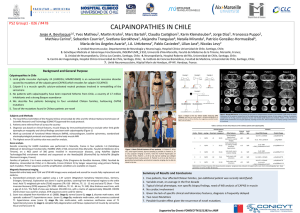

Universidad Politécnica de Guanajuato Proyecto Integrador Cultura de compra Mercadotecnia Estratégica Docente: Roció Gonzales Martínez Presenta: Jessica Estefania Alejos Velazquez 15030364 6°D Introducción In the next research, we want to know the habits of each country, compare it to culture as they distribute their money available to people in their respective country, as well as what they consume the most in each country. Three countries will be analyzed as they are Germany, Chile and China to give to knowing their habits at the time of buying The shopping culture GERMANY GERMANY: ARRIVING TO THE CONSUMER 1. Consumer profile Prosperous economic sectors New communication information technologies, banking, insurance, medical and chemical sectors. 2. Consumer behavior Each month the GFK Market Studies Institute publishes the consumer climate in Germany. German consumers are in the habit of buying by catalog and, increasingly, by Internet. The price and quality factor are decisive. The German consumer shows a great tendency to compare prices and to buy frequently in the "discount stores". It is influenced by the offers and does not hesitate to visit several points of sale to take advantage of the most attractive prices. This consumer has very strict selection criteria according to the type of product you want to buy. For durable consumer goods the criteria are, in this order, safety and quality, prestige, comfort, comfort and price. For the products of the day to day, the only determining criterion is the price. For the purchase of professional equipment, the preference for safety leads to purchasing criteria focused on quality, reliability, supplier tracking and after-sales service. The price is not one of the determining criteria in this type of products. On the contrary, for the smallest materials or the industrial material, the price factor is the one that is imposed. 3. Resort to credit by the consumer Consumer credit in Germany has grown very little in recent years. The reasons are diverse, although we can highlight the scarce economic growth of the moment, the persistent unemployment, the loss of consumer confidence, a culture contrary to indebtedness, among others. German consumers are the most cautious: 60% consult blogs and opinions before purchasing a product. And Canadians seem to be among the most impatient when it comes to shopping, 39% prefer to make their purchases quickly. CHILE Consumer profile Prosperous economic sectors Food products for animals, organic products, electronics, computers. The expanding market and growth of Chile has implied an explosion of consumer demand. Likewise, during the last years the improvement of living conditions has generated a rapid increase in spending on household appliances. Consumer confidence continued to rise during the first quarter of 2016, slowing the downward trend of the other Latin American economies. A progressive rise in real wages and a moderate increase in credit have sustained private consumption in 2016. Although price remains an important factor in purchasing decisions, quality, durability, technology, service to the consumer are also taken into account. client and service availability. In fact, it is said that Chile entered a "consumerism phase", in which consumption is perceived as a form of gratification and social status, beyond covering the needs of consumers. Market studies also suggest that environmental factors are increasingly important when choosing a product. In fact, it is pointed out that Chilean society is the most respectful of the environment in Latin America. Chilean consumers, heavily urbanized, have benefited from an increase in income and greater access to credit. Therefore, Chileans are not interested in basic needs the majority buy electronic goods, such as DVDs, mobile phones, music and computers. In fact, Chile is a leader in Latin America in terms of penetration of mobile phones and social networks (Facebook, Twitter). Digital goods and services, branded products and housing equipment have become part of the daily life of most Chileans. The increase in purchasing power also allows Chilean consumers to invest more in health and education. Another important element about the Chilean consumer is that the demographic growth of the country has slowed down. The average age was 33 years in 2014, and the largest population (60 years or older) should increase during the next ten years, generating opportunities in the "silver economy" (dedicated to retirees). INCOME OF A CHILEAN CONSUMER 26.8% of your income goes to a family for food. 14% is used to pay rent / dividend. 9.4% of the income to household equipment. 12.7% of revenues are destined to transport. 5.5% of your income goes to recreation. 5.5% of your income goes to health. CHINA Consumer goods (modern amenities, decoration, automobile, tourism), construction products and services (renovations, construction, etc.), high technology products and renewable energies. China is experiencing a consumer revolution, and foreign products that use marketing, advertising and advanced search techniques are at the forefront. The notoriety of the brand is increasingly important and sophisticated advertising begins to have a key role to attract the Chinese consumer. China is a "collectivist" society, where the group prevails over the individual. As a result, Chinese consumers "adjust" to the rules and rules of the group to which they belong. The great passion for golf that has emerged in recent years in China (1 million golfers) attests to the need for belonging to a group (the rich) and the consequent conformity of individuals to the expectations of that group. In this way, advertising in China is usually directed more to groups than to individuals. There is not one China, but many. The middle class represents around 240 million people - that is, 19% of the population, according to the Chinese Academy of Social Sciences. According to a more realistic estimate of the American firm McKinsey (which deals with the question of the middle class from the perspective of income and not of goods, as does the Academy of Social Sciences), 105 million Chinese urban households, spread mainly by The coastline, they could have more than 25,000 RMB per year in 2009. Again, according to McKinsey, the lower middle class could integrate 290 million people in 2011 and reach 520 million people in 2025. Currently, 120 million Chinese they still live on less than 1 USD per day. The Chinese consumer is very sensitive to brands. They also believe that the price is an indication of the quality of the product. The most important selection criteria are the price and the service of the sellers. On the contrary, the guarantee or the possibility of return of the products has less relevance. In general, the Chinese attach great importance to the search for information prior to the purchase of a product. Word of mouth is the main source of information. Chinese consumers like to see what's available, especially when it comes to foreign products. They are very curious about foreign products but still prefer the national ones. China is the largest market for global luxury brands, accounting for 47% of global sales of luxury consumer products. Historically, China is a country with a high rate of savings, one of the highest in the world. Consumer credit is developing but still limited In conclusion as we already see the form of purchase and spending money in three countries is different see to what your people gives more importance at the time of purchase. the differences are various but in the different cultures the basic products that are acquired are different.