Titel 1 - Siicex

Anuncio

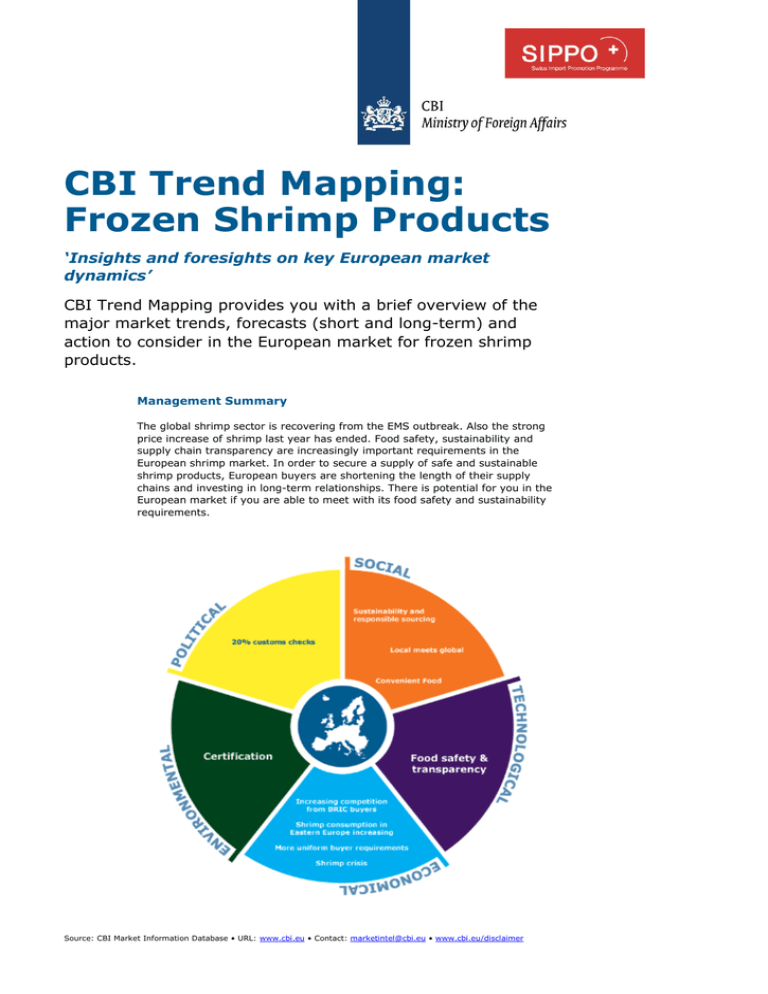

CBI Trend Mapping: Frozen Shrimp Products ‘Insights and foresights on key European market dynamics’ CBI Trend Mapping provides you with a brief overview of the major market trends, forecasts (short and long-term) and action to consider in the European market for frozen shrimp products. Management Summary The global shrimp sector is recovering from the EMS outbreak. Also the strong price increase of shrimp last year has ended. Food safety, sustainability and supply chain transparency are increasingly important requirements in the European shrimp market. In order to secure a supply of safe and sustainable shrimp products, European buyers are shortening the length of their supply chains and investing in long-term relationships. There is potential for you in the European market if you are able to meet with its food safety and sustainability requirements. Source: CBI Market Information Database • URL: www.cbi.eu • Contact: [email protected] • www.cbi.eu/disclaimer CBI Trend Mapping: Frozen Shrimp Products Social Market Drivers Considerations for action Increasing attention given to and If you have any activities that protect the sustainability and responsible sourcing environment or support local communities, The shrimp farming sector, particularly in include these in your marketing strategy. Asia, has received negative comment from In 2013 Global G.A.P. and the Aquaculture Europe’s media in countries such as Stewardship Council started to work together Germany and the Netherlands (e.g. child in order to harmonise their requirements. A labour in Thailand). The sector has been step by step approach makes it possible to first criticised for its negative impact on become Global G.A.P. certified and then work communities and the environment. The towards ASC certification. This can make it result is that consumers are increasingly easier for you to work towards certification. aware of the negative social and environmental impact of shrimp farming. Owing to this media attention and increasing consumer awareness, ever greater numbers of European buyers are seeking out shrimp suppliers able to prove the sustainability and responsibility of their product by means of certification or else suppliers with a responsible story underpinning their product. It is important to be aware of your company’s impact on the environment and local communities. If you have special activities within your company to support communities or the environment, you should include these in your marketing strategy. As an example, you could produce leaflets about your activities or else present your company at tradeshows. Local meets global If you meet international buyer requirements, Buyer requirements for shrimp products in consider marketing this domestically as well. the high-end market segments in developing countries are becoming stricter. The gap is reducing between buyer requirements in Europe and in high-end market segments in developing countries. In the short term, standards in developing countries will remain less stringent than in Europe. However, the differences between food safety and sustainability requirements in developing countries and in Europe will reduce over the long term. Nevertheless, these different standards are unlikely to merge into one global standard. Convenience food Invest in value-adding processing activities in Owing to the pressures of time and the terms of knowledge and technology in order to number of consumers who do not know how increase the value of your product. to prepare shrimp, demand is increasing for ready-to-eat and easy-to-cook, value-added shrimp products. Currently, only simple value-adding activities such as peeling and portioning are outsourced. However, as a result of price pressure, there will be more complex value-adding activities over the long term, such as the production of marinated shrimp being outsourced to processors in developing countries. This offers you opportunities if you are able to produce quality value-added shrimp products such as skewers or marinated shrimp. Source: CBI Market Information Database • URL: www.cbi.eu • Contact: [email protected] • www.cbi.eu/disclaimer CBI Trend Mapping: Frozen Shrimp Products Technological Market Drivers Considerations for action Food Safety and transparency Discuss with your buyers whether it would be a Food safety and transparency are good idea to, in addition to BRC and IFS, increasingly important in all parts of Europe. become accredited for other food safety Previous problems with the quality of shrimp standards. products, as well as related financial and reputational risks to European buyers, resulted in greater stringency concerning market access requirements. Private quality standards and supply chain transparency are increasingly used as market access requirements in order to guarantee safe shrimp products to European consumers. Quality standards relate both to European regulations and to additional buyer requirements such as BRC and IFS. You need to comply with the highest standards by becoming BRC or IFS-approved and to trace every product you sell by introducing proper administrative systems for your sourcing activities. Transparency relates to the traceability of shrimp products. Over the short to long term, quality and transparency are expected to become even more important. Economic Market Drivers More uniform buyer requirements In earlier years there was the huge difference in buyer requirements throughout the EU. Now it seems that the EU market is becoming more uniform. This is partly caused by the more stringent EU regulations but also by the fact that retailers throughout the EU increasingly apply the same buyer requirements. The uniformity of the EU market is likely to increase further by initiatives such as the Global Sustainable Seafood Initiative (and earlier the Global Food Safety Initiative) which will benchmark certification initiatives and offers retailers a tool to work with more than one certification initiative. Considerations for action Global shrimp crisis impacts EU demand Although other markets currently may be The global outbreak of EMS has caused more interesting than the EU, consider to record prices in the international market. In continue to do business with your EU order to reduce the impact on consumer customers in order to maintain your prices, consumer sellers have initially started relationships for when prices turn back to to purchase smaller size shrimp and to use normal. higher glazing and soaking rates in order to limit the impact of EMS on consumer prices. Although the outbreak of EMS still has an impact on the global shrimp market, the sector is slowly recovering and prices will slowly move towards pre-crisis levels. Source: CBI Market Information Database • URL: www.cbi.eu • Contact: [email protected] • www.cbi.eu/disclaimer CBI Trend Mapping: Frozen Shrimp Products Shrimp consumption in Eastern Europe Discuss with your buyers whether you could increasing supply specific products that would enable you Eastern Europe is still experiencing economic to penetrate the emerging shrimp market in growth and this is expected to continue in Eastern Europe the near future. Consumers are very price Do market research on Eastern Europe and conscious and shrimp are relatively new to contact buyers located in Eastern Europe to most consumers. Product characteristics discuss the products that are greatest in present fewer compliance difficulties than in demand and the most important market other parts of Europe. However, the shrimp segments. market in Eastern Europe is expected to remain small in the short term, although the market is set to grow significantly over the long term. The best mode of entry is via importers in Western Europe that are expanding their businesses. Increasing competition from BRIC Try to find buyers who buy not only on a spot buyers market basis but who are also willing to invest European buyers are being faced with in longer term relationships through contracts competition from BRIC countries that are or partnerships. offering the same or higher prices while having less stringent product requirements. Consequently, European buyers will sometimes need to accept lower profit margins and pay higher prices for the raw material. This situation will become even more difficult for European buyers in the long term. In terms of shrimp, the significance of this trend will depend on the increase in production volume. As long as demand increases faster than supply, this will have a positive impact on your business. The result for you will be an improved future bargaining position with European buyers; buyers will also be more likely to secure their supply by investing in relationships with suppliers that are more sustainable. Environmental Market Drivers Considerations for action Certification in the mainstream market If you are interested in becoming ASC or Sustainability certification initiatives used to Global GAP-approved, please contact ASC, the target specific niche markets. At present, the Dutch Sustainable Trade Initiative or the Global mainstream market is also increasingly GAP website for support and assistance. sourcing shrimp products that have certification trademarks. This is especially true in the case of large supermarket chains in northern and western Europe. Currently, the most commonly required certificate is Global GAP. However, supermarket chains in western Europe have announced that they wish all their shrimp products to be certified by the Aquaculture Stewardship Council (ASC) as of 2015 onwards. ASC is expected to gain in importance in other parts of Europe over the long term. If you want to supply leading European retailers, you will have to invest in sustainable certification. The ASC shrimp certification is has started in 2014 and the first ASC certified shrimp are expected to become available at the end of Source: CBI Market Information Database • URL: www.cbi.eu • Contact: [email protected] • www.cbi.eu/disclaimer CBI Trend Mapping: Frozen Shrimp Products 2014. ASC will introduce a standard for large farms and a separate one for smallholder farms. Certification in niche markets There are various niche markets throughout Europe where specific certification initiatives are market access requirements. These certification initiatives mostly relate to fair trade or organic production. Niche markets are expected to expand in line with growing awareness on the part of European consumers concerning what they eat and how their food is produced. Particularly suitable candidates for organic certification are shrimp produced in extensive or else intensive production systems where only natural foods have been used and no additives. If you are selling organically produced shrimp, you should ask you buyer whether certifying your product would present you with an opportunity. For information on certification initiatives, please visit the CBI database or ITC’s standards map. Political Market Drivers Considerations for action 20% customs checks on consignments Set up a public-private work group to discuss of shrimp food safety issues in the EU market and to European health authorities continue to develop a strategy to prevent sanctions by EU apply strict policies to the import of tropical authorities shrimp. Various countries, such as India and Indonesia, are being confronted with 20% Lobby with your government for good customs checks that are imposed following representation in Brussels in order to the detection of contaminated batches of inform/stay informed about European shrimp. With consumer awareness rising Commission decision makers. about the use of chemicals and medicinal drugs in shrimp production, regulations will In order to stay up-to-date on changes to EU remain strict and sanctions will be imposed if regulations, and to influence EU policy, make the situation does not improve. European sure that you are a member of your national sanctions will have a negative impact on seafood exporters association. your competitive position in the European market over the short to long term. Therefore it is crucial that you cooperate within your national exporters’ association and with the national government to ensure regulatory compliance in the shrimp sector. This survey was compiled for CBI by LEI Wageningen UR in collaboration with CBI sector expert Siegfried Bank Disclaimer CBI market information tools: http://www.cbi.eu/disclaimer Source: CBI Market Information Database • URL: www.cbi.eu • Contact: [email protected] • www.cbi.eu/disclaimer