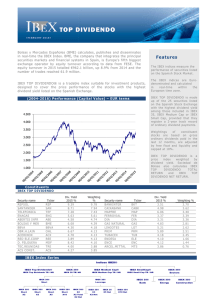

Features - Ibex 35

Anuncio

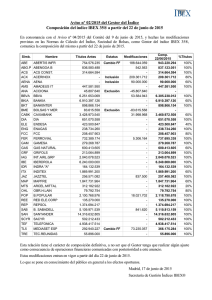

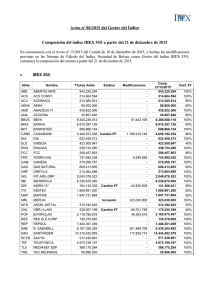

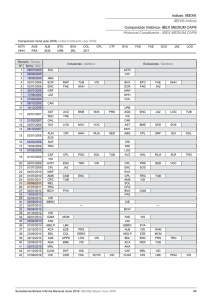

Features Bolsas y Mercados Españoles (BME) calculates. Publishes and disseminates in real-time the IBEX Index. BME. The company that integrates the principal securities markets and financial systems in Spain. is Europe's fifth biggest exchange operator by equity turnover according to data from FESE. The trading volume in September came in at €42.8 billion, up 39% from the previous month and the number of trades reached 3.7 million, up 18% from the same month a year earlier. The IBEX indices measure the performance of securities listed on the Spanish Stock Market. IBEX MEDIUM CAP is a market cap weighted index adjusted by free float. IBEX MEDIUM CAP® is a tradable index suitable for derivatives. Designed to represent the performance of the medium-sized securities traded on the Spanish Stock Market. IBEX MEDIUM CAP is Eurodenominated and calculated in real-time within the European time zone. IBEX MEDIUM CAP® is the benchmark for Exchange-traded funds (ETFs) issued by LYXOR INTERNATIONAL ASSET MANAGEMENT. IBEX MEDIUM CAP is made up by the 20 securities following those on IBEX 35 by free-float adjusted market cap. Provided that their annualised rotation on free float capital is above 15%. Selection criteria of constituents have no sector diversification bias. 10 Y Performance (Capital Value) – EUR terms 25.000 23.000 21.000 19.000 17.000 15.000 13.000 IBEX MEDIUM CAP is a price return index. Sociedad de Bolsas also calculates IBEX MEDIUM CAP total return and an IBEX MEDIUM CAP net return. 11.000 9.000 7.000 5.000 IB Constituents IBEX MEDIUM CAP BE Security name Ticker EBRO FOODS ZARDOYA OTIS BOLSAS Y MER PROSEGUR MELIA HOTELS G.CATALANA O INM. COLONIA VIDRALA ATRESMEDIA ALMIRALL EBRO ZOT BME PSG MEL GCO COL VID A3M ALM Weigthing% 8.91 8.22 7.66 7.03 6.87 6.70 6.14 5.19 5.00 4.87 Security name Ticker NH HOTEL APPLUS SERVI CODERE EUSKALTEL LOGISTA COR.ALBA CIE AUTOMOT. SACYR OBR.H.LAIN FAES NHH APPS CDR EKT LOG ALB CIE SCYR OHL FAE Weigthing% 4.33 3.99 3.64 3.62 3.60 3.01 2.96 2.92 2.73 2.63 X 35®NV IBEX Index Series Indices IBEX® IBEX Top Dividendo® IBEX 35® IBEX Medium Cap® IBEX SmallCap® IBEX 35® IBEX Top Dividendo TR / NR IBEX 35 TR/ NR IBEX Medium Cap TR / NR IBEX Small Cap TR / NR Sectors IBEX 35® Short IBEX 35® Leverage IBEX 35® Short IBEX 35® Short IBEX 35® Short IBEX 35® Short IBEX 35® X2 IBEX 35® X3 X2 X3 X5 X10 X2 Total X3 Net X2 Net IBEX 35 X5 Net IBEX 35® X10 Net IBEX 35® IBEX 35® IBEX 35® Bank Energy Construction Sector breakdown IBEX Medium Cap IBEX 35 IBEX Small Cap 1 . O i l a nd en er g y 2 . B as i c ma t er ia l s . i nd us tr y an d c o ns tr u c t io n 2 0 . 2 9% 0 . 0 0% 6 . 2 0% 8 . 4 0% 2 6 . 2 1% 3 0 . 8 9% 3 . Co ns um er g o ods 1 5 . 7 1% 2 2 . 3 8% 2 2 . 4 5% 9 . 9 0% 2 2 . 9 1% 4 . 4 6% 3 0 . 1 6% 2 4 . 7 1% 3 3 . 5 0% 1 5 . 5 4% 3 . 7 9% 2 . 5 0% 4 . Co ns um er ser v i ce s 5 . F in an c ia l an d r ea l es ta t e s er v i ce s 6 T ec hn o lo gy a nd t e l ec omm un i ca t io ns Information Index Launch 1st July 2005 Eligibility Criteria Highest market cap adjusted by free float (excluding IBEX 35 Returns breakdown constituents) 6 M % 1 2M % 3Y % 5Y % I B EX 3 5 - 3 . 85 - 1 4 .5 8 - 3 . 99 4.99 I B EX 3 5 T o ta l Re tur n - 1 . 34 - 1 0 .7 9 9.52 36.56 I B EX 3 5 Ne t R et ur n - 1 . 81 - 1 1 .5 2 6.67 29.43 I B EX M ed iu m C ap - 2 . 87 - 9 . 13 15.12 69.18 I B EX M ed iu m C ap T ot a l R e tur n - 1 . 27 - 6 . 87 23.68 92.62 I B EX M ed iu m C ap N et R et ur n - 1 . 56 - 7 . 29 22.00 87.80 Weighting 3.61 1.88 11.08 - 5 . 78 Market cap adjusted by free I B EX Sm al l Ca p Index Calculation Real-time float Volatility 1 - Y ear % 3 - Ye ar s % 5 - Ye ar s % Maximum weighting limit of 20% in reviews I B EX 3 5 27.21 22.18 23.81 I B EX 3 5 T o ta l Re tur n 27.18 22.17 23.79 I B EX 3 5 Ne t R et ur n 27.18 22.16 23.79 Currency I B EX M ed iu m C ap 19.50 17.55 17.80 I B EX M ed iu m C ap T ot a l R e tur n 19.49 17.52 17.77 Euro I B EX M ed iu m C ap N et R et ur n 19.49 17.52 17.77 I B EX Sm al l Ca p 19.50 18.89 17.77 Base Date December 29th 1989 Correlation (returns. since J an 1992) I B EX 3 5 I B EX 35 1 0 0% M e d ium S ma l l TD Base Level 3.000 I B EX M ed iu m 7 8% 1 0 0% I B EX Sm al l 6 3% 7 1% 1 0 0% I B EX TD 8 9% 8 5% 7 4% 1 0 0% Review Dates Quarterly Vendor Codes Ordinary in June and December I SI N R e ut er s B l o omb er g I B EX 3 5 E SO SI 0 0 0 0 00 5 < .I B EX > I B EX I nd ex <GO > I B EX 3 5 T o ta l Re tur n E S 0 SI 0 0 0 00 4 7 < .I B EX T R> I B EX 3 5TR I nd ex <GO > I B EX 3 5 Ne t R et ur n E S 0 SI 0 0 0 00 6 2 < .I B EX N R> I B EX NR I nd ex < GO > I B EX M ed iu m C ap I B EX M ed iu m C ap T R E S 0 SI 0 0 0 00 1 3 E S 0 S0 0 0 00 2 7 3 < .I B EX C> < .I B EX CT> I B EX C I nd ex <GO > I B EX C T I nd e x <GO > Index Rules I B EX M ed iu m C ap N R E S 0 S0 0 0 00 2 8 1 < .I B EX C N> I B EX C N I n de x < GO > Available at www.sbolsas.com I B EX Sm al l Ca p I B EX 3 5 E S 0 S0 0 0 00 0 2 1 E S 0 SI 0 0 0 00 3 9 < .I B EX S > < .I B EX D> I B EX S I n de x < GO > I B EX TDI V I nd ex <GO > [email protected] www.bolsasymercados.es © Sociedad de Bolsas. S.A. 2016. All rights reserved. "IBEX 35®". "IBEX Medium Cap®". "IBEX Small Cap®" and “IBEX Top Dividendo®” are trade marks of the Sociedad de Bolsas. S.A. and all such marks are used under licence. All rights in and to the IBEX 35. IBEX Medium Cap. IBEX Small Cap and IBEX Top Dividendo vest in Sociedad de Bolsas and its licensors. All information is provided for information purposes only. No responsibility or liability is accepted by Sociedad de Bolsas or its licensors for any errors. loss or liability arising from the use of this publication. Distribution of IBEX index values and the use of the IBEX Indices to create financial products requires a licence from Sociedad de Bolsas. Follow-ups in March and September Factsheet Data Sociedad de Bolsas data as at 16th September 2016