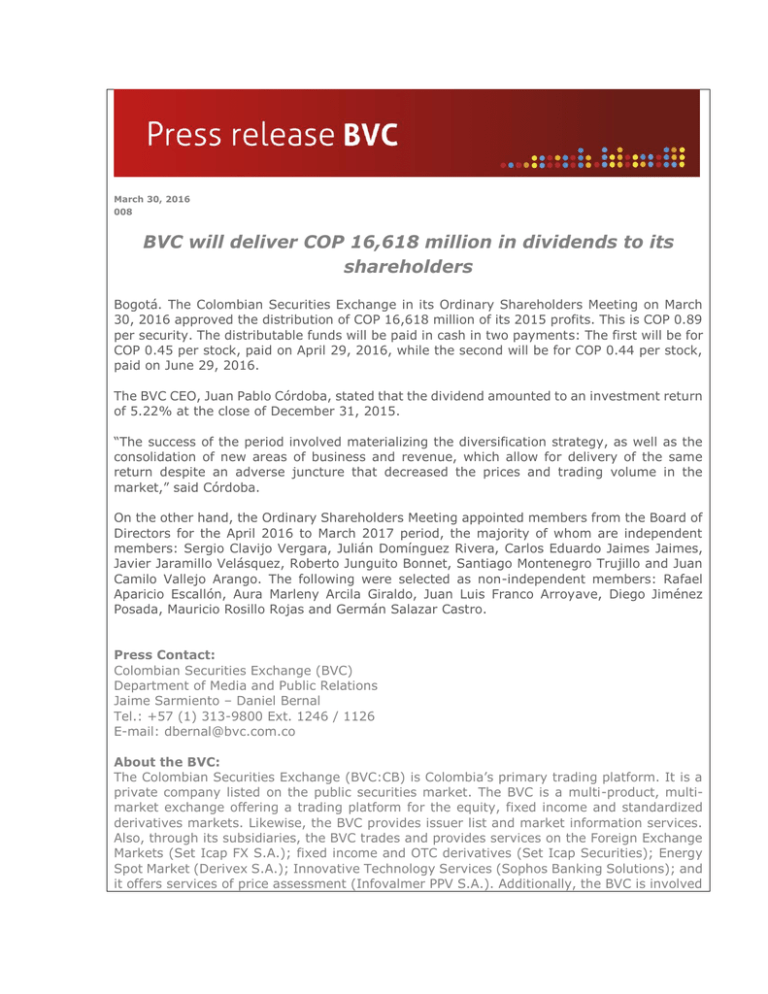

BVC will deliver COP 16,618 million in dividends to its shareholders

Anuncio

March 30, 2016 008 BVC will deliver COP 16,618 million in dividends to its shareholders Bogotá. The Colombian Securities Exchange in its Ordinary Shareholders Meeting on March 30, 2016 approved the distribution of COP 16,618 million of its 2015 profits. This is COP 0.89 per security. The distributable funds will be paid in cash in two payments: The first will be for COP 0.45 per stock, paid on April 29, 2016, while the second will be for COP 0.44 per stock, paid on June 29, 2016. The BVC CEO, Juan Pablo Córdoba, stated that the dividend amounted to an investment return of 5.22% at the close of December 31, 2015. “The success of the period involved materializing the diversification strategy, as well as the consolidation of new areas of business and revenue, which allow for delivery of the same return despite an adverse juncture that decreased the prices and trading volume in the market,” said Córdoba. On the other hand, the Ordinary Shareholders Meeting appointed members from the Board of Directors for the April 2016 to March 2017 period, the majority of whom are independent members: Sergio Clavijo Vergara, Julián Domínguez Rivera, Carlos Eduardo Jaimes Jaimes, Javier Jaramillo Velásquez, Roberto Junguito Bonnet, Santiago Montenegro Trujillo and Juan Camilo Vallejo Arango. The following were selected as non-independent members: Rafael Aparicio Escallón, Aura Marleny Arcila Giraldo, Juan Luis Franco Arroyave, Diego Jiménez Posada, Mauricio Rosillo Rojas and Germán Salazar Castro. Press Contact: Colombian Securities Exchange (BVC) Department of Media and Public Relations Jaime Sarmiento – Daniel Bernal Tel.: +57 (1) 313-9800 Ext. 1246 / 1126 E-mail: [email protected] About the BVC: The Colombian Securities Exchange (BVC:CB) is Colombia’s primary trading platform. It is a private company listed on the public securities market. The BVC is a multi-product, multimarket exchange offering a trading platform for the equity, fixed income and standardized derivatives markets. Likewise, the BVC provides issuer list and market information services. Also, through its subsidiaries, the BVC trades and provides services on the Foreign Exchange Markets (Set Icap FX S.A.); fixed income and OTC derivatives (Set Icap Securities); Energy Spot Market (Derivex S.A.); Innovative Technology Services (Sophos Banking Solutions); and it offers services of price assessment (Infovalmer PPV S.A.). Additionally, the BVC is involved in the whole securities industry value chain through holdings in the Central Securities Depository (Deceval), the Central Counterparty Risk Clearing House (CRCC) and in the FX Clearing House (CCDC).