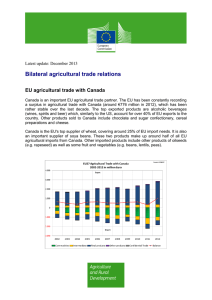

SourceTracking results in agriculture and rural development in less-than-ideal conditions

Anuncio