Country Dossier Mexico

Anuncio

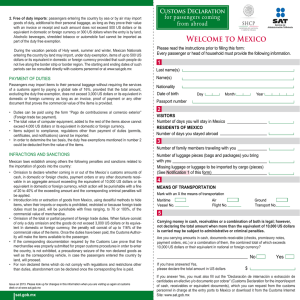

Country Dossier Mexico NOTICE: For use on the Europa site, portions of the original version have been removed. As a consequence, page numbering may be interrupted. Mexico Table of Contents Overview of Customs Procedures Customs Regimes List of Customs Procedure Codes List of Entry Ports and Codes Description of Specimen Documents Citations Overview of Customs Procedures Mexican Customs Law permits only customs brokers or in-house customs agents to file requests for customs clearance of goods. Customs clearance is processed through the Integral Customs Automatic System (SAII), which is regulated by the Tax Administration Service (SAT). SAT, under the Ministry of Finance, is responsible for inspecting all imports into the country and overseeing the General Customs Administration. The SAII system allows the electronic exchange of information between the General Customs Administration, customs offices, customs brokers, warehouses and banking institutions authorised to collect duties related to foreign trade. The document for clearing imports into the country is the Pedimento. The Pedimento is electronically submitted to Customs by the broker and is validated by Customs with an eight (8) digit electronic seal after which the customs broker generates an electronic signature in the form of a bar code. Once the Pedimento is validated, the customs broker on behalf of the importer pays the applicable duties and taxes. An electronic payment seal from the Administracion General de Aduanas is generated on the Pedimento confirming payment of duties. This document and the merchandise are presented to the Customs official who reviews the documentation and attests to its compliance with the information filed electronically by a second electronic seal. The mechanism for random inspection (green, yellow, red channel) is activated and customs clearance is granted by way of a third and final seal, Selección Autorizada, once all inspections are finalized depending on the channel selected. This final seal proves that the goods cleared customs. Imports of plant and animal products are regulated by the Ministry of Agriculture (SAGARPA). Processed foods and beverages are regulated by the Ministry of Health (SSA). Imports must comply with the standards known as NOMs of each regulating authority. Imports with a value of USD$500.00 are subject to full inspection by SENASICA (the inspection division of SAGARPA) at the port of entry prior to customs release. Once inspected, a certificate of inspection is issued by SENASICA and is used by the customs broker to expedite the customs clearance. 2 Mexico Customs Regimes 1. Definitive Importation When importing goods on a definitive basis, the importer must pay import duties and taxes prior to customs release. The official document for import declaration is: • Pedimento The following documents must be enclosed with the Pedimento: • Commercial invoice • Bill of Lading or AWB • Import permits, Sanitary Certificates, Notice of Importation when applicable • Certificate of Origin – required in order to claim preferential treatment under Mexico and EU Free Trade Agreement 2. Temporary Import Goods may be temporarily imported for two purposes: • Export in the same condition • Processing, manufacturing, transformation or repaired for further exportation The document to carry out temporary import operations is the Pedimento, which must be filled out with the applicable codes for this type of importation. 3. Fiscal Deposit Goods destined for fiscal deposit regime may be subject to operations such as conservation, exhibition, labelling, packaging, inspection and the taking of samples, provided the nature and customs value of the goods is not altered as a result of such operations. Import duties, taxes and, where applicable, antidumping duties and the customs processing fee, are determined at the time of importation but are not paid unless the goods are destined to definitive importation. The document for fiscal deposit regime is the Pedimento, which is filled out with the applicable codes. 4. In-Transit There are two types of in-transit importations: • Domestic: Used by Mexican importers to clear goods through the customhouse closest to their facility, rather than where the goods enter into Mexico • International Transit: goods which need to cross the country and leave Mexico 3 Mexico The importer of goods under domestic in-transit regime pays duties and taxes adjusted for inflation during transit time to the Customs office where the goods are cleared. The document used for entry under domestic or international transit regime is the in-transit Pedimento, which must be filled out with the applicable codes for this type of regime. 4 Mexico List of Customs Procedures Codes Below are the most common procedure codes used for importation of goods into Mexico. The procedure code is entered in the field labeled “Pedimento Code”: A1 Definitive importation C1 Definitive importation to the Mexican northern border zone (duty exempt special economic zone) A2 Temporary importation of goods by PITEX companies 1 H2 Temporary importation of goods by Maquiladoras 1 BP Temporary importation of samples A4 Importation of goods destined to fiscal deposit regime G1 Withdrawal of goods subject to fiscal deposit regime to be definitively imported K2 Withdrawal of goods subject to fiscal deposit regime to be returned to their place of origin H5 Withdrawal of goods subject to fiscal deposit regime for temporary importation by Maquiladoras T3 Domestic in-transit regime T7 International in-transit regime through national territory 1 These are temporary importation programs that allow for the temporary entry of goods into Mexico for the purpose of repair, transformation, or manufacture. These programs require that a specific percentage of the processed, repaired, or transformed goods be exported abroad. A certain percentage of these goods can be entered for consumption. However, customs duties, countervailing duties, and most charges will be due at the time of filing the importation. 5 Mexico List of Entry Ports and Codes Entry port is identified as “customs house” on the Pedimento. The code appears on the electronic seal that confirms payment of duty and can appear in the electronic validation seal section as well. 6 Customs house Section 01 0 Name ACAPULCO, GRO. AND INTERNATIONAL AIRPORT “GENERAL JUAN N. ALVAREZ”, ACAPULCO, GRO. 02 0 AGUA PRIETA, SON. 05 0 SUBTENIENTE LOPEZ, Q. ROO AND INTERNATIONAL AIRPORT “CHETUMAL”, CHETUMAL, QUINTANA ROO. 06 0 CD. DEL CARMEN, CAMPECHE, INTERNATIONAL AIRPORT “ING. ALBERTO ACUÑA ONGAY”, CAMPECHE, CAMPECHE AND INTERNATIONAL AIRPORT OF CIUDAD DEL CARMEN, CAMPECHE. 06 1 CAMPECHE, CAMP. 07 0 CD. JUAREZ, CHIH. 07 1 INTERNATIONAL BORDER OF “ZARAGOZA-ISLETA”, ZARAGOZA, CHIH. 07 2 “SAN JERONIMO-STA. TERESA”, JUAREZ, CHIHUAHUA. 07 3 INTERNATIONAL AIRPORT “ABRAHAM GONZALEZ”, CIUDAD JUAREZ, CHIHUAHUA. 08 0 COATZACOALCOS, VERACRUZ. 11 0 ENSENADA, B.C. AND INTERNATIONAL AIRPORT “EL CIPRES”, ENSENADA, B.C. 12 0 GUAYMAS, SONORA, INTERNATIONAL AIRPORT “JOSE MARIA YANEZ”, GUAYMAS, SONORA, INTERNATIONAL AIRPORT “CD. OBREGON”, CIUDAD OBREGON, SON. AND INTERNATIONAL AIRPORT “IGNACIO PESQUEIRA”, HERMOSILLO, SONORA. 16 0 MANZANILLO, COLIMA MANZANILLO, COLIMA. 17 0 MATAMOROS, TAMPS., INTERNATIONAL BORDER “GRAL. IGNACIO ZARAGOZA” TAMPS. AND INTERNATIONAL AIRPORT “SERVANDO CANALES”, MATAMOROS, TAMPS. AND INTERNATIONAL AIRPORT “PLAYA DE ORO”, 17 1 INTERNATIONAL BORDER LUCIO BLANCO-LOS INDIOS, TAMPS. 18 0 MAZATLAN, SINALOA, INTERNATIONAL AIRPORT “GRAL. RAFAEL BUELNA”, MAZATLAN, SIN. AND INTERNATIONAL AIRPORT “DEL VALLE DEL FUERTE”, AHOME, SIN. 18 3 TOPOLOBAMPO, SIN. 18 4 INTERNATIONAL AIRPORT OF CULIACAN, SIN. 19 0 MEXICALI, B.C. AND INTERNATIONAL AIRPORT “GRAL. RODOLFO SANCHEZ TABOADA”, MEXICALI, B.C. 19 2 LOS ALGODONES, B.C. 19 3 SAN FELIPE, B.C. AND INTERNATIONAL AIRPORT OF SAN FELIPE, B.C. 20 0 MEXICO 20 1 POSTAL OF D.F. 20 2 IMPORTATION AND EXPORTATION OF CONTAINERS. PANTACO, D.F. (Railroad) 23 0 NOGALES, SON. AND INTERNATIONAL AIRPORT “NOGALES”, NOGALES, SON. 24 0 NUEVO LAREDO, TAMPS. AND INTERNATIONAL AIRPORT “QUETZALCOATL”, NUEVO LAREDO, TAMPS. 27 0 PIEDRAS NEGRAS, COAH., INTERNATIONAL AIRPORT “PIEDRAS NEGRAS”, COAH., INTERNATIONAL AIRPORT “MONCLOVA”, MUNICIPALITY OF MONCLOVA. COAH., AND INTERNATIONAL BORDER “COAHUILA 2000”, MUNICIPALITY OF PIEDRAS NEGRAS, COAH. 27 1 INTERNATIONAL AIRPORT “PLAN DE GUADALUPE”, RAMOS ARIZPE, COAH. 28 0 PROGRESO, YUC. 28 2 INTERNATIONAL AIRPORT “MANUEL CRESCENCIO REJON”, MERIDA, YUC. 30 0 CD. REYNOSA, TAMPS. 30 3 NUEVO AMANECER, CD. REYNOSA, TAMPS. Mexico 30 4 INTERNATIONAL AIRPORT “GRAL. LUCIO BLANCO”, DE REYNOSA, TAMPS. 33 0 SAN LUIS RIO COLORADO, SON. 34 0 CD. MIGUEL ALEMAN, TAMPS. 34 2 GUERRERO, TAMPS. 37 0 CD. HIDALGO, CHIS., INTERNATIONAL AIRPORT “TAPACHULA”, TAPACHULA, CHIS. AND INTERNATIONAL BORDER “BENITO JUAREZ”, CIUDAD HIDALGO, CHIS. 38 0 TAMPICO, TAMPS. AND INTERNATIONAL AIRPORT “FRANCISCO JAVIER MINA”, TAMPICO, TAMPS. 39 0 TECATE, B.C. 40 0 TIJUANA, B.C. 40 1 MESA DE OTAY, B.C. 40 2 INTERNATIONAL AIRPORT “ABELARDO L. RODRIGUEZ” TIJUANA, B.C. 42 0 TUXPAN, VER. 43 0 VERACRUZ, VER. 43 2 INTERNATIONAL AIRPORT “GRAL. HERIBERTO JARA CORONA”, VERACRUZ, VER. 44 0 CD. ACUÑA, COAH. AND INTERNATIONAL AIRPORT “CIUDAD ACUÑA”, CIUDAD ACUÑA, COAH. 46 0 TORREON, COAH., INTERNATIONAL AIRPORT “FRANCISCO SARABIA”, TORREON COAH., AND INTERNATIONAL AIRPORT “PRESIDENTE GUADALUPE VICTORIA” DURANGO, COAH. 47 0 INTERNATIONAL AIRPORT “LIC. BENITO JUAREZ”, MEXICO, D.F. 47 1 SATELITE SOUTH SIDE OF THE INTERNATIONAL OF MEXICO CITY, D.F. 47 2 AUTOMATED POSTAL HEADQUARTERS OF THE INTERNATIONAL AIRPORT OF MEXICO CITY, D.F. 48 0 GUADALAJARA, JAL., AND INTERNATIONAL AIRPORT “MIGUEL COSTILLA”, TLAJOMULCO DE ZUÑIGA, GUADALAJARA, JAL. 48 7 HIDALGO Y RAILWAY STATION CORRIDOR OF THE CITY OF GUADALAJARA, JAL. 50 0 SONOYTA, SON. AND INTERNATIONAL AIRPORT OF PUERTO PEÑASCO, SONORA. 51 0 LAZARO CARDENAS, MICH. 51 1 INTERNATIONAL AIRPORT “IXTAPA ZIHUATANEJO”, ZIHUATANEJO, GUERRERO. 52 0 MONTERREY, N.L. 52 1 INTERNATIONAL AIRPORT “MARIANO ESCOBEDO”, APODACA, N.L. 52 2 INTERNATIONAL AIRPORT “DEL NORTE”, MONTERREY, NUEVO LEON. 53 0 CANCUN, Q. ROO. 53 2 INTERNATIONAL AIRPORT “COZUMEL”, COZUMEL, Q. ROO. 53 3 PUERTO MORELOS, Q. ROO. 64 0 QUERETARO, QRO. 64 2 INTERNATIONAL AIRPORT “GRAL. FRANCISCO J. MUJICA”, MORELIA, MICH. 64 3 CELAYA, GTO. 64 4 INTERNATIONAL AIRPORT “GUANAJUATO”, SILAO, GTO. 64 5 LEON, GTO. 65 0 TOLUCA, MEX. AND INTERNATIONAL AIRPORT “LIC. ADOLFO LOPEZ MATEOS”, TOLUCA, MEX. 67 0 CHIHUAHUA, CHIH. 67 1 INDUSTRIAL PARK LAS AMERICAS, CHIH. 67 2 INTERNATIONAL AIRPORT “GRAL. ROBERTO FIERRO VILLALOBOS”, CHIHUAHUA, CHIH. 73 0 AGUASCALIENTES, AGS., INTERNATIONAL AIRPORT “LIC. JESUS TERAN”, AGUASCALIENTES, AGS. AND INTERNATIONAL AIRPORT “PONCIANO ARRIAGA”, SAN LUIS POTOSI. 75 0 PUEBLA, PUE. AND INTERNATIONAL AIRPORT “HERMANOS SERDAN”, PUEBLA, MEX. 80 0 COLOMBIA, N.L. 81 0 ALTAMIRA, TAMPS. 83 0 DOS BOCAS, TAB., INTERNATIONAL AIRPORT OF THE CITY OF PALENQUE, CHIAPAS. 83 1 INTERNATIONAL AIRPORT “C.P.A. CARLOS ROBIROSA”, VILLAHERMOSA, TAB. 83 2 FRONTERA, TABASCO. Mexico Specimen Documents Pedimento Purpose – Customs declaration form for customs clearance Issuing Authority – General Customs Administration Where entry number is marked – electronically generated by customs broker, appears in section labelled, “electronic validation seal” above the broker’s bar code and in field labelled “Pedimento number” Where procedure code is marked - field labelled “Pedimento code” “Type of Operation” field will show IMP for import. “Regime” field will show a) IMD for definitive importations or b) DFI refers to importations for fiscal deposit. Where duty amount is marked – section labelled “Liquidation” Where stamps are posted – column at top right hand side of form labelled “Seals” 8 Mexico PEDIMENTO Pedimento number: Destination: Type of Operation: Exchange rate: Gross Weight: Means of transportation Entry / Exit Page 1 of N Pedimento code: Regime: SEALS Custom House(s): Dollars Values: Arrival: Exit: Customs Value Price Paid: Importer / Exporter Information Tax Payer Identification Number: Name or Corporate Name: CURP: (Population Registry Number) Fiscal Domicile: Insurances value Insurances Freight Packing Other payments Electronic validation seal: Customs house code and customs section code: Marks, numbers and total amount of pieces: Dates Total of duties Entry Payment Filing Taxes and Duty Rate Code Duty Rate duties Liquidation Concept P.F.2 Amount Concept P.F.3 Amount Totals DTA (fee) ISAN (tax) Cash VAT (tax) C.C. (duty) Other IGI (duty) REC. (duty) Total Provider or buyer Information Fiscal ID Invoice number Date Name or Corporate Name Fiscal Domicile INCOTERM Currency Currency value factor factor Related Parties Currency Factor Recipient’s Information Fiscal ID Means of Name or Corporate Name Fiscal Domicile Identification: Country: Transportation Number (track number / order / shipment number / ID: Number / Container Type Code / Complementary identification code Customs Account and Guaranty Customs Accounts Account Type: Guaranty Code: Consecutive number: Issuance institution Account number: Deposit Total: Date: Discharges 2 3 Payment Form Idem 9 Dollars value Mexico Number of the Original Pedimento: Date of the Original Operation: Code of the Original Pedimento: Observations Entries Tariff Item SEC Subdivision V.M.4 Related parties UMC5 Quantity of UMT6 Quantity of UMT Country of selling/purchasing UMC Country of origin/destination Description Custom /USD Duty Duty value Price paid Unit Price Permit Model Code Complement Code of guarantee referred the Total of deposit Discharge’ signature Code INST. EMISORA Product’s code Vehicle’s serial number Mileage Permit’s number Commercial Value in dollars Compleme nt Date Amount Value Added Brand Vehicle’s serial number E.R.7 P. F.8 Code Account number Estimated Price Mileage Quantity UMT/UMC Complement Consecutive number Quantity in UMC of the estimated price Determination and/or payment of duties according with the application of article 14 of the TLCUE Value of the non originating goods Amount of the General Import Duty Observations of entries CUSTOMS BROKER, OR IN-HOUSE CUSTOMS BROKER STATEMENT UNDER OATH PURSUANT TO ARTICLE 81 OF THE CORPORATE NAME: CUSTOMS LAW. TAX ID: CURP: ATTORNEY-IN-FACT/ AUTHORIZED PERSON CUSTOMS BROKER NUMBER OR AUTHORIZATION NUMBER FOR IN-HOUSE CUSTOMS BROKER: NAME: TAX ID: 4 CURP: Valuation Method Commercial Unit of Measurement 6 Unit of measurement according to the TIGIE 7 Exchange Rate 8 Payment Form 5 10 SIGNATURE Mexico Electronic Seals Purpose – 1) Proof of duty payment 2) Proof of inspection/document review 3) Proof of Final Customs clearance Issuing Authority – General Customs Administration, electronically generated on the Pedimento once payment of duty and inspections are completed Where stamps are located – column at top right hand side of form labelled “Seals” English Translation 1) Electronic seal confirming duty payment appears at top of column labelled “Seals”. General Customs Administration Bank: (authorized by SHCP to receive duty payment with corresponding code) 1.- Banamex 2.- Bancomer 3.- Bital 4.- Bursamex, S.A. de C.V. 5.- Operadora de Bolsa, S.A. de C.V. 6.- Vector Casa de Bolsa, S.A. de C.V. Customs Mexico City Airport (470) – code and name will vary Box: 04 (internal Customs use) Bank transaction number: Entry number (Pedimento): Date: Time: Import: (duty amount) 2) Electronic seal confirming that documentation presented for review is in accordance with entry information filed electronically. Date Time Operation: Entry number (Pedimento) Company name: carrier name; most imports into Mexico arrive via truck Vehicles: ** Customs Release (from document review)** ***COMPLETED*** 3) 11 Authorized Passage Date Time Operation: Entry (Pedimento): **Customs Release (final clearance)** ***COMPLETED*** Mexico Citations Customs Law, DOF (15 December 1995) as amended (30 December2002) Foreign Trade Law, DOF (27 July1993), as amended (13 March 2003) Foreign Trade General Rules, annex 2 DOF, (4 April 2005) Administración General de Aduanas Av. Hidalgo 77, Módulo IV, Piso 3, Col. Guerrero, Deleg. Cuauhtémoc, 06300,\DF, Mexico www.aduanas.sat.gob.mx 12