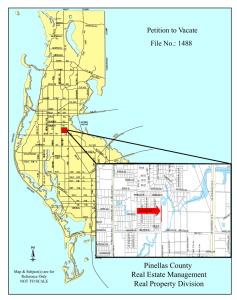

The Monday, October 17, 2016 Work Session Meeting of the City

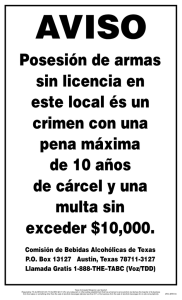

Anuncio