SOLUCIÓN DE LA TERCERA PRÁCTICA CALIFICADA DE

Anuncio

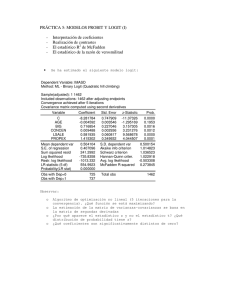

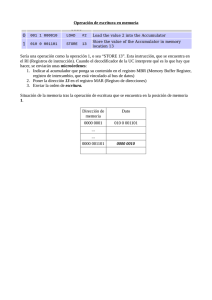

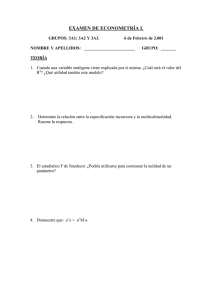

UNIVERSIDAD NACIONAL DE PIURA FACULTAD DE ECONOMIA DEPARTAMENTO DE ECONOMIA SOLUCIÓN DE LA TERCERA PRÁCTICA CALIFICADA DE ECONOMETRIA I 1º El investigador quiere explicar la participación laboral de la mujer casada (ENFT) considerando las variables: GAMAR, EDUC, EXPER, EXPER^2, NM6 y NM6Y18. Ayude al investigador a construir un modelo probit para las primeras 700 observaciones. (8 puntos) ELECCIÓN DEL MODELO PROBIT VARIABLE GAMAR EDUC EXPER EXPER^2 NM6 NM6Y18 SIGNO BETA CORRECTO Z CALCULADO SIGNIFICAN. + + +/+/- -0.012755 0.101325 0.062272 0.001538 -0.542059 0.005783 SI SI SI SI SI SI -2.932777 4.644022 9.039912 6.695664 -5.493298 0.157057 ALTA ALTA ALTA ALTA ALTA NO N90 = 1.64485 N95 = 1.95996 GAMAR EDUC EXPER EXPER^2 NM6 GAMAR 1.000000 0.286269 -0.176315 -0.163933 0.039840 R Mc Fadden 0.009268 0.023753 0.098411 0.055329 0.034043 2.64E-05 N99 = 2.57583 EDUC 0.286269 1.000000 0.075238 0.025576 0.108366 EXPER -0.176315 0.075238 1.000000 0.938095 -0.197885 EXPER^2 -0.163933 0.025576 0.938095 1.000000 -0.184783 NM6 0.039840 0.108366 -0.197885 -0.184783 1.000000 Se elimina EXPER^2. Dependent Variable: ENFT Method: ML - Binary Probit (Quadratic hill climbing) Sample: 1 700 Included observations: 700 Convergence achieved after 4 iterations Covariance matrix computed using second derivatives Variable Coefficient Std. Error z-Statistic Prob. C GAMAR EDUC EXPER NM6 -1.499944 -0.016646 0.139782 0.052026 -0.514656 0.297344 0.005066 0.025292 0.007160 0.106570 -5.044477 -3.285810 5.526636 7.266644 -4.829281 0.0000 0.0010 0.0000 0.0000 0.0000 McFadden R-squared S.D. dependent var Akaike info criterion Schwarz criterion Hannan-Quinn criter. LR statistic Prob(LR statistic) Obs with Dep=0 Obs with Dep=1 0.152596 0.487774 1.146595 1.179103 1.159162 142.7299 0.000000 272 428 Mean dependent var S.E. of regression Sum squared resid Log likelihood Restr. log likelihood Avg. log likelihood Total obs Los signos son los correctos y todas las variables son altamente significativas (z > 2.57583). El modelo en conjunto es significativo (LR = 142.7299 > 9.49 = chi(4)). 0.611429 0.438063 133.3701 -396.3084 -467.6733 -0.566155 700 BAJO BAJO BAJO BAJO BAJO BAJO 2 COEFICIENTE DE BONDAD TIPO VALOR R2 EFFRON MC FADDEN CRAGG-UHLER 0.198417 0.198056 0.152596 0.250225 El coeficiente de bondad de ajuste es bajo. Expectation-Prediction Evaluation for Binary Specification Equation: MODPROB Success cutoff: C = 0.5 Estimated Equation Dep=0 Dep=1 Total P(Dep=1)<=C P(Dep=1)>C Total Correct % Correct % Incorrect Total Gain* Percent Gain** 137 135 272 137 50.37 49.63 50.37 50.37 77 351 428 351 82.01 17.99 -17.99 NA Constant Probability Dep=0 Dep=1 Total 214 486 700 488 69.71 30.29 8.57 22.06 0 272 272 0 0.00 100.00 0 428 428 428 100.00 0.00 0 700 700 428 61.14 38.86 El r2 de conteo es bajo (69.71 %) y el porcentaje de ganancia es de 22.06 %. Goodness-of-Fit Evaluation for Binary Specification Andrews and Hosmer-Lemeshow Tests Equation: MODPROB Grouping based upon predicted risk (randomize ties) Quantile of Risk Low High 1 2 3 4 5 6 7 8 9 10 0.0108 0.3288 0.4381 0.4984 0.5634 0.6223 0.6726 0.7463 0.8111 0.8780 0.3249 0.4355 0.4983 0.5630 0.6215 0.6709 0.7455 0.8106 0.8764 0.9907 Total H-L Statistic Andrews Statistic Actual Dep=0 Expect Actual Expect Total Obs H-L Value 55 46 34 38 30 23 14 16 8 8 54.1565 43.4950 36.9734 32.9306 28.5022 24.7711 20.3488 15.4932 11.0070 5.01600 15 24 36 32 40 47 56 54 62 62 15.8435 26.5050 33.0266 37.0694 41.4978 45.2289 49.6512 54.5068 58.9930 64.9840 70 70 70 70 70 70 70 70 70 70 0.05804 0.38101 0.50682 1.47367 0.13278 0.19598 2.79259 0.02129 0.97478 1.91220 272 272.694 428 427.306 700 8.44916 8.4492 9.5909 Dep=1 Prob. Chi-Sq(8) Prob. Chi-Sq(10) El Test H-L y Andrews nos confirma que el modelo se comporta y se ajusta bien (Prob > 0.05). 0.3909 0.4771 3 50 Series: Residuals Sample 1 700 Observations 700 40 30 20 10 0 -1.00 -0.75 -0.50 -0.25 0.00 0.25 0.50 Mean Median Maximum Minimum Std. Dev. Skewness Kurtosis 0.000991 0.141763 0.896116 -0.987358 0.436807 -0.360305 1.895118 Jarque-Bera Probability 50.75124 0.000000 0.75 Los residuos no se distribuyen normal (JB = 50.75124 > 5.99 = chi(2)). Dependent Variable: ENFT Method: ML - Binary Logit (Quadratic hill climbing) Sample: 1 700 Included observations: 700 Convergence achieved after 4 iterations Covariance matrix computed using second derivatives Variable Coefficient Std. Error z-Statistic Prob. C GAMAR EDUC EXPER NM6 -2.534530 -0.028298 0.231193 0.094066 -0.838567 0.505861 0.008827 0.043385 0.013274 0.177720 -5.010334 -3.205928 5.328822 7.086320 -4.718481 0.0000 0.0013 0.0000 0.0000 0.0000 McFadden R-squared S.D. dependent var Akaike info criterion Schwarz criterion Hannan-Quinn criter. LR statistic Prob(LR statistic) Obs with Dep=0 Obs with Dep=1 0.155580 0.487774 1.142608 1.175116 1.155174 145.5211 0.000000 272 428 Mean dependent var S.E. of regression Sum squared resid Log likelihood Restr. log likelihood Avg. log likelihood Total obs PROBIT McFadden R-squared Log likelihood Akaike info criterion Schwarz criterion Hannan-Quinn criter. Sum squared resid 0.152596 -396.3084 1.146595 1.179103 1.159162 142.7299 0.611429 0.437295 132.9028 -394.9128 -467.6733 -0.564161 700 LOGIT 0.155580 -394.9128 1.142608 1.175116 1.155174 132.9028 El modelo logit es mejor porque tiene los menores criterios de información y los mayores McFadden y log likelihood. Efmggamar = c(2)*enftf*(1-enftf) = -0.005437144431848025 Efmgeduc=c(3)*enftf*(1-enftf) = 0.04442151277672045 4 Efmgexper =c(4)*enftf*(1-enftf) = 0.01807389054149432 Efmgnm6=c(5)*enftf*(1-enftf) = -0.161122410130612 Obs 701 702 703 704 705 706 707 708 709 710 ENFT 0.000000 0.000000 0.000000 0.000000 0.000000 0.000000 0.000000 0.000000 0.000000 0.000000 ENFTF1 0,552193 0,761846 0,563484 0,942201 0,431336 0,309737 0,485316 0,618318 0,491337 0,316790 ENFTF2 1,000000 1,000000 1,000000 1,000000 0,000000 0,000000 0,000000 1,000000 0,000000 0,000000 Tabulation of ENFT-ENFTF2 Sample: 701 753 Included observations: 53 Number of categories: 2 Value -1 0 Total 2º Count 27 26 53 Percent 50.94 49.06 100.00 Estime el modelo siguiente: HTRAB = F(GAMAR, EDUC, EXPER, EDAD, INGFAM, NM6)) y evalué signos y significancia. (4 puntos) Dependent Variable: HTRAB Method: ML - Censored Normal (TOBIT) (Quadratic hill climbing) Sample: 1 753 Included observations: 753 Left censoring (value) at zero Convergence achieved after 6 iterations Covariance matrix computed using second derivatives Variable Coefficient Std. Error z-Statistic Prob. C GAMAR EDUC EXPER EDAD INGFAM NM6 1404.874 -201.8530 -38.23400 25.17984 -26.84469 0.195569 -388.0557 263.6269 9.143016 15.14258 4.664159 4.780045 0.008580 76.78860 5.329023 -22.07729 -2.524934 5.398582 -5.615992 22.79469 -5.053559 0.0000 0.0000 0.0116 0.0000 0.0000 0.0000 0.0000 27.46945 0.0000 Error Distribution SCALE:C(8) Mean dependent var S.E. of regression Sum squared resid Log likelihood Avg. log likelihood Left censored obs Uncensored obs 760.4416 740.5764 569.4098 2.42E+08 -3622.857 -4.811231 325 428 27.68318 S.D. dependent var Akaike info criterion Schwarz criterion Hannan-Quinn criter. Right censored obs Total obs 871.3142 9.643711 9.692838 9.662637 0 753 5 El signo de educación no es el correcto y todas las variables son altamente significativas. 3º. Estimar el modelo logit que explique la probablidad de que una familia sea propietaria de una casa para las primeras 8 observaciones, luego evalué la capacidad predictiva del modelo. (4 puntos) obs 1 2 3 4 5 6 7 8 9 10 1 6 0,156250 0,057190 P 0,200000 0,240000 0,300000 0,350000 0,450000 0,514286 0,600000 0,660000 0,750000 0,800000 INGRESO 6.000000 8.000000 10.00000 13.00000 15.00000 20.00000 25.00000 30.00000 35.00000 40.00000 Modified: 1 10 // varu=1/(nunfam*p*(1-p)) 0,109649 0,079365 0,054945 0,064103 0,089127 0,133333 0,040404 0,250000 Dependent Variable: LOG(P/(1-P)) Method: Least Squares Sample: 1 8 Included observations: 8 Weighting series: 1/SQR(VARU) Variable Coefficient Std. Error t-Statistic Prob. C INGRESO -1.655593 0.083001 0.142520 0.007899 -11.61653 10.50792 0.0000 0.0000 Weighted Statistics R-squared Adjusted R-squared S.E. of regression Sum squared resid Log likelihood F-statistic Prob(F-statistic) 0.948461 0.939871 0.157988 0.149760 4.561135 110.4164 0.000044 Mean dependent var S.D. dependent var Akaike info criterion Schwarz criterion Hannan-Quinn criter. Durbin-Watson stat -0.321000 0.621220 -0.640284 -0.620423 -0.774234 1.303022 Unweighted Statistics R-squared Adjusted R-squared S.E. of regression 0.958869 0.952014 0.161688 Mean dependent var S.D. dependent var Sum squared resid obs 9 10 LF 1,249440 1,664444 P 0,750000 0,800000 PF 0,777203 0,840834 obs 9 EPMAPF 0,043656 RCREMPF 0,039185 UPF 0,021888 4º Comente y fundamente su respuesta: (4 puntos) 4.1. 4.2. Los modelos de elección discreta se estiman por máxima verosimilitud. Todo modelo de elección múltiple se estima por mínimos cuadrados. -0.385008 0.738111 0.156859