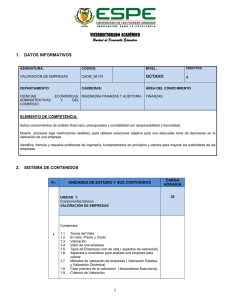

Operaciones de Inversión

Anuncio