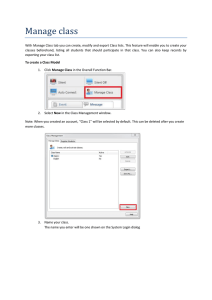

Odyssey in International Markets - Inter

Anuncio