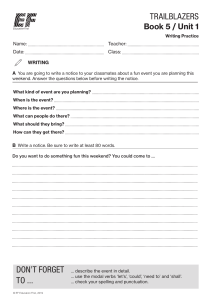

LONDON, DECEMBER 4, 2017 TO STEPHEN NDUKA UDENSI DEAR SIR, CERTIFICATE OF OWNERSHIP THE BANK GUARANTEE ================================================================================== BENFICIARY: STEPHEN NDUKA UDENSI KEEPER OF THE FAITHFUL ASSET NAMED: CASH-BACKED BANK GUARANTEE # CB200.238-027 GUARANTEE NUMBER: 641,399/19 AMOUNT: USD 1,250,000,000 (ONE BILLION TWO HUNDRED AND FIFTY MILLION DOLLARS) MATURITY DATE: NOVEMBER 27, 2019 ================================================================================== BLOOMBERG – CODE (TXIGS): TXI7329JYAB0 TYPE OF BONDS: COUPON BONDS - CUSIP NUMBER: (641,399/19) 459058FT5 -----------------------------------------------------------------------------------------------------------------------------------EUROCLEAR COMMON CODE: 100746228 - DIGITAL CERTIFICATED: 60001972378840642965531 ------------------------------------------------------------------------------------------------------------------------------------ISIN: US459058FT50 IBRD / HSBC HOLDINGS PLC ------------------------------------------------------------------------------------------------------------------------------------WKN CODE: A188CD ------------------------------------------------------------------------------------------------------------------------------------CODE SWIFT: MIDLGB22 ------------------------------------------------------------------------------------------------------------------------------------SECURITY SERVICE LTD ------------------------------------------------------------------------------------------------------------------------------------DIVISION INTERNATIONAL AREA DEPARTAMENT SWIFT AND CUSTODY ------------------------------------------------------------------------------------------------------------------------------------- ____________________________ MARC MOSES GROUP CHIEF RISK OFFICER ____________________________ MARK TUCKER NON-EXECUTIVE GROUP CHAIRMAN AND CHAIRMAN OF THE NOMINATION COMMITTEE ONLY 01 PAGE close app Euroclear Bank securities search > Interesting links Swarch using ISIN, name or Common Code: ISIN list Your opinion counts: US459058FT50 have your say Reset form > Search > When search results appear, click on column header to sort the information. 1 - 1 of 1 Name ISIN Common Rate code Nominal currency IBRD, 1.125% 27nov2019 US459058FT50 100746228 1.125 USD First closing Payment date 4 DEC 2017 27 NOV 2019 Record date Market 4 DEC 2017 G Last Instrument update NOTE 27 NOV 2019 1 - 1 of 1* APPLICANT INITIALS PAGE 01 OF 22 Euroclear Bank securities search HSBC HOLDINGS PLC - US459058FT50 Detailed general information Common code: Issuer name: HSBC HOLDINGS PLC Instrument: NOTE Shortname: HSBC HOLDINGS PLC Nominal currency: USD Issuer category: Credit institution Issuer country: UNITED KINGDOM Issuer city: LONDON General Information Security name: HSBC HOLDINGS PLC Additional specifications: SECREG Instrument: NOTE ISIN: First Closing: 4 DEC 2017 ECB Tiering: Instrument nature Code Creation Date: Market category Instrument Debt Note Market Global Global US CFI code: ISMAG: Total issued amount: 1,250,000,000 4 DEC 2017 FATCA Withholding Not subject to FATCA First Closing: Tax: withholding Tax Security next closing date: Tax retention: Not subject to withholding Nominal currency: USD Security last closing date: Common code: 100746228 Legal Form: Registered Maturity Date (*): 27 NOV 2019 Certification requirement: No certification required Certification type: No certification Last update: Service agents Role Certificarion date: Name City Initial PRINCIPAL AGENT HSBC HOLDINGS PLC LEAD MANAGER HSBC SECURITIES (USA) INC LONDON Physical from: NEW YORK Permanent global Global from holder: (*)For floating rate notes, the maturity date serves only as an indication, until it Is fixed after the final coupon starting date. APPLICANT INITIALS PAGE 02 OF 22 After Exchange Coupon/dividend information Rato type: Fixed rate Interest rate: 1.125% Settlement information Multiple tradable amount 1,000 Minimum tradable amount: 1,000 Quantity type: Face amount 30.5 Euroclear claerances (internal instructions) authorised: Yes Payment date: 27 NOV 2019 Yes, free and against Record date: 4 DEC 2017 Receipts in Euroclear (external instructions) Authorized: Coupon calculation: Method: Deliveries from Euroclear (external instructions) Yes, free and again 30/2036 Tax retention: Not subject to whihholging Authorized: Payment processing The payment processing Settlement autorized with Clearstream Bank Indicator indicator is expected to be displayed around 20 days before the next payment date (if any). Coupon/dividend currency (*): USD Coupon/dividend amount (**). Coupon/dividend Required open cities: Domestic Market hollday Lux: Clearstream Banking No Frankfurt ellgible: Lending/Borrowing: Available for lending Specialised depositary: (*) EMU-in entiliments are paid in EUR in Euroclear (**) Per nominal value of 1000 for debt issues, per unit for coupon Clearing system: Detailed coupon/dividend information Common depositary: Current coupon Last/Previous coupon 1.125% 1.125% Expected fixing date: Nominal currency (*): USD USD FRN reset frequecy code: Amount (**): 30.5 30.5 Record date rule: Fixed amount: No No Market claims/ Payment date: 27 NOV 2019 27 NOV 2019 Value date: 27 NOV 2019 27 NOV 2019 4 DEC 2017 4 DEC 2017 Coupum compensations Start date: 4 DEC 2017 4 DEC 2017 End date: 4 DEC 2017 4 DEC 2017 APPLICANT INITIALS Semi-annually Neither processed nor reported in Euroclear (*) EMU-in entitlements are paid in EUR in Euroclear (**) Per nominal value of 1000 for debt issues, per for equities Interesting link(s): Ex-date: DEPOSIROTY TRUST CY NEW TORK Payment Frequency: Interest rate: Record Date: Yes PAGE 03 OF 22 Euroclear Bank home/Resources/Databases and lists/Securities Database/ Services Markets Connectivity Resources Single Platform News Training Initiatives About Securities Database Show a printable version of this screen Issue Name Additional Specificaions Duly Endorsed to Instrument ISIN Code First Closing Date Record Date Issuer Category Value Legal From Certificate requirement Certificate Type Physical Form APPLICANT INITIALS HSBC HOLDINGS PLC 1,250,000,000 IBRD STEPHEN NDUKA UDENSI NOTE Nominal currency USD Common Code 111834024 US459058FT50 Maturity Date (*) 27 NOV 2019 4 DEC 2017 4 DEC 2017 Credit institution 1,250,000,000 REGISTRED DIGITAL CERTIFICATED Nº 60001972378840642965531 DIGITAL NOTES IN DEFINITIVE FORM PAGE 04 OF 22 Euroclear Bank home/Resources/Databases and lists/Securities Database/ Markets Services Connectivity Resources Single Platform News Training Initiatives General information Issue name Additional specifications Instrument ISIN First closing date Next coupon payment date Servicing agents HSBC HOLDINGS PLC Nominal Currency IBRD Common Code NOTE Maturity date (*) US459058FT50 4 DEC 2017 27 NOV 2019 Role LEAD MANAGER PRINCIPAL AGENT TRANSFER AGENT USD 100746228 27 NOV 2019 (*) For floating rate notes, the maturity date serves only as an indication, until it is fixed after the final coupon starting date. Detailed general information Security short name Issue name Issuer category Issuer city ISIN Instrument Market First closing date Next closing date Last closing date Legal Form Certification requirement Certification Type Exchange date Global form holder Remark IBRD, 1.125% 27 NOV 2019 IBRD, 1.125% 27 NOV 2019 Credit institution Category LONDON US459058FT50 NOTE Global 4 DEC 2017 4 DEC 2017 4 DEC 2017 Registred No certification requirement No certification Initial Permanent global Local clearing system APPLICANT INITIALS Credit institution PAGE 05 OF 22 About Euroclear Bank home/Resources/Databases and lists/Securities Database/ Markets Services Connectivity Resources Single Platform News Training Initiatives About Security code Information Sedol 1 access code ISIN Cusip BB Nbr BL-5 Clar stream Block Code CFI Code Beneficiary Country issue CA Processing Status Instrument WKN B3Z5XR8 US459058FT50 459058FT5 8603202 308222 FTV200238027 RBXXLW STEPHEN NDUKA UDENSI UNITED KINGDOM Blockade-P-Transfer NOTE A188CD Settlement code Common Code Cedel BL-2 EuroClear Reference Delivery Code Independent Securit Code Tx80255 100746228 202781 7498026 89021 83307 TQSTJNX01663-9370 Sender Reference Fund Base Currency EuroClear Instructions USD AXTI/RIKNLTSVW/RBXXLW3583X CB200.238-027 0 0980094 HSBC HOLDINGS PLC Issued Amount Bonds Quantity Total amount assigned Digital Certificate N 1,250,000,000 1,250,000,000 1,250,000,000 60001972378840642965531 Securities Identifications BB Number Registration Minimum tradable Amount Fed Number Fed Mnemonic Official Statement Instructions Registered Holder Blocking Instructions Blocking Period - Number of Days INVE / In Favor of Linked Transaction Underlying Security Notifications Issuer Bank Option Security Execution Requested CA Security Instructions HSBC HOLDINGS PLC THE FINANCIAL INSTRUMENT FREE AND CLEAR WITHOUT ANY LIMITATIONS CONDITIONS OR RESTRICTIONS BLOCKADE FOR A PERIOD OF ONE YEAR AND MONTH STEPHEN NDUKA UDENSI BACK TO BACK WAIVED ANY CLAIM AVAILABLE AS CREDITED PREVIOUSLY VERIFIED AND CONFIRMED WITH THE ISSUER THE CENTRAL BANK OF BRAZIL SINGLE TEXT EUROCLEAR BONDER INTERNATIONAL APPLICANT THE CENTRAL BANK OF BRAZIL AXTI/RIKNLTSVW/RBXXLW3583X APPLICANT INITIALS PAGE 06 OF 22 Euroclear Bank home/Resources/Databases and lists/Securities Database/ Services Markets Connectivity Resources Single Platform News Training Initiatives Coupon/dividend and redemption information Rate type Interest rate Coupon/dividend currency(*) Coupon/dividend amount(**) Coupon/dividend payment date Rate date Interest rate calculation method Tax retention Payment processing indicator Fixes rate 1.125% USD 30.5 27 NOV 2019 4 DEC 2017 24/206 Not subject to withholding tax The payment processing indicator is expected to be displayed around 20 days before next payment date (if any) Detailed coupon/dividend information Current coupon/dividend Last/previous coupon/dividend Interest rate 1.125% 1.125% Currency (*) USD USD Amount (*) 30.5 30.5 Fixed amount No No Payment date 27 NOV 2019 27 NOV 2019 Value date 27 NOV 2019 27 NOV 2019 Record date 27 NOV 2019 27 NOV 2019 Start date 4 DEC 2017 4 DEC 2017 27 NOV 2019 End date 27 NOV 2019 180 Number of days 180 Semi-annually Payment fraquency Expected fixing date FRN reset frequency code Record date rule 1 ICSD BD PRIOR TO PAYMENT DATE Market claims / Coupon Neither processed nor reporter in Euroclear compensations (**)Per nominal value of 1000 for debt issues, per unit for equities View more detailed redemption information - No information to report View other future event(s) - No information to report Settlement information Multiple tradable amount Minimum tradable amount Quantity type Euroclear clearences (internal instructions) Authorized Deliveries from Euroclear (external instructions) Autorized Settlement authorized with Clearstream Bank Lux Clearstream Banking Frankfurt eligible Lending Borrowing Specialised depositary Clearing System Remote Market BIC code Common depositary APPLICANT INITIALS 1.000 1.000 Face amount Yes No, transfer ownership only Yes, free of payment only Yes No Available for lending RBXXLW3583X PAGE 07 OF 22 About Euroclear Bank home/Resources/Databases and lists/Securities Database/ Services Markets Connectivity Resources Single Platform News Training Reservation Information BENEFICIARY: STEPHEN NDUKA UDENSI HOLDER: HSBC HOLDINGS PLC LONDON DEPOSIT TRANSACTION OBLIGATION OF SECURITY [MTN] CORPORATE IRREVOCABLE, ASSIGNABLE AND CONFIRMED INVESTOR SUITABILITY, HSBC HOLDINGS PLC ISSUER: USD1,250,000,000 AMOUNT: US459058FT50 ISIN: 100746228 COMMON CODE: 76300013329 ACCOUNT: RBXXLW CFI CODE: NOTE INTRUMENT: 4 DEC 2017 ISSUED DATE: 27 NOV 2019 MATURITY: USD CURRENCY: WE OF EUROCLEAR, WITH FULL AUTHORITY AND LEGAL RESPONSIBILITY HEREBY CONFIRM THAT WE WILL BE UTILIZING THE ASSETS IN DEPOSIT BY HSBC HOLDINGS PLC LONDON HELD IN OUR EUROCLEAR REFERENCE 89021. THE CONTRACTS THAT THE ISSUER HSBC HOLDINGS PLC ARE WILLING AND ABLE TO ISSUE THE BANK CREDIT TRANSFER AGAINST THE ASSET FOR THE ABOVE STANDBY LETTER OF CREDIT OF CASH/ASSET/MEDIUM TERM NOTE, WE HEREBY CONFIRM THAT THIS INSTRUMENT IS FREE AND CLEAR OF ANY ENCUMBRANCES AND CLEAN WITHOUT LIMITATION AND RESERVED IN FAVOR OF STEPHEN NDUKA UDENSI. APPLICANT INITIALS PAGE 08 OF 22 Initiatives About Euroclear Bank home/Resources/Databases and lists/Securities Database/ Services Markets Connectivity Resources Single Platform News Training Initiatives About HSBC HOLDINGS PLC WITH PARTNERSHIP IBRD DATE: DECEMBER 4, 2017 REFERENCE: HSBC/IBRD/USD125B/8851 APPLICANT: HSBC HOLDINGS PLC LONDON FOR BENEFIT OF: STEPHEN NDUKA UDENSI ISSUER: HSBC HOLDINGS PLC LONDON ISIN: US459058FT50 COMMON CODE: 100746228 MATURITY: 27 NOV 2019 CURRENCY: USD ACCOUNT NUMBER: 76300013329 DEAR SIR, WE HEREBY CONFIRM OUR READINESS TO ISSUE BANK GUARANTEE FOR USD 1,250,000,000.00 (ONE BILLION TWO HUNDRED AND FIFTY MILLION DOLLARS) THAT WAS PARTIALLY REDEEMED FROM THE ISIN US459058FT50 VALUED USD 1,250,000,000.00 (ONE BILLION TWO HUNDRED AND FIFTY MILLION DOLLARS) THE FUND IS CLEAN AND CLEAR OF NON-CRIMINAL ORIGIN AND WITHOUT ENCUMBRANCE AND LIEN. THE BENEFICIARY OF THIS STANDBY LETTER OF CREDIT IS CONFIRMED. FOR AND ON BEHALF HSBC HOLDINGS PLC WITH PARTNERSHIP IBRD MARC MOSES GROUP CHIEF RISK OFFICER APPLICANT INITIALS PAGE 09 OF 22 Euroclear Bank home/Resources/Databases and lists/Securities Database/ Markets Services Connectivity Resources Single Platform News Training Initiatives Capture Display Received Date Cusip Number ISIN 4 DEC 2017 (641,399/19) 459058FT5 US459058FT50 Common Code Ticket Number Transaction Number Access Code Desk 100746228 HSBC/IBRD/USD125B/8851 2258001562486 98THVW54219 NORMAL Issue name Additional specifications Instrument Maturity date (*) First closing date Next coupon payment date HSBC HOLDINGS PLC IBRD NOTE 27 NOV 2019 4 DEC 2017 27 NOV 2019 (*) For floating rate notes, the maturity date serves only as an indication, until it is fixed after the final coupon starting date. APPLICANT INITIALS PAGE 10 OF 22 About Euroclear Bank home/Resources/Databases and lists/Securities Database/ Markets Services Connectivity Resources Single Platform News Training Clear More Detail General Information Issuer Name Issuer Category Issuer Country Issuer City HSBC HOLDINGS PLC OTHER UNITED KINGDOM LONDON Total Issued Amount BB Number Registration Digital Certificate Number USD 1,250,000,000 CB200.238-027 60001972378840642965531 Physical Form Global Form Holder PERMANENT GLOBAL LOCAL CLEARING SYSTEM ISIN Common Code Settlement code US459058FT50 100746228 Tx80255 APPLICANT INITIALS PAGE 11 OF 22 Initiatives About Euroclear Bank home/Resources/Databases and lists/Securities Database/ Services Markets Connectivity Resources Single Platform News Training Initiatives About Text of Bank Guarantee WE, HSBC HOLDINGS PLC 8 CANADA SQUARE, E14 5HQ, LONDON, UNITED KINGDOM, HEREBY IRREVOCABLY UNDERTAKE TO PAY YOU ON FIRST DEMAND, IRRESPECTIVE OF THE VALIDITY AND THE LEGAL EFFECTS OF THE ABOVE MENTIONED CREDIT RELATIONSHIP AND WAIVING ALL RIGHTS OF OBJECTIONS AND DEFENSE ARISING FROM SAID CREDIT RELATIONSHIP, ANY AMOUNT UP TO USD 1,250,000,000,00 (ONE BILLION TWO HUNDRED AND FIFTY MILLION DOLLARS) PRINCIPAL, INTEREST AND ALL OTHER CHARGES INCLUDED, UPON RECEIPT OF YOUR DULY SIGNED REQUEST FOR PAYMENT OR BY TRANSMISSION SWIFT STATING THAT AN AMOUNT EQUIVALENT TO THE AMOUNT CLAIMED UNDER THIS INSTRUMENT HAS BECOME DUE TO YOU AND HAS REMAINED UNPAID BY YOUR CLIENT STEPHEN NDUKA UDENSI. YOUR CLAIM WILL BE CONSIDERED AS HAVING BEEN MADE ONCE WE ARE IN POSSESSION OF YOUR WRITTEN REQUEST FOR PAYMENT OR THE SWIFT TO THIS EFFECT. THE TOTAL AMOUNT WILL NOT BE REDUCED BY ANY PAYMENT EFFECTED BY US THEREUNDER. APPLICANT INITIALS PAGE 12 OF 22 Euroclear Bank home/Resources/Databases and lists/Securities Database/ Markets Services Connectivity Resources Price Information Last Price Change from Prev. Day Turnover real Turnover nominal Price Fixings Bid/Ask Bid/Ask Date High Low 133.121% -/0.00 0 1 127.931 : 175.321 125,000 : 125,000 130.671 107.421 Duration in years Modified Duration in years 1.733 1815 Accrued interest in % Accrued interset days 0.57410 90 Bid/Ask Volume nominal Interest Payment Count Coupon 127.931 : 175.321 125,000 : 125,000 Annually 9.66 52-week-high 52-week-low Yield in % (last price) Yield in % (ask) 130.671 107.421 0.98513 0.74896 APPLICANT INITIALS Single Platform News Training PAGE 13 OF 22 Initiatives About Euroclear Bank home/Resources/Databases and lists/Securities Database/ Services Markets Connectivity Resources Single Platform News Training Initiatives CENTRAL BANK OF BRAZIL Bank Guarantee Credit Holder: Cash-Backed Guarantee #: Amount: Issue Date: Expiry Date: STEPHEN NDUKA UDENSI CB200.238-027 USD 1,250,000,000.00 (ONE BILLION TWO HUNDRED AND FIFTY MILLION DOLLARS) DECEMBER 4, 2017 DECEMBER 4, 2018 We, the Central Bank of Brazil, hereby issue with full bank responsibility and liability for and on behalf of STEPHEN NDUKA UDENSI, the current Cash-Backed BG with cash funds in the amount of USD 1,250,000,000.00 (ONE BILLION TWO HUNDRED AND FIFTY MILLION DOLLARS) as to the date of this letter to be used on CASH-BACKED transactions between HSBC HOLDINGS PLC and our client mentioned above. The amount of the present official bank guarantee is blocked in the floating account of the Central Bank of Brazil. We further reinstate that the present instrument is in our custody and will not be altered or pledged for a period of one (1) year and one (1) month from the date of this instruction. However, it may be renewed upon request and renegotiation. We Central Bank of Brazil as the issuing bank, declare that the guarantee is free and clear of any deductions, limitations, conditions or restrictions. For and on behalf of Central Bank of Brazil Authorized signatures MARCIO BARREIRA DE AYROSA MOREIRA Head Department of Banking Operations and Payments System Registration: 6.778.784-3 APPLICANT INITIALS ALEXANDRE KIOTO ARAUJO YAMASUCHI Analyst Central Bank Of Brazil ID code: 04404271 PAGE 14 OF 22 About Euroclear Bank home/Resources/Databases and lists/Securities Database/ Services Markets Connectivity Resources Single Platform News Training Initiatives TO: HSBC HOLDINGS PLC FROM: CENTRAL BANK OF BRAZIL About 4 DEC 2017 DECLARATION IT IS HEREBY ACKNOWLEDGED AND CONFIRMED THAT THE CENTRAL BANK OF BRAZIL AND MINISTRY OF POPULAR FOR THE FINANCES AT BRAZIL, HAVE AUTHORIZED THE TRANSFER OF OWNERSHIP OF THE FOLLOWING GLOBAL BONDS TO STEPHEN NDUKA UDENSI OF THE FOLLOWING GLOBAL BONDS HERE BELLOW STATED. ISIN CODE CUSIP NUMBER COMMON CODE FIRST CLOSING DATE MATURITY DATE AMOUNT ISSUER CURRENCY SERIAL REGISTRATION CEDEL INSTRUMENT BENEFICIARY :US459058FT50 :(641,399/19) 459058FT5 :100746228 :4 DEC – 2017 :27 NOV – 2019 :USD$ 1,250,000,000 :CENTRAL BANK OF BRAZIL :USD :CB200.238-027 :202781 :GLOBAL BONDS :STEPHEN NDUKA UDENSI THE BONDS HAVE BEEN ISSUED FROM THE CENTRAL BANK OF BRAZIL AND THE FINANCE ALL OTHER GOVERNMENT AUTHORITIES. WE BANK CENTRAL OF BRAZIL, HEREBY DECLARE THAT ALL THE BONDS HAVE BEEN LEGALY ASSIGNED AND TRANSFERRED TO STEPHEN NDUKA UDENSI. TO SUPPORT A SOCIAL PROJECT FOR BRAZIL AND HAS ISSUED FREE AND CLEAR OF ANY DEDUCION OR FEE BY THE GOVERNMENT OF BRAZIL OR BY ANY OTHER SUB-DIVISION OF GLOBAL AUTHORITY THEREOF OR THEREIN AND WITHOUT ANY ENCUMBRANCE WHATSOEVER AND THE THESE BONDS ARE FREELY NEGOTIABLE FOR THE PURPOSE WHICH BENEFICIARY HAS DEFINED. BRASÍLIA, DF-BRAZIL, DECEMBER 4, 2017. MARCIO BARREIRA DE AYROSA MOREIRA Head Department of Banking Operations and Payments System Registration: 6.778.784-3 APPLICANT INITIALS ALEXANDRE KIOTO ARAUJO YAMASUCHI Analyst Central Bank Of Brazil ID code: 04404271 PAGE 15 OF 22 Euroclear Bank home/Resources/Databases and lists/Securities Database/ Markets Services Connectivity Resources Single Platform News Training TO: HSBC HOLDINGS PLC FROM: CENTRAL BANK OF BRAZIL Initiatives About 4 DEC 2017 DEPARTMENT OF EXTERNAL DEBT OF INTERNATIONAL RELATIONS OFFICIAL SAFE-KEEPING RECEIPT WE, HEREBY CENTRAL BANK OF BRASIL, WITH FULL BANKING RESPONSABILITY DECLARE WE HAVE IN CUSTODY THE FOLLOWING GLOBAL BONDS: INSTRUMENT NAME: CASH-BACKED BANK GUARANTEE # CB200.238-027 ISIN CODE: US459058FT50 ISSURER: CENTRAL BANK OF BRASIL FIRST CLOSING DATE: 27 NOV 2019 AMOUNT: USD$ 1,250,000,000,00 (ONE BILLION TWO HUNDRED AND FIFTY MILLION DOLLARS) CUMMON CODE: 100746228 LEGAL REPRESENTATIVE: STEPHEN NDUKA UDENSI. THE CUSTODY IS DURING ONE YEAR AND ONE MONTH. AUTOMATICALLY RENEWABLE. WE CENTRAL BANK OF BRAZIL AS THE ISSUING BANK, DECLARE THAT: THE BONDS ARE FREE AND CLEAR OF ANY DEDUCTIONS, LIMITATIONS CONDITIONS OR RESTRICTIONS. FOR AND ON BEHALF CENTRAL BANK OF BRAZIL AUTHORIZED SIGNARURES BRASÍLIA, DF-BRAZIL, DECEMBER 4, 2017. MARCIO BARREIRA DE AYROSA MOREIRA Head Department of Banking Operations and Payments System Registration: 6.778.784-3 APPLICANT INITIALS ALEXANDRE KIOTO ARAUJO YAMASUCHI Analyst Central Bank Of Brazil ID code: 04404271 PAGE 16 OF 22 Euroclear Bank home/Resources/Databases and lists/Securities Database/ Services Markets Connectivity Resources Single Platform News Training TO: HSBC HOLDINGS PLC FROM: CENTRAL BANK OF BRAZIL Initiatives About 4 DEC 2017 OFFICIAL CERTIFICATION WE, CENTRAL BANK OF BRAZIL AT SQUARE 3, BLOCK B, ED SEDE ZIP CODE 70.074.900 BRASÍLIA (DF) BRAZIL; FOR AND ON BEHALF OUR CLIENT: STEPHEN NDUKA UDENSI; WE HEREBY ISSUE OUR IRREVOCABLE CASH-BACKED BANK GUARANTEE # CB200.238-027, IN YOUR FAVOR FOR: HSBC HOLDINGS PLC WITH ADDRESS: 8 CANADA SQUARE, E14 5HQ, LONDON, UNITED KINGDOM; FOR THE BENEFIT OF ACCOUNT NAME: STEPHEN NDUKA UDENSI; UP TO AN AGGREGATE AMOUNT OF: USD$ 1,250,000,000,00 (ONE BILLION TWO HUNDRED AND FIFTY MILLION DOLLARS) IN THE LAWFULL CURRENCY OF THE EUROPEAN UNION; AS A SECURITY FOR YOUR GRANTING LOAN TO: STEPHEN NDUKA UDENSI. THIS STAND BY LETTER OF CREDIT IS AVALIBLE BY YOUR SIGHT DRAFTS OR CLAIM DRAWN ON US ACCOMPANIED BY YOUR SIGNED STATEMENT CERTIFYING THAT: STEPHEN NDUKA UDENSI HAS DEFAULTED IN THEIR OBLIGATIONS. WE AGREE THAT ALL DRAFTS DRAWN HEREUNDER IS IN COMPLIANCE WITH THE TERMS OF THIS CREDIT AND SHALL BE HONORED UPON PRESENTATION. EACH DRAWING HONORED AND EACH PAYMENT OR PREPAYMENT BY THE UNDERSIGNED HEREUNDER SHALL PERTAIN-TO REDUCE THE AMOUNT AVAILABLE UNDER THIS LETTER OF CREDIT. THIS STANDBY LETTER OF CREDIT WILL BE VALID UNTIL: 4 DEC 2018 WE HEREBY UNDERTAKE TO PAY YOU THAT ANY CLAIM IN RESPECT OF THE PRINCIPAL (INTEREST, COMMISSIONS, AND CHARGES) FOR THE MAXIMUM AMOUNT OF: USD$ 1,250,000,000,00 (ONE BILLION TWO HUNDRED AND FIFTY MILLION DOLLARS) IN THE LAWFUL CURRENCY OF THE EUROPE UNION; WHICH IS STILL OUTSTANDING, SHALL BE PAID BY US, PROVIDED THAT A CLAIM IS MADE BY YOU WITHIN THE EXPIRY DATE. THIS STANDBY LETTER OF CREDIT IS SUBJECTED TO THE PRATICE OF DOCUMENTARY CREDITS, 2007 REVISION, ICC PUBLICATION NO 600. FOR AND BEHALF CENTRAL BANK OF BRAZIL, ADDRESS, SQUARE 3, BLOCK B, ED. SEDE, ZIP CODE 70.074.900 BRASÍLIA (DF) BRAZIL. SINCERELY, BRASÍLIA, DF-BRAZIL, DECEMBER 4, 2017. MARCIO BARREIRA DE AYROSA MOREIRA Head Department of Banking Operations and Payments System Registration: 6.778.784-3 APPLICANT INITIALS ALEXANDRE KIOTO ARAUJO YAMASUCHI Analyst Central Bank Of Brazil ID code: 04404271 PAGE 17 OF 22 Euroclear Bank home/Resources/Databases and lists/Securities Database/ Services Markets Connectivity Resources Single Platform News Training Initiatives About LOND MBE R 41,, 22001177 NDO ON, N, DDECE ECEM BER CERTIFICATE OF OWNERSHIP THE BANK GUARANTEE WE, THE UNDERSIGNED HSBC HOLDINGS PLC, IN ACCORDANCE WITH CENTRAL BANK OF BRAZIL AND IBRD, AND IN CONFORMITY WITH THE ARTICLES OF NATIONAL CONSTITUTION, GRANTS THE FULL OWNERSHIP TO: STEPHEN NDUKA UDENSI UPON YOUR FIRST DEMAND, THE OWNERSHIP OF INSTRUMENT HERE BELOW STATED: ISIN CODE CUSIP NUMBER COMMON CODE FIRST CLOSING DATE MATURITY DATE AMOUNT ISSUER CURRENCY SERIAL REGISTRATION :US459058FT50 IBRD :(641,399/19) 459058FT5 :100746228 :4 DEC – 2017 :27 NOV – 2019 :USD$ 1,250,000,000,00 :CENTRAL BANK OF BRAZIL :USD :CB200.238-027 CEDEL INSTRUMENT BENEFICIARY :202781 :GLOBAL BONDS :STEPHEN NDUKA UDENSI MARC MOSES APPLICANT INITIALS MARK TUCKER NON-EXECUTIVE GROUP CHAIRMAN AND CHAIRMAN OF THE NOMINATION COMMITTEE PAGE 18 OF 22 Euroclear Bank home/Resources/Databases and lists/Securities Database/ Markets Services Connectivity Resources Single Platform News Training Initiatives About Securities Database Show a printable version of this screen Euroclear Bank Securities Database (International) Euroclear System On-line Securities Code Information Beneficiary: Information: Type: Issue Bank: Issue City: ISIN Code: Value: Currency: Creation Date: STEPHEN NDUKA UDENSI Custody Bank Transfer HSBC HOLDINGS PLC LONDON US459058FT50 1,250,000,000 USD 4 DEC 2017 NOTE, THE CONFIRMATION MADE UNDER THE INTERNATIONAL PARAMETERS OF FINANCIAL ORGANIZATIONS PREVIOUSLY MENTIONED CODE VERIFIED TO BANK THIS TRANSACTION SUCCESSFUL. APPLICANT INITIALS PAGE 19 OF 22 Euroclear Bank home/Resources/Databases and lists/Securities Database/ Services Markets Connectivity Resources Single Platform News Training Initiatives About Securities Database Show a printable version of this screen Information Centre Securities SUBJECT: EUROCLER 89021 Welcome to our system of EUROCLEAR BANK, their transaction was processed by our system in a successful way. Registered under the number Tx80255 in an effective and reliable way. Bank Name Bank Address Swift Code Account Name Account Number Common Code Beneficiary ISIN Value Currency HSBC HOLDINGS PLC 8 CANADA SQUARE, E14 5HQ, LONDON, UNITED KINGDOM MIDLGB22 STEPHEN NDUKA UDENSI 76300013329 100746228 STEPHEN NDUKA UDENSI US459058FT50 1,250,000,000 USD Yours Sincerely The Euroclear Webteam APPLICANT INITIALS PAGE 20 OF 22 Euroclear Bank home/Resources/Databases and lists/Securities Database/ Markets Services Connectivity Resources Single Platform News Training Initiatives About Securities Database Show a printable version of this screen Euroclear Bank Securities Database (International) Euroclear System On-line Securities Code Information Bank Name: In Favour of: Swift Code: ISIN: Information: Digital Certificate Number: Issue City: EuroClear Code: Blockade Code: Value: Currency: BL - 5 Number: BL - 2 Number: Blockade Date: Sedol 1 Access Code: Settlement Code: Settlement Day: Trade Day: Status: HSBC HOLDINGS PLC STEPHEN NDUKA UDENSI MIDLGB22 US459058FT50 Free e Clear Delivery Transfer 60001972378840642965531 LONDON 89021 FTV200238027 1,250,000,000 USD 8603202 7498026 4 DEC 2017 B3Z5XR8 Tx80255 27 NOV 2019 4 DEC 2017 Delivery Free Payment NOTE THE CONFIRMATION MADE UNDER THE INTERNATIONAL PARAMETERS OF FINANCIAL ORGANIZATIONS PREVIOUSLY MENTIONED CODE VERIFIED TO BANK THIS TRANSACTION SUCCESSFUL. APPLICANT INITIALS PAGE 21 OF 22 Euroclear Bank home/Resources/Databases and lists/Securities Database/ Services Markets Connectivity Resources Single Platform News Training Initiatives About Automatic coupon compensation Under certain circumstances, we may decide to offer an automatic coupon compensation service for a specific payment by adjusting the cashback of your securities transaction instruction. We offer the automatic coupon compensation service upon our discretion. To find out if a specific security is eligible, go to the ‘More detailed coupon/dividend information’ section in our Securities database. To benefit from the service, you must follow all of the following criteria: The security must be eligible for the automatic coupon compensation service. The actual settlement date of the trade must be after the record date of the coupon. The contractual settlement date of the trade must be before the interest period ending date of the coupon. The transaction must be an against payment internal transaction (i.e between two Euroclear Bank Participants). We adjust compensations for the entire actual period and value date of the applicable coupon payment. If a partial redemption , without reduction of the nominal amount, pays alongside the coupon (same payment date), these proceeds will also be included in the compensation. Automatic coupon compensation is applied even if your trade settles ‘late’ or after the coupon payment date. In practical terms, this means: Receipt - Crediting your account and debiting your counterparty Delivery - Debiting your account and crediting your counterparty We may adjust the compensation manually after we have processed the actual coupon if: Your trade was not automatically compensated due to missing coupon information on the settlement date; or the payment details (price, record date, interest period) have changed since settlement date. We will usually notify you of a manual adjustment by updating the initial corporate action notification (DACE notice type 360 INTR ‘Standard Income payment’) or equivalents SWIFT MT 799/760. We automatically detect eligible trades for compensation based on four above-mentioned criteria. If you disagree with our automatic compensation you will need to agree on further adjustments directly with your counterparty. (*)For floating rate notes, the maturity date saves only as an indication, until it is fixed after the final coupon starting date. APPLICANT INITIALS PAGE 22 OF 22