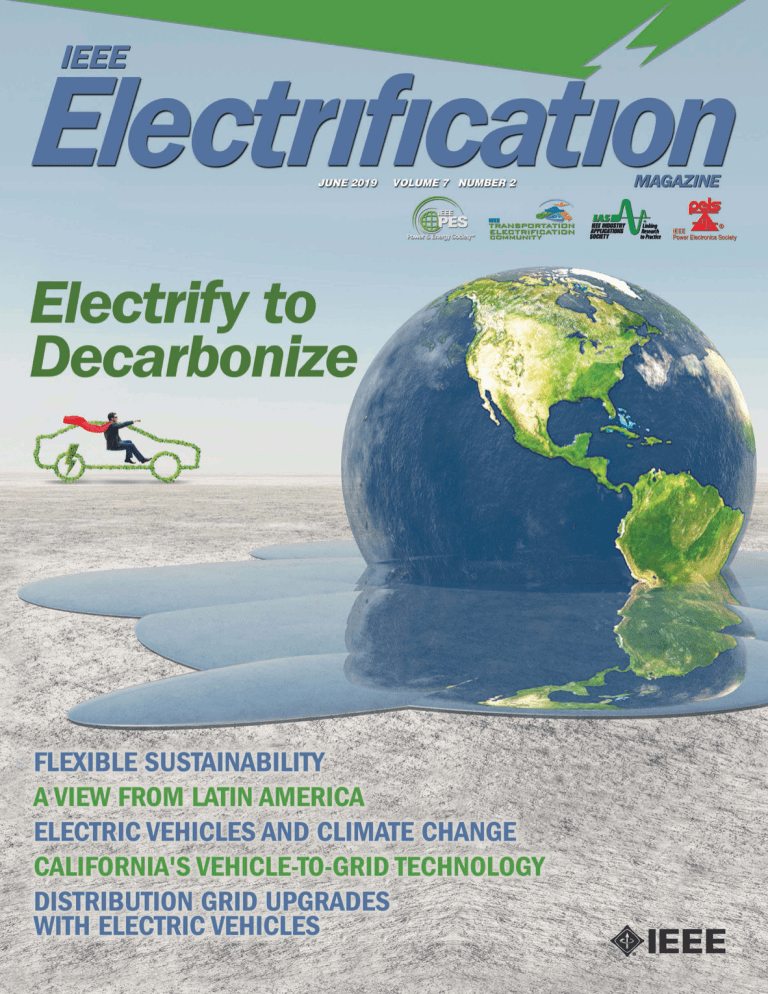

2019 IEEE PES GENERAL MEETING 4-8 AUGUST ATLANTA, GA USA Expect Uncertainty | Prepare to Adapt Join us for the 2019 PES General Meeting in Atlanta, Georgia R EGI STR AT ION I S NOW OP EN! The 2019 IEEE PES General Meeting will be held August 4-8, 2019, at the Hilton Atlanta in Atlanta, GA, USA The PES General Meeting attracts over 3,400 professionals from every segment of the electric power and energy industry. It features a comprehensive technical program with paper presentations, poster and panel sessions, tutorials, short courses, a number of technical tours, a student program and companion activities. As always, IEEE PES has put together an outstanding technical program, with Super Sessions addressing such topics as: • Resiliency and coping with uncertainty • Impact of High Penetration of Renewable Resources • Energy Storage • Risk-based Transmission Planning and Operation Don’t miss this spectacular event- make plans now to attend! We look forward to seeing you in Atlanta! IEEE PES – More Power to the Future TM For more information visit: pes-gm.org/2019 Digital Object Identifier 10.1109/MELE.2019.2916528 IEEE VOL. 7, NO. 2 JUNE 2019 ISSN 2325-5987 WWW.IEEE-PES.ORG/ MAGAZINE F E AT U R E S 12 Flexibility in Sustainable Electricity Systems 40 Multivector and multisector nexus perspectives. High value for capabilities beyond one-way managed charging. Eduardo Alejandro Martínez Ceseña, Nicholas Good, Mathaios Panteli, Joseph Mutale, and Pierluigi Mancarella 22 Electric Vehicles in Latin America Slowly but surely toward a clean transport. Jairo Quirós-Tortós, Luis Victor-Gallardo, and Luis (Nando) Ochoa 33 Electric Vehicles and Climate Change Potential Benefits of Vehicle-to-Grid Technology in California Jonathan Donadee, Robbie Shaw, Oliver Garnett, Eric Cutter, and Liang Min 46 Will Electric Vehicles Drive Distribution Grid Upgrades? The case of California. Jonathan Coignard, Pamela MacDougall, Franz Stadtmueller, and Evangelos Vrettos Additional contributions and improved economic justification. Hamidreza Nazaripouya, Bin Wang, and Doug Black D E PA R T M E N T S & C O L U M N S 2 5 57 60 64 ABOUT THIS ISSUE TECHNOLOGY LEADERS NEWSFEED DATES AHEAD VIEWPOINT The IEEE Smart Cities Initiative serves as a neutral broker of information among industry, academic, and government stakeholders. Page 59. Cover image: Realizing a carbon-free future for the planet will require flexible, sustainable energy systems. COVER IMAGES–GLOBE: ©ISTOCKPHOTO.COM/BESTDESIGNS CAR: IMAGE LICENSED BY INGRAM PUBLISHING MISSION STATEMENT: IEEE Electrification Magazine is dedicated to disseminating information on all matters related to microgrids onboard electric vehicles, ships, trains, planes, and off-grid applications. Microgrids refer to an electric network in a car, a ship, a plane or an electric train, which has a limited number of sources and multiple loads. Offgrid applications include small scale electricity supply in areas away from high voltage power networks. Feature articles focus on advanced concepts, technologies, and practices associated with all aspects of electrification in the transportation and off-grid sectors from a technical perspective in synergy with nontechnical areas such as business, environmental, and social concerns. IEEE Electrification Magazine (ISSN 2325-5897) (IEMECM) is published quarterly by the Institute of Electrical and Electronics Engineers, Inc. Headquarters: 3 Park Avenue, 17th Floor, New York, NY 10016-5997 USA. Responsibility for the contents rests upon the authors and not upon the IEEE, the Society, or its members. IEEE Operations Center (for orders, subscriptions, address changes): 445 Hoes Lane, Piscataway, NJ 08854 USA. Telephone: +1 732 981 0060, +1 800 678 4333. Individual copies: IEEE members US$20.00 (first copy only), nonmembers US$136.00 per copy. Subscription Rates: Society members included with membership dues. Subscription rates available upon request. Copyright and reprint permissions: Abstracting is permitted with credit to the source. Libraries are permitted to photocopy beyond the limits of U.S. Copyright law for the private use of patrons 1) those post-1977 articles that carry a code at the bottom of the first page, provided the per-copy fee indicated in the code is paid through the Copyright Clearance Center, 222 Rosewood Drive, Danvers, MA 01923 USA; 2) pre-1978 articles without fee. For other copying, reprint, or republication permission, write Copyrights and Permissions Department, IEEE Operations Center, 445 Hoes Lane, Piscataway, NJ 08854 USA. Copyright © 2019 by the Institute of Electrical and Electronics Engineers, Inc. All rights reserved. Postmaster: Send address changes to IEEE Electrificaton Magazine, IEEE Operations Center, 445 Hoes Lane, Piscataway, NJ 08854 USA. Canadian GST #125634188 PRINTED IN U.S.A. Promoting Sustainable Forestry Digital Object Identifier 10.1109/MELE.2019.2906626 SFI-01681 IEEE Elec trific ation Magazine / J UNE 2 0 1 9 ABOUT THIS ISSUE Electrify to Decarbonize By Manuel Avendaño XTREME WEATHER AND FAILURE TO MITIGATE AND adapt to climate change are the gravest threats facing the world, according to the World Economic Forum’s 2019 Global Risks Report. The year 2018 reminded us that climaterelated disasters—namely, storms, fires, and floods—are becoming more severe and happening more often. Meanwhile, the United Nations’ Intergovernmental Panel on Climate Change has issued a special report on the impacts of global warming of 1.5 °C above preindustrial levels, which could trigger more extreme events. In the United States, the National Climate Assessment, a report from 13 government agencies, described the far-reaching implications of climate change and concluded that “the evidence of human-induced climate change continues to strengthen and that impacts are increasing across the country.” In the southwest region of the United States (and California in particular), climate change is exacerbating the key factors that lead to wildfires: heat, drought, and tree-murdering insect outbreaks. According to the California Department of Forestry and Fire Protection, 10 of the 20 most destructive California wildfires have happened since 2015. The 2017 and 2018 wildfire seasons demonstrated the increasing threat of wildfires to California and led to what could be described as the first bankruptcy catalyzed by climate change. In January 2019, Pacific Gas and Electric Company, one of the largest energy companies in the United States, filed for bankruptcy protection, citing US$30 billion in potential liabilities from fire-related lawsuits. The cumulative evidence from the scientific assessment of climate change and its already palpable effects confirms that the predicted global climate crisis has materialized. Time is running out to implement a comprehensive climate-change response strategy and avoid irreversible impacts. Achieving a sustainable future requires integrated, practical, and cost-effective approaches pursued through broad-based partnerships with governments (local, state, federal, and tribal), businesses, organizations (including electric utilities), and individuals. E 2 EDITORIAL BOARD Iqbal Husain Editor-in-Chief North Carolina State University North Carolina, USA [email protected] Tamas Ruzsanyi Editor, Electric Trains Ganz-Skoda Hungary [email protected] Eduardo Pilo de la Fuente Editor, Electric Trains EPRail Research and Consulting Spain [email protected] Jose Conrado Martinez Editor, Electric Trains Directcion de Estrategia y Desarrollo Spain [email protected] Suryanarayana Doolla Editor, Microgrid Indian Institute of Technology Bombay India [email protected] Mohammad Shahidehpour Editor, Microgrid Illinois Institute of Technology Illinois, USA [email protected] Steve Pullins Editor, Microgrid GridIntellect Tennessee, USA [email protected] Antonello Monti Editor, Microgrid RWTH Aachen Germany amonti@eonerc .rwth-aachen.de Marta Molinas Editor, Electric Ships Norwegian University of Science and Technology Norway [email protected] Herb Ginn Editor, Electric Ships University of South Carolina South Carolina, USA [email protected] Robert Cuzner Editor, Electric Ships University of Wisconsin-Milwaukee Wisconsin, USA [email protected] Chris Searles Editor, Electric Vehicles BAE Batteries Wisconsin, USA Chris.Searles@ baebatteriesusa.com Silva Hiti Editor, Electric Vehicles Rivian California, USA [email protected] Eduard Muljadi Editor, Electric Vehicles Auburn University Alabama, USA [email protected] Syed A. Hossain Editor, Electric Planes GE Aviation Ohio, USA [email protected] Kaushik Rajashekara Editor, Electric Planes University of Houston Texas, USA [email protected] Babak Nahid-Mobarakeh Editor, Electric Planes University of Lorraine France [email protected] Bulent Sarlioglu Editor, Electric Planes University of Wisconsin-Madison Wisconsin, USA [email protected] IEEE PERIOD IC ALS MAGAZINES DEPARTMEN T 445 Hoes Lane, Piscataway, NJ 08854 USA Mark Gallaher Managing Editor Geri Krolin-Taylor Senior Managing Editor Janet Dudar Senior Art Director Gail A. Schnitzer Associate Art Director Theresa L. Smith Production Coordinator Felicia Spagnoli Advertising Production Manager Peter M. Tuohy Production Director Kevin Lisankie Editorial Services Director Dawn M. Melley Staff Director, Publishing Operations ADVERTISIN G SALES Erik Henson Naylor Association Solutions Tel: +1 352 333 3443 Fax: +1 352 331 3525 [email protected] Digital Object Identifier 10.1109/MELE.2019.2906628 Date of publication: 11 June 2019 Khwaja Rahman Editor, Electric Vehicles General Motors Michigan, USA [email protected] IE E E E l e c t r i f i c ati o n M agaz ine / J UN E 2019 Digital Object Identifier 10.1109/MELE.2019.2906627 ELANTAS is Your Solution Provider for Hybrid and Electric Vehicles Increasing expert consensus shows that electrification of energy end uses—transport, heating and cooling, industry processes, and others—will be crucial to reach carbonemission goals and mitigate climate change. A holistic view is required to combine energy carriers (electricity, thermal sources, and fuels) with infrastructures, such as transportation, water, and data networks, to achieve sustainable decarbonization based on the integration of energy systems. In this issue, with the theme “Electrify to Decarbonize,” researchers, industry professionals, and policy makers from the global electricity sector provide insights into how electrification can help other sectors and consumers decarbonize in the context of a rapidly evolving, digital world. The issue includes broad-perspective and case-study articles covering such topics as the climate–energy nexus, frameworks for utility-driven and policy-based electrification, grid scenarios for reducing greenhouse gas emissions, and the electrification of end-use services in the transportation, building, and industrial sectors. The articles focus on advanced concepts, technologies, and practices associated with electrification in a decarbonized future from a technical perspective as well as on how to address business, environmental, and social concerns. This issue begins with the “Technology Leaders” column “The Drive to Zero” by Heather Tomley of the Port of Long Beach, which has set a goal for zero-emissions operations by 2035. This article highlights six landmark electrification projects at the second-busiest seaport in the United States. The contribution also underscores the effectiveness of broadbased partnerships for leveraging investments in innovative electricity ventures. The first project includes testing more than 100 pieces of zero-emissions equipment and trucks, developing a nearzero-emissions tugboat, and deploying two of the cleanest vessels available. The second project represents the largest demonstration and deployment in the United States of zeroemissions cargo-handling equipment at a single port. The third project has three core components: establishing an electric vehicle (EV) charging infrastructure; developing software to identify, estimate, and forecast the costs and requirements of establishing and operating zero-emissions terminals; and installing the world’s first dc fast-charging system in a seaport environment. The goal of the fourth project is to develop a microgrid capable of isolating from the grid and protecting terminal operations against grid failures and related losses and damage. The fifth project focuses on demonstrating three battery-electric top handlers, tested for the first time, as well as testing to compare the performance of a hydrogen fuel cell yard truck with a battery-electric yard truck. The sixth project involves the development of an economical, realistic road map to EV planning for the Port and its supplychain partners. Insulating Films Impregnating Materials, Conformal Coatings, Encapsulation and Potting Resins for use in Motors Chargers Power Electronics Battery Packs Celebrating 100 Years of Innovation ELANTAS PDG, Inc. • 5200 North Second Street, St. Louis MO 63147 • 314-621-5700 ELANTAS PDG Olean • 1405 Buffalo Street, Olean NY 14760 • 716-372-9650 [email protected] • www.elantas.com IEEE Elec trific ation Magazine / J UNE 2 0 1 9 3 ABOUT THIS ISSUE The comprehensive electrification of port operations in the United States dovetails with the multivector vision of energy flexibility being pursued in the Eastern Hemisphere. In “Flexibility in Sustainable Electricity Systems,” by Eduardo Alejandro Martínez Ceseña, Mathaios Panteli, and Mathaios Panteli of the University of Manchester; Nicholas Good of Upside Energy Ltd.; and Pierluigi Mancarella of the University of Melbourne, a holistic approach to combining energy carriers with an existing energy infrastructure is described. This article is a call to action to rethink the role and value of flexibility in the operation of the energy sector to leverage available resources and strategic investments for the provision of services. The remainder of the issue is focused on another key electrification front: EVs that charge from an increasingly clean electric grid to help decarbonize the transportation sector. An assessment of the electrification of light-duty EVs in developing economies is offered in “Electric Vehicles in Latin America” by Jairo Quirós-Tortós and Luis Victor-Gallardo, both of the University of Costa Rica, and Luis (Nando) Ochoa of the University of Melbourne. This article provides an overview of financial and nonfinancial incentives for EVs in Latin America, hurdles for the deployment of a public charging infrastructure, and quantification of public charging stations available in Mexico, Central America, and South America. The authors also present a methodology developed in Costa Rica to define locations for fast-charging stations and the results of an economic assessment that sheds light on why the pace of EV adoption in Latin America is so slow. Latin American countries may tap into the accelerating vehicle electrification efforts taking place in California to develop their own 4 I E E E E l e c t r i f i cati o n M agaz ine / J UN E 2019 pathway to decarbonize the transportation sector. For example, in “Electric Vehicles and Climate Change,” Hamidreza Nazaripouya of the University of California, Riverside, and Bin Wang and Doug Black of Lawrence Berkeley National Laboratory describe the potential value streams of EVs for owners, fleet aggregators, electric utilities, and transmission system operators. Their article investigates the economic justification of EVs and their deployment, taking into consideration the grid services provided by EVs to improve reliability, security, and resilience. The potential benefits of vehicleto-grid (V2G) technology for California’s customers are examined in “Potential Benefits of Vehicle-to-Grid Technology in California” by Jonathan Donadee and Liang Min of the Lawrence Livermore National Laboratory and Robbie Shaw, Oliver Garnett, and Eric Cutter of Energy and Environmental Economics, Inc. The results of their modeling indicate that the grid value of deploying EVs with bidirectional charging and discharging capabilities can be more than four times that of one-directional flow EVs at specific locations. This article finds that relaxing limits on discharging the battery of EVs would increase the electric grid value of V2G by 32%, but the energy discharged would also increase by 47%. The findings encourage more research and analysis to determine whether the additional battery wear and tear offsets the benefits of V2G for vehicle owners. Support for electrification in transportation should also be evaluated through the lens of the electric utility. This is the perspective of “Will Electric Vehicles Drive Distribution Grid Upgrades?” by Jonathan Coignard and Evangelos Vrettos of Lawrence Berkeley National Laboratory, Pamela MacDougall of the Natural Re_ sources Defense Council, and Franz Stadtmueller of Pacific Gas and Electric Company. The article offers a thorough analysis of the impact of EV charging on 39 real-world distribution feeders in Northern California. The results are then extrapolated for a larger set of more than 1,000 residential feeders within the service area of Pacific Gas and Electric Company and used to determine whether the increase in EV load will require system upgrades, e.g., direct control measures or indirect control mechanisms, such as economic incentives. The analyses are based on actual distribution feeder models used in regular utility operations. This issue is rounded out with the “Viewpoint” column, “Southern California Edison’s Blueprint for Integrated Electrification” by Manuel Avendaño and Devin Rauss of Southern California Edison. The column outlines the utility’s integrated approach to decarbonize the electric power sector and transition fossilfuel-dependent sectors to clean electric power in California. This systematic approach, known as the Clean Power and Electrification Pathway, calls for the following by 2030: 80% carbon-free electricity, more than 7 million EVs (including light, medium, and heavy duty) in use, and the electrification of space and water heating for almost a third of buildings. This blueprint, if followed, will help reduce the threat of climate change and improve public health related to air quality. This issue on electrifying to decarbonize would not have been possible without the hard work from the dedicated authors who developed insightful and well-written articles. Special thanks to Editor-in-Chief Iqbal Husain for his kind guidance and unwavering support. We trust this special issue of IEEE Electrification Magazine will excite readers about the endless opportunities for integrated electrification and motivate them to join the cleanenergy revolution. TECHNOLOGY LEADERS The Drive to Zero By Heather Tomley HEN THE PORT OF LONG Beach (POLB) in California adopted the Green Port Policy in 2005, it made a permanent commitment to sustainability and reducing pollution from all sources associated with port-related operations at the complex that sits at the edge of the greater Los Angeles area on the U.S. West Coast. The policy set the stage for aggressive clean air programs, the success of which has led to today’s transformational drive toward a zero-emissions port. Today, the POLB is at the forefront in establishing such policies. With our largest deployment of clean air technologies to date, we are moving as swiftly as possible toward the full integration of advanced technologies into ships, trucks, trains, off-road equipment, and small harbor craft. The key to closing the gap is eliminating harmful emissions from heavy-duty trucks and off-road cargohandling equipment, which operate around the clock at the secondbusiest container seaport in the United States. The POLB, along with the Port of Los Angeles, has set goals for transitioning all terminal equipment to zero emissions by 2030 and transitioning all on-road trucks calling at the Port to zero emissions by 2035. W Digital Object Identifier 10.1109/MELE.2019.2906629 Date of publication: 11 June 2019 2325-5987/19©2019IEEE The goals are outlined in the guiding document for the neighboring Southern California ports of Long Beach and Los Angeles—the 2017 Clean Air Action Plan (CAAP) Update. The plan also sets targets for combating global warming and climate change by reducing greenhouse gases (GHGs) to 40% below 1990 levels by 2030 and 80% below 1990 levels by 2050. Similar to clean air initiatives that have already resulted in unprecedented reductions of diesel particulate matter (DPM), nitrogen oxides (NOx), and sulfur oxides (SOx), it is a tall order the Port cannot fulfill by itself. The cost of going fully zero emissions is estimated at US$7–14 billion, and the challenges include developing commercialized technology (i.e., reliable, clean equipment and vehicles that can withstand the demanding, real-world operations of a busy port) and ensuring that the infrastructure for alternative power and fuel is prepared to keep the machinery running. Although the Port is technology neutral, many of its current efforts focus on electricity because most recent advances for port-related equipment have involved battery and plug-in technologies. Consequently, the demand for electricity is projected to quadruple, making energy planning, management, and resilience a priority. Pooling resources and know-how is the Port’s path forward, exemplified by its robust fundraising for grants to pursue large-scale demonstrations of zero-emissions equipment and advanced energy systems. At the same time, the POLB is committed to ensuring that California’s interconnected system of trade, which accounts for one-third of the state’s economy in the form of more than 5 million jobs and US$740 million in gross domestic product, remains competitive and continues to thrive. The partnerships we have developed and continue to build on over the years are more critical today than ever. Lasting progress occurs when the manufacturers that make the equipment and the terminal operators and trucking companies that purchase and use the equipment work together toward clean air solutions that make sense commercially. This article describes in detail the six recently launched projects the POLB is pursuing along with a variety of partners and stakeholders. The projects are key components of efforts to develop the near-zero- and zero-emissions technology that will allow the Port to meet its goals. Partnering Toward Zero The Port recently secured nearly US$80 million in matching grants from the California Energy Commission (CEC) and the California Air IEEE Elec trific ation Magazine / J UNE 2 0 1 9 5 TECHNOLOGY LEADERS to zero emissions and its expertise in maximizing available resources and collaborating with private and public sector partners. These projects—all of which focus on meeting regional and statewide clean air sustainability goals, balancing them with the operational needs of the maritime and goods movement industries, and serving as models for other seaports, industries and communities—are the epicenter of how we get to zero. Figure 1. A diesel yard tractor at the Pier J container terminal. Kalmar tractors like this will be part of the test of battery-electric engines versus fuel-cell engines. Figure 2. Kalmar yard tractors with battery-electric engines will be part of the demonstration projects. Resources Board (CARB) to move ahead with six transformative projects. All of these involve multiple private and public partners contributing significant resources as well as researchers and consultants who will collect and analyze data and report their results. Each project has a rigorous testing and data collection period of at least three months. Participants include all of the Port’s six container terminals (container cargo represents 75% of the Port’s business). Southern California Edison (SCE), the Port’s local electric utility, is a partner on five projects. The roster of participants draws on global and regional expertise in 6 I E E E E l e c t r i f i cati o n M agaz ine / J UN E 2019 international trade; labor; transportation; manufacturing; engineering; sustainability research; and energy resource planning, analysis, and forecasting. Education outreach and workforce development are also components of all six projects. Each project will be evaluated in terms of its benefits to adjacent commercial, industrial, and residential zones. Areas include neighborhoods disproportionately impacted by emissions and traffic associated with port operations, known as disadvantaged communities. The level of grant support shows how far the Port has come in terms of the depth and breadth of its drive Sustainable Terminals Accelerating Regional Transformation Project The Sustainable Terminals Accelerating Regional Transformation (START) project is the largest in terms of reach and scope. With a US$50 million grant from CARB, the US$102 million project involves testing more than 100 pieces of zero-emissions equipment and trucks at three California seaports: Long Beach, Oakland, and Stockton. The project will also develop a near-zero-emissions tugboat, deploy two of the cleanest ships to call on the West Coast, and advance workforce development programs to support sustainable goods movement. SCE will play a lead role, and private sector partners will demonstrate the equipment across the intermodal network, including a full near-zero/ zero-emissions supply chain at Long Beach’s Pier C in partnership with ocean carrier Matson Navigation Company and terminal operator SSA Marine. Specifically, the project will test 33 battery-electric yard tractors (Figures 1 and 2), one battery-electric top handler, 16 8,000-pound batteryelectric forklifts, 10 battery-electric 400-hp class-8 trucks, nine electric rubber-tired gantry (e-RTG) cranes, and one all-electric rail car mover, all of which will validate the potential to convert fleets of vehicles to zero emissions and retain fully operational capabilities. Additionally, 18 36,000-pound battery-electric forklifts, five battery-electric 500-hp class-8 trucks, and two battery-electric top handlers will be deployed to test improved performance capability at scale. Lastly, the demonstration will leverage some of the cleanest vessels available: two tier-three ships and one near-zero-emissions tierfour electric-drive tugboat. Important firsts at Long Beach include the largest fleet of conventionally operated zero-emissions yard tractors at a single port and the first deployment of tier-three low-NOx oceangoing vessels on the West Coast. Other maritime and goods movement partners are tugboat operator Harley Marine, trucking company Shippers Transport Express (a subsidiary of SSA Marine), Nichols Brothers Boat Builders, and General Dynamics NASSCO. Original equipment manufacturers (OEMs) include DINA, Taylor Machine Works Inc., Peterbilt Motors Company, Wiggins Lift Company Inc., and Nordco Inc. Engineering, and the technology partners are TransPower, Cavotec, BYD Motors Inc., Thor Trucks, and Robert Allan Ltd. START Yard Tractors and Trucks DINA yard tractors and Peterbilt class 8 trucks will be equipped with stateof-the-art TransPower technology that increases efficiency, reduces energy consumption, and extends the operating life of the vehicles. TransPower’s features include xx automated manual transmission software that regulates shifting xx onboard inverter-charger units that improve reliability xx the Cell-Saver Battery Management System, which better regulates battery usage and recharging xx the power control and accessory system, which combines hundreds of components into a single, easy-to-install assembly. START Top Handlers Taylor’s top handler will feature BYD’s lithium-iron-phosphate batteries with improved safety features and long life cycles. The equipment reflects BYD’s ongoing collaborative efforts involving electric motors, power drive systems, batteries, and other specialized components, which are designed to meet end users’ precise, optimized capacities, torques, and other specifications. START Vessels Harley Marine, a tugboat operator, has designed and engineered an innovative propulsion and electrical generation system that dramatically reduces diesel consumption during standard operation. Exceeding the cleanest-available standard of tier four, the diesel-electric hybrid system for a tug features six Caterpillar C32 diesel engine generators (994 kW, 1,332 hp, and tier four), a power management system, two variable-frequency drives, two electric propulsion motors, and two azimuth drives. The electric-drive tugboat utilizes shared load capability, operating on one engine during low-speed transit and on additional engines only as needed, thus cutting diesel consumption by more than half compared to that of conventional tugs. Because it can run exclusively on electricity, the electricdrive system also creates a model operating system for integrating battery technology. Matson is investing nearly US$1 billion to modernize its Hawaii service, including two of the largest container ships ever built in the United States and two tier-three low-NO x ships (Figure 3). The engines will be equipped with selective catalytic reduction (SCR) technology with urea injection and exhaust gas recirculation (EGR). While SCR and EGR are standard components of tier-three engines for land applications, this will be the first application for marine engines used in West Coast operations. START Infrastructure START also involves building charging infrastructure. Seven charging stations will be installed for this project, with five directly adjacent to Shippers Transport Express and two at the Clean Trucks Program Terminal Access Center. The latter will be the first publicly available heavy-duty truck charging stations in the South Coast Air Basin. Oakland and Stockton will manage installation of charging infrastructure at their respective ports. The START project is part of California Climate Investments, a California-wide initiative investing billions of cap-and-trade dollars into reducing GHGs, strengthening the Figure 3. The Matson Shipping Company’s newest ship, the Daniel K. Inouye, is the largest container ship ever built in the United States. The only tier-three container ship to call regularly at the POLB, it is part of the START project for a near-zero supply chain centered at POLB’s Pier C. IEEE Elec trific ation Magazine / J UNE 2 0 1 9 7 TECHNOLOGY LEADERS from rubber with inlaid steel reinforcement, which lies over a channel cast in the dock. Zero-Emissions Yard Tractors ITS will work with BYD to deploy seven all-electric yard tractors. The LBCT will deploy an additional five battery-electric yard tractors, for a total of 12 units in the demonstration. Two yard tractors will be compatible with an automated “smart” yard tractor charging system to test the fast, large-scale charging system needed to transition the fleet to zero emissions. Figure 4. Diesel-powered RTG cranes at Pier J at the POLB. Cranes like these will be retrofitted to run on electricity. These will stack and sort cargo in the container yard. economy, and improving public health and the environment. Under the workforce development component, the Port will share lessons learned with Long Beach City College (LBCC) and the Long Beach Unified School District and support related education and workforce programs with school districts and community colleges in Oakland and Stockton. The project is due to be completed by June 2021. Zero-Emissions Terminal Equipment Transition Project With a US$9.7 million grant from the CEC, this US$13.7 million project involves 25 pieces of new and repowered off-road cargo-handling equipment and trucks. The total includes nine e-RTGs being repowered at Pier J and four liquefied natural gas (LNG) fuel drayage trucks equipped with plug-in hybrid technology. The project represents the nation’s largest demonstration and deployment of zero-emissions cargo-handling equipment at a single port. The Port is partnering with three terminal operators to test the equipment: International Transportation Service (ITS) at Pier G, Long Beach Container Terminal (LBCT) at Middle Harbor, and Pacific Container Terminal 8 I E E E E l e c t r i f i cati o n M agaz ine / J UN E 2019 Zero-Emissions Hybrid-Electric Trucks (operated by SSA Marine) at Pier J. Other partners include drayage trucking company Total Transportation Services, Inc. (TTSI); OEM partners and technology vendors Cavotec, BYD, and U.S. Hybrid Corporation; and SCE and natural gas provider Clean Energy Fuels Corporation. TTSI will work with US Hybrid to repower four underpowered 9-L Class 8 drayage LNG trucks. US Hybrid will convert the underutilized trucks to plug-in hybrid electric and use geofencing to operate in zero-emissions mode within the Port. Those same trucks will still be able to run on natural gas, with extended-range LNG capability. Zero-Emissions RTG Cranes Zero-Emissions Infrastructure SSA Marine is working with Cavotec to repower nine existing ZPMC diesel-electric RTGs—the nation’s largest deployment of fully electric RTGs—by replacing their onboard diesel engines with a grid-connected electric conversion system and a battery package that enable disconnection from the grid and blocks changing during normal operations. (Figure 4). While grid-connecting equipment is not new, Cavotec provides an innovative motorized cable management system that ensures reliable delivery of power, data, and communications. By locating the feed point for the cable in the center of the container block, the technology allows the e-RTG to move in both directions from the feed point. The cable reels are located underground in Cavotec’s Panzerbelt, a cable protection system incorporating a continuous semiflexible belt fabricated SCE will work with the Port to complete approximately US$3.45 million in infrastructure upgrades to provide power to 24 charging points for the electric yard tractors and electrical infrastructure that support the e-RTGs. SCE is building the infrastructure for the charging points (with a total load of 5 MVA) on the west side of Pier G, with service from a local SCE substation. Features include two pad-mounted switches, one pad-mounted capacitor bank, and two 2,500-kVA transformers (12– 480 kV) as well as a meter cabinet, conductor, and six slab boxes. SCE is also designing, installing, and maintaining the electric infrastructure for powering the e-RTGs. Its infrastructure will include a new 12-kV circuit in an existing wharf substation, a new pad to house 12-kV switchgear, a new four-way remoteactuated gas switch, a vault upgrade, and three new meters. SCE will distribute the two 12-kV circuits to two new substations near the proposed e-RTG stacking runs. These substations would transform the 12 kV to 4,160 V and then distribute the 4,160 V circuits to two termination points—one for each RTG stacking run—for a total of four 4,160-V termination points. SSA Marine will be connecting the e-RTGs to the grid at these points. The project includes a first-inthe-nation battery package replacing the onboard auxiliary diesel engines allowing the e-RTGs to unplug from the grid and move from one container stack to another during normal operations. The package will be contained within a 20-ft cargo container. Ten battery-electric yard trucks will use 200-kW charging stations from BYD. The project will install six of these chargers at a central location on Pier G for ITS and four at Middle Harbor for the LBCT. Although there will initially be only six at Pier G for ITS, the new infrastructure being installed by SCE will support up to 20. These high-powered chargers will enable the terminals to overcome a key barrier to widespread market adoption of zero-emissions technologies, i.e., the ratio of charge time to operating time, so that yard trucks can meet the real-world minimum requirements of two shifts per day. Under a separate funding stream, ITS and the LBCT will each install a 100-kW “smart charger,” supporting the fast, large-scale charging system while transitioning its fleet to zero emissions. Innovations include charging “arms,” which intelligently engage with a properly modified yard tractor and disengage when charging is complete. The plug-in hybrid trucks will be equipped with onboard chargers. TTSI will also install two transformerequipped charging stations, where the trucks can plug in and recharge. The trucks will be able to refuel at TTSI’s on-site LNG fueling stations as well as at nearby Clean Energy, which offers Redeem, the first commercially available LNG vehicle fuel. The workforce development component of the Zero-Emissions Terminal Equipment Project will assess the existing skills of the region’s workforce and expand training programs for jobs that support the Port’s transition to zero-emissions equipment. The Port’s partners are LBCC and the International Brotherhood of Electrical Workers (IBEW). The project is due to be completed in late 2020. Port Advanced Vehicle Electrification Project The Port Advanced Vehicle Electrification Project (PAVE) focuses on strategic, cost-effective solutions for future deployments of charging and alternative fuel infrastructure in zero-emissions cargo-handling equipment. Total Terminals International (TTI), SCE, TransPower, and the IBEW are among the partners. Others include ChargePoint, Inc., a leading electric vehicle (EV) charging network; Kalmar Global, a leading terminal tractor OEM; the Electric Vehicle Infrastructure Training Program, an industryled training program; the South Coast Air Quality Management District, the region’s air quality regulatory agency; the Electric Power Research Institute (EPRI); and Ramboll, a leader in sustainability engineering. With a US$8 million grant from the CEC, the US$16.8 million project has three core components: xx installing sufficient electrical infrastructure to support up to 39 charging stations in the future xx developing software to identify, estimate, and forecast the costs and requirements of establishing zero-emissions terminals and advanced energy operations xx installing the world’s first dc fastcharging system in a seaport environment. The project supports the first phase of transition to a zero-emissions future at the Port’s largest container terminal, Pier T, operated by TTI. PAVE Dynamic Energy Forecasting Tool The Port, Ramboll, port tenants, EPRI, and SCE are developing a first-ever flexible software tool known as the Dynamic Energy Forecasting Tool (DEFT). DEFT will allow the Port to evaluate the impact of new electrical equipment on the existing port electrical infrastructure and assess where electrical and refueling infrastructure upgrades may be required. DEFT will also analyze how a combination of energy efficiency measures, energy storage, flexible charging times, and other steps could help the Port and its tenants avoid costly infrastructure upgrades. The software will be adaptable and customizable to account for changing assumptions unique to specific tenants and operators. The POLB will make DEFT available to other ports and terminal operators and offer training to better guide planning and infrastructure deployments for others transitioning to zero emissions. PAVE Infrastructure The PAVE infrastructure will be based at TTI’s Pier T facility, where the Port estimates full electrification of all vehicles and cargo-handling equipment could require more than 85 MVA of instantaneous power demand, excluding any load management technologies. As such, the project incorporates an array of technology and software solutions to help the Port and its tenants intelligently and efficiently deploy zeroemissions freight vehicles and equipment. Based on TTI’s current and future plans for battery-electric yard hostlers and forklifts, PAVE will install electrical infrastructure and “stubouts” supporting up to 39 charging stations at Pier T. Fast Charging Long Beach will be the world’s first port to deploy and demonstrate a IEEE Elec trific ation Magazine / J UNE 2 0 1 9 9 TECHNOLOGY LEADERS combined charging system/1.0-dc fastcharging system, i.e., the ChargePoint Express Plus, for heavy-duty, zeroemissions cargo-handling equipment. ChargePoint will provide four 240-kW Express Plus dispensers and six 160-kW power blocks, deployed so that each dispenser can deliver up to 240 kW of power simultaneously to four yard hostlers equipped for dc fast charging. The system incorporates a scalable modular design capable of accommodating different power requirements, charging standards, and site and capacity constraints. It is designed to last more than 12 years to match the average yard hostler replacement cycle. The Express Plus also uses dc power, which means all ac-to-dc conversions happen not on the hostler but within the charging system, with much faster charging times. Utilizing dc fast charging could ultimately help eliminate the use of onboard equipment chargers, which is expected to reduce the price of the proposed electric yard hostlers (currently twice as expensive as their diesel counterparts) and potentially increase the battery capacity of battery EVs and equipment. This would be highly beneficial in rigorous port duty cycles, which involve up to three shifts per day with only a limited time to recharge, and help promote widespread deployment of zero-emissions technologies. Energy Storage ChargePoint’s fast-charging dispensers will be integrated with a 384-kWh/375-kW ac-connected energy storage system and controller. The system uses Nissan Leaf battery technology. Known as grid-saver containerized energy storage (CES), the system will support operation of the dc fastcharging system and enable the Port and SCE to test energy storage as a way to shave capacity requirements, reduce energy costs, and increase reliability. Grid-saver CES incorporates nickel manganese cobalt lithium-ion battery technology and a compact, high-efficiency inverter packaged in a 10 I E E E E l e c t r i f i cati o n M agaz ine / J UN E 2019 portable, climate-controlled 20-ft shipping container rated for seaside atmospheric conditions. The PAVE project supports emerging connector standards, vehicle grid standards, enhanced grid reliability through real-time communication with utilities, and opportunities for Port terminals to participate in demand-response programs. PAVE is due to be completed by March 2022. Microgrid Project The Port’s Microgrid Project focuses on energy resilience for critical infrastructure. With a US$5 million grant from the CEC, the US$7.1 million project involves developing a system of on-site power generation, storage, and controls, capable of isolating from the grid and protecting terminal operations against grid failures and related losses and damages. The project will be based at the Port’s Joint Command and Control Center (JCCC), a state-of-the-art facility that houses the Port’s Security Division and Harbor Patrol operations. The JCCC also serves as an interagency base for joint operations with the Long Beach Police Department, Port of Los Angeles, U.S. Coast Guard, U.S. Customs and Border Protection, and Marine Exchange of Southern California, which tracks arrivals and departures of all ships from Port Hueneme to San Diego. Schneider Electric will design, engineer, construct, and commission the microgrid. The project entails installing a 300-kW solar carport, an energy control center with microgrid controls, and a 330-kW stationary battery energy storage system. The project includes a 250-kW microgridextending mobile battery energy storage system that can be dispatched around the Port in lieu of diesel generators in case of outages. The JCCC was chosen because it is a critical facility that the Port wants to make more resilient, equipped with skilled staff who are able to operate the microgrid. Other technical partners include SCE, the CEC, EPRI, the U.S. Department of Energy National Renewable Energy Laboratory (NREL), and the Advanced Power and Energy Program of the University of California, Irvine. Paid on-the-job apprenticeships during construction, as well as outreach to share project information with ports and community colleges throughout California, are part of the workforce development component. Outreach will include a “lessons learned” document designed to support the replication and commercialization of the system at other seaports, critical facilities, and operational centers of similar size. Partners include the IBEW, LBCC, and California community colleges. The Port’s microgrid is expected to be operational and ready for its 12-month demonstration by mid-2020. The Commercialization of the POLB Off-Road Technology Project The Commercialization of the POLB Off-Road Technology (C-PORT) project combines the demonstration of three never-before tested battery-electric top handlers and the head-to-head testing of a hydrogen fuel-cell yard truck with a battery-electric yard truck. A US$5.3 million CARB grant supports this US$8.3 million demonstration. Testing will be conducted at two container terminals: SSA Marine at Pier J and the LBCT’s Middle Harbor. Partners include CARB, BYD, Kalmar, TransPower, Taylor, the International Longshore and Warehouse Union, hydrogen provider Air Products, fuelcell provider Loop Energy Inc., truck manufacturer China National Heavy Duty Truck Group Company/Sinotruck UQM, and engineering and data consultant Tetra Tech. C-PORT Top Handlers BYD’s battery-electric top handlers featuring its highly stable battery will be the first precommercial demonstration of an electrified top handler vehicle. The deployment also represents a unique collaboration with manufacturers working together to streamline procurement and integration so that electric motors, power drive systems, batteries, and other specialized vehicle components are built to precise and optimized capacities, torques, and other specifications. If successful, the demonstration could save an operator billions of dollars because top handlers are critical and unique pieces of equipment for container management; other ports and goods movement industries could realize this benefit as well. C-PORT Battery-Electric Yard Truck TransPower will outfit the industry’s popular Kalmar yard truck with the same technology being tested in the START project. TransPower’s technology will also incorporate a specially designed, heavy-duty, hightorque, electric fifth-wheel arm capable of rapidly engaging and disengaging for high-capacity yard truck operations (i.e., 40–50 engage/ disengage events per shift). The truck will use a space-saving battery pack customized for Kalmar’s yard trucks, accommodating steps on both sides of the tractor so that operators can climb into the cab more easily and safely. C-PORT Fuel-Cell Yard Truck UQM technologies, in collaboration with Loop Energy Inc., will demonstrate the first and only fuel-cell yard truck in development. Utilizing hydrogen fuel eliminates “range anxiety,” commonly associated with battery EVs, as well as the need for using traditional fueling methods. Loop’s precommercial eFlow hydrogen fuelcell system uses a proprietary design that removes 30–40% of the capital cost of traditional fuel cells. Loop achieves this reduction through uniform oxygen dispersion across the entire active area of the fuel cell, thereby increasing power production per unit of area by up to 40%. Loop’s proton exchange membrane fuel cells are the first to create uniform current density across the cell, maximizing power production per unit area, enhancing hydrogen-to-electricity conversion efficiency, and increasing fuel-cell durability. Project information will be integrated into the coursework at the Port-sponsored Academy of Global Logistics at Cabrillo High School in Long Beach to support education and workforce development for port technologies. Other education partners include LBCC, the Center for International Trade and Transportation at California State University, the City of Long Beach, and community-based environmental organization Green Education, Inc. C-PORT is due to be completed in 2020. Port Community EV Blueprint The Port Community EV Blueprint (PCEVB) focuses on developing a comprehensive plan that identifies the path toward zero emissions and charts an economical, realistic approach to EV planning for the Port and its supply chain partners. The EV-specific road map is also being developed as a resource for other California ports. The US$375,000 project is partly funded with a US$200,000 CEC grant. In addition to the CEC, SCE, and NREL, project partners are the Pacific Merchant Shipping Association, an independent trade association representing terminal operators and ocean carriers, and the City of Long Beach Office of Sustainability. The process will engage multiple business, utility, and residential stakeholders. The blueprint will cover all aspects of zero-emissions planning and transformation, including concrete actions and milestones for transitioning marine terminals, heavy-duty drayage trucks, and visitor facilities (i.e., hotels, commercial centers, and cruise ship terminals) to emissions-free operations. In addition to evaluating equipment and vehicle fleet conversion, it will address plans for energy manage- ment and resilience in critical infrastructure and the broader implications of moving to zero emissions for adjacent commercial, industrial, and residential zones, including disadvantaged communities. The PCEVB is being developed to help the Port and its partners navigate the complexities and time frames for achieving the Port’s zeroemissions goals without incurring excessive costs or disrupting economic activity. Specific tasks include xx analyzing technologies and systems that potentially offer the best mix of economic, environmental, and technical performance specific to the region xx identifying factors, including the existing wealth of vehicle usage and driving pattern data, to determine optimal locations for EV charging infrastructure xx creating maps of proposed and existing charging sites in the harbor district that also have accessibility to travel routes xx comparing and/or developing the analytical tools, software applications, and data needed to improve future planning activities xx assessing the effects of EV charging on utility rates and whether special rates may be needed to minimize financial impacts on terminals, which are already significant energy consumers xx evaluating financial and business models and collaborative strategies for creating EV-ready communities, including opportunities for financing, grants, and incentives (public and private), allowing equipment owners and manufacturers to accelerate the deployment of EVs and charging infrastructure xx developing outreach strategies, including materials such as journal articles, webinars, and conference presentations, and expanding support by education (continued on page 59) IEEE Elec trific ation Magazine / J UNE 2 0 1 9 11 MAN WITH LIGHTBULB—©ISTOCKPHOTO.COM/Z_WEI, ENERGY SET ON TRAY—©ISTOCKPHOTO.COM/ROCCOMONTOYA By Eduardo Alejandro Martínez Ceseña, Nicholas Good, Mathaios Panteli, Joseph Mutale, and Pierluigi Mancarella Flexibility in Sustainable Electricity Systems Multivector and multisector nexus perspectives. S ENVIRONMENTAL CONCERNS INCREASE, RESEARCHERS, POLICY MAKers, and the public in general are becoming more interested in options to make energy more sustainable while at the same time ensuring that energy systems are affordable, reliable, and resilient. This dynamic is bringing about challenges across the world, as established energy systems (such as those in cities) must be enhanced to integrate large volumes of renewable A Digital Object Identifier 10.1109/MELE.2019.2908890 Date of publication: 11 June 2019 12 I E E E E l e c t r i f i cati o n M agaz ine / J UN E 2019 2325-5987/19©2019IEEE this increased flexibility must be properly balanced within the context of potential competition between services, e.g., tradeoffs when deciding whether to use water to generate electricity or irrigate crops. Smart and strategic use of flexibility from the demand side and different energy technologies (e.g., from distributed devices, such as EHPs, to large technologies, such as hydropower plants) will be critical for sustainable development based on both novel multivector and water–energy nexus perspectives. Using examples of a smart district and an integrated energy–water system, this article illustrates sophisticated applications of resource flexibility that to go beyond power systems and take advantage of joining with other energy vectors and sectors. A Flexible Energy Future Different Energy Futures Figures 1–4 present different options for developing an energy system that supplies a district with electricity and heat. In a traditionally decoupled case (see Figure 1), dedicated systems supply customers with different energy vectors, such as electricity and heat. This configuration allows independent operation of each network and market, without the explicit consideration of other systems. However, in this example, the demand side has a limited ability to support the system, since customers would have to change their behavior or be curtailed (which incurs discomfort) to reduce their energy demand. Figure 2 illustrates the electricity-centered approach to integrating intermittent RES in the electricity sector and electrifying other energy vectors (e.g., heat). This approach offers the advantage of allowing the RES generation to produce heat, but the demand for heat and RES generation may be poorly correlated. This is the case in the United Kingdom, where the greatest heat demand occurs during winter when energy generated from PV is low. Once again, there is little flexibility for the demand side to provide system support. Electricity Network Gas Network energy sources (RES), while new or evolving systems (for instance, in developing economies) must be planned to manage the increasingly extreme conditions associated with climate change. In these contexts, the flexibility to intelligently use and invest in resources that go beyond the power system (e.g., other energy vectors such as heat, gas, or water dams) can be extremely valuable from the perspective of sustainable development. In cities, energy decarbonization and sustainable development are encouraging the electrification of transportation, heating, and other services, as well as the integration of RES on a large scale. Take the United Kingdom as an example. With the goal of decarbonizing transports by 2040, the sale of new gasoline and diesel cars will be banned by 2032. Also, the U.K. government offers a sevenyear domestic renewable heat incentive for customers who install electric heat pumps (EHPs) or other forms of renewable heating, because heating corresponds to 40% of domestic energy demand. These solutions seem highly attractive at first glance, because electricity produced with RES can be easily decarbonized and is becoming progressively cheaper. However, accommodating the newly increasing demand for RES generation in the electrical system is not an easy task. Massive investments in electricity grid infrastructure (e.g., lines and substations) would be required to accommodate the new power flows, as well as in generation, storage, and other technologies that can provide reserve and active control to balance the highly intermittent output of some RES, such as wind and solar photovoltaic (PV). A more effective approach would be to take advantage of the existing assets. These resources would include district heating and gas networks, as well as ongoing advances in information and communication technologies (ICTs) and automation, to allow the demand-side flexibility that is now mostly enabled by multienergy technologies. This multivector approach to demand-side flexibility empowers customers to use combinations of energy vectors (e.g., electricity, heat, and gas) to better meet their energy needs, while also providing valuable capacity and reserve support to the energy system. The multivector approach to energy flexibility recognizes the attractiveness of using a suite of energy vectors and networks to meet customer needs. Taking this vision a step further, it may not make sense to constrain flexibility to the energy sector in areas where little or no energy infrastructure has been installed, such as in rural areas or developing economies. Instead, it is more valuable and sensible to consider the flexibility that investing in some infrastructures can offer different sectors, such as hydropower plants that merge the energy and water sectors and allow flexibility to benefit other sectors (e.g., releasing water from the energy sector to be used in the agricultural sector). Using resources flexibly offers new opportunities to bring lighting, water, food, and other valuable services to underserved customers efficiently. However, in the so-called water–energy nexus, Electricity Demand Heat Demand Boiler Electricity Heat Gas Figure 1. The traditionally decoupled energy services. IEEE Elec trific ation Magazine / J UNE 2 0 1 9 13 With the goal of decarbonizing transports by 2040, the sale of new gasoline and diesel cars will be banned by 2032. Installing energy storage, such as batteries and thermal energy storage (TES), may tackle some of these issues. A battery can store the surplus PV generated for later use or, as shown in Figure 3, convert it to heat and store it for later use. This strategy could reduce electricity demand because the heat stored in the TES could reduce EHP operation later. This system is more flexible than the two presented previously, as the new multienergy system allows the intelligent use of TES (through the use of ICT and automation) to control electricity imports and exports without affecting customers. For example, electricity imports can be reduced by ramping down the EHP while still meeting customer needs with the TES. The downside to this approach is that it does not take advantage of the available infrastructure, such as the gas network and boiler shown in Figure 1. Other options, such as the one presented in Figure 4, involve installing various low-carbon multienergy technologies, such as combined heat and power (CHP) boilers and TES. Other technologies, such as PV and EHP, can also be Electricity Network Sun Electricity Demand PV Heat Demand EHP Electricity Heat Insolation Figure 2. Electrifying heat. added. This type of system is highly flexible, as there are multiple controllable options to meet the electricity and heat demands. For example, if grid electricity is inexpensive and clean due to the availability of RES, electricity imports can be increased by ramping down the CHP boiler and meeting heat demand with the TES and boiler. It is also possible to reduce the grid imports (e.g., to provide an active network management) by ramping up the CHP boiler and storing surplus heat with the TES. This gives customers new options not only to meet their energy needs but to also reduce their energy bills, minimize their carbon emissions, or pursue other objectives. Integrated Multienergy Systems The different energy futures presented in Figures 1–4 should be expected to lead to various mergers of energy vectors. This coupling can impact the networks in place to supply each vector, such as electricity, gas, and, where applicable, district heating. Understanding these complex effects is not trivial; it is necessary because the large-scale electrification of heating and transports can lead to significant electricity network stress. Further, in a multienergy future, actively managing stress in one network can lead to issues in others, e.g., the use of CHP boilers to provide electricity network support may cause issues in the heat and gas networks. To visualize the effects, it is helpful to map how different energy vectors are converted to useful services or energy vectors (e.g., using generators and other conversion technologies) and how energy vectors are distributed to customers using the available networks. To illustrate this dynamic, consider the Manchester district in the United Kingdom, presented in Figure 5. The district comprises 26 buildings owned by the University of Manchester, some of which are connected to the same electricity distribution (6.6 kV), district Electricity Network Electricity Demand PV EHP Electricity TES Heat Figure 3. Electrifying heat and installing TES. 14 I E E E E l e c t r i f i cati o n M agaz ine / J UN E 2019 Heat Demand Insolation CHP Gas Network Sun Electricity Network Boiler Electricity Figure 4. Installing CHP and TES. Electricity Demand TES Heat Heat Demand Gas Electricity Heat Gas Figure 5. The Manchester multienergy district. heating, and gas networks. The district has an annual demand of 28 GWh (6-MW peak) of electricity and 18 GWh (12-MW peak) of heat. The current, baseline annual energy costs and carbon emissions are 3.1 £M and 19.1 ktCO2, respectively. Different options for meeting the district’s electricity and heat needs are mapped using Sankey diagrams in Figures 6–8. The district and various options to make it more flexible were investigated in the District Information Modeling and Management for Energy Reduction (DIMMER) research project (Patti et al. 2015). Figure 6 depicts the traditionally decoupled energy system used as a baseline to represent current conditions. In this case, electricity is delivered to customers using the electricity networks, while heat is produced with local boilers or larger boilers connected to a district heating network, which takes fuel from the gas network. In the electrified future presented in Figure 7, the gas network is no longer used; instead, significantly more electricity is taken from the grid (compared with the baseline in Figure 6) to supply EHPs. The electricity grid would require additional capacity to reliably meet the new demand. In this context, the reliability of the electricity system becomes more critical, since outages would impact both electricity and heat supplies and can make customers vulnerable, especially during periods of harsh ambient conditions. In the United Kingdom, energy system stress and the effects of contingencies on the network and customers are the highest during the coldest winter days. Figure 8 presents a multienergy future in which the electricity grid, local EHPs, and district CHP boilers meet customer needs. The additional demand on the electricity grid is modest compared with the case presented in Figure 7, and the system still utilizes some of the gas network’s capacity. In this case, future demand growth can still be met with low-carbon technologies (e.g., CHP Grid Electricity Electricity Network Electricity Local Gas Boiler Heat Heat Network Gas Network Heat Losses District-Level Conversion Losses Gas Boiler Gas Losses Figure 6. The Sankey diagram: decoupled energy services. Ambient Heat Local EHP Heat Heat Network Grid Electricity Electricity Network Heat Losses DistrictLevel EHP Electricity Figure 7. The Sankey diagram: multienergy system. boilers), which may not require network reinforcements. The system also is more flexible to withstanding contingencies in the electricity or gas networks. If the electricity supply is interrupted, local heat and electricity can be produced with the CHP boilers, while the EHPs can be used to supply some customers if the supply of gas is interrupted. IEEE Elec trific ation Magazine / J UNE 2 0 1 9 15 Ambient Heat Local EHP Gas Network DistrictLevel CHP Grid Electricity Electricity Network The multienergy future offers greater flexibility, the use of existing assets, and less network stress than the electrified future. However, this energy future is also the most complex because the traditionally decoupled energy systems (e.g., electricity, heat, and gas) would operate as a single integrated system. As a result, the energy sector would no longer comprise independent systems that provide electricity, heat, gas, and other energy vectors. Instead, the energy system will comprise integrated assets that use combinations of multiple available energy vectors to meet customers’ needs for lighting, heating, cooking, and other services. Even though the examples from Figures 1–8 are for multivector applications of flexibility in smart cities, it is possible to infer some key ideas that are applicable to the energy nexus in rural areas and developing economies. First, more and potentially better options to meet customer needs become available when we consider the coupling of multiple sectors (the energy vectors in the examples). Flexibility makes the system more resilient to extreme events caused by climate change (network contingencies in the examples). New tradeoffs can arise as limited resources are used to provide different resources, e.g., water can be used to generate electricity or for irrigation. A demand response could be used to reduce energy bills or carbon emissions in the examples. Heat Heat Network Heat Losses Conversion Losses Electricity Figure 8. The Sankey diagram: electrifying heat. TABLE 1. The installed boiler, PV, EHP, and CHP capacities in each case. Aggregated Installed Capacity Throughout the District (kW) Case Boiler PV EHP CHP Baseline 24,000 93 0 0 Conservative 24,000 1,068 310 260 Modest 24,000 2,250 1,715 1,925 Extreme 24,000 3,410 2,650 2,700 The Value of Multivector Flexibility TABLE 2. The performance of the Manchester district subject to the considered cases and BAU practices. Investing in Multienergy Assets Baseline Conservative Modest Extreme Annual economic savings* 0% 9.06% 12.22% 14.83% Annual carbon savings* 0% 10.14% 19.94% 26.90% Peak electrical demand reduction* 0% 4.67% 2.20% 2.37% Peak heat demand reduction* 0% 15.50% 52.80% 72.51% To illustrate the value of flexibility attributable to multienergy assets, consider the Manchester district under traditionally decoupled baseline conditions and business as usual (BAU) operation (i.e., the heat-following mode). In addition to the baseline case, which represents the system’s *: compared with the baseline. TABLE 3. The performance of the Manchester district subject to the considered cases: BAU versus smart practices. Conservative Extreme BAU Smart BAU Smart BAU Smart Annual economic savings* 9.06% 9.54% 12.22% 21.44% 14.83% 28.43% Annual carbon savings* 10.14% 10.28% 19.94% 27.00% 26.90% 38.07% Peak heat demand reduction* 4.67% 12.63% 2.20% 41.03% 2.37% 49.38% Peak electrical demand reduction* 15.50% 28.48% 52.80% 84.88% 72.51% 95.07% *: compared with the baseline. 16 Modest I E E E E l e c t r i f i cati o n M agaz ine / J UN E 2019 Using resources flexibly offers new opportunities to bring lighting, water, food, and other valuable services to underserved customers efficiently. shows that using a smart operation for the district can improve its performance, especially in extreme cases where more controllable resources are available. The study is taken one step further by optimizing the operation of the district based on a wide range of different objectives, including minimizing of costs and emissions and maximizing benefits from trading active network management, energy, reserve, and other services in relevant markets. See the suite of results in terms of the net present cost (NPC) in Figure 9. This smart operation of the district is more in line with the premise that an energy system should not be operated to provide energy vectors (e.g., electricity and gas), but instead use combinations of available energy vectors to meet customers’ needs for lighting, heating, and other services. The results show that it is possible to achieve different environmental and economic savings by customizing the district’s operation. This 20 CO2 (ktCO2) current conditions, three different cases are considered: conservative, modest, and extreme. In the conservative case, in addition to installing PV, EHP, and CHP devices, Manchester University invests in awareness campaigns to encourage switching lights and computers off when they are not in use, as well as modest interventions in double-glazed steel windows and waterproof roof covers. In the modest case, the university makes additional investments in energy devices and efficiency measures. In the extreme case, relatively large investments in energy efficiency measures are made, which are coupled with a significant installation of energy infrastructure. The total PV, EHP, and CHP capacities associated with each case are presented in Table 1, and the district’s relevant economic and environmental performance is presented in Table 2. In these cases, following BAU practices, the multienergy infrastructure operates in the heat-following mode. These practices do not take advantage of the energy sector’s variable needs or the district’s potential to operate in a smart manner. Accordingly, it is reasonable to assume that the benefits reported in Table 2 correspond mainly to the multienergy assets’ value of flexibility. Smarter Operation It is possible to pursue different objectives, such as achieving economic and carbon savings, by optimizing the set points of the controllable devices within the district. Smart operation, in which the district is operated considering variable price signals that reflect the costs of the energy supply, network/system operation, and taxes, allows customers to minimize their energy bills and carbon emissions and could also permit them to trade demand-side flexibility in different markets. This type of operation can be substantially more attractive than traditional BAU practices, as shown in Table 3. The study 18 16 14 12 10 2 2.2 2.4 2.6 2.8 NPC (M£) 3 3.2 3.4 Baseline (BAU) Baseline (Smart) Conservative (BAU) Modest (BAU) Extreme (BAU) Conservative (Smart) Modest (Smart) Extreme (Smart) Figure 9. The performance of the Manchester district under different conditions. TABLE 4. The value of flexibility associated with assets and smart operation. Economic Savings (%*) Conservative Modest Extreme Benefit Attributed To Minimum Maximum Minimum Maximum Minimum Maximum Assets 10.17 9.06 20.02 12.22 27.06 14.83 Smart operation 0.31 0.47 8.61 9.98 13.1 15.33 Total 10.48 9.54 28.63 22.20 40.16 30.16 *: compared with the baseline energy costs. IEEE Elec trific ation Magazine / J UNE 2 0 1 9 17 A significant volume of energy may be generated and consumed locally, instead of produced by large generators and then transported. information is particularly valuable in an uncertain future where RES generation, asset costs, and other assumed parameters are different from what is forecast. For example, carbon targets can still be met by changing the operation of the Manchester district without investing in additional assets, even if the future differs from the forecast. It is important to emphasize that smart operation provides flexibility and can be as valuable as, or more valuable than, the one provided by the asset. This can be deduced by comparing the extreme (BAU) and conservative (smart) cases in Figure 9. The latter, which uses fewer assets, can outperform the former, which does not take advantage of smart operation. This is further demonstrated in Table 4, which takes the maximum and minimum values from Figure 9. The table shows that most benefits in the extreme case can be attributed to smart operation of the assets. This is an important result because it Beyond the Demand Side Impacts on the Energy System As flexibility increases in the energy sector, mostly due to introducing multienergy technologies at the demand side, smart-community multienergy systems such as the Manchester district will take some business away from current actors. That is, a significant volume of energy may be generated and consumed locally, instead of produced by large generators and then transported by the transmission system operator (TSO) and multiple distribution network operators (DNOs). This new system operation may be beneficial if it Contractor Network Operator System Operator demonstrates that it is not enough to foresee a sustainable multivector future by in stalling RES and multienergy technologies; most of the value offered by these technologies will materialize only if the assets use smart operation also. Contractor TSO Policy Implementer Network Operator DNO Tax Raiser Demand-Side Flexibility Government Smart Customers Trader DNO Other Retailer Service Provider Gas DNO Trader Trader Gas Shipper Electricity Producer Energy Figure 10. The value flow map. 18 I E E E E l e c t r i f i cati o n M agaz ine / J UN E 2019 Cash Information Contractor Gas DNO TSO DNO Government Electricity Producer District Electricity Generation (MW) Change in Operational Revenue (k£/Year) displaces dirty and expensive electricity generation units. payments. This would have a negative impact in the form But it can also be harmful if, for instance, it reduces the of lost revenue (compared with the BAU case) for electricity revenue of network operators who are responsible for conproducers, the government, and network operators, i.e., necting the multienergy resources and enabling the busireduced distribution and transmission use of system chargness of smart districts or if it makes the business case for es (DUoS and TUoS, respectively). As discussed previously, generating new firms. some of these effects can be considered acceptable if, for To understand the effects that demand-side flexibility example, carbon-intensive generators are driven out of (e.g., from the Manchester district) can have, it is convebusiness. However, the reduced revenue may not be acceptnient to map the interactions within the energy sector able, especially considering that the integration of different (see Figure 10). Developed using value-flow approaches, distributed multienergy technologies within the district the map tracks the energy, cash, and information exchangmay lead to increased network stress and costs. es between different actors in the energy sector. These exchanges are based on 800 1) the physical characteristics of Wholesale Electricity the system (e.g., electricity is 600 Imbalance generated by producers and Capacity 400 travels through the transmisElectricity DUoS sion and distribution networks Electricity TUoS 200 to reach customers) BSUoS 2) the regulatory framework (e.g., 0 ESO and VAT customers pay retailers who Whole Gas then pay DNOs, the TSO, and –200 Gas DUoS other actors) O and M –400 3) emerging business cases (e.g., Net contractors may provide opera–600 tion and maintenance to the multienergy infrastructure within the smart district). A main advantage of the valueflow mapping approach is that it facilitates quantifying the effects of district optimization on different revenue flows, for customers with- Figure 11. The business case analysis. BSUoS: balancing services use of system; ESO: environin the district and other actors (see mental and social obligation; VAT: value-added tax. the quantification of the change of revenue for selected actors in Figure 11). In this context, the district 250 manager, retailer, aggregators, or other actors that can represent cus200 tomers in different energy markets no longer focus only on the provi150 sion of energy vectors but, instead, concentrate on providing services. 100 These services can be tracked to the actors who would normally 50 provide them, so that the impact of the smart district on the business 0 of such actors can be assessed. 1 6 11 16 21 In this example, smart operation Time (h) of the Manchester district in the extreme case brings about signifiConventional (BAU) Hydro (BAU) PV (BAU) Conventional (Smart) Hydro (Smart) PV (Smart) cant benefits for customers. It takes advantage of price arbitrage in the wholesale energy market and Figure 12. The conventional, hydropower, and PV-generation profiles subject to BAU reduces network charges and tax and smart operation. IEEE Elec trific ation Magazine / J UNE 2 0 1 9 19 From the perspective of the energy system and different actors, this information is critical for understanding potential issues regarding the introduction of demand-side flexibility. For example, based on the study presented in Figure 11, it may be convenient to introduce active network-management services, adjust network charges, or introduce other mechanisms to allow network operators to support their business as well as the business of the smart district. A multisector energy nexus approach is better suited for providing food, water, lighting, and other critical services for people in rural communities and developing economies. production of clean power. In this example, peak conventional generation and total PV generation in the smart cases are 15% lower and 20% higher, respectively, than in the BAU case. This increased power system flexibility can bring attractive benefits to the energy sector by reducing electricity costs and carbon emissions and by displacing conventional peaking generation. That is, the system’s flexibility would allow it to meet customers’ needs for affordable and sustainable electricity. However, the added flexibilThe Energy Nexus ity could, instead, be used to maintain The multivector application of energy the affordability and sustainability of system flexibility can meet customers’ current energy services while reducing needs in cities that have established the use of hydropower. The result networks. Taking a step further, a mulwould be reduced future investments tisector energy nexus approach is better suited for providing in hydropower capacity, lower water demand to generate food, water, lighting, and other critical services for people in electricity, and more water available for irrigation, drinking, rural communities and developing economies. To illustrate and other uses. Also, it could potentially avoid the conthis, consider the flexible use of hydropower plants to balstruction of costly carbon-intensive infrastructure in differance intermittent RES (e.g., PV power) by storing surplus ent sectors. solar power as water. As shown in Figure 12, which is based Based on such a water–energy nexus vision, the energy on the IEEE 14-bus test network, smart operation of the system is treated as part of a wider suite of interrelated hydropower plant can greatly reduce the peak conventional sectors. In this context, flexibility is no longer constrained generation capacity required by the system and increase the to the use of energy vectors to meet customers’ needs; it also optimizes the use of water, food, and other resources. To investigate this advanced use of flexibiliInvestment Energy Nexus Simulator ty, novel frameworks, such as the Scenario one presented in Figure 13, have Water been proposed. They assess interacClimate Water Model Allocation Scenarios tions among different sectors and shed light on the smart use of flexiInvestment bility and the infrastructure deployProfiles ment that would be the most beneficial for different sectors subEnergy Mix Energy Model ject to an uncertain future. Energy Demand Nexus tools can bring specialized models of different sectors together in an iterative fashion to produce a wide range of strategies for investing in electrification, Other Models multienergy technologies, and other infrastructures needed to meet customers’ needs. The tools are particularly attractive for highly uncertain scenarios in which Environmental, the use of flexibility (from differAssessment Economic, and Model ent energy vectors and various Other Criteria sectors) is critical, such as for developing future energy–water– food systems that are resilient to Figure 13. The energy nexus planning and assessment framework. climate change. 20 I E E E E l e c t r i f i cati o n M agaz ine / J UN E 2019 Even with the sophisticated energy nexus tools, the identified strategies are seldom perfect and will have several positive and negative impacts in different sectors (i.e., tradeoffs). Assessing the tradeoffs between different sectors is not an easy task (e.g., comparing the value of minimizing the risks of a power outage against the risks of a flood) and will require lengthy negotiations among planners, policy makers, and relevant actors in each sector. Regardless, the identified strategies could be significantly better than those identified by addressing a single sector. Conclusions The United Nations sustainable development goals are increasingly motivating the flexible use of different resources from various vectors and sectors to meet customer needs. A multivector approach to demandside flexibility will be particularly valuable in cities that already have a significant energy infrastructure. In these cases, integrating multienergy technologies, such as cogeneration, batteries, and thermal storage, would make the energy system significantly more flexible if it is enabled with ICT, automation, and smart control. Large-scale deployment of these resources may lead to a new role for flexibility in operating the energy sector, as its focus will no longer be on providing electricity, gas, and other vectors. Instead, it will primarily use combinations of energy vectors to accomodate customers’ services. The services that the smart use of flexibility can provide do not have to be constrained to energy, particularly in rural areas or developing economies where little or no energy infrastructure is in place. Instead, a more holistic multisector nexus approach can be used to enable the use of flexibility to better provide energy, water, food, and other key services. Although the multivector and nexus approaches are more complex than the traditionally decoupled ones for energy planning, they provide attractive options to better tackle large challenges, such as climate change and the large-scale integration of RES. In this context, it is critical to rethink the role of flexibility as a means to intelligently take advantage of the resources and strategic investments available and effectively provide the required services. Acknowledgments We would like to acknowledge the following groups for financial support as part of their projects: European Commission, for “DIMMER: District Information Modeling and Management for Energy Reductions” under grant FP7 609084; the U.K. Engineering and Physical Sciences Research Council, for “MY-STORE: Multi-Energy StorageSocial, Techno-Economic, Regulatory and Environmental Assessment under Uncertainty” under grant EP/ N001974/1; and the U.K. Economic and Social Research Council, for “FutureDAMS: Design and Assessment of Water-Energy-Food-Environment Mega-Systems” under grant ES/P011373/1. For Further Reading E. A. Martínez Ceseña and P. Mancarella, “Energy systems integration in smart districts: Robust optimisation of multienergy flows in integrated electricity, heat and gas networks,” IEEE Trans. Smart Grid, vol. 10, no. 1, pp. 1122–1131, 2019. X. Liu and P. Mancarella, “Modelling, assessment and Sankey diagrams of integrated electricity-heat-gas networks in multi-vector district energy systems,” Appl. Energy, vol. 167, pp. 336–352, Apr. 2016. N. Good, E. A. Martínez Ceseña, C. Heltorp, and P. Mancarella, “A transactive energy modelling and assessment framework for demand response business cases in smart distributed multi-energy systems,” Energy. [Online]. Available: https://www-sciencedirect-com.manchester.idm.oclc.org/ science/article/pii/S0360544218303177 E. A. Martínez Ceseña, N. Good, A. L. A. Syrri, and P. Mancarella, “Techno-economic and business case assessment of multi-energy microgrids with co-optimization of energy, reserve and reliability services,” Appl. Energy, vol. 210, pp. 896– 913, Jan. 2018. N. Good, E. A. Martínez Ceseña, and P. Mancarella, “Ten questions concerning smart districts,” Build. Environ., vol. 116, pp. 362–376, June 2017. E. A. Martínez Ceseña, T. Capuder, and P. Mancarella, “Flexible distributed multi-energy generation system expansion planning under uncertainty,” IEEE Trans. Smart Grid, vol. 7, no. 1, pp. 348–357, 2016. N. Good, E. A. Martínez Ceseña, L. Zhang, and P. Mancarella, “Techno-economic assessment and business case modelling of low carbon technologies in distributed multi-energy systems,” Appl. Energy, vol. 167, pp. 158–172, Apr. 2016. Y. Zhou, M. Panteli, R. Moreno, and P. Mancarella, “System-level assessment of reliability and resilience provision from microgrids,” Appl. Energy, vol. 230, pp. 374–392, Nov. 2018. E. Patti, A. Ronzino, A. Osello, V. Verda, A. Acquaviva, and E. Macii, “District information modeling and energy management,” IT Professional, vol. 17, no. 6, pp. 28-34, Nov./Dec. 2015. Biographies Eduardo Alejandro Martínez Ceseña (alex.martinezcesena@ manchester.ac.uk) is with the University of Manchester, United Kingdom. Nicholas Good ([email protected]) is with Upside Energy Ltd, Manchester, United Kingdom, and the University of Manchester, United Kingdom. Mathaios Panteli (mathaios.panteli@manchester. ac.uk) is with the University of Manchester, United Kingdom. Joseph Mutale ([email protected]) is with the University of Manchester, United Kingdom. Pierluigi Mancarella (pierluigi.mancarella@unimelb .edu.au) is with the University of Melbourne, Australia, and the University of Manchester, United Kingdom. IEEE Elec trific ation Magazine / J UNE 2 0 1 9 21 By Jairo Quirós-Tortós, Luis Victor-Gallardo, and Luis (Nando) Ochoa Electric Vehicles in Latin America Slowly but surely toward a clean transport. HE NUMBER OF LIGHT-DUTY ELECTRIC vehicles (EVs) in Latin America—from plug-in hybrid to fully electric—is expected to increase during the next decade as a result of multiple incentives that promote their adoption combined with the increasing cost effectiveness of the technology. Latin American countries are slowly but surely T Digital Object Identifier 10.1109/MELE.2019.2908791 Date of publication: 11 June 2019 22 I E E E E l e c t r i f i cati o n M agaz ine / J UN E 2019 moving toward the electrification of the transport sector, trying to harness the corresponding environmental, health, and economic benefits, particularly when coupled with a low-carbon electricity-generation portfolio, such as many of those in the region. However, before the region sees EVs being adopted at levels already realized in countries in Europe and Asia, and in the United States, several challenges need to be addressed. A number of factors limit the progress of EVs in Latin America, including x upfront costs that are too high for developing countries x lack of effective subsidies for EVs that reduce the purchasing cost x insufficient charging infrastructure x subsidized fossil fuels x a lack of vehicle fuel-efficiency standards x bidding processes that prioritize least-cost options and disqualify cleaner technologies with higher upfront costs. To overcome these barriers, governments need to strengthen financial incentives and standards favoring clean technologies, expand programs for electrifying high-use vehicles, develop electric mobility strategies and goals, and create public-private partnerships. MAP—©ISTOCKPHOTO.COM/BGBLUE, CAR—IMAGE LICENSED BY INGRAM PUBLISHING 2325-5987/19©2019IEEE TABLE 1. Development indicators for Latin America. Country GDP (Millions in US$) GDP Growth (%) Population Unemployment (% of Total Labor Force) Argentina 637.59 −2.6 44,271,041 8.35 Bolivia 37.51 4.3 11,051,600 3.23 Brazil 2,055.50 1.4 209,288,278 12.83 Chile 277.08 4 18,054,726 6.96 Colombia 309.19 2.8 49,065,615 8.87 Costa Rica 57.06 3.3 4,905,769 — Ecuador 103.06 1.1 16,624,858 3.83 El Salvador 24.81 2.5 6,377,853 4.38 Guatemala 75.62 2.8 16,913,503 — Honduras 22.98 3.5 9,265,067 — Mexico 1,149.92 2.2 129,163,276 3.42 Nicaragua 13.81 −4 6,217,581 — Panama 61.84 4.6 4,098,587 3.90 Paraguay 29.73 4.4 6,811,297 4.61 Peru 211.39 4.1 32,165,485 — Uruguay 56.16 2 3,456,750 7.89 Venezuela — — 31,977,065 — Constructed with data from the World Economic Forum of the IMF for October 2018. In this article, we provide an overview of the different incentives in place in Latin America and discuss the effectiveness of each given the international experience. We also discuss challenges associated with the deployment of public charging stations, list the number of public charging stations available in Latin America, and describe a simplified methodology developed in Costa Rica for defining the location of fast-charging stations. We conclude by presenting the results of an economic assessment of the technology to understand the reasons behind the current low number of EVs in Latin America and, more importantly, to highlight key actions needed from policy makers to promote a greater EV adoption. Latin America Today Latin America refers to a group of 13 dependencies and 20 countries. Due to data availability, however, in this article we discuss the situation in 17 of them: Argentina, Bolivia, Brazil, Chile, Colombia, Costa Rica, Ecuador, El Salvador, Guatemala, Honduras, Mexico, Nicaragua, Panama, Paraguay, Peru, Uruguay, and Venezuela. The region extends from the northern border of Mexico to the southern tip of South America, with the total population estimated at 600 million inhabitants living in a total area of approximately 7,412,003 mi2 (19,197,000 km2). According to the International Monetary Fund (IMF), in 2018 Latin America had a gross domestic product (GDP) growth of approximately 2.28% (excluding Venezuela) (see Table 1). In the same year, the region experienced a population growth of approximately 6 million while facing an unemployment rate growth of close to 0.6%, which, in turn, led to an average unemployment rate of 6.2%. Over the past decade, the number of people living in metropolitan areas increased by 10% in the region, resulting in 80% of the Latin American population residing in urban areas. During the same decade, the number of light-duty internal combustion (IC) vehicles grew in these areas by approximately 40%, which has caused congestion issues due to the relatively poor 30-year-old infrastructure (see the 2016 report from the Inter-American Development Bank). Aiming to reduce the environmental impact of this growing urbanization and uptake of light-duty IC vehicles, multiple countries in the region set aggressive environmental targets during the 2015 United Nations Climate Change Conference. Given that carbon dioxide emissions in the Latin American transport sector represent approximately IEEE Elec trific ation Magazine / J UNE 2 0 1 9 23 45% of the total, these goals usually translate into the electrification of the transportation sector (both private and public fleets). The adoption of EVs will help decarbonize the economy of the region, and Latin America already has one of the cleanest electricity-generation portfolios in the world as a result of its high production of hydroelectric power and the growing deployment of wind and solar power plants. According to International Energy Agency (IEA) data (electricity information for 2016), the use of renewables, including hydroelectric power, in the electricity mix is, on average, 41.3%, with Brazil, Costa Rica, Paraguay, and Uruguay producing more than 70% from clean technologies (see Figure 1). If Latin America continues increasing the use Honduras Nicaragua 49.1% 50.9% Mexico 57.1% 42.9% 15.3% Costa Rica 84.7% Colombia 1.8% Guatemala 98.2% 34.1% 65.9% Venezuela 40.2% 59.8% 39.9% 41.9% 60.1% 33.4% 58.1% 66.6% EI Salvador Panama 19.7% 39.8% 60.2% 80.4% 49.7% 50.3% Ecuador Brazil Peru 21.9% 78.1% Latin America Bolivia 100% 41.3% Paraguay 58.7% Hydro, Solar, Wind, Biofuels, and Geothermal Other Sources 43.3% 56.7% Chile 3.4% 27.2% 72.8% 96.7% Uruguay Argentina Figure 1. Renewable energy use per country in Latin America, created with data from the IEA. hydro: hydroelectric. 24 I E E E E l e c t r i f i cati o n M agaz ine / J UN E 2019 of renewables, it will be in a strong position to ensure that the demand resulting from the electrification of transport is supplied by low carbon generation, reducing overall emissions. However, the region faces three key challenges: lack of incentives, insufficient charging infrastructure, and the low cost effectiveness of EVs, which we discuss in the following sections. What Incentives Are in Place? and owners of IC vehicles pay fees or tax increases. An advantage of this approach is that it makes it easier for countries to sustain financial incentives for EVs during longer periods. When defining the type of financial support in each country, governments must take into account the corresponding tax structure to avoid significant fiscal impacts (as an illustration, see the tax structure of some countries in Latin America as detailed in Table 2). Because valueadded and import taxes of IC vehicles are generally an important share of the tax structure (they represent, on average, approximately 65% of the total tax in the region), The number of EVs in Latin America is growing, but it has not reached a five-digit figure as of yet. Aiming to meet this milestone and reduce corresponding greenhouse-gas emissions, some Latin American countries have put in place a number of financial (e.g., reducing taxes) and TABLE 2. The tax structure for vehicles nonfinancial (e.g., dedicated parking in some Latin American countries (%). spaces) incentives, tighter fuel-econImport Value omy standards, and electric-mobility Tax Duty Added strategies. The following sections Argentina IC 0.5 21 describe the common incentives in place in the region and list the counEV 2 10.5 tries that have adopted them. Brazil IC 35 18 Financial Incentives Financial incentives are generally the most direct option for promoting the uptake of EVs in Latin America (and worldwide). Therefore, governments in the region are making efforts to provide economic support that lowers the current high retail price (one of the main barriers to EVs). In general, governments are cutting down the cost of EVs through rebates and reduced taxes. From a practical perspective, both options are effective in achieving a lower EV cost. Rebates, however, are more beneficial when a light vehicle tax structure is in place. Although governments in Latin America are promoting the uptake of EVs through financial incentives, they face a challenge when offering tax exemptions or rebates, as vehicle taxes usually represent an important income stream. Additionally, this financial support may be seen as socially regressive because early EV adopters tend to belong to the high-income population. Thus, a less controversial approach—used in Chile, for instance—is to implement revenue-neutral financial incentives for EVs. Here, owners of EVs receive rebates or tax reductions, Chile Colombia Costa Rica Ecuador El Salvador Honduras Mexico Panama Paraguay Peru Uruguay Other Total (Arithmetic Sum) 8.5 30 8.5 21 25 78 EV 0 18 20 38 IC 6 19 0 25 EV 6 19 0 25 IC 35 19 8 62 EV 0 0 0 0 IC 1 13 38.5 52.5 EV 0 0 0 0 IC 15 14 15 44 EV 0 0 0 0 IC 25 13 6 44 EV 25 13 6 44 IC 10 15 30 55 EV 10 15 30 55 IC 0 16 4 20 EV 0 16 0 16 IC 0 7 25 32 EV 0 7 5 12 IC 15 10 0.5 25.5 EV 0 10 0.5 10.5 IC 9 16 37 62 EV 9 16 37 62 IC 23 22 39.5 84.5 EV 0 22 10.75 32.75 Constructed with data from the 2016 report from the Inter-American Development Bank and available information per country. Some values are calculated as the average. IEEE Elec trific ation Magazine / J UNE 2 0 1 9 25 Financial incentives are generally the most direct option for promoting the uptake of EVs in Latin America (and worldwide). Latin American countries tend to promote a reduction of or exemption from these taxes for EVs. Costa Rica and Ecuador offer an exemption from the value-added tax for EVs, and Colombia set a partial reduction. Multiple countries—including Brazil, Colombia, Costa Rica, and Mexico— have adopted a full exemption from the import tax, and Argentina set a partial reduction to this tax. Governments can also incentivize the adoption of EVs through the deployment of financial incentives that reduce the yearly costs of owning and/or using an EV. The typical options are reductions in ownership or circulation annual taxes (e.g., Colombia and Costa Rica), tolls (e.g., Colombia, Costa Rica, and Mexico), parking fees, insurance, subsidies for electricity (e.g., Ecuador and Mexico), and so on. Although these incentives help, they do not reduce the up-front cost of EVs (they reduce costs over a multiple-year time span); this explains why governments put more effort into reducing the purchasing cost of EVs. (Colombia), San José (Costa Rica), México D. F. (México), and São Paulo (Brazil), enacted license-plate-based restrictions on the use of cars during certain weekdays and peak hours. This policy, however, led to an incremental increase in car ownership and use levels because some households bought a second car (usually an old car with high emission levels). In this context, exempting EVs from license-platebased restrictions is probably one of the best options for Latin American cities to provide nonfinancial incentives for EV adoption. Colombia and Costa Rica have implemented this type of policy to promote the adoption of EV technology. The third nonfinancial incentive is to allow EVs to use a number of dedicated parking spaces in public parking lots. This practice, successfully implemented in Colombia, Costa Rica, and Mexico, is likely to be a good policy for promoting EVs, because it will affect the parking availability of IC vehicles only marginally while providing a valuable benefit for EVs. Nonfinancial Incentives Financial incentives are the most effective way to promote EVs; however, nonfinancial incentives are also important in the transition toward a clean transport. Although these incentives are country specific, or even city specific, the following are common: 1) allowing EVs to use bus-only lanes 2) offering a waiver on driving restrictions (e.g., licenseplate-based restrictions) for EVs 3) providing dedicated EV parking spaces. Allowing EV users to use bus-only lanes can have benefits; however, this practice may lead to poorer public transportation services, which, in turn, may result in more people leaving the public transportation system and, thus, be a detriment to urban transportation sustainability. Consequently, although this practice is used in European cities, it might not be a suitable policy in Latin American cities, especially if public transportation is to be promoted. To mitigate environmental and/or congestion problems, governments in Latin American cities, such as Bogotá Where Does Latin America Stand on Public Charging Infrastructure? Public charging infrastructure is important to ensure that EV users can travel distances longer than what is typical for commercially available EVs in the region [approximately 124 mi (200 km) with a full battery]. The deployment of this infrastructure—more specifically, level 2 (semirapid) and level 3 (fast) charging stations—has already started across the region. Table 3 illustrates how quickly these charging stations can reach 80% capacity for two common battery sizes. To help EV users locate public chargers, the private and public sectors use different online platforms (e.g., https:// www.plugshare.com/, https://www.electromaps.com/puntosde-recarga/mapa, and https://movilidad.ute.com.uy/carga .html). These online platforms inform EV users about the availability of charging stations and report the connector type of the charger, which is critical so that users can check compatibility with their EV. Figure 2 shows the maximum number of level 2 and level 3 chargers (regardless of connector type) reported by these online platTABLE 3. The estimated time required to charge a battery to 80% capacity. forms per country (obtained from 20–26 January 2019). There are Charger Power approximately 628 level 2 chargers Battery (90.5%) and 66 level 3 chargers Level 2 (Semirapid) 3.7–22 kW Level 3 (Fast) 22–200 kW Capacity (9.5%) in Latin America. 11 kW 22 kW 50 kW 100 kW 150 kW (kWh) Although these are estimated values, they allow us to compare 28 ~2 hr ~1 hr ~27 min ~14 min ~9 min the current situation of public fast 40 ~3 hr ~1.5 hr ~38 min ~20 min ~13 min chargers in Latin America with 26 I E E E E l e c t r i f i cati o n M agaz ine / J UN E 2019 The up-front cost of EVs is usually higher than that of IC vehicles; however, their yearly operation and maintenance costs are typically lower. respect to the rest of the world, based on the Global EV Outlook 2018 of the IEA. According to this report, there were 82,880 publicly available fast outlets in China and 21,280 in Japan, Germany, France, Norway, the United Kingdom and the United States combined (these countries hold 93% of fast chargers worldwide). Mexico and Brazil stand out as leaders in the region with the most charging stations. Mexico is the only country in Latin America with Tesla stores (see the Tesla website, https:// www.tesla.com/, checked in January 2019), which explains why there are 12 Tesla superchargers and approximately 330 Tesla public outlets. Brazil has two fast-charger corridors: one between Rio de Janeiro and Campinas and another between Florianópolis and Foz do Iguaçu. After Mexico and Brazil, Costa Rica is the next country with the most publicly accessible chargers in Latin America. In 2018, Costa Rica passed legislation for EV incentives, enforcing the deployment of public infrastructure to its eight distribution companies. Hence, the government is obliged to plan for the deployment of the country’s charging infrastructure, and electricity distribution companies must follow suit. location of level 3 chargers in strategic places, aiming to provide sufficient resources to reach every corner of the country. To help define the location of these fast-charging stations, the University of Costa Rica developed a simplified methodology (see Figure 3) starting with preliminary locations that can be estimated with engineering models or derived from expert knowledge. It also uses an EV energy-consumption model, geo-referenced data, and origin–destination data to define the corresponding locations. The methodology estimates locations that ensure the availability of level 3 charging in densely populated areas as well as coverage for long trips. In the case of the Costa Rican process, preliminary locations were defined by engaging with key stakeholders from the electricity and transport sector, who established Public Charging Stations: Level 2 8 Level 3 5 Locating Fast Chargers: A Costa Rican Case Study Costa Rica in Central America has almost 5 million inhabitants living in an area of 19,730 mi2 (51,100 km2). Its electricity sector is characterized by a highly renewable power-generation mix and a national electricity access rate above 99%, as provided by the eight power utilities. As part of recent legislation to promote EVs in Costa Rica (law 9815, official since February 2018), distribution companies must locate public chargers across the country to ensure that EV users can drive their EVs all over the national territory. Accordingly, there must be a charging station (level 2 or level 3, preferably level 3) approximately every 50 mi (80 km) on national roads and approximately every 75 mi (120 km) on secondary roads. As part of a national initiative, the electricity sector will prioritize the 7 9 6 1 Argentina 2 1 2 Brazil 105 25 3 Chile 21 6 4 Colombia 17 7 5 Costa Rica 47 1 6 Ecuador 4 7 Guatemala 8 Mexico 402 9 Panama 1 10 Paraguay 6 11 Peru 12 Uruguay 1 4 2 11 1 10 23 12 1 3 1 23 Figure 2. The estimated number of publicly available chargers among Latin America countries. IEEE Elec trific ation Magazine / J UNE 2 0 1 9 27 Grid and Road Data a list of possible options based on knowledge of the infrastructure (see Quirós-Tortós et al. 2018). These locations Origin– Preliminary Topographic were evaluated with two purposes in mind: the first Destination Locations Data allowed analysis of densely populated areas with high Data vehicle traffic, and the second ensured that EVs can reach the farthest town in the country, considering that driving range varies with topography. To define the locations in densely populated regions, Longest Trips Roads and such as the greater metropolitan area (GMA), the methodand EV Modeling Population Density ology uses origin–destination information to understand the typical routes between households and study and Metropolitan Energy Locations Consumption work places or frequently attended venues (e.g., hospitals). By representing connected districts as nodes and using data from the main road system and demographics, the methodology places fast-charging locations in the GMA by covering all of the connections (i.e., roads) between the Legend: Grid Availability origin and destination zones (i.e., groups of adjacent disInputs tricts). The result is that every GMA resident could have Potential access to a level 3 charger nearby when the metropolitan Analysis Installation Areas locations are deployed. Outputs To estimate whether an EV reaches a destination far Refined Location Proposal away from the GMA, the methodology uses altitude profiles (i.e., topographic data) to analyze the effect of topography in the routes of interest. In addition, it adopts a model that Figure 3. The methodology for planning the location of level 3 chargers throughout Costa Rica. allows the quantification of EV energy consumption while considering the altitude and other physical properties of EVs to understand the distances an EV can travel with a given amount of energy Public Charging Stations: Level 3 National Roads: in the battery. Starting from the center of the country and traveling through the main roads to the farthest points, the methodology places a fast-charging station when the GMA energy consumed reaches a previously defined percentage of battery capacity, considering a charge of up to 80% at these stations. The locations must meet technical requirements, such as the availability of three-phase distribution lines. To check the fulfillment of such technical requirements, the methodology transposes geospatial Total: 11 San José x9 data from the electricity system 34 6 Alajuela and the road system. Once every main road has its Cartago 2 corridor of fast-charging stations, 3 Heredia the methodology checks whether 4 Guanacaste there are two consecutive charging Puntarenas 5 stations where energy consumpLimón 3 tion is below an 80% capacity of the battery and deletes one of them aiming to create a minimal charging network. Also, stations near the Figure 4. The locations of proposed public fast-charging stations in Costa Rica. farthest towns may not be necessary 28 I E E E E l e c t r i f i cati o n M agaz ine / J UN E 2019 in the short term under the premise that, once such a destination is Input Data reached, the driver can wait longer Up-Front Cost of Vehicle Discount Rate TCO Horizon Vehicle Performance by using a level 2 charger. The methodology checks for directions Typical Yearly Driving Distance Estimated Energy Price Forecast both to and from the destination to Estimated Maintenance Cost Over the TCO Horizon ensure that the EV user can reach the starting point. Figure 4 shows the proposal for TCO Calculations fast-charging infrastructure in Costa Rica. The study reports that a minimum of 34 level 3 chargers can NPV of Total Energy (kWh or L) Energy Cost cover the growing uptake of EVs. Expenditures Consumption With such a network, new EV owners could complete the drive to any place in the country, with the exception of remote locales that Figure 5. The calculation methodology of the TCO. even comparably sized IC vehicles have difficulty getting to. A more robust charging network would enable travelers to reach a destination and quickly Argentina return home, because there would be fast-charging sta**Bolivia tions in the farthest towns. Brazil Ultimately, the outcomes from this methodology will Chile help Costa Rican policy makers determine the most suitColombia able places for fast chargers across the country. FurtherCosta Rica more, because the methodology requires data that are **Ecuador usually available in most countries, it provides the basis for similar methodologies that can be adopted in other *El Salvador Latin American countries (and internationally) where EV*Guatemala charging infrastructure has yet to be defined. *Honduras The Economics of EVs: Total Cost of Ownership The up-front cost of EVs is usually higher than that of IC vehicles; however, their yearly operation and maintenance costs are typically lower. Therefore, to understand the cost effectiveness of EVs compared with IC vehicles, it is important to carry out an economic assessment of total cost of ownership (TCO). TCO quantifies the financial implications of owning and operating a vehicle over a span of years. The value calculated with this analysis represents the net present value (NPV) of all expenses over the ownership period (i.e., the TCO horizon). In the following sections, we present a methodology for quantifying the TCO of vehicles and the corresponding results for the region. The latter not only helps with understanding the economic barriers that EVs face in Latin America but also highlights some of the possible ways to promote their uptake. Calculating the TCO TCO analysis can include very detailed financial information, such as taxes, financial costs, maintenance, repairs, costs of fuel (for IC vehicles) or electricity (for EVs), subsidies, and a salvage value when the ownership period expires. However, obtaining all this information is still complex in Latin American countries. Therefore, we present a simplified methodology for estimating the TCO of vehicles in Latin America (see Figure 5). Mexico *Nicaragua Panama *Paraguay *Peru *Uruguay 0 5 10 15 20 25 30 35 40 45 50 61.6 Vehicle Purchase Cost (×US$1,000) EV Avg.:US$40,990 IC Vehicle Avg.:US$21,960 *EV prices are the Latin America average. **EV and large-sedan prices are the Latin America average. Figure 6. The up-front vehicle costs in the analyzed Latin American countries in 2019. The input data for this methodology include xx up-front cost of the vehicle: indicates the retail price of the vehicle xx discount rate: represents the opportunity cost of using capital to own the vehicle xx TCO horizon: defines the vehicle-ownership period xx vehicle performance: indicates how much energy (in kilowatt hours) or liters of gasoline are needed to travel 1 km IEEE Elec trific ation Magazine / J UNE 2 0 1 9 29 xx typical yearly driving distance: allows quantification of ation and maintenance costs (paid every year of vehicle possession). yearly energy consumption xx estimated energy price forecast: a highly uncertain variable that allows quantification of the cost of driving the vehicle per year xx estimated maintenance cost over the TCO horizon: consists of all costs needed to ensure that the vehicle can operate (e.g., repairs, replacement of parts, oil changes, and so on). The TCO methodology then follows the next steps: xx energy consumption: quantifies the yearly energy consumption using vehicle performance and typical yearly driving distance xx energy cost: estimates the total energy cost (i.e., operation cost) in US$ for each year of the TCO horizon by multiplying the energy consumption and the price forecast xx NPV of total expenditures: determines the NPV of each cost over the years. The costs considered here are up-front costs (paid at once in the first year) and oper- What Are the TCO Numbers in Latin America? 30 Uruguay Peru Paraguay *Nicaragua Mexico Panama Mexico *Honduras Honduras Guatemala El Salvador Ecuador Costa Rica Costa Rica Chile Colombia Colombia Brazil Bolivia I E E E E l e c t r i f i cati o n M agaz ine / J UN E 2019 Uruguay Peru Paraguay Panama Nicaragua Guatemala El Salvador Ecuador Chile Brazil Bolivia Argentina TCO (×US$1,000) Argentina Gasoline Price (US$/liter) Residential Electricity Rate at 500 kWh Consumption (US$ cent/kWh) Figure 6 shows the up-front costs per country gathered in early 2019. (The retail price may be affected by tax exemptions, which are not considered here.) The cost of EVs (e.g., a Leaf and Ioniq) is always higher than that of IC vehicles (e.g., a Corolla, Sentra, or Elantra), on average by 187%. The analysis uses average values when data are not available (see Figure 5). This analysis excludes Venezuela due to uncertain data. Figure 7 then shows the current electricity rates (as of June 2018) and gasoline prices (as of January 2019) in each Latin American country. In terms of the forecast for gasoline prices, we use the trend provided by the New Policies scenario presented at the World Energy Outlook 2018 of the IEA. The electricity cost forecast follows the trend provided in the Annual Energy Outlook 2018 of the U.S. Energy Information Administration. Based on consultations with vehicle manufacturers, we assume an average maintenance cost of US$1,200/year for an IC vehicle. 1.8 25 Although this value is lower during Avg.:US$ cent 14.25 1.6 the first years of use, it increases sigAvg.:US$ 1.01 20 1.4 nificantly after 5 years (according to 1.2 consulted garages). An EV has fewer 15 1 moving parts, so it has much lower 0.8 10 maintenance costs: in this case, 30% 0.6 of the costs for an IC vehicle. 0.4 5 Vehicle performance varies per 0.2 car and country, but we use an EV per0 0 formance of 5.33 km/kWh and an IC vehicle performance of 13.85 km/L, similar to that of a large sedan. Based on typical values from the *For countries without available data, the average value was used. economic literature, we use a discount rate of 5%. Figure 7. The electricity rates in Latin American countries at the end of 2018. Avg.: average. Figure 8 presents the TCO results, considering a TCO horizon of 6 years (i.e., by 2025) and a yearly driving dis70 tance of approximately 12,500 mi EV IC Vehicle 60 (~20,000 km), the average value in 50 Costa Rica and assumed for all other 40 countries. For these inputs, Figure 7 highlights that EVs are more cost 30 effective only in Costa Rica. It also 20 shows that Honduras, Panama, Para10 guay, and Uruguay have a TCO dif0 ference lower than US$5,000, which implies that EVs can become as cost effective in the short term in these Latin American countries. In addition, these results highlight the fact Figure 8. The results of the TCO assessment for a six-year TCO horizon and a yearly driving distance of 20,000 km. that countries with lower up-front costs and electricity prices are more prone to see more benefits from EVs. From a customer perspective, it is interesting to understand when the total cost of owning an EV becomes lower than the cost of owning an IC vehicle. For this purpose, we introduce the TCO match year, which indicates the number of years needed to own an EV for it to be as cost effective as an IC vehicle (considering a yearly driving distance of 20,000 km and the same energy and vehicle costs described). Figure 9 shows the countries whose TCO match year is fewer than 20 years; only 10 countries meet this criterion. More importantly, Figure 9 highlights the fact that there are three counties (Costa Rica, Panama, and Uruguay) with a TCO match year fewer than 10 years, which, in turn, indicates that people living in these countries are likely to get more economic benefits from EVs much faster than in other countries. Latin America. We also listed the number of public charging stations available in different countries and described a simplified methodology, developed in Costa Rica, for defining the location of fast-charging stations. Finally, we presented the results of an economic assessment of EVs to understand the corresponding cost effectiveness and highlight potential actions policy makers can take to promote greater EV adoption. The key conclusions are summarized as follows. Incentives Today Similar to other regions, Latin American countries are deploying financial (e.g., reducing taxes) and nonfinancial incentives (e.g., dedicated parking spaces) to promote the uptake of EVs. Because import and value-added taxes represent, on average, approximately 65% of the total tax in the region, Latin American countries are applying tax What Does It Take to Make EVs as Cost Effective as IC Vehicles? The TCO methodology can be adapted to quantify the incentives needed to make EVs as cost effective as IC vehicles for a given period and a given yearly driving distance. This can help policy makers in the region promote tax exemptions or rebates to increase the uptake of EVs. Table 4 shows the required incentive per country to make EVs as cost effective, considering 20,000 km and 6 years of ownership. As mentioned, policy makers in Honduras, Panama, Paraguay, and Uruguay need to provide a relatively low incentive (<US$5,000) to promote the deployment of EVs, and this represents approximately 10% of the up-front cost of an EV. This assessment also shows that, on an average, 22% of the retail cost of EVs in Latin America is needed to incentivize their deployment in the region. This assessment can be carried out for different years and yearly driving distances to cater to the characteristics of each country. However, for all of these cases, the methodology can be used to inform policy makers about the different options they have to promote EVs. TCO Match Year 5 Yearly Driven Distance: 20,000 km 3 4 7 6 1 Brazil 19 2 Chile 17 3 Costa Rica 6 4 Honduras 11 5 Mexico 13 6 Nicaragua 15 7 Panama 8 8 Paraguay 10 9 Peru 17 10 Uruguay 9 1 9 8 10 2 What Can Be Learned From the Region? We presented an overview of the different incentives in place in Figure 9. The TCO match year between EVs and IC vehicles considering a yearly driving distance of 20,000 km. IEEE Elec trific ation Magazine / J UNE 2 0 1 9 31 TABLE 4. The incentive needed per country to make EVs as cost effective as IC vehicles, considering a driving distance of 20,000 km and 6 years of ownership (values rounded up). Country Required Incentive (US$) Incentive/UpFront Cost (%) Argentina 25,821 42 Bolivia 11,545 28 Brazil 10,270 21 Chile 9,942 25 Colombia 16,391 39 Costa Rica EVs are already cost effective Ecuador 12,149 30 El Salvador 8,060 20 Guatemala 11,498 28 Honduras 4,308 11 Mexico 6,517 18 Nicaragua 6,995 17 Panama 1,557 5 Paraguay 4,135 10 Peru 8,339 20 Uruguay 4,759 12 reductions or exemptions to these types of taxes to lower the up-front cost of EVs, which is one of the main barriers to EV ownership. Incentives that reduce the yearly costs of owning and/or using EVs are also deployed in the region, but these have a lower impact on the economics of EVs. Waivers on driving restrictions (e.g., license-plate-based restrictions) and dedicated parking spaces are two suitable nonfinancial incentives, as their implications are usually low. The allowance to use bus-only lanes, however, can be detrimental to urban transportation sustainability, because it may result in more people leaving the public transportation system. Charging Infrastructure Public charging infrastructure is important to promote the uptake of EVs (see the “Charge Ready Program from Southern California Edison” for initiatives in the United States). There are multiple online platforms that report location, availability, and other information related to public charging stations, particularly for level 2 (semirapid) and level 3 (fast). There are approximately 628 level 2 chargers (90.5%) and 66 level 3 chargers (9.5%) in Latin America. Overall, Mexico, Brazil, and Costa Rica are leading in the region, with 85% of the total (level 2 plus level 3) public chargers. Costa Rica is making significant progress in terms of public chargers, and, as a result of a recently enacted law, charging stations must be placed strategically. 32 I E E E E l e c t r i f i cati o n M agaz ine / J UN E 2019 We presented a methodology for this purpose that aims to provide sufficient resources to reach every corner of the country. This methodology can be adopted in other Latin American countries (and internationally) where charging infrastructure has yet to be defined. Cost of Owning an EV The cost effectiveness of EVs, compared with IC vehicles, can be understood through a TCO analysis. We presented a simplified methodology that allows the quantification of total expenditures (as net present values) of the up-front, operation, and maintenance costs paid every year of vehicle possession. Given the set of assumptions (due to data unavailability), the results show that EVs in Costa Rica are already effective when people drive more than 20,000 km per year and own the vehicle for at least 6 years. EVs in Panama and Uruguay become cost effective after 8 and 9 years if people still drive 20,000 km per year. Maintaining this yearly driving distance, people in all the other Latin American countries require more than 10 years of ownership or the introduction of financial incentives that reduce the up-front cost of EVs. The developed TCO methodology was adapted to quantify the financial incentives needed per country to make EVs as cost effective by 2025. On average, the region requires a reduction of 22% in the retail cost of EVs, which could be achieved through tax cuts. For Further Reading International Energy Agency, “Global EV outlook 2018: Towards cross-modal electrification,” Paris, France, May 2018. [Online]. Available: https://webstore.iea.org/global-ev-outlook-2018 J. A. Gómez-Gélvez, C. Hernán Mojica, V. Kaul, and L. Isla, The Incorporation of Electric Cars in Latin America, Inter-American Development Bank, 2016.[Online]. Available: https://publications .iadb.org/publications/english/document/The-Incorporationof-Electric-Cars-in-Latin-America.pdf J. Quirós-Tortós et al., “Propuesta de ubicación de la infraestructura de recarga rápida para vehículos eléctricos en Costa Rica,” Sept. 2018. [Online]. Available: https://sepse.go.cr/documentos/ Propuesta-de-ubicacion-de-L3.pdf. J. Quirós-Tortós, L. F. Ochoa, and T. Butler, “How electric vehicles and the grid work together: Lessons learned from one of the largest electric vehicle trials in the world,” IEEE Power Energy Mag., vol. 16, no. 6, pp. 64–76, Nov.–Dec. 2018. doi: 10.1109/MPE.2018.2863060. Southern California Edison, “Charge Ready Program—Fact sheet.” [Online]. Available: https://www1.sce.com/wps/wcm/ connect/ff38bcac-8460-47ff-81d0-66ec4c3d7887/Charge_ Ready_EVSE_Fact_Sheet.pdf?MOD=AJPERES Biographies Jairo Quirós-Tortós ([email protected]) is with the University of Costa Rica. Luis Victor-Gallardo ([email protected]) is with the University of Costa Rica. Luis (Nando) Ochoa ([email protected]) is with the University of Melbourne, Australia, and the University of Manchester, United Kingdom. By Hamidreza Nazaripouya, Bin Wang, and Doug Black ©ISTOCKPHOTO.COM/FARUKULAY LIMATE AND WEATHER PATTERNS ARE changing in California and across the planet. Extreme weather events such as wildfires are happening more frequently, precipitation has become increasingly variable, heat waves are more common, and temperatures are warming. Climate and weather scientists have tracked the observed changes since the mid-20th century and linked them mainly to human activity and influence. The human activity, including the burning of fossil fuels, has led to a significant release of carbon dioxide and other greenhouse gases into the atmosphere, which disrupts the global carbon cycle and leads to global warming. C According to the 2018 California Energy Commission report, in that state, transportation is the largest source of greenhouse emissions, accounting for about 40.6% of the total and more than 50% when emissions from refineries are included. Given this, the fundamental effort of California for reducing greenhouse gas emissions is to transform the transportation system from gasoline to electric vehicles (EVs), aligned with Senate Bill 350 encouraging transportation electrification. Currently, EVs make up only a small percentage of the auto market. In 2017, the new EV sales market share in California was 4.92%; for the United States, this number was 1.18%. Obstacles to increasing EV market share Electric Vehicles and Climate Change Additional contributions and improved economic justification. Digital Object Identifier 10.1109/MELE.2019.2908792 Date of publication: 11 June 2019 2325-5987/19©2019IEEE IEEE Elec trific ation Magazine / J UNE 2 0 1 9 33 The aim of this article is to study the extra potential value of EVs to end users, EV fleet aggregators, utility companies, and system operators. include high vehicle costs and lack of a clear economic justification for manufacturers and end users. The EV industry still relies on federal and state subsidies, and there is a debate about whether the industry can stand on its own feet without these supports. Currently, the major force behind federal and state efforts to promote EVs is clean transportation goals, and the only economic incentive for EV users is the fuel cost savings. The aim of this article is to study the extra potential value of EVs to end users, EV fleet aggregators, utility companies, and system operators. The objective is to improve the economic justification for EVs and encourage deployment of the technology, not only because of environmental concerns but also for the services it can provide in terms of grid reliability, security, and resilience. EV and Electricity Markets The current power grid faces a future for which it was not designed. This includes dealing with high variability in power supply due to large-scale integration of renewable energy resources, a rapidly aging infrastructure that threatens grid resilience and reliability, and the additional burden placed on the grid by the widespread adoption of EVs. Although high demand and the stochastic nature of EV loads might be considered as challenges for grid operation, the EV as a mobile and flexible energy storage system brings new opportunities to manage the grid. EVs are assets in the grid that can address future challenges by providing grid services traditionally reserved for conventional generation resources such as peaking units and battery storage systems. Proper coordination and optimal charging of EVs enable them to participate in energy and ancillary service markets across the network. According to a U.S. Department of Transportation report, personal vehicles in the United States were driven for 56.1 min/day on average in 2009. While they are parked for about 23 h/day, these EVs could achieve the secondary purpose of providing valuable services to the grid, including ancillary services, emergency backup power, and demand profile leveling, on a daily basis. This could help the local and state-wide community improve the economics and reduce environmental costs of stable power, prevent black-out scenarios, and reduce the timing imbalance between peak demand and renewable energy production, besides contributing to greenhouse gas emissions reductions. The California Independent System Operator (CAISO) offers wholesale market aggregators the proxy demand resource (PDR) product, which enables aggregators to offer demand-response resources directly into the wholesale 34 I E E E E l e c t r i f i cati o n M agaz ine / J UN E 2019 energy and ancillary service markets. It also allows non-generator resources (NGRs) to bid their 15-min capacity into the regulation market. PDR resources can bid economically into the following markets: 1) the dayahead energy market with a minimum load curtailment of 100 kW, 2) the day-ahead and real-time nonspinning reserve market with a minimum load curtailment of 500 kW, and 3) the 5-min real-time energy market. Additionally, smaller loads may be aggregated to achieve minimum load curtailment. It should be noted that PDR is only a load curtailment product and is not enabled for load increase. In this article, we show how EVs as deferrable loads can participate in electricity markets and be optimally shifted to various timespans and so meet grid objectives in different markets. In the following, we discuss some of the potential programs for EV participation and then present a real-world case study, including detailed specifications of the EV fleet and quantified benefits. Time-of-Use Tariff Structure To alleviate stress on the grid and reduce load during peak demand hours, utilities in California offer time-of-use (TOU) pricing, which includes lower prices during lowdemand periods. EV owners can benefit from this program and reduce their bills by cooperating with utility companies in distributing the loads over time and improving the load factor. In California, for commercial customers under the TOU tariff structure, two categories of costs are generally applied: energy charge and demand charge. Energy charges are calculated as the product of electricity energy amount, measured in kilowatt hours (kWh) per time period, and the per-kWh rate corresponding to the time period. Demand charge is calculated based on the maximum power measured in each demand period multiplied by the corresponding demand charge rate, in US$/kW. Adopting an optimal EV charging schedule and/or equipping EVs with vehicle-to-grid (V2G) capability (i.e., sending energy back to the grid during peak demand) can minimize monthly energy bills and contribute to reducing the load on the power grid. Peak-Day Pricing Plan Peak-day pricing (PDP) is a time-varying rate structure that offers higher rates during peak-usage periods and lower rates at other times. The higher-rate events typically occur on the hottest days of the summer. According to Pacific Gas and Electric (PG&E), customers participating in PDP can expect between nine and 15 PDP event days in addition to TOU pricing each year. On event days, an extra charge is added to the regular TOU rate during the peak period: for example, under PG&E’s E-19 tariff program, the peak period is from 2 p.m. to 6 p.m. In return, customers receive discounts on regular summer electricity rates. When participating in this program, customers must elect a capacity reservation level (CRL) based on their historical data usage measured every 15 min. During PDP events, the energy usage below the CRL is protected and billed at non-PDP rates (e.g., the TOU rates), while usage above the CRL is subject to PDP rates with higher energy and demand charges. In this program, regular summer rates are discounted. customers the opportunity to receive financial incentives for reducing loads on event days. Credits are based on the difference between the customer’s actual metered load during an event and a baseline load calculated from the customer’s usage data prior to the event. For the most part, customers are notified of events by noon the previous day. That is, DBP events are dispatched in day-ahead operations; thus, preplanning is necessary for optimizing the benefits. Aggregated EVs can be utilized as valuable resources in response to DBP events, following virtual-battery modeling approaches similar to those used for the PDR programs. The EV as a mobile and flexible energy storage system brings new opportunities to manage the grid. Ancillary Service Market According to the U.S. Federal Energy Regulatory Commission, ancillary services are “those services necessary to support the transmission of electric power, to maintain reliable operations of the interconnected transmission system.” Ancillary services are utilized to achieve instantaneous supply–demand balance in electric transmission systems by calling services from various grid components—not only traditional electricity generators but also demand-side distributed energy resources. A regulation up/down market is a representative type of ancillary service market. EVs with the capability to follow the regulated up and down signals within a short period of time can be coordinated to serve as effective and reliable resources for regulation services Case Study Results and Discussion A parking garage located in Oakland, California, was selected as the testing facility for performing a case study. The real-world data sets for this facility were collected from the PG&E utility electric meter. The data sets include four years of historical building load, public and fleet EV itineraries, and energy demand records for more than 20,000 EV charging sessions. The detailed fleet information is included in Table 1. Information on the charging stations installed at the demonstration site and used in this study is listed in Table 2. TABLE 1. EV fleet information for the case study. PDR Market The PDR program in California allows end-use customers to bid demand-response services directly into CAISO’s wholesale day-ahead and real-time markets through a demand-response provider as PDRs. Aggregated EVs can participate in the PDR market, where fleet EVs are treated as a “virtual battery” with the flexibility to sell their power in the PDR market. For EVs with V2G capabilities, sell operations can be achieved by discharging the vehicle batteries; for smart-charging vehicles (V1G), selling power would be achieved by reducing the aggregate power consumption relative to the baseline of the load profile. CAISO uses a baseline energy calculation to determine the amount of energy curtailed. PHEV Model Battery Capacity (kWh) Number Nissan Leaf 24 12 Chevy Bolt 60 2 Ford Focus Electric 23 17 Toyota RAV4 41.8 2 Toyota Prius 4.4 2 Chevy Volt 16.5 2 Ford C-Max Energi 7.6 3 PHEV: Plug-in hybrid electric vehicle. Demand Bidding Program To increase system reliability, some utility companies are paying additional incentives to industrial, commercial, and agricultural customers to reduce their energy consumption during certain time periods. Demand bidding programs (DBPs) at Southern California Edison and PG&E are examples of this. According to program documents from the California Public Utilities Commission, a DBP is a voluntary demand-response bidding program that provides enrolled TABLE 2. Charging station information. Ports Charger Model Number Level 1 Level 2 CT2100 14 1 1 CT4020 11 0 2 IEEE Elec trific ation Magazine / J UNE 2 0 1 9 35 0.4 Minimum: 0 Maximum: 1 Mean: 0.3972 Median: 0.3602 Probability 0.3 0.2 0.1 0 0 0.2 0.4 0.6 Flexibility 0.8 1 Figure 1. The probability distribution of the charging session flexibility index. TABLE 3. PG&E’s E-19 demand charge and energy charge rates. Demand Charges US$/kW Time Period Maximum peak demand, summer US$18.74 Noon–6:00 p.m. Maximum part-peak US$5.23 demand, summer 8:30 a.m.–Noon and 6:00–9:30 p.m. Maximum demand, US$17.33 summer Any time Maximum part-peak US$0.13 demand, winter 8:30 a.m.–9:30 p.m. Maximum demand, US$17.33 winter Any time Energy Charges US$/kWh Time Period Peak, summer US$0.14726 Noon–6:00 p.m. Part-peak, summer US$0.10714 8:30 a.m.–Noon and 6:00–9:30 p.m. Off-peak, summer US$0.08057 Any time Part-peak, winter US$0.10166 8:30 a.m.–9:30 p.m. Off-peak, winter US$0.08717 Any time Electric Bill (US$) 10,000 8,000 TOU Market Participation The first study includes load shifting and cost reduction through smart charging and scheduling optimization under TOU prices only. Table 3 summarizes demand charge and energy charge rates according to PG&E tariffs. As shown in Table 3, the energy charge and demand charge rates in winter are lower than those in summer. As a result, the test site’s actual total monthly costs for energy charges in winter were slightly lower than those for summer, indicated by the blue bars in Figure 2. In addition, the total monthly demand charges in winter were considerably lower than those in summer, shown in Figure 2 by the orange bars. Two separate optimization problems with different cost objectives are defined as use cases. The first cost objective includes only the total monthly energy charge; the second includes the summation of total monthly energy and demand charge. The load profile of two consecutiive days with the maximum monthly demand in June is shown in Figure 3, with (a) and (b) corresponding to minimization of the first and second cost objectives, respectively. In Figure 3(a), a large portion of the EV load has been shifted to time periods with lower energy charge rates; in Figure 3(b), the monthly load peak around 10 a.m. is shaved to minimize the monthly demand charge. 6,000 4,000 Ancillary Service Market Integration 2,000 In this section, another capability is enabled that allows EVs to participate in ancillary service markets in addition to the TOU market. The day-ahead prices for ancillary service regulation up and down are collected from CAISO’s Open Access Same-Time Information System (OASIS) for two years. As shown in Figure 4, the EV load profile becomes spikier when supporting ancillary service market 0 Months Energy Charge Cost Demand Charge Cost Figure 2. The actual total monthly cost of energy and demand charges at the test site for two years starting from January, in chronological order. 36 The deferability of the EV charging load can be denoted by the flexibility index, defined by the actual charging time in each session divided by the total plug-in time. The distribution of the flexibility indices for all collected charging sessions in this study is shown in Figure 1. In this case study, the charging scheduling problem for EVs is formulated as an optimization problem based on mathematical models of each market. The mathematical model includes the physical and market constraints imposed on the participation of EVs in the electricity market (e.g., state of charge and power and energy capacity) as well as an objective function that aims to maximize EV revenue and minimize the testing facility electricity bill. This section demonstrates the optimization results of EVs participating in the demand-response programs and ancillary service markets described in the previous section. The benefit analysis is conducted based on real data from the testing facility as well as pricing information from PG&E and CAISO. I E E E E l e c t r i f i cati o n M agaz ine / J UN E 2019 TABLE 4. Monthly revenue from the Power (kW) Part-Peak Region Shifted Load 100 50 150 12:00 24:00 (a) 12:00 24:00 Shaved Peak 100 50 00:00 12:00 24:00 (b) 12:00 24:00 Baseload (kW) Optimized EV Load (kW) Original Building Load (kW) Figure 3. An example load profile showing the smart-charge EV load shifting to minimize electric costs for two consecutive days. In June: (a) minimization of the first cost objective and (b) minimization of the second cost objective. Power (kW) regulation market. 150 00:00 Power (kW) Peak Region 120 110 100 90 80 70 60 50 40 30 00:00 Year Ancillary Service Month Revenue Year Ancillary Service Month Revenue 2015 1 US$90.38 2016 1 US$74.53 2015 2 US$66.42 2016 2 US$66.33 2015 3 US$73.88 2016 3 US$90.37 2015 4 US$95.73 2016 4 US$71.75 2015 5 US$78.09 2016 5 US$68.62 2015 6 US$67.75 2016 6 US$95.70 2015 7 US$76.57 2016 7 US$69.22 2015 8 US$68.51 2016 8 US$77.28 2015 9 US$78.16 2016 9 US$61.50 2015 10 US$80.48 2016 10 US$78.24 2015 11 US$63.24 2016 11 US$79.70 2015 12 US$98.11 2016 12 US$115.14 The monthly revenue results are simulated by applying EV management strategies over two selected years, as shown in Table 4. The highest monthly revenue is calculated as US$115 for December 2016, and the lowest revenue obtained is US$61.50 for September 2016. PDR Market Participation 12:00 24:00 12:00 24:00 Baseload (kW) Optimized EV Load (kW) Original Building Load (kW) Figure 4. An example load profile for two days of ancillary service regulation up and down market participation. participation, because optimization tends to change power consumption when a high regulation price signal is anticipated. However, with the possibility that the increased EV charging load causes new demand peaks and thus high demand charges, optimization evaluates the tradeoff globally on a monthly basis. As depicted in Figure 4, the adjusted power consumption profiles due to participation in the regulation market are constrained so as not to exceed the monthly demand peaks set by the TOU-based optimization. In this study, the duration of each regulation commitment during optimization is 15 min, within which the actual regulation signals are dispatched every 4 s. A 15-min interval is considered as the finest resolution for EV control. In addition, both regulation up and regulation down bids are allowed in the same time periods. The same analysis is conducted for PDR market integration by combining the TOU charges with the revenues from the PDR markets as the objective function. Figure 5(a) shows the day-ahead PDR price for two consecutive days. In California, CAISO requires that each participant in the PDR market have at least a 1-h commitment. Therefore, additional constraints must be applied on the optimization problem to guarantee that each market participation event spans more than four time steps (15 min per step). As shown in Figure 5(b), the green curve indicates the actual EV power consumption profile, while the red curve represents the virtual sell power of the EV aggregator given price signals from the PDR market. Note that the total energy consumption according to the actual power consumption profile is equal to that calculated from the baseline profile. In addition, in this problem, the participation of EVs in the PDR market is modeled with a binary variable, which reflects that the EV aggregator does not have to stay in the market for the entire day and can plan to participate in the market when PDR prices are economically desirable. Table 5 summarizes the calculated monthly revenues from PDR markets. DBP Participation DBP market integration has many similarities with PDR market participation. The main difference is that the DBP IEEE Elec trific ation Magazine / J UNE 2 0 1 9 37 Price (US$/kWh) market occurs only when DBP events are issued by the program facilitator, whereas hourly price signals in the PDR market are available daily. In PG&E’s DBP program, the fixed rate of US$0.5/kW is credited to commercial customers 0.1 0.05 0 –0.05 00:00 12:00 24:00 12:00 24:00 Day-Ahead PDR Price (US$/kWh) Power (kW) (a) 50 0 –50 00:00 12:00 24:00 12:00 24:00 Baseline (kW) Virtual Sell Power (kw) Actual Power (kW) (b) Figure 5. The results of PDR market participation: (a) PDR price (in US$/kWh) and (b) baseline, virtual sell, and actual powers (in kW). TABLE 5. Monthly revenue from the PDR market. Year PDR Month Revenue Year PDR Month Revenue 2015 1 US$29.20 2016 1 US$26.76 2015 2 US$17.44 2016 2 US$32.45 2015 3 US$34.12 2016 3 US$35.92 2015 4 US$33.76 2016 4 US$30.16 2015 5 US$31.74 2016 5 US$24.23 2015 6 US$22.64 2016 6 US$46.00 2015 7 US$21.39 2016 7 US$12.96 2015 8 US$29.07 2016 8 US$24.79 2015 9 US$31.48 2016 9 US$20.76 2015 10 US$32.22 2016 10 US$29.67 2015 11 US$20.40 2016 11 US$18.81 2015 12 US$35.27 2016 12 US$52.72 TABLE 6. Monthly revenue from the DBP market. 38 when they reduce their demand during DBP events. The results for DBP market participation in this study are shown in Table 6. It is assumed that the power capacity threshold for participation is greater than or equal to 10 kW and that each commitment should be at least 2 consecutive hours in duration. Due to the 2-h commitment constraint, existing EV resources were not qualified to participate in all 2016 DBP events. Thus, the profit-generating capacity for EVs is not as high as that for the regulation market. Year Month Event Number Revenue 2016 6 5 US$16 2016 7 6 US$10 I E E E E l e c t r i f i cati o n M agaz ine / J UN E 2019 PDP Participation For the PDP market integration analysis, the impacts of the CRL on monthly PDP revenues are studied by selecting different values for historical PDP events. The monthly peaks above the CRL receive PDP credits, while the energy usage is not protected by the CRL and is billed at a fixed PDP rate. PDP events are issued only during summers and only during peak and part-peak demand periods. The monthly PDP benefit is calculated by subtracting the monthly event energy charge from the summation of PDP credits for peak demand and part-peak demand periods. In Figure 6, PDP benefits for summer months in 2016 are shown with varying CRLs. For months with only one PDP event, i.e., August and September, PDP credits dominate the total benefit, which decreases as the CRL increases. On the contrary, in months with more PDP events, when the CRL increases from 10 kW to 60 kW, the energy charge becomes dominant because there is less unprotected energy usage. As the CRL increases to greater than 60 kW, the monthly benefits decrease because of the weaker protection by the CRL. The annual total PDP benefit varies with the CRL, where the optimal CRL value is close to 40 kW. Summary Given the increase of EV penetration in recent years and future potential growth, California is in a unique position to use these resources to provide services to the grid, including reducing peak demand, mitigating the timing imbalance between peak demand and renewable energy production, stabilizing the grid, and compensating for the impacts of intermittent resources. These are in addition to EVs’ contributions in reducing greenhouse gas emissions. EVs with V1G (smart charging) capabilities can alleviate the grid stress associated with vehicle charging in times of load ramps and peak demand through demandresponse programs. Also, EV owners who consume energy sustainably can benefit from reduced charging costs through TOU pricing, PDP, ancillary service, PDR, and DBP programs. Using aggregators, EVs with V1G capabilities can also provide a range of services to the grid, including regulation services, for which the providers/owners would be compensated. This provides the scope for EVs to help reduce the investment needed from local authorities and utilities for grid maintenance equipment, lowering costs associated with reliability measures, which can, in turn, lead to reduced energy costs. 500 PDP Revenue (US$) 400 300 200 100 0 –100 –200 –300 0 20 40 60 80 100 Capacity Reserve (kW) 120 140 arbitrage, and more. However, there is a long debate regarding the impact on battery life of charging and discharging EVs and how to calculate the actual revenue generated, which are both out of the scope of this article. Finally, proper regulation and standards can promote and facilitate the use of this technology and encourage stakeholders to invest more in the EV industry. Investors and stakeholders should have a clear and accurate understanding of market models. To this end, the regulatory environment should offer them this vision as well as attractive incentives, while removing the regulatory restrictions that prevent them from collecting revenue. Acknowledgments June 2016, Five PDP Events July 2016, Five PDP Events Aug. 2016, One PDP Event Sept. 2016, One PDP Event Annual, 12 PDP Events The research described here was funded by the California Energy Commission under Work for Others Contract EPC14-057 and supported by the U.S. Department of Energy under Contract DE-AC02-05CH11231. Figure 6. The impact of capacity reserve on PDP benefits. TABLE 7. Monthly revenue for combined programs in the case study. Combined Programs TOU+AS TOU+PDR TOU+DBP TOU+PDP Monthly Revenue US$61.50 US$12.96 –115.14 –52.72 US$0–16 US$80– 480 V1G capability is not only useful for supporting the grid but may also protect battery health and prolong battery life. The main factors that affect battery life are the average state of charge (SOC), the charging power level, and the amount of charge transfer. Smart charging, by keeping the average SOC and charge transfer low, can improve battery life. Our investigation found that there are some variations in revenue generated by EVs based on the combination of service type, seasonal pricing, and territory of operation. Table 7 summarizes the range of monthly revenues for different combinations of programs in this case study. Despite this residual uncertainty concerning the provided value, it is nonetheless evident that EVs have the potential to generate significant revenue for all stakeholders, with earnings proportional to the extent of their integration. Additionally, there are certain geographic areas where EVs can have greater value, including those highly dependent on renewable energies, and those likely to have congestion, all of which can promote increased integration of EVs and better justify their economics. In this article, we investigated only the potential value created by V1G capability. Although adding V2G capability provides EVs with more flexibility in electricity markets (and consequently more value) by allowing participation in spinning/nonspinning reserves, voltage regulation, energy For Further Reading A. Santos, N. McGuckin, H. Y. Nakamoto, D. Gray, and S. Liss, “Summary of travel trends: 2009 national household travel survey,” U.S. Federal Highway Admin., Washington, DC, Rep. FHWA-PL-ll-022, June 2011. [Online]. Available: https://nhts .ornl.gov/2009/pub/stt.pdf D. Black, J. MacDonald, N. DeForest, and C. Gehbauer, “Los Angeles Air Force Base vehicle to grid demonstration,” presented at the CalCharge Battery Consortium Kick-off, Lawrence Berkeley Nat. Lab., May 2013. [Online]. Available: https:// escholarship.org/uc/item/7jh4d3t7 D. Black, R. Yin, and B. Wang, “Smart charging of electric vehicles and driver engagement for demand management and participation in electricity markets,” Lawrence Berkeley Nat. Lab., Apr. 2018. [Online]. Available: https://www.energy .ca.gov/2019publications/CEC-500-2019-036/CEC-500-2019-036.pdf B. Wang, Y. Wang, H. Nazaripouya, C. Qiu, C. C. Chu, and R. Gadh, “Predictive scheduling framework for electric vehicles with uncertainties of user behaviors,” IEEE Internet Things J., vol. 4, no. 1, pp. 52–63, 2017. S. Parvar, H. Nazaripouya, and A. Asadinejad, “Analysis and modeling of electricity market for energy storage systems,” presented at the 10th Conference on Innovative Smart Grid Technologies (ISGT 2019), Washington DC, 2019, pp. 1–5 S. Narayana Gowda, T. Zhang, H. Nazaripouya, C. Kim, and R. Gadh, “Transmission, distribution deferral and congestion relief services by electric vehicles,” presented at the 2019 IEEE Innovative Smart Grid Technologies North America Conf., Washington, DC, Poster 2019ISGT0020. California Independent System Operator, “What the duck curve tells us about managing a green grid,” 2016. Accessed on: Jan. 11, 2013. [Online]. Available: https://www.caiso.com/ documents/flexibleresourceshelprenewables_fastfacts.pdf Biographies Hamidreza Nazaripouya ([email protected]) is with the University of California, Riverside. Bin Wang ([email protected]) is with Lawrence Berkeley National Laboratory, California. Doug Black ([email protected]) is with Lawrence Berkeley National Laboratory, California. IEEE Elec trific ation Magazine / J UNE 2 0 1 9 39 By Jonathan Donadee, Robbie Shaw, Oliver Garnett, Eric Cutter, and Liang Min Potential Benefits of Vehicle-to-Grid Technology in California High value for capabilities beyond one-way managed charging. Digital Object Identifier 10.1109/MELE.2019.2908793 Date of publication: 11 June 2019 40 I E E E E l e c t r i f i cati o n M agaz ine / J UN E 2019 ©ISTOCKPHOTO.COM/CABORI ITH ELECTRIC VEHICLES (EVs) RAPIDLY becoming more popular, along with a need for flexible energy storage resources in the electric grid, the development of vehiclegrid integration (VGI) technology has taken on a new urgency. VGI encompasses any technology that helps EVs better integrate with the grid, including management of charging and control of bidirectional charging and discharging. The practice of managing the one-directional flow of power from the grid to vehicles (V1G) is currently being rolled out across California and in many W 2325-5987/19©2019IEEE is reluctant to invest in developing and deploying V2G technology. As part of CEC-funded project 14-086, Distribution System Aware Vehicle to Grid Services for Improved Grid Stability and Reliability, Energy and Environmental Economics, Inc. (E3) was tasked with quantifying the potential benefits of V2G technology for California’s ratepayers across a variety of use cases. In this article, we share results and key insights from E3’s study. We believe that these results provide regulators and industry with the critical information necessary to help identify the best opportunities for V2G technology in California. Modeling the Electric Grid Benefits of V2G Optimized Dispatch Using the CEC Solar + Storage Tool To estimate the electric grid benefits of V2G, we conducted a case study covering several scenarios and use cases between the present and the year 2030. The case study was performed using the CEC Solar + Storage Tool developed by E3. New EV-specific modeling and dispatch optimization features were added to the tool, including the unique constraints that transportation creates for EVs used as DERs. The model optimizes a joint-dispatch schedule for a group of EVs that plug in at a common 60 0.12 50 0.1 40 0.08 30 0.06 20 0.04 10 0.02 - EV SOC 0 1 2 3 4 5 6 7 8 9 10 11 12 13 14 15 16 17 18 19 20 21 22 23 24 (10) Price (US$/kWh) (kWh) places where EVs have become popular. V1G programs in California include San Diego Gas and Electric’s Power Your Drive, EV-specific retail tariffs from Southern California Edison, and the Charge Forward smart charging pilot program from Pacific Gas and Electric in collaboration with automaker BMW. The capability to inject power from an EV’s battery into the electric grid is known as vehicle-to-grid (V2G). Adding V2G capability to EVs would enable them to deliver much greater benefits to the electric grid than V1G. There are, however, significant barriers to the widespread deployment of V2G, including the development of standards for information exchange, regulatory frameworks, and business models. These barriers are similar to those facing other distributed energy resources (DERs) but are even more complex because vehicles are mobile and require the flexibility to connect to a variety of EV service equipment (EVSE) and charge or discharge at many different locations. Another key barrier to further development and deployment of V2G identified at the California Energy Commission’s (CEC’s) recent VGI Roadmap Update Workshop is a lack of knowledge about the value that V2G can provide and what the most promising V2G use cases are for capturing that value. Without this knowledge, industry Charge Work –0.02 Charge Home Work Discharge Home Discharge 60 0.12 Driving Discharge 50 0.1 Utility Avoided Cost 40 0.08 30 0.06 20 0.04 10 0.02 - Price (US$/kWh) (kWh) Hour of Day (a) 0 (10) 1 2 3 4 5 6 7 8 9 10 11 12 13 14 15 16 17 18 19 20 21 22 23 24 –0.02 Hour of Day (b) Figure 1. (a) A V1G and (b) a V2G dispatch during solar overgeneration for a single EV at home on a weekend day. IEEE Elec trific ation Magazine / J UNE 2 0 1 9 41 12 54.77 54.62 54.04 53.46 53.45 53.04 54.35 54.87 55.22 52.71 53.53 51.31 48.5 46.95 44.02 49.76 50.81 53.44 55.59 54.94 55.45 54.35 55.46 55.16 11 50.74 50.87 51.7 51.61 51.44 51.33 52.04 50.98 45.54 43.55 43.1 40.24 39.31 38.56 40.92 47.23 50.26 50.85 52.2 51.67 51.38 52.23 52.14 51.37 47.9 48.07 49.05 50.66 49.81 39.49 39.51 34.44 34.23 34.37 36.71 40.92 45.72 49.15 50.85 52.71 53.36 52.29 52.89 51.44 49.54 10 49.41 49.14 48.4 9 52.61 52.31 51.28 50.12 50.51 51.22 50.32 45.33 39.61 38.39 35.85 36.48 36.5 38.03 43.22 47.12 50.07 55.03 54.94 53.82 54.99 55.3 53.88 52.94 54.8 56.96 54.62 51.93 53.97 53.8 52.25 8 53.44 53.09 52.51 51.42 52.14 52.25 50.87 44.99 38.58 37.64 37.01 36.29 37.48 37.01 43.42 46.16 49.1 7 49.38 49.86 50.59 50.31 51.6 52.87 48.33 44.28 38.9 36.17 35.61 35.44 34.72 35.22 41.21 44.1 47.59 51.18 53.84 53.42 50.89 52.72 51.86 50.41 6 45.15 45.93 45.98 45.9 45.14 45.15 43.2 38.85 30.47 28.79 26.33 21.45 22.31 24.9 32.23 34.95 42.26 48.1 50.12 48.42 47.35 49.71 49.6 45.47 5 42.15 42.57 42.44 42.44 42.45 42.86 41.66 31.41 21.33 20.21 17.26 16.05 16.96 18.1 24.73 31.22 34.32 42.16 45.06 45.87 45.66 46.49 46.76 43.48 42.4 43.14 43.69 36.22 27.46 23.45 20.36 4.09 –2.32 11.41 24.31 32.02 37.81 44.13 46.73 46.54 46.47 46.56 46.41 43.83 4 42.35 42.91 42.97 42.7 3 48.43 47.91 47.61 47.63 47.41 47.87 49.1 49.01 37.5 33.93 30.38 20.97 19.35 27.16 28.61 34.7 44.12 47.98 48.98 49.5 49.65 49.49 48.85 48.13 2 51.67 52.02 52.01 51.55 51.6 51.83 53.87 54.15 52.1 43.31 39.58 39.03 39.1 39.95 37.07 40.5 49.67 50.9 53.08 53.4 52.29 51.04 52.86 51.5 24 23 22 21 20 19 18 17 16 15 14 13 1 54.55 53.91 54.76 54.7 54.23 54.32 55.54 55.98 55.93 50.54 50.16 50.92 50.25 47.47 42.92 49.01 51.92 52.89 55.94 54.64 54.19 54.41 55.96 55.39 Hour 12 11 10 9 8 7 6 5 4 3 2 1 Month Figure 2. The average hourly energy prices ($/MWh) in 2030 under the base scenario. 42 I E E E E l e c t r i f i cati o n M agaz ine / J UN E 2019 workplace during work hours and at separate homes during other times. For this study, we modeled a group of five vehicles, each having a 60-kWh battery and a maximum charging and discharging power of 6.6 kW. We assumed that each vehicle has access to a V2G-capable EVSE at both home and work. The tool can model several VGI use cases. To create a baseline for determining the value of optimized EV dispatch, an “unmanaged” charging profile is generated. Under an unmanaged charging strategy, whenever an EV plugs in, it is charged immediately at maximum power until a full state of charge (SOC) is reached. Dispatch can then be conducted in either V1G mode or V2G mode so that the incremental benefits of these technologies can be determined. V1G and V2G dispatch can be optimized from the perspective of customers (e.g., to maximize their bill savings) or from the utility’s perspective to minimize its cost of supplying electricity, commonly known as the utility’s avoided cost. The charging and discharging dispatch can also be cooptimized with the sale of frequency-regulation ancillary service (AS) to the grid. A common concern about V2G technology is that discharging the vehicle’s battery will increase battery degradation, thus shortening its useful life for transportation. To address these concerns, the optimization model can penalize the discharge of energy from an EV’s battery to the grid and also penalize the SOC for being outside of a specified range. For this study, we chose penalties based on EV battery cycle life and cost of replacement and penalized states of charge outside the range of 30 to 95%. V2G Dispatch Flexibility Creates Advantages Over V1G Optimized dispatches of EV charging and discharging created with the Solar + Storage tool demonstrate why V2G is a much more flexible resource than V1G. Figure 1 shows example optimized dispatches under V1G and V2G modes for a single vehicle plugged into the grid for 23 h on a Saturday, making one late evening trip at 9 p.m. The utility avoided costs represent a typical early summer day in the future California electric grid when solar overgeneration causes negative midday energy market prices and loads are paid for their consumption. As shown in Figure 1, discharging in the morning leaves the V2G vehicle with more available battery capacity for charging during the period of negative avoided cost than the V1G vehicle. The V2G vehicle can then discharge some energy from its fully charged battery in the high-value evening hours, either before or after taking a trip. By absorbing excess solar generation through charging, the load of the V1G vehicle creates a benefit for the utility of US$0.06 on this day. However, because the V2G vehicle is able to charge far more energy than the V1G vehicle at midday and then discharge to the grid at high-value times, it creates a benefit of US$1.96 for the utility. These values are absolute and not relative to other charging profiles. 12 42.92 43.35 44.12 45.57 45.58 45.32 42.94 45.15 45.34 36.75 28.5 27.39 27.29 30.21 34.07 40.56 45.41 46.2 44.24 43.77 42.25 42.73 44.7 43.41 –6.97 –2.71 25.09 38.58 44.28 44.17 43.9 43.09 45.52 47.51 48.79 44.3 –13 11 43.81 43.42 43.25 43.31 43.59 43.8 46.82 46.48 26.54 16.28 –3.5 54.4 71.15 79.24 67.13 56.06 52.97 48.31 48.79 30.41 43.01 44.4 64.91 82.78 75.45 60.48 62.87 62.23 51.45 2.4 7.74 –5.96 –7.01 9 54.22 52.46 49.61 46.7 47.38 48.33 49.81 35.89 20.28 12.84 –2.06 –6.09 –7.51 –3.49 25.09 37.51 48.83 78.91 75.23 63.94 64.11 58.06 57.81 54.96 10 47.01 46.9 45.81 45.12 43.01 44.49 52.31 42.04 13.29 –0.05 –22.96 –25.67 –25.85 –18.75 20.61 37.7 Month 8 52.62 52.21 52.34 51.59 51.12 51.25 48.87 36.59 21.26 19.6 28.47 37.61 43.38 53.65 69.86 64.66 54.89 51.13 52.89 47.58 6.7 0.28 7 46.48 47.44 47.84 47.89 47.8 48.79 42.31 34.5 20.17 18.27 17.55 9.41 6 39.43 38.03 38.68 38.62 38.63 38.04 34.96 28.01 16.61 –0.11 –8.55 –16.69 –21.32 –22.23 10.58 19.66 28.8 30.46 40.77 42.29 37.66 40.51 45.99 40.8 14.6 20.26 29.52 28.67 31.48 33.33 36.46 34.42 –30 –30 –30 –30 –30 31.4 30.43 31.19 31.2 29.66 30.89 26.57 19.79 0.58 –24.58 –30 5 30.01 30.01 28.27 26.91 26.39 24.63 25.4 10.12 –1.49 –13.75 –14.67 –24.44 –22.88 –16.91 –9.36 –1.57 23.03 23.42 33.48 30.48 30.85 36.8 42.87 34.74 4 –30 –17.12 25.71 32.14 33.55 34.93 34.57 35.03 36.99 37.17 –30 –30 3 37.14 37.94 37.91 37.52 36.71 36.01 34.59 35.18 15.95 0.53 –28.74 –30 40.26 39.33 39.75 40.02 40.79 42.3 41 20.5 20.27 24.99 35.29 41.22 2 42.19 42.86 44.01 44.42 44.9 44.32 44.58 43.22 38.69 26.16 –0.17 –7.78 –8.07 –8.56 –8.32 20.98 36.97 37.85 38.49 38.91 38.86 41.08 42.65 42.6 16 15 14 13 12 Hour 11 10 9 8 7 6 5 4 3 2 1 We considered two scenarios for evaluating VGI technologies: a base and a high-value scenario. The value streams that change between the base and high-value scenarios are energy and AS market prices, distribution network capacity value, and generation capacity value. Unlike other value streams in the study, AS revenues are not captured as an avoided cost but modeled as a service that can be offered, subject to market and physical constraints. Energy and AS market prices are based on California Public Utilities Commission (CPUC) Integrated Resources Planning (IRP) proceeding cases and are estimated using production simulation. The base scenario aligns with the CPUC IRP reference case, in which a roughly 50% renewable portfolio standard (RPS) is achieved by 2030. This matches the 2030 goal of California’s recently adopted law, Senate Bill 100. In our high-value case, the electric grid achieves an 80% RPS by 2030. The effects of increasing renewable penetration on energy market prices are shown in Figures 2 and 3, with red indicating negative energy prices and green indicating high energy prices. In the high-value scenario, negative midday energy prices are more pronounced throughout the year. Energy prices are generally lower in the high-value scenario, with the exception of higher evening-time energy prices in the fall. Because energy prices can be an opportunity cost for providing AS, we believe that AS market trends would follow energy market trends in the high-value scenario, causing lower midday AS prices and higher prices during fall evenings than under current market conditions. Generation capacity value is estimated for the base and high-value scenarios using a net cost of new entry calculation, assuming that a new combustion turbine would be built to meet additional generation-peaking capacity needs. The base scenario aligns more nearly with current market conditions, where there is no near-term need for additional generation capacity, leading to values of US$76/kW-yr in 2018 and rising to US$121/kW-yr in 2030. In the high-value scenario, we 17 Avoided Cost Value Streams 1 42.26 42.65 44.15 45.26 45.88 46.92 44.2 45.59 50.18 36.22 22.99 19.8 18 19 20 21 22 23 24 An EV with V2G also has an advantage in capturing value during times with high energy prices or high generation and distribution capacity value. An EV with V2G will fill its battery and prepare to discharge as much energy as possible during times of high value, while an EV with V1G can create value only by shifting coincidental charging loads to off-peak times. From the dispatch results, we also observe that, if a V1G vehicle rarely drives and thus consumes relatively little energy, there is less load that can be shifted to periods of negative pricing and less value in managing its charging load. Conversely, a V2G vehicle that mostly sits unused for transportation offers more scheduling flexibility and value to its utility as a DER than does an EV that frequently requires large amounts of energy for transportation. Figure 3. The average hourly energy prices ($/MWh) in 2030 under the high-value scenario. IEEE Elec trific ation Magazine / J UNE 2 0 1 9 43 Unmanaged Charging Smart Charging (V1G) V2G V2G With AS Real Levelized Cost (US$/Yr/EV) 600 400 200 0 US$313 US$243 –US$94 –200 –US$248 –400 Costs Net and Value Benefits Costs Net and Value Benefits Costs Net and Value Benefits Costs Net and Value Benefits CO2 Cost System Energy Cost Net Benefit Net Cost ASs RPS Cost Distribution Capacity Transmission Capacity Generation Capacity Figure 4. The levelized costs and benefits for the base scenario under the utility’s control. CO2: carbon dioxide. assume that 2018 is the resource balance year, giving values of US$124/kW-yr in 2018 and increasing to US$144/kW-yr in 2030. Given recent approvals by the CPUC for energy storage projects, it is possible that, in the near future, a zero-emissions resource such as battery energy storage may be a more appropriate reference resource with a much greater avoided cost for generation capacity. Although distribution network capacity can be very valuable, the value is very location specific, and the opportunities to defer distribution upgrades with DERs can be limited. Based on an analysis of distribution avoided costs filed with the CPUC, we chose distribution capacity values of US$20/ kW-yr and US$120/kW-yr for the base and high-value scenarios, respectively, with the high-value scenario representing a capacity-constrained area in Southern California. V2G Delivers Value Over V1G Our modeling indicates that V2G technology can transform an EV from a load the utility incurs a cost to serve into a DER that creates significant benefits. The total cost/benefit and the avoided cost component value streams are shown for several VGI use cases in Figures 4 and 5 for the base and high-value scenarios, respectively. These figures suggest the costs for and benefits to the utility from serving and managing a group of five EVs in different use cases on a levelized per-vehicle, per-year basis. Generation capacity, distribution capacity, and AS are the most significant value streams captured. When AS is not provided, there is an energy value stream benefit; however, when AS is provided, energy 44 I E E E E l e c t r i f i cati o n M agaz ine / J UN E 2019 costs are incurred to enable greater participation in AS markets. In the high-value scenario, the ability to provide AS adds little benefit over load shifting with V2G. We also studied a sensitivity case in the high-value scenario, where the model’s constraints and penalties for reducing battery degradation are removed. In that case, the total benefit rose by US$359/vehicle/yr along with the annual energy discharged, from 10,225 kWh/vehicle/yr to 15,051 kWh/vehicle/yr. The incremental values of V1G and V2G technologies are shown in Table 1 for the different scenarios and use cases. The table also includes the annual energy discharged per vehicle with V2G. Realizing the Value of V2G The results of our modeling indicate that it will be most advantageous to deploy V2G technology in generation and distribution capacity-constrained locations, where the value of V2G can be more than four times that of V1G. If energy storage becomes the preferred generation capacity resource, then all of the dollar values presented in Table 1 will be even greater. When automakers design V2G systems as a feature on vehicles, they must be convinced that any additional battery wear and tear will be outweighed by the V2G benefits for the vehicle owner. Our modeling shows that relaxing the limits on discharging the battery would increase the electric grid value of V2G by 32%, although the energy discharged would also increase by 47%. There are challenges that must be overcome before consumers can access the large potential value streams of distribution capacity and AS. There may be only a few locations 1,600 Smart Charging (V1G) Unmanaged Charging V2G V2G With AS Unconstrained V2G With AS US$1,380 Real Levelized Cost (US$/Yr/EV) 1,400 1,200 US$1,021 US$1,005 1,000 800 600 400 200 0 –US$92 –200 –400 –US$345 Costs Net and Value Benefits Costs Net and Value Benefits Costs Net and Value Benefits Costs Net and Value Benefits Costs Net and Value Benefits CO2 Cost Net Benefit Net Cost ASs RPS Cost System Energy Cost Distribution Capacity Transmission Capacity Generation Capacity Figure 5. The levelized costs and benefits for the high-value scenario under the utility’s control. CO2: carbon dioxide. TABLE 1. A summary of incremental benefits and discharged energy for VGI use cases (average per vehicle). Scenario AS Provided with V2G? V1G Versus Unmanaged (US$) V2G Versus V1G (US$) Energy Discharged (kWh) Unconstrained high value Yes 253 1,472 15,051 High value Yes 253 1,113 10,225 High value No 253 1,097 7,969 Base Yes 154 407 9,454 Base No 154 337 6,322 Note: The incremental benefits are in terms of the utility’s costs and benefits of serving EV charging. The incremental costs associated with equipment and enabling technology are not included in this calculation. with significant distribution value, and VGI remains unproven as a reliable resource for distribution planning. We also see that the small, incremental benefit of providing AS instead of performing load shifting with V2G may not be worth the cost of the expensive communications and equipment necessary to participate in today’s AS markets. When industry is ready to adopt V2G, it must develop new business models and vehicle warrantees that share these costs, benefits, and risks of V2G among automakers, vehicle owners, utilities, and VGI service providers. Acknowledgments A portion of this work was performed under the auspices of the U.S. Department of Energy by Lawrence Livermore National Laboratory, California, under contract DE-AC52-07NA27344. This work was funded in part by the CEC under agreement EPC-14-086. Biographies Jonathan Donadee ([email protected]) is with Lawrence Livermore National Laboratory, Livermore, California. Robbie Shaw ([email protected]) is with Energy and Environmental Economics, Inc., San Francisco, California. Oliver Garnett ([email protected]) is with Energy and Environmental Economics, Inc., San Francisco, California. Eric Cutter ([email protected]) is with Energy and Environmental Economics, Inc., San Francisco, California. Liang Min ([email protected]) is with Lawrence Livermore National Laboratory, Livermore, California. IEEE Elec trific ation Magazine / J UNE 2 0 1 9 45 By Jonathan Coignard, Pamela MacDougall, Franz Stadtmueller, and Evangelos Vrettos Will Electric Vehicles Drive Distribution Grid Upgrades? The case of California. HE FINITE NATURE OF FOSSIL FUELS, THE effects of climate change, and concerns about air-quality issues are each stimulating initiatives in many sectors of the economy to reduce the amount of carbon dioxide pouring into the atmosphere. Much attention is focusing on the transportation sector, an especially large contributor of greenhouse gas emissions. According to the Intergovernmental Panel on Climate Change, approximately 23% of T total energy-related carbon dioxide emissions come from vehicles. The widespread push for alternatives to gasolinepowered vehicles has led to cumulative sales of more than 4 million electric vehicles (EVs) worldwide. In California, cumulative sales of EVs passed 500,000 in November 2018. The shift to EVs in California is taking place at the same time that use of renewable energy sources is emerging. Renewables now represent 34% of retail electricity sales in the state, which has set an ambitious target of 100% Digital Object Identifier 10.1109/MELE.2019.2908794 Date of publication: 11 June 2019 46 I E E E E l e c t r i f i cati o n M agaz ine / J UN E 2019 2325-5987/19©2019IEEE Grid Considerations for Large-Scale EV Integration In August 2018, one of every 10 new vehicle purchases in California was an EV. As EV adoption has implications for power systems, we discuss the challenges for the distribution grid and what is currently being done by utilities to prepare for the electrification of passenger vehicles. Characteristics of EV Load Demand At a macro scale, EVs appear to pose only a modest burden on the electric grid. The California Energy Commission estimates that 3.9 million EVs could add 15,500 GWh of energy demand, equivalent to just 5% of California’s current total annual energy demand. However, at a micro scale, EVs represent a significant addition to traditional household loads. In 2018, PG&E recorded that the average peak demand—the aggregate demand from residential customers divided by the number of customers—was approximately 1 kW/household (the 1 kW value includes the natural power smoothing across several customers and does not reflect the maximum instantaneous peak demand at the household level). By comparison, most EVs commonly charge at 6.6 kW with a level 2 charger. At an average of 37 mi driven per day, an EV in the United States consumes approximately 10 kWh/day, which is a significant portion of the 17.5 kWh of average daily household consumption in California. A typical EV charging period at residential locations starts between 4 and 7 p.m. and coincides with the grid peak demand observed around 8 p.m. Therefore, in terms of energy consumption and power demand, an additional level 2 residential charging station is similar to an additional house on the grid. In terms of geographical distribution and density, EV adoption is not expected to be evenly distributed across all distribution grids. On the contrary, EVs are typically found in clusters, as demographics and peer pressure are key factors when buying an EV. Some disparities will exist regionally. For instance, the National Renewable Energy Laboratory (NREL) map of EV density shows that the IEEE Elec trific ation Magazine / J UNE 2 0 1 9 ©ISTOCKPHOTO.COM/LYUDINKA, CALIFORNIA MAP— ©ISTOCKPHOTO.COM/FRANKRAMSPOTT, PALM TREE—IMAGE LICENSED BY INGRAM PUBLISHING penetration of renewable energy sources by 2045. Both trends are creating challenges for distribution grids, which traditionally have been designed to incorporate a number of large power plants connected to the transmission network to serve a predictable aggregated load made up of many small customers. The rise of distributed energy resources (DERs), such as fast-charging stations for EVs and solar panels, is disrupting the predictability and homogeneity of distribution grids. As a result, it is necessary to evaluate grid planning, operation, reliability, and rate plans/tariffs. This article discusses how the distribution grid infrastructure can be adapted to accommodate the electrification of passenger vehicles. We show the impact of uncontrolled EV charging on 39 real-world distribution feeders in Northern California and then extrapolate the results for a larger set of more than 1,000 residential feeders within the service area of the Pacific Gas and Electric Company (PG&E). Our objective is to determine what, if any, special requirements are needed to accommodate EV loads and whether charging stations can be installed within the existing network without additional direct control structures or indirect control mechanisms, such as economic incentives. We provide recommendations for reducing the costs associated with adapting the distribution grid for demands related to the shift to EVs. Although many scientific papers have included impact analyses about EV integration, they often use prototypical feeder models and synthetic data as the input for simulations. We believe that investigations using actual distribution feeder models from regular utility operations can provide more realistic results and better inform strategic investment and planning decisions. 47 In terms of geographical distribution and density, EV adoption is not expected to be evenly distributed across all distribution grids. density of EVs in San Francisco is 20 times greater than that in Sacramento. As most EVs are purchased by higher-income households, disparities might also appear between neighborhoods, which means that higher-income neighborhoods will likely reach an EV penetration of 100% or higher before other neighborhoods. Note, however, that EV adoption could become more homogenous as supplies increase and prices fall. As California ramps up to its goal of 5 million EVs by 2030, a new charging infrastructure is already being installed at workplaces, residential areas, parking lots, and other public places. In fact, various databases, such as Plugshare and OpenChargeMap, are now available to track the charging infrastructure and keep EV drivers informed. In this new situation, utilities need to take into account plans for charging infrastructures and analyze the expected impact of uncontrolled EV charging on the distribution grid. Characteristics of the Distribution Grid Distribution grid planning is needed to determine the investments required to ensure a reliable power supply within network constraints. EVs have the potential to disrupt the grid. To prevent that from happening, plans need to be made now for widespread EV integration. As more DERs are added on the network, distribution grid planning becomes more complex. With weather conditions affecting renewable energy sources, daily weather forecasts need to be considered. Also, the state of charge for batteries and sudden load variations from EVs have to be incorporated into plans. While tools exist to simulate individual components of the power system [transmission grids, distribution grids, photovoltaics (PVs), buildings, communication infrastructure, and EVs], few frameworks are available to enable holistic power system cosimulation. Therefore, improved tools for distribution grid planning could help to better measure the required capacity margin for feeders in the presence of significant Feeders (%) 20 Median Capacity Margin: 3.1 MW 15 Distribution Grid Reinforcement and Associated Costs 10 5 0 0 1 2 3 4 5 6 7 8 Feeder Capacity margins (MW) 9 10 Figure 1. The capacity margin in megawatts for more than 3,000 feeders in PG&E’s territory in 2017. 48 variable generation and load units, such as EVs. To allow for traditional load growth, distribution grids are built with some capacity margin. In this study, we had access to a database of 3,000 distribution feeders in PG&E’s service area and estimated the available capacity margin for each feeder (Figure 1). Overall, the available capacity margin for 50% of the 3,000 feeders is less than 3.1 MW. While this margin is large enough for traditional peakload growth, it might not be sufficient to accommodate the higher power consumption of EV chargers. For instance, if all stations are in use, 50% of the feeders could host, at most, only 25 dc fast chargers (rated at 120 kW) or 470 smaller level 2 chargers (rated at 6.6 kW). As the energy demand from charging stations follows the geographically uneven adoption of EVs, some feeders might have high EV penetrations, while others could experience no or negligible additional power demand from EVs. The higher power requirement of fast-charging EVs, the potential clustering of EVs on the same feeder, and their distance from the feeder head all affect the grid. As a result, medium- and low-voltage networks in their current state might not reliably support high EV penetration. In general, distribution grids could encounter undervoltages and currents exceeding transformer and line power ratings, harmonics, and phase imbalances. These effects could reduce reliability, increase power losses, and lower margins for future load growth, which will result in a cost for both utilities and customers. Fortunately, utilities regularly perform long-term load forecasting, taking into account the adoption of EVs and the resulting impact on the system, while prioritizing capital investments to maintain adequate capacity. To ensure grid reliability, simulation tools need to adequately represent the stochasticity of EV demand and offer potential control strategies. Addressing this rapid load growth, utilities can take a number of actions, including reinforcing the grid with additional lines and transformers, adding local stationary storage, incentivizing off-peak consumption with time-of-use (TOU) rates, and developing ecosystems for grid assets (such as EVs) to provide distribution grid services. I E E E E l e c t r i f i cati o n M agaz ine / J UN E 2019 Utilities are regulated monopolies with a strong incentive to promote grid reinforcement, as they are directly remunerated for their investments. In this context, the grid could be reinforced for the theoretical worst-case scenario where all EVs charge at the same time during peak hours, therefore justifying expenditures for additional lines, TOU rates are the most popular form of time-varying rates for both EV and non-EV customers. transformers, capacitor banks and/or voltage regulators for voltage support, and stationary storage. Table 1 provides the estimated costs for different grid reinforcement measures. These estimates must be considered with caution because they vary significantly from country to country. Still, they illustrate the order of magnitude of the required expenditure. Even though grid reinforcement is the traditional way utilities deal with anticipated load growth, it is not necessarily the only way to manage the peak-demand increase from EVs. Other measures include the use of advanced distribution management systems and the deployment of smart EV chargers with price signals to properly manage EV charging and shift the demand to times when the grid is under less stress. Measures based on TOU rates are discussed in the next section. Financial Incentives Through TOU Retail Rates Standard, fixed-price electricity rates do little to encourage EV adoption or optimize charging times. In fact, such rates may even discourage efficient charging practices because customers are apt to charge when it is most convenient to them rather than when it is most beneficial to the grid. In contrast, time‐varying rates convey price signals that better reflect the cost of producing and delivering energy at different hours. Time‐varying rates include TOU rates, critical peak pricing, peak time rebates, and dynamic hourly pricing. In addition, some utility rates include a demand charge, which is typically based on a customer’s maximum power demand during a month. TOU rates are the most popular form of time‐varying rates for both EV and non-EV customers. To avoid increases in peak demands, large utilities in California offer retail rates that encourage residential customers to charge their EVs during off-peak hours, namely between 11 p.m. and 7 a.m. For example, PG&E offers TOU tariffs nonspecific to EVs and two EV-specific rate plans for residential customers, one combining EV and household consumption and the other separating the two and using a dedicated metering system. PG&E has enrolled 45,000 customers in EV rate plans, which accounts for 25–30% of the registered EVs in PG&E’s territory. The current off-peak rate for electricity is US$0.13/kWh, which is equivalent to approximately US$1.30/gallon of gasoline. This enables EV drivers to save a significant amount of money, as current gasoline prices are around US$3.50/gallon. Hence, PG&E estimated that 80% of EV charging is done during off-peak hours. Furthermore, customers on EV rates consumed 10–25% less energy at peak hours compared to standard residential consumers in PG&E’s territory. Although this might be the result of a small number of already informed consumers, EVs have the potential to influence consumption patterns toward more grid-friendly behavior simply by educating and sending price signals to consumers. Because managing peak demand is a key challenge for electric utilities, they need to provide EV customers with clear electricity price signals to encourage charging during off‐peak periods. Electric utilities can achieve high levels of customer enrollment by defaulting customers onto an appropriate rate (through an opt‐out design). EVs as an Opportunity for the Grid While studies have highlighted how integrating EVs in the distribution grid affects operations, other studies have also suggested using the flexibility of EVs to provide services to transmission system operators, utilities, and renewable energy plants. EVs should not be considered merely passive loads. Thanks to their energy-storage capabilities, EVs have the potential to provide services beyond transportation, and these services can go beyond standard TOU rates. EVs, generally idle more than 90% of the day TABLE 1. The estimated capital cost for lines, cables, transformers, capacitor banks, and stationary storage systems from a European study. Components Estimated Capital Cost Medium-voltage overhead lines/cables US$115,000–US$230,000/km Low-voltage cables US$80,000–US$115,000/km Low-voltage overhead lines US$35,000–US$75,000/km Ground-mounted medium/low-voltage transformer US$16,000–US$40,000 Pole-mounted medium/low-voltage transformer US$6,000 High/medium-voltage transformer US$2,000,000–US$6,000,000 Capacitor banks, fixed and switched US$20,000–US$50,000/MVA reactive Stationary storage US$650/kWh IEEE Elec trific ation Magazine / J UNE 2 0 1 9 49 Standard, fixed-price electricity rates do little to encourage EV adoption or optimize charging times. and with a high degree of flexibility, are quick-response units with the potential to offer bidirectional power flow, known as a vehicle-to-grid (V2G) function. Studies have estimated that EVs could provide active and reactive power support as well as renewable energy integration support. Through active power support roles, EVs can help manage congestion, reduce power losses, shift loads, shave peaks, fill valleys, and control voltages (voltage control through active power management is more relevant for distribution grids with lower nominal voltages due to the higher line reactance/line resistance ratios of distribution lines.) Reactive power support comes in the form of reactive power compensation (injection or absorption) to regulate voltage profiles and/or minimize reactive power losses. Renewable energy support is typically in the form of capacity firming to compensate for the intermittent nature of wind and solar power generation. As experimentally validated in a field trial at the Los Angeles Air Force Base, V2G could also provide ancillary services, which are becoming more important as synchronous generators are replaced with inverter-based generation on bulk electric systems. Although these value streams are typically for larger customers (workplaces and parking lots, for example), they might also be accessible to residential customers via aggregators. Some prototypical projects to enlarge the type of services provided by EVs already exist. In the case of ancillary services, the field trial project at the Los Angeles Air Force Base found a theoretical profit of US$70/month/vehicle. However, in practice, the project recorded net losses due to additional fees from participating in the market. The ancillary service market is a small fraction of the energy market. Therefore, it is exposed to saturation effects. In 2018, eMotorWerks, a company selling connected EV chargers, mobilized 6,000 chargers corresponding to 30 and 70 MWh virtual batteries to participate in the California Independent System Operator’s demand-response market. Both of these examples represent services provided at the transmission level. As of today, there are few demonstration projects and field tests to coordinate EVs for the provision of distribution grid services. Two examples are the EcoGrid EU project, funded by the European Union, and the Nikola project, funded by the Danish ForskEL R&D program. The Technical University of Denmark is involved in both demonstrations. While some utilities and states (especially California) invest in programs to ease the transition to an electrified transportation sector, this is not necessarily the case across the United States and among smaller utilities. A recent survey of 486 utilities (Smart Electric Power Alliance, 2018) states that nearly 75% of the utilities were in the early stages of planning for EV market growth. Furthermore, regulatory uncertainties make replicating EV programs between states and utility territories difficult. Therefore, collaboration will be essential for widespread deployment of EVs. Methodology for Impact Analysis and Case Study This study evaluates the impact of large EV penetration on distribution grids from the PG&E service area in a future scenario where each household has one EV. Typically, for residential feeders, 4,000–8,000 EVs were added according to the total number of households on each feeder (Figure 2). The scenario assumes that 50% of the vehicles have access 38 8k 36 Number of EVs 32 6k 28 26 25 4k 19 2k 11 9 4 6 5 2 15 12 14 13 8 3 18 34 33 24 22 17 16 21 37 35 31 27 23 7 30 29 20 10 1 0 0 2k 4k 6k 8k 10 k Feeder Peak Demand (kW) 12 k 14 k Figure 2. A graph showing the number of EVs added per feeder as a function of the feeder’s peak demand. Each feeder is represented by a blue dot. The dashed red line indicates where y = x. 50 I E E E E l e c t r i f i cati o n M agaz ine / J UN E 2019 to a level 2 charger (6.6 kW) at work, and 50% of home chargers are level 2, the rest being traditional outlets (1.4 kW). The impact of the additional load demand from EVs is measured in terms of voltage deviation from the nominal value, increased line loadings, and remaining feeder capacity. The objective of this analysis is to determine whether measures are needed to accommodate EV loads and whether charging stations can be installed on existing networks without additional control structures or economic incentives. The methodology developed is practical and inspired by similar investigations performed by PG&E for interconnection planning (Figure 3). At the feeder level, we used a detailed topology, including electrical characteristics for each component, as well as the location and average energy demand for each customer. The historical measurements from the supervisory control and data acquisition (SCADA) system give hourly active and reactive power demand at the feeder head. Using historical measurements and the known grid topology, we ran power-flow analyses using CYMDIST commercial software, which is widely used by many electric utilities in the United States. A number of EVs were added at each node based on the number of connected residential customers, and subsequent power flows were run incorporating EV charging profiles. The power-flow results with and without EVs were then compared to quantify the impact of EVs on the grid. EVs should not be considered merely passive loads. Detailed Feeder Models In California, and more specifically in PG&E’s territory, the capacities of the distribution grids typically range from less than 1 to 25 MW with a nominal voltage of 12 kV, although some networks have a nominal voltage of 4 or 21 kV. Networks are usually constructed with a meshed topology, but they operate radially and can be reconfigured during scheduled and unscheduled outages. While significant parts of the grid are wired with three phases, the edge of the grids can be wired with two phases or even one phase and the neutral. For this analysis, 39 feeders with different topologies, customer breakdowns, and historical demand profiles were studied. The feeders are connected to eight different substations, as shown in Figure 3. The 39 detailed feeder models are representative of the larger PG&E territory in terms of design, capacity, and nominal voltage. Half of the feeders serve mainly residential customers, while the rest serve a mix of industrial, commercial, agricultural, and special load customers. Feeder lengths vary from 2 to 64 km, with 68% of the feeders under 10 km; 56% of the feeders have a nominal voltage at 12 kV. The historical demand profiles from 2016 reveal that 80% of the feeders have a peak demand between 3 and 15 MW. EV Load Demand To include EVs in power-flow analysis, spatial and temporal aspects of EV charging power demand must be considered. The spatial distribution of EVs is readily obtained Feeder Head 1) Historical active and reactive power demand is imposed. Substations Include 3–12 Feeders 2) One EV is added for each household at each node. 3) We run a power flow analysis before and after the EVs. Substations (a) (b) Figure 3. (a) The locations of the substations used in this analysis. (b) An example of feeder topology and the main steps of the methodology. IEEE Elec trific ation Magazine / J UNE 2 0 1 9 51 Low Mid High 150 100 50 0 0 :0 21 0 :0 18 :0 0 15 :0 0 16 June 2017 12 0 :0 09 :0 0 :0 06 00 :0 0 0 03 Power Demand (kW) based on the assumption of one EV per household and known information on residential house connections at each node. To determine the temporal demand from EVs, various load shapes for 100 EVs charging at home were simulated under different scenarios (Figure 4). The load profiles are based on 2,952 full-day vehicle itineraries from the National Household Travel Survey of 2009 in California. The itineraries define when, how far, and to which location vehicles are traveling, enabling estimation of on-road energy consumption and state of charge during the day. EV on-road consumption is derived from the V2Gsim powertrain model developed at the Lawrence Berkeley National Laboratory. Time Figure 4. An EV load profile at residential locations for 100 EVs for Power-Flow Analysis 20 After EVs Before EVs 15 10 18 December 2016 Time 0 0 :0 00 :0 21 0 :0 18 0 15 :0 0 :0 12 0 :0 09 0 :0 06 :0 03 :0 00 0 5 0 Feeder Power Demand (MW) low-demand (low; blue), middle-demand (mid; orange), and highdemand (high; green) scenarios. 19 December 2016 Figure 5. The historical load shape from SCADA measurements EV Load Demand (kW) (blue) and the load shape with additional EVs and PVs (orange). 600 400 200 0 1 2 3 4 5 6 7 8 9 10 11 12 13 14 15 Distance (km) Figure 6. An example of the spatial distribution of the EV load demand at the peak time for a feeder. The load demand is summed over intervals of 0.5 km. 52 Multiple scenarios were explored with respect to where EVs charge and which type of charger they use. Specifically, EVs could charge at workplaces, public places, or at home with chargers ranging from 1.4 (traditional outlet) to 120 kW (dedicated dc fast charger). Different scenarios (low, middle, and high demand) were analyzed with varying numbers of vehicles charging at workplaces and varying percentages of level 2 chargers (6.6 kW) at residential locations (Figure 4). In all scenarios, if a charger is available, EVs start charging as soon as they arrive at their destination without any control. In the most aggressive scenario (high), EVs only charge at home with a level 2 charger, leading to a significant peak demand of 175 kW. Meanwhile, in the low-demand scenario, all EVs have access to a charger at their workplaces and have only a traditional outlet at home (1.4 kW), thus leading to a smaller peak demand of 68 kW. The middle-demand scenario is constructed by assuming that 50% of the vehicles charge at work and that 50% of the chargers at home locations are 6.6-kW level 2 chargers (the rest being traditional outlets). This scenario leads to a peak demand at residential locations of 100 kW, which occurs around 6:30 p.m. Although the high-demand scenario could theoretically lead to a 660-kW peak demand (100 times 6.6 kW), the impact of level 2 chargers on peak demand is not as dramatic because not all EVs arrive at the same time and require only 51 min, on average, to charge (23 mi traveled per day). I E E E E l e c t r i f i cati o n M agaz ine / J UN E 2019 On the distribution grid side, the historical SCADA data of active power at the feeder head were selected for four days when the feeder approaches its maximal loading, between 3 p.m. and 11 p.m. This ensures that the days simulated are representative of the maximum evening peak demand and therefore potentially lead to the highest annual voltage deviation and line loading when correlated with residential EV load demand. On the days selected, the historical load demand is enforced at the feeder head, hence setting different loading conditions as time progresses. In addition, a load-allocation method was used to proportionally vary individual load connections based on their known energy demand, such that the aggregate load demand across all nodes matches the load demand historically recorded at the feeder head. This process results in time-varying power injection of data for each node into the grid model and for each time step. One EV is connected per household, so the EV load demand is added to the historic SCADA demand based on the number of residential consumers at a node (Figure 5). Due to the known information on the number of households at each node, EVs not only have a temporal dimension, as reflected by the load shape of Figure 4, but also a spatial dimension within the grid, as shown in Figure 6. PVs were also added to cover 25% of the feeder’s annual energy need (both before and after adding EVs). PV power output on the days simulated is based on feeder-specific solar irradiance data from the NREL solar irradiance database. Although PVs provide additional generation during the day, they do not assist in meeting the evening peak demand due to time separation. Therefore, regardless of their penetration, PVs do not affect the results obtained with uncontrolled EVs. Power-flow simulations were run with a 30-min time step for the four days with the highest evening peak demand for each of the 39 feeders. At each time step, various simulation results were saved, including results related to nodal voltages, line loading, and power demand at the feeder head. Figure 7 provides instances of results for each node of one feeder as a function of distance from the feeder head, including the voltage and line-loading profiles of that feeder. Each of the plots presents two scenarios: the first scenario is without EVs (blue), and the second scenario is with one EV per household (orange). The voltage profile shows that one branch of the network is significantly affected by EV demand, with some nodes below 95% of the nominal voltage. In contrast, another branch has a higher voltage with EVs (around 9 km) due to the higher setting of a tap-changing transformer. The line-loading profile shows that some lines are above their maximal capacity, especially as we get closer to the feeder head. Such results are collected individually for each feeder and day; they are then aggregated to the statistical results presented in the next section. Power-Flow Analysis Results and Discussion The objective of this analysis is to determine whether a scenario with one EV per household will require specific attention and whether charging stations can be installed within the existing network without additional direct control structures or indirect control mechanisms based on economic incentives. The scenario selected for the following results assumes that 50% of the EVs have access to level 2 chargers at workplaces and that only 50% of households are equipped with level 2 chargers, with the rest only using traditional outlets. Results Before and After Adding Uncontrolled EVs in 39 Feeders The impact of EVs is measured with three metrics: the remaining power capacity at the feeder head (defined as the current maximum peak demand minus the projected peak demand with the additional EV demand), the lowest observed nodal voltage, and the highest observed line loading. Figures 8–10 show the respective results for the 39 feeders before and after adding one EV per household. For 19 of the 39 feeders, residences consumed more than 50% of the energy. We refer to those feeders as residential feeders. Among the residential feeders, when one EV per household is added, 58% of the feeders exceed their remaining power capacity, 16% are below the 0.95-p.u. voltage limit, and 47% have some line overloading, which indicates that line-overloading problems are more likely to be the limiting factor. Overall, 68% of the feeders with residential energy consumption accounting for at least 50% of total energy demand (13 feeders from the set of 19 feeders) are violating their maximum feeder head capacity, voltage limit, or line-loading limit. On average for the residential feeders, EVs increase the projected peak demand by 64%, decrease the lowest nodal voltage by 0.02 p.u., and increase the highest line loading by 40%. These impacts lead residential feeders to have, on average, −0.21 MW of remaining capacity, 0.98 p.u. for the lowest voltage, and 99% for the highest line loading. Based on 39 feeders, our results clearly suggest that the middle-demand scenario with one EV per household 1.06 160 Before EVs 1.04 After EVs 140 Line Loading (%) Voltage (p.u.) 120 1.02 1 0.98 0.96 100 80 60 40 20 0.94 0 0 5 10 Distance (km) (a) 15 0 5 10 Distance (km) (b) 15 Figure 7. (a) A feeder voltage profile at the peak demand (6:30 p.m.) per unit (p.u.) of the nominal voltage. (b) The feeder line loading profile at the peak demand in the percentage of the maximum line capacity. IEEE Elec trific ation Magazine / J UNE 2 0 1 9 53 Remaining Capacity (MW) 15 3 10 3 13 2 1 0 5 7 11 810 6 4 5 15 20 19 21 25 30 16 12 9 38 14 17 18 22 0 24 23 32 2 36 34 28 26 31 33 4 3537 27 29 15 13 1 0 78 11 10 5 6 9 20 19 30 25 21 12 14 16 26 18 –5 20 40 60 Residential Customers (%) (a) 80 0 36 35 33 34 37 31 24 17 0 28 27 29 23 22 38 32 20 40 60 Residential Customers (%) (b) 80 Figure 8. The remaining capacity in megawatts for 39 feeders. (a) The feeders before adding the EV demand (blue) and (b) the same feeders after adding one EV per household (orange). Highest Line Loading (%) 160 140 24 18 14 22 17 120 100 18 14 22 24 80 60 4 1 0 2 40 9 5 67 8 10 11 12 13 16 15 20 19 21 9 28 30 23 17 33 4 3436 27 31 26 29 25 32 1 0 37 35 38 0 20 40 60 Residential Customers (%) (a) 80 2 21 12 6 5 7 10 11 8 13 16 19 20 15 29 3 3 20 31 33 37 28 34 26 30 27 36 32 35 25 38 23 0 20 40 60 Residential Customers (%) (b) 80 Figure 9. The highest line loading in the percentage of the maximum line capacity for 39 feeders. (a) The feeders before adding the EV demand (blue) and (b) the same feeders after adding one EV per household (orange). Lowest Voltage (p.u.) 1.04 3 1.02 5 8 0 1 1 0.98 7 4 1213 910 6 11 19 21 20 14 15 2 16 17 18 24 22 23 7 19 13 34 3537 29 27 30 3 38 25 26 31 5 0 1 32 33 4 8 6 12 910 11 14 16 36 0.96 15 17 28 0.94 38 25 26 29 31 18 2 21 20 22 32 33 24 23 2730 34 35 37 36 0.92 28 0.9 0 20 40 60 Residential Customers (%) (a) 80 0 20 40 60 Residential Customers (%) (b) 80 Figure 10. Graphs showing the lowest nodal voltage per unit (p.u.) of the feeder head voltage for 39 feeders. (a) Feeders before adding the EV demand (blue). (b) The same feeders after adding one EV per household (orange). 54 I E E E E l e c t r i f i cati o n M agaz ine / J UN E 2019 As shown in this study, with one EV per household, 60% of residential feeders might need some grid reinforcement. 0.1 6 :0 0 12 :0 0 09 :0 0 06 :0 0 03 :0 0 00 :0 0 21 :0 0 4 3 January 2016 0.05 0 –10 –8 8 18 0.15 Mean Margin Before EVs: 3.3 MW 12 10 :0 0 0.2 Mean Margin After EVs: –0.9 MW Theoretical Impact From Controlled EVs 14 15 0.25 theoretical scenario where the control mechanism allows us to shift EV demand to off-peak hours and regulate it to a constant value. To investigate the value of direct control schemes or indirect control mechanisms based on economic incentives, the possibility of shifting EV demand to off-peak hours without creating a new peak (or with minimizing the magnitude of the newly created peak) was studied. The previously uncontrolled EV demand was shifted to between 6 p.m. and 6 a.m. while minimizing peak demand (Figure 12). This approach assumes perfect knowledge and control of the system. In reality, not all EVs will participate in the same control mechanism, and a constant aggregate EV power cannot be achieved due to forecast errors and the possibility of packet losses and delays affecting communication systems. Nonetheless, this analysis provides a theoretical result suggesting that, of 19 residential feeders, 11 are subject to a peak-demand increase even in the fully controlled case (Figure 13). However, note that this peak increase is limited to 27% of the current peak demand in the worst case and to 8% on average for all residential feeders. Clearly, this is significantly better than the uncontrolled EV case, with a potentially 104% peak-demand increase in the worst case and a 64% increase on average. Moreover, perfect knowledge and control of EV charging to minimize peak-demand increase could enable feeders to remain below their maximum capacity limit with no further reinforcement Power Demand (MW) Density Probability Even though detailed voltage and line-loading analyses for all PG&E feeders are not possible due to limited distribution grid models and SCADA data, the relative impact of EVs on feeder capacity was extrapolated for 1,054 feeders in the San Francisco Bay area. Based on available geographical coordinate information, the feeders in this area are likely to be predominantly residential (>50% of residential energy demand). The average relative peak demand increase (64%) computed for the 19 residential feeders was assumed to be representative of the larger feeder data set, and it was applied for each of the 1,054 feeders. Figure 11 shows the impact of the one-EV-per-household scenario on the remaining capacity per feeder. Based on the results, 60% of the feeders in the San Francisco Bay area would reach or exceed their maximum loading limit. Arguably, these generalized results should be viewed with caution because of the simplifying assumptions made due to lack of detailed data. Nevertheless, the results indicate again that the middle-demand scenario with one EV per household requires specific control mechanisms or grid reinforcement so that the distribution grid will not be disrupted by additional load demand from uncontrolled EV charging. We estimate that, for the feeders with no remaining capacity in the San Francisco Bay area, 28% of the EVs on average would need to charge off-peak to ensure that 75% of the feeders do not exceed their maximum capacity threshold. In other words, 28% of the EVs would need to follow TOU incentives to charge during offpeak times. In the next section, we provide results for a :0 0 Uncontrolled EV Impact on a Larger Data Set with 1,054 Feeders 12 requires control mechanisms or reinforcement on most residential distribution grids to ensure that they will not exceed their maximum capacity. 4 January 2016 Time –6 –4 –2 0 2 4 6 Feeder Capacity Margin (MW) After EVs 8 10 Before EVs Figure 11. The feeder capacity margin in megawatts for 1,054 feeders in the San Francisco Bay area before EVs (blue) and after EVs (orange) are added. SCADA + Controlled EVs SCADA + Uncontrolled EVs SCADA Figure 12. The feeder’s historic load profile without EVs (blue), the additional load demand from uncontrolled EVs (orange), and the additional load demand with controlled EVs (red) from 6 p.m. to 6 a.m. to minimize peak demand. IEEE Elec trific ation Magazine / J UNE 2 0 1 9 55 23 29 24 22 37 31 33 35 26 27 34 28 21 25 38 30 36 32 20 Peak Demand Increase (%) 160 140 120 100 80 60 40 20 0 Feeder IDs Feeder Limit Uncontrolled EVs Controlled EVs Figure 13. The peak-demand increase for 19 residential feeders with uncontrolled EVs (blue) and controlled EVs (orange). Red dots mark the maximum increase possible with the existing grid infrastructure. (as indicated by the red dots in Figure 13). Practically speaking, some local grid reinforcement will be necessary to ensure adequate capacity margin. Reinforcing the grid with storage systems is also a way to address the problem. This measure provides local support and also accommodates more use of renewable energy. PG&E is implementing stationary storage with 567-MW capacity approved across four projects, including a 10-MW aggregation of behind-the-meter batteries located at customer sites and connected to the distribution grid. Utilities are also demonstrating DER management systems for optimizing the use of such flexible resources. Path Forward for EV Adoption EVs are leading consumers to demand less gasoline and more electricity. As they charge from the distribution grid primarily at residential locations, uncontrolled EV charging will likely increase peak demand, potentially leading to a degradation in the reliability and quality of the power supply. As shown in this study, with one EV per household, 60% of residential feeders might need some grid reinforcement. Traditionally, reinforcing the grid has implied investment in new lines, transformers, and capacitor banks to cover predictable loads. However, this might prove costly when planning for the potential worst-case scenario with synchronized EV charging. Reinforcing the grid should be coupled with some sort of EV demand management program. With perfect knowledge and control of EV charging parameters, peak demand could be contained to an approximately 8% average increase, as opposed to a 64% increase in the uncontrolled case. Large utilities in California are now able to encourage off-peak charging by providing EV customers with electricity price signals through static TOU rates. On average, shifting 28% of EVs to off-peak charging with TOU rates would limit the peak-demand increase to existing feeder capacity margins for most residential feeders. Although static TOU rates have been successful, some concerns exist regarding their ability to 56 I E E E E l e c t r i f i cati o n M agaz ine / J UN E 2019 provide adequate incentives in more dynamic systems, as well as the risks they bring to creating new peak demands at the beginning of lower-priced off-peak periods. In this context, new static TOU rate designs need to be developed that enable demand management systems and coexist with options that accommodate greater flexibility. As the spread of solar PVs and fast-charging EVs makes power systems less predictable, forms of dynamic pricing have been suggested to align real-time distribution grid conditions with economic incentives. While some control strategies and business models exist at the transmission-grid level, distribution grids are in the very early stages of adopting dynamic pricing. The path forward for high EV penetration includes a combination of innovations in TOU rate designs, long-term load forecasting to plan grid reinforcement, and a DER management system with local dynamic price signals to optimize the grid for EVs and other DERs. For Further Reading A. Allison and M. Whited, “Electric vehicles are not crashing the grid: Lessons from California Synapse,” Synapse Energy Economics, Nov. 2017. [Online]. Available: http://www.synapseenergy.com/sites/default/files/EVs-Not-Crashing-Grid17-025_0.pdf K. Knezovic, M. Marinelli, A. Zecchino, P. B. Andersen, and C. Traeholt, “Supporting involvement of electric vehicles in distribution grids: Lowering the barriers for a proactive integration energy,” Energy, vol. 134, pp. 458–468, Sept. 2017. N. B. Arias, S. Hashemi, P. B. Andersen, C. Træholt, and R. Romero, “Distribution system services provided by electric vehicles: Recent status, challenges, and future prospects,” IEEE Trans. Intell. Transp. Syst., Jan. 2019. doi: 10.1109/ TITS.2018.2889439. Smart Electric Power Alliance, “Utilities and electric vehicles: Evolving to unlock grid value,” Mar. 2018. [Online]. Available: https://sepapower.org/resource/utilities-electricvehicles-evolving-unlock-grid-value/ J. Wamburu, S. Lee, P. Shenoy, and D. Irwin, “Analyzing distribution transformers at city scale and the impact of EVs and storage,” in Proc. Ninth Int. Conf. Future Energy Systems, 2018, pp. 157–167. Pacific Gas and Electric Company, “Smart grid annual report,” 2018. [Online]. Available: https://www.pge.com/pge_ global/common/pdfs/safety/how-the-system-works/electricsystems/smart-grid/AnnualReport2018.pdf Biographies Jonathan Coignard ([email protected]) is with Lawrence Berkeley National Laboratory, Berkeley, California. Pamela MacDougall ([email protected]) is with Lawrence Berkeley National Laboratory, Berkeley, California. Franz Stadtmueller ([email protected]) is with Pacific Gas and Electric Company, San Francisco, California. Evangelos Vrettos ([email protected]) is with Lawrence Berkeley National Laboratory, Berkeley, California. NEWSFEED IEEE Power & Energy Society Scholarship Plus Initiative N 2011, THE IEEE POWER & Energy Society (PES) Scholarship Plus Initiative was established in the United States and Canada to increase the number of well-qualified, entry-level engineers joining the power and energy industry. Since that time, financial donations to the program have enabled 1,556 scholarships to be awarded to 917 students studying at more than 200 schools. Nearly 500 PES Scholars have graduated and are now working in the field. The program has had a positive impact, with more students getting involved in the power industry. As PES Scholar Travis Durgan from Michigan Technological University recently noted, I became interested in engineering as a field where I can be challenged and satisfy both my scientific and creative interests. I also wanted a degree that would help me help others. Studying engineering has honed my problem-solving and critical-thinking skills and afforded me opportunities to work in community development, both in and outside of the United States. A large factor I PES Plus Scholar Travis Durgan studies electrical engineering at Michigan Technological University. in choosing electric power engineering as a focus was my fascination with energy transfer, electromagnetic induction, and signal manipulation. I learned the basics of these working as an audio engineer, and they drew me toward an electrical engineering degree. I am also a strong proponent for sustainable design and living. This makes me want to be involved in increasing the penetration of renewable energies into the grid. There are multiple ways an organization or person can get involved in the program: 1) become a mentor 2) promote the program to students 3) provide a financial contribution 4) offer internship or cooperative opportunities to PES Scholars. Visit the IEEE PES Scholarship Plus website (www.ee-scholarship.org) to find out how this program is helping address the shortage of engineers in the power and energy industry. Financial donations to the program have enabled 1,556 scholarships to be awarded to 917 students studying at more than 200 schools. Digital Object Identifier 10.1109/MELE.2019.2908916 Date of publication: 11 June 2019 IEEE Electrific ation Magazine / J UNE 2 0 1 9 57 NEWSFEED IEEE Campaign Supports IEEE PES Scholarship Plus Initiative HE IEEE POWER & ENERGY Society (PES) enjoys a close working relationship with the IEEE Foundation, the philanthropic partner of the IEEE. The IEEE PES Scholarship Plus Initiative, a priority initiative of the IEEE Foundation, aims to increase the number of well-qualified, entry-level engineers by rewarding top power and energy engineering students with up to US$7,000 as well as real-world career experiences. This is all provided thanks to donor support. These are exciting times for the IEEE Foundation and the many IEEE programs supported through philanthropy. The foundation continues to marshal all available resources to drive new levels of technological access, innovation, and engagement through far-reaching global initiatives designed to transform lives through the power of technology and education. We are excited to share the fruits of our efforts, made possible by the generosity of our donors. Moreover, we are proud to announce that, as of 5 February 2019, the Realize the Full Potential of IEEE Campaign has reached 60.8% of its goal! T Digital Object Identifier 10.1109/MELE.2019.2908917 Date of publication: 11 June 2019 58 I E E E E l e c t r i f i cati o n M agaz ine / J UN E 2019 participates plays a vital role in That is, it has received US$18.24 million helping us employ technological toward the US$30 million campaign. innovation to solve pressing This ambitious campaign was launched global challenges, such as acin February 2018, and we thank you, cess to electriour friends, for its fruitcal power, clean ful progress. Learn At an extraordinary water, and digimore about the camtime in the history of tal connectivity. paign at https://www the organization, each At an extraor.ieeefoundation.org/ donor who participates dinary time in the campaign. We are history of the organiconfident that, with helps ensure that the your support, we will future of the IEEE holds zation, each donor w ho participates meet or exceed the even greater promise helps ensure that the goal by IEEE Day 2020. than its historic past. future of the IEEE A contribution to the holds even greater IEEE PES Scholarship promise than its hisPlus Fund will help toric past. We welcome you to help the IEEE Foundation reach its target. build on a legacy that will positiveMake your donation online at https:// ly and indelibly impact generations www.ieeefoundation.org/Donate_ to come. PES_Scholarship. As IEEE Foundation Executive IEEE Executive Director Stephen Director Karen A. Galuchie noted, Welby said, “Each and every program that the I congratulate the Foundation IEEE Foundation supports through on its success in reaching 60% philanthropy is addressing a pressing of its goal for the Realize the need in some corner of the world.” Full Potential of IEEE Campaign. The Foundation is an imporGaluchie personally donates to protant partner to the Institute— grams that “empower and nourish the resources brought to bear bright young minds about technology by the foundation amplify the and how they can be used to improve impact of IEEE’s programs and the human condition,” just as the PES initiatives to truly make a differScholarship Plus Initiative does. Learn ence in communities around more about the IEEE Foundation at the world. Every donor who https://www.ieeefoundation.org. IEEE Smart Cities Initiative: Advancing Smart City Technologies HE IEEE SMART CITIES INItiative brings together IEEE’s broad array of technical Societies and organizations to advance the state of the art in smart city technologies for the benefit of society and to serve as a neutral broker of information among industry, academic, and government stakeholders. The organizers of IEEE Smart Cities are working to make the technical community the authoritative voice and leading source of credible technical information and educational content about smart cities and such related functional domains as xx sensors and intelligent electronic devices T Digital Object Identifier 10.1109/MELE.2019.2908918 Date of publication: 11 June 2019 Technology Leaders using preliminary charging stanxx dards developed for heavy-duty off-road vehicles and equipment in the San Pedro Bay ports as a springboard for pursuing statewide and federal adoption of standards to ensure consistent and cost-effective charging requirements for all seaports. Other elements include exploring innovative charging options; accounting for how to manage increasing loads associated with electrification while achieving resiliency and energy savings; and aligning the blueprint with the California Public Utility Commission’s Integrated Resources Plan, the California Independent System Operator’s local capacity requirements process, and state transportation goals. Completing the blueprint xx communication networks and cybersecurity xx systems integration xx intelligence and data analytics xx management and control plat- forms. Visit the IEEE Smart Cities website (https://smartcities.ieee.org/) for the latest information on smart city webinars and to access the Smart Cities Resource Center. The Fifth IEEE Annual International Smart Cities Conference (ISC2 2019) will be held in Casablanca, Morocco, 14–17 October 2019. The theme of the conference is “Frugality and Inclusion Paving the Way Toward Future Smart Sustainable Cities and Communities.” The flagship conference sponsored by IEEE Smart Cities, ISC2 2019 will bring together policy makers, administrators, infrastructure operators, industry representatives, economists, sociologists, academics, and other researchers and practitioners to discuss and collaborate on issues related to smart cities. The conference will include panels, plenary talks, technical sessions, tutorials, workshops, and exhibitions. Visit https://ieee-isc2 .org/ for more information. (continued from page 11) by June 2019 will allow the Port to seek additional funding for plan implementation and infrastructure. The Deep Dive Toward Zero Emissions The Green Port Policy marked the Port’s transition from regulatory compliance to its game-changing pursuit of clean air, water, soil, and sustainability programs. After the original CAAP was adopted in 2006, early strategies focused on incentives for participation in voluntary programs, green practices negotiated into leases, tariff requirements, and the ports’ joint Technology Advancement Program (TAP). The results have been dramatic: DPM emissions have dropped 88%, SOx has plummeted 97%, and NOx has fallen 56% since 2005, according to the Port’s 2017 Air Emissions Inventory. GHGs were not targeted in the original CAAP, but the same strategies resulted in an 18% reduction in GHGs since 2005. All of this has occurred while cargo increased by 12%. TAP prototypes led to a number of the breakthroughs incorporated into today’s large-scale demonstrations. The Port’s focus on cutting GHGs will also aid in further reducing DPM, NOx, and SOx emissions. Aiming high has paid big dividends for the economy and the environment and provides ample opportunities to forge ahead toward zero. Biography Heather Tomley (heather.tomley@ polb.com) is with the Port of Long Beach, California. IEEE Elec trific ation Magazine / J UNE 2 0 1 9 59 DAT E S A H E A D 2019 11– 14 J U N E EEEIC/I&CPS Europe 2019: IEEE International Conference on Environment and Electrical Engineering and 2019 IEEE Industrial and Commercial Power Systems Europe, Genova, Italy, https://www.eeeic.net/eeeic/ 17– 20 J U N E COMPEL 2019: 20th Workshop on Control and Modeling for Power Electronics, Toronto, Ontario, Canada, https:// compel2019.org/ 17– 21 J U N E WoW 2019: IEEE PELS Workshop on Emerging Technologies: Wireless Power Transfer, London, United Kingdom, http:// www.wpw2019.org/ 19– 21 J U N E ITEC 2019: IEEE Transportation Electrification Conference and Expo, Novi, Michigan, United States, contact Rebecca Krishnamurthy, [email protected], https://itecconf.com 23– 27 J U N E PowerTech 2019: IEEE PowerTech Milan, Milan, Italy, contact Prof. Federica Foiadelli, [email protected], http:// ieee-powertech.org/ 4– 8 AU G U S T GM 2019: IEEE PES General Meeting, Atlanta, Georgia, United States, contact Matt Stryjewski, [email protected], http://pes-gm.org/2019/ 13– 16 AU G U S T ESTS 2019: IEEE Electric Ship Technologies Symposium, Arlington, Virginia, United States, contact Dr. Scott Sudhoff, [email protected], https://ests19.mit.edu/ 20– 23 AU G U S T PowerAfrica 2019: IEEE PES/IAS PowerAfrica, Abuja, Nigeria, contact Tunde Salihu, [email protected], https://ieeepowerafrica.org/ 60 2 7 –3 0 A UGUS T SDEMPED 2019: IEEE 12th International Symposium on Diagnostics for Electrical Machines, Power Electronics, and Drives, Toulouse, France, http://www.sdemped2019.com/en/ index.html 2 –6 S E P TE MBE R EPE’19 ECCE Europe 2019: 21st European Conference on Power Electronics and Applications, Genova, Italy, http:// www.epe2019.com/ 9 –1 0 S EP TEMBER SLED 2019: IEEE 10th International Symposium on Sensorless Control for Electrical Drives, Torino, Italy, https://attend .ieee.org/sled-2019/ 1 5 –1 8 S E P TE MBE R ISGT LA 2019: IEEE PES Innovative Smart Grid Technologies Latin America, Gramado, Brazil, contact Gabriel Arguello, [email protected], https://attend.ieee.org/isgt-2019/ 2 9 S E P TE MBE R–2 OCTOBE R ISGT Europe 2019: IEEE PES Innovative Smart Grid Technologies Europe, Bucharest, Romania, contact Prof. George Cristian Lazaroiu, [email protected], http://sites.ieee.org/ isgt-europe-2019/ 2 9 S E P TE MBE R–3 OCTOBE R ECCE 2019: IEEE Energy Conversion Congress and Exposition, Baltimore, Maryland, United States, http://www.ieeeecce.org/2019/ 2 9 S E P TE MBE R–3 OCTOBE R 2019 IEEE Industry Applications Society Annual Meeting, Baltimore, Maryland, United States, https://ias.ieee .org/2019annualmeeting For more information on upcoming conferences, please visit the following websites: IEEE Power & Energy Society: https://www.ieee-pes.org/ meetings-and-conferences/conference-calendar 22– 24 AU G U S T IEEE Transportation Electrification Community: https://tec .ieee.org/conferences-workshops EATS 2019: AIAA/IEEE Electric Aircraft Technologies Symposium, Indianapolis, Indiana, United States, https:// propulsionenergy.aiaa.org/EATS/ IEEE Industry Applications Society: https://ias.ieee.org/ events-conferences/conference-schedule.html Digital Object Identifier 10.1109/MELE.2019.2908915 Date of publication: 11 June 2019 IEEE Power Electronics Society: https://www.ieee-pels.org/ conferences I E E E E l e c t r i f i cati o n M agaz ine / J UN E 2019 Viewpoint (continued from page 64) technologies with a low risk of stranded investment by 2050). SCE’s GHG abatement methodology assessed more than 40 key measures of clean energy technologies in five main sectors: 1) transportation (electric, hydrogen fuel cell, and natural-gas vehicles, among others) 2) electric power (large-scale renewable generation, hydrogen pipeline injection, biogas, and so forth) 3) industrial [efficiencies in heating, ventilation and air conditioning (HVAC), machine drive, and so forth] 4) residential (efficiency in home appliances, water and space heating electrification, heat-pump water heaters, and air-source heat pumps, among others) 5) commercial (water and space heating electrification and efficiencies in ventilation, lighting, and so forth). SCE developed three scenarios to achieve the 36 MMT of incremental abatement (incentivized by California’s multisector cap-and-trade program): the renewable natural gas (RNG) pathway, the hydrogen path- way, and the clean power and electrification pathway. Of these three deep, long-term decarbonization scenarios, we determined that the clean power and electrification pathway is the optimal combination of measures to achieve the 2030 GHG goal (Table 1). In the RNG pathway, less largescale renewable generation is required because natural gas in pipelines is substituted with RNG. Excess renewable generation (mostly wind and solar) is managed through power-to-gas (PtG) conversion of electric power into synthetic methane, with landfill capture and conversion as the main sources. An important challenge to the RNG pathway is that the commercialization of PtG technology is at a very early stage of development, with a limited number of pilot plants in operation. Moreover, the price to produce and potentially import significant amounts of RNG entails a higher abatement cost. In the hydrogen pathway, a hydrogen-natural gas blend at 7% hydrogen by volume is transported over a natural gas pipeline network for end uses. Excess renewable generation (mostly wind and solar) is managed through electrolysis to produce hydrogen. An important challenge to the hydrogen pathway is the need to build hydrogen production facilities, which are not currently present in California. Moreover, hydrogen production is energy intensive, and its potential as grid-scale storage is limited, in part, by its low round-trip efficiency. The cost to produce and build the infrastructure for hydrogen results in the highest abatement cost of all three pathways. SCE’s Blueprint for Integrated Electrification The clean power and electrification pathway focuses on three economic sectors—electricity, transportation, and buildings—and is defined by three interdependent measures: xx 80% carbon-free electricity xx more than 7 million electric vehicles (including light, medium, and heavy duty) xx electrifying space and water heating in almost one-third of the state’s building stock. As electricity becomes cleaner, every electric vehicle and electric TABLE 1. A comparison of decarbonization scenarios. (Source: Southern California Edison 2017a.) Clean Power and Electrification RNG Hydrogen (H2) Carbon-free electric power 80% 60% 80% Light-duty vehicles 7 million electric vehicles 7 million electric vehicles 2 million electric vehicles 4 million H2 vehicles Medium-heavy-duty vehicles 21% of vehicles electrified 12% of vehicles using compressed natural gas 4% of heavy-duty vehicles using H2 Commercial and residential Up to 30% electrification 42% of natural gas replaced by RNG 7% of natural gas replaced by H2 Average abatement cost (180 MMT) US$37/MT US$47/MT US$70/MT Incremental abatement cost (last 36 MMT) US$79/MT US$137/MT US$262/MT IEEE Elec trific ation Magazine / J UNE 2 0 1 9 61 VIEWPOINT space and water heater becomes cleaner over its lifespan. Decarbonize the Grid If the energy produced in California by large-scale resources is 80% carbon-free and energy efficiency and distributed solar are maximized, GHG emissions will be reduced from 84 MMT/year to 28 MMT/year, or 31.1% of the 2030 GHG reduction goal (Figure 1). Supplying 80% carbon-free energy would require a state generation portfolio comprising nondispatchable resources, including wind and solar, and dispatchable resources, including hydroelectric generators, as well as the addition of up to 30 GW of renewable capacity. SCE plans to integrate the resulting high penetration of large-scale renewable resources by diversifying the anticipated renewables portfolio in terms of resource availability and location, increasing the capacity of the transmission grid, and enhancing the integration across the Western Interconnection (one of the two major ac power grids in the continental U.S. power transmission grid). Under the clean power and electrification scenario, as many as 10 GW of energy storage from fixed and transportable sources will be required to help manage the volatility and uncertainty of nondispatchable resources, such as wind and solar, by providing energy balancing on hourly, daily, and seasonal bases. The challenges faced by California today, including the “duck curve,” i.e., the difference between electricity demand and the amount of available solar generation throughout the day, can be mitigated by adding energy storage at scale and enabling load shifting with electric vehicles. SCE expects these challenges to be exacerbated by the addition of more nondispatchable renewables to the system; thus, gas-fired generation and hybrid systems, such as peaker plants that combine battery energy storage with gas turbines, may be needed to preserve service reliability. Decarbonizing California’s grid will also require modernizing the distribution system to integrate the distributed energy resources that SCE expects its customers will continue adopting, including rooftop and community solar, battery storage, and electric vehicles. Grid modernization using existing and emerging smart grid technologies will allow these distributed energy resources to be better integrated and optimized and so help improve overall system reliability, resilience, and safety. Electrify Transportation The electrification of 24% of lightduty vehicles, 15% of medium-duty vehicles, and 6% of heavy-duty vehicles, with the power to supply those cars and trucks coming from an increasingly decarbonized grid, will help reduce GHG emissions from 169 MMT/year to 111 MMT/year, or 32.2% of the 2030 GHG reduction goal (Figure 1). SCE sees the need for at least 7 million cars and light trucks, 180,000 medium-duty trucks and vans, and 22,000 heavy-duty trucks and buses on California’s roads by 2030 to achieve the state’s aggressive climate and air quality goals and help phase out internal combustion vehicles by 2050. Supporting 7 million electric vehicles will require a huge build-out of charging infrastructure, including up to 700,000 public and workplace charging stations. For this reason, the ongoing charging-infrastructure pilots run by California utilities, which account for more than 19,000 charge points today, will need to step up to rapidly deploy more infrastructure and chargers to meet the expected proliferation of light-duty electric vehicles. The electrification of mediumduty and heavy-duty trucks and industrial vehicles and equipment, including forklifts, transport refrigeration units, passenger buses, and intermodal freight trucks, is underway. Accelerating this will require developing the adequate charging infrastructure and innovative collaborations, for instance, electrification of port operations and goods Industrial 17.2% Transportation 32.2% Electric Power 31.1% Residential and Commercial 6.7% Cap and Trade 6.7% Agricultural 6.1% Figure 1. GHG reductions across six sectors that are necessary to reach California’s 2030 goals. (Source: Southern California Edison 2017a.) 62 I E E E E l e c t r i f i cati o n M agaz ine / J UN E 2019 movement and indoor agriculture. Larger plug-in electric and plug-in hybrid trucks are going through the development stage, and the initial deployments must be supported by more charging infrastructure to deliver clean and reliable electric fuel. Electrify Buildings SCE estimates that electrifying nearly 33% of space and water heating in homes and businesses, in addition to increased energy efficiency and strong building codes and standards, could reduce GHG emissions from 49 MMT/year to 37 MMT/year, or 6.7% of the 2030 goal (Figure 1). Collaboration among manufacturers, repair service providers, and policy makers will be required to achieve the electrification of residential and commercial buildings. Current building codes and standards are based on the 20th century paradigm of electric power generation dominated by petroleum, natural gas, and coal. A rapid paradigm shift is necessary, based on SCE’s vision of the decarbonized grid supporting and incentivizing the use of clean-electric appliances and evolving technologies in new buildings. For example, controllable electric space and water heating, powered by rooftop solar generation with surplus solar power for electric vehicle charging, could be incorporated in a future version of the zero-netenergy framework, which is focused on reducing the carbon footprint for new home construction. Concurring Visions SCE’s vision for a clean energy future is shared by other utilities and government agencies. In 2018, National Grid, Waltham, M a s s a ch u s e t t s , released the Northeast 80 × 50 pathway, its blueprint for reducing GHG emissions to 80% below 1990 levels by 2050. National Grid’s pathway calls for 67% carbon-free electricity, 10 million electric vehicles on northeast roads by 2030, doubling the rate at which buildings are retrofitted with energy efficiency projects, and transitioning almost 5 million homes and buildings that still use heating oil to either gas or electricity. Similarly, Portland General Electric published a white paper in 2018 laying out its vision for the role of a clean energy future in achieving Oregon’s environmental goals. The company’s vision includes achieving 70% carbon-free generation by 2040, modernizing the electric grid, and customer adoption of new technologies, including electric vehicles. In 2018, the California Energy Commission put forward its decarbonization strategy for a clean high-renewable future. The strategy encompasses a 74% decarbonization of electricity, 6 million zero-emission vehicles, and electric heat pumps for 50% of new HVAC and water heating by 2030. An Electrifying Future SCE has developed a blueprint for integrated electrification that others can follow for broad decarbonization. It leverages existing policies and uses existing technologies to produce the most feasible and costeffective solution to decarbonize the electric power sector and, afterward, transition fossil-fuel-dependent sectors to clean electric power. We can transition to a low-carbon economy by midcentury, and we can meet predefined goals to reduce GHG emissions across all energy sectors: electricity, fuels, and gases. Additionally, we are proud, as an investorowned utility, to lead the way. Why SCE? Because many resources and stakeholders are needed to address climate change, and electric utilities have the size, scope, and infrastructure to support efficient electrification fueled by clean electricity for all consumers. However, everyone is a stakeholder in this effort, and we need a sense of urgency. Now is the time to come together and figure out how to respond to this crucial moment in the history of our industry and of society in general. To quote the British thinker and philosopher Jonathon Porritt, “The future will either be green or not at all.” The possibilities for electrification are exciting. Not only can it make a better world, it simply makes business sense. Efficient electrification catalyzed by clean energy helps meet customer demands and supports the creation of more green jobs across the economy. It creates a new energy paradigm that can mitigate the impact of greenhouse gases and improve air quality and human health today and for generations to come. For Further Reading Southern California Edison, “The clean power and electrification pathway,” Southern California Edison, Rosemead, CA, White Paper, 2017a. [Online]. Available: https://newsroom.edison.com/ internal_redirect/cms.ipressroom.com. s3.amazonaws.com/166/files/20187/ g17-pathway-to-2030-white-paper.pdf Southern California Edison, “The clean power and electrification pathway: Appendices,” Southern California Edison, Rosemead, CA, White Paper, 2017b. [Online]. Available: https://www .edison.com/content/dam/eix/ documents/our-perspective/g17p a t h w ay - t o - 2 0 3 0 - w h i t e - p a p e rappendices.pdf Biographies Manuel Avendaño (manuel.avendano @sce.com) is with Southern California Edison. Devin Rauss (devin.rauss@sce .com) is with Southern California Edison. IEEE Elec trific ation Magazine / J UNE 2 0 1 9 63 VIEWPOINT Southern California Edison’s Blueprint for Integrated Electrification By Manuel Avendaño and Devin Rauss ALIFORNIA HAS BEEN aggressively confronting climate change for more than a decade. State policy makers, supported by two-thirds of the state’s adult residents (according to a recent Public Policy Institute of California poll), have backed increasingly more stringent regulations to reduce greenhouse gas (GHG) emissions. In 2006, the state legislature set initial goals to reduce the state’s GHG emissions to 1990 levels by 2020 and to 40% and 80% below the same baseline by 2030 and 2050, respectively. The key pillars of California’s climate change strategy to meet the 2030 GHG emissions target include x reducing the petroleum used in vehicles by 50% x doubling the energy efficiency savings at existing buildings x managing natural and working lands so they can store carbon x reducing the release of short-lived climate pollutants (for example, methane and black carbon). More recently, the state has established a target of 100% carbon-free energy by 2045. The measure also requires California’s electric companies to procure 50% of their energy from renewable sources by 2026 and 60% by 2030. C Digital Object Identifier 10.1109/MELE.2019.2906633 Date of publication: 11 June 2019 64 I E E E E l e c t r i f i cati o n M agaz ine / J UN E 2019 Given that electric power ac counts for only 19% of California’s GHG emissions, the state is also addressing the remaining 81% of emissions: transportation (45%), agriculture (8%), residential and commercial (11%), and industrial (17%). Achieving California’s goals requires significant resources, many stakeholders, and a massive and highly organized effort. The electrification of energy end uses—transport, heating and cooling, industry processes, and others—will be vital to achieve carbon emission targets. Southern California Edison (SCE) and its parent company, Edison International, Rosemead, California, have embraced the state’s ambitious goals. In fact, Edison International signed on to the “We Are Still In” campaign, affirming continued commitment to support the Paris Climate Change agreement’s goals, and has taken concrete steps to expand the role of efficient electrification fueled by clean energy. In late 2017, we released a white paper laying out our vision for the role of a clean energy future in achieving California’s environmental goals, based on the results of an extensive modeling study to assist in long-range planning. The underlying assumptions are being used in current and upcoming planning and continually updated and evaluated by SCE. Evaluation of Decarbonization Scenarios by SCE The SCE study focuses on reducing emissions economy-wide by 180 million metric tons (MMT), from 440 MMT in 2015 to 260 MMT in 2030. The modeling framework incorporates economic adoption and renewablegeneration optimization models and provides a view across multiple sectors of the economy. The study assumes that 144 MMT of GHG abatement will come from existing and expected policies identified in the Scoping Plan issued by California’s clean-air agency, the California Air Resources Board, to address Assembly Bill 32. SCE used four key criteria to assess potential measures and technologies aimed at decreasing the remaining 36 MMT needed to reach the 180 MMT goal: 1) GHG abatement potential (total technical potential instead of feasible potential) 2) marginal abatement costs (cost of an additional unit of abatement) 3) feasibility (for instance, availability of technology, infrastructure requirements, economies of scale, consumer preference, and timing of deployment) 4) likelihood that technology will enable California to meet its more stringent 2050 GHG emissions reduction goal (for example, (continued on page 61) 2325-5987/19©2019IEEE IF YOU ARE READING THIS... YOU BELONG WITH IEEE POWER & ENERGY SOCIETY Grow your Technical Expertise - Expand your technical knowledge through publications, live conferences, webinars and tutorial • Connect with a Global Network - Interact with other professionals through local chapter activities, technical committees, and live events • Contribute to the Future of our Industry - Impact the future of power and energy through technical committees, standards development, research publishing, and humanitarian activities • Save Money on Valuable Programs - Enjoy reduced rates on many exclusive products and services including books and eBooks, tutorials, journals and articles, conferences, standards, technical reports, and continuing education Join the global leaders in power and energy who are bringing More Power to the Future™ Learn more: www.ieee-pes.org Digital Object Identifier 10.1109/MELE.2019.2916529 EVERYTHING YOU NEED IN ONE PLACE Visit the IEEE PES Resource Center: resourcecenter.ieee-pes.org The IEEE PES Resource Center is the most extensive library in the world devoted exclusively to the power and energy industry. You don’t have to be a PES member to access the Resource Center’s vast array of content available to assist in your research, presentations, or academic programs, and benefit your professional development! PES Member Access: Most materials in the PES Resource Center are free to society members - an important member benefit. Non-PES Member Access: Discounted prices, for IEEE members, are listed for each product. Non-members also have access to all the products on the IEEE PES Resource Center. • Download PES Magazines • Watch Video Tutorials & Archived Webinars • Access Conference Videos & Presentations • Update Your License with CEU/PDH credits • Download Complete Technical Reports Digital Object Identifier 10.1109/MELE.2019.2916530 & IAS 2019 PowerAfrica Conference Abuja, Nigeria • 20-23 August 2019 Join IEEE Power and Energy Society (PES), Industrial Applications Society (IAS) and IEEE Nigeria Section for the 6th Annual PowerAfrica: “Power Economics and Energy Innovations in Africa” Attendees can expect to be enriched by this forum where research scientists, engineers, and practitioners present and discuss the latest research findings, innovations, emerging technologies and applications. With a focus on power systems integrations, business models, technological advances, policies and regulatory frameworks for the African continent, you will enjoy a program that covers vital topics such as: • Smart Energy Regulation and Policy • Smart Grid Design and Security • Smart Technology Application • Electrical Safety and Industry Standards • Industrial Renewable Energy • Challenges and Opportunities of Accessible Power Visit ieee-powerafrica.org to learn more and register Digital Object Identifier 10.1109/MELE.2019.2916531