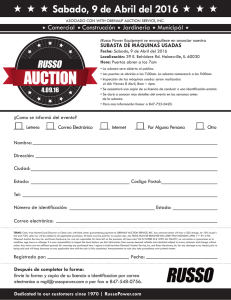

CURRICULUM: Virtual Real Estate Wholesaling In 30 Days COURSE: Where and How To Locate Wholesale Properties and Find Investors/End Buyers? By REI INVESTMENT SOCIETY 1|Page Trainer & Mentor: Ebonie Caldwell of REI Investment Society THE BEST WAY TO FIND WHOLESALE PROPERTIES: Most at a sheriff's sale, estate or private auction. foreclosure auction lists are published by the county several weeks before the sales. Estate and private auctions are also generally advertised several weeks in advance. By reviewing these lists, you have the opportunity to scope out a property prior to the sale date. Be advised, however, that while you can see the property from the street, you may not inspect it or trespass to get a better look. Wholesaling generally refers to the process of buying a property for below market price, and then selling it to another investor, usually without fixing up the property - it's a procedure also sometimes described as "flipping properties". Buying and selling wholesale real estate property can be difficult and challenging as sellers are instinctively inclined to sell their property for more if they realize you are a wholesale investor. Whereas the deal itself can sometimes be difficult, finding properties to resell at a profit is relatively easy - if you know where to look. Many people who sell properties at wholesale prices are what might be called "motivated sellers" - those who are desperately trying to sell for a compelling reason. These reasons can include foreclosure, relocation or personal or health issues. There are several methods of finding suitable properties that can potentially be wholesaled. Some of the best wholesale deals can be obtained from a county or city that has taken over a property, often for failure to pay taxes - a procedure known in the industry as "landbanking". Concentrate on looking for foreclosures. Apart from lists provided by banks and other lenders, you can also locate foreclosures by reading the notices issued by the city or county and posted in the legal sections of business journals and local newspapers. Some properties are available to purchase when the city or county has "red-tagged" them, meaning that the house is unfit for human habitation because of a safety or health issue. Look for newspaper advertisements that state that the advertiser buys properties - "We buy Houses" is often a giveaway. These are usually ads that have been placed by fellow investors and there is nothing to stop you calling them and asking for their list of properties. Networking is important when it comes to locating and buying wholesale properties. If local realtors are aware that you are interested in potential wholesale deals, you will find it a lot easier to find properties. A good network of useful contacts is invaluable and one of the best things you can have in real estate. Make sure you always follow up with your contacts - rather than waiting for them to call you back. And sometimes the simple approach is effective - many successful investors advise that you can do worse than simply drive around respectable neighborhoods and look for slightly run down houses that are for sale. Many people who are trying to locate wholesale properties make the understandable mistake of concentrating on the cheapest properties in their area. In fact, a profit can be made from wholesaling more expensive homes as there are usually homeowners who are desperate to sell their more expensive 2|Page Trainer & Mentor: Ebonie Caldwell of REI Investment Society home, too. Wholesaling has been around for a while, but in recent years it has become more widespread and acceptable - and contrary to what some people believe, it is perfectly legal. And with the right knowledge, foresight and connections it can be a profitable venture. The most important quality of any successful wholesaler is their ability to generate leads. You can have a good grasp of the area and the process, but without incoming leads you won’t get very far. Fortunately, there are many different ways that you can get your phone to ring. Investors can utilize every resource from Craigslist to direct mail campaigns. Depending on your budget, you can find something in the middle that works for you. Branch out and market as many different ways as you can. You don’t need to spend a lot of money, but you do need to be consistent with everything you do. Wholesaling is very much a numbers game: the more leads you have coming in, the higher chance you can turn a deal. Every new lead is an opportunity for a potential deal. It is important that you know which leads can turn into deals and which leads are going to eat up time. In most cases, the strength of any deal can be directly derived from the property and the location. This means that you need to have a good grasp on the market and which properties generate the greatest value. You should constantly be looking at what sold and what is currently on the market. Use every opportunity that comes your way to evaluate a property. This means going to open houses or even driving neighborhoods. When you wholesale, there has to be enough upside for you to get the property at your price point while still having an investor see value. If you don’t know the area, you will end up wasting time putting together deals that no investor really wants. It is also smart to have an idea of the potential repair costs. If you over- or underestimate the cost of repairs even a little bit, you will have a bad deal. Most investors that buy wholesale properties will look to put some work in and quickly put the property back on the market. You can’t fool a seasoned investor by decreasing the cost of repairs or the condition of the property. If you know how much work is really needed, you should incorporate it into your offer. If you can’t get the homeowner or the bank to see your price, you need to move on to the next deal. You need to know the real numbers on the property before you make any offer and evaluate any deal. Getting the property at your price is a critical factor in every wholesale deal, but it is only one part of the equation. Once you get the property at your price, you need to find an end buyer. This means having a buyers list ready and forming as many relationships as possible. You can find buyers in every investment club meeting or every networking group you attend. They may be on real estate sites and local bandit signs too. The more buyers you have on your list, the greater the chance that you can quickly turn your property over. Wholesaling typically doesn’t offer the same returns as a typical rehab. Therefore, you need to turn your wholesale deals over as quickly as possible. This means having a solid list of ready and willing buyers. 3|Page Trainer & Mentor: Ebonie Caldwell of REI Investment Society Having a deep buyers list is great, but it is better to have a smaller dedicated list of people you have worked with previously. Every time you complete a transaction, you should take the time and find out what your buyer is looking for. If you know what your buyers want, you can look for specific properties and deals and streamline your wholesale business. If you deliver good properties and good deals, you can be sure that your investors will want to work with you again. If you embellish the numbers and exaggerate the returns, you will find it hard for buyers to take you seriously. Wholesaling is a great way to earn money and learn the real estate business, but it requires time and effort. This can be viewed as good practice in helping you generate leads, negotiate deals and work with fellow investors. There are some investors who focus exclusively on the wholesale side of the business, with great success might I add. If you focus on these areas and put the time in, you can quickly become a wholesale master. AUCTION.COM AND/OR AUCTIONS Real estate auctions are growing in popularity, especially for people looking for a bargain. Experienced investors often buy property this way, but technology has simplified the process and has made it less intimidating to new investors—as long as you do your homework. Here is how to get a good deal with online auctions: • • • • • • Do your homework on the market Look at related comps in the area Speak to property management companies to learn facts about rent in the area, which includes o looking at rental rates in the area o finding out how long it takes to rent in the area Speak to a construction general contractor to learn about what the property needs and the cost it will take to effect those changes Walk the property with your contractor and property manager Have a max number you are willing to pay before the action—AND NEVER GO OVER IT Of course, there are also missteps to be avoided when accessing online auctions. Many mistakes come from bidders trying to take shortcuts and/or not controlling their emotions. The most common errors made on Auction.com include: • • • • Getting too excited and overbidding on a property Not properly evaluating repair costs Not properly estimating rental rates Not inspecting the property in question What Types of Properties are Sold at Auction? 4|Page Trainer & Mentor: Ebonie Caldwell of REI Investment Society While virtually any type of property or asset can be sold at auction, most home auctions—and the type you’ve probably heard the most about, thanks to the housing crisis—are foreclosures. Depending on the state, a trustee assigned by the lender or an officer of the court conducts a foreclosure sale to recover the balance of a loan from a borrower who’s defaulted on their mortgage payments. According to RealtyTrac, as of March 2015, there were close to 850,000 homes in some stage of foreclosure in the United States. Nearly 42% of them were up for auction. But “distressed” property isn’t the only type of asset you can buy at auction. More and more nondistressed properties are being sold at auction today, including luxury homes and commercial assets such as office buildings, hotels and apartment buildings. Some developers are even conducting auctions for newly built homes. There are two types of real estate auctions: live (in-person) and online. The latter is becoming more and more prevalent as people grow more comfortable with making major purchases online. No matter which route you choose, remember that buying real estate can be complicated. Companies like Auction.com are making the process more efficient and transparent, but in most cases there are still long contracts, escrow, disclosure documents and other paperwork required by law. Buying Foreclosure Properties at Live Auctions The phrase “real estate auction” often brings to mind the stereotypical image of a small group of investors, huddled around an auctioneer on the county courthouse steps. And in fact, almost all foreclosure auctions are conducted live in front of (or in a room inside of) county courthouses. Many states only require a publicly accessible space, like a hotel ballrooms or room in a convention center. In some of these larger venues, hundreds of foreclosure properties might be auctioned on a single day. Some of the larger counties in Florida now conduct foreclosure sales online; Wayne County Mich., the county in which Detroit is located, conducts online tax lien sales (where the government seizes a home due to unpaid taxes). The laws vary widely from state to state, so be sure to check out the specific rules governing your state. Live foreclosure auctions are free to attend and open to the public to ensure that a home being foreclosed upon receives the highest possible recovery for the bank or lender and the smallest deficiency for the borrower. Anyone can attend; however, if you want to bid, you’ll need to register. In almost all cases, you’ll have to show that you’re in possession of sufficient funds to pay for the property in full. (There are a few states that allow an auction day deposit and payment in full the following day). Here are the basic steps for participating in a live foreclosure auction: 5|Page Trainer & Mentor: Ebonie Caldwell of REI Investment Society Find and track foreclosure auctions. Foreclosure sales data is usually available from the specific county either online or at the county courthouse, or from the third-party foreclosure sales agent, often called a “trustee.” You can also work with a local real estate agent or broker to identify these properties, but you should know in advance that, by law, there is no agent commission on these sales. Do your research. Be sure you read and understand all due diligence documents and transaction details prior to the auction. It wouldn’t be a bad idea to seek independent advice from a real estate attorney or a knowledgeable real estate agent. Research the estimated market value of the property, how much the borrower owes on the mortgage, and whether there are any liens against the property. This last point is especially important. If you’re the winning bidder, you may have to pay off these liens. It’s worth hiring a title company or real estate attorney to run title searches on properties you’re interested in bidding on. Drive by the property, if possible. This will let you see the home’s condition—from the outside. Homes in the foreclosure process are usually occupied by the owner who’s being foreclosed upon or a renter. Do not trespass or disturb the occupant! Doing so is a criminal offense. When you bid on a foreclosure, you’re bidding on the property “as-is.” You won’t know what condition you’ll find inside once you take possession. Extra, unexpected repairs could cost you thousands of dollars, so take that into account when figuring out how much you can comfortably bid. There’s a saying among investors that’s a pretty, good rule of thumb: “How it looks on the outside is what it’s going to look like on the inside.” In other words, an unkempt exterior indicates an unkempt interior, while a home with great curb appeal will probably look similar inside! Get your financing in order. Most foreclosure auctions accept cash, bank money order or cashier’s checks for payment. In nearly every state, you’ll have to pay in full immediately following the auction of the property; a few states allow you to pay a percentage at auction and the rest within a certain timeframe. County foreclosure auctions often require advance deposits. The deposit amount varies across municipalities, but generally runs from 5% to 10% of the expected final bid amount of the property. Confirm all auction details, even on the day of the auction. It’s very common for foreclosure auctions to be postponed or even cancelled. Sometimes an auction is cancelled because the borrower comes up with the money to pay the lender the amount they owed, obtains a loan modification or sells the property as a short sale. Auctions might be postponed for a myriad of reasons; for example, the bank or lender might not be able to compile the proper documentation in time, or the owner might request more time to complete a short sale. 6|Page Trainer & Mentor: Ebonie Caldwell of REI Investment Society Attend the auction and bid! Check in at least one hour before the auction’s start. Get an Auction Bidder Card and raise it when the auctioneer announces a price that you’re prepared to accept as your winning bid. If you win the auction, your payment is due immediately or the following business day (dependent on state). Once you’ve paid in full, you’ll complete a certificate of sale or an execution of sale receipt, deed upon sale and IRS Form 8300, subject to state-specific laws. Wait for your certificate of title. While you’ll get your certificate of sale immediately, the actual certificate of title may take as much as 10 days to complete. During that time, the original owner may file an objection to the sale and pay the amount owed in full to retain their rights to the property. Don’t do any work on the property until you receive the certificate of title. Buying Property in an Online Auction In an online auction, you won’t find yourself standing on the steps of the county courthouse or packed into a hotel ballroom. You could be anywhere when you bid—at home, the office, even an airport—as long as you have an Internet connection. Bidding can occur 24 hours a day over the course of days or weeks, instead of on a single day. Online auctions also broaden the types of properties you can bid on: short sales, non-distressed, bank-owned homes (known as REOs), and commercial property and notes. The steps for bidding in an online auction are similar to a live auction. Find a property you love. With online auctions, you can search for and bid on properties all over the country. You can even bid on multiple properties at once. Do your due diligence. Many online auction sites provide a wealth of information on the property page, including maps, estimated market value and any liens. Be sure you read it all! It’s also a good idea to conduct your own due diligence, including a title search, and seek independent advice from a real estate agent or broker, a real estate attorney, or another experienced investor. Unlike live foreclosure sales, most homes sold in online auctions do have an agent commission (called “broker co-op” in the business), which allows a real estate agent to get paid for their services. As with foreclosures, visit the property if you’re local. The real estate agent may even offer open houses; if so, bring your contractor with you to help you assess what repairs might be needed. Register for the auction. Most online auctions require you to register and submit a refundable deposit in the form of a credit card authorization. This simple process ensures that all bidders are serious and motivated. (Don’t worry—you’ll get the deposit back if you’re not the winning bidder.) 7|Page Trainer & Mentor: Ebonie Caldwell of REI Investment Society Prepare your financing. To expedite the close if you win, start gathering the following documents before the auction: • • • Proof of funds or financing information. Although most online auction sites don’t provide financing, Auction.com has a large—and growing—number of homes with financing available. Entity documents if you’re bidding under a company name or entity such as an LLC, trust or limited partnership. An earnest money deposit, which is usually 5% of the total purchase price and due one business day after the auction ends. And if you’re the winner? Be ready for things to move fast. With Auction.com, for example, the contracting department will contact you within two hours and walk you through the online purchase and sale agreement, which shows the total purchase price and the timeline for submitting documents and payments. Make sure that escrow receives your documents and payments on time; otherwise, you could lose your earnest money deposit. Look closely at the property page for each property you are planning to bid on. Many properties have what’s called a “buyer’s premium,” which is the fee charged by the auction company for conducting the sale, from marketing through the closing. The amount can vary, but it’s usually 5% of the winning bid amount. Many properties don’t have a buyer’s premium because the bank or seller has arranged to pay this fee out of their proceeds from the sale. Title insurance. It’s a good idea to purchase title insurance. Here’s why: The properties in an online auction often have quit claim or special warranty deeds that will transfer the bank’s interest in the property to you at closing. The problem is that any undiscovered liens will transfer to you as well! Title insurance protects you from these risks. For some homes, you can buy title insurance through escrow; for others, you can buy it after closing. Occasionally, you’ll receive clear and marketable title to the property at closing. It depends on where the home is in the foreclosure process. This is another reason why a knowledgeable real estate agent or attorney can provide a valuable service to you. Buying real estate at auction can be a lucrative—and fun—way to start or enhance your investing career. It can also mean years of heartache for the uninformed, so take advantage of all the resources available to make sure you know what you’re getting into. WHY BUY FROM AN AUTION AS A WHOLESALER? Here are some reasons why you should consider buying at foreclosure auctions. Whether you are a buy-and-hold investor or like to buy and sell property for fast cash I believe that auctions in the current market should be a source of deals to supplement your overall investment strategy. 8|Page Trainer & Mentor: Ebonie Caldwell of REI Investment Society 1. Little Competition When I recently attended an auction in Orlando, FL I was amazed to see the small amount of retail buyers. Bidding was not that fierce on individual properties, half of the crowd attending the auction consisted of investors who were bidding on multiple properties. 2. Buy at Fire Sale Prices While observing the entire auction in Orlando recently, I was amazed to see how cheap properties were going for. Oceanside condos selling for $150,0000, Five bedroom brand-new homes selling for $80,000. 50% off retail value prices were not unheard of and I was shocked to think that banks would be willing to let these properties sell at these prices. 3. No Middlemen What I like about auctions is that you know prior to bidding your max allowable offer. If you have taken into account your profit, holding costs, marketing costs and closing costs. Once the auctioneer says sold, you will have a good deal and there is no long drawn out process to get the property. Sometimes it is frustrating dealing with sellers, banks and the entire short sale process in some cases. With auctions you can close on your property within 3-4 weeks. 4. Limited Risk Seems like a contradiction right? If you buy in the right area and at the right price the odds of losing money is minimized. If you studied your market, you did your research on properties coming up for auction and you have a profit strategy in place for the particular property then using this approach to make money in real estate may be the right option for you. At the minimum, it should be a tool that is part of your overall investment strategy. Buying at an active auction has its own risk of getting carried away with the bidding. When a bidding war occurs, many bidders forget their pre-auction property analysis and bid far more than they expected to pay. If bidding against others for a property, set your limit and stick to it While there is a great deal of potential for profit, buying an auction property carries another risk. Most auctioneers (including sheriff's) will require you to put 10% of the purchase price down at 9|Page Trainer & Mentor: Ebonie Caldwell of REI Investment Society the time of a winning bid. You will also be required to settle within 30 days of the auction. If you do not settle, you lose your deposit. As such, this method of buying is not for those unwilling to take a risk in their house flip. Financing auction purchases can be very difficult. Most lenders will require an appraisal, or at least a walkthrough of the property before closing, which is frequently impossible with auctions. You need to be in the position to pay cash, and if desired, finance the property later. Going through a reliable hard money lender or broker is your best option as they are treated as cash, if you don’t have cash on hand. Classifieds Are classified still a viable resource for a property purchase? Is there a potential perk of having access to more "For Sale by Owner" properties? Sadly, the use of the daily newspaper as a medium to sell properties has significantly diminished. While many local papers still run classified ads for properties in their print and online versions, it is not considered the best source for finding a property to purchase. Searching the newspaper can be very time consuming. The listings will cover large geographic areas, without a way to electronically search for specific areas or characteristics. In this digital age, that seems archaic and almost impossible. Many of the websites listed above in the MLS section, as well as Craigslist, have made the digital search for real estate investment the norm in almost every region of the United States. As discussed above, internet searches can offer access to both listings by brokers and "sale by owners" properties. Become Friends With Other Wholesalers: Wholesalers are regularly buying and selling, but be wary of their markups! Wholesalers are in the business of finding distressed properties and properties with a lot of equity inside of them, putting them under contract and then finding a buyer who will execute the house flip. The buyer will essentially take the place of a wholesaler in the contract, paying a fee to the wholesaler for being the middleman. Although this is not the most cost-effective method of making a property purchase for a house flip, it can be very time efficient and may save money in the long run. Many wholesalers do this as their full time job and are well connected in certain neighborhoods, and to certain agents and sellers. If you're interested in working with a wholesaler, you can generally find them in real estate investment groups and through internet searches. Consider this other wholesaler as your “BirdDog” as your personal assistant who is out there knocking on doors and marketing for you. 10 | P a g e Trainer & Mentor: Ebonie Caldwell of REI Investment Society CRAIGSLIST TO FIND WHOLESALE PROPERTIES AND TO FIND END BUYERS/INVESTORS: Craigslist is an outstanding way to build a wholesale buyers list for little to no cost. If you’re a real estate investor, Craigslist should be one of the sites you bookmark and visit daily to help you grow your business.Craigslist has long been a treasure trove of leads for real estate investors, from buyer leads to seller leads to rental tenants to contractors, and more. It’s so good because there are always many people on Craigslist at any given time and you can be sure that the people who are visiting the real estate section have some interest in real estate… that is, they’re at least thinking about participating in some kind of transaction (even if they’re not ready today). Before reading on its important for newbie wholesalers to know that you can do this before you ever have a deal under contract. "How" you might ask? The key is partnering up with a few other active wholesalers in your area! They have lots of deals - market those while you're working on getting your own under contract! However, one piece of advice: always ask permission to market another wholesaler's deals. You will only tick people off if you don't...plus its simply not cool. What's great is that you can not only build a buyers list, but you can make some money if you find a buyer for the other wholesaler's property! Additionally, let's talk about cost. Yes, Craigslist is free, so it could be zero cost, but if you're looking to generate a large list of potential buyers and have better things to do than sit around posting ads on Craigslist (trust me, you do!), you will want to consider paying a virtual assistant to help. So now that we have all of that out of the way, here's how you can use CraigsList to build a wholesaler buyer's list. There are three key things we do with every ad: • • • We hide the email address so that people don’t email us We include a link to our squeeze page that requests their email address and then provides access to the deals We place the links in the “For Sale By Owner” category for the appropriate county area (for Such as New York, New York, Las Vegas, Nevada, Chicago, IL, etc…) If you go to the real estate for sale section of Craigslist, you’ll be inundated with a list of properties, each title proclaiming in all caps: “123 MAIN STREET!!! FIXER-UPPER” “3 BEDROOM 2 BATH” “COUNTRY CHARM!!!” 11 | P a g e Trainer & Mentor: Ebonie Caldwell of REI Investment Society … There are a lot of all-caps and a lot of exclamation points. It’s easy to get lost in the crowd. So, how do you master Craigslist to make it a key part of your buyer-lead-building strategy? And, how do you stand out from the crowd and attract more buyer leads? Here Are 5 Strategies To Get More Craigslist Buyer Leads Leverage these 5 Craigslist marketing strategies for your real estate investing business or even as a real estate agent. Craigslist Marketing Buyer Leads Strategy #1. Put On YOUR Buyer Brain Before you start posting your deals, you need to know who you are posting them for. So many properties in Craigslist miss out on a huge opportunity by creating mundane post titles like “3 bedroom, 2 bathroom!” Is that the best information for your buyer? Start by identifying who your buyer is. Do you sell to retail buyers? Rent-to-own tenants? Landlords? Flippers? Get as specific as possible. Maybe you are a turnkey wholesaler and your perfect buyer is an out-of-state owner. Maybe you flip properties and your perfect buyer is a rent-to-own tenant with bad credit but a good job. 12 | P a g e Trainer & Mentor: Ebonie Caldwell of REI Investment Society Once you identify your buyer, you need to get into their brain and think about WHY they want to buy a property from you. No one cares about the address of your property until they are ready to visit. And not all buyers care about the number of bedrooms and bathrooms either. Here are 3 simple but powerful tips to help get in the brain of your cash buyers with your Craigslist ads. • • • Your out-of-state investing buyers want to know the cash flow numbers Your flipping buyers want an assessment of how much work is required to flip the property Your rent-to-own tenant-buyers want to know that you’ll work with them on their unique financing situation You need to figure out why your buyers are looking in the first place… then build that information into your ads. Craigslist Marketing Buyer Strategy #2. Create a Compelling Post Title That Speaks To Your Buyer’s “Why” 13 | P a g e Trainer & Mentor: Ebonie Caldwell of REI Investment Society Your buyers have a reason for buying properties and it has NOTHING to do with the property’s address (that most people post as the post title). Create a title that speaks to your buyer’s key reason for buying. To borrow from the examples above: Your out-of-state investing buyers want to know the cash flow numbers so a post title that catches their attention… Turnkey property cash flowing $500/month” Your flipping buyers want an assessment of how much work is required to flip the property so a post title that catches their attention… … “Easy-to-fix property 50% below market, requires only $10K for a fast flip” 14 | P a g e Trainer & Mentor: Ebonie Caldwell of REI Investment Society Your rent-to-own customers want to know that you’ll work with them on their unique financing situation so a post title that says… “Bad credit? No problem with this beautiful rent-to-own home” Should you include exclamation points and ALL-CAPS? Those might have worked when people were first posting but it seems like most people are using that strategy now so you might consider using regular sentence case to write your title since it will be unique against a list of ALL CAP POSTS. You should test both a regular (sentence case) title and an ALL CAPS title and see what works in your market… but in general I’m not a fan of all caps titles on Craigslist ads or email subject lines. It just feels like I’m being yelled at in a weird silent way ;-) In the end, it’s not important whether you use CAPS, symbols in your ad title, arrows… whatever. The important thing is that your ad title stands out visually in the list of other ads. Which Craigslist Real Estate Ads Stand Out To You Below? Making your Craigslist ads stand out… Notice how small changes in your ad title can make it stand out from the other ads. You can use symbols, numbers, or even just making your ad title a different length than the other ads on the page can improve the results of your ads! Craigslist Buyer Leads Strategy #3. Attach The Best Pictures For Your Prospects Goal 15 | P a g e Trainer & Mentor: Ebonie Caldwell of REI Investment Society Pictures are a challenging part of the real estate investor’s Craigslist marketing strategy. The burning question is: Do pictures help? Here’s our assessment: • • If your buyer is a homeowner/retail buyer (that is: if they will be living in the property themselves) then pictures will help. If your buyer is an investor (i.e. a flipper or they want to own rental property) then pictures probably won’t help as much as the numbers. (They might help but not to the same degree as someone who will live in the property). Also, the quality of the picture should really vary based on the type of buyer you’re looking for. • • • Retail Buyers want to see very pretty and polished pictures. So post great pictures to catch their attention. When most retail buyers see a crummy picture that makes the house look bad, they immediately start thinking of all of the work they’ll have to do to make the house “pretty”. Turnkey Investors want to see pictures that show the house is nice, is well kept, in a neighborhood that’ll attract the type of tenant they want, etc. So you don’t need the professional pictures like you may post for a retail buyer, but make sure the house looks like it’s in great shape and well kept in the pictures to turnkey investors. Cash Buyers / Flippers often want to see a house that is in rough shape in comparison to the others in the neighborhood. So don’t fret over trying to make your pictures fancy. In fact, fancy professional pictures could give the flipper / rehabber / cash buyer the impression that the house is too expensive and isn’t a deal. Show the flaws in the house, show what they’ll have to fix, but make sure to show the good parts of the deal as well. Which Pictures Stand Out And Which Ones Don’t? 16 | P a g e Trainer & Mentor: Ebonie Caldwell of REI Investment Society Craigslist has a “gallery” view now… that in many markets is the default view for looking at real estate. So are your ads standing out and helping grab your potential prospect? The pictures with orange arrows above don’t really show the property well and don’t grab your attention. So again it comes back to knowing who your buyers are. Many real estate posts have pictures in them and they aren’t great quality pictures. One picture may show a room with windows; another picture may show a house with a tree in front of it. Clearly all of the pictures were taken on a smartphone. If you are going to take pictures, take great pictures (vivid pictures with plenty of contrast) that show key parts of the property that will interest your buyer based on their “why”. (Flippers should see the parts that are great and the parts that need fixing. Cash flow investors should see that a property is solid enough to attract and retain good tenants). But here’s one more argument against images: Since many listings do have pictures, your listing might actually stand out if you don’t have pictures – especially when Craigslist is in the thumbnail or gallery mode. So you can use the lack of pictures to your advantage if you have a great ad title that draws the real estate buyer in. The main thing you want to do is stand out in the sea of other Craigslist ads. Try both ads with images and without. 17 | P a g e Trainer & Mentor: Ebonie Caldwell of REI Investment Society And try ads with great images and ugly ones and see which produces the best result for you following our guidelines above. Craigslist Buyer Leads Strategy #4. Deploy A Pricing Strategy That Makes Sense Price your property right… Sometimes playing the “$1” pricing game or showing no price at all can backfire and prevent your property from showing up to the right buyers. Price your property right. Also, recognize that the As you post your listing, you are prompted to enter a price. Here are the four possible pricing options you have: 1. 2. 3. 4. The right price A price that is too low A price that is too high No price at all Although people can sort with high prices first or low prices first, potential buyers will rarely search for high prices first (because serious buyers usually want to pay less). And if they search by price at all, your no-price listing may not show up at all. This reduces your choices to: the right price or a price that is eye-catchingly low. If a price is too low ($1.00) you might show up at the top of the list when sorted by low price first but what will you gain? You may incur the wrath of someone who wants to flag you for mispricing your property. Ultimately it will depend on the kind of deals you do and who your buyers are. The best rule of thumb is to always price the property for your best price upfront. 18 | P a g e Trainer & Mentor: Ebonie Caldwell of REI Investment Society Studies have shown that starting high then lowering over time actually leads to a 13% decrease in the sales price of the house. Craigslist Buyer Leads Strategy #5: Include A Call To Action In the body of your listing, include relevant details that the buyer will find helpful. But most people stop there. “2BR, nice community.” While that might be true, people need to be told what to do next. So create a clear call to action that entices them and reminds them of the urgency of the offer. “Contact us today – this deal will go fast.” You might also consider offering a bonus to leads who contact you. Make sure that the bonus is valuable, tied to your offer, and benefits your specific buyer (as identified in strategy #1). 19 | P a g e Trainer & Mentor: Ebonie Caldwell of REI Investment Society Don’t get too aggressive on your free bonuses because they could cause people to flag your listing but if you take an authentic, measured approach that is targeted to a specific audience, you should find it helpful. An example might be for flippers: “Contact me about this property and I’ll even throw in a $250 coupon for Home Depot upon closing” Or this one for out-of-state investors: “Contact me about this property and we’ll even waive our first months property management fee!” Start Getting More Craigslist Buyer Leads Right Now Craigslist is a powerful source of leads no matter what you use it for. If you want buyers, follow these 5 simple strategies to take your buyer lead building to the next level! If you found this blog post helpful, stay tuned because we have an entire Craigslist training that will be available soon to give you an even more comprehensive step-by-step strategy to dominate Craigslist and build seller leads, buyer leads, and more. Step one: Find a property If you are advertising correctly, your phone will ring off the hook. Find a property with sufficient equity and get busy. Let's use the example of a property worth $100,000 that you negotiate down to a buying price of $55,000. You fill out your sales contract with the homeowner as the seller and you as the buyer. We like to use contracts from the Board of Realtors. They are easy to use, and homeowners are familiar with them. Call your local Board of Realtors to see if they sell contracts to the public. If not, most office supply stores sell real estate contracts. One of the first lines on the sales contract is a place for the buyers' name. Put your name and the words "and/or assigns" after it. This will allow you to assign the contract to the rehabber. 20 | P a g e Trainer & Mentor: Ebonie Caldwell of REI Investment Society To make the contract binding, you have to leave a deposit with the homeowner at the time of signing. We typically leave $100.00 for Earnest Money! This way, if we are unable to wholesale the property, we are not out a lot of money. $100! Who would take that? Everyone! When we first started asking homeowners to take a $10 deposit, we thought we'd get kicked out of the house. To our surprise, no one gave us any grief. If you say it like this: "We typically give a $100 deposit and close in 45 days. This 45 days is used as our due-diligence period to actually find an end buyer. That won't be a problem, will it?" They always say, "Okay." The only reason a homeowner won't take $100 is because of the way you present it. Speak with confidence. Step two: Start building your buyers list. This is a list of rehabbers who will buy your wholesale properties. [Here is a recap from a previous article: How to Build Your List of Buyers ] First, run an ad in the paper that says something like: Handy, investor special Great deal for rehabbers! 555-555-5555 OR Investor special Thousands below market--Won't last! 555-555-5555 When investors begin calling, get their information. Take their name, number, fax, and email, and put that information in a database. Then the next time you find another deal, you'll have a list of buyers. Run your ads for sixty to ninety days. Even if you sell your property the next day, keep the ads running. Tell the investors that the property sold; however you are working on another, and ask if you can you call them once the deal is finalized. They will always say yes. Our buyers list has close to one thousand names. We have been collecting them for years. Every time we get a deal under contract, we fax and email our list and boom--the deal is gone. Remember, the faster you find a buyer, the faster you get paid. Step three: Negotiate a deal with your rehabber This is how a wholesale real estate transaction might look. Say the house is worth $100,000 in good condition. The homeowners are distressed--either they are behind in their payments or facing foreclosure. They have to move quickly. Say they owe $50,000 on the property, and they 21 | P a g e Trainer & Mentor: Ebonie Caldwell of REI Investment Society need $5,000 to move and pay deposits for their new place. (Remember, you know this because you have asked them what they are seeking as a result of your assistance.) You offer them $55,000, and they accept. The house is worth $100,000 in good condition. You figure it will take approximately $15,000 in repairs to get it to market condition. You have a rehabber lined-up, and you know he'll pay 65% of the retail value. You decide to sell it to him for $65,000, making $10,000 as your assignment fee. The new price is $55,000 to the homeowners and $10,000 to you for putting the deal together. The rehabber will fix-up the property and make the difference between the $65,000 and the $100,000 fair market value. If the rehabber does a good job on the property and keeps rehab costs low, the potential profit is $15,000 to $20,000. Not too bad either! Step four: Prepare for closing Using your investor-friendly title company, move towards a closing. The beauty about title companies is that they do all the work for you. All you have to do is find the deal, wholesale it to your rehabber, and go to closing. The title company does the rest. Folks, it's that simple! Wholesaling real estate is fun, and the money is quick. Can you see why I love it so much? USING FOR SALE BY OWNER TO LOCATE PROPERTIES: In an effort to save on brokerage fees, some homeowners attempt to sell their homes themselves rather than hire real estate brokers to list the homes for them. Would-be buyers seek out these "for sale by owners"--commonly referred to as FSBOs--in the hope that the sellers will pass along the savings. Both solo buyers and buyers represented by real estate agents may purchase FSBOs. When a buyer is represented, her agent negotiates directly with the FSBO seller. FSBOs can found through a variety of media. • • • Search FSBO websites. Real estate websites that focus on FSBOs meet the needs of home buyers who search for homes online. The most comprehensive offer advanced search tools, consumer guides for buyers, and city, neighborhood and school information. Browse Craigslist. Begin at the Craigslist.org homepage. Find your state in the list on the right side of the screen, and then navigate to your city or region. Once you arrive at your local Craigslist page, find the heading for Housing, and then click Real Estate for Sale. Ads for FSBOs are identifiable by the word "owner" at the end of the headlines. Read newspaper classifieds. The Sunday paper has the most ads, but chances are your paper publishes new ads nearly every day. Since many states require real estate brokers to include information in their ads that identifies them as brokers, ads without this information likely are from private sellers. 22 | P a g e Trainer & Mentor: Ebonie Caldwell of REI Investment Society • • Tour desired neighborhoods to look for FSBO yard signs. The signs usually have a phone number passers-by can use to call owners for more information about the homes and to schedule showing appointments. Work with a buyer agent, who can search for FSBOs on your behalf and save you time and effort by screening the results. An agent can also access FSBO homes listed in the MLS by brokers that offer a la carte listing services. Since the buyer agent receives a percentage of the commission paid by the seller to the listing agent, the buyer pays no additional fee for the buyer agent's services. Tip • • If you're not represented by an agent, search a legal site like Nolo.com for the forms your state requires for the sale of real estate. Search comparables--local homes similar to the one you're interested in that have sold recently--on consumer real estate sites like Zillow.com to get a sense of the market value. The data on these sites may not always be 100 percent accurate or up-do-date, but they can provide you with a good starting point for deciding how much to offer. Warning • The disclosures, contracts and addenda used in real estate transactions are complex legal documents. Don't sign anything you don't understand. When in doubt, consult an attorney. 23 | P a g e Trainer & Mentor: Ebonie Caldwell of REI Investment Society