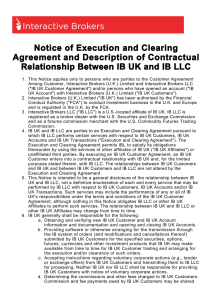

Notice of Execution and Clearing Agreement

Anuncio