PRIMERA PRÁCTICA CALIFICADA DE ECONOMETRIA II 1° El

Anuncio

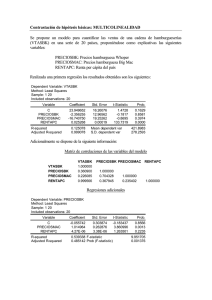

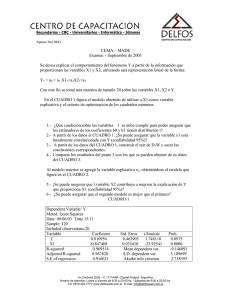

UNIVERSIDAD NACIONAL DE PIURA DPTO. ACAD. DE ECONOMETRIA Y METODOS CUANTITATIVOS PRIMERA PRÁCTICA CALIFICADA DE ECONOMETRIA II 1° El investigador especifica el siguiente modelo: GC = a + b PNB + c GC(-1) + U1 GI = d + e (PNB -PNB(-1)) + f PNB(-1) + g R(-4) + U2 R = h + i PNB + j (PNB - PNB(-1)) + k (M - M(-1)) + l R(-1) + U3 PNB = GC + GI + G Se le pide: 1.1. Estimar la función inversión por mínimos cuadrados bietápicos y verifique que la perturbación es ruido blanco. (6 puntos) Dependent Variable: GI Method: Two-Stage Least Squares Sample (adjusted): 1972Q1 2009Q1 Included observations: 149 after adjustments Instrument list: C GC(-1) PNB(-1) R(-4) M-M(-1) R(-1) G Variable Coefficient Std. Error t-Statistic Prob. C PNB-PNB(-1) PNB(-1) R(-4) -62.14682 -1.019254 0.230155 -13.32002 12.47107 0.249664 0.008228 1.896503 -4.983279 -4.082497 27.97321 -7.023462 0.0000 0.0001 0.0000 0.0000 R-squared Adjusted R-squared S.E. of regression F-statistic 0.912906 0.911104 43.06564 543.4915 Mean dependent var S.D. dependent var Sum squared resid Durbin-Watson stat 405.6423 144.4405 268924.1 1.238780 Sample: 1972Q1 2009Q1 Included observations: 149 Autocorrelation .|*** .|* Partial Correlation | | .|*** .|. | | AC PAC Q-Stat 1 0.372 0.372 21.056 0.000 2 0.125 -0.015 23.454 0.000 24 Series: Residuals Sample 1972Q1 2009Q1 Observations 149 20 16 12 8 4 0 -150 -100 -50 0 Prob 50 100 150 Mean Median Maximum Minimum Std. Dev. Skewness Kurtosis 1.43e-14 1.690194 150.9629 -162.4246 42.62693 -0.109658 5.357270 Jarque-Bera Probability 34.79661 0.000000 Breusch-Godfrey Serial Correlation LM Test: Obs*R-squared 23.51279 Probability 0.000001 Dependent Variable: RESID Method: Two-Stage Least Squares Variable Coefficient Std. Error t-Statistic Prob. C PNB-PNB(-1) PNB(-1) R(-4) RESID(-1) 2.298957 -0.035066 -0.003044 1.277387 0.348226 2.664835 0.023842 0.003836 1.539668 0.078578 0.862701 -1.470733 -0.793452 0.829651 4.431593 0.3897 0.1435 0.4288 0.4081 0.0000 R-squared 0.157804 Mean dependent var 1.43E-14 Breusch-Godfrey Serial Correlation LM Test: Obs*R-squared 23.72026 Probability 0.000007 Dependent Variable: RESID Method: Two-Stage Least Squares Variable Coefficient Std. Error t-Statistic Prob. C PNB-PNB(-1) PNB(-1) R(-4) RESID(-1) RESID(-2) 2.401008 -0.037263 -0.003139 1.328669 0.361925 -0.041370 2.680141 0.024328 0.003852 1.547357 0.083665 0.085012 0.895851 -1.531666 -0.815103 0.858670 4.325893 -0.486643 0.3718 0.1278 0.4164 0.3920 0.0000 0.6273 R-squared 0.159196 Mean dependent var 1.43E-14 4.333282 4.266026 Probability Probability 0.039120 0.038882 ARCH Test: F-statistic Obs*R-squared Dependent Variable: RESID^2 Method: Least Squares Sample (adjusted): 1972Q2 2009Q1 Included observations: 148 after adjustments Variable Coefficient Std. Error t-Statistic Prob. C RESID^2(-1) 1489.393 0.169769 341.8062 0.081555 4.357419 2.081654 0.0000 0.0391 R-squared 0.028825 Mean dependent var 1797.016 ARCH Test: F-statistic Obs*R-squared 2.205784 4.369608 Probability Probability 0.113873 0.112500 Dependent Variable: RESID^2 Method: Least Squares Sample (adjusted): 1972Q3 2009Q1 Included observations: 147 after adjustments Variable Coefficient Std. Error t-Statistic Prob. C RESID^2(-1) RESID^2(-2) 1429.581 0.163237 0.034230 366.9638 0.083260 0.083283 3.895700 1.960577 0.411011 0.0001 0.0519 0.6817 R-squared 0.029725 Mean dependent var 1786.480 White Heteroskedasticity Test: F-statistic Obs*R-squared 38.14019 91.94592 Probability Probability 0.000000 0.000000 Dependent Variable: RESID^2 Method: Least Squares Sample: 1972Q1 2009Q1 Included observations: 149 Variable Coefficient Std. Error t-Statistic Prob. C PNB-PNB(-1) (PNB-PNB(-1))^2 PNB(-1) PNB(-1)^2 R(-4) R(-4)^2 5065.567 -57.37079 1.763680 -4.678255 0.000841 495.6960 -23.75207 2591.431 8.129623 0.128659 2.591239 0.000437 419.2194 22.80827 1.954738 -7.057005 13.70818 -1.805412 1.924253 1.182426 -1.041380 0.0526 0.0000 0.0000 0.0731 0.0563 0.2390 0.2995 R-squared 0.617087 Mean dependent var 1804.860 White Heteroskedasticity Test: F-statistic Obs*R-squared 26.31825 93.89767 Probability Probability 0.000000 0.000000 Dependent Variable: RESID^2 Method: Least Squares Sample: 1972Q1 2009Q1 Included observations: 149 Variable Coefficient Std. Error t-Statistic Prob. C PNB-PNB(-1) (PNB-PNB(-1))^2 (PNB-PNB(-1))*PNB(-1) (PNB-PNB(-1))*R(-4) PNB(-1) PNB(-1)^2 PNB(-1)*R(-4) R(-4) R(-4)^2 R-squared 1.2. 4707.116 -46.11173 1.820128 -0.022705 6.763227 -4.663337 0.001205 -0.239730 607.8990 4.203946 0.630186 2705.725 38.01827 0.132682 0.018281 3.176839 3.114289 0.000740 0.297096 715.5028 31.03289 1.739687 -1.212883 13.71802 -1.241959 2.128917 -1.497400 1.628869 -0.806914 0.849611 0.135467 Mean dependent var 0.0841 0.2272 0.0000 0.2163 0.0350 0.1366 0.1056 0.4211 0.3970 0.8924 1804.860 Verifique si PNB se puede tratar como exógena en la función consumo. (3 puntos) Dependent Variable: PNB Method: Least Squares Sample (adjusted): 1972Q1 2009Q1 Included observations: 149 after adjustments Variable Coefficient Std. Error t-Statistic Prob. C GC(-1) PNB(-1) R(-4) M-M(-1) R(-1) G -3.080040 0.468748 0.660678 -6.154040 0.780825 -0.226749 0.334458 14.93192 0.099402 0.077507 2.173091 0.413093 2.023923 0.107842 -0.206272 4.715664 8.524095 -2.831929 1.890192 -0.112035 3.101360 0.8369 0.0000 0.0000 0.0053 0.0608 0.9110 0.0023 R-squared 1972Q1 1973Q1 1974Q1 1975Q1 0.999118 Mean dependent var 2433.421 Modified: 1971Q1 2009Q1 // frpnb.fit(f=actual) pnbf 1253.516 1296.611 1321.031 1340.128 1351.291 1366.054 1376.372 1394.327 1426.753 1450.054 1459.957 1453.699 1434.615 1419.906 1420.061 1436.370 Dependent Variable: GC Method: Least Squares Sample (adjusted): 1972Q1 2009Q1 Included observations: 149 after adjustments Variable Coefficient Std. Error t-Statistic Prob. C PNB GC(-1) PNBF -1.366045 0.254412 0.978050 -0.235553 4.817074 0.036841 0.026841 0.040999 -0.283584 6.905643 36.43881 -5.745335 0.7771 0.0000 0.0000 0.0000 R-squared 0.999618 Mean dependent var 1493.913 Wald Test: Equation: FE Test Statistic Value F-statistic Chi-square 1.3. 33.00888 33.00888 df Probability (1, 145) 1 0.0000 0.0000 Determine qué tipo de variable es el PNB en la tasa de interés. (3 puntos) U1t GCt-1 Rt-4 GCt GIt U3t-4 U2t Gt PNBt PNBt-1 Rt-1 Rt U3t U3t-1 Mt-Mt-1 La variable PNB es endógena porque las flechas llegan y se tiene: E (PNBt u 3t +1 ) = 0 E (PNBt u 3t ) = 0 E (PNBt u 3t −1 ) = 0 E (PNBt u 3t − 4 ) ≠ 0 Por lo tanto, la variable PNB en la tercera ecuación es predeterminada. 1.4. Verifique la causalidad de Granger entre inversión y tasa de interés. (3 puntos) Pairwise Granger Causality Tests Sample: 1971Q1 2009Q1 Lags: 3 Null Hypothesis: Obs F-Statistic Probability R does not Granger Cause GI GI does not Granger Cause R 150 8.50310 3.07447 3.1E-05 0.02970 Pairwise Granger Causality Tests Sample: 1971Q1 2009Q1 Lags: 6 Null Hypothesis: Obs F-Statistic Probability R does not Granger Cause GI GI does not Granger Cause R 147 6.92339 3.93928 2.0E-06 0.00117 Null Hypothesis: Obs F-Statistic Probability R does not Granger Cause GI GI does not Granger Cause R 144 6.66620 1.59897 9.4E-08 0.12246 Null Hypothesis: Obs F-Statistic Probability R does not Granger Cause GI GI does not Granger Cause R 141 6.63880 1.99148 6.1E-09 0.03092 Pairwise Granger Causality Tests Sample: 1971Q1 2009Q1 Lags: 9 Pairwise Granger Causality Tests Sample: 1971Q1 2009Q1 Lags: 12 2° Comente y fundamente su respuesta. (5 puntos) 2.1. Una variable exógena estricta puede considerarse una variable exógena fuerte y viceversa. 2.2. La prueba de exogeneidad y la de causalidad de Granger se puede aplicar a todo modelo multuecuacional.