- Ninguna Categoria

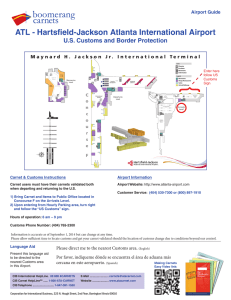

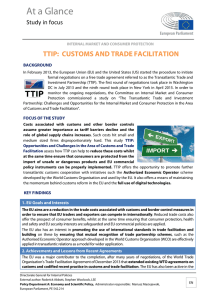

Customs issues falling under INTA`s new remit

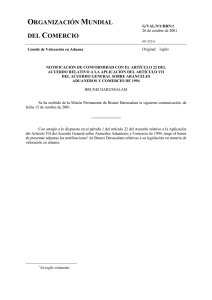

Anuncio