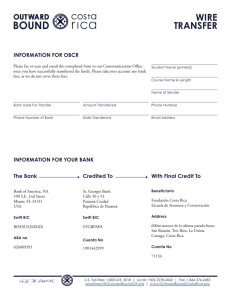

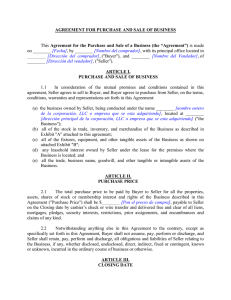

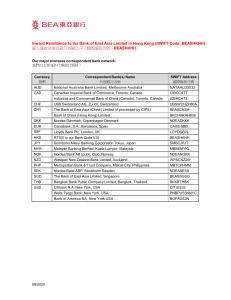

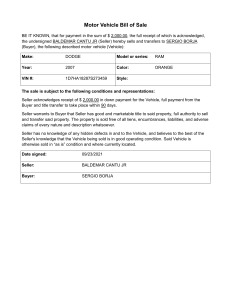

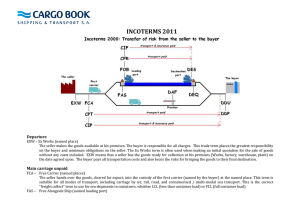

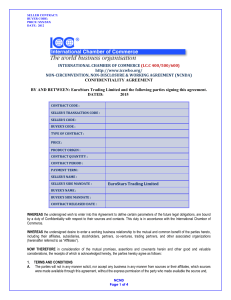

MT799 MT799 is an essential part of international trade; a ‘free format message’ sent between banks, which confirms funds or proof of deposits on a potential trade. MT799 allows banks to communicate between each other freely through the SWIFT system, rather than being a mechanism for transferring funds or paying. If you deal with Bank Guarantees, Documentary Credits, and Letters of Credit (LCs), you may have heard the term ‘MT799’ being used. A SWIFT code (also commonly referred to as SWIFTBIC) is a unique identifier, which banks use to identify and send money to overseas banks. SWIFT MT799 The MT799 is a free format SWIFT message type in which a banking institution confirms that funds are in place to cover a potential trade. This can, on occasion, be used as an irrevocable undertaking, depending on the language used in the MT799, but is not a promise to pay or any form of bank guarantee in its standard format. The function of the MT799 is simply to assure the seller that the buyer does have the necessary funds to complete the trade. If the subject line of the MT799 is marked as RWA message, it can never block any funds of the Buyer. An account with the SWIFT MT799 capability allows bank-to-bank SWIFT electronic verification for Proof of Funds in compliance with the SWIFT Category 7 “Treasury Markets & Syndication” message types. The MT799 is usually issued before a contract is signed and before a letter of credit or bank guarantee is issued. After the MT799 has been received by the seller’s bank, it is then normally the responsibility of the seller’s bank to confirm to Buyer’s bank with full bank responsibility that the Seller owns the product and is capable of the delivery as written in the referring SPA, at which point the trade continues towards commencement. The actual payment method after delivery used by us is MT103 (wire transfer), or in case of default the SBLC to pay the goods. An MT799 is an automated message sent electronically from one bank to another, so you won’t really ’see’ an MT799 at all. The paperwork associated with an MT799 will vary from bank to bank, though most banks follow a similar format. We will send you our verbiage, which is common standard (ICC) and only varies a bit from bank to bank.