The conduct of Monetary Policy in Central America and Dominican

Anuncio

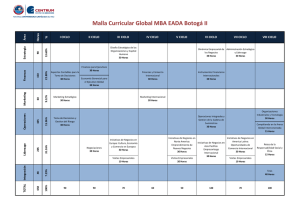

The conduct of Monetary Policy in Central America and Dominican Republic, in an Increasingly Globalised Environment República Dominicana Guatemala El Salvador Honduras Nicaragua Co st a Ri ca Alfredo Blanco Executive Secretary CAMC Barbados, May 10, 2007 Background Inflation in Central America and Dominican Republic, Latin America and Advanced Economies 25.0 Central America and Dominican Republic 20.0 Latin America Avanced Economies 15.0 6.2% 10.0 4.8% 5.0 2.6% 0.0 1994 1995 1996 1997 1998 1999 2000 2001 2002 2003 2004 2005 2006 2 CARD: Net Current Transfers Central America and Dominican Republic: Net Current Transfers -including Remittances(Millions of US $) 16,000 12,000 8,000 4,000 0 1990 1991 1992 1993 1994 1995 1996 1997 1998 1999 2000 2001 2002 2003 2004 2005 2006 3 CARD: Capital Inflows Central America and Dominican Republic: Capital Inflows. (Millions of US $) 56,000 Average 2000-2006 US $41.3 billions 44,000 32,000 Average 1990-1999 US $20.6 billions 20,000 8,000 1990 1991 1992 1993 1994 1995 1996 1997 1998 1999 2000 2001 2002 2003 2004 2005 2006 4 CARD: Accumulation of Reserves Central America and Dominican Republic: Net International Reserves (Millions of US $) (1998:01 - 2007:02) 16,000 12,000 8,000 4,000 0 1998 1999 2000 2001 2002 2003 2004 Costa Rica El Salvador Guatemala Nicaragua Rep. Dominicana CARD 2005 2006 2007 Honduras 5 Monetary Frameworks in CARD …towards flexibility Countries Before 2000 After 2000 El Salvador Monetary Targeting Dollarisation (2001) Nicaragua Crawling Peg Crawling Peg (2007?) Costa Rica Crawling Peg Bands (2006) Honduras Bands Bands (2006) República Dominicana Monetary Targeting Monetary Targeting (2006) Guatemala Monetary Targeting Towards Inflation Targeting (2002) 6 The Case of Guatemala, since 2002 ¾ ¾ ¾ ¾ New Organic Law of the Central Bank. Nine Indicative Variables. Towards Forward Looking Approach. Inflation Forecasting. Semi-Structural Model. Mechanisms of Transmission. ¾ Transparency. ¾ Accountability. 7 BANCO DE GUATEMALA BOLETÍN DE PRENSA La Junta Monetaria, en su sesión celebrada el 25 de abril de 2007, decidió elevar la tasa de interés líder de la política monetaria en 25 puntos básicos, de 5.25% a 5.50%..... luego de haber conocido el balance de riesgos de inflación, los resultados del corrimiento mecánico del Modelo Macroeconómico semiestructural y la orientación de las variables indicativas, ………… 8 BANCO DE GUATEMALA BOLETÍN DE PRENSA …. tomó en consideración que los pronósticos de inflación presentados por los departamentos técnicos del Banco de Guatemala, tanto para 2007 como para 2008, se ubicaban por arriba de la meta establecida para cada uno de esos años, aspecto que, en el contexto del esquema de metas explícitas de inflación, aconsejaba restringir la política monetaria. 9 …..However There are still important challenges to improve the efficiency in the conduct of Monetary Policy in an increasingly globalised enviroment. Large Quasifiscal Deficits. The structure of foreign exchange markets. Less developed capital markets. 10 Agenda The CAMC is working on harmonization of policies. Matrix of policies – Harmonization in legal reserve requirements. – Harmonization in instruments used in open market operations. – Transparency: inflation report and surveys of inflationary expectations. A Monetary discussions. Union is not yet under 11 The conduct of Monetary Policy in Central America and Dominican Republic, in an Increasingly Globalised Environment www. secmca.org [email protected] Barbados, May 10, 2007