Features - Bolsa de Madrid

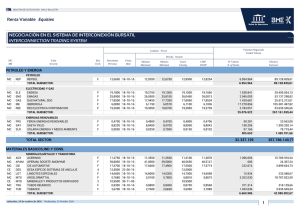

Anuncio

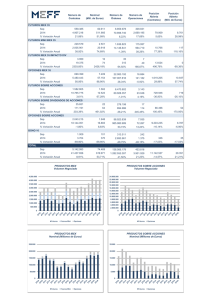

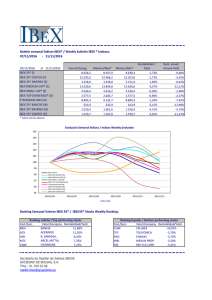

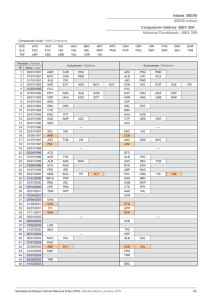

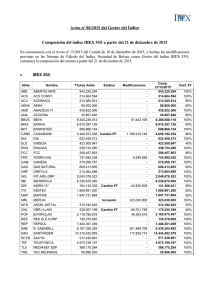

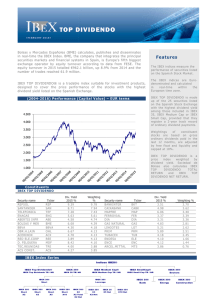

Features Bolsas y Mercados Españoles (BME) calculates, publishes and disseminates in real-time the IBEX Index. BME, the company that integrates the principal securities markets and financial systems in Spain, is Europe's fifth biggest exchange operator by equity turnover according to data from FESE. The trading volume in September came in at €42.8 billion, up 39% from the previous month and the number of trades reached 3.7 million, up 18% from the same month a year earlier. The IBEX indices measure the performance of securities listed on the Spanish Stock Market. The IBEX indices are Eurodenominated and calculated in real-time within the European time zone. IBEX 35® SHORT X3 is a tradable index suitable for derivatives, designed to represent the triple inverse performance of the IBEX 35 Total Return. IBEX 35® SHORT X3 is the benchmark for warrants issued by Societe Generale The IBEX 35® SHORT X3 index tracks the inverse daily performance in the IBEX 35® TOTAL RETURN in the opposite direction, that is, if on a trading session the return on IBEX 35® TOTAL RETURN is negative, the return on IBEX 35® SHORT X3 on the same trading session will be positive in a triple proportion. (2013-2016) Performance (Capital Value) – EUR terms 200 180 160 140 120 The formula for the calculation of IBEX 35® SHORT X3 incorporates a risk-free, fixed income investment component. 100 80 60 Sociedad de Bolsas also calculates a IBEX 35 ® DOUBLE, QUINTUPLE & X10 SHORT, and a IBEX 35® DOUBLE, TRIPLE, QUINTUPLE LEVERAGE & X10 40 Comentes del 35® INVER Constituents IBEX 35 Total Return BEX 35®NVERSO Security name INDITEX SANTANDER TELEFONICA IBERDROLA BBVA AMADEUS IT REPSOL CAIXABANK ABERTIS INFR FERROVIAL AENA GAS NATURAL Ticker ITX SAN TEF IBE BBVA AMS REP CABK ABE FER AENA GAS Weig% Security name RED ELE.CORP INT.AIRL.GRP GRIFOLS ENDESA ACS CONST. B. SABADELL ENAGAS GAMESA BANKINTER BANKIA B.POPULAR MAPFRE 13.38 12.62 10.20 8.50 7.64 4.32 3.89 3.28 3.05 3.01 2.60 2.43 Ticker REE IAG GRF ELE ACS SAB ENG GAM BKT BKIA POP MAP Weig% 2.32 2.25 1.84 1.77 1.76 1.45 1.39 1.31 1.31 1.13 1.06 0.97 Security name MEDIASET ESP DIA MERLIN PROP. ARCEL.MITTAL ACCIONA CELLNEX ACERINOX VISCOFAN MELIA HOTELS TEC.REUNIDAS INDRA "A" Ticker TL5 DIA MRL MTS ANA CLNX ACX VIS MEL TRE IDR Weig% 0.80 0.74 0.71 0.68 0.66 0.65 0.56 0.50 0.46 0.41 0.36 IBEX Index Series Indices IBEX® IBEX Top Dividendo® IBEX 35® Top Dividendo TR /35 NR INVERSO IBEX 35 ) TR/ NR ciónIBEX precios IBEX IBEX 35® Short IBEX Medium Cap® IBEX SmallCap® IBEX 35® IBEX Medium Cap TR / NR IBEX Small Cap TR / NR Sectors IBEX 35® Leverage IBEX 35® Short IBEX 35® Short IBEX 35® Short IBEX 35® Short IBEX 35® X2 IBEX 35® X3 X2 X3 X5 X10 X2 Total X3 Net X2 Net IBEX 35 X5 Net IBEX 35® X10 Net IBEX 35® IBEX 35® IBEX 35® Bank Energy Construction Sector breakdown I B EX 3 5 1 . O i l a nd en er g y Information 2 0 . 2 9% 2 . B as i c ma t er ia l s . i nd us tr y an d c o ns tr u c ti o n 8 . 4 0% 3 . Co ns um er g o ods 4 . Co ns um er ser v i ce s 1 5 . 7 1% Index Launch 9 . 9 0% 22nd April 2010 5 . F in an c ia l an d r ea l es ta t e se r v ic es 3 0 . 1 6% 6 T ec hn o lo gy a nd te l ec omm un i ca t i on s 1 5 . 5 4% Index Calculation Real-time Returns breakdown 6 M % 1 2M % 3Y % I B EX 3 5 -3.85 -14.58 -3.99 5Y % 4.99 I B EX 3 5 T o ta l Re tur n -1.34 -10.79 9.52 36.56 I B EX 3 5 Sh or t -2.50 3.92 -21.65 -45.61 I B EX 3 5 D ou b le Sh or t -8.15 0.66 -46.93 -77.88 Weighting Index based on IBEX 35 Total Return I B EX 3 5 Sh or t X 3 -15.80 -8.58 -68.32 -93.12 I B EX 3 5 Sh or t X 5 -36.14 -38.98 -93.89 - I B EX 3 5 Sh or t X 1 0 Currency -81.27 -93.11 - - Euro Volatility 1 - Y ear % 3 - Ye ar s % 5 - Ye ar s % I B EX 3 5 27.21 22.18 23.81 I B EX 3 5 T o ta l Re tur n 27.18 22.17 23.79 I B EX 3 5 Sh or t 26.46 21.84 23.65 I B EX 3 5 D ou b le Sh or t 52.44 43.46 47.26 I B EX 3 5 Sh or t X 3 78.10 64.97 70.93 I B EX 3 5 Sh or t X 5 128.81 107.77 - I B EX 3 5 S h or t X 1 0 257.30 - - Base Date December 30th 2003 Base Level 15,000 Review Dates Quarterly S harpe Ratio SH ARP E 1 Y SH ARP E 3 Y SH ARP E 5 Y I B EX 35 I B EX CD I B EX I nv I B EX I nv X 2 I B EX I nv X 3 I B EX I nv X 5 I B EX I n v X10 -0.0448 -0.0367 0.0197 0.0113 0.0028 -0.0061 -0.0305 0.0006 0.0132 -0.0271 -0.0337 -0.0398 -0.0374 - 0.0055 0.0196 -0.0352 -0.0426 -0.0498 - - Vendor Codes I B EX 3 5 I SI N E S 0 SI 0 0 0 00 0 5 R e ut er s < .I B EX > B l o omb er g I B EX I nd ex <GO > I B EX 3 5 T o ta l Re tur n E S 0 SI 0 0 0 00 4 7 < .I B EX T R> I B EX 3 5TR I nd ex <GO > I B EX 3 5 Sh or t E S 0 SI 0 0 0 00 8 8 < .I B EX SH > I B EX SH I nd e x <GO > I B EX 3 5 D ou b le Sh or t E S 0 SI 0 0 0 00 7 0 < .I B EX DS > I B EX D S I n de x < GO > I B EX 3 5 Sh or t X 3 E S 0 SI 0 0 0 00 8 8 < .I B EX T S> I B EX T S I nde x < GO > I B EX 3 5 Sh or t X 5 E S 0 SI 0 0 0 01 9 5 < .I B EX I > I B EX I NX 5 I nd ex <GO > I B EX 3 5 Sh or t X 1 0 E S 0 SI 0 0 0 17 3 0 < .I B EGX > I B EX SH X I nd e x <GO > [email protected] www.bolsasymercados.es © Sociedad de Bolsas, S.A. 2016. All rights reserved. "IBEX 35®", "IBEX Medium Cap®", "IBEX Small Cap®" and “IBEX Top Dividendo®” are trade marks of the Sociedad de Bolsas, S.A. and all such marks are used under licence. All rights in and to the IBEX 35, IBEX Medium Cap, IBEX Small Cap and IBEX Top Dividendo vest in Sociedad de Bolsas and its licensors. All information is provided for information purposes only. No responsibility or liability is accepted by Sociedad de Bolsas or its licensors for any errors, loss or liability arising from the use of this publication. Distribution of IBEX index values and the use of the IBEX Indices to create financial products requires a licence from Sociedad de Bolsas. . Ordinary in June and December Follow-ups in March and September Index Rules Available at www.sbolsas.com Factsheet Data Sociedad de Bolsas data as at 16th September 2016