internet to an increasingly mobile web, and the growing importance of online video. The countries covered are Finland, France, Germany, Italy, Poland, and the United Kingdom. Together, they represent a range of different European media systems. The report is based on interviews conducted between April and July 2016 with 54 people, primarily executives, senior managers, and editors at private sector news organisations with a background in television broadcasting and newspaper publishing (see the list of interviewees in the appendix). In each country we selected four private sector media companies: one commercial television broadcaster, two national newspapers (one upmarket daily and one mid-market or tabloid newspaper, when possible), and one regional newspaper (two in Germany, where regional newspapers make up much of the industry). Table 1.1 shows the list of organisations covered. The purpose of the sample is to cover a wide range of different types of private sector legacy news organisations operating in different contexts. In a previous report, we have analysed how public service media in the same six countries are adapting to the same changes in the media environment (Sehl et al. 2016). The focus of the report is on how these different newspapers and commercial broadcasters are responding to the evolving challenges and opportunities of digital media. We analyse them together here because they have two things in common. First, unlike digital-born news organisations, they have engaged with the rise of digital media from a legacy starting point that gives them resources including brand reputation, loyal audiences, and revenues to invest in news production, but also means that they have set ways of doing things and are more constrained by tradition than pure players operating only on the internet (Boczkowski 2004, Christensen et al. 2012, Küng 2015). Second, unlike public service media, they will only survive if they continue to operate a sustainable business. 11 PRIvATE SECTOR MEDIA AND DIGITAL NEWS Table 1.1 News organisations covered in this study Finland France Germany Italy Poland UK National newspaper Helsingin Sanomat Le Monde Süddeutsche Zeitung La Repubblica Gazeta Wyborcza Daily Telegraph National newspaper Iltalehti Le Figaro BILD Il Corriere della Sera Fakt Daily Mail Commercial television MTv TF1 RTL and n-tv* Mediaset TvN24 ITv La Voix du Nord Rheinische Post and Westdeutsche Allgemeine Zeitung Il Resto del Carlino Dziennik Zachodni Manchester Evening News Regional newspaper Aamulehti** * In addition to RTL, i.e. the main German private sector TV channel, we included n-tv, the news channel belonging to the same media group (Mediengruppe RTL Deutschland). ** For the Finnish regional newspaper Aamulehti we did not conduct interviews directly with the newspaper’s representatives, but with a representative of Lännen Media which produces nationwide content for 12 Finnish regional newspapers including Aamulehti. It is important to underline that these organisations face this digital future from very different starting points, depending on the individual organisation and the country in which it operates. Print newspaper readership and advertising are in clear decline, whereas television viewing and television advertising markets have, until recently, seemed more stable. Countries differ in terms of the pace of print decline, trends in television, and the development of digital media. Table 1.2 shows a number of key indicators in terms of the structure of media use and advertising markets in each country to provide some context for the analysis. As is clear from Table 1.2, the countries covered represent quite different media systems. All have higher levels of internet use, smartphone use, and social media use than the global average, though Italy and Poland have significantly lower levels of internet penetration than the other four countries. Print newspaper circulation is declining in all six countries, but from very different levels. Television viewing varies too. These differences in media use in turn also influence the advertising market across platforms. The basic business issues faced by private sector legacy news organisations in this environment have been clear for more than a decade. Revenues from print are in decline, television so far has been more stable in most countries (but news is marginal to the business), and while the overall digital economy is growing rapidly, digital gains do not make up for print losses for newspapers, and digital revenues are very small compared to legacy revenues for television. Advertising has so far been the most important source of digital revenue, but publishers have struggled to build a sustainable business on this alone, because of their cost structure, because dominant international players like Google and Facebook capture a large share of the overall market and because supply outstrips demand, leading to low advertising rates and commodification of content. Three developments in particular represent further challenges and opportunities for private sector news organisations, namely the growing importance of social media, the rapid move to a more mobile-centred media environment, and the promise of online video. All of our interviewees see this as a radically different environment from the desktop and search-dominated internet of the past 12 PRIvATE SECTOR MEDIA AND DIGITAL NEWS Table 1.2 Six-country overview population (millions) Finland France Germany Italy Poland UK 5.5 66.8 81.4 60.8 37.9 65.1 MediA uSe television viewing per person (2013) (minutes per day) 174 226 221 261 247 232 Change in tv viewing 2012–13 (minutes per person per day) -1.7% -1.7% -0.5% 1.6% 1.6% -3.7% Newspaper circulation per 1000 adult population 338 117 232 61 61 185 Change in newspaper circulation 2010–15 -22% -15% -17% -35% -37% -31% internet penetration 94% 84% 88% 62% 68% 93% Facebook use (of all internet users) 64% 57% 52% 71% 67% 63% Social media as a source of news (of all online news users) 45% 40% 31% 54% 58% 35% Smartphone use for news (of all online news users) 59% 44% 40% 53% 58% 46% Combined online reach of private sector legacy news organisations 62% 43% 49% 61% 70% 59% Combined online reach of public service media 44% 15% 23% 15% 11% 51% AdveRtiSiNg expeNdituRe Size of the national advertising market (€ millions) Advertising expenditure per capita (€) 1,122 10,046 19,409 7,003 1,571 18,588 205 150 238 115 41 285 Advertising expenditure per media (share of the whole national advertising market) Newspapers (print) 37% 8% 24% 9% 3% 13% Television 23% 32% 23% 47% 53% 25% Internet 23% 31% 30% 26% 24% 47% Change in Tv advertising 2010–14 -0.4% -6% 9% -27% 5% 17% Change in newspaper advertising 2010–15 -25% -26% -20% -50% -63% -31% Change in advertising expenditure Sources: World Bank (2016) for population per country in 2015; EAO (2014) for television viewing per person in 2013; WAN-IFRA (2015) for newspaper circulation in 2014 (average circulation of daily paid-for newspapers per 1000 adult population); Internet World Stats (2016) for internet penetration in 2014; Newman et al. (2016) and additional analysis on the basis of data from digitalnewsreport.org for Facebook use in 2016 (Q12a ‘Which, if any, of the following social networks have you used for any purpose in the last week?’), for social media use as a news source in 2016 (Q3 ‘Which, if any, of the following have you used in the last week as a source of news?’), for smartphone use for news in 2016 (Q8b ‘Which, if any, of the following devices have you used to access news in the last week?’), and for online reach of private sector and public service media (Q5b ‘Which, if any, of the following have you used to access news in the last week?’); WAN-IFRA (2016a) for size of the national advertising market (total advertising expenditure in € millions, exchange rates GB£/€ and Zloty/€ 31 Dec. 2014) in 2015 (in 2014 for the UK) and advertising expenditure per media in 2015 (in 2014 for the UK); Our calculation based on WAN-IFRA (2016a) data on size of the national advertising market in 2015 (in 2014 for the UK) and World Bank (2016) data for population per country in 2015 for advertising expenditure per capita; EAO (2016) for change in TV advertising expenditure; WAN-IFRA (2015) for change in newspaper advertising expenditure (2014 vs 2010 for the UK, 2015 vs 2010 for the other countries). 13 PRIvATE SECTOR MEDIA AND DIGITAL NEWS and highlight the pace and the profound nature of the change under way as a major challenge – even as many are optimistic that they are well positioned to seize the opportunities ahead. The question is how to respond as the situation continues to evolve. As Jason Mills, head of digital at ITv News, told us: There is continuous change in digital journalism … just staying even in touch is a challenge in itself for any newsroom with limited resources. Where do you focus? You can’t be everywhere … and the focus of six months ago might be a completely different focus now, and it might change again in six months’ time.1 The rest of this report focuses on how different private sector legacy news organisations like newspapers and broadcasters are dealing with these challenges and opportunities. In section 2 we review the search for new business models. Then, we turn to new sources of digital revenues. In section 4, we discuss approaches to social media. In section 5, we turn to mobile strategies. Finally, we discuss approaches to online video. Throughout, we provide examples of some of the initiatives our interviewees from across Europe have shared with us. 1 Jason Mills, head of digital, ITv News, interviewed by Alessio Cornia in London on 26 May 2016. 14 PRIvATE SECTOR MEDIA AND DIGITAL NEWS 2. The Search for New Business Models Legacy revenues from print and television remain critically important for all the organisations covered here, as they do more broadly across the news industry. Despite years of decline in highincome democracies, 93% of global newspaper revenues still come from print, and in many newspapers print operations still subsidise digital operations (WAN-IFRA 2015). Similarly, revenues from traditional television far outstrip digital revenues for the broadcasters we cover. Managing legacy operations while simultaneously developing new digital operations remains a central challenge. Private sector legacy news organisations thus need to operate as what management scholars call ‘ambidextrous organisations’ (O’Reilly and Tushman 2004), simultaneously attending to the products and processes of the past, while also preparing for a very different future. In newspapers, the balance between past and future is generally based on a combination of eroding legacy revenues, across-the-board cost-cutting, and investment in digital operations with the aim of moving beyond traditional business models to a digitally sustainable future. So far, the rapid decline in legacy revenues and the much slower growth of digital revenues has been accompanied by very significant cuts in most organisations and in many cases sharp declines in the market value of news media. Catherine Joly, general secretary of the Le Monde Group, argues that organisations such as her own need to continually rationalise legacy operations and cut printing, distribution, and production costs to remain sustainable and be able to invest in digital opportunities. Despite the declining figures, the traditional print business still represents around 80% of Le Monde revenue.2 An 80–20 or 90–10 split between legacy and digital revenues is common across the newspapers covered and most titles are seeing total revenues fall year-onyear as legacy declines continue to outpace digital growth. The main difference here is the pace of change and the implications for how urgently a given organisation needs to change to ensure longer term sustainability. As Magdalena Chudzikiewicz, chief digital officer and member of the board of Polska Press Grupa, says, ‘[news organisations in] countries like Poland that have experienced a big drop in press revenues in recent years have had to develop much more quickly online than in countries that still enjoy stable press revenues’.3 In contrast, in markets like Germany, where the decline in print circulation and advertising has been less severe, publishers have ‘a bit more time for the transformation’ says Stefan Plöchinger, digital editor Süddeutsche Zeitung and editor-in-chief of SZ.de.4 In television, in contrast, the balance is generally based on the belief that legacy revenues will continue to be stable for the foreseeable future and investment in digital operations is more aimed at maintaining brand awareness, enhancing image, and connecting with younger audiences with the aim of drawing them to traditional television, rather than at developing independently profitable digital operations.5 A representative of a broadcasting organisation explained off-the-record: Television hasn’t yet had the same decline that newspapers saw. … So, in many ways that presents a challenge because the necessity is not quite so ... the time span is much longer so there isn’t like a [situation where] we have to sort it out now.6 2 3 4 5 6 Catherine Joly, general secretary, Le Monde Group, interviewed by Alessio Cornia in Paris on 19 May 2016. Magdalena Chudzikiewicz, chief digital officer and member of the board, Polska Press Grupa, interviewed by Annika Sehl in Warsaw on 8 June 2016. Stefan Plöchinger, digital editor Süddeutsche Zeitung and editor-in-chief SZ.de, interviewed by Annika Sehl in Munich on 20 May 2016. Television has been more stable than print in terms of audience and advertising, but some argue the sector still faces a ‘slow crisis’ as average audiences are rapidly growing older, television viewing amongst younger people is rapidly declining, and other players seem better positioned to dominate online video (see Nielsen and Sambrook 2016). Quote not for attribution. 15 PRIvATE SECTOR MEDIA AND DIGITAL NEWS Łukasz Dulniak, social media and new projects manager at the Polish channel TvN24, says that their ‘core business is still traditional television’, but they ‘keep up with digital developments’ not only to ‘chase the audience’, but also to market the company brand and ‘to keep the image of the company as an innovator’.7 Similarly, Jason Mills, head of digital at ITv News, highlights how the digital strategy of ITv News ‘is more about brand than it is about monetisation; … News is not there to perform a revenue-generating opportunity, it’s to create a good brand as part of the wider ITv brand.’8 2.1. Building Digital Audiences Because of the different trends affecting legacy revenues in the newspaper and television sectors, newspapers and broadcasters have so far developed diverse perspectives on the urgency to change and very different approaches to digital. Across all the six countries covered, leading newspapers have invested more aggressively in digital than most commercial broadcasters have. As Figure 2.1 shows, the investments seem to have helped them build bigger digital audiences. Most of the newspapers we cover here have higher reach online than offline, and also in many cases have higher online reach than broadcasters with far higher offline reach. In contrast, most broadcasters still have much higher offline than online reach. Figure 2.1 Offline and online reach of the covered commercial broadcasters and national newspapers (% weekly usage) # " #&" ,I?>I1O\/4L,07" !%" $'" [1I3=YA=Y/V>YCD>?/4L,07" &" :1/;CY<1/4LFE7" #!" #)" Z=I</4JKF7" 0123N>N1M3" #%" %" %" :1/L=A>MC/4LFE7" !" VW<<1H?3UO1/X1=?HYA/4JKF7" '*" #!" #)" ')" :>/F1NHTTI=U>/4,-E7" ,I/BCMM=1M1/<1II>/V1M>/4,-E7" $#" $!" J>R1?>/SQTCMUR>/489:7" #%" %" L>G?/489:7" #'" P>=IQ/;>=I/4567" *" -1I1AM>NO/4567" $&" $'" #(" &" ;-.'/0123/4L,07" !%" %" '$" -L#/4LFE7" ZMC><U>3?1M3" ''" $!" +#" &" F-:/>G?H1II/4JKF7" '!" ##" ;1<=>31?@-ABCD/4,-E7" !'" $%" %" +'" -.0/489:7" ,-./0123/4567" !" )" !#" '#" #)" $)" ')" 9]=Y1/M1>UO/4^7" +)" !)" *)" ()" 9YI=Y1/M1>UO/4^7" Source: Newman et al. (2016) and additional analysis on the basis of data from digitalnewsreport.org. The offline reach is the percentage of respondents who, in each country, recall having used for news in the previous week a brand (listed among other broadcasters and press brands). Online reach is the percentage of respondents who recall having used for news a brand (listed among other online brands). 7 Łukasz Dulniak, social media and new projects manager, TvN24, interviewed by Annika Sehl in Warsaw on 8 June 2016. 8 Jason Mills, head of digital, ITv News, interviewed by Alessio Cornia in London on 26 May 2016. 16 PRIvATE SECTOR MEDIA AND DIGITAL NEWS The question is, then, what kind of business can be built around these audiences? Traditionally, the news business was based primarily on advertising and sales (Hamilton 2004, Picard 2011), with readers’ and viewers’ attention sold to advertisers and news content made available either free at the point of consumption (for broadcast television) or for pay (most newspapers and some cable/satellite television). With the exception of some specialist brands (such as business newspapers) and a few outliers, the general approach to digital news in the 2000s converged on an advertising-supported model with news made available free of charge to users with a view to growing audiences to a size where it was hoped advertising revenues alone would sustain the business. While some news organisations have succeeded in attracting very large audiences online, the business has continued to be difficult as many advertisers prefer alternative online options and the abundant supply means advertising rates are generally very low. As Malcolm Coles, director of digital media at the Telegraph, explains: A newspaper reader on average tends to give more revenue to the company than a digital reader. Most news markets around the world have seen a sort of long-term decline in the sale of print products, and the rise in digital for most of them has yet to replace that revenue. So I guess the big opportunity is being able to get your brand in front of many more people, and the big challenge is how do you make money out of doing that?9 The underlying shift here is from a situation in the 1990s where media organisations had considerable market power because advertisers had few alternatives to print and television, to a situation in the 2010s where media organisations have far less market power because advertisers have many alternatives, including both highly targeted search and social advertising, advertising on digital-born content sites, specialised sites for classified advertising (real estate, automotive, jobs, etc.), and the rise of ‘content-less advertising’ around auto-generated services on price comparison sites and the like. The abundant supply and intense competition has driven down advertising rates, and the situation publishers face is effectively captured by Kevin Beatty, CEO of dmg media, the consumer publishing part of the Daily Mail and General Trust plc (DMGT plc), who says: ‘In digital media everybody is your competitor. … There is more competition for advertising in digital than advertising to go around.’10 2.2. The Difficulties of Digital Advertising Interviewees point to three main reasons why the digital advertising market is getting more difficult for news media, supported by the data in Table 2.1. 1. The dominant positions of large US-based technology companies like Google and Facebook in the digital advertising market, due to their attractive products and very high number of users, which enables them to sell larger audiences, more targeted advertising, and at lower rates than those of traditional news providers. Their position varies by country, but, globally, Google is estimated to attract over 30% of all digital advertising, and Facebook over 10% (Seetharaman 2016). Donata Hopfen, publishing director and head of management board of the BILD-Group, clearly explains how these developments in the digital advertising market have led the group to adopt a new business model: ‘Large platforms take out large portions of the money [in the digital market], so we have concluded that we will not succeed with advertising revenues alone to finance the digital business. [So] we are looking for new business models.’11 9 Malcolm Coles, director of digital media,Telegraph Media Group, interviewed by Alessio Cornia in London on 9 June 2016. Kevin Beatty, CEO, dmg media, interviewed by Alessio Cornia in London on 10 May 2016. 11 Donata Hopfen, publishing director and head of management board, BILD-Group, interviewed by Annika Sehl in Berlin on 21 July 2016. 10 17 PRIvATE SECTOR MEDIA AND DIGITAL NEWS 2. The rapid move from desktop to mobile in digital news consumption. Many of the organisations we have spoken to already get a large majority of their traffic from mobile devices, and the mobile advertising market is challenging because rates are low, as there is less space on the screen for advertising and advertising slows down load times, driving readers away. Antti Haarala, head of digital services at the tabloid Iltalehti in Finland, comments: ‘People are using mobile more and more, but we are not yet getting the revenue out of it that we would like to get’.12 Furthermore, technology companies, especially Facebook, are even more dominant in mobile advertising than in desktop advertising. 3. The rise in the use of ad-blocking software is also threatening the digital advertising revenues of news providers. Table 2.1 shows how the use of ad-blockers is particularly high in some countries: France, Germany, Finland, and, especially, Poland. Marek Kopeć, product manager of Fakt24.pl, online asset of the Polish tabloid Fakt, stresses the relevant implications of this trend: ‘We know that there is no future in display advertising.’13 Although the rise of ad-blocking software is a worry in many news organisations, only a few have adopted concrete actions to combat it. Among the news organisations covered in this report, BILD is the first national brand to adopt a ‘no ad, no content’ strategy to combat the use of ad-blockers (see the box). Table 2.1 Digital advertising figures Finland France Germany Italy Poland UK internet advertising expenditure per head in 2014 Fixed internet (GB£) Mobile internet (GB£) n/a n/a 44 1 51 3 19 2 12 0 84 25 24% 30% 25% 20% 38% 21% Ad-blockers Use of ad-blocking software (of all online news users) Sources: Ofcom (2015) for internet advertising expenditure (internet advertising is spending by advertisers on paid search, banner/display, classified, video, and other online formats; fixed internet advertising refers to spend on adverts viewed on laptop and desktop computers; mobile advertising includes all advertising delivered to mobile devices). Newman et al. (2016) for ad-blockers (QAD3 ‘Do you currently use software on any of your personal devices (e.g. laptop, smartphone etc.) that allows you to block adverts on the internet, e.g. Adblock plus?’). 12 13 Antti Haarala, head of digital services, Iltalehti, interviewed by Annika Sehl in Helsinki on 2 June 2016. Marek Kopeć, product manager of Fakt24.pl, interviewed by Annika Sehl in Warsaw on 10 June 2016. 18 PRIvATE SECTOR MEDIA AND DIGITAL NEWS The ‘No Ad, No Content’ strategy of BILD Source: Screenshot from bild.de with active ad-blocker. In October 2015, the tabloid BILD was the first major newspaper in Germany to block all content on their website for users with an active ad-blocker. Since then, BILD has asked their users: • to turn off their ad-blocker, or to whitelist the site (giving detailed information on how to do this), or • to pay €1.99 a month for BILDsmart, a version with 90% less ads and 50% faster loading time. As a result, BILD reported that the ad-block ratio was reduced by 80% after three months. At the same time, the marketable reach increased by about 10% (Deutz and Fard-Yazdani 2016). In addition to the ‘no ad, no content’ strategy, the publishing company Axel Springer has also gone to court against ad-blocking firms. The case is still ongoing. 2.3. The Move to Pay Models Increasingly, newspaper publishers are experimenting with various alternatives to the free, advertising-supported model that has been the standard approach for so long. Starting with experiments in France and Germany in 2010 and later in the United States from 2011, various pay models have been developed, ranging from hard paywalls where only paying readers can access content, or ‘freemium’ models where some content is only for paying readers with the rest being freely accessible, to metered models where users can read a set number of articles per month or week before they are asked to pay. Some publishers report they are making progress. Donata Hopfen highlights BILD’s ‘freemium’ approach, a strategy pursued since 2013, and says: ‘BILDplus, our paid content offer, actually duplicates our successful print business in the digital space. We currently have over 320,000 subscribers on a monthly basis’.14 Table 2.2 shows the percentage of internet users who say they have paid for online news in the last year (in the form of a digital subscription, combined digital/print offer, or one-off payment for an article or e-edition) as well as the average amount people say they have paid. Higher median figures in some countries suggest more subscriptions, lower median figures in others suggest more one-off payments for individual articles or issues. 14 Donata Hopfen, publishing director and head of management board, BILD-Group, interviewed by Annika Sehl in Berlin on 21 July 2016. 19 PRIvATE SECTOR MEDIA AND DIGITAL NEWS Table 2.2 Digital sales figures Finland France Germany Italy Poland UK 15% 11% 8% 16% 20% 7% 40 33 36 28 9 82 paying for online news Proportion that paid for online news in the last year Yearly median payment for online news (GB£) Sources: Newman et al. (2016) for paying for online news (Q7a ‘Have you paid for online news content, or accessed a paid-for online news service in the last year? This could be digital subscription, combined digital/print subscription or one-off payment for an article or app or e-edition’ and OPTQ7bi ‘How much have you paid for online news content, or for access to a paid online news service in the last year?’). 2.4. Differences in Strategies and Adopted Business Models Though pay models are increasingly widely used, newspapers have not converged on any one approach and many still operate free models. Table 2.3 illustrates the basic business models adopted by the news organisations we cover. It also provides information on the news organisations’ main sources of digital revenues and on the digital contribution to their overall revenues. The table is based on information collected during interviews. In many cases, the table provides only general information, rather than precise numbers, because data on news brands’ revenues and revenue composition are not necessarily public information. These data have therefore to be treated with caution but provide a general indicator of the different approaches adopted. 20 PRIvATE SECTOR MEDIA AND DIGITAL NEWS Table 2.3 Business models and main sources of digital revenue Country Finland Brand Main source of digital revenue Business model on digital (reported information) Italy (reported approx. shares of the total revenue or reported information) Helsingin Sanomat Metered paywall n/a Minority (most of the revenue from print) Iltalehti Freemium Ads Balanced between digital ad print MTV Ads based* Ads Ads (display and instream video ads) Over 10% and growing Le Monde Freemium Similar shares for ads and subscriptions Approx. half of digital revenues from ads and half from subscriptions (but subscriptions are growing fast) Slightly less than 20% from digital (BL**) Le Figaro Freemium Ads Approx. 90% from ads 25% from digital (GL***) TF1 Ads based* Ads France Germany Details on the main source of digital revenues Digital contribution Minority (most of the revenue from TV) Approx. 60% from ads, 40% from subscriptions (but subscriptions are growing fast) 3% from digital (BL**) La Voix du Nord Metered paywall Ads Süddeutsche Zeitung Metered paywall Similar shares for ads and subscriptions Minority (most of the revenue from print) BILD Freemium n/a n/a RTL Ads based* Ads Minority (most of the revenue from TV) Rheinische Post Metered paywall Ads 10% from digital (BL**) Westdeutsche Allgemeine Zeitung Ads based*, pay model planned Ads Minority (most of the revenue from print) Il Corriere della Sera Metered paywall Ads La Repubblica Ads based* Ads 13–15% from digital (BL**) Mediaset (TgCom) Ads based* Ads Minority (most of the revenue from TV) Il Resto del Carlino Ads based* Ads 10% from digital Approx. 3/4 from ads and 1/4 from digital subscriptions Minor (most of the revenue from print) Source: Approximate figures and other information collected during the interviews. Data should be carefully interpreted as a general indicator of industry trends, rather than precise figures on the digital business performances of individual news organisations. * Ads based means that the business model is mainly based on different kind of advertising (e.g. display, pre-rolls, native etc.). Some of the news organisations have also other sources of digital revenue (e.g. subscription to e-papers). **BL= brand level (digital contribution to the overall news brand’s revenues). ***GL= group level (digital contribution to the overall group’s revenues). Continued overleaf... 21 PRIvATE SECTOR MEDIA AND DIGITAL NEWS Table 2.3 continued Country Poland UK Brand Main source of digital revenue Business model on digital (reported information) Details on the main source of digital revenues Digital contribution (reported approx. shares of the total revenue or reported information) Gazeta Wyborcza Metered paywall with elements of hard paywall Similar shares for ads and subscriptions Minority (most of the revenue from print) Fakt Ads based* Ads Minority (most of the revenue from print) TVN24 Ads based* n/a n/a Dziennik Zachodni Freemium Ads Minority (most of the revenue from print) 30% of ads revenues come from digital Daily Telegraph Metered paywall Ads, subscriptions, commerce Majority of the revenue still from print Mail Online Ads based* Ads Minority (most of the revenue from print) ITV News Digital news is cross subsidised by other broadcasting activities n/a Minority (most of the revenue from TV) Manchester Evening News Ads based* Ads Minority (most still from print) Source: Approximate figures and other information collected during the interviews. Data should be carefully interpreted as a general indicator of industry trends, rather than precise figures on the digital business performances of individual news organisations. * Ads based means that the business model is mainly based on different kind of advertising (e.g. display, pre-rolls, native etc.). Some of the news organisations have also other sources of digital revenue (e.g. subscription to e-papers). **BL= brand level (digital contribution to the overall news brand’s revenues). ***GL= group level (digital contribution to the overall group’s revenues). Two trends emerge from Table 2.3. First, all the broadcasters covered in this study rely on advertising for their digital revenues, in line with their historic reliance on a free, advertisingsupported model. Not a single commercial broadcaster pursues a pay model for digital news. Andrea Delogu, deputy general director of the information directorate at Mediaset in Italy, explains that offering news free of charge is almost a natural choice for commercial broadcasters: We are aware that our TgCom24 system (TV, radio, internet and mobile) is doing so well on digital not only because of our high quality news, but also because our offer is free of charge (except for a SMS news offer that is active from several years). Furthermore, our business model for television broadcasting is based on free content. As a result, we are consistently inclined to transfer the same business model also on the other media.15 Second, newspapers increasingly rely on pay models. As the table illustrates, 13 out of 19 newspapers where we did interviews operate a pay model. In France, Germany, and Finland all the national and regional newspaper organisations covered are pursuing some kind of pay model (or 15 Andrea Delogu, deputy general director of the information directorate, Mediaset, interviewed by Alessio Cornia in Milan on 28 Apr. 2016. 22 PRIvATE SECTOR MEDIA AND DIGITAL NEWS are planning to do it soon).16 Metered paywalls and freemium models are the most common approaches. Stefan Plöchinger explains why Süddeutsche Zeitung chose to adopt a metered paywall in 2015: We want to attract new people. People who come to our website should feel so good about it that they come back. When they come back they often return many times and it is up to us to define a limit of five or six times a week. And then we say: ‘Okay, now it would be really nice if you would pay’ … So a very classic funnel logic.17 One of the strategies adopted by Süddeutsche Zeitung in order to activate the funnel logic is to offer trial access to their best news stories to convert readers into subscribers. Plöchinger reported that the most successful case was a story on Afghan refugees that generated 1,600 subscriptions.18 Catherine Joly, general secretary of the Le Monde Group, explains that since they had already reached a big audience base with their free offer, Le Monde decided to adopt a freemium model some years before their main competitors implemented any form of paywall. They have established two different homepages, one addressed to non-subscribers and one, with a better selection of news and premium content, that is accessible only to those who pay. They have established special teams within their newsroom to focus on this content and services, working closely with the marketing department in order to develop better offers for subscribers. According to Joly, subscriptions are growing fast and generate approximately half of their digital revenue.19 Also the French regional newspaper La Voix du Nord adopted a paywall solution (see the box overleaf). 16 In these countries, many news providers introduced one of these paid models years ago; some, such as the Finish Iltalehti, the French Le Figaro, and the German Süddeutsche Zeitung, have recently introduced them, and some others, such as the German Westdeutsche Allgemeine Zeitung, plan to introduce one in 2016. 17 Stefan Plöchinger, digital editor Süddeutsche Zeitung and editor-in-chief SZ.de, interviewed by Annika Sehl in Munich on 20 May 2016. 18 Ibid. 19 Catherine Joly, general secretary, Le Monde Group, interviewed by Alessio Cornia in Paris on 19 May 2016. 23 PRIvATE SECTOR MEDIA AND DIGITAL NEWS La Voix Du Nord – A regional approach to pay Source: Screenshot from lavoixdunord.fr with a prompt to pay. The French regional newspaper La Voix du Nord adopted a metered paywall in 2012. Bruno Jauffret, digital development director at Groupe Rossel-La voix, explains that the number of digital subscriptions has grown rapidly, to the extent that the title now has 30,000 subscribers, of which 10,000 are digitalonly. Approximately 40% of their digital revenue comes from digital subscriptions. Many of their competitors in the French regional market have adopted a freemium model, where national and international news are generally free and local content must be paid for. La Voix du Nord instead opted for a metered model because they considered it easier for readers to understand: [We chose a metered model] because it is simpler. We asked our readers, and we found that it was hard for them to understand the freemium models, to understand which content is free and which is premium. We therefore decided to make the offer as simple as possible. [This way, we can] allow readers to access our news directly and focus our attention only on customers who have a real value for us: those who use our brand regularly and who are ready, or may be ready, to pay for this frequent use.20 The situation in Poland, Italy, and the UK is more mixed. In Poland, both the national quality newspaper Gazeta Wyborcza and the regional paper Dziennik Zachodni have some kind of paywall, but the tabloid Fakt has opted for a free-access model. Danuta Breguła, head of business development at Gazeta Wyborcza, says that they used to be part of the Piano National System, a platform allowing subscribers to access the content published by several news brands. When they realised that their news accounted for most of the content available within that system, they ‘discovered that [their] content has a value’, and decided to build their own metered paywall instead, which they successfully launched in 2015. This is based on their in-house technology.21 Fakt is instead pursuing scale and relying on advertising. In Italy, Il Corriere della Sera is the first of the main Italian news providers to have adopted a paywall, having launched a metered paywall at the end of January 2016. Michela Colamussi, marketing director responsible for the digital products of Il Corriere della Sera, is satisfied with the first results: four and a half months after the introduction of the paywall, Il Corriere della Sera had already generated 30,000 digital subscriptions.22 The Italian news brand with the widest online reach, La Repubblica, considers keeping free access to news as a main component of its digital strategy. Like Fakt in Poland, they are going for scale and relying on advertising. As Alessio Balbi, head of online at La Repubblica, explains: 20 Bruno Jauffret, director of digital development, La Voix du Nord, interviewed by Alessio Cornia, via Skype on 23 June 2016. Danuta Breguła, head of business development, Gazeta Wyborcza, interviewed by Annika Sehl in Warsaw on 9 June 2016. 22 Michela Colamussi, marketing director, digital product and video, RCS, interviewed by Alessio Cornia in Milan on 12 May 2016. 21 24 PRIvATE SECTOR MEDIA AND DIGITAL NEWS We believe that only a limited number of big media organisations today have the opportunity to reach a big audience of millions of daily visitors. … La Repubblica is the leader in the Italian digital market and therefore it is natural that we want to play this game, which is only open to a small number of players. … So far, our digital revenue has been able to sustain this strategy, and therefore we don’t want to change our business model.23 As for the UK, the Daily Telegraph is the only title covered here that has adopted a pay model (a metered paywall). The Mail Online relies on different forms of advertising (display, programmatic, native, branded content, and affiliate advertising), as does the Manchester Evening News. Kevin Beatty from dmg media explains that keeping free access to its digital content is part of their longer-term investment in expanding the Mail brand’s reach through Mail Online internationally and in particular in the UK and the US.24 The site has built very high global reach and generated £73 million in revenues in the year ending in September. (By comparison, the Daily Mail and the Mail on Sunday combined legacy revenues were close to half a billion in 2015.)25 Beatty also says that the market activity in the digital media space is carefully tracked and observed and although there may be some instances of an increased acceptance of pay models, free access is and will remain an essential component of their digital strategy: Online paid content? We are not prescriptive about this: we watch what everybody else is doing, we watch what works and what doesn’t. We see things that haven’t worked in the past becoming a little bit more acceptable now, but we have set out very clearly that we are in the process of building large audiences and high engagement levels with that audience, and in doing that we need to be free to access. … Digital is still an investment for us, … an investment that has given us the opportunity for the first time in our history to generate a customer base which is truly international.26 Finally, Table 2.3 (pp 22–23) shows clearly how digital activities still only account for a minority of overall revenues in all the organisations covered, despite the large national, and in some cases international, audiences that some news brands reach and the gradual growth in subscriptions and pay models. As pointed out at the beginning of this report, print and television still represent a large majority of overall revenues in all the news organisations covered. Whether one considers digital advertising and the pursuit of scale, the move to pay models and smaller but more engaged audiences of subscribers, or various combinations of these, the traditional, basic model of relying on advertising and content sales is clearly difficult to replicate in an abundantly supplied online environment dominated by large technology companies with appealing products, better data and technology, large numbers of users, and economies of scale. Peter Lindsay, director of strategy at the Telegraph, is worth quoting at length on why digital advertising and sales will not generate the kinds of revenues many newspapers became used to in this environment in the 1990s: The internet has obviously made access to content much easier, and has also enabled many new organisations and individuals to create content. That’s particularly true of written content, and this can make it more difficult to signal which content is worth paying for. … This is a fundamental change from print, when the basic economics and fixed costs involved put a limit on the amount of content that was out there; it has been difficult to adjust to for an industry which was used to an automatic association between journalism 23 Alessio Balbi, head of online, La Repubblica, interviewed by Alessio Cornia in Rome on 29 Apr. 2016. Kevin Beatty, CEO, dmg media, interviewed by Alessio Cornia in London on 10 May 2016. 25 http://www.dmgt.com/~/media/Files/D/DMGT/reports-and-presentations/100-51070.pdf. 26 Kevin Beatty, CEO, dmg media, interviewed by Alessio Cornia in London on 10 May 2016. 24 25 PRIvATE SECTOR MEDIA AND DIGITAL NEWS and paying customers. One solution publishers are exploring is to more strongly demarcate between breaking news and live content, on the one hand, and in-depth commentary, perspectives and insight, on the other. … The expectation is that there is a value inherent in expert, well-researched perspectives and insight, and that this can therefore be charged for. Despite this, as long as digital content is as widely produced and available as it is today, the lack of scarcity is always going to be a risk to the long-term sustainability of digital subscriptions for publishers.27 27 Peter Lindsay, director of strategy, Telegraph Media Group, interviewed by Alessio Cornia in London on 21 June 2016. 26 PRIvATE SECTOR MEDIA AND DIGITAL NEWS 3. New Sources of Digital Revenue Motivated by declining legacy revenues and the challenging digital advertising and sales environment, news media are increasingly looking for new sources of revenue. Three strategies are particularly widespread among newspaper publishers. First, they are developing new projects to increase existing digital revenues by, for example, investing in ‘verticals’ (i.e. new content offerings beyond their main brand) to attract new audiences. Second, they are also increasing their efforts to produce and sell native advertising and branded content to supplement more traditional forms of advertising. Third, they are diversifying their business activities into completely new areas (e.g. digital marketing services, events, and e-commerce), building on their existing audience and brand value to create alternative revenue streams. Because of their more stable legacy revenues and their lower emphasis on developing digital operations into an independently sustainable business, most commercial broadcasters are engaged in fewer experiments of this sort. 3.1 New Strategies to Increase Existing Digital Revenues First, a growing number of newspaper publishers are developing new content-based projects with the aim of drawing in new audiences and advertisers. This approach is well-known from past print products like automotive sections and the like and is increasingly used for digital products too. Some of these are verticals with distinct brands, others are sections of the main brand with a high degree of marketing and promotion. Le Monde is an interesting example of a legacy news organisation developing new content offers to strengthen their digital revenue. The French newspaper is focusing on two projects, among others: Pixels, launched in 2015, and Les Décodeurs, launched in 2014 and enlarged in 2016. Pixels is a content section focusing on new technologies, digital culture, and online gaming, addressing an audience that is younger and ‘more geeky’ than Le Monde’s traditional readership.28 From the beginning, the project was conceived on the basis of a sustainable business model and close cooperation between the editorial and the business parts of the organisation. Catherine Joly, general secretary of Le Monde Group, explains that the strategy behind Pixels is to reach new and more targeted audiences (young users who are interested in new technologies), therefore attracting new digital advertising revenue (investments coming from technology companies).29 The second project, Les Décodeurs, is a content section produced by a team of 12 journalists that focuses on fact checking, data journalism, and busting hoaxes, providing explanations, context, and verifications on the topics that are most discussed in digital environments. Nabil Wakim, director of editorial innovation at Le Monde, highlights that Les Décodeurs is a good example of how Le Monde is gaining significant audience reach by adapting its journalistic approach, marked by a strong focus on hard news and a rigorous process of verification, to new web formats: [With Les Décodeurs] we adapt our journalism to a bigger audience. This doesn’t mean we focus on stupid subjects; it rather means that we use new formats, native web formats, to explain complicated topics in the simplest way possible. When we were working on the project development, we called it for fun ‘the serious version of BuzzFeed’. … The Les Décodeurs team also worked on the Panama papers, … and they were successful in explaining this difficult topic in an understandable way. The public response was very good. It may generate between 10% and 15% of Le Monde traffic.30 28 Nabil Wakim, director of editorial innovation, Le Monde, interviewed by Alessio Cornia in Paris on 19 May 2016. Catherine Joly, general secretary, Le Monde Group, interviewed by Alessio Cornia in Paris on 19 May 2016. 30 Nabil Wakim, director of editorial innovation, Le Monde, interviewed by Alessio Cornia in Paris on 19 May 2016. 29 27 PRIvATE SECTOR MEDIA AND DIGITAL NEWS Compared with Pixels, Les Décodeurs follows a more traditional digital strategy of expanding its general audience, rather than focusing on niche topics to attract more targeted audiences, Joly explains.31 Le Figaro is also investing in the development of new content to expand its digital audience reach and to attract new advertisers. For example, the French newspaper has recently created a gardening section, has strengthened its digital sports offer, and has launched a website in Chinese, Figarochic.cn, that focuses on French tourism, fashion, and culture. The Le Figaro Group is also expanding its audience base by acquiring digital companies, such as CCM Benchmark. Jean-Luc Breysse, deputy general director of Le Figaro Group says that, with these operations, the group ‘continues to invest in quality and added-value content, a strategy at the core of its past, present and probably future success’. He reports that, with 25 million unique visitors per month generated by all the group’s websites, they are now able to reach half the French population. He also points out that, in France, they are now the fourth player in terms of digital audience reach, just after Google, Facebook, and Microsoft. In order to better monetise this large digital audience through programmatic advertising and real-time bidding (RTB),32 Le Figaro recently established a team of 30 people, within their business sector, who use big data to foster their advertising and ecommerce revenues. Finally, Breysse explains that Le Figaro Group’s digital strategy requires a large and qualified audience base to remain positioned in the digital advertising market race: Everybody is kind of piling into the advertising market, and that’s a big threat for the media. So, our priority is to be strong and to have enough data. The key is just to be a major actor in this sector. … Facebook, Google, and Amazon are becoming stronger, because they have huge databases and huge power. We need to accelerate in this sector, because at the moment targeted advertising is growing at the expenses of both print and display. In times of economic crisis, advertisers tend to favour targeted advertising spent with return they think they can measure precisely.33 Beyond the launch of verticals and sections, news organisations are investing in new repackaged content products (see the box opposite). 31 Catherine Joly, general secretary, Le Monde Group, interviewed by Alessio Cornia in Paris on 19 May 2016. Real-time bidding means the buying and selling of online ad impressions through real-time auctions while a webpage is loading. If the bid is won, the buyer’s ad is instantly displayed on the publisher’s site. 33 Jean-Luc Breysse, deputy general director, Le Figaro Group, interviewed by Alessio Cornia in Paris on 2 June 2016. 32 28 PRIvATE SECTOR MEDIA AND DIGITAL NEWS Packaging as a way to reuse content: The Iltalehti News App IL Pika One opportunity for news organisations to use their content efficiently is packaging. This strategy, which was also mentioned in the New York Times Innovation Report (New York Times 2014), means that content already produced is repackaged, for example in special reports, to better meet the needs of certain users. At the same time, this also allows news organisations to monetise content they already possess at almost no additional cost. One example of packaging is a simplified news app called IL Pika (translated: ‘IL Quick’) recently introduced by the Finish tabloid newspaper Iltalehti. IL Pika is complementary to the newspaper’s main app but has only 25 news items and is aimed at users who want the latest update on the most important news several times a day. Antti Haarala, head of digital services at Iltalehti, describes the additional app as a ‘curated view of what’s the most important news of the day and a quick glance at most recent stories’.34 The app presents news in several sections: main topics, news, sports, entertainment, and lifestyle. For more topics and articles, the user is recommended to use the main Iltalehti app. Content on both apps is free of charge. Source: Screenshot of the news app IL Pika. 3.2. Focusing on Native Advertising and Branded Content Second, many news organisations are also investing in strengthening their native advertising and branded content activities. Native advertising has been a part of many news organisations’ strategies for some time but the growth of ad-blockers, the rise of distributed content, and the threat to digital revenues from social media platforms have all led to renewed interest. Some research suggest users have reservations about native advertising unless very clearly and carefully marked as such, especially when it comes to hard news (Newman et al. 2015). But news organisations searching for new sources of revenue are increasingly investing in developing appropriate formats for native advertising. The overall demand is still hard to establish, but a number of news organisations are already reporting that native advertising and sponsored content account for a majority of their digital advertising revenues, and industry observers expect the market to grow in the future (Boland 2016). Stefan Betzold, managing director digital at BILD, explains that native advertising is one of the main priorities for BILD in 2016 and that they have just created the BILD Brand Studio, a team fully dedicated to native advertising: 34 Antti Haarala, head of digital services at Iltalehti, interviewed by Annika Sehl in Helsinki on 2 June 2016. 29 PRIvATE SECTOR MEDIA AND DIGITAL NEWS We need to find additional ways to monetise our reach and refinance our operations, and branded content and native advertising are definitely key components in that strategy. … The BILD Brand Studio team creates brand stories and branded content videos for our advertising partners in BILD’s tonality and Look & Feel. … That’s definitely growing, maybe the biggest and best-growing advertising product this year.35 The Telegraph is also strongly focusing on native advertising and has recently created Spark, a special division to work on branded content (see the box). Similarly, the Daily Mail Group (dmg media) has created a division, Mail Brands, to work with their commercial partners on branded content and cross-media advertising solutions. Spark - The Daily Telegraph’s Division for Branded Content Source: Screenshot from spark.telegraph.co.uk. In 2015, the Telegraph launched Spark, a new division which works on branded content and creative solutions tailored to brands’ needs. A team of 50–60 people – journalists, sales officials, digital designers, developers, and data analysts – writes content and creates video on behalf of brands. Most of the branded content is hosted on the Telegraph website, but it is also published in print or given to the clients to be used in their own campaigns. Sparks aims to support creativity with data analytics that are used to drive content engagement, to make real-time decisions during the campaigns, and to provide clients with post-campaign analysis. Our interviewees did not provide figures on the contribution of native advertising to the organisations’ digital revenues. In many cases, they provided just general information, describing it as a growing but still marginal source of revenue. Only in the UK do a few interviewees describe native advertising as already being a significant source of revenue. For example, Kevin Beatty, CEO of dmg media, says: [Branded content] is a significant part of our digital revenue. Programmatic is growing very fast and will continue to do so. In the UK we work closely with our advertisers and their agencies to create the type of marketing content that work most effectively with that audience. This is an important part of our digital revenues and one where we really do have a competitive advantage.36 Similarly, Peter Lindsay, director of strategy at the Telegraph, reports that the revenue generated by their branded content division Spark is a ‘growing and sizeable chunk of both print and digital 35 36 Stefan Betzold, managing director digital, BILD, interviewed by Alessio Cornia in vienna on 21 Apr. 2016. Kevin Beatty, CEO, dmg media, interviewed by Alessio Cornia in London on 10 May 2016. 30 PRIvATE SECTOR MEDIA AND DIGITAL NEWS advertising revenue’. He also highlights that sponsored content involves high production costs, but nevertheless is considered a sector where it is easier for news organisations to capitalise on their storytelling skills and compete with the big technology companies that dominate other sectors of the digital advertising market: Unlike display advertising, [with content marketing] there is a significant cost to us to provide that service. We have a team of people who produce that content. Nonetheless, it’s an area where we’re competitive versus Facebook and Google because we actually have expertise in writing content, something we can add value to.37 In Italy, as in other countries, native advertising is also growing, but Italian interviewees refer to some degree of resistance to native advertising and branded content within newsrooms. Pier Paolo Cervi, general director of the digital division at Gruppo L’Espresso, illustrates that ‘in Italy native advertising is growing, but slower than in the Anglo-Saxon countries because of market reasons, but also because a cultural resistance within Italian newsrooms, where the distinction between editorial and branded contents probably represents a more sensitive issue’.38 Michela Colamussi, marketing director responsible for the digital products of Il Corriere della Sera, reports that when, in 2015, RCS established Numix Studios, a creative team dealing with branded content and multimedia storytelling projects, at first journalists were cautious about the introduction of native advertising, but after being reassured about the clear distinction between branded and editorial content they accepted it: It has not been easy for us to focus on branded content because, traditionally, content production is within the newsroom’s sphere of activity. ... There were some initial reservations but, when we found a way to clearly label branded content, the newsroom accepted it and the marketing division started to sell it.39 3.3. Diversification Strategies Third, many news organisations have adopted diversification strategies to explore new sectors outside their core market. The aim is to look for alternative revenue streams by starting ecommerce activities or providing business companies with a wide range of services, from digital and cross-media marketing solutions to event organisation. Peter Lindsay explains that, for too long, many newspaper publishers have been trying to rely on the same revenue streams online: display advertising and digital subscriptions. The Telegraph Media Group has therefore diversified its business by moving into new areas, such as travel, events, and financial services. Even if these business areas are far away from their core business, the newspaper’s assets (the perspective it shares with its public and its reputation) are considered key factors for expanding into new markets. As Lindsay explains: What we provide as a business is a perspective on the world. That perspective on the world isn’t just about politics, it’s about any topic, and it allows us to form loyal relationships and ties with certain types of individual who share that perspective. … Therefore, we are expanding more dramatically into other business areas such as travel, events, and financial 37 Peter Lindsay, director of strategy, Telegraph Media Group, interviewed by Alessio Cornia in London on 21 June 2016. Pier Paolo Cervi, general director of the digital division, Gruppo L’Espresso, interviewed by Alessio Cornia in Milan on 23 May 2016. 39 Michela Colamussi, marketing director, digital product and video, RCS, interviewed by Alessio Cornia in Milan on 12 May 2016. 38 31 PRIvATE SECTOR MEDIA AND DIGITAL NEWS services, where we give customers … [curated recommendations], a curated view on what they should be doing or buying or where they should be going on holiday.40 The results of this diversification strategy are seen as promising at the Telegraph. Lindsay says that the revenue generated by these auxiliary activities is still smaller than their legacy print business, but is already rivalling the amount of revenue they generate from digital subscriptions and is expected to form a series of strong pillars that sit alongside both subscriptions and digital advertising in the near future. At the Finnish tabloid Iltalehti, which has moved into new areas such as dating and travel services, they are also satisfied with the initial results and plan to expand into new digital services, reports Antti Haarala, head of digital services.41 Several national and regional newspaper publishers have recently expanded into events and sponsorships, auxiliary activities that link online and offline operations. Both Le Monde and the Manchester Evening News, for example, have created new website sections and niche publications aimed at students and their families. The goal is to attract new advertisers who are interested in these specific targets, as well as to organise educational events that will generate alternative revenue through sponsorships. Other news organisations are investing in digital marketing services. The German regional newspaper Westdeutsche Allgemeine Zeitung, for example, has established an agency offering small- and medium-sized business companies operating at the regional level a wide range of services, from Google AdWords and search engine optimisation (SEO) support to website construction. As with e-commerce, service sales, events, and sponsorship, this is another example of how newspaper publishers are pursuing new sources of revenue beyond advertising and sales but still based on the audience and brand of their main news operations (in contrast to, say, standalone classified advertising sites or the like).42 3.4 Different Approaches to Diversification Three different approaches to diversification and business innovation emerge from our analysis. First, some interviewees consider diversification strategies and experiments with new sources of revenue as opportunities that can be fully exploited only by strongly investing in them. This approach seems to characterise the Telegraph’s strategy in moving into new e-commerce areas, for example. Peter Lindsay explains: I think the mistake that publishers have made in the past is that they’ve tried to grow these auxiliary businesses on the side, in a corner somewhere. … So, our philosophy from the start has been: if we intend to play in these markets, we have to invest in actually competing, genuinely competing. Not as a publisher, but as a travel competitor, as a financial services competitor, … i.e. we’re going to be a business that’s going to operate in multiple markets. Therefore, we need to have people who know what they’re doing in those markets. So our number one priority has been to hire the talent and the teams who understand those markets … We’ve been investing significantly in growth for those areas.43 40 Peter Lindsay, director of strategy, Telegraph Media Group, interviewed by Alessio Cornia in London on 21 June 2016. Antti Haarala, head of digital services, Iltalehti, interviewed by Annika Sehl in Helsinki on 2 June 2016. 42 Some media conglomerates are performing well overall but in part by diversifying beyond publishing and news to services, classified advertising, business-to-business and the like with no direct connection to the business of news. 43 Peter Lindsay, director of strategy, Telegraph Media Group, interviewed by Alessio Cornia in London on 21 June 2016. 41 32 PRIvATE SECTOR MEDIA AND DIGITAL NEWS A second approach is still to consider business innovation and diversification as opportunities, but opportunities that have to be pursued with caution and with incremental investment. This approach emerges, for example, in the way Joly explains the method used to launch and run Le Monde’s new products such as Pixels and Les Décodeurs: Regarding the method we used for our new products, they all are very agile projects that we can scale [based on the results they are producing]. We don’t hugely invest in them before seeing what they can return to us, we go into these areas in an incremental way. … The same applies to online videos: we don’t start by immediately establishing big teams before seeing if the project works and produces revenue. … When we develop new projects we start by experimenting and we see the level of revenue they produce.44 Commenting on how La Repubblica is organised for producing and selling native advertising, Balbi points out that the way news organisations approach innovation is one of the main differences between the Italian market and other international contexts: In other international markets, in particular in the UK and US, when a new development emerges our competitors tend to go into it heart and soul, by establishing big teams working on it and big budgets. The Italian market is much less dynamic and is characterised by a stronger resistance. … Our approach to new developments is much more cautious. This approach also characterises our group and I think it presents strengths and weaknesses. For example, when tablets were a new development, some years ago, some international newsrooms created big teams to work on that area, and after a couple of years most of these people were fired. On the one hand, this approach is exciting because it demonstrates a greater ability to deal with risk and innovation. On the other hand, it is true that, in the Italian context, this approach would have led to a huge catastrophe. The Italian approach is more cautious and perhaps also wiser.45 The third approach views business and editorial innovation as an opportunity but, at the same time, believes that journalism should focus on its core business and media organisations should not experiment with products that have little to do with journalism. This approach emerged in a few conversations where our interviewees commented on lessons learned from previous experiences with diversification strategies. For example, describing some previous attempts at introducing special portals and apps aimed at niche audiences, Stephan Marzen, managing director of Rheinische Post, concluded that news organisations should stay focused on their core business: The basic idea was that we can win additional user groups and this way get further reach that we can monetise. But that did not work out at all. Now we have integrated them into our large portals. We call this focusing on the core business. Here, the bet did not pay off.46 Similarly, Eva Messerschmidt, manager of sales and digital products at n-tv, explains that n-tv ‘only diversify in terms of platforms, but not in terms of products’.47 As they seek to develop new business models and search for new sources of revenue, private sector legacy news organisations have to deal with a broader ongoing transformation in the whole media environment. Not only does the general move from legacy platforms to digital continue 44 Catherine Joly, general secretary, Le Monde Group, interviewed by Alessio Cornia in Paris on 19 May 2016. Alessio Balbi, head of online, La Repubblica, interviewed by Alessio Cornia in Rome on 29 Apr. 2016. 46 Stephan Marzen, managing director, Rheinische Post, interviewed by Annika Sehl in Düsseldorf on 17 May 2016. 47 Eva Messerschmidt, manager of sales and digital products, n-tv, interviewed by Annika Sehl in Cologne on 19 May 2016. 45 33 PRIvATE SECTOR MEDIA AND DIGITAL NEWS apace, the way in which people use digital media is also evolving rapidly. The three central contemporary trends our interviewees highlight as most important are (1) the growing importance of social media, (2) the move from desktop to mobile, and (3) the potential of online video. We will deal with social media in the next section before moving on to mobile and online video. 34 PRIvATE SECTOR MEDIA AND DIGITAL NEWS 4. Approaches to Social Media The growing importance of social media is a central driver of a broader change in how people find and access news online. Direct access via websites and apps is becoming relatively less important, and search and especially social media are becoming more important. Table 4.1 shows how online news users across the six countries covered in this report say they come across news online. Direct entry is still important in some countries, such as Finland and the UK (both of which have very popular public service media and some newspapers with high reach online), but search and social media are important across the board, and more important than direct access in several countries. Table 4.1 How people come across news online Finland France Germany Italy Poland UK direct entry (via website or app) 62% 27% 27% 22% 27% 47% Search 15% 35% 37% 54% 62% 20% Social media 24% 26% 21% 36% 38% 25% Source: Newman et al. (2016) and additional analysis on the basis of data from digitalnewsreport.org. Q10 ‘Thinking about how you got news online (via computer, mobile or any device) in the last week, which were the ways in which you came across news stories?’ (Only some options listed above.) With the rise of distributed discovery, news organisations have had to come to terms with an environment where they have less and less control over how people find and access their news. Discovery is already distributed across direct entry, search, social media, and for some messaging apps. The next step is from distributed discovery to distributed content, as popular platforms increasingly offer formats for off-site consumption of news content, including YouTube Channels, Facebook Instant Articles, Twitter Moments, SnapChat Discover, and the like. We discuss distributed discovery first, the rise of distributed content next. 4.1 Distributed Discovery From the point of view of individual news organisations, the relative importance of direct entry, search, and social media as sources of traffic varies greatly. Some strong brands still get most of their traffic from people coming direct. But many get a majority from search and social referrals, increasingly especially social.48 All the organisations covered work to various degrees with search engine optimisation and social media optimisation to increase their referrals. Some make major investments in these activities to maximise reach and visibility. The rationale is clear. As Jochen Herrlich, managing director of digital at Funke Medien – which publishes the major German regional newspaper Westdeutsche Allgemeine Zeitung – says: ‘news publishers have to go where the audience is’.49 48 The percentage coming from social varies by organisation, some say about 20%, some as much as 80%. For some, search is still more important than social, but social is generally becoming more and more important. 49 Jochen Herrlich, managing director digital, Funke Medien, interviewed by Annika Sehl in Berlin on 13 May 2016. 35 PRIvATE SECTOR MEDIA AND DIGITAL NEWS Google is overwhelmingly the most important source of search referrals, and Facebook equally overwhelmingly the most important source of social traffic. Our interviewees’ experience is broadly in line with the overall picture provided by audience analytics companies, which suggests search remains an important source of referrals but has been overtaken by social media – especially Facebook. In late 2015, Parse.ly, for example, estimated that 45% of referrals across their sample of nearly 400 publishers come from social media (39% from Facebook alone) and 32% from search (vanNest 2015). (Yahoo and Twitter were next, both under 5%.) Search has been central for years by now, whereas the role of social media and especially Facebook has evolved rapidly. Across Parse.ly’s sample, the percentage of referrals coming from Facebook was around 10% in January 2014, around 20% in January 2015, and around 40% by the end of 2015. As one interviewee put it when asked about the most important sources of traffic: ‘Facebook. Then comes Facebook. And then Facebook.’50 4.2. Distributed Content In the course of 2015 and 2016, we have seen the beginning of a move beyond distributed discovery to distributed content as some large technology companies have developed new products such as Snapchat Discover (launched January 2015), Facebook Instant Articles (launched May 2015), and Apple News (launched June 2015) to host news on their own platforms. In each case, news organisations publish directly into a format created by the platform, and in return normally get reach as well as a share of the advertising revenue generated. For platforms, these initiatives aim at making the wider service more attractive to users by offering a way of accessing news that is more appealing than that offered by the mobile web, where pages often load very slowly and are cluttered with intrusive advertising, or are perhaps not optimised for mobile use at all. In response to the same problems of poor user experiences on the mobile web, Google has in 2015 launched the Accelerated Mobile Pages (AMP) project in collaboration with a range of publishers and technology companies to help create standards for mobile optimised content and advertising able to offer as attractive a user experience as that offered by new off-site formats (WAN-IFRA 2016b). Unlike, for example, Facebook Instant Articles, AMP is not a format for off-site content, because it is still hosted by each publisher. But it is tied in with distributed discovery as it is one way of helping articles perform well in search rankings that increasingly prioritise mobile optimised sites. While many of the organisations covered here are working with one or more of these new formats for distributed content, it is important to underline that they have limited experience with them. Most of these initiatives have launched first in the United States and with a select set of launch partners, only gradually opening up to more publishers. They are also in most cases made available to users in different markets step by step. This means that media users in much of Europe have so far had limited exposure to most of these formats and that news organisations have little practical experience with them. Most interviewees anticipate that distributed discovery will continue to become more important, and distributed content accessed via off-site formats too. But the development is still surrounded by much uncertainty and little robust evidence. One interviewee says about the experience of working with Facebook Instant Articles and Google’s 50 Quote not for attribution. 36 PRIvATE SECTOR MEDIA AND DIGITAL NEWS AMP format in 2016 that, so far, ‘the impact they’ve had has been much less material than we expected’.51 Another interviewee has a broadly similar view of the current situation, but also says this will probably change rapidly: I think where we’ll end up in a couple of years’ time is we’ll have two sources of traffic. There’ll be distributed traffic which never comes near our site and people may care about the brand, they may not. And then there’ll be the brand loyal traffic which is already what we’re spending more of our time focusing on as well.52 4.3. Opportunities and Challenges for News Organisations Distributed discovery and the rise of distributed content presents news organisations with a range of opportunities and challenges. All the people we interviewed see search engines and social media as simultaneously intermediaries they need to work with to extend their reach and as potential competitors seeking control over distribution channels, audience data, and opportunities for monetisation. The central reason for working with search engines and social media is very clear: reach. Facebook in particular increasingly enables news organisations to reach a wider public, in particular younger people and other audiences who do not normally come direct to their sites or apps, let alone their legacy products. Michel Floquet, deputy director of information at TF1, says that ‘the main opportunity is to get in touch with a specific audience, younger people, who don’t rely on television newscasts anymore’.53 Social media in particular is seen as a necessary part of the fight for attention and reach. As noted in Table 1.2, between 50 and 70% of all online news users in the six countries covered are on Facebook. Anu Kuistiala, editor-in-chief, digital, at MTv News in Finland, explains the implications: Well, in my view it would be stupid to not to go there. Because why would you fight against such giants? You can only lose by doing that. So it’s better to cooperate. … In Finland, a small country, there are around two million people who use [Facebook] daily. So if we don’t go there, [the audience] doesn’t come to us. That would be ridiculous. I mean, the biggest mistake would be not to go there.54 This opportunity, however, also comes with a number of challenges that all our interviewees underline to various degrees. The most important challenges include: • • • • How do news organisations ensure editorial control and brand recognition in a more distributed environment? How do news organisations capture audience data to inform decision-making? How do news organisations design onward journeys from one piece of content to the next if people come across it via third-party platforms? How do news organisations monetise search and social media traffic effectively to ensure they can cover the cost of producing news content? 51 Ibid. Ibid. 53 Michel Floquet, deputy director of information, TF1, interviewed by Alessio Cornia in Paris on 3 June 2016. 54 Anu Kuistiala, editor-in-chief, digital, MTv News, interviewed by Annika Sehl in Helsinki on 1 June 2016. 52 37 PRIvATE SECTOR MEDIA AND DIGITAL NEWS The risk, as some see it, is that publishers become what Bruno Jauffret from La Voix du Nord calls ‘content providers for Facebook’.55 Another interviewee says the danger is that ‘you’re on a social media platform and [people] can’t tell the difference between the information that’s there and they believe it’s all created via Facebook or via Google, etc.’56 The question of monetisation is tightly tied to the question of whether an organisation is primarily basing its digital business on advertising or more on pay models. For advertising-based businesses, referral traffic is useful as long as the advertising rates are high enough, but, with low rates especially on mobile, as one interviewee, who understandably does not want to have the quote attributed, says: ‘Honestly, now, I think there is no business model’.57 For off-site, distributed content, while the current revenue split may seem attractive, many worry about whether the terms will change over time. For organisations developing pay models, search and social are seen more as marketing tools for attracting people and raising brand awareness with the clear goal of converting them to subscribers. Kaius Niemi, senior editor-in-chief of Helsingin Sanomat, explains their approach, focused more on conversion than on traffic: [Social media] is not only creating more page views but also [helping us reach] segments that we are not reaching so much with subscriptions. … We’re really trying to get people to stay more within our system, so that they do not just come in and quickly read an article and go back out again. … There’s a lot of people who are not really paying for anything although they keep coming back … We think that we are learning how to convert them little by little but it’s still really challenging, it’s not easy.58 4.4. The Link between Analytics, Editorial Priorities, and Organisational Imperatives All the organisations covered work to different degrees with search engine optimisation, social media optimisation, and other strategies to leverage distributed discovery. Most of them are at least experimenting with distributed content formats. (Though all are conscious of the cost implications of potentially having to build teams to publish directly into different bespoke formats with different specifications all ultimately controlled by a third-party platform.) But their approach, and what they aspire to achieve, varies. News organisations’ approach to the rise of a more distributed media environment can be broadly categorised into those organisations that seek synergy across as many platforms as possible, those that engage with intermediaries on the basis of their ambition to be as self-reliant as possible, and those that aim to be more selective in their engagement. First, some news organisations are aggressively seeking synergy across as many platforms as possible with as much content as possible. The most important examples of this are US-based digital start-ups like BuzzFeed and to various degrees the Huffington Post, Mic, Quartz, and vox (WAN-IFRA 2016b). But some private sector legacy news organisations have adopted a similar 55 Bruno Jauffret, director of digital development, La Voix du Nord, interviewed by Alessio Cornia, via Skype on 23 June 2016. 56 Quote not for attribution. 57 Ibid. 58 Kaius Niemi, senior editor-in-chief, Helsingin Sanomat, interviewed by Annika Sehl in Helsinki on 31 May 2016. 38 PRIvATE SECTOR MEDIA AND DIGITAL NEWS approach, in the US most prominently perhaps CNN and the Washington Post, who have both invested heavily in distributed discovery and distributed content, and in France Libération, which publishes all of its roughly 150 daily pieces on Facebook Instant Articles (Southern 2016a). None of the organisations we cover here have adopted a similarly aggressive pursuit of synergy. Second, some news organisations seek self-reliance first and foremost, and have not embraced the new formats offered by digital intermediaries. Several of the organisations we cover here, particularly in France and Germany, are reluctant to distribute their content through third-party platforms. Many define their approach as a ‘wait and see’ tactic, explaining that, before taking a decision on whether or not to adopt this strategy, they prefer to wait for the first results produced by competitors that started experimenting earlier. Other organisations are more direct in saying that they reject these solutions because the risks are much greater than the benefits. This is the case, for example, of Le Figaro. Anne Pican, digital director of Le Figaro’s website, says that they refused to take part in Facebook Instant Articles and defines their approach to distributed content as ‘conservative’ and ‘hyper-pragmatic’: We are aware that our only exit strategy is our brand. If we distribute our content just anywhere, after a while people won’t come to our own sites any more.59 Jean-Luc Breysse, deputy general director of Le Figaro Group, adds that Le Figaro Group also decided to adopt a ‘wait and see’ approach to Google AMP, due to the risk of losing control over their monetisation strategies and their audience data: Obviously there is a risk that eventually, when the majority of the media companies’ audience is generated by dominant social media platforms, which is already the case in some countries, our ability to leverage that audience is not in our favour. It is a risk, all the more so, since these social media platforms have a track record of changing frequently and often radically their content promotion policy.60 Similarly, Le Monde refuses to be part of Facebook Instant Articles and Google AMP. Instead, they started a project with Snapchat Discover because this platform addresses an audience, younger people, that is completely different from Le Monde’s average readership. Snapchat is seen as an opportunity to reach new audiences rather than a competitor in the advertising market.61 Similarly, the German commercial broadcaster RTL is not taking part in Facebook Instant Articles and uses social networks only ‘to draw attention and direct users to the content of our offers’, says Frank Müller, editor-in-chief of RTL interactive, who also explains that the reasons for using social media platforms only as teasers are to ‘market the content ourselves and monetise the reach’.62 This points to the third, and most widespread, compromise approach, where news organisations aim to be selective. Every new form of distributed discovery and distributed content requires upfront investments of scarce resources, and many organisations are determined to evaluate early results in terms of reach and revenues delivered by new formats like Facebook Instant Articles and Google AMP before they decide how much to invest. Here, news organisations make minor commitments when opportunities present themselves, evaluate, and then decide which formats to pursue. Dmg media in the UK is one example. Kevin Beatty explains that the Mail Online ‘continues 59 Anne Pican, digital director of Figaro.fr, Le Figaro, interviewed by Alessio Cornia in Paris on 19 May 2016. Jean-Luc Breysse, deputy general director, Le Figaro Group, interviewed by Alessio Cornia in Paris on 2 June 2016. 61 Catherine Joly, general secretary, Le Monde Group, interviewed by Alessio Cornia in Paris on 19 May 2016. 62 Frank Müller, editor-in-chief, RTL interactive, interviewed by Annika Sehl in Cologne on 20 May 2016. 60 39 PRIvATE SECTOR MEDIA AND DIGITAL NEWS to enjoy large numbers of people coming directly to the homepage’, and they are ‘really focused on that’. The CEO of dmg media also explains that Martin Clarke, the publisher of Mail Online, participates in many of the third party distribution/partnership options, but they ‘don’t rush into it’: We work with all of the major providers … [but] we just don’t rush into it. We are not on Apple News in the UK, for example, … [but] we do participate in Facebook Instant Articles and we are on Snapchat. We will continue to work with the social media platforms to see how best we can make that business model work for us, whilst having to work for them.63 The Telegraph is also experimenting with distributing content offsite via Facebook Instant Articles and Apple News, and also works with Google AMP. Peter Lindsay says they ‘are happy to experiment’, but they ‘are also happy to pull back if they are not working’. He also comments on the first results of these experimentations: [Results] are fine. I would say with all of them they’re not yet fundamentally changing the dynamic of our audience, but there’s potential promise there. … I think we have to be careful about ensuring we continue to have direct access to our own customers.64 Similarly, the Italian national newspapers Il Corriere della Sera and La Repubblica are experimenting on both Facebook Instant Articles and Google AMP. Although they say that other Italian publishers have adopted an enthusiastic approach and distribute all the content they can on third-party platforms, they preferred to adopt a cautious approach. For example, Michela Colamussi says that Il Corriere della Sera publishes only a small proportion of the digital news they produce on Facebook Instant Articles.65 A key concern here is whether engagement with distributed discovery and distributed content will generate a reasonable return on investment and with the longer term implications of embracing new distributed formats. This is tied to each news organisations’ digital business model. For advertising-based models, there may be concerns over the revenue split between publisher and platform, and over the longer term implications if the terms change over time. For pay models, a lot rests on whether a given format enables subscription models and the like. Süddeutsche Zeitung, for example, is sceptical of Facebook Instant Articles because it does not offer good solutions for publishers with a paywall. As Stefan Plöchinger explains: We do not feel badly treated. But you can become disillusioned very fast when you realise that for a project like Facebook Instant Articles, there is no effort, for example, to enable a subscription model. Therefore, we will not be part of it because subscription is an important part of our business model. … We realise that communication with them immediately stops when we want to discuss business models that also work for us.66 63 Kevin Beatty, CEO, dmg media, interviewed by Alessio Cornia in London on 10 May 2016. Peter Lindsay, director of strategy, Telegraph Media Group, interviewed by Alessio Cornia in London on 21 June 2016. 65 Michela Colamussi, marketing director, Digital Product and video, RCS, interviewed by Alessio Cornia in Milan on 12 May 2016. 66 Stefan Plöchinger, digital editor Süddeutsche Zeitung and editor-in-chief SZ.de, interviewed by Annika Sehl in Munich on 20 May 2016. 64 40 PRIvATE SECTOR MEDIA AND DIGITAL NEWS 4.5. Dealing with Large Technology Companies Some interviewees explained off-the-record that the need to keep good relationships with social media and search engines affects the choice of many news organisations to take part in new initiatives, whether around distributed discovery or distributed content. One interviewee said: ‘Often news organisations participate in these experiments because they fear that not taking part might lead to them being penalised, e.g. they might be pushed down the search rankings.’67 Another media manager explained that their news organisation decided to be involved partly because they cannot have conflictual relationships with a platform that currently drives a large share of the overall traffic to their website. The underlying asymmetry is clearly and explicitly recognised by some interviewees, like one senior digital editor from a major news organisation who told us frankly: Facebook is not dependent on us. At a very basic level. If [we] would not be here now, that would not be a problem for Facebook. Facebook needs publishers as a group, because people share their content and that is why Facebook is keen to have good relations with publishers. But they do not need us.68 67 68 Quote not for attribution. Ibid. 41 PRIvATE SECTOR MEDIA AND DIGITAL NEWS 5. Approaches to Mobile The second current trend all interviewees focused on is the growth in the use of smartphones to access news. As Peter Lindsay states: ‘it’s old news to say that mobile is growing: mobile is already the dominant platform of choice’, the ‘number one platform for access’ to digital news.69 News organisations are perfectly well aware that changing news consumption habits have a direct impact on their business. Nabil Wakim, director of editorial innovation at Le Monde, for example, explains that while their desktop traffic is quite stable, on their mobile apps it is growing between 5% and 10% per year and, especially on their mobile website, it is growing at a rate that can vary from 50% to 100% per year.70 A large share, in some cases even a majority, of the overall news brands’ page views already comes from mobile devices.71 The growth of mobile is certainly driven by the increasingly important role of social media and search engines in mobile news consumption behaviour. Malcolm Coles, director of digital media, Telegraph Media Group, explains: Mobile platforms like Facebook, Twitter, and increasingly Google have given us bigger reach than ever before. … We know that most Facebook traffic is about 80 to 90% mobile.72 Therefore, the growth in mobile use surely represents a great opportunity for news organisations to extend their digital reach. However, mobile use also involves the challenge of monetisation. Andreas Fettig, head of online at DerWesten, the website of Westdeutsche Allgemeine Zeitung, says: About half of our reach is mobile now. So it is very, very important as a distribution channel and probably … will be even more important in the future. But, honestly, publishers have not yet developed a convincing business model for it.73 A central challenge in the search for sustainable business models for mobile news is that the mobile advertising market is much less developed than the desktop advertising market. This is a major issue emphasised by all the organisations covered here. Although mobile devices account for 56% of Le Figaro’s traffic, for example, mobile may generate only 13% of the French newspaper’s digital revenues, says the group’s deputy general director Jean-Luc Breysse.74 Similarly, Emanuele Callioni, director of multimedia contents and technologies at Mediaset, reports that their traffic is almost equally split between desktop and mobile, but mobile generates only 10% of their digital turnover.75 Stefan Betzold, managing director digital at BILD, explains that the shift in consumers’ behaviour from desktop to mobile internet use is challenging the news industry because of the lower yields in the mobile advertising market, where the dominance of intermediaries is even greater than in the desktop internet advertising sector: The relevance of mobile is growing, but there are two side effects. First, there is mobile 69 Peter Lindsay, director of strategy, Telegraph Media Group, interviewed by Alessio Cornia in London on 21 June 2016. Nabil Wakim, director of editorial innovation, Le Monde, interviewed by Alessio Cornia in Paris on19 May 2016. 71 This statement is based on figures provided by our interviewees. 72 Malcolm Coles, director of digital media, Telegraph Media Group, interviewed by Alessio Cornia in London on 9 June 2016. 73 Andreas Fettig, head of online derwesten.de, DerWesten, interviewed by Annika Sehl in Essen on 18 May 2016. 74 Jean-Luc Breysse, deputy general director, Le Figaro Group, interviewed by Alessio Cornia in Paris on 2 June 2016. 75 Emanuele Callioni, director of multimedia contents and technologies, Mediaset, interviewed by Alessio Cornia in Milan on 11 May 2016. 70 43 PRIvATE SECTOR MEDIA AND DIGITAL NEWS monetisation, which is still much less than it is on online [desktop] – so the advertising ARPU [average revenue per user] in mobile is still much lower than the ARPU for an online visitor. Besides, there is a discrepancy between time spent [on mobile] by users and advertising spends from the clients. … [Second,] the dominance of the US platforms on mobile is even stronger than it is online. So if you look at the online competition, more or less 50% of the advertising spend goes to big US platforms – being the Apples, Googles, Facebooks, etc. If you look at the mobile market, according to eMarketer data, already twothirds of it is going to the big platforms.76 This is compounded by the smaller amounts of screen space and the poor user experience of most existing advertising formats when transferred to mobile. The most profitable desktop digital advertising formats simply do not work on small mobile screens. 5.1 Strategies towards Mobile Despite these challenges, the rapid growth in smartphone use for news strongly motivates news organisations to invest in mobile. Marek Kopeć, product manager of Fakt24.pl, explains that they consider investment in mobile an investment in the future: Our strategy is to be the leading publisher in every channel, including mobile. We are fulfilling our strategic objectives, but … the Polish market is not yet ready for mobile campaigns. It’s growing about 300% year on year, but the base is still small. We want to be the leader and we need the reach. … It is an investment for the future.77 How are legacy news organisations responding to the growth of mobile? Many news organisations are working on a range of solutions to adapt their content to mobile devices. Andreas Fettig, head of online at derwesten.de, for example, explains that they plan to switch their website to a responsive design to ensure their news is optimised for both desktop and mobile internet.78 Other news organisations such as Rheinische Post, Le Figaro, and Il Corriere della Sera have created dedicated teams that are working on adapting their content presentation to mobile devices. Stephan Marzen, managing director at Rheinische Post, explains that different platforms involve different kinds of usage by the audience, and so they adapt text length and photo size to optimise their news for mobile consumption.79 Similarly, the Telegraph’s strategy focuses on adapting their content to the specific requirements of mobile use. However, Peter Lindsay explains that, rather than establishing a team dedicated to mobile, they ask all their journalists to ‘think mobile-first’.80 Alessio Balbi says that La Repubblica has started a redesign of their websites and that they are doing so adopting a mobile-first approach: this time they did not start by changing the desktop homepage, as they had done many times in the past; rather, they started by designing the news pages for mobile devices, then they will work on the mobile homepage and, finally, they will work on the homepage for the desktop site.81 76 Stefan Betzold, managing director digital, BILD, interviewed by Alessio Cornia in vienna on 21 Apr. 2016. Marek Kopeć, product manager of Fakt24.pl, interviewed by Annika Sehl in Warsaw on 10 June 2016. 78 Andreas Fettig, head of online derwesten.de, DerWesten, interviewed by Annika Sehl in Essen on 18 May 2016. 79 Stephan Marzen, managing director, Rheinische Post, interviewed by Annika Sehl in Düsseldorf on 17 May 2016. 80 Peter Lindsay, director of strategy, Telegraph Media Group, interviewed by Alessio Cornia in London on 21 June 2016. 81 Alessio Balbi, head of online, La Repubblica, interviewed by Alessio Cornia in Rome on 29 Apr. 2016. 77 44 PRIvATE SECTOR MEDIA AND DIGITAL NEWS Other news organisations have already adopted a mobile-first approach. Jason Mills, for example, explains how they rebuilt the ITv News website some years ago: When we rebuilt the website, four and a half years ago, it was built mobile-first. So that’s why it’s a stream of news (because it’s adapting the thumb-down thumbing behaviour, so you go down the stream); that’s why it’s very short little updates for short mobile consumption; and we will subtitle almost every video now for mobile consumption; and that’s why it’s a very simple website. It’s very simple on desktop because it’s built with mobile in mind. All content should be mobile first, so articles shouldn’t be too long, should be picture rich, the video is short for clips. Video exists as part of the native storytelling, not as a side bar of video.82 Mobile web and app users have different profiles. Jason Mills explains that ITv News registers a strong return rate and a high page view per user on the ITv app, whereas on the mobile browser they register a high bounce rate and a low rate of page views per user. This is because of the high number of visitors arriving on their mobile website from the Facebook app.83 Similarly, David Higgerson, digital publishing director at Trinity Mirror (Regionals), points out that although the Manchester Evening News’s app users account for only 1% of their total users, they generate 30% of the total page views. Therefore, app users are ‘the most loyal and engaged’ audience for the brand.84 Since the news apps are most likely to be used by the most loyal audiences, both ITv News and the Manchester Evening News have focused strongly on the development of their apps. Mills explains that ITv’s heritage is around regional news, and therefore personalised content and personalised notifications are key features differentiating their news from the competitors’ offers: Apps allow you to identify where people are. So we have an app that gives you the news that’s local to you. We divided the country up into about 75 different areas and therefore you can get the news that’s local to your area, or any area you want. … We basically personalise alerts so you can get them around a story you’re interested in or around a local area that you are interested in.85 Similarly, the Manchester Evening News segments its audience to deliver personalised notifications on the basis of different audience interests. Higgerson says: People respond very well to push notifications when we target it around the things that they have chosen to be interested in. … One of the challenges we had in Manchester is [that there are two rival football teams:] Manchester City and Manchester United. If we send a blanket push notification for football, we just upset people. So we can segment them.86 Personalisation of content does not work well in every context and for every news organisation. Anu Kuistiala, editor-in-chief for digital at MTv News, for example, points out that they have experimented with personalised news, but only a limited part of their audience used this feature.87 In addition, MTv’s app allows users to upload user-generated content (UGC), mainly pictures and 82 Jason Mills, head of digital, ITv News, interviewed by Alessio Cornia in London on 26 May 2016. Ibid. 84 David Higgerson, digital publishing director, Trinity Mirror (Regionals), interviewed by Alessio Cornia in Manchester on 1 July 2016. 85 Jason Mills, head of digital, ITv News, interviewed by Alessio Cornia in London on 26 May 2016. 86 David Higgerson, digital publishing director, Trinity Mirror (Regionals), interviewed by Alessio Cornia in Manchester on 1 July 2016. 87 Anu Kuistiala, editor-in-chief, digital, MTv News, interviewed by Annika Sehl in Helsinki on 1 June 2016. 83 45 PRIvATE SECTOR MEDIA AND DIGITAL NEWS videos.88 Similarly, TvN24 in Poland, in addition to their general news app and website, have launched Kontakt24, a new platform (app and website) devoted to the gathering of UGC. The platform receives more than 100 contributions (news) per day from more than 70,000 citizen journalists, and a dedicated team verifies the information before publication, says Mateusz Sosnowski, TvN news portals unit director and TvN24 portal editor-in-chief.89 The next step many organisations are focusing on is getting mobile notifications to work better in terms of alerting users to compelling content and engaging them more. Push notifications are not used only for news. For example, Kaius Niemi explains that, on weekdays, Helsingin Sanomat tends to send notifications only about important news, whereas at weekends they use this tool to notify their subscribers that other kinds of content, such as books, are available free of charge on their app.90 88 Jyrki Huotari, managing editor, MTv News, interviewed by Annika Sehl in Helsinki on 2 June 2016. Matrusz Sosnowski, TvN news portals unit director and TvN24 Portal editor-in-chief, interviewed by Annika Sehl via phone on 14 July 2016. 90 Kaius Niemi, senior editor-in-chief, Helsingin Sanomat, interviewed by Annika Sehl in Helsinki on 31 May 2016. 89 46 PRIvATE SECTOR MEDIA AND DIGITAL NEWS 6. Approaches to Online Video Many news organisations are now investing in online news video operations.91 Their interest in this format is mainly driven by the fact that, in all the countries covered in this report, video advertising yields are growing fast and are already higher than display advertising yields. Marek Kopeć, product manager of Fakt24.pl, explains that the Polish tabloid publishes about 400 videos per month because online video ‘is a huge opportunity and, on the business side, it’s working very well’: [Thanks to online videos] we are fighting for the TV budgets, which are very high, much higher than press budgets and online budgets. … So, this is why this is fast growing and this is why we are investing in that area.92 Online video advertising is therefore a growing and potentially important revenue stream for publishers. Michela Colamussi, for example, reports that advertisers are strongly interested in prerolls93 and ‘the more digital video you can stream, the more digital revenue you can generate’. Il Corriere della Sera is therefore able to generate 18–20 million video views per month, and online video produces approximately 20% of their digital revenues.94 Similarly, La Repubblica generates between 30 and 40 million online video views per month, and online video already produces between 20% and 25% of their digital advertising revenue, says Pier Paolo Cervi, general director of the digital division of Gruppo L’Espresso.95 Online video is also considered important because it allows news organisations, in particular newspaper publishers, to adopt new and more effective storytelling formats. Julian Reichelt, editorin-chief BILD Digital, explains that it would be ‘stupid’ for a brand like BILD, which focuses strongly on emotions, not to fully exploit the potential of online video: Since the production has become so much easier, it would be even more stupid not to do it. Because video content can be very emotive, … it’s content that gets directly into the brain. You can consume videos when you are tired, they can be consumed out of the corner of your eye, [whereas] I cannot read like that. … Video emotionalises immediately, it reaches us immediately, that is the core of images. It immediately reaches my emotions. … That is why it is obligatory for an emotive brand like BILD. We have also invested a lot to learn techniques, technologies, and knowledge about the distribution of videos. And it has meant that on BILD more videos are watched than ever before.96 6.1 Strategies for Online News Video News organisations are therefore investing strongly in online video production and curation. The Finnish tabloid Iltalehti, for example, publishes between 150 and 200 videos per week, and tries to add a video to most of the stories they distribute, says Erkki Merilouto, publishing editor, news, at Iltalehti.97 They have established a dedicated video unit for this purpose, but they also encourage 91 For a more detailed analysis of online video news production, consumption, and strategies, see Kalegorepolous et al. 2016. 92 Marek Kopeć, product manager of Fakt24.pl, interviewed by Annika Sehl in Warsaw on 10 June 2016. 93 A pre-roll is an online video ad that runs before an online video. 94 Michela Colamussi, marketing director, digital product and video, RCS, interviewed by Alessio Cornia in Milan on 12 May 2016. 95 Pier Paolo Cervi, general director of the digital division, Gruppo L’Espresso, interviewed by Alessio Cornia in Milan on 23 May 2016. 96 Julian Reichelt, editor-in-chief BILD Digital, BILD, interviewed by Annika Sehl in Berlin on 13 May 2016. 97 Erkki Merilouto, publishing editor, news, Iltalehti, interviewed by Annika Sehl in Helsinki on 1 June 2016. 47 PRIvATE SECTOR MEDIA AND DIGITAL NEWS their journalists to shoot short videos with their smartphones when they are out in the field doing interviews or collecting information.98 Iltalehti is also experimenting with Facebook Live and producing subtitled video, focusing on lighter topics such as lifestyle and DIY, that can be watched without the audio. Many other news brands are currently experimenting with social video or have already started to produce it. These subtitled videos can be watched without the audio and work particularly well on social media platforms. This is considered a trendy format that can lead to success on social media. Stefan Plöchinger says Süddeutsche Zeitung started publishing social video only a few months before the interview, and acknowledges that they have ‘ignored that form of video storytelling for years’.99 Other news organisations are also experimenting with new ways to monetise online video (see the box opposite). In 2009 the Italian newspaper La Repubblica established a visual desk, a team of approximately 30 people that publishes between 130 and 150 videos per day and creates other visual and interactive widgets and content. One third of the published videos are internally produced, one third are bought from news agencies, and one third come from their network of video-makers, says Alessio Balbi, head of online at La Repubblica.100 Pier Paolo Cervi, general director of the digital division at Gruppo L’Espresso, explains that, in the first phase of online video development, La Repubblica moved from text-based news to video-based news, whereas in the current second phase the brand is expanding its online video offer to cover also entertainment and lifestyle topics. Within this strategy, the Italian newspaper has recently launched Webnotte, a weekly music programme that hosts the most popular Italian bands and singers. The gigs are both live-streamed and curated to produce short vODs that are distributed in particular through Facebook. Generally, each episode is watched by 300,000 to 400,000 unique visitors.101 Investing in a format that has little to do with news allows La Repubblica to reach new audiences and to attract new sponsorship.102 Other news organisations have expanded their use of online video in sectors not strictly related to news and experimented with new formats. BILD, for example, launched a (digital) paid content offer in 2013, which includes on-demand highlight clips of football matches. Donata Hopfen explains that in June 2016 they had 200 million monthly video views, mainly due to breaking news and the European Soccer Championships.103 Similarly, the Telegraph has launched an online video series focusing on news and explainers, but also on other topics such as lifestyle, fashion, and recipes. Peter Lindsay explains the Telegraph’s strategy for online videos: Our philosophy there is: we have to be very clear what segment of video we’re playing in. A lot of publishers go into video without a clear strategy of what they’re doing. So we are trying to make a name and carve a niche for types of content that the Telegraph can be known for. So certain types of multi-episode short series, not necessary long form, but 98 Antti Haarala, head of digital services, Iltalehti, interviewed by Annika Sehl in Helsinki on 2 June 2016. Stefan Plöchinger, digital editor Süddeutsche Zeitung and editor-in-chief SZ.de, interviewed by Annika Sehl in Munich on 20 May 2016. 100 Alessio Balbi, head of online, La Repubblica, interviewed by Alessio Cornia in Rome on 29 Apr. 2016. 101 Pier Paolo Cervi, general director of the digital division, Gruppo L’Espresso, interviewed by Alessio Cornia in Milan on 23 May 2016. 102 Alessio Balbi, head of online, La Repubblica, interviewed by Alessio Cornia in Rome on 29 Apr. 2016. 103 Donata Hopfen, publishing director and head of management board, BILD-Group, interviewed by Annika Sehl in Berlin on 21 July 2016. 104 Peter Lindsay, director of strategy, Telegraph Media Group, interviewed by Alessio Cornia in London on 21 June 2016. 105 Jean-Luc Breysse, deputy general director, Le Figaro Group, interviewed by Alessio Cornia in Paris on 2 June 2016. 106 Pierre Mauchamp, deputy editor-in-chief, La Voix du Nord, interviewed by Alessio Cornia via Skype on 27 June 2016. 99 48 PRIvATE SECTOR MEDIA AND DIGITAL NEWS short to medium form. Again, some of it around politics, but some of it is around lifestyle and food and drink and recipes. So the Telegraph becomes more of a destination for video and known for certain types of video. So we’re not trying to compete with Netflix or the BBC. Nor are we trying to compete with really fast breaking news video. Like a lot of that breaking news video can be adapted from the Press Association and regurgitated, right. So we’re trying to be clever about where we invest, and we expect the proportion of advertising from video to grow a lot over the next two to three years.104 New video formats and new ways to monetise video Source: Screenshot from bild.de with a 360-degree video. News organisations are experimenting with 360-degree and virtual reality (vR) video, as well as new ways to monetise online video. • innovation – BILD is experimenting with 360-degree and vR video to help their audience experience the place where a story is happening. They use these new technologies to encourage people to keep watching important topics such as the Syrian refugee crisis and ISIS. BILD is now working on shortening post-production times to be able to use 360-degree and vR videos for breaking news as well (Southern 2016b). • plan for a web tv channel – Le Figaro plans to launch a web Tv channel by the end of 2016. Jean-Luc Breysse, deputy general director of the group, explains that video has become a must to extend storytelling capabilities and add value for the internet user. It is not going to be a classic 24-hour news channel; rather, they aim to provide ‘the Figaro touch in terms of political stance, tone and atmosphere’ through commentaries and analysis on current affairs, but with a live stream and also a video on demand (vOD) offer. The channel will focus on topics such as politics and economy, but also entertainment.105 • Content syndication – La Voix du Nord, together with its mother group Rossel-La voix, has recently developed My video Place, a business-to-business (B2B) platform hosting online video focusing on regional content. The hosted videos are also produced by other regional newspapers and Tv broadcasters involved in the project. Other news organisations can host the videos on their own platforms and the advertising revenues are shared between the three parties: the host, the producer and the platform My video Place. Pierre Mauchamp, deputy editor-in-chief of La Voix du Nord, explains that this platform is an increasingly important source of revenue because national news brands often need video material when important events occur at the local level.106 49 PRIvATE SECTOR MEDIA AND DIGITAL NEWS 6.2 The Difficulties in (Not) Being a Broadcaster in the Online Video Era Producing online video still represents a challenge for newspaper organisations, whose traditional medium is the written word. Nabil Wakim, for example, explains that Le Monde has approximately 10 million online video views per month, but producing video is still ‘complicated’ for them: We started doing our journalism with text, therefore video is important but is still new for us. We are aware that it is a long-term construction project. We will not become, overnight, a media organisation that works primarily with videos. Out of 350 journalists working in our newsroom, we have a video team of ten people. Of course, video is important for us, but producing video is expensive, it requires investment in skilled people. We are building it little by little.107 Producing online video is challenging, especially for some regional newspapers, whose structures and resources are generally more limited than those of national newspapers. Stephan Marzen, for example, says that, at Rheinische Post, they are absolutely aware of the relevance of online video but, ‘unfortunately’, they don’t produce enough videos.108 Similarly, Debora Peroni, online marketing manager at Il Resto del Carlino, explains that, despite the high value of online video advertising, it is quite difficult for them to sustain original video production with the revenue generated by this activity, because of the high cost of producing online videos internally. For this reason, most of the videos they distribute are bought from an external agency.109 This solution is quite common. DerWestern, for example, produces one to two original videos per day focusing on regional events, and purchases other video from external agencies, says Andreas Fettig, head of online at derwesten.de.110 But many national newspapers also rely heavily on external services for video production, even when video teams have been established within their newsroom. As Kevin Beatty explains, even a newspaper with a large digital reach such as the Mail Online is principally a curator, rather than a producer, of online video: We are primarily a commissioner, a curator of great video, and obviously because of our scale we get huge video plays, but at the moment we don’t originate much of our own bespoke video.111 Producing online video is a challenge for television broadcasters too, because online video is a different format that involves different quality standards and production procedures from television content. As pointed out by Julian Reichelt, editor-in-chief BILD Digital, broadcasting organisations often struggle to escape from established routines: The greatest disruption, I believe, is not for us but for TV. We have already gone through this, with what the internet has done to the print media. The biggest disruption I see at the moment is for TV. With live technologies like Periscope, or the successful Facebook Live, this will be bitter, because TV investments in technology were higher and therefore the write-off is higher for them. … We see that TV, much like print in the beginning, has enormous difficulties making use of the new technologies. Fear of self-cannibalism, strong habits: … ‘where is my big camera?’ … ‘where is my sound man?’ They are going through the same as we did.112 107 Nabil Wakim, director of editorial innovation, Le Monde, interviewed by Alessio Cornia in Paris on 19 May 2016. Stephan Marzen, managing director, Rheinische Post, interviewed by Annika Sehl in Düsseldorf on 17 May 2016. 109 Debora Peroni, online marketing manager, Monrif Net, interviewed by Alessio Cornia in Bologna on 16 May 2016. 110 Andreas Fettig, head of online derwesten.de, DerWesten, interviewed by Annika Sehl in Essen on 18 May 2016. 111 Kevin Beatty, CEO, dmg media, interviewed by Alessio Cornia in London on 10 May 2016. 112 Julian Reichelt, editor-in-chief BILD Digital, interviewed by Annika Sehl in Berlin on 13 May 2016. 108 50 PRIvATE SECTOR MEDIA AND DIGITAL NEWS The fact that online video quality standards represent an issue for television broadcasters, as well as the difficulties in finding the right balance between the costs and benefits of online video, is confirmed by other interviewees. Eva Messerschmidt, manager of sales and digital products at ntv, also says that, as a Tv news channel, they ‘have the great advantage to rely on well-produced and high-quality video material’. N-tv also established a web-video unit to produce original videos for social media and other digital channels. However, they do this by ‘always bearing in mind the cost-benefit ratio’: [Online] video needs a lot of clicks to recoup their production cost. Anyway, as a broadcaster we can benefit from our access to existing visual material. But due to innovative ideas and new possibilities we are contemporaneously developing even further. … As the brand n-tv, a company of Mediengruppe RTL Deutschland, we have to comply with certain quality standards. Although we would achieve many clicks with funny catvideos we are clear in our minds that it does not fit to the brand n-tv.113 In a context where most broadcasters are not inclined to invest in original online video production, some broadcasters can easily find a position in this specific market. Łukasz Dulniak, social media and new projects manager at TvN24, explains that the other Polish news broadcasters are not significantly investing in digital, and this is a big opportunity for TvN: Neither of them has really significant digital news operations going on, so what differentiates TVN24.pl is that we just have a lot of video to use and to flood the web with it. … We sell news, but all of our news has video. That’s our way of business right now.114 113 Eva Messerschmidt, manager of sales and digital products, n-tv, interviewed by Annika Sehl in Cologne on 19 May 2016. 114 Łukasz Dulniak, social media and new projects manager, TvN24, interviewed by Annika Sehl in Warsaw on 8 June 2016. 51 PRIvATE SECTOR MEDIA AND DIGITAL NEWS 7. Conclusion In this report, we have analysed how private sector legacy news organisations like newspapers and commercial broadcasters across Europe are adapting to a continually changing digital media environment. Based on interviews with 54 executives, senior managers, and editors across 25 legacy news organisations in Finland, France, Germany, Italy, Poland, and the United Kingdom, we have shown that newspapers and commercial broadcasters, sometimes criticised for their conservatism (e.g. Boczkowski 2004, Christensen et al. 2012, Küng 2015), are investing in a wide variety of new digital initiatives to reach new audiences and generate new revenues. All the organisations covered see audiences moving from offline media to online media – quickly in the case of print to digital, and so far more slowly in the case of television to online. All aim to make similar moves to retain the audience connection on which both their editorial impact and their business models depend. ‘We need to be where the audience is’ is a frequently repeated mantra. All are also making significant investments across social media, mobile media, and online video – and sometimes in all three – as they seek to adapt to a constantly and rapidly evolving digital media environment. Especially for smaller local and regional players, or for larger companies with rapidly declining legacy revenues, freeing up resources for these investments is a major challenge. Experimentation is necessary, but also costly and uncertain. These are common features found across the cases covered in six otherwise very different markets – different in how developed digital media, social media, and mobile media use is, and different in terms of how rapidly legacy media are losing audiences and advertising. Many of the newspapers and commercial broadcasters we have researched here have built significant audience reach online, but so far, few have developed profitable business models for digital news. This is another common feature across all six countries. In most cases, 80 to 90% of revenues and most of the profit still comes from legacy operations that are declining (print) or still stable (broadcasting). Digital revenues are still limited and the resources for investments in digital generally come from cross-subsidies from legacy operations or from cost-cutting elsewhere in each organisation. This means all of these legacy media have to continue balancing exploiting present business models with exploring future opportunities. Most of the organisations covered have historically offered digital news free at the point of consumption and primarily relied on display advertising for digital revenues. With the exception of a few dominant players, this model is widely seen as under severe pressure from a combination of three factors: (1) the large and growing share of online advertising going to international players like Google and Facebook, (2) the low average revenue per users on the mobile web (where advertising rates are lower and each page contains fewer ads), and (3) the increasing use of ad-blockers. These challenges mean that more and more newspapers are moving to various forms of pay models, with the exception of a few high-profile titles with very large audiences. Only a minority of online news users have been willing to pay so far, but interviewees are cautiously optimistic that the number will grow. Beyond the turn to pay models, private sector legacy news organisations are exploring other alternative sources of revenue to supplement display advertising and subscription, most importantly (1) the launch of new verticals, repackaged content products, and sections aimed at cultivating specific audiences more effectively, (2) investment in native advertising and branded content activities that are more effectively differentiated from generic display advertising, and (3) diversification with a move into e-commerce, business-to-business services, and offline activities including events and merchandising. National newspapers are generally exploring new avenues more aggressively than broadcasters, in large part because the decline in their legacy revenues is 53 PRIvATE SECTOR MEDIA AND DIGITAL NEWS much more severe, making the transition to digital that much more urgent. Local and regional newspapers are experiencing similar declines in legacy revenues, but in many cases have fewer resources to invest in new initiatives. This too is a common feature across all six countries. Broadcasters, who have more stable legacy revenues, have also invested in building digital reach, but have so far invested less in developing digital news as a part of their overall business. The degree to which different private sector legacy news organisations invest in digital initiatives, and the overall strategy they pursue (scale and advertising versus niche with a greater emphasis on pay) varies depending on a range of external and internal factors. The external factors are largely beyond the control of any one individual organisation, and include (1) how quickly audiences in a given country are moving to digital media and how technologically advanced the environment is, (2) the development of the digital media market itself including advertising expenditures and people’s willingness to pay, (3) the inherited, historically pathdependent structure of the news industry itself, and (4) how existing and new entrants, including both news organisations and other players, compete for audiences and advertising, including how they price their products and services. The certainty that both private sector and public service competitors continue to offer online news free at the point of consumption means that organisations aiming to succeed with pay models need to be confident that their news is of higher quality, effectively differentiated from alternatives, and clearly recognised as such by audiences. This challenge is particularly clear in the extremely competitive English-language market where users have many free alternatives to choose from when any one title opts for a pay model. In terms of internal factors, over which individual organisations have a greater degree of control, previous research has highlighted the importance of some factors that are specific to the news industry and some that are seen as more generally applicable across industries. Lucy Küng’s research on innovation in digital news suggests that common traits of more successful organisations include a clear strategic focus, senior leadership dedicated to change, a pro-digital culture, and a deep integration of editorial, technological, and commercial expertise in developing new products and services (Küng 2015). Most of the organisations covered here aspire to acquire these traits, with varying degrees of success. Strategic focus is particularly difficult in a very uncertain and constantly changing environment, and a commitment to legacy media and established ways of doing things still runs deep in the organisational culture of many newspapers and commercial broadcasters. More generally, this points to the importance of a variety of organisational features that business scholars have underlined as important for balancing the exploration of future opportunities and the exploitation of present ones. Generally, new exploratory and innovation-oriented initiatives benefit from a high degree of autonomy and separation from day-to-day operations even as they need to be carefully managed at the senior level to ensure progress is evaluated, lessons learned, and decisions made about what to continue, what to discontinue, and what new experiments to launch (see e.g. Christensen et al. 2012, O’Reilly and Tushman 2004). While attractive in principle, these more autonomous or separate structures can be difficult to maintain in practice as more converged or integrated operations offer opportunities for cost-saving and an important opportunity to change the overall culture of an organisation to be more pro-digital. Provided the organisation as a whole accepts a new strategic focus and develops a pro-digital culture, integration may work. If not, digital operations are likely to continue to be constrained by established ways of doing journalism and doing business. 54 PRIvATE SECTOR MEDIA AND DIGITAL NEWS All our interviewees expect to see audiences and advertising continue to move from offline to online media, and expect to see the digital media environment itself continue to change, driven by evolving forms of use, new technologies, and initiatives from large technology companies. Individual private sector legacy news organisations are adapting to this with varying degrees of success, but no clear generally applicable model(s) for sustainable digital news production have been developed so far. Every organisation examined is experimenting and forging its own path, seeking a balance between exploiting legacy operations, building digital operations, and exploring the opportunities ahead. Experimentation and exploration are an uncertain business, but encouraging in themselves - it is because of their decision to invest in the future that newspapers and commercial broadcasters continue to be central to an increasingly digital media environment. 55 PRIvATE SECTOR MEDIA AND DIGITAL NEWS References Note: All URLs were accessed in Sept. 2016. Boczkowski, P. 2004. Digitizing the News: Innovation in Online Newspapers. Cambridge, MA: MIT Press. Boland, M. 2016. ‘Native Ads will Drive 74% of All Ad Revenue by 2021’, Business Insider, 14 June, http://www.businessinsider.com/the-native-ad-report-forecasts-2016-5?IR=T. Christensen, C. M., Skok, D. and Allworth, J. 2012. ‘Breaking News’, Nieman Reports, Sept. http://niemanreports.org/articles/breaking-news. Deutz, J. and Fard-Yazdani, D. 2016. Axel Springer’s Presentation at the Berenberg TMT Conference 2016, Zurich, 1 June 2016, http://www.axelspringer.de/dl/23496576/16-0530_AxelSpringer_Berenberg_Zuerich_neu.pdf EAO. 2014. Yearbook 2014: Television, Cinema, Video and On-Demand Audiovisual Services – the Pan-European Picture. Strasbourg: European Audiovisual Observatory. EAO. 2016. Yearbook 2015: Television, VOD, Cinema and Video in 39 European States: Markets and Players, Services and Usage. Strasbourg: European Audiovisual Observatory. (Yearbook Online Service accessed July 2016). Hamilton, J. 2004. All the News that’s Fit to Sell: How the Market Transforms Information into News. Princeton, NJ, and Oxford: Princeton University Press. Internet World Stats. 2016. Online database, http://www.internetworldstats.com/europa.htm#fi. Kalogeropoulos, A., Cherubini, F. and Newman, N. 2016. The Future of Online News Video. Oxford: Reuters Institute for the Study of Journalism. Küng, L. 2015. Innovators in Digital News. London: I.B. Tauris. Mediatique. 2012. The Provision of News in the UK. A Report for Ofcom. London: Mediatique. Newman, N., Fletcher, R., Levy, D. and Nielsen, R. K. 2016. Digital News Report 2016. Oxford: Reuters Institute for the Study of Journalism. Newman, N., Levy, D. and Nielsen, R. K. 2015. Digital News Report 2015. Oxford: Reuters Institute for the Study of Journalism. New York Times. 2014. Innovation, 24 Mar. http://www.presscouncil.org.au/uploads/52321/ufiles/The_New_York_Times_Innovation_Report__March_2014.pdf. Nielsen, R. K. 2012. Ten Years that Shook the Media World. Oxford: Reuters Institute for the Study of Journalism. Nielsen, R. K. and Sambrook, R. 2016. What is Happening to Television News? Oxford: Reuters Institute for the Study of Journalism. 57 PRIvATE SECTOR MEDIA AND DIGITAL NEWS Ofcom. 2015. International Communications Market Report 2015. London: Ofcom. O’Reilly, C. A. and Tushman, M. L. 2004. ‘The Ambidextrous Organization’, Harvard Business Review 82, 74–81. Picard, R. G. 2011. The Economics and Financing of Media Companies. 2nd edn. New York: Fordham University Press. Seetharaman, D. 2016. ‘Facebook Revenue Soars on Ad Growth’, Wall Street Journal, 28 Apr. http://www.wsj.com/articles/facebook-revenue-soars-on-ad-growth-1461787856. Sehl, A., Cornia, A. and Nielsen, R. K. 2016. Public Service News and Digital Media. Oxford: Reuters Institute for the Study of Journalism. Southern, L. 2016a. ‘For France’s Libération, Facebook Instant Articles Drives a 30 Percent Increase in Time Spent’, Digiday UK, 23 Mar. http://digiday.com/publishers/facebook-instantarticles-leads-30-percent-increase-time-spent-liberation. Southern, L. 2016b. ‘How Bild is Using vR and 360-Degree video for Breaking News’, Digiday UK, 1 Aug. http://digiday.com/publishers/bild-using-vr-360-degree-video-breaking-news. vanNest, A. 2015. ‘Facebook Continues to Beat Google in Sending Traffic to Top Publishers’, Parse.ly, 4 Dec. http://blog.parsely.com/post/2855/facebook-continues-to-beat-google-insending-traffic-to-top-publishers. WAN-IFRA. 2015. World Press Trends 2015. Paris: WAN-IFRA. WAN-IFRA. 2016a. World Press Trends Database, http://www.wptdatabase.org. WAN-IFRA. 2016b. Distributed Content. Part 1: What it All Means to News Publishing Strategy. Paris: WAN-IFRA. World Bank. 2016. Online database, http://data.worldbank.org/indicator/SP.POP.TOTL. 58 PRIvATE SECTOR MEDIA AND DIGITAL NEWS List of Interviewees Positions are those people held at the time they were interviewed. FINLAND Helsingin Sanomat Kaius Niemi, senior editor-in-chief, Helsingin Sanomat Iltalehti Antti Haarala, head of digital services, Iltalehti Erkki Merilouto, publishing editor, news, Iltalehti MTV Jyrki Huotari, managing editor, MTV News Anu Kuistiala, editor-in-chief, digital, MTV News Aamulehti/ Lännen Media Matti Posio, editor-in-chief, Lännen Media FRANCE Le Monde Catherine Joly, general secretary, Le Monde Group Nabil Wakim, director of editorial innovation, Le Monde Le Figaro Jean-Luc Breysse, deputy general director, Le Figaro Group Anne Pican, digital director of Figaro.fr, Le Figaro TF1 Nicolas Fertin, head of MyTF1 News, TF1 Michel Floquet, deputy director of information, TF1 La Voix du Nord Bruno Jauffret, director of digital development, La Voix du Nord Pierre Mauchamp, deputy editor-in-chief, La Voix du Nord GERMANY Süddeutsche Zeitung Stefan Plöchinger, digital editor Süddeutsche Zeitung and editor-in-chief SZ.de BILD Stefan Betzold, managing director digital, BILD Donata Hopfen, publishing director and head of management board, BILD-Group Julian Reichelt, editor-in-chief BILD Digital, BILD RTL and n-tv Eva Messerschmidt, manager of sales and digital products, n-tv Frank Müller, editor-in-chief, RTL interactive 59 PRIvATE SECTOR MEDIA AND DIGITAL NEWS Rheinische Post Rainer Leurs, editor-in-chief RP Online, Rheinische Post Stephan Marzen, managing director, Rheinische Post Westdeutsche Allgemeine Zeitung Andreas Fettig, head of online derwesten.de, DerWesten Jochen Herrlich, managing director digital, Funke Medien ITALY La Repubblica Alessio Balbi, head of online, La Repubblica Pier Paolo Cervi, general director of the digital division, Gruppo L’Espresso Il Corriere della Sera Davide Casati, digital editor, Il Corriere della Sera Michela Colamussi, marketing director, digital product and video, RCS Venanzio Postiglione, deputy editor-in-chief, Il Corriere della Sera Nicola Speroni, business unit director, RCS Mediaset Emanuele Callioni, director of multimedia contents and technologies, Mediaset Andrea Delogu, deputy general director of the information directorate, Mediaset Il Resto del Carlino Beppe Boni, deputy editor-in-chief, Il Resto del Carlino Paolo Giacomin, deputy editor-in-chief for the group’s news websites, Monrif Debora Peroni, online marketing manager, Monrif Net POLAND Gazeta Wyborcza Danuta Breguła, head of business development, Gazeta Wyborcza Wojciech Fusek, deputy editor-in-chief, Gazeta Wyborcza Roman Imielski, managing editor of Wyborcza.pl, Gazeta Wyborcza Fakt Robert Felus, editor-in-chief, Fakt Maciej Kabroński, head of Fakt24.pl, Fakt Marek Kopeć, product manager of Fakt24.pl, Fakt TVN24 Łukasz Dulniak, social media and new projects manager, TVN24 Matrusz Sosnowski, TVN news portals unit director and TVN24 portal editor-in-chief Dziennik Zachodni Magdalena Chudzikiewicz, chief digital officer and member of the board, Polska Press Grupa Tomasz Krawczyk, editorial development director, Polska Press Grupa Marek Twaróg, editor-in-chief, Dziennik Zachodni 60 PRIvATE SECTOR MEDIA AND DIGITAL NEWS UK Daily Telegraph Malcolm Coles, director of digital media, Telegraph Media Group Peter Lindsay, director of strategy, Telegraph Media Group Daily Mail Kevin Beatty, CEO, dmg media ITV Magnus Brooke, director of policy and regulatory affairs, ITV Jason Mills, head of digital, ITV News Manchester Evening News Beth Ashton, social media editor, Manchester Evening News David Higgerson, digital publishing director, Trinity Mirror (Regionals) Seb Ramsay, digital development editor, Manchester Evening News 61 RISJ PublIcatIonS DIGITAL NEWS PROJECT REPORTS Journalism, Media and Technology Predictions 2016. Nic Newman Editorial Analytics: How News Media are Developing and Using Audience Data and Metrics. Federica Cherubini and Rasmus Kleis Nielsen Public Service News and Digital Media. Annika Sehl, Alessio Cornia, and Rasmus Kleis Nielsen What's Happening to TV News? Rasmus Kleis Nielsen and Richard Sambrook Online Video News. Antonis Kalogeropoulos, Federica Cherubini, and Nic Newman Digital News Report 2016. Nic Newman, Richard Fletcher, David A. L. Levy and Rasmus Kleis Nielsen Private Sector Media and Digital News. Alessio Cornia, Annika Sehl, and Rasmus Kleis Nielsen DIGITAL NEWS PROJECT REPORTS FORTHCOMING Asia-Pacific Supplementary Digital News Report 2016. Kruakae Pothong and Rasmus Kleis Nielsen The Rise of Fact-Checking Sites in Europe. Lucas Graves and Federica Cherubini Alerts and Notifications. Nic Newman Digital-born News Media in Europe. Tom Nicholls et al. SELECTED RISJ BOOKS (published jointly with I.B.Tauris) Media, Revolution, and Politics in Egypt: The Story of an Uprising. Abdalla Hassan The Euro Crisis in the Media: Journalistic Coverage of Economic Crisis and European Institutions Robert G. Picard (ed) Local Journalism: The Decline of Newspapers and the Rise of Digital Media. Rasmus Kleis Nielsen (ed) The Ethics of Journalism: Individual, Institutional and Cultural Influences. Wendy N. Wyatt (ed) Political Journalism in Transition: Western Europe in a Comparative Perspective Raymond Kuhn and Rasmus Kleis Nielsen (eds) Transparency in Politics and the Media: Accountability and Open Government Nigel Bowles, James T. Hamilton, David A. L. Levy (eds) The Media, Privacy and Public Shaming: The Boundaries of Disclosure. Julian Petley SELECTED RISJ CHALLENGES (published jointly with I.B.Tauris) The Right to Be Forgotten: Privacy and the Media in the Digital Age. George Brock The Kidnapping of Journalists: Reporting from HighRisk Conflict Zones. Robert G. Picard and Hannah Storm Innovators in Digital News. Lucy Küng Journalism and PR: News Media and Public Relations in the Digital Age. John Lloyd and Laura Toogood Reporting the EU: News, Media and the European Institutions. John Lloyd and Cristina Marconi Climate Change in the Media: Reporting Risk and Uncertainty. James Painter Women and Journalism. Suzanne Franks Transformations in Egyptian Journalism. Naomi Sakr Supported by Reuters Institute for the Study of Journalism reutersinstitute.politics.ox.ac.uk digitalnewsreport.org 9 781907 384226 I G I TA L N E W S P R O J E C T D I G I TA L N E W S P R O J E C T D I G I TA L N E W S P R O J E C T D I G I TA L N E W S ISBN 978-1-907384-22-6