EasyVista emerges as a mid-enterprise ITSM contender

Anuncio

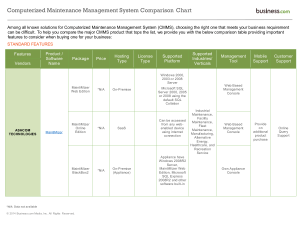

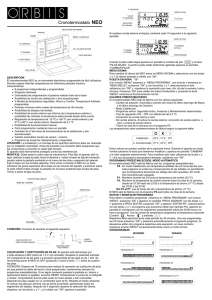

EasyVista emerges as a mid-enterprise ITSM contender Analyst: Dennis Callaghan 16 Jun, 2014 SaaS and North America are driving new growth for ITSM stalwart EasyVista. With an updated product and a talent infusion from Numara, the company appears to be a formidable contender in mid-enterprise IT service management (ITSM). The 451 Take Though hardly a new player on the ITSM scene, EasyVista is reemerging as a serious competitor in the space. The company is targeting the North American market for really the first time with a SaaS offering backed by a global datacenter network. Its new ServiceApps technology gives EasyVista a slick tool to build codeless service applications that can be extended beyond the IT department. Like any 26-year-old firm, EasyVista has a maintenance stream that can make it vulnerable to competitors. But as the company's revenue grows – driven by SaaS subscriptions and software licenses – the opportunity it has to crack the North American market is outweighing that weakness. EasyVista is a worthy challenger to ServiceNow in the mid-enterprise segment. Context EasyVista traces its roots to the Staff & Line Group, an IT consultancy founded in 1988 in Paris. Like many consultancies, the company's business evolved into the software it developed for clients. That software, known as EasyVista, eventually became the company's name. EasyVista went public in 2005, the same year it introduced a SaaS version of its flagship ITSM offering. About 47% of the company's stock trades on the NYSE Euronext, with the rest privately held by cofounders Sylvain Copyright 2014 - The 451 Group 1 Gauthier (CEO) and Jamal Labed (COO), along with recently hired Andy White, who is executive VP of marketing and GM, Americas. White is a veteran of the ITSM space, having previously been an executive at FrontRange, Numara Software and BMC Software after it acquired Numara. He has brought in other ex-Numara hands to help in sales and marketing, especially in the US. EasyVista reported about $20m (€14.7m) in revenue in 2013, up from $11.9m in 2010. The company is projecting to hit the $25m revenue mark this year. Of last year's revenue, more than 50% – $11.3m – was new license revenue, with a nearly even split between on-premises software licenses and SaaS. Maintenance ($5.7m) and professional services ($3m) made up the rest. With 130 employees worldwide, EasyVista has dual headquarters in Paris and New York City. It also has sales and support offices in San Francisco, Dallas, Montreal and Cambridge, Massachusetts in North America; and the UK, Germany, Spain, Portugal and Italy in Europe. Products EasyVista offers a suite of ITSM software applications as well as a platform on which customers can build their own service applications for IT or business department use cases. The company's flagship offering is EasyVista Service Manager, which is a workflow engine that supports ITIL-based service management applications (incident, problem, change, etc.) and CMDB; IT asset lifecycle management; IT financial management; organizational and customer service management; and project management. Service Manager is built on EasyVista's Neo platform, which includes Neo Design, Neo Connect and Neo Deliver. Neo Design comprises a workflow engine and forms and reports templates for customers to build their own service applications without coding. Neo Connect supports codeless integration to third-party applications and data sources. Neo Deliver is an on-demand software delivery platform. The product is available as licensed on-premises software or as EasyVista Cloud. Both the on-premises and SaaS versions are on the same codebase. EasyVista Cloud is backed by 12 tier three-, SaaS 70 Type II- and ISO 27001-certified datacenters, and is managed by two cloud management center teams, one in North America and one in Europe. There are six colocation datacenters in North America, five in Europe and one in Singapore. The company recently released EasyVista ServiceApps, which is how it markets the presentation engine for building new custom service applications for IT and business department use cases. Copyright 2014 - The 451 Group 2 Customers EasyVista has approximately 900 customers in the upper midmarket and enterprise segments. Most of those clients – almost 90% – are in Europe, but North America is its fastest-growing market as it went from 19 North American customers in 2012 to 74 by the end of 2013. The company typically sells to organizations with 4,000-50,000 employees; 25-600 IT staff members; and 20,000-200,000 nodes to manage. That pretty much keeps EasyVista out of the 500 largest enterprises in the world, but gives it good penetration at the next-largest organizations. Finance and insurance, travel, education, manufacturing, retail and distribution, information technology, biotechnology/pharmaceutical/chemicals, government and professional services are its key verticals. SaaS is a faster-growing part of the company's business, accounting for 61% of its new customer implementations last year, though only about 38% of total customer implementations. With 150 CMDB users and 75,000 configuration items, the city of Barcelona is EasyVista's largest customer by scale. Rabobank is its largest single account. Other reference customers include McDonald's, Paul Weiss, ESPN, L'Oréal Group, Mercedes-Benz, Washington State Department of Corrections, Greatbatch, FCCI Insurance Group, Moss Adams and Jewelers Mutual Insurance Company. Partners EasyVista has 280 partner engineers at 40 VARs that work on implementing, integrating and customizing its software. The company sells mostly direct – about 90% in the US – and mostly indirect – about 60% in the rest of the world. However, it is building a partner network in the US to better support its growing customer base there. EasyVista also has MSP partners that offer its software as a managed service to their customers, as well as several technology partners such as Microsoft (for the .Net framework that it's developed in) and Qlik, for the reporting EasyVista uses. Technology integration partners include LANDesk, Oracle, SAP, Bomgar and LogMeIn. Competition Competing at the lower end of the enterprise segment and the higher end of the midmarket space, EasyVista encounters ServiceNow on just about every deal it vies for. Cherwell Software also shows up as a frequent rival, with BMC, HP and Axios making occasional appearances on deals. Startup ITinvolve is looking to move up to larger accounts, so EasyVista figures to run into it Copyright 2014 - The 451 Group 3 eventually. FrontRange, SAManage and SysAid should be contenders at the lower end of EasyVista's market segment. CA Technologies has offerings for both enterprise and midmarket customers. Sunview Software is another competitor in the midmarket. All of these companies have SaaS options, with ITinvolve and SAManage SaaS-only vendors. SWOT Analysis Strengths Weaknesses EasyVista has been around for 26 years, has a growing business and an experienced management team, and can provide customers with the confidence of dealing with a publicly traded firm. The company's SaaS infrastructure is second only to ServiceNow among the ITSM providers we've evaluated. The company remains small, especially relative to how long it's been in business. It still has a sizeable maintenance business, which can make it vulnerable to newer rivals. Opportunities Threats EasyVista has mostly been a European vendor throughout its history. It's just getting started in the lucrative US market. SaaS is a growing part of the company's business as well. It's hard to beat ServiceNow at its own game, but EasyVista seems to have found a niche it can effectively compete in. However, we do expect ServiceNow to contend more aggressively at the lower end of its target market. Other firms, especially startups, will look to poach EasyVista's licensed software maintenance customers. Copyright 2014 - The 451 Group 4 Reproduced by permission of The 451 Group; © 2014. This report was originally published within 451 Research's Market Insight Service. For additional information on 451 Research or to apply for trial access, go to: www.451research.com Copyright 2014 - The 451 Group 5