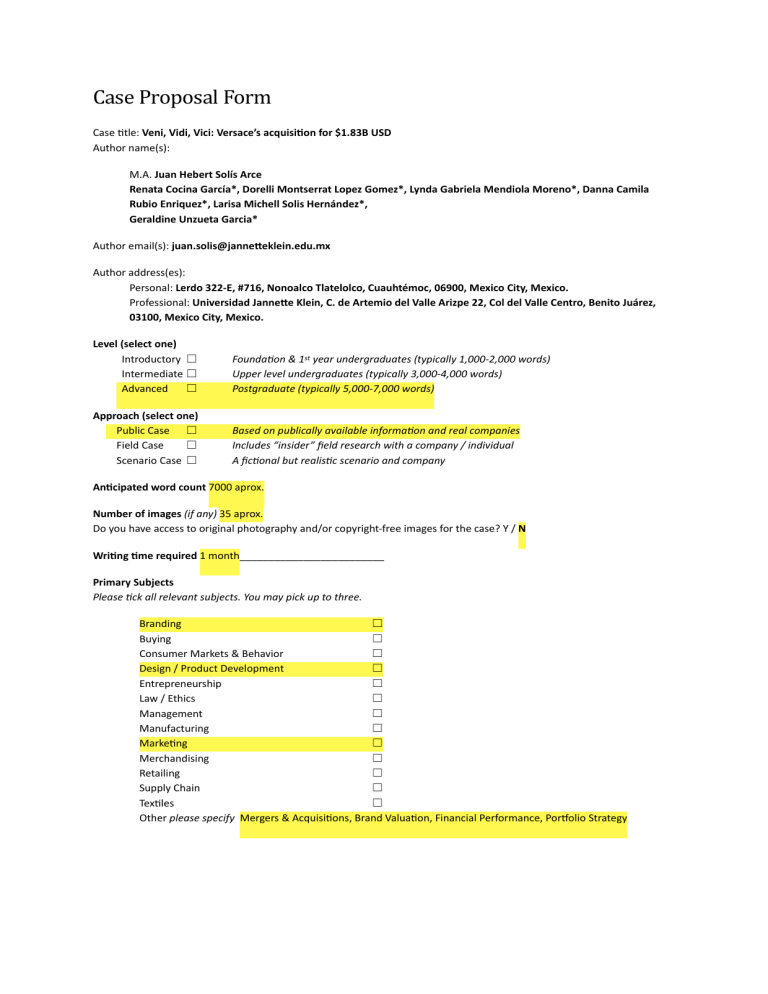

Case Proposal Form Case tle: Veni, Vidi, Vici: Versace’s acquisi on for $1.83B USD Author name(s): M.A. Juan Hebert Solís Arce Renata Cocina García*, Dorelli Montserrat Lopez Gomez*, Lynda Gabriela Mendiola Moreno*, Danna Camila Rubio Enriquez*, Larisa Michell Solis Hernández*, Geraldine Unzueta Garcia* Author email(s): juan.solis@janne eklein.edu.mx Author address(es): Personal: Lerdo 322-E, #716, Nonoalco Tlatelolco, Cuauhtémoc, 06900, Mexico City, Mexico. Professional: Universidad Janne e Klein, C. de Artemio del Valle Arizpe 22, Col del Valle Centro, Benito Juárez, 03100, Mexico City, Mexico. Level (select one) Introductory ☐ Intermediate ☐ Advanced ☐ Founda on & 1st year undergraduates (typically 1,000-2,000 words) Upper level undergraduates (typically 3,000-4,000 words) Postgraduate (typically 5,000-7,000 words) Approach (select one) Public Case ☐ Field Case ☐ Scenario Case ☐ Based on publically available informa on and real companies Includes “insider” eld research with a company / individual A c onal but realis c scenario and company An cipated word count 7000 aprox. Number of images (if any) 35 aprox. Do you have access to original photography and/or copyright-free images for the case? Y / N Wri ng me required 1 month_________________________ Primary Subjects Please ck all relevant subjects. You may pick up to three. tf ti ti ti fi ti ti ti tt ti tt fi ti ti ti ti ti ti ti Branding ☐ Buying ☐ Consumer Markets & Behavior ☐ Design / Product Development ☐ Entrepreneurship ☐ Law / Ethics ☐ Management ☐ Manufacturing ☐ Marke ng ☐ Merchandising ☐ Retailing ☐ Supply Chain ☐ Tex les ☐ Other please specify Mergers & Acquisi ons, Brand Valua on, Financial Performance, Por olio Strategy Case Outline Brief Descrip on (150 words) Gianni Versace S.p.A. (Versace) is an Italian luxury fashion house founded in 1978 by the namesake designer. A worldwide recognized brand, Versace was expected to formalize its IPO in 1997 before facing the tragic murder of its founder. As Santo and Donatella mourn and survive Gianni, they also take on the management and creative helms of the rm. In 2019 (22 years later,) the overall performance of the brand nally got a nancial valuation and acquisition by Capri Holdings (formerly known as Michael Kors Holdings) in a business transaction that asked for USD 1.83B (a percentage of which was cash for the stakeholders) in exchange for all shares of the brand. As Donatella leads the resurrection of some of her brother’s iconic prints, the launch of a digital- rst advertising campaign, and a Guinness’ World Record editorial, this case offers the reader a walk in Donatella’s stilettos on the eve of the nancial materialization of her life-long work. Learning Objec ves 1. Identify the key marketing strategies that Versace shaped in order to raise its brand equity prior to the acquisition. 2. Evaluate wether the negotiation is in line with industry gures, cash ows, brand value, working capital forecasts and business liabilities. 3. Analyze the risks associated with the nal agreement by taking into consideration Versace’s nancial and managerial performance, CAPRI’s portfolio strategy and academic theories regarding brand management and valuation, mergers & acquisitions and communication strategies. 4. Propose alternative solutions that mitigate the risks of failure, maximize the value of the new portfolio and bullet-proof the business from repeating its mistakes and staying competitive. Company Overview (100 words) In 2019, privately owned and independent companies like Versace are going ex nct in the luxury fashion industry. The compe ve landscape has landed in the Asia-Paci c region as a new demand source for scar goods. Conglomerates like LMVH, Kering, Chanel, OTB, and Michael Kors Holdings have become the norm to sustain compe ve advantage by building economies of scale regarding manufacturing, distribu on, and communica on costs and fees. While joining one of these business groups might seem like reasonable partners for Versace, they might not have the company's best interests for its status, strategy, or even its survival. Joining a business group seems an inevitable (but not trivial) situa on for Donatella. She holds a decisive in uence in the brand's valua on as crea ve director of the rm. Assuming a year-long nego a on, we can revisit her crea ve decisions as the dilemma of brand value comes into e ect. fi ti ti ti fi ti fi ff fl ti ti fi ti fi fi fi ti fi ti ti ti ti ti fi ti ti ti ti fi fi ti ti fl During 2018, in a crucially mely manner, Donatella leads a marke ng strategy towards raising the value of her legacy as a business asset. By making choices such as resurrec ng some of the brand's acclaimed prints, launching a digital- rst adver sing campaign, and producing a Guinness World Record photography, we can appreciate the symbolic, material, and visual value of Versace. Business Problem (100 words) The agreed price tag is not arbitrary. While it serves a function to promote Versace's luxury status, it is also the climax of all marketing efforts and design initiatives made by Versace. During 2018, Donatella faced the opportunity to execute a branding strategy towards raising the brand value before the nal agreement. The proposed case analyses the precedents of nancial valuation and brand associations and documents the most illustrative academic frameworks to contextualize the decisions and leadership. Business Ques ons (50 words) Considering both tangible and intangible assets of the business, the conditions of the acquisition and the agreed monetary value: 1. Is Versace overvalued, undervalued or fairly valued? 2. What can we learn form Donatella’s value creation strategy? 3. What return can Michael Kors expect from the investment? fi ti fi 4. What risks lie ahead for CAPRI as a fashion group?