The Great Bubble

Anuncio

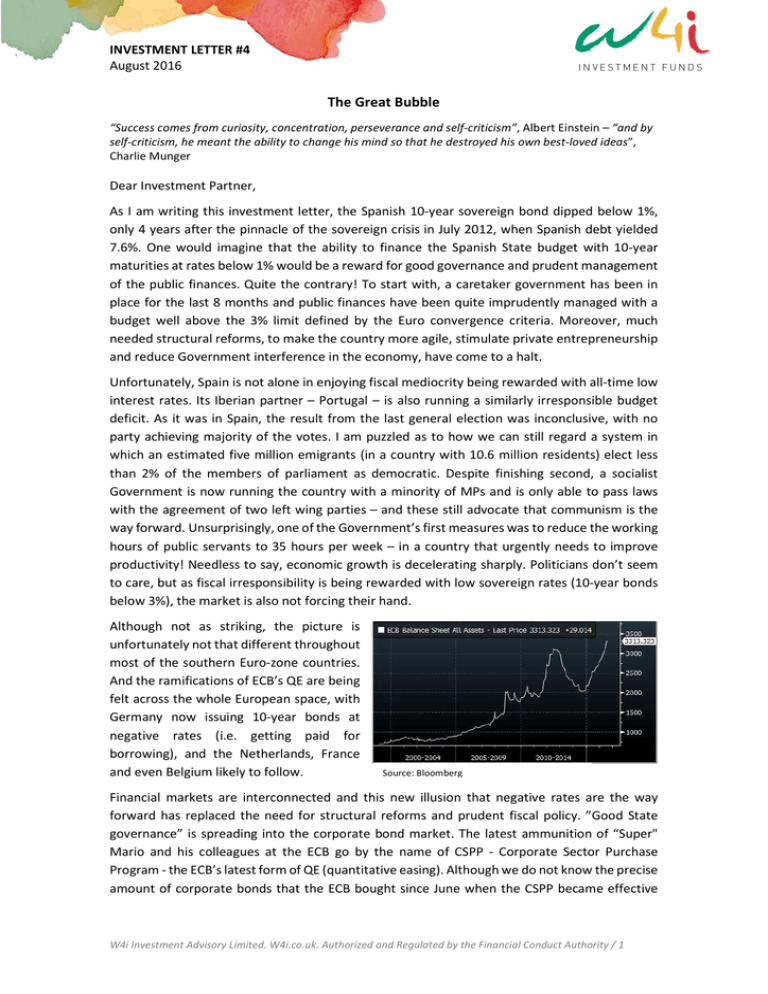

INVESTMENT LETTER #4 August 2016 The Great Bubble “Success comes from curiosity, concentration, perseverance and self-criticism”, Albert Einstein – “and by self-criticism, he meant the ability to change his mind so that he destroyed his own best-loved ideas”, Charlie Munger Dear Investment Partner, As I am writing this investment letter, the Spanish 10-year sovereign bond dipped below 1%, only 4 years after the pinnacle of the sovereign crisis in July 2012, when Spanish debt yielded 7.6%. One would imagine that the ability to finance the Spanish State budget with 10-year maturities at rates below 1% would be a reward for good governance and prudent management of the public finances. Quite the contrary! To start with, a caretaker government has been in place for the last 8 months and public finances have been quite imprudently managed with a budget well above the 3% limit defined by the Euro convergence criteria. Moreover, much needed structural reforms, to make the country more agile, stimulate private entrepreneurship and reduce Government interference in the economy, have come to a halt. Unfortunately, Spain is not alone in enjoying fiscal mediocrity being rewarded with all-time low interest rates. Its Iberian partner – Portugal – is also running a similarly irresponsible budget deficit. As it was in Spain, the result from the last general election was inconclusive, with no party achieving majority of the votes. I am puzzled as to how we can still regard a system in which an estimated five million emigrants (in a country with 10.6 million residents) elect less than 2% of the members of parliament as democratic. Despite finishing second, a socialist Government is now running the country with a minority of MPs and is only able to pass laws with the agreement of two left wing parties – and these still advocate that communism is the way forward. Unsurprisingly, one of the Government’s first measures was to reduce the working hours of public servants to 35 hours per week – in a country that urgently needs to improve productivity! Needless to say, economic growth is decelerating sharply. Politicians don’t seem to care, but as fiscal irresponsibility is being rewarded with low sovereign rates (10-year bonds below 3%), the market is also not forcing their hand. Although not as striking, the picture is unfortunately not that different throughout most of the southern Euro-zone countries. And the ramifications of ECB’s QE are being felt across the whole European space, with Germany now issuing 10-year bonds at negative rates (i.e. getting paid for borrowing), and the Netherlands, France and even Belgium likely to follow. Source: Bloomberg Financial markets are interconnected and this new illusion that negative rates are the way forward has replaced the need for structural reforms and prudent fiscal policy. ”Good State governance” is spreading into the corporate bond market. The latest ammunition of “Super" Mario and his colleagues at the ECB go by the name of CSPP - Corporate Sector Purchase Program - the ECB’s latest form of QE (quantitative easing). Although we do not know the precise amount of corporate bonds that the ECB bought since June when the CSPP became effective W4i Investment Advisory Limited. W4i.co.uk. Authorized and Regulated by the Financial Conduct Authority / 1 INVESTMENT LETTER #4 August 2016 (some estimate €8-10 billion… a week), the repercussion in the form of negative rates is evident. It is quite irrelevant how much the ECB has effectively bought of corporate bonds so far (say €70-120 billion), more important are the effects that this policy is having on the financial markets, which we try to address below. Negative yielding corporate bonds Gradually the "negative yield virus" is spreading from the European sovereigns to the corporate bond market. It is currently estimated that around €600 billion of corporate bonds with maturities longer than 12 months have negative yields and an estimated €5 billion are trading at negative rates of more than 40bps (-0.4%). Why should investors be happy to pay a corporate issuer for the "privilege" of owning their corporate bonds? Although we are not fixed income specialists, we certainly do not consider this a compelling investment proposition, even assuming that there is a zero probability of bond default. Having been in the professional investment business for the last 25 years and having lived through the last three investment "bubbles" and I venture to tag the current situation in the fixed income market as potentially the biggest financial bubble of all. The consensus seems to be that the current deflation situation will force ECB’s expansionary monetary policy for longer, thus anchoring bond yields at low(er) levels, which is supportive of bond prices. With hindsight, there is one rationale in common for every single one of the four bubbles (87’s Black Monday, late 90’s Dotcom, ’06 US housing and current Euro bond bubble) referred to above: “this time it is different” with the belief that prices keep going up indefinitely. Liquidity squeeze ECB's intervention in the corporate bond market is drying up liquidity, driving prices up and “artificially” compressing bond yields even further. Merrill Lynch estimates that the unwinding of negative yields (i.e. what happens if the global $12 trillion of negative yielding fixed income assets moves to zero yield) would produce $200 billion of losses! Fixed income investors that today are experiencing a false sense of security will eventually want to run away at the first signs of a less supportive Central Bank monetary policy (not only ECB, but Fed and BoJ as well). Investment logic will prevail and negative rates will reverse one day, with bond holders bearing heavy losses. Shift to higher risk debt instruments In a context where sovereign and corporate debt is yielding close to nil or even negative returns, it is only natural that investors reacted, by shifting towards riskier asset classes that provide some yield: Emerging Markets and High Yield investments. While merits exist in a portfolio’s W4i Investment Advisory Limited. W4i.co.uk. Authorized and Regulated by the Financial Conduct Authority / 2 INVESTMENT LETTER #4 August 2016 allocation to such assets, there is a step up in the number of risks such as sovereign risk, exchange-rate risk, volatility risk or credit risk, which the investor needs to understand… and for which he needs compensation. Shift to other asset classes Some other asset classes have also been boosted by this fervent search for yield. Real estate investments and listed property companies in particular have also been great beneficiaries of the collapse of bond yields. In simplistic terms, a property company is a leveraged investment of the underlying assets it owns. For example, German listed real estate companies have performed remarkably well recently (over the last year, Vonovia’s price +30%, LEG Immobilien’s +40% and Deutsche Wohnen +50%) and are trading at premiums to net asset values of between 20% and 30%. Investors in Germany struggle with Government bonds that are yielding negative rates and are therefore being “pushed” into residential properties that offer yields, in many cases, of only 1-2%. So far, residential rents in Germany have been rising steadily, a phenomenon partially explained by the influx of refugees, amongst others. Such stretched valuations could only be justified if one believed that rental growth of 3-5% could be sustainable for a long period of time. We caution against German real estate because rental growth might disappoint once new house supply (and there is plenty coming) enters the market. Remember the Spanish housing bubble when listed companies’ valuations were also backed by rosy assumptions of sustained property and rental price inflation? Toxicity of negative yields is “killing” both banks and insurance business models (particularly traditional life insurance) Without wanting to become too technical, although recently the spreads of non-financial companies have tightened (as you would expect in the aftermath of ECB's QE), bank spreads have widened. This divergent behaviour between non-financial and financial companies is quite unusual. Over the last 10 years it only happened after the fallout of Lehman Brothers and very briefly in July 2014 when oil prices reached their lowest point. I struggle to understand how the ECB intends to stimulate growth and bank lending when it is literally suffocating the business model of the banks. Commercial banks traditionally make their money by having a positive spread between what they receive from lenders and what they pay to depositors. In our opinion, negative rates do not stimulate healthy lending and in fact only help to keep uncompetitive companies afloat. I disagree with ECB officials’ reasoning that the current low interest rate environment favours corporate investment, thus contributing to economic growth. At W4i, we spend our days meeting the management teams of companies that we potentially can invest in, their competitors, suppliers and clients to have a complete picture of the value chains. So far we have not come across any serious company that is using the current low interest rate environment and negative interest rates to make long term investment decisions in new production capacity that generates new jobs and ultimately stimulates sustainable growth. Quite the contrary, prudent management teams are postponing new strategic investment decisions because of the uncertainty and unsustainability that this ECB monetary policy is bringing, exacerbated by geoW4i Investment Advisory Limited. W4i.co.uk. Authorized and Regulated by the Financial Conduct Authority / 3 INVESTMENT LETTER #4 August 2016 political developments such as Brexit. New bond issuance is being used by good companies to replace more expensive existing debt rather than to finance new capital expenditure. We believe that the mechanism of transmission of monetary policy to the real economy in the shape of higher corporate investment, households applying for new mortgages or anticipating future consumption is failing to produce desirable effects. Instead the ECB is stimulating an ever growing bubble in the bond market. European Equities outflow So far this year it is estimated that more than €60 billion has been reallocated from European equities to bonds or other investment classes. This outflow from equities drove European equity returns down (year to date, by more than 6%, as of August 26th), at the same time that bond spreads have tightened to the delight of fixed income investors. We believe that this shift away from equities, and European equities in particular, creates very attractive investment opportunities. In order to make our point we will use a concrete example of Unilever, the Anglo-Dutch consumer goods’ company. After the ECB’s CSPP announcement last April, it issued bonds maturing in 2020 with a zero coupon rate (0.08% yield to maturity in issuance). We asked ourselves a very simple question: Would we rather invest in Unilever’s bonds with a maturity of 4 years that currently yields 0% or would we buy shares of the same company that currently have a 3% dividend yield? The relative attractiveness of equities in a low bond yield environment Unilever has not cut its dividend for the past 50 years. The last time it kept the dividend constant year on year was 21 years ago (1995). And the dividends’ long term growth rate is around 7.5% a year, well above inflation. Of course we have no idea at what price Unilever’s shares will be trading in 4 years’ time when the zero coupon bond matures. Unilever is currently trading at 20 times the estimated earnings for 2017 and there is no certainty of where the multiple will be in 4 years’ time. If the past is to be taken into account (we firmly believe that the more we know about the past, the better prepared we are to understand the future), over the last decade, Unilever delivered a return on equity in excess of 20% for shareholders. We believe that consumers will continue to buy Unilever’s products by eating their ice cream on hot summer days or cleaning their clothes with their washing powder. We have some difficulty in articulating a scenario in which the earnings and dividends’ power of the company would be seriously compromised. So investors are left with a current dividend of around 3% and the prospects of recurring income in the form of future dividends, which grow at potentially, 5-7% per annum. Conversely, Unilever’s bond investor will be paid 0 (zero) during these 4 years and in the end of the period, the maximum he can aspire to is the full payment of the principal. In simplistic terms Unilever equity investors can afford a 15% drop in the price of Unilever shares in 4 years and still be better off than the investors who bought the most recent bond issue. However, if the Unilever share price drops 15% by 2020 and if the company is able to continue to deliver the same growth in dividends as for the past 20 years, the dividend yield on 2020 would be 4.8% (for reference, the W4i Investment Advisory Limited. W4i.co.uk. Authorized and Regulated by the Financial Conduct Authority / 4 INVESTMENT LETTER #4 August 2016 maximum dividend yield Unilever ever got to in the past 20 years was 5.1% in 2009). We personally do not believe in the sustainability of a deflationary world, therefore preferring to continue to be invested in Unilever shares instead of running the major risk of owning its bonds that deliver no income. Currently we are amongst the minority as investors around the world are shifting their holdings from “risky” equities (that pay growing nominal dividends) into “safer” bond investment (that pay no nominal income). If you need evidence that this is the case, just look at the investment portfolios of insurance companies or pension funds that have been reducing equity investments even further, supposedly to mitigate the schemes’ volatility. Combining this lower expected return on the assets (consequence of lower allocation to equities), with the ballooning of the liabilities (result of the fall in yields), the result is a rapid increase in the pension deficits, which necessarily raises doubts about their sustainability and the capacity to provide income to their retirees. But for us as equity managers, we thank Mr. Draghi for this immense arbitrage opportunity that he has presented us with. Our investment performance During Q2 both the European Opportunities fund and the Iberian Opportunities fund outperformed their benchmarks. As of the end of July, since inception on July 1st 2015, the W4i European Opportunities Fund outperformed the MSCI Europe Total Return index (i.e. including dividends) by 10.5% delivering +3.2% total return vs. -7.3% for the index. Over the same period, the W4i Iberian Opportunities Fund outperformed the IBEX 35 Total Return index by 19.2% delivering +2.9% total return vs. –16.3% for the index. While relative performance is encouraging, we want investors to be assured that we are particularly keen on maintaining absolute performance in positive territory, year-to-date and since inception, that being the highest motivation to continue to put forth our best efforts in the day-to-day management of investors’ and our own funds. Looking ahead, we feel particularly happy with our portfolios, with a balanced combination of structural compounders (post correction at more attractive valuations), cyclical opportunities (in depressed end markets, but with tentative signs of earnings’ reversions) and special situations, leaving us confident over the medium term. W4i Investment Advisory Limited. W4i.co.uk. Authorized and Regulated by the Financial Conduct Authority / 5 INVESTMENT LETTER #4 August 2016 Funds’ performance since launch I renew my invitation for you to join us and allow us to invest your money alongside ours. In the meantime, ¡Buen camino! and invest actively. Firmino Morgado W4i Investment Advisory Limited. W4i.co.uk. Authorized and Regulated by the Financial Conduct Authority / 6