The consolidated EBITDA

Anuncio

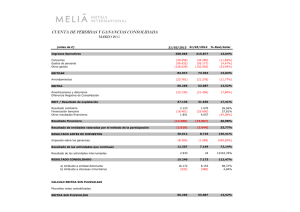

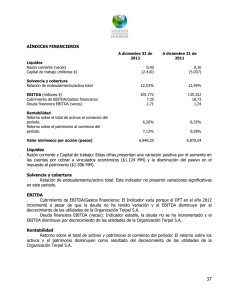

Asesores Financieros 1Q15 Results Presentation| June 2015 Resultados Dec-14 Agenda 01 02 03 04 General Background Main SK’s subsidiaries Financial Consolidated Highlights Exhibits figures Corporate Presentation | Sigdo Koppers Company Overview Sigdo Koppers, Chilean conglomerate founded in 1960. One of the most dynamic and important industrial groups in Chile. Our commitment is a long term investment industrial approach, aiming to be a comprehensive supplier of products and services for the mining and industrial operations worldwide. Sales (US$ millions) Consolidated EBITDA (US$ millions) Ingeniería y Construcción Enaex Magotteaux SK SK Comercial Comercial 60.43% 60.72% 95.00% 85.77% Net Profit Puerto Ventanas SK Godelius CHBB SKBergé 50.01% 58.19% 74.59% 40.00% (US$ millions) Source: Company Note: The percents correspond to the ownership of Sigdo Koppers over its subsidiaries, as of March 2015, (1) Net Profit of 2011 have an extraordinary effect of US$157 millions mainly due to the sale of CTI (2) Net Profit of 2013 have an extraordinary loss of US$29.2 millions mainly due to the sale of Sigdopack 286(1) 121(2) 3 Corporate Presentation Sigdo Koppers Corporate Governance Board of Directors Ownership Structure 5,95% Stock Brokers 6,43% Mutual Funds and other institutional investors 9,21% Pension Funds and Insurance companies 3 4 2 1. Juan Eduardo Errázuriz Ossa Chairman 3. Juan Andrés Fontaine Talavera Director 5. Norman Hansen Rosés Director 1 5 6 1,99% Others 7 2. Naoshi Matsumoto Takahashi Vicepresident Ownership structure as of Mar-15 4. Horacio Pavez García Director Daily Average vol. traded (1): US$0,6 millions 6. Canio Corbo Lioi Director Market Cap: US$1,650 millions (As of Mar 30th 2015) 7. Jaime Vargas Serrano Director Source: Santiago Stock Exchange. (1) Last 12 month 4 Corporate Presentation | Investment approach Supplier of products and services for the mining aprox. 75% of the SK’s Consolidated EBITDA comes from the exposure to the mining activities Strategic Focus: Provide products and services for the mining and industry Involved in the main stages of the mining value chain 1 MINING DEVELPOMENT 2 MINING OPERATION ORE PROCESSING 4 3 SALES & LOGISTICS … Anglo American - Minera Los Bronces: 1 Codelco – Andina: 1 BHP Billiton - Minera Escondida: 1 +2 + +2 + +2 + 3 3 3 + + 4 4 5 Results as of Mar-15 Agenda 01 02 03 04 General Background Main SK’s subsidiaries Financial Consolidated Highlights Exhibits figures 6 Results as of Mar-15 Highlights as of March 2015 The consolidated revenues droped in Consolidated Income Statement US$95.72 millon Figures in ThUS$ Mar-14 Mar-15 Var. 646.159 550.438 -14,8% 92.476 89.603 -3,1% 14,3% 16,3% 105.369 102.425 -2,8% Profit (Loss) 55.425 48.077 -13,3% Sigdo Koppers Net Profit (non recurrent) 35.333 31.381 -11,2% Dic-14 3.428.052 Mar-15 3.403.048 1.602.489 Sales EBITDA (1) EBITDA Margin EBITDA Pro Forma (2) Total Assets US$79 millon explained by a lower activity in ICSK US$15 million exchange rate US$7 million explained by lower activity in machinery distribution business in SKC explained by Sigdo Koppers’ consolidated EBITDA was Var. US$89.6 million as at March 2015, a decline of 3.1%. Nonetheless, the EBITDA margin rose from 14.3% to 16.3%, a reflection of the cost control efforts in several of the companies. -0,7% The net profit totaled US$31.4 million, a 1.617.665 0,9% 787.549 680.954 -13,5% decrease of 11.2% compared to the close of the previous year. 2,15 1,88 ROE 11,23% 10,80% ROCE 9,39% 9,47% Total Equity (3) Deuda Financiera Neta Deuda Financiera Neta/ EBITDA Sigdo Koppers has a good consolidated cash liquidity of US$286.5 million and a conservative level of consolidated debt. The net financial debt-to-EBITDA ratio is 1.88. EBITDA = Ganancia Bruta + Otros Ingresos por Función – Costos de Distribución - Gastos de Administración – Otros Gastos por Función + Gastos de Depreciación y Amortización (1) (3) EBITDA Pro-forma: considera las utilidades de empresas relacionadas que no consolidan. 7 Results as of Mar-15 Level of Activity - Physical Sale Commercial & Automotive Services Industrial Ing. y Construcción Enaex SK Comercial SK Rental (MTons) (units) Fleet (US$MM) (millions Men Hours) Puerto Ventanas Magotteaux SKBergé (Mtons) (Tons) (units) 8 8 Results as of Mar-15 EBITDA Pro-Forma By business area : Mar-14 v/s Mar-15 (US$ Thu) EBITDA Pro-Forma by business area -2,8% Lower performance in both Leasing and Distribution & Services Lower EBITDA Pro-Forma en CLP (-42,4%) Lower EBITDA due to lower physical sales Less favorable exchange rate conditions Services Industrial Increased Revenue and operational efficiency in Port Business Better performance in both castings and grinding balls. Less IT expenses Commercial y Automotive 9 9 Results as of Mar-15 CAPEX Capex Áreas de Negocios Área Servicios Mar-14 Mar-15 MUS$ MUS$ Major investments in fixed assets: 3.441 4.898 Ingeniería y Construcción SK 1.464 1.812 Puerto Ventanas 1.977 3.086 21.810 13.735 Ventanas: Begins construction of warehouse for copper concentrate capacity of 46,000 Tons (US $ 21 million investment) 4.744 8.179 Enaex: New Plant for cartridged emulsions in Rio 17.066 5.556 - - 5.816 1.651 5.816 1.651 - - 31.066 20.284 Área Industrial Enaex Magotteaux SK Inv. Petroquímicas Área Comercial y Automotriz SK Comercial (1) SKIA Capex Empresas SK (1) Capex Neto: El Capex de SKC incluye la venta de maquinaria usada de SK Rental Puerto Loa de 14.400 Tons/year million) (Investment US$ 11 SK Comercial: Lower investment in SK Rental’s fleet, lower activity. 10 10 Results as of Mar-15 Conservative Financial Profile Financial Net Debt/EBITDA Financial Debt Matriz Servicios Current 30% Industrial 1,88x Non Current 70% Comercial y Automotriz US$ 968 millon – Consolidated US$ 681 millon – Financial Net Debt Cash (US$ millon) Financial Key Indicators Consolidated Leverage : 1,10x Financial Net Leverage : 0,42x Financial Net Debt/EBITDA: 1,88x Rating: A+ (Feller-Rate, Fitch-Ratings) 11 11 Results as of Mar-15 Agenda 01 02 03 04 General Background Main SK’s subsidiaries Financial Consolidated Highlights Exhibits figures Results as of Mar-15 Ingeniería y Construcción SK Ingeniería y Construcción Sigdo Koppers Revenue EBITDA Mar-14 MM$ 94.240 6.577 Mar-15 MM$ 51.247 2.548 EBITDA Margin 7,0% 5,0% EBITDA Pro-Forma (*) 10.404 5.989 -42,4% Controller's net profit 5.847 3.121 -46,6% Horas (Miles) 7.837 Horas (Miles) 5.111 Tota l ma n-hours executed Var. % -45,6% -61,3% Var. -34,8% ICSK reached 5.1 million man-hours (-35%), reflecting a drop in activity, particularly in the mining sector. Its net profit totaled CH$3.121 billion (US$5.0 million), a decrease of 47% in pesos compared to the first quarter of 2014. Pro-Forma EBITDA (*) de $5.989 millon (-42,4%) The backlog as of March 31, 2015 was US$695 million, a rise of 58.4% in pesos compared to December 2014. The reason was the award of the SIC-SING interconnection project that will entail an investment of close to US$320 million. Backlog distribution: Chile (89%) & Perú (11%). (*) Incorpora la utilidad empresas relacionadas 13 Results as of Mar-15 Puerto Ventanas Puerto Ventanas Consolidated Mar-14 Mar-15 Var. MUS$ MUS$ % Revenue 35.330 33.904 -4,0% EBITDA 11.612 12.176 4,9% 32,9% 35,9% 6.241 7.201 1.524.332 1.597.306 4,8% 307.076 305.289 -0,6% EBITDA Margin Controller's net profit PVSA - Tons transferred Fepasa - Th Ton-Km 15,4% Puerto Ventanas 1,597,306 tons (+4.8%) transfered as of Mar-15 Coal (+22%) Clinker (+59%) Cooper Concentrate (-16%) Revenues from the Port Business grew 4% compared to Mar-14 Port business EBITDA increased 18% due to higher operating efficiency and more favorable exchange rate. EBITDA Margin: 60% PVSA Holds a market share of 62% in solid bulk as of March 2015 Fepasa Fepasa carried a total of 305,289 Ktons-Km of cargo 1Q15 (-1%) Mining cargo (21% of total transported): +4% in Ton/Km Forestry cargo (pulp): (54% transported): +4% in Ton/Km of total Fepasa consolidated EBITDA reached US$3 millions (-12% en pesos) EBITDA Margin: 15% Fepasa signed a contract with Anglo American to carry copper concentrate via railroad from Las Tortolas Plant (Los Andes) to Puerto Ventanas, beginning operations in 2017. 14 Results as of Mar-15 Enaex Enaex Revenue EBITDA EBITDA Margin Controller's net profit Mar-14 Mar-15 MUS$ 147.418 40.587 MUS$ 155.784 38.064 27,5% 24,4% 27.177 23.690 Var. % 5,7% -6,2% -12,8% Enaex recorded revenues of US$156 million (+6%) Physical sales totaled 199 Ktons(-5%) Increase of 4% in physical sales in the rock blasting services business compared to 1Q14. The average price of ammonia reach US$501/ton (+11%) The consolidated EBITDA of Enaex was US$38 million (-6%) Physical Sales Evolution (Thu tons) Enaex recorded a net profit of US$24 million (-13%) Enaex agreed to buy Davey Bickford, a global manufacturer and distributor of electronic detonators for the explosives industry at $ 103.3 million Euros. Enaex bought 50% share of Xion Participacoes, for $ 70 million. Enaex now controls 100% of the Brazilian company IBQ (Britanite). 15 Results as of Mar-15 Magotteaux Magotteaux Group (1) Revenue EBITDA EBITDA Margin Controller's net profit Mar-14 MUS$ 194.952 15.646 Mar-15 MUS$ 191.445 20.599 Var. % -1,8% 8,0% 10,8% 0,0% 6.979 7.702 10,4% 31,7% Consolidated income totaled US$191 million as of 1Q15 (-2%) Physical sales totaled 96 Mtons (+3%) 93,712 tons of mill balls (+4%) (80% in mining) 12,373 tons of castings (53% in cement, 30% in agregates) Magotteaux Group (1) Mar-14 Mar-15 Tons Tons Var. % Mill Ba lls 80.745 83.712 3,7% Ca s ting 12.386 12.373 -0,1% Total 93.131 (1) 96.085 3,2% Consolidated figures of Magotteaux & SK Sabo Chile S.A. EBITDA amounted to US$21 millions as of Mar-15 (+32%) Better performance and margins in the business lines of casting and grinding balls Lower SG&A – reorganization process The company earned a net profit of US$8 millions as of 1Q15. Start-up phase of the new HiCr ball production plant in Thailand that will have a capacity to produce 50,000 tons. 16 Results as of Mar-15 SK Comercial Mar-14 MUS$ 98.143 Mar-15 MUS$ 87.899 Var. % -10,4% Distribution Business Rental Business 66.928 61.082 -8,7% 39.158 36.653 -6,4% Consolidation adjust -7.942 -9.835 23,8% 15.956 15.729 -1,4% 16,3% 17,9% 1.770 1.440 SK Comercial Revenue EBITDA EBITDA Margin Controller's net profit -18,6% Consolidated revenues totaled US$88 millions (-10%) The machinery distribution business sold 501 units (-4%). Distribution of SK Rental Fleet by Country (US$) SK Rental revenue dropped 6% compared to 1Q14 (FX impact) SK Rental Consolidated fleet reaches 4,901 units (valued at US $ 250 millions) Consolidated EBITDA reached US$16 millions (-1%) Consolidated EBITDA Margin of 18% The net profit of SK Comercial totaled US$1.4 millions This result is composed of a lower yield in machinery rental business in Chile (SK Rental) and lower business performance in Distribution Services. 17 Results as of Mar-15 SK Inversiones Automotrices SK Inversiones Automotrices Utilidad Neta Controladora Mar-14 MM$ 3.453 SKIA recorded revenues of MCH$4,423 (US$7 millions) (+28%). Mar-15 MM$ 4.423 Var. % 28,1% Chile Perú Result affected by favorable exchange rate. SKBergé sold 16,442 units, showing an decrease of (18%) compared to 1Q14. Best performance in overseas sales 8,880 units (+1%) Colombia Argentina ANAC recorded sales of 63,593 units in Chile at the end of 1Q15 (-28%). High growth potential in countries with low density of cars like Peru and Colombia 18 Results as of Mar-15 Summary highlights of SK Companies – 1Q15 Ingeniería y Construcción Sigdo Koppers: Recorded 5 millions Man Hours (-35%) (Includes direct sales and consortiums) The award of the SIC-SING interconnection project that will entail an investment of close to US$320 million. Puerto Ventanas: Higher valued sales in the Port Business (+4%) with greater operational efficiency, EBITDA margin reached 60% in the port business Consolidated net profit reached US$7 millions (+15%) Enaex: Physical sales of 198,660 Tons of explosives (-5%) and growth in service of rock fragmentation in Chile (+4%). Net profit of US$24 millions (-13%) Magotteaux: Higher physical sales (+3%) (Balls +4% & Casting 0%) Net profit of US$8 millions (+10%) SK Comercial: Net profit reached US$1.4 millions (-19%). Contraction of Distribution and Rental of machinery businesses in Chile. Crecimiento en ventas de SK Rental en Perú (+10%) & Colombia in growth stage SKBergé: Decreased of units sold -18% (abroad +1% & in Chile -32%) Better conditions of FX 19 Results as of Mar-15 Agenda 01 02 03 04 General Background Main SK’s subsidiaries Financial Consolidated Highlights Exhibits figures Results as of Mar-15 Income Statement of Sigdo Koppers Figures in ThUS$ Sigdo Koppers Consolidated Income Statement Mar-14 Sales Mar-15 Var. 646.159 550.438 -14,8% -502.315 -418.808 16,6% 143.844 131.630 -8,5% 4.141 3.756 -9,3% Distribution costs -22.438 -20.208 9,9% Administrative expenses -61.047 -52.585 13,9% Other operating expenses -1.539 -1.295 15,9% 62.961 61.298 -2,6% 92.476 89.603 -3,1% 14,3% 16,3% 1.120 935 -16,5% -13.851 -12.365 10,7% 12.893 12.822 -0,6% 2.404 -4.329 -280,1% -2.568 2.447 195,3% 1.830 -195 -110,7% 7 0 64.796 60.613 -6,5% -9.371 -12.536 -33,8% 55.425 48.077 -13,3% Sales expenses Gross income Other operating income Operating income EBITDA % EBITDA Margin Interest income Interest expenses Related companies income Exchange differentials Price - level restatement Other income (losses) Gain (losses) between book value and fair value (financial assets) Income before taxes Income tax Income Gain (losses) from uncontinnued operations Net income Income attributable to Sigdo Koppers Income a ttri butabl e to non-control l i ng i nteres ts Net income 0 - 55.425 48.077 -13,3% 35.333 31.381 -11,2% 20.092 16.696 -16,9% 55.425 48.077 -13,3% 21 Results as of Mar-15 Revenue of Sigdo Koppers Revenue Business Areas Figures in ThUS$ Mar-14 Services Mar-15 Var. 206.129 115.976 -43,7% 170.799 82.072 -51,9% 35.330 33.904 -4,0% 343.338 348.121 1,4% Enaex 147.418 155.784 5,7% Magotteaux (1) 194.952 191.445 -1,8% Ingeniería y Construcción SK Puerto Ventanas Industrial Sigdopack SK Inv. Petroquímicas 0 - - 968 892 -7,9% 98.143 87.899 -10,4% SK Comercial 98.143 87.899 -10,4% (2) - - - -1.451 -1.558 7,4% 646.159 550.438 -14,8% Commercial & Automotive SKIA Parent company & adjustment (3) Consolidated Sales (1)Magotteaux’s figures include income of SK Sabo Chile S.A. companies through which Sigdo Koppers controls Magotteaux. The profits attributable to the controller were adjusted in the different (2) SK Inversiones Automotrices S.A. (SKIA) does not account for the income of SKBergé because it holds 40% of its shares and, therefore, does not consolidate its financial statements. (3) Eliminations and adjustments as of December are mainly the result of consolidated intercompany eliminations. 22 Results as of Mar-15 EBITDA of Sigdo Koppers EBITDA Business Areas Services Figures in ThUS$ Mar-14 Mar-15 Var. 23.572 16.257 -31,0% Ingeniería y Construcción SK 11.920 4.081 -65,8% Puerto Ventanas 11.652 12.176 4,5% 56.862 59.221 4,1% 40.587 38.064 -6,2% 15.646 20.599 31,7% - - Industrial Enaex Magotteaux (1) Sigdopack SK Inv. Petroquímicas 0 629 558 -11,3% 15.935 15.707 -1,4% 15.956 15.729 -1,4% -21 -22 7,0% Parent company & adjustment -3.893 -1.582 -59,4% Consolidated EBITDA 92.476 89.603 -3,1% 14,3% 105.369 16,3% 102.425 -2,8% Commercial & Automotive SK Comercial SKIA (3) EBITDA Margin Consolidated pro-forma EBITDA (1) Magotteaux’s figures through December include the EBITDA of SK Sabo Chile S.A. (2) SK Inversiones Automotrices S.A. (SKIA) does not account for the EBITDA of SKBergé because it owns 40% of its shares and, therefore, it does not consolidate its financial statements. (3) Pro Forma EBITDA = EBITDA + Related Company Profits 23 Results as of Mar-15 Net Profit of Sigdo Koppers Total Companies Net profit Business Areas Figures in ThUS$ Mar-14 Services % SK Mar-15 Var. 16.839 12.199 -27,6% 10.598 4.998 -52,8% 6.241 7.201 15,4% 34.483 31.780 -7,8% 27.177 23.690 -12,8% 6.979 7.702 SK Inv. Petroquímicas (2) 327 Commercial & Automotive Mar-15 Attributable to parent company Figures in ThUS$ Mar-14 Mar-15 Var. 9.526 6.529 -31,5% 60,43% 6.405 3.020 -52,8% 50,01% 3.121 3.509 12,4% 23.796 21.768 -8,5% 60,72% 16.502 14.384 -12,8% 10,4% 95,00% 6.967 7.063 1,4% 388 18,7% 74,59% 327 321 -1,8% 8.028 8.522 6,2% 7.775 8.316 7,0% SK Comercial 1.770 1.440 -18,6% 85,77% 1.518 1.234 -18,7% SKIA 6.258 7.082 13,2% 99,99% 6.257 7.082 13,2% 59.349 52.501 -11,5% 41.097 36.613 -10,9% -5.764 -5.232 35.333 31.381 Ingeniería y Construcción SK Puerto Ventanas Industrial Enaex Magotteaux (1) SK companies profit Parent company & adjusments Total consolidated profit (1) Magotteaux’s figures include income of SK Sabo Chile S.A. The profits attributable to the controller were adjusted in the different companies through which Sigdo Koppers controls Magotteaux. (2) The profit of CHBB was adjusted in SK Inversiones Petroquímicas S.A. through which Sigdo Koppers controls CHBB. -11,2% (3) Extraordinary effect associated with the sale of Sigdopack in September 2013. 24 Results as of Mar-15 Cash Flow of Sigdo Koppers Consolidated Cash Flow Operating cash flow Figures in ThUS$ Mar-14 Mar-15 Var. 91.624 95.248 4,0% -38.999 -17.879 -54,2% -39.900 -20.105 -49,6% Fixed assets sales 750 405 -46,0% Other 151 1.821 1106,0% 17.128 -25.092 -246,5% 8.420 -26.031 -409% -11.748 -9.998 -14,9% 0 -246 3.378 17.078 0 11.183 -100,0% -34,5% Total net cash flow 69.753 52.277 25,1% Effect of exchange rate changes -1.190 -4.292 260,7% 283.960 282.768 -0,4% Investment cash flow Capex Finance cash flow Net variation in financial liabilities Interest Dividends Capital increased Other Cash and cash equivalent 25 Results as of Mar-15 Balance Sigdo Koppers Consolidated Balance Sheet Figures in ThUS$ Dec-14 Mar-15 Var. Current Assets Cash and cash equivalent 237.470 286.501 20,6% Account and sales receivables 559.715 544.882 -2,7% Inventories 311.007 298.366 -4,1% 54.256 52.474 -3,3% 1.162.448 1.182.223 1,7% Property, plants & equipment 1.181.320 1.154.793 -2,2% Other long-term assets 1.084.284 1.066.032 -1,7% Total long-term assets 2.265.604 2.220.825 -2,0% Total assets 3.428.052 3.403.048 -0,7% Other current assets Total current assets Long-term assets Current liabilities Short-term financial debt 306.441 288.959 Accounts payable 272.273 287.037 5,4% Other current liabilities 155.592 171.333 10,1% 734.306 747.329 1,8% Long-term financial debt 718.578 678.496 -5,6% Other long-term liabilities 373.429 359.558 -3,7% Total long-term liabilities 1.092.007 1.038.054 -4,9% Total liabilities 1.826.313 1.785.383 -2,2% 1.198.855 1.209.978 0,9% 403.634 407.687 1,0% Total equity 1.602.489 1.617.665 0,9% Total liabilities and equity 3.428.802 3.403.048 -0,8% Total current liabilities -5,7% Indicators Net Financial Debt Working Capital Working Capital Days Days of Consolidated Inventory Accounts Receivable (Days) Accounts Payable Days 787.549 598.449 87 58 82 51 680.954 556.211 84 58 83 56 Long-term liabilities Equity Attributable to the controller Attributable to non-controlling interests 26 D Results as of Mar-15 Revenue by country (incl. SK Bergé) As of december 2014 Ventas Áreas de Negocios Chile Perú MUS$ Área Servicios MUS$ Colombia Brasil Asia MUS$ MUS$ MUS$ Otros Países MUS$ MUS$ MUS$ 12,9% Ingeniería y Construcción SK 83,7% 16,3% - - - - - - Puerto Ventanas 100% - - - - - - - 51,0% 0,0% 13,1% 15,4% 3,9% - - - - - 3,7% Magotteaux 13,1% - - 12,4% 18,0% 24,0% 28,4% 4,1% 100% 30,1% SK Comercial 80,2% SKIA 53,4% 60,7% Ventas Empresas SK - 9,8% 0,0% - 58,5% 6,8% 0,0% 96,3% Área Comercial y Automotriz 0,0% 0,0% Enaex SK Inv. Petroquímicas 0,0% 0,0% Europa 87,1% Área Industrial 0,0% Norte America - 9,2% 0,5% 15,9% 1,1% 2,8% 33,4% 11,2% 16,8% 4,5% - - 0,0% - 2,6% 0,0% - - - - - - - 3,4% 4,5% - 0,0% 1,6% 2,0% 5,3% 2,1% As of March 2015 Ventas Áreas de Negocios Chile Perú MUS$ Área Servicios MUS$ Colombia Brasil Asia MUS$ MUS$ MUS$ MUS$ MUS$ MUS$ Ingeniería y Construcción SK 81,1% 18,9% - - - - - - Puerto Ventanas 100% - - - - - - - 16,1% 13,8% 4,8% 0,0% 0,0% 6,4% 0,0% Otros Países 13,4% 49,1% 0,0% Europa 86,6% Área Industrial 0,0% Norte America 9,8% 0,0% 0,0% 0,0% Enaex 94,5% - - - - - - 5,5% Magotteaux 11,8% - - 11,7% 17,9% 29,4% 25,1% 4,2% SK Inv. Petroquímicas Área Comercial y Automotriz SK Comercial SKIA Ventas Empresas SK 100% - 56,0% 32,2% 8,5% - 0,5% - 80,3% 15,5% 1,7% 2,5% 49,4% 36,7% 10,3% 57,3% 16,9% 4,0% - 2,8% 0,0% - 3,9% 0,0% - 6,4% 0,0% - 5,5% 2,8% 3,6% 3,2% 27 Asesores Financieros 4Q14 Results Presentation| Larrain Vial Andean Conference March 2015