Germany

Anuncio

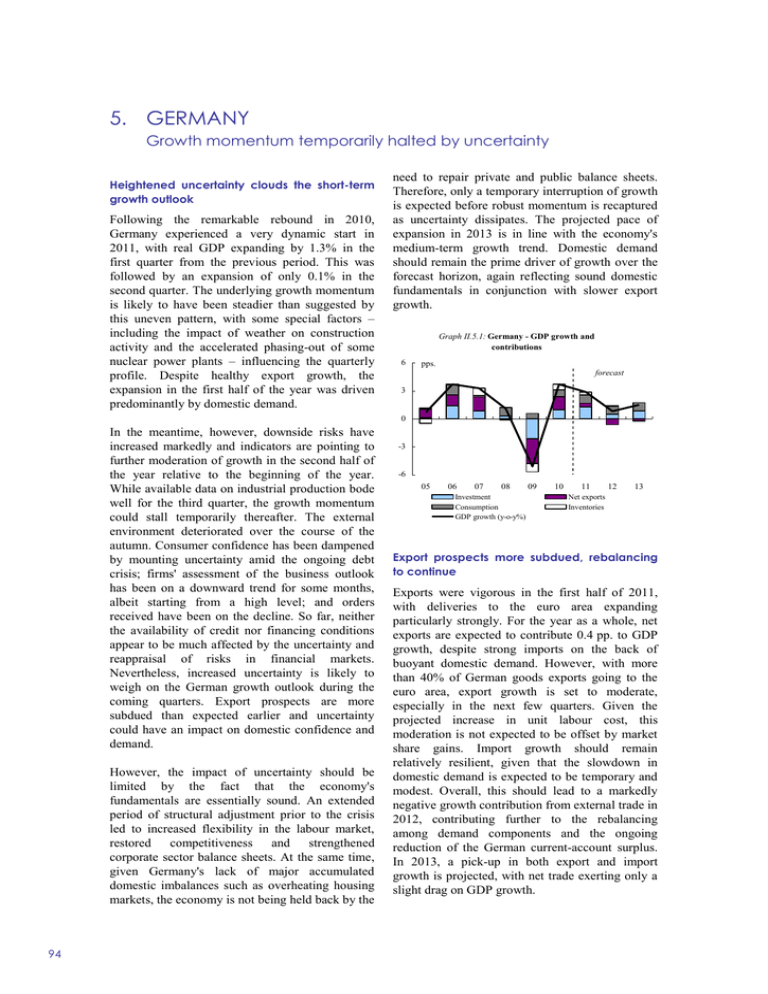

5. GERMANY Growth momentum temporarily halted by uncertainty Heightened uncertainty clouds the short-term growth outlook Following the remarkable rebound in 2010, Germany experienced a very dynamic start in 2011, with real GDP expanding by 1.3% in the first quarter from the previous period. This was followed by an expansion of only 0.1% in the second quarter. The underlying growth momentum is likely to have been steadier than suggested by this uneven pattern, with some special factors – including the impact of weather on construction activity and the accelerated phasing-out of some nuclear power plants – influencing the quarterly profile. Despite healthy export growth, the expansion in the first half of the year was driven predominantly by domestic demand. need to repair private and public balance sheets. Therefore, only a temporary interruption of growth is expected before robust momentum is recaptured as uncertainty dissipates. The projected pace of expansion in 2013 is in line with the economy's medium-term growth trend. Domestic demand should remain the prime driver of growth over the forecast horizon, again reflecting sound domestic fundamentals in conjunction with slower export growth. Graph II.5.1: Germany - GDP growth and contributions 6 pps. forecast 3 0 In the meantime, however, downside risks have increased markedly and indicators are pointing to further moderation of growth in the second half of the year relative to the beginning of the year. While available data on industrial production bode well for the third quarter, the growth momentum could stall temporarily thereafter. The external environment deteriorated over the course of the autumn. Consumer confidence has been dampened by mounting uncertainty amid the ongoing debt crisis; firms' assessment of the business outlook has been on a downward trend for some months, albeit starting from a high level; and orders received have been on the decline. So far, neither the availability of credit nor financing conditions appear to be much affected by the uncertainty and reappraisal of risks in financial markets. Nevertheless, increased uncertainty is likely to weigh on the German growth outlook during the coming quarters. Export prospects are more subdued than expected earlier and uncertainty could have an impact on domestic confidence and demand. However, the impact of uncertainty should be limited by the fact that the economy's fundamentals are essentially sound. An extended period of structural adjustment prior to the crisis led to increased flexibility in the labour market, restored competitiveness and strengthened corporate sector balance sheets. At the same time, given Germany's lack of major accumulated domestic imbalances such as overheating housing markets, the economy is not being held back by the 94 -3 -6 05 06 07 08 Investment Consumption GDP growth (y-o-y%) 09 10 11 12 13 Net exports Inventories Export prospects more subdued, rebalancing to continue Exports were vigorous in the first half of 2011, with deliveries to the euro area expanding particularly strongly. For the year as a whole, net exports are expected to contribute 0.4 pp. to GDP growth, despite strong imports on the back of buoyant domestic demand. However, with more than 40% of German goods exports going to the euro area, export growth is set to moderate, especially in the next few quarters. Given the projected increase in unit labour cost, this moderation is not expected to be offset by market share gains. Import growth should remain relatively resilient, given that the slowdown in domestic demand is expected to be temporary and modest. Overall, this should lead to a markedly negative growth contribution from external trade in 2012, contributing further to the rebalancing among demand components and the ongoing reduction of the German current-account surplus. In 2013, a pick-up in both export and import growth is projected, with net trade exerting only a slight drag on GDP growth. Member States, Germany Moderating exports temporarily weighing on investment Gross fixed capital formation was a key driver of the upturn, expanding by 5½% in 2010 and by 9½% y-o-y in the first half of 2011. However, the current uncertainty is likely to affect investment over the coming quarters. Specifically, while financing conditions are still favourable and capacity utilisation remains above the long-term average, the uncertain outlook is likely to lead firms to postpone their investment projects, with spending on machinery and equipment being particularly sensitive to the moderation of export prospects. However, such postponed plans are likely to be implemented once the economy returns to its previous stable growth path in the course of 2012. The momentum of construction investment was particularly buoyant in the first half of 2011. Looking forward, while the phasing out of public sector stimulus measures weighs on the construction outlook, private housing investment is likely to remain lively, supported by still favourable financing conditions and robust disposable income growth. Investors' likely preference for investment opportunities carrying relatively limited risk may also prop up residential construction activity. Consumption growth dented by uncertainty in the near term Private consumption held up well during the 2008-09 recession and expanded steadily in 2010 and early 2011, underpinned by buoyant labour market developments. The drop in household consumption recorded in the second quarter of 2011 was somewhat puzzling, as it exceeded by far the impact of the temporary increase in inflation on real disposable income, but the spending dip is expected to be offset in the short term. Over the coming quarters, the current uncertainty could impinge on household consumption behaviour, although labour market resilience should continue to support disposable income, as should continued robust wage growth. In comparison to other Member States the medium-term outlook for private consumption is further supported by the absence of large deleveraging needs in the household sector, as well as a relatively limited restraining effect from fiscal consolidation needs. Labour market to remain resilient Having proven remarkably resilient during the recession,(60) the performance of the German labour market has been vibrant during the upturn, with a projected rise in employment of about 1.3% in 2011, one of the highest rates of increase since reunification. Having recorded only a minor increase in the context of the recession, the unemployment rate dropped to an average of 6.1% in 2011, the best performance since the early 1990s, although the share of long-term unemployment in total unemployment remains high. Only a moderate further improvement in the unemployment rate is expected over the forecast horizon. Survey data indicate that firms plan to further increase employment in the short term. However, with more subdued growth ahead, labour demand should also moderate. While a significant further increase in employment is forecast for 2012, this reflects to a large extent the statistical carry-over resulting from the continuous improvement in 2011. Developments should, however, continue to benefit from the increased flexibility in the German labour market. In 2009, the latter facilitated a substantial reduction in hours worked, thereby greatly limiting the impact of the crisis on the employment headcount. It is expected that firms will react in a similar manner to possible future demand shocks. Employment creation is projected to quicken slightly as the economy resumes its stable growth path later in the forecast period. In a medium-term perspective, shortages in certain high-skill segments of the labour market could turn into a major bottleneck for Germany's growth potential against the background of the trend decrease in the working-age population. Wages and moderate consumer price inflation to Supported by buoyant labour market conditions, wages rose substantially in the first half of 2011, with a sizeable increase in hours worked and voluntary one-off payments contributing to a markedly positive wage drift. Despite healthy productivity developments, this is projected to result in a clear increase in unit labour costs, contrary to the pre-crisis trend of improving cost competitiveness. While the clouding of the economic outlook might have a slightly damping (60) See box 1.2.1 in chapter 1.2. Post-recession labour market patterns in the EU for details. 95 European Economic Forecast, Autumn 2011 impact on forthcoming wage negotiations for 2012, wage growth is nevertheless expected to remain vigorous in view of the still tight labour market. Together with moderating productivity developments from firms making use of flexible working time agreements, this is forecast to lead to a further increase in unit labour costs. Following the intensification of inflationary pressures on the back of rising energy prices in late 2010 and early 2011, consumer price inflation is projected to slow. HICP inflation should average 2.4% in 2011 and remain below 2% in 2012 and 2013, in view of the weaker economic outlook. Given comparatively more resilient domestic demand in Germany than in other euro-area economies, domestic forces are expected to take over as the main driver of price increases, reflected in a moderate rise in core inflation to 1¾% in 2013. measures, including in particular the asset transfer from Hypo Real Estate Group (HRE) to the related bad bank FMS Wertmanagement, contributed 1.3% of GDP to the deficit. The transfer of impaired assets from ailing banks to related bad banks was also the main reason for the increase of the debtto-GDP ratio from 74.4% in 2009 to 83.2% in 2010. Graph II.5.2: Germany - General government gross debt and deficit 6 % of GDP 5 % of GDP forecast 85 80 4 75 3 70 2 65 1 60 0 55 -1 -2 50 99 00 01 02 03 04 05 06 07 08 09 10 11 12 13 Key risks related to the resolution of the crisis Risks to the forecast are mainly related to the successful resolution of the international sovereign-debt and financial crisis. On the one hand, the forecast assumes that major feedback loops from the financial sector via credit supply to economic activity are less likely to occur in Germany than in other countries. The increased profitability of firms limits their external financing needs, while Germany's current position as a perceived safe haven also benefits the private sector to some extent. Adverse effects cannot be excluded, however, should the current uncertainties drag on for a prolonged period of time. Moreover, should further substantial financial sector support measures prove necessary and put strain on the public finances, the resulting fiscal consolidation needs would weigh on domestic demand. At the same time, an earlierthan-expected resolution of the crisis could greatly limit its impact, especially on domestic demand. Financial market stabilisation drove up deficit and debt ratios in 2010 The general government deficit rose from 3.2% of GDP in 2009 to 4.3% of GDP in 2010. Economic stimulus measures in line with the European Economic Recovery Plan (EERP) and financial market stabilisation were the main drivers behind the increase, while the swift economic recovery and the remarkably robust labour market had a favourable impact. Financial sector stabilisation 96 Gross debt (rhs) Deficit (lhs) Deficit threshold (3%) Debt threshold (60%) Accelerated fiscal improvement in 2011 The general government deficit in 2011 is forecast to drop more rapidly than expected earlier, to 1.3% of GDP rather than the 2% predicted in the spring forecast. Favourable cyclical conditions are boosting tax and social contribution revenues. In addition, the phasing out of stimulus measures (around 0.2% of GDP) and fiscal consolidation efforts under the "Zukunftspaket" adopted in 2010 (around 0.3% of GDP) are contributing to deficit reduction. For example, the contribution rate for unemployment insurance was increased to 3% after its temporary reduction in 2009 from 3.3% to 2.8% as part of the stimulus package. Consolidation measures under the "Zukunftspaket" include on the revenue side new taxes on aviation and nuclear fuel, a bank levy and reduced energy tax exemptions and on the expenditure side lowered allowances for parents and benefits for long-term unemployed, as well as savings in federal administration and the employment agency. Moreover, the latest health care reform, which took effect in January 2011 and includes a 0.6 pp. increase in the contribution rate and measures to curb expenditure growth, also contributes to consolidation (around 0.4% of GDP). Member States, Germany Sustained, but slower consolidation in 2012-13 Gross debt is projected to fall by 1.5 pps. to 81.7% of GDP in 2011, to 81.2% of GDP in 2012 and to 79.9% of GDP in 2013 due to the denominator effect of GDP growth. Financial sector measures are expected to have a debt-decreasing effect of 0.4% of GDP in net terms in 2011, mainly due to the recent redemption of injected capital by Commerzbank. Debt projections also include the impact of guarantees to the EFSF, bilateral loans to Greece, and the participation in capital of the ESM as planned at the cut-off date of this forecast. The winding-up of assets accumulated in bad banks could potentially lead to falls in the debt stock, while the ongoing financial market turmoil poses downside risks for Germany's indebtedness in the medium term and could require new state intervention. The deficit is predicted to decline further in 2012 and 2013, though at a slower pace due to the moderate growth outlook. It is estimated to reach 1% of GDP in 2012 and 0.7% of GDP in 2013. Consolidation should continue to be supported by the phasing-out of public investments undertaken in the context of the stimulus package and measures adopted under the Zukunftspaket. The structural general government deficit is estimated to fall from 1.3% of GDP in 2011 to 0.4% of GDP in 2013. The constitutional debt brake, which is being phased in as from 2011, is expected to further improve Germany's budgetary position by setting a structural deficit ceiling for the federal government of 0.35% of GDP as of 2016 and stipulating structurally balanced budgets for the federal states as of 2020. In contrast, demographic change poses a risk to the sustainability of social security systems and public finances in the medium to long term. Table II.5.1: Main features of country forecast - GERMANY 2010 GDP Private consumption Public consumption Gross fixed capital formation of which : equipment Exports (goods and services) Imports (goods and services) GNI (GDP deflator) Contribution to GDP growth : Annual percentage change bn EUR Curr. prices % GDP 2476.8 100.0 1423.0 2008 2009 2010 2011 2012 2013 1.5 1.1 -5.1 3.7 2.9 0.8 1.5 57.5 1.1 0.6 -0.1 0.6 1.2 1.1 1.1 488.8 19.7 1.4 3.1 3.3 1.7 0.9 1.0 1.1 433.6 17.5 1.1 1.7 -11.4 5.5 7.3 2.7 4.6 170.8 6.9 2.4 3.8 -22.8 10.0 10.1 3.5 7.1 1159.8 46.8 6.5 2.7 -13.6 13.7 7.8 3.9 6.2 1024.4 41.4 5.6 3.3 -9.2 11.7 7.9 5.8 7.2 2522.8 101.9 1.6 0.6 -4.3 3.4 2.9 0.8 1.5 1.1 1.2 -1.6 1.6 2.2 1.4 1.7 -0.1 0.0 -0.9 0.6 0.3 0.0 0.0 0.5 -0.1 -2.7 1.4 0.4 -0.6 -0.2 0.2 1.2 0.0 0.5 1.3 0.4 0.2 8.6 7.5 7.8 7.1 6.1 5.9 5.8 2.0 2.1 0.0 2.0 3.4 2.5 2.6 0.7 2.3 5.5 -1.1 1.8 2.1 1.3 -0.7 1.5 4.2 -1.7 1.1 0.7 -0.2 16.2 17.4 17.0 17.0 16.8 16.7 16.6 1.4 0.8 1.2 0.6 0.8 1.4 1.5 - 2.8 0.2 1.2 2.4 1.7 1.8 0.3 -1.8 6.0 -2.5 -3.0 -0.1 0.0 4.4 7.3 5.7 6.4 5.5 4.9 4.7 1.1 6.2 5.8 5.8 5.1 4.4 4.2 1.1 6.2 5.8 5.8 5.1 4.4 4.2 -2.5 -0.1 -3.2 -4.3 -1.3 -1.0 -0.7 -2.5 -1.1 -1.2 -3.5 -1.3 -0.7 -0.4 - -0.8 -1.3 -2.4 -1.3 -0.7 -0.4 59.0 66.7 74.4 83.2 81.7 81.2 79.9 Domestic demand Inventories Net exports Employment Unemployment rate (a) Compensation of employees/f.t.e. Unit labour costs whole economy Real unit labour costs Saving rate of households (b) GDP deflator Harmonised index of consumer prices Terms of trade of goods Merchandise trade balance (c) Current-account balance (c) Net lending(+) or borrowing(-) vis-à-vis ROW (c) General government balance (c) Cyclically-adjusted budget balance (c) Structural budget balance (c) General government gross debt (c) 92-07 (a) Eurostat definition. (b) gross saving divided by gross disposable income. (c) as a percentage of GDP. 97