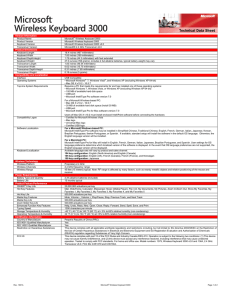

lOMoARcPSD|4330130 Case Revenue recognition at Microsoft IFRS 2 (Universiteit van Amsterdam) StuDocu is not sponsored or endorsed by any college or university Downloaded by Marco Blanke ([email protected]) lOMoARcPSD|4330130 For the exclusive use of M. Bredenoord, 2019. CASE: A-234 DATE: 06/01/18 REVENUE RECOGNITION AT MICROSOFT CORPORATION We believe ASC 606 is a significant improvement to the existing revenue accounting guidance…[ASC 606] provides more consistency and comparability to accounting for contract revenue across industries, and we believe it will lead to more relevant financial information for investors.1 —Frank H. Brod, Corporate Vice President, Finance and Administration and Chief Accounting Officer, Microsoft Corporation (“Microsoft”) In July 2017, software and device giant Microsoft [NasdaqGS: MSFT] adopted a new accounting standard that market observers described as one of “the most historic accounting changes to hit the U.S. capital markets in decades.”2 Twelve years in the making, the Financial Accounting Standards Board’s (FASB) 2014-09 Revenue from Contracts with Customers (Topic 606) laid out new rules for making revenue recognition consistent across industries, both in the U.S. and internationally through its International Financial Reporting Standards (IFRS) equivalent, IFRS 15. While implementation of the standard, beginning in fiscal year 2018, would have an impact on many industries, perhaps the greatest effect would be felt by software companies, where “multiple-element arrangements” that bundled software licenses, upgrades, and post-contract customer support or services were ubiquitous. COMPANY BACKGROUND Cofounded in 1975 by college dropouts Bill Gates and Paul Allen, Microsoft began as a software company, developing an implementation of the programming language BASIC for the early 1 Frank H. Brod, “ASU Topic 606—Deferral of the Effective Date,” Comment Letter No. 30, May 27, 2015. Tien Tzuo, “Yes, It's Accounting, But ASC 606 Could Have A Huge Impact On Your Company,” Forbes, August 10, 2017, https://www.forbes.com/sites/groupthink/2017/08/10/asc-606-is-the-biggest-business-story-youve-neverheard-how-it-will-affect-your-company/ (May 29, 2017). Jaclyn Foroughi, CFA, and Professor Anne Beyer prepared this case as the basis for class discussion rather than to illustrate either effective or ineffective handling of an administrative situation. 2 Copyright © 2018 by the Board of Trustees of the Leland Stanford Junior University. Publicly available cases are distributed through Harvard Business Publishing at hbsp.harvard.edu and The Case Centre at thecasecentre.org; please contact them to order copies and request permission to reproduce materials. No part of this publication may be reproduced, stored in a retrieval system, used in a spreadsheet, or transmitted in any form or by any means –– electronic, mechanical, photocopying, recording, or otherwise –– without the permission of the Stanford Graduate School of Business. Every effort has been made to respect copyright and to contact copyright holders as appropriate. If you are a copyright holder and have concerns, please contact the Case Writing Office at [email protected] or write to Case Writing Office, Stanford Graduate School of Business, Knight Management Center, 655 Knight Way, Stanford University, Stanford, CA 94305-5015. This document is authorized for use only by Matthijs Bredenoord in IFRS 2 [6314M0031] taught by Sanjay Bissessur, University of Amsterdam from Apr 2019 to Jul 2019. Downloaded by Marco Blanke ([email protected]) lOMoARcPSD|4330130 For the exclusive use of M. Bredenoord, 2019. Revenue Recognition at Microsoft Corporation A-234 p. 2 Altair 8800 microcomputer. Microsoft focused on early variants of Microsoft BASIC, then offered of its first hardware product and operating system in 1980. That same year, Microsoft formed a pivotal partnership with International Business Machines (IBM) [NYSE: IBM]—then the world’s largest computer maker—to bundle Microsoft’s operating system with IBM computers. The result was an early incarnation of MS-DOS, the main operating system for IBM Personal Computer (PC) compatible computers throughout the 1980s and early 1990s. In 1985, Microsoft released its first retail version of Microsoft Windows (Windows 1.0), a graphical extension of MS-DOS. At the same time, the company also extended its partnership with IBM in the development of a new operating system with a hardware design proprietary to IBM. Having established itself as the dominant developer of operating systems, Microsoft went public the following year at $25.75 per share. Adjusted for splits and dividends, $10,000 invested at the initial public offering would be worth roughly $13.2 million in 2018, an annual growth rate of 25.2 percent over the last 32 years! As of March 13, 2018, Microsoft remained one of the top three most-valued public companies in the world with a $726.93 billion market capitalization (trailing only Apple [NasdaqGS: AAPL] and Alphabet [NasdaqGS: GOOG, GOOGL]), while its cofounder, Bill Gates, was the world’s second-wealthiest individual. (See Exhibit 1 for a chart of Microsoft’s historical stock price) By 2018, Microsoft continued to adapt to the dynamic and highly competitive technological environment, expanding beyond software and computing hardware into cloud-based services, subscriptions, gaming, and marketing—all with “an intelligent edge infused with artificial intelligence.”3 As a result, Microsoft remained the leading software company in the world, with revenues of $90 billion and profits of $21.2 billion in fiscal year 2017. Since its initial public offering in 1986, revenues and net income grew an average of 22.4 percent and 23.6 percent per year, respectively (see Exhibit 2 for a chart of Microsoft’s historical revenue, operating income, and net income; Exhibit 3 for Microsoft’s fiscal year 2017 financial statements and excerpts from footnotes; and Exhibit 4 for selected quarterly data). In fact, in the 32 years since Microsoft’s IPO, revenue increased in every year except two (2009 and 2016). BRIEF HISTORY OF REVENUE RECOGNITION ACCOUNTING In 1970, prior to the formation of FASB, the Accounting Principles Board (APB) issued Statement No. 4 (APB No. 4) Basic Concepts and Accounting Principles Underlying Financial Statements of Business Enterprises.4 At the time, the guidance provided that “revenue is generally recognized when both of the following conditions are met: (i) the earnings process is complete or virtually complete, and (ii) an exchange has taken place.”5 Over the next decade, as the computing industry evolved, so too did the accounting required to recognize revenue. By late 1984, over a decade after formation of the FASB in 1973, the Board established the Statement of Financial Accounting Concepts No. 5 (CON 5) Recognition and Measurement in Financial Statements of Business Enterprises. In a similar manner to APB No. 3 Microsoft Corporation 2017 Form 10-K, p. 29. The FASB replaced the APB in 1973. 5 Accounting Principles Board, “Basic Concepts and Accounting Principles Underlying Financial Statements of Business Enterprises,” paragraph 150. 4 This document is authorized for use only by Matthijs Bredenoord in IFRS 2 [6314M0031] taught by Sanjay Bissessur, University of Amsterdam from Apr 2019 to Jul 2019. Downloaded by Marco Blanke ([email protected]) lOMoARcPSD|4330130 For the exclusive use of M. Bredenoord, 2019. Revenue Recognition at Microsoft Corporation A-234 p. 3 4, CON 5 took a two-pronged approach to revenue recognition, stating that “recognition involves consideration of two factors (a) being realized or realizable and (b) being earned, with sometimes one and sometimes the other being the more important consideration.”6 With the growth of the Internet during the 1990s, new software models emerged including bundled services, Software-as-a-Service (SaaS), and cloud computing services. However, because Generally Accepted Accounting Principles (GAAP) did not directly address the recognition of software revenues, Microsoft chose to adopt a conservative policy that deferred revenues from certain product sales. During 1996, for example, Microsoft began to ratably recognize revenue for “a portion of all Windows-based operating system license fees, including those licensed through retail and OEM channels.”7 At the time, this meant that 80 percent of revenues were recognized when OEMs shipped the product, with the remaining 20 percent of revenues recognized over a life cycle of two years. Recognizing the limitations of prevailing accounting rules, the American Institute of Certified Public Accountants (AICPA) issued Statement of Position (SOP) 97-2 in 1997 (later amended by SOP 98-9) to define revenue recognition for software companies. Specifically, revenue was recognized when all of the following criteria were met: (i) persuasive evidence of an arrangement exists; (ii) delivery has occurred; (iii) the vendor’s fee is fixed and determinable; and (iv) collectibility is probable.8 In addition, SOP 97-2 provided guidelines for recognizing revenue of multiple-element arrangements, which was hugely influential for the software industry. Specifically, the fee for various elements was to be allocated based on Vendor Specific Object Evidence (VSOE) of fair value for each element—the price charged when each individual element was sold separately. However, if VSOE did not exist for every single element in the arrangement, revenue was not recognized until all of the elements had been delivered. So, if a company could not establish VSOE, it would have to defer revenue for all products and services delivered until the entire contract was completed. Recognizing that VSOE might result in misleading revenue numbers, SOP 97-2 provided an exception for post-contract customer support including when-and-if available software updates: if the only undelivered element was such post-contract customer support, the entire fee was recognized ratably during the service period rather than at the end of the service period. Despite this exception, SOP 97-2 meant that software companies providing post-contract customer support could not record any revenue at the time of sale. 6 FASB, Concepts Statement 5, paragraphs 83 (a) and (b), p. 30. Microsoft Corporation 1996 Form 10-K, p. 2. 8 AICPA Technical Practice Aids, Statement of Position 97-2 Software Revenue Recognition, October 27, 1997, https://www.fasb.org/jsp/FASB/Document_C/DocumentPage?cid=117615644259 (May 29, 2018), p. 3. In December 1999, the Securities and Exchange Commission (SEC) issued Standards Accounting Bulletin 101 (SAB 101) Revenue Recognition, which extended similar criteria for revenue recognition outside of the software industry. Revenue was generally realized or realizable and earned when all of the following criteria were met: persuasive evidence of an arrangement exists; delivery has occurred or services have been rendered; the seller’s price to the buyer is fixed and determinable; and collectibility is reasonable assured. For more information, see SEC, Staff Accounting Bulletin No. 104, December 17, 2003, https://www.sec.gov/interps/account/sab104rev.pdf (May 29, 2018), p. 10-11. 7 This document is authorized for use only by Matthijs Bredenoord in IFRS 2 [6314M0031] taught by Sanjay Bissessur, University of Amsterdam from Apr 2019 to Jul 2019. Downloaded by Marco Blanke ([email protected]) lOMoARcPSD|4330130 For the exclusive use of M. Bredenoord, 2019. Revenue Recognition at Microsoft Corporation A-234 p. 4 The high hurdle of VSOE was believed to be a leading cause of revenue restatements and even led to an inability for some companies to comply properly or in a timely manner. In October 2007, for example, Japanese electronics company, NEC Corp., was delisted from the Nasdaq due to improper recognition of bundled services for fiscal years 2000 through 2005. As additional guidance for numerous industry-specific and transaction-specific standards were issued,9 a significant gap developed in the accounting for economically similar transactions. The requirement of VSOE in the software industry was a prime example of the divergence between the general principles of revenue recognition and the detailed guidance for particular industries or transactions. ASC TOPIC 606 As early as January 2002, FASB disseminated a proposal for a new agenda project, which intended to increase financial statement comparability across companies and industries. In October 2004, the Board added the goal of converging international accounting standards. Nearly a decade later, in May 2014, FASB issued ASU 2014-09 Revenue from Contracts with Customers, creating Topic 606, while the International Accounting Standards Board (IASB) issued IFRS 15 Revenue from Contracts with Customers.10 The converged standards set forth a five-step process for recognizing revenue from contracts with customers that applied irrespective of the company’s line of business: Step 1: Step 2: Step 3: Step 4: Step 5: Identify the contract(s) with a customer. Identify the performance obligations in the contract.11 Determine the transaction price.12 Allocate the transaction price to the performance obligations in the contract. Recognize revenue when (or as) the entity satisfies a performance obligation.13 For the software industry, the new standard meant that the requirement of VSOE of fair value of individual elements was no longer necessary for recognizing revenue prior to all elements of the contract being completed. Instead, ASU 2014-09 required companies to allocate the transaction price to the performance obligations based on VSOE if it existed, or their estimates of the standalone selling price of each individual element if VSOE did not exist. 9 Examples include Subtopic 985-605, Software, issued in 2009; Subtopic 605-35, Construction-Type and Production-Type Contracts, issued in 2009; Subtopic 605-25, Revenue Recognition—Multiple-Element Arrangements, issued in 2009; Subtopic 360-20, Property, Plant, and Equipment—Real Estate Sales, issued in 2011 10 For further information about ASC Topic 606, see “JetBlue and the New Revenue Recognition Standard,” GSB No. A-231. 11 A performance obligation is a promise in a contract with a customer to transfer a good or service. If an entity promises to transfer more than one good or service to the customer, the entity should account for each promised good or service as a performance obligation only if it is (1) distinct, or (2) a series of distinct goods or services that are substantially the same and have the same pattern of transfer. 12 Under ASC 606, the transaction price is the amount of consideration the selling party expects to be entitled to in exchange for transferring promised goods and services. This includes the expected of most likely amount of variable consideration. 13 ASU 2014-09, p. 2. This document is authorized for use only by Matthijs Bredenoord in IFRS 2 [6314M0031] taught by Sanjay Bissessur, University of Amsterdam from Apr 2019 to Jul 2019. Downloaded by Marco Blanke ([email protected]) lOMoARcPSD|4330130 For the exclusive use of M. Bredenoord, 2019. Revenue Recognition at Microsoft Corporation A-234 p. 5 ASC Topic 606 introduced several other new provisions. When estimating the transaction price in Step 3, entities were required to include the expected amount of variable components of the selling price and allocate it to the various performance obligations (Step 4). Under previous GAAP, most variable revenue could not be recognized until the contingency was resolved. Moreover, the timing of revenue recognition (Step 5) could also change under ASC Topic 606 as it focused on the transfer of control over a good or service to the consumer to determine whether a performance obligation had been satisfied. Previous GAAP focused on when substantially all risk of loss from the sale of goods or services passed to the consumer. MICROSOFT’S CONTRIBUTION TO THE DEVELOPMENT OF ASC TOPIC 606 Because investors paid great attention to top-line revenue when assessing a company, Microsoft, with its continual growth and complex mix of product and service offerings, was keen to weigh in on the topic of revenue recognition. This was not unusual. Indeed, the FASB’s rule-making process was designed to offer any interested party, including companies, auditors and investors, multiple opportunities to comment on and provide input to its proposed new standards. In 2002, just two months after the launch of FASB’s proposal for the project on issues related to revenue recognition, then-Director of External Reporting at Microsoft Bob Laux recognized in a comment letter to FASB that “issues involving revenue recognition are among the most important and most difficult that standard setters and accountants face.”14 At the same time, Laux emphasized the need for FASB to be sensitive to transition issues: Microsoft has a significant amount of unearned revenue, some of which is due to the provisions of SOP 97-2, Software Revenue Recognition. We would find it unconscionable if a transition provision required that unearned revenue currently recognized on a company’s balance sheet be “washed away” in a cumulative effect adjustment and never be reflected as revenue in a company’s income statement.15 Specifically, Laux was referring to undelivered elements totaling nearly $5.6 billion (roughly 22 percent of revenue) that were carried as unearned revenue on the balance sheet as a liability in fiscal 2001 (see Exhibit 5 for a historical chart of Microsoft unearned revenue and accounts receivable). Because customers had prepaid for delivery of multiple elements and Microsoft had yet to deliver them all, the company accumulated a large liability. Laux was concerned that a new revenue recognition standard might accelerate the recognition of revenue and that Microsoft might never reap the benefits from showing large parts of to-date deferred revenue on its income statement. In June 2009, in response to FASB’s Discussion Paper on a single revenue recognition model, Laux, who was then Microsoft’s senior director of financial accounting and reporting, provided additional input for standard setters and raised several concerns regarding the complex nature of 14 Bob Laux, “Proposal for a New Agenda Project on Issues Related to the Recognition of Revenues and Liabilities,” Reference Number: 1050-001, Comment Letter No. 18, FASB, March 29, 2002, p. 1. 15 Ibid., pp. 1-2. This document is authorized for use only by Matthijs Bredenoord in IFRS 2 [6314M0031] taught by Sanjay Bissessur, University of Amsterdam from Apr 2019 to Jul 2019. Downloaded by Marco Blanke ([email protected]) lOMoARcPSD|4330130 For the exclusive use of M. Bredenoord, 2019. Revenue Recognition at Microsoft Corporation A-234 p. 6 Microsoft’s revenue, stating that “software arrangements often include numerous obligations which will be satisfied at indeterminate times in the future, such as software support, ‘when-andif-available’ software deliverables, deployment planning services, training, etc.”16 Just over a year later, in October 2010, Microsoft was one of nearly a thousand companies responding to FASB’s original exposure draft (ED) entitled “Revenue from Contracts with Customers.” In his comment letter, Laux strongly argued against FASB’s proposed accounting for “bug fixes”: The guidance in ASC 985-605, ‘Software Revenue Recognition’, seems to indicate that bug fixes are corrections of latent defects by stating that ‘bug fixes are necessary to maintain compliance with published specifications’. The Implementation Guidance of the ED indicates that, ‘If the entity would be required to repair defective products, it does not recognize revenue for the portion of the transaction price attributable to the products’ components expected to be replaced in the repair process’. This guidance may be operational for a tangible product, but is not operational for software, as components of software are not replaced. Furthermore, Microsoft provides bug fixes for software for up to 10 years after the introduction of the software, which under the guidance in the ED, could result in the deferral of revenue for 10 years.17 Laux also highlighted the significant effect the ED would have on Microsoft’s revenue recognition for multi-year volume licensing agreements, which consisted of perpetual software licenses as well as rights to future versions of software products: Under the guidance of ASC 985-605 [Topic 605], Microsoft accounts for these arrangements as subscriptions and recognizes revenue ratably over the term of the arrangement. Under the guidance in the ED, we believe we will have to account for the software licenses separately from the rights to future versions of the software products, with revenue for the software licenses recognized upfront and revenue attributable to the rights to future versions of the software products recognized ratably over the term of the arrangement.18 Following the issuance of ASU 2014-09 (ASC Topic 606) in May 2014, Microsoft Corporate Vice President of Finance and Administration and Chief Accounting Officer Frank Brod provided a comment letter to FASB generally supporting the update and its subsequent amendments. Under the final version of the standard, potential future bug fixes did not preclude a company from recognizing any revenue at the time of sale. Instead, bug fixes were considered part of post-contract customer support—a separate performance obligation. 16 Bob Laux, “Preliminary Views on Revenue Recognition in Contracts with Customers,” Reference Number: 1660100, Comment Letter No. 208, FASB, June 19, 2009, p. 1. 17 Bob Laux, “Revenue Recognition (Topic 605): Revenue from Contracts with Customers,” Reference Number: 1820-100, Comment Letter No. 410, FASB, October 22, 2010, pp. 1-2. 18 Ibid., p. 2. This document is authorized for use only by Matthijs Bredenoord in IFRS 2 [6314M0031] taught by Sanjay Bissessur, University of Amsterdam from Apr 2019 to Jul 2019. Downloaded by Marco Blanke ([email protected]) lOMoARcPSD|4330130 For the exclusive use of M. Bredenoord, 2019. Revenue Recognition at Microsoft Corporation A-234 p. 7 MICROSOFT’S ADOPTION OF ASC TOPIC 606 In August 2017, one month after adopting ASC Topic 606, Microsoft management held a conference call with market observers to discuss its adoption of the new revenue recognition standard. According to Brod, recognition for many areas of Microsoft’s business remained unchanged; however, the most material changes affected two products with multiple elements: Windows 10 OEM licenses and on-premises annuity contracts that included the right to future software updates (“software assurance”). Windows 10 OEM Licenses Prior to the adoption of ASC Topic 606, Microsoft recognized Windows 10—released in July 2015—OEM license revenue ratably over the life of the product, which ranged from two to four years. Because customers received unspecified updates and upgrades over the life of the device at no additional cost, and because those updates and upgrades could not be sold on a stand-alone basis, Microsoft was unable to establish VSOE of fair value. Under the new revenue standard, however, VSOE was no longer required and Microsoft recognized roughly 97 percent of revenue upfront at the time of sale, or at the time of billing and delivery. The remaining three percent of Windows 10 OEM revenue would be deferred over a three-year period to reflect the value of software updates. Meanwhile, customer billing and cash flow remain unchanged. On-Premises Annuity Contracts with License and Software Assurance On-premises annuity contracts comprised two components: a software license component and a software assurance component, which included rights to updates and support. Prior to the adoption of ASC Topic 606, again due to the absence of VSOE, Microsoft recognized revenue ratably over the assurance period for both licenses and software assurance in alignment with billing. Under the new standard, revenue for the license component of these contracts would be accelerated and recognized at the time of sale, while recognition of revenue for the software assurance component would remain ratable over the assurance period. Speaking to the impacts of the changes, Brod revealed: First, this change results in some revenue from the license component being recognized ahead of customer invoicing driving an increase in accounts receivable. Second, the upfront recognition of this license component revenue drives higher volatility in quarterly revenue and changes the seasonality patterns of our reported revenue within a given year. And third, revenue from the license component that is recognized upfront is no longer recorded in unearned revenue.19 19 Microsoft Investor Relations, “MSFT New Accounting Standards and FY18 Investor Metrics Conference Call,” August 3, 2017, p. 4. This document is authorized for use only by Matthijs Bredenoord in IFRS 2 [6314M0031] taught by Sanjay Bissessur, University of Amsterdam from Apr 2019 to Jul 2019. Downloaded by Marco Blanke ([email protected]) lOMoARcPSD|4330130 For the exclusive use of M. Bredenoord, 2019. Revenue Recognition at Microsoft Corporation A-234 p. 8 As with Windows 10 OEM licenses, commercial bookings, customer billings, and cash flow for on-premises annuity contracts remained unchanged. Market Perception With top-line revenue being of fervent interest to the investor community, the new accounting standard was sure to baffle the market. According to a report from Citigroup, “We expect that (the new rules) will cause significant investor confusion over the next 12 months to the financial analysis of companies ranging from small companies up to the largest, including Microsoft.”20 As a result, some market participants discussed the use of more stable measures of financial performance. According to Investor’s Business Daily: “In industries that will be impacted most by the new rules, some analysts are talking about using more steady free cash flow as an alternative metric to earnings per share. The reason is free cash flow will be less impacted by the 606 rules.”21 Morgan Stanley analyst Snehaja Mogre confirmed, “As the new standard will not impact actual cash flows, we expect investors to increase their reliance on cash flow metrics.”22 Beyond transitional friction, Microsoft and its investor base expected the new standard to result in higher quarterly volatility. As revenue under the new standard tracked sales more closely relative to the old standard, seasonality of sales transactions within a year would be visible in Microsoft’s quarterly revenue numbers. Meanwhile, industry participants expected to see less impact on companies with cloud-based, SaaS business models involving renewable subscriptions than those selling licensed software installed on a customer’s personal computer. Enterprise software and cloud computing-focused Oracle Corporation [NYSE: ORCL], for example, stated that: “We plan to adopt Topic 606 in the first quarter of fiscal 2019…and we do not believe there will be a material impact to our revenues upon adoption.”23 As a result, research provider Moody’s Investors Service [NYSE: MCO] suggested that more software companies would move to a subscription model, as opposed to upfront licensing fees, to ease the impact of the new standard.24 Some investors worried about the less conservative approach the new standard took towards revenue recognition. Joe Bishop, head of equity at asset management firm Pine River Capital Management, observed: The new standard is more aggressive on revenue recognition, even in cases where cash has not been collected from the customer. Surprisingly, this move reverses nearly two decades of more conservative accounting standards following the 20 Reinhardt Krause, “This New Rule on Revenue Recognition Could Shake Up Earnings,” Investor’s Business Daily, June 30, 2017, https://www.investors.com/news/technology/top-line-turmoil-booking-revenue-faster-couldshake-up-earnings/ (May 29, 2018). 21 Ibid. 22 Ibid. 23 Oracle Corporation 3Q 2018 10-Q, p. 10. 24 David Gonzales, “Sector In-Depth: Accounting - US: The changing top line - Software sector braces for volatility under new revenue rule,” Moody’s Investors Service, November 14, 2017. This document is authorized for use only by Matthijs Bredenoord in IFRS 2 [6314M0031] taught by Sanjay Bissessur, University of Amsterdam from Apr 2019 to Jul 2019. Downloaded by Marco Blanke ([email protected]) lOMoARcPSD|4330130 For the exclusive use of M. Bredenoord, 2019. Revenue Recognition at Microsoft Corporation A-234 p. 9 scandals of the late 1990s and early 2000s. I worry that, in the long term, this change will increase the chances that investors will be misled.25 However, others believed that the standard would provide investors and managers with a better understanding of organizations’ performance. Shauna Watson, global managing director for finance and accounting at professional services firm Resource Global Professionals [NASDAQ: RECN], noted, “Despite all the pain and expense, CFOs will have more transparency into their revenue numbers and how they are contracting with customers.’’26 CONCLUSION As far back as 1999, famed analyst Mary Meeker took note of Microsoft’s growing unearned revenue account, saying, “We believe the company’s core earnings power is higher than printed and is held back, in part, by the company’s aggressive revenue-deferral efforts.”27 At the time, the total amount of deferred revenue on Microsoft’s balance sheet was equal to roughly 80 cents per share (on an undiluted basis). By fiscal year 2017, that same figure ballooned to nearly $5.75 per share. As of 2018, it remained unclear whether a decrease in the amount of this liability as a result of the new standard would translate into more transparent growth and returns over the long run. 25 Tien Tzuo, “Opinion: This new accounting rule could radically change how some companies recognize revenue,” marketwatch.com, September 27, 2017, https://www.marketwatch.com/story/this-new-accounting-rule-couldradically-change-how-some-companies-recognize-revenue-2017-09-27 (July 11, 2018). 26 Ibid. 27 Ronald Fink, “Smooth Operator,” CFO Magazine, August 1, 1999, http://ww2.cfo.com/strategy/1999/08/smoothoperator/ (May 29, 2018). This document is authorized for use only by Matthijs Bredenoord in IFRS 2 [6314M0031] taught by Sanjay Bissessur, University of Amsterdam from Apr 2019 to Jul 2019. Downloaded by Marco Blanke ([email protected]) lOMoARcPSD|4330130 For the exclusive use of M. Bredenoord, 2019. p. 10 Revenue Recognition at Microsoft Corporation A-234 Exhibit 1 Microsoft Historical Stock Price and Trading Volume (1986-2018) $120 1,200 $100 1,000 $40 400 $20 200 $- 16 13 / 3/ 13 / 3/ 3/ 13 / 14 12 10 13 / 3/ 13 / 3/ 3/ 13 / 08 06 04 13 / 3/ 13 / 3/ 00 13 / 3/ 98 13 / 3/ 13 / 3/ 3/ 13 / 96 94 92 13 / 3/ 13 / 3/ 88 13 / 3/ 13 / 3/ 13 / 3/ Volume (MN) 18 600 02 $60 90 800 86 $80 Closing Price ($US) Source: Compiled by author using data from CapitalIQ. This document is authorized for use only by Matthijs Bredenoord in IFRS 2 [6314M0031] taught by Sanjay Bissessur, University of Amsterdam from Apr 2019 to Jul 2019. Downloaded by Marco Blanke ([email protected]) lOMoARcPSD|4330130 For the exclusive use of M. Bredenoord, 2019. p. 11 Revenue Recognition at Microsoft Corporation A-234 Exhibit 2 Microsoft Revenue, Operating Income, and Net Income (1985-2017) $100,000 $90,000 $80,000 $70,000 $60,000 $50,000 $40,000 $30,000 $20,000 Revenue ($US MN) Operating Income ($US MN) 17 20 15 20 13 20 11 20 07 09 20 20 05 20 03 20 01 20 99 19 19 97 95 19 93 19 89 91 19 19 87 19 19 85 $10,000 $- Net Income ($US MN) Source: Compiled by author using company data. This document is authorized for use only by Matthijs Bredenoord in IFRS 2 [6314M0031] taught by Sanjay Bissessur, University of Amsterdam from Apr 2019 to Jul 2019. Downloaded by Marco Blanke ([email protected]) lOMoARcPSD|4330130 For the exclusive use of M. Bredenoord, 2019. p. 12 Revenue Recognition at Microsoft Corporation A-234 Exhibit 3 Microsoft Fiscal Year 2017 Financial Statements and Selected Footnotes INCOME STATEMENTS (in millions, except per share amounts) Year Ended June 30, 2015 2016 2017 Revenue: Product Service and other Total revenue Cost of revenue: Product Service and other Total cost of revenue Gross margin Research and development Sales and marketing General and administrative Impairment, integration, and restructuring Operating income Other income (expense), net Income before income taxes Provision for income taxes Net income Earnings per share: Basic Diluted Weighted average shares outstanding: Basic Diluted Cash dividends declared per common share $ 75,956 17,624 93,580 $ 21,410 11,628 33,038 60,542 12,046 15,713 4,611 10,011 18,161 346 18,507 6,314 12,193 $ $ 1.49 1.48 $ 8,177 8,254 1.24 61,502 23,818 85,320 $ 17,880 14,900 32,780 52,540 11,988 14,697 4,563 1,110 20,182 (431) 19,751 2,953 16,798 $ $ 2.12 2.10 $ 7,925 8,013 1.44 57,190 32,760 89,950 15,175 19,086 34,261 55,689 13,037 15,539 4,481 306 22,326 823 23,149 1,945 21,204 $ $ 2.74 2.71 $ 7,746 7,832 1.56 This document is authorized for use only by Matthijs Bredenoord in IFRS 2 [6314M0031] taught by Sanjay Bissessur, University of Amsterdam from Apr 2019 to Jul 2019. Downloaded by Marco Blanke ([email protected]) lOMoARcPSD|4330130 For the exclusive use of M. Bredenoord, 2019. p. 13 Revenue Recognition at Microsoft Corporation A-234 Exhibit 3 (continued) Microsoft Fiscal Year 2017 Financial Statements and Selected Footnotes BALANCE SHEETS (in millions) Year Ended June 30, 2016 2017 Assets Current assets: Cash and cash equivalents Short-term investments Total cash, cash equivalent, and short-term investments Accounts receivable Inventories Other Total current assets Property and equipment, net of accumulated depreciation Equity and other investment Goodwill Intangible assets, net Other long-term assets Total assets Liabilities and stockholders' equity Current liabilities: Accounts payable Short-term debt Current portion of long-term debt Accrued compensation Short-term income taxes Short-term unearned revenue Securities lending payable Other Total current liabilities Long-term debt Long-term unearned revenue Deferred income taxes Other long-term liabilities Total liabilities Commitments and contingencies Stockholders' equity: Common stock and paid-in capital Retained earnings Accumulated other comprehensive income (loss) Total stockholders' equity Total liabilities and stockholders' equity $ 6,510 106,730 113,240 18,277 2,251 5,892 139,660 18,356 10,431 17,872 3,733 3,416 $ 193,468 $ $ $ 6,898 12,904 5,264 580 27,468 294 5,949 59,357 40,557 6,441 1,476 13,640 121,471 68,178 2,282 1,537 71,997 $ 193,468 7,663 125,318 132,981 19,792 2,181 4,897 159,851 23,734 6,023 35,122 10,106 6,250 $ 241,086 7,390 9,072 1,049 5,819 718 34,102 97 6,280 64,527 76,073 10,377 531 17,184 168,692 69,315 2,648 431 72,394 $ 241,086 This document is authorized for use only by Matthijs Bredenoord in IFRS 2 [6314M0031] taught by Sanjay Bissessur, University of Amsterdam from Apr 2019 to Jul 2019. Downloaded by Marco Blanke ([email protected]) lOMoARcPSD|4330130 For the exclusive use of M. Bredenoord, 2019. p. 14 Revenue Recognition at Microsoft Corporation A-234 Exhibit 3 (continued) Microsoft Fiscal Year 2017 Financial Statements and Selected Footnotes CASH FLOWS STATEMENT (in millions) 2015 Operations Net income Adjustments to reconcile net income to net cash from operations: Goodwill and asset impairments Depreciation, amortization, and other Stock-based compensation expense Net recognized gains on investments and derivatives Deferred income taxes Deferral of unearned revenue Recognition of unearned revenue Changes in operating assets and liabilities: Accounts receivable Inventories Other current assets Other long-term assets Accounts payable Other current liabilities Other long-term liabilities Net cash from operations Financing Proceeds from issuance (repayment) of short-term debt, net Proceeds from issuance of debt Repayments of debt Common stock issued Common stock repurchased Common stock cash dividends paid Other, net Net cash from (used in) financing Investing Additions to property and equipment Acquisition of companies, net of cash acquired, and purchases of intangible and other assets Purchases of investments Maturities of investments Sales of investments Securities lending payable Net cash from (used in) investing Effect of foreign exchange rates on cash and cash equivalents Net change in cash and cash equivalents Cash and cash equivalents, beginning of period Cash and cash equivalents, end of period $ Year Ended June 30, 2016 2017 12,193 $ 16,798 $ 21,204 7498 5,957 2,574 (443) 224 45,072 (44,920) 630 6,622 2,668 (223) 332 57,072 (48,498) 0 8,778 3,266 (2,073) (3,296) 67,711 (57,735) 1,456 (272) 62 346 (1,054) (624) 1,599 29,668 (530) 600 (1,167) (41) 88 (260) (766) 33,325 (925) 50 1,066 (539) 81 386 1,533 39,507 4,481 10,680 (1,500) 634 (14,443) (9,882) 362 (9,668) 7,195 13,884 (2,796) 668 (15,969) (11,006) (369) (8,393) (4,963) 44,344 (7,922) 772 (11,788) (11,845) (190) 8,408 (5,944) (8,343) (8,129) (3,723) (1,393) (25,944) (98,729) (129,758) (176,905) 15,013 22,054 28,044 70,848 93,287 136,350 (466) 203 (197) (23,001) (23,950) (46,781) (73) (67) 19 (3,074) 915 1,153 8,669 5,595 6,510 $ 5,595 $ 6,510 $ 7,663 This document is authorized for use only by Matthijs Bredenoord in IFRS 2 [6314M0031] taught by Sanjay Bissessur, University of Amsterdam from Apr 2019 to Jul 2019. Downloaded by Marco Blanke ([email protected]) lOMoARcPSD|4330130 For the exclusive use of M. Bredenoord, 2019. Revenue Recognition at Microsoft Corporation A-234 p. 15 Exhibit 3 (continued) Microsoft Fiscal Year 2017 Financial Statements and Selected Footnotes Excerpts from NOTE 1 — ACCOUNTING POLICIES Revenue Recognition Revenue is recognized when persuasive evidence of an arrangement exists, delivery has occurred, the fee is fixed or determinable, and collectability is probable. Revenue generally is recognized net of allowances for returns and any taxes collected from customers and subsequently remitted to governmental authorities. Microsoft enters into arrangements that can include various combinations of software, services, and hardware. Where elements are delivered over different periods of time, and when allowed under U.S. GAAP, revenue is allocated to the respective elements based on their relative selling prices at the inception of the arrangement, and revenue is recognized as each element is delivered. We use a hierarchy to determine the fair value to be used for allocating revenue to elements: (i) vendor-specific objective evidence of fair value (“VSOE”), (ii) third-party evidence, and (iii) best estimate of selling price. For software elements, we follow the industry specific software guidance which only allows for the use of VSOE in establishing fair value. Generally, VSOE is the price charged when the deliverable is sold separately. Customers purchasing a Windows 10 license will receive unspecified updates and upgrades over the life of their Windows 10 device at no additional cost. As these updates and upgrades will not be sold on a stand-alone basis, we are unable to establish VSOE of fair value. Accordingly, revenue from licenses of Windows 10 is recognized ratably over the estimated life of the related device, which ranges between two to four years. Certain volume licensing arrangements include a perpetual license for current products combined with rights to receive unspecified future versions of software products, which we have determined are additional software products and are therefore accounted for as subscriptions, with billings recorded as unearned revenue and recognized as revenue ratably over the coverage period. Cost of Revenue Cost of revenue includes: manufacturing and distribution costs for products sold and programs licensed; operating costs related to product support service centers and product distribution centers; costs incurred to include software on PCs sold by OEMs, to drive traffic to our websites, and to acquire online advertising space; costs incurred to support and maintain Internet-based products and services, including datacenter costs and royalties; warranty costs; inventory valuation adjustments; costs associated with the delivery of consulting services; and the amortization of capitalized software development costs. Capitalized software development costs are amortized over the estimated lives of the products. This document is authorized for use only by Matthijs Bredenoord in IFRS 2 [6314M0031] taught by Sanjay Bissessur, University of Amsterdam from Apr 2019 to Jul 2019. Downloaded by Marco Blanke ([email protected]) lOMoARcPSD|4330130 For the exclusive use of M. Bredenoord, 2019. p. 16 Revenue Recognition at Microsoft Corporation A-234 Exhibit 3 (continued) Microsoft Fiscal Year 2017 Financial Statements and Selected Footnotes Excerpts from NOTE 15 — UNEARNED REVENUE Unearned revenue by segment was as follows: (In millions) June 30, 2017 Productivity and Business Processes Intelligent Cloud More Personal Computing Corporate and Other Total 2016 $ 14,291 $ 12,497 11,472 13,464 3,334 3,420 6,606 13,304 $ 44,479 $ 33,909 Corporate and Other consists of the net revenue deferral from Windows 10. Revenue from Windows 10 is primarily recognized at the time of billing in the More Personal Computing segment, and the deferral and subsequent recognition of revenue is reflected in Corporate and Other. Source: Compiled by author using company filings. This document is authorized for use only by Matthijs Bredenoord in IFRS 2 [6314M0031] taught by Sanjay Bissessur, University of Amsterdam from Apr 2019 to Jul 2019. Downloaded by Marco Blanke ([email protected]) lOMoARcPSD|4330130 For the exclusive use of M. Bredenoord, 2019. p. 17 Revenue Recognition at Microsoft Corporation A-234 Exhibit 4 Microsoft Select Quarterly Financial Information (2015-2018) 1Q15 2Q15 3Q15 4Q15 1Q16 2Q16 3Q16 4Q16 1Q17 2Q17 3Q17 4Q17 1Q18 2Q18 3Q18 4Q18 Select Income Statement Data Revenue COGS Net income Select Balance Sheet Data Accounts Short-term Receivable, unearned net revenue Long-term unearned revenue $ $ $ $ $ $ $ $ $ $ $ $ $ $ $ $ $ $ $ $ $ $ $ $ $ $ $ $ $ $ $ $ $ $ $ $ $ $ $ $ $ $ $ $ $ 23,201 26,470 21,729 22,180 20,379 23,796 20,531 20,614 21,928 25,826 23,212 23,317 24,538 28,918 26,819 TBA $ $ $ $ $ $ $ $ $ $ $ $ $ $ $ 8,273 10,136 7,161 7,468 7,207 9,872 7,722 7,979 7,844 9,901 8,060 6,456 8,278 11,064 9,269 TBA $ $ $ $ $ $ $ $ $ $ $ $ $ $ $ 4,540 5,863 4,985 (3,195) 4,620 4,998 3,756 3,122 5,667 6,267 5,486 6,513 6,576 (6,302) 7,424 TBA 12,887 16,186 12,427 17,908 11,444 14,507 12,247 18,277 11,129 14,343 12,882 19,792 14,561 18,428 17,208 TBA $ $ $ $ $ $ $ $ $ $ $ $ $ $ $ 20,713 19,192 18,232 23,223 21,603 20,929 20,876 27,468 26,304 26,085 26,518 34,102 22,778 21,309 21,370 TBA 1,825 2,051 1,966 2,095 2,784 4,102 5,017 6,441 7,284 8,595 9,215 10,377 2,126 2,500 2,585 TBA Source: Compiled by author using company data. This document is authorized for use only by Matthijs Bredenoord in IFRS 2 [6314M0031] taught by Sanjay Bissessur, University of Amsterdam from Apr 2019 to Jul 2019. Downloaded by Marco Blanke ([email protected]) lOMoARcPSD|4330130 For the exclusive use of M. Bredenoord, 2019. p. 18 Revenue Recognition at Microsoft Corporation A-234 Exhibit 5 Microsoft Quarterly Unearned Revenue by Segment ($US BN) 1Q15 2Q15 3Q15 4Q15 Commercial Licensing $ 16,959 $ 15,776 $ 14,697 $ 17,672 Commercial Other $ 3,483 $ 3,486 $ 3,526 $ 5,641 Rest of Segments $ 2,096 $ 1,981 $ 1,975 $ 2,005 Total $ $ $ $ 22,538 21,243 20,198 25,318 In June 2015, we announced a change in organizational structure to align to our strategic direction as a productivity and platform company. During the first quarter of fiscal year 2016, our chief operating decision maker, who is also our Chief Executive Officer, requested changes in the information that he regularly reviews for purposes of allocating resources and assessing performance. As a result, beginning in fiscal year 2016, we report our financial performance based on our new segments, Productivity and Business Processes, Intelligent Cloud, and More Personal Computing.28 4Q15 1Q16 2Q16 3Q16 4Q16 1Q17 2Q17 3Q17 4Q17 1Q18 2Q18 3Q18 Productivity and Business Processes $ 11,643 $ 10,719 $ 10,110 $ 9,635 $ 12,497 $ 11,486 $ 11,447 $ 11,159 $ 14,291 $ 11,808 $ 11,290 $ 11,185 Intelligent More Personal Corporate and Cloud Computing other 10,346 3,246 83 9,291 3,035 1,342 8,811 2,900 3,210 8,658 2,848 4,752 11,472 3,334 6,606 10,322 3,298 8,482 9,749 3,034 10,450 9,722 2,930 11,922 13,464 3,420 13,304 10,156 2,940 9,759 2,760 9,987 2,783 $ $ $ $ $ $ $ $ $ $ $ $ Total Unearned Revenue 25,318 24,387 25,031 25,893 33,909 33,588 34,680 35,733 44,479 24,904 23,809 23,955 Source: Compiled by author using company data. 28 Microsoft 2016 Form 10-K, p. 6. This document is authorized for use only by Matthijs Bredenoord in IFRS 2 [6314M0031] taught by Sanjay Bissessur, University of Amsterdam from Apr 2019 to Jul 2019. Downloaded by Marco Blanke ([email protected]) lOMoARcPSD|4330130 For the exclusive use of M. Bredenoord, 2019. p. 19 Revenue Recognition at Microsoft Corporation A-234 Exhibit 6 Microsoft Unearned Revenue and Accounts Receivable (1986-2017) $50,000 $45,000 $40,000 $35,000 $30,000 $25,000 $20,000 $15,000 $10,000 $5,000 Unearned Revenue ($US MN) 20 16 20 14 20 12 20 10 20 08 20 06 20 04 20 02 20 00 19 98 19 96 19 94 19 92 19 90 19 88 19 86 $- Accounts Receivable ($US MN) Source: Compiled by author using company data. This document is authorized for use only by Matthijs Bredenoord in IFRS 2 [6314M0031] taught by Sanjay Bissessur, University of Amsterdam from Apr 2019 to Jul 2019. Downloaded by Marco Blanke ([email protected])