- Ninguna Categoria

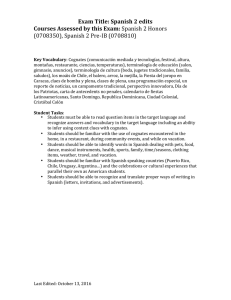

The reform of the Spanish electricity sector

Anuncio

The reform of the Spanish electricity sector In this article, we analyze the measures included in the new Royal Decree being prepared by the Government, with the aim of ending the tariff deficit of the Spanish electricity sector, in other words, the difference between the electricity companies´ receivables and end-user tariffs. The reform is mainly focused on adjustments to the remuneration for renewables energies and the introduction of a toll on self-consumption. The new rule will also modify the current auction system for determining the cost of electricity for consumers. The electricity sector suffered a fall in demand of 2.3% in 2013, in addition to a decline of 1.5% in 2012 (Table 1). The dependence of demand on industrial consumption explains the larger decline in electricity demand relative to GDP for the first time since 2009. Falling demand has adverse consequences on the financial sustainability of the system, as more than half the sector’s costs are fixed. The fact that this demand contraction continued into the first two months of 2014 –demand is down 0.8%, adjusted for calendar and temperature factors– is worrisome. Output under the special regime (renewable energies, co-generation, waste plants) increased by 8.1%, bringing its share of output up to 30.2%, 1 Partners at A.F.I. – Analistas Financieros Internacionales, S.A. compared to 25.5% in 2012. Output from strictly renewable energies increased by 14.3%, mainly due to meteorological conditions, as installed power only increased by 2% in 2013. Bearing in mind that 61% of renewable energy output comes from wind, which is unpredictable and irregular, the system is approaching the limit of its capacity to absorb renewable energies. In fact, in 2013, Red Eléctrica, the system operator, had to manage hours in which high levels of wind and hydraulic output coincided with extremely low demand, thus forcing a cutback in output even in nuclear plants. 51 SEFO - Spanish Economic and Financial Outlook The electricity tariff deficit of 2013 is expected to have reached 4.5 billion euros, below the 5.6 billion euros deficit of 2012, mostly due to energy taxes which entered into force on January 1st, 2013. Including the 2013 result, the accumulated debt stock is projected to rise above 30 billion euros. Recent regulatory measures aim to correct this imbalance through a deep cutback in revenues from renewable energies, but not without generating uncertainty over Spain´s investment climate, as well as the need for renegotiation of outstanding debt tied to renewables projects. Vol. 3, N.º 2 (March 2014) Arturo Rojas and Pablo Mañueco1 Arturo Rojas and Pablo Mañueco Table 1 Peninsular annual energy balance Vol. 3, N.º 2 (March 2014) GWh 2013 SEFO - Spanish Economic and Financial Outlook 2012 % 12/11 2011 Hydro 34,205 75.8 19,455 -29.4 27,571 Nuclear 56,378 -8.3 61,470 6.5 57,731 Coal 39,792 -27.3 54,721 25.8 43,488 Combined cycle 25,409 -34.2 38,593 -23.9 50,734 Gross production 155,785 -10.6 174,240 -2.9 179,525 Self-consumption -6,241 -20.9 -7,889 8.9 -7,247 Hydro 7,095 53.1 4,633 -12.5 5,294 Wind 53,926 12.0 48,103 14.2 42,105 Solar photovoltaic 7,982 2.3 7,803 10.0 7,092 Solar thermoelectric 4,554 32.3 3,443 87.9 1,832 Renewable thermal 5,011 5.6 4,729 10.4 4,285 Non-renewable thermal 52 % 13/12 32,048 -4.3 33,442 4.3 32,051 Special regime 110,616 8.1 102,152 10.2 92,660 Net production 260,160 -3.1 268,503 1.3 264,938 Pumped storage consumption -5,769 14.9 -5,023 56.2 -3,215 Peninsula-Balearic interc. -1,266 International exchanges Demand (at power station busbars) -570 -500 -6,958 -37.9 -11,200 83.9 -6,090 246,166 -2.3 251,710 -1.5 255,633 Source: Red Eléctrica. Table 2 Year-on-year GDP and electricity demand in mainland Spain Year GDP Electricity demand 2008 0.9 1.1 2009 -3.7 -4.7 2010 -0.3 3.1 2011 0.4 1.9 2012 -1.4 -1.5 2013 -1.2 -2.3 Sources: INE and REE. The excellent rain year of 2013 decimated coal and natural gas energy output, which fell by 27% and 34%, respectively. With such low consumption levels, combined-cycle plants face a difficult operating environment. Combined cycle output is at its lowest in ten years, and installed capacity ten years ago was only 17% of the current level. Utilization in 2013 at full charge of 1,000 hours of combined-cycle plants versus 4,280 hours in 2008 and the 5,000 hours for which they were designed, is utterly insufficient to achieve profitability on an investment which has a useful life period of 25 years. Not even capacity payments, which are received irrespective of output, can make up for such severe under-use of the 25,353 MW of combined cycles, all built since 2001. The reform of the Spanish electricity sector Electricity Industry Act 24/2013 The Electricity Industry Act 24/2013, of December 26th, 2013, acknowledges the inability of previous measures to end the revenue deficit. Financial balance is finally to be attained by allowing greater flexibility in the remuneration of regulated activities, especially renewable energies, in order to adjust to changes in the electricity system and, in particular, to trends in the economy. Spain has therefore moved away from a sound and stable system that was predictable in the long term, and Spain has moved away from a sound and stable system that was predictable in the long term, and adopted a flexible model that will be subject to review every three years. Law 24/2013 mandates that system revenues will be sufficient to cover all the costs of the electricity system, and it imposes on itself budgetary balance for any regulatory measure related to the electricity industry. From now on, an increase of costs for the electricity system or a reduction of revenues must include an equal reduction in other cost items to ensure system balance. Hence, it relies on automatic mechanisms in toll revisions to correct any deficits that should arise. Vol. 3, N.º 2 (March 2014) The tariff deficit of 2013 is expected to reach 4.5 billion euros, but it will fall short of the 5.6 billion euros deficit of 2012. In 2013, the reduction in the deficit was due to the taxes on energy which entered into force on January 1st, 2013 and whose purpose is to reduce the deficit subtracting income from generation activity. The 2013 deficit will be added to the accumulated debt of 26.1 billion euros, announced by the Spanish National Energy Commission, as of May 10th, 2013. Eliminating the annual deficit would require a 10% increase in the price of electricity, in a manner that is linear for all consumers, and a hike of somewhat more than 30% in access tolls, which are part of the tariff determined by the Ministry of Industry. This would come in addition to the 22% increase in tolls between 2004 and 2012, which has driven the price of electricity in Spain far above the European Union average. Reducing the accumulated deficit will require a recovery in electricity demand. adopted a flexible model that will be subject to review every three years. 53 Tolls on self-consumption One controversial aspect of Law 24/2013 relates to self-consumption of customers connected to the electricity grid, who are obligated to contribute to covering system costs and services in the same amount as other consumers. That is, a kWh produced by a consumer will accrue the same toll payment as a kWh purchased from the grid. Both the National Energy Commission and the National Competition Commission have come out against self-consumption tolls, but the Ministry of Industry has decided to avoid the flight of consumer demand that would be caused by the incentive to save on the tolls. Only about 40% of the cost of electricity corresponds to market generation cost. Hence, if tolls need not be paid, the self-consumption saving would be substantial. For the Ministry of Industry, the economic burden of the annual deficit payments and of aid to renewable energies must be borne by all consumers connected to the grid in proportion to their electricity consumption, irrespective of the self-consumption component. A decrease in demand from self-consumption in SEFO - Spanish Economic and Financial Outlook Nuclear plant output fell by 8.3% in 2013, the lowest level since 2009. Because nuclear technology is the only one that does not receive capacity payments, the fall in output is fully carried over to the income statement. Similarly, nuclear energy revenue has fallen as a result of the new taxes introduced by Law 15/2012, of tax measures, which entered into force on January 1st, 2013: the tax on the value of production (equivalent to 7% of revenue) and two new taxes on production and storage of spent nuclear fuel and other radioactive waste. Arturo Rojas and Pablo Mañueco addition to the fall in demand for electricity due to the economic crisis would make it impossible to balance the sector’s revenues and costs without asking consumers to bear a larger burden, which would create an even larger incentive for selfconsumption. Vol. 3, N.º 2 (March 2014) Voluntary price for small consumers SEFO - Spanish Economic and Financial Outlook 54 Law 24/2013 creates a Voluntary Price for Small Consumers, which replaces the old lastresort tariff, except for consumers considered vulnerable, who can benefit from a social voucher, or for customers who, temporarily, have no current supply contract with an operator. The last-resort tariff (TUR in its Spanish initials) is the maximum price that can be charged by operators designated as last-resort suppliers to entitled consumers. Until 2013, the TUR was determined by adding supply and access toll costs to the estimated cost of electricity through CESUR (Energy Contracts for the Supply of Last Resort) auctions. In December 2013, the invalidation of the CESUR auction revealed the extra cost the auction system added to the last-resort tariff. Hence, consumers can save by turning directly to the deregulated market. The name and conceptual change introduced by Law 24/2013 relating to the TUR is positive, as a regulated price is always an obstacle to market deregulation. Hence, the protection of a minimum benchmark price should be applied mainly to vulnerable customers. At the same time, mechanisms must be set up for suppliers to have incentives to buy energy at the lowest possible price, and for this price to be passed on to customers. Precisely one of the problems of the CESUR auctions was that forward purchases of energy took place through intermediaries. Voluntary prices for small consumers will be uniform through the country: that is, in both the mainland and in offshore Spanish territories. That means tacit maintenance of subsidies for the islands, where the cost of production is greater than on the mainland. Voluntary prices will be set by the Ministry of Interior, but their calculation will observe the principle of income sufficiency, and the additive nature of costs, and the process will be monitored to prevent distortions in market competition. The voluntary price for small consumers will additively include the following items in its structure: ■■The production cost of electricity, which will be determined on the basis of market mechanisms in relation to the average price forecast in the market of output during the regulatory period, and it will be subject to revision irrespective of other items. ■■Access tolls and applicable charges. ■■Supply costs. The Ministry of Industry will have to define the new mechanism for calculating the cost of production, having ruled out the previous model of the CESUR auction. The aim is to minimize market fluctuations, but the cost of energy must also adequately reflect the costs of the defined period. If the time horizon is long –for example, three months, as in the previous CESUR auctions– the demand volume risk assumed by leading operators would be larger, and this cost has to be compensated to suppliers. An alternative for a quarterly period may involve combining several auctions with the futures market prices of the OMIP, the Iberian Energy Derivatives Exchange. A single quarterly auction, like the CESUR auction, is not advisable, because the result may be affected by atypical circumstances that distort the price, as was the case in December 2013. With three forward auctions carried out every month in the preceding quarter, the entire quarterly generation price would not be linked to the market conditions of just one day. The forward market is also a useful reference point for the generation cost to be allocated to the voluntary price. Both OTC and OMIP forward electricity markets in Spain operate The reform of the Spanish electricity sector The auction mechanism can cover suppliers’ market price risk, as fixed price sellers assume the risk. If the daily market price is lower than the auction price, sellers receive the difference and, conversely, if the market price during the period is higher than the auction price, the seller covers the difference. Remuneration of renewable energies In the initial period of renewable energy regulation, the Government sought the promotion of such energies, starting with the Electricity Sector Act 54/1997 of November 27th until Royal Decree 661/2007. In the second period, from 2009, a 4.7% fall in electricity demand on the mainland revealed the need to rein in the increase in capacity. One of the cornerstones of the reform of the electricity sector is the reformulation of the remuneration of renewable energies. From 1998 to 2008 –that is, in the ten years prior to the economic crisis– installed capacity under the Special Regime, which includes renewable energies and co-generation, increased by a cumulative average of 17%. In the same period, mainland electricity demand increased at an average pace of 4% year-on-year. Between 2008 and 2012, with a less favorable regulatory framework, the capacity of the special regime slowed down its average growth rate to 7% yearon-year, but demand contracted by 1.3% on average every year. Following the tax measures on energy introduced in 2013, which had the greatest impact on conventional energy, and the downward revision in 2012 of remuneration of distribution activity, the largest adjustment of the new regulation for 2014 is aimed at the Special Regime. The draft Royal Decree unveiled the new methodology for determining facility revenue, as it constitutes a radical departure from the previous regulation. One of the frequent criticisms of the Spanish renewables model was that it awarded the same remuneration of all facilities of the same technology, wind or solar, regardless of the fact that returns varied widely, especially in wind. A good wind site achieves in excess of 3,000 hours of yearly production, while the average aggregate production of mainland facilities amounted to 2,380 hours. The same remuneration per kWh for all wind farms, regardless of their level of output, was a clear incentive for developers to seek out the best sites. There is no doubt that the growth of wind and solar facilities would not have been quite as strong without the incentive of capitalizing on the most attractive sites in the form of higher revenues. Spain’s leadership in developing certain technologies for electricity production based on renewable sources was possible thanks to the existence of a sound and stable –and, above all, predictable– economic and legal framework. It established the price of electricity for the entire lifetime of the facility, that is, between 20 and 25 years, based on an initial price that would have been revised with CPI less 0.25%, initially, and less 0.50% from 2012. Vol. 3, N.º 2 (March 2014) As with the last-resort tariff, the energy cost of the voluntary price will have to be established, adjusted for the different consumption time profile and the cost of adjustment services. Premiums on the market price of renewable energies, co-generation and waste management energy, amounted to approximately 9 billion euros in 2013. Although this amount represents a slowdown to 5.5% growth from 24.2% in 2012, the Ministry of Industry believes that a drastic reduction in aid to such energies is unavoidable in order to achieve a re-balancing of electricity sector revenues and costs. 55 SEFO - Spanish Economic and Financial Outlook with a high level of liquidity, and the mechanism would be accessible to all suppliers. Vol. 3, N.º 2 (March 2014) Arturo Rojas and Pablo Mañueco SEFO - Spanish Economic and Financial Outlook 56 Following the steep fall in electricity demand in 2009, Royal Decree 1614/2010 laid down the first limit on the number of production hours with entitlement to the premium. For wind facilities, a maximum of 2,589 hours a year was set, provided the aggregate system average exceeded 2,350 hours. But at the end of 2010, some 86% of current facilities were already in operation. So the limitation on the number of hours could not have been taken into account at the time of the investment decision. The initial long term certainty about the price at which a kWh of renewable energy was going be sold cleared the way for transactions in which the seller could make significant gains, as long as the plant had a few years in operation in order to prove average output. Instead of a guaranteed price that would be updated on an annual basis according to inflation less 0.5%, the new regulation is going to guarantee a reasonable before-tax return throughout the regulatory lifetime of the project. The facility’s year of operating authorization will be a key factor, as the reasonable return is measured from that date. The new regulation on remuneration of renewable energies will be comprised of the market price of the energy plus a rate per unit of installed power that covers the investment costs that cannot be recovered and an operating rate that covers the operating costs that cannot be recovered. Reasonable before-tax return is set at 7.398%, which is the average return between July 2003 and June 2013, of 10-year State bonds plus 300 basis points. When the new regulation is approved, remuneration of renewable energies will be comprised of the market price of the energy plus a rate per unit of installed power that covers the investment costs that cannot be recovered and an operating rate that covers the operating costs that cannot be recovered. Investment costs are determined by the facility type based on a standard value of the initial investment in an efficient and orderly business. The new regulation states that its aim is to increase legal certainty for a reasonable return, but it does not extend the same certainty to foreseeability of cash flows, as the draft Royal Decree provides no certainty about long-term prices, as the parameters are periodically revised. Six-year regulatory periods are established for revisions, with the first ending on December 31st, 2019, and such periods are divided into three subperiods of three years. That is, the parameters for calculating revenue may change again in 2017. The only defined parameters not subject to revision in regulatory periods are two: the useful life and the standard value of the initial investment. Hence, reasonable return may be revised upwards in the long term if conditions in the sector improve. A rate of 1% will be used in revising operating costs from 2014, instead of CPI or, from 2013, core inflation (which does not include changes in the prices of unprocessed foods and domestic fuels), less an efficiency factor, except for items whose evolution is already regulated (tolls, 7% tax on revenue effective from 2013). While the previous regulation set overall remuneration for each type of renewable energy (i.e., wind, photovoltaic, thermal solar), the proposed new regulation assigns to each facility different income levels on the basis of its specific characteristics. For example, for photovoltaic facilities built under Royal Decree 661/2007, the new regulation will take into account the specific technology installed (fixed panels or tracker panels with one or two axes), a factor that was irrelevant under the 2007 regulation. For photovoltaic facilities built under Royal Decree 1578/2008, the The reform of the Spanish electricity sector Another novel aspect is the increase to 30 years of regulatory useful life of photovoltaic facilities, instead of the 25 years in which the highest remuneration was guaranteed in the initial regulation (Royal Decree 661/2007), or the 28 years that were established from 2011 (Royal Decree-law 14/2010). By increasing the number of years, the regulation reduces the amortization of the recognized investment and nominal revenue is lower, in exchange for maintaining the revenue flow for five more years. For thermo-solar plants and wind farms, the useful life remains the same in the period of higher revenue under the previous regulation, 25 and 20 years, respectively. In the proposed new regulation, the combination of different categories of renewables –cogeneration, wind, solar, hydroelectric, biomass, waste– with the characteristics of each facility –specific technology, start-up year, tender call, climate zone, hours of operation– results in 1,276 facility types, each with specific remuneration to achieve the reasonable return. The degree of detail of renewable facilities introduced by the proposed new regulation is one of its weak points, as it ignores the fact that current investors –in the vast majority of cases– are not the ones who made the initial investment. Transactions between investors were made in accordance with the characteristics and specific performance of each facility. Hence, buyers paid a higher price for facilities that achieved higher returns on the initial investment. As no returns are guaranteed on the amount of such investment, investors that purchased the best-performing facilities –and, thus, paid for goodwill– are going Under the new regulation, revenues from renewable energy facilities are going to decline considerably, in some cases by nearly 50%. To the extent that these projects involved a high degree of financial leverage, the debt must be restructured and the repayment period extended in order to adjust debt service to the new revenue levels. From a financing point of view, renewable projects remain viable because of their high cash generation capacity, as fuel is free, and, in photovoltaic facilities, the addition of another five years of useful life will allow for paying off the totality of the debt. However, owners’ expectations are to lose the entire investment. Share value will be reduced to the value of options if the recovery of demand allows for improving remuneration in a more-or-less distant future. Conclusions The Ministry of Industry is prepared to resolve the annual tariff deficit through a deep cutback in the revenue from renewable energies. The effort to homogenize facilities in terms of initial investment, operating costs and the characteristics of each plant will mean that the most profitable facilities under the previous regulation will see the largest loss of revenue. It would have been difficult for the Ministry to take into account, when applying the principle of reasonable returns, the amount paid by current facility owners, as this amount was higher than the initial theoretical investment in most cases. Investors that have paid for goodwill will have to amortize it and recognize the loss on their books. Debt-financed facilities will be unable to meet their repayment schedule, although the long remaining useful life will allow banks to recover both principal and interest. Owners now face battles on two fronts: the first is the court claim brought against the abandonment of the legal framework in which investments were made, as Vol. 3, N.º 2 (March 2014) Revenue to obtain reasonable return will not take into account regional taxes. At present, three Spanish regions –Castile La Mancha, Castile Leon, and Galicia– levy a surcharge on wind production. to receive actual returns far below the reasonable level. In contrast, investors that purchased worseperforming facilities can obtain near-reasonable returns, as they did not pay for goodwill. 57 SEFO - Spanish Economic and Financial Outlook return will take into account the technology and the geographic area in relation to solar radiation. Vol. 3, N.º 2 (March 2014) Arturo Rojas and Pablo Mañueco SEFO - Spanish Economic and Financial Outlook 58 no renewable energy facility would have been built or financed without a certain outlook of sufficient remuneration over the long term. The second is the negotiation of debt conditions with financial institutions, with the aim of preventing default on payment of debt service, resulting in enforcement of guarantees and repossession of facilities by the bank. In this regard, a positive step can be seen in Royal Decree-Law of March 2014, with urgent measures to facilitate debt refinancing, aimed at assisting viable enterprises in renegotiating their debt through haircuts or conversions of debt into capital. Undoubtedly, enterprises with reasonable returns guaranteed by the Ministry of Industry must be considered viable.

Anuncio

Documentos relacionados

Descargar

Anuncio

Añadir este documento a la recogida (s)

Puede agregar este documento a su colección de estudio (s)

Iniciar sesión Disponible sólo para usuarios autorizadosAñadir a este documento guardado

Puede agregar este documento a su lista guardada

Iniciar sesión Disponible sólo para usuarios autorizados