Main Figu of the AC

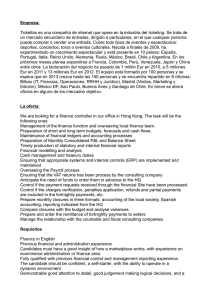

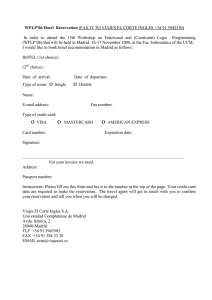

Anuncio