Flash Note 30/06/2016 Asia. Day 5 after the Brexit (the calm persists)

Anuncio

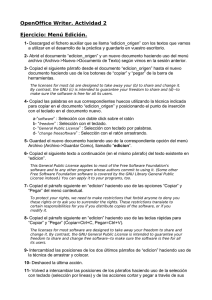

Flash Note 30/06/2016 Alex Fusté @AlexfusteAlex [email protected] Asia. Day 5 after the Brexit (the calm persists) Markets o Japan equity markets ended flat on Thursday with the Nikkei up 0.06%. Markets were sold after a firmer open, broadly mirroring gains in the yen. TOPIX sectors were mixed with gains led by resources and declines driven by textiles. News flow was very light and today's data releases had little impact. o China was slightly flat, with the Shenzen B gaining +0.59% but the Shanghai Stock Exchange lower (0.1%). o India was higher again (+0.66%) o Malaysia +0.5% o And Hong King showing the strongest gains: up +1.6% o Bonds: Japanese 10yr government bond unchanged (with yields going up by just 1bp to -0.22%). Yen o JPY strengthened slightly (from 102.75 to 105.58) and gave place to a discussion about the yen's safe haven phenomenon and the problems it poses for the Japanese government with few easy options to curb a rise that hurts exporters and could tip the economy back into recession. In sum, some of the conclusions reached is that the global economic dynamics contributing to the yen's strength persist, while the effectiveness of unilateral intervention and additional monetary easing are questioned. Este documento ha sido realizado por Andbank, principalmente para su distribución interna e inversores profesionales. Este documento no debe ser considerado como consejo de inversión ni una recomendación de compra de ningún activo, producto o estrategia. Las referencias a cualquier emisor o título, no pretenden ser ninguna recomendación de compra o venta de dichos títulos. Japanese economy – Hard Data o May industrial production -2.3% m/m vs consensus -0.1% and +0.5% in April. o Housing starts +9.8% y/y vs consensus +4.8% and +9.0% in April. o Financial flows in Japanese securities for the week ended 25-Jun. (Just domestic investors are buying Japanese securities. This could explain partially the repatriation effect and the recent strength of the JPY) Domestic investors: Net buyers of ¥211.6B in foreign equities vs ¥72.4B of net purchases in previous week. Net buyers of ¥394.2B in foreign longterm debt vs revised ¥457.5B of net sales in previous week. International investors: Net sellers of ¥184.2B in domestic equities vs revised ¥232.8B of net sales in previous week. Net sellers of ¥2,157.5B in domestic longterm debt vs revised ¥487.7B of net sales in previous week. Regards, Alex Fusté Chief Economist Andbank Este documento ha sido realizado por Andbank, principalmente para su distribución interna e inversores profesionales. Este documento no debe ser considerado como consejo de inversión ni una recomendación de compra de ningún activo, producto o estrategia. Las referencias a cualquier emisor o título, no pretenden ser ninguna recomendación de compra o venta de dichos títulos.