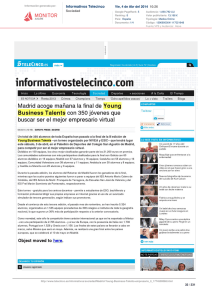

VII Seminario de Media GESTEVISION TELECINCO S.A.

Anuncio

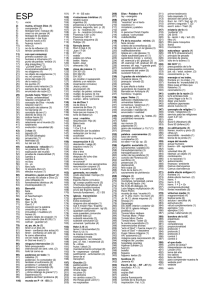

GESTEVISION TELECINCO S.A. VII Seminario de Media 19 de enero de 2010 1 GROUP 9M09 9M08 VAR. % Total Net Revenues (€ mn) 432.2 734.9 -41.2% Total Operating Costs 343.3 405.5 -15.3% EBITDA adj.* (€ mn) 89.0 329.4 -73.0% 20.6% 44.8% 82.5 324.3 19.1% 44.1% Net Profit Reported (€ mn) 62.2 228.4 -72.8% Net Profit Adjusted** (€ mn) 78.5 242.4 -67.6% FCF (€ mn) 70.0 283.6 -75.3% 16.2% 38.6% (€million) EBITDA adj/Net Revenues EBIT (€ mn) EBIT/Net Revenues Audience Share, Jan 1st – December 31st 2009 16.4% 15.1% 14.7% 13.9% -74.6% 24 h Total Individuals FCF/Total Net Revenues Net Cash Position -176.9 -51.1 16.7% 16.2% PT 20:30 Total Individuals Audience Share Commercial Target, Jan 1st – December 31st 2009 15.5% 16.4% 15.3% 14.9% n.a. 13.8% 14.4% * After the rights consumption ** Excluding the Net Impact of the amortization of the PPA of Endemol NINE MONTHS 2009 HIGHLIGHTS 24 h Commercial Target PT 20:30 Commercial Target Sources: SOFRES 2 3 BROADCASTING Minutes Thousands 235 7,200 230 6,700 225 220 6,200 215 5,700 210 205 5,200 200 4,700 195 190 4,200 Years Yr 1995 Yr 1996 Yr 1997 Yr 1998 Yr 1999 Yr 2000 Yr 2001 Yr 2002 Yr 2003 Yr 2004 Yr 2005 Yr 2006 Yr 2007 Yr 2008 Yr 2009 Minutes Thousands 211 214 209 210 213 210 208 211 213 218 217 217 223 227 227 5,343 5,445 5,493 5,584 5,678 5,639 5,660 5,754 5,824 6,167 6,205 6,270 6,502 6,688 6,890 Yr Yr Yr Yr Yr Yr Yr Yr Yr Yr Yr Yr Yr Yr Yr 1995 1996 1997 1998 1999 2000 2001 2002 2003 2004 2005 2006 2007 2008 2009 Stable TV Consumption in 2009 vs 2008 per minutes but increasing by number of viewers Sources: SOFRES 4 BROADCASTING January 1st – December 31st 2009 16.2% 15.1% 14.7% Audience 24h & Prime Time (20:30), Total Individuals 16.4% 16.7% 13.9%13.2% 13.7% 8.2% 8.7% 10.2% 9.4% 6.8% 7.5% 7.5% 6.9% Tem. Pay -3.0 -3.8 -0.9 -1.3 -1.3 -0.7 -0.4 -0.8 +1.3 +2.0 +5.1 +4.6 -0.4 -0.6 3.8% 3.1% 3.9% 3.8% Other +0.7 +0.7 -0.7 +0.7 -0.5 +0.5 Vs. 2008 Audience 24h Audience Prime Time (20:30) Audience 24h & Prime Time (20:30), Commercial Target* 16.4% 15.3% 15.5% 14.9% 13.8% 14.4% 10.5% 11.1%10.4% 11.0% 9.8% 8.9% 8.4% 8.6% 9.0% 8.3% Tem. Pay -4.1 -5.1 -1.2 -0.8 -0.5 -0.2 0.0 -0.5 +1.5 +2.1 In 2009, TL5 is leader between the commercial channels. +4.8 +4.1 -0.8 -0.8 3.6% 3.1% 3.8% 3.3% Other +0.8 +0.7 +0.3 +1.3 -0.8 -0.8 * Commercial target: Audience group comprising of individuals from 16 to 59 living in communities of over 10,000 inhabitants and across middle and upper social classes Sources: SOFRES 5 BROADCASTING January 1st – December 31st 2009 Thematic Thematic TDT Pay Total individuos Telecinco Antena 3 FORTA Cuatro La Sexta Total Day 15.1 14.7 13.2 8.2 6.8 10.2 Morning 14.1 15.6 11.8 6.3 5.1 Afternoon 12.5 15.7 15.1 8.8 Evening 14.7 14.8 13.0 PT 20:30 16.2 13.9 Late night 20.3 Daytime 14.5 Total individuals Telecinco Locals TVE1 La 2 7.5 3.9 16.4 3.8 15.1 9.1 4.1 14.4 4.3 7.4 8.1 5.9 3.1 18.8 4.5 6.9 6.8 10.1 8.4 3.9 17.1 4.2 13.7 8.7 7.5 9.4 6.9 3.8 16.7 3.1 15.5 10.4 10.4 6.6 9.9 7.5 4.8 12.0 2.8 15.1 13.0 8.0 6.5 10.6 7.8 4.0 16.3 4.2 Antena 3 FORTA Cuatro La Sexta Thematic Thematic TDT Pay Locals TVE1 La 2 TC 15.5 15.3 10.5 10.4 8.4 9.4 9.0 3.8 13.8 3.6 Men 12.5 13.4 13.7 8.7 8.2 11.1 8.3 4.2 15.5 4.4 Women 17.2 15.8 12.8 7.9 5.6 9.5 6.9 3.9 17.2 3.4 4 - 12 8.3 13.7 9.7 6.8 4.1 29.3 12.3 3.7 8.6 3.5 13 - 24 13.9 18.3 9.7 12.6 8.3 12.2 8.3 3.5 10.3 2.7 25 - 34 14.7 15.6 9.2 12.0 9.1 11.2 8.9 3.6 12.2 3.6 35 - 54 15.3 15.0 11.9 9.2 7.8 9.6 8.5 3.7 15.3 3.7 55 - 64 16.8 14.1 15.8 6.5 6.0 7.7 6.1 4.1 18.8 4.2 +64 16.1 13.1 18.0 4.5 4.8 6.6 4.8 4.5 23.2 4.3 2009 Audience share: slots of the day and population Sources: SOFRES 6 BROADCASTING January 1st – December 31st 2009 -4.6% 17.3 17 16 16.5 2.6% 15.6 15.2 15.1 -9.8% 15.6 15.3 15.2 14.7 15 16.1 14.7 13.8 14 13 12 11 10 TL5 1 Quarter 09 A3 2 Quarter 09 TVE1 3 Quarter 09 2009 Audience per quarter: Telecinco is the only big channel improving its audience during the last quarter of the year 4 Quarter 09 Sources: SOFRES 7 DIGITAL TELEVISION Analogical Channel's' Simulcast Exclusive DTT Channles DTT Audience share 52.7% 50% 40.2% 40% 30% 20% 21.9% 23.8% 28.7% 26.0% 27.3% 8.4% 7.6% 7.9% 6.9% 6.4% 31.9% 8.9% 35.3% 10.1% 12.5% 43.4% 45.6% 47.0% 13.1% 13.5% 13.4% 49.1% 13.3% 13.8% 38.9% 33.9% 35.8% 32.2% 29.9% 27.7% 23.0% 25.2% 20.3% 10% 19.4% 15.5% 17.0% 18.4% 0% TL5 started its new digital strategy in august 1.6 1.4 1.2 1.0 0.8 Technical Coverage: 93% Household Penetration: 74.7% (Source: SOFRES) Equipment: 24,192,885 units sold 0.6 0.4 0.2 Jan09 Feb09 Mar- Apr-09 May09 09 Jun- Jul-09 Aug09 09 Sep- Oct-09 Nov09 09 Sources: SOFRES Dec09 8 9 BROADCASTING September 1st – December 31st 2009 Audience 24h & Prime Time (20:30), Total Individuals 15.4% 16.3% 15.0% 13.8% 13.4%12.5% 17.5% 13.3% 11.8% 10.8% 7.7% 7.4% 6.8% 8.1% 6.7% 7.4% 4.9% Tem. Pay 4.8% 3.5% 3.0% Other Audience 24h Audience Prime Time (20:30) 15.9% 15.2% Audience 24h & Prime Time (20:30), Commercial Target* 15.5% 14.0% 14.1% 14.0% 9.9% 10.8% 9.7% 11.0% 9.9% 10.3% 8.3% 8.8% 8.1% 8.6% 5.0% Tem. Pay In the new season, TL5 is leader between the commercial channels. 4.6% 3.3% 3.0% Other * Commercial target: Audience group comprising of individuals from 16 to 59 living in communities of over 10,000 inhabitants and across middle and upper social classes Sources: SOFRES 10 BROADCASTING September 1st – December 31st 2009 Audience Prime Time Total Individuals Audience 24h Total Individuals 0.6% 0.5% 0.6% 1.6% 2.2% 0.0% 0.7% 0.9% 3.5% 3.0% 0.0% 0.8% 0.8% 0.8% 1.4% 0.9% 1.5% 0.1% 0.2% 15.5% 13.8% 0.2% 16.3% 0.4% 15.2% 17.0% 16.0% 8.3% 0.1% 17.5% 13.4% 0.1% 7.7% 0.5% 8.1% 7.4% 6.7% 6.8% 23.2% TL5 is leader in the multichannel environment. 16.6% 15.8% 8.5% 7.5% Sources: SOFRES 23.1% 11 INTERNET Nº1 page among the others broadcaster’s webs September 09 Unique Users* Page viewed* 1 Telecinco.es 2 RTVE.es 3 Antena3tv.com 6.71 4.46 3.13 24% 10% -6% 132.21 50% 69.46 24% 59.27 -16% Average minutes* 07:04 13% 23:59 107% 07:51 -6% Nº4 web in the ranking of the media companies September 09 Unique Users* Page viewed* 1 2 3 4 5 El Mundo Marca.com 20Minutos.es Telecinco.es Sport.es 23.74 19.94 9.18 6.71 5.03 10% 4% 5% 24% -7% 393.93 7% 499.42 11% 99.35 -7% 132.21 50% 92.62 -18% Average minutes* 08:17 2% 09:14 22% 06:13 -9% 07:04 13% 05:14 11% At September 2009 Telecinco improves its records of single users and viewed pages. Page Viewed 132.2 Unic Users +58% 6.7 +76% 83.7 3.8 2008 ** 2009 ** 2008 ** 2009** Source: Nielsen Online (data obtained with Country Market Intelligence), audited by OJD *September Data in million and % versus June 2009 ** Data of the month of September Aim achieved: a leader website with its own identity 12 13 ADVERTISING Advertising Revenues, Nine Months 2009 Special Initiative’s share on 9M09 Telecinco Gross Advertising Revenues 16.6% Gross TV Advertising Revenues (million €) Special Initiatives (million €) -41.6% -40.8% 695.8 113.7 406.5 67.3 (€ millions) 9M08 9M09 9M08 9M09 Commercial Strategy, 9M2009 Audience Share % 15.0% SECONDS GRP’s (20”) % % % -18.5% +3.6% -17.0% C/GRP’s (20”) % -30.2% TV gross Adv. Revenues € Mill. 406.5 % -41.6% Source: TNS & Publiespaña TL5 TV advertising revenues 14 ADVERTISING TV advertising market by sectors Sector Breakdown Sector Growth (% on total Adv sales) (9M09 vs. 9M08) Finance Retail Telecos Automotive 7.5 9.3 10.0 20.5 Retail -11.5% Health & Beauty -13.9% Finance -23.2% 9.8 9M09 22.8 Food Other 20.1 Food -23.6% Telecos -26.0% Other -36.3% Automotive -48.8% Health & Beauty TV Advertising Market by Sectors at 9M09 Source: Publiespaña 15 ADVERTISING POWER RATIO LEADER LUN ES 19 Power ratio including Digital channels M A RTES 2 0 M IER COLES 2 1 JUEV ES 2 2 LU N2 ES SÁB ADO 4 26 V IER NES 2 3 A RINGO T ES 22 75 DMOM M IER C OLES 2 8 JU EV ES 2 9 EL C OLEC C ION IST A ( D E IM Á GEN ES) FUSIÓN SONORA V IER N ES 3 0 D OM IN GO 0 LU 1 NES 2 6 SA B A D O 3 1 M ÁS QU E COC HES GT IN FOR M A TIV OS TELECINCO Power ratio of Telecinco SEN SA C IÓN D E SEN SAC IÓN DE V IV IR V IV IR 72 ED EL & ST A R C K GRAN HERM AN O DIARIO ® D IA RIO ® GRA N HERM ANO GR AN HERM ANO GRAN HERM A NO GRAN HERM AN O GRA N HERM ANO GRAN HERM AN O ® D IA RIO DIARIO D IAR IO DIARIO DIARIO DIARIO GR AN HERM ANO ® ® ® ® ® ® DIARIO GRA N HERM ANO GR AN HERM ANO GRAN HERM A NO GRAN HERM AN O GRA N HERM ANO GRAN HERM AN O ® D IA RIO DIARIO D IAR IO DIARIO D IA RIO DIARIO GR AN HERM ANO GUERR A DE SESOS M A TCHGOLF ® ® ® GUERRA DE SESOS GUERR A DE SESOS GUERRA D E SESOS D IA RIO GR AN HERM ANO DIARIO 10 0 %SU N SEN SA C IÓN D E V IV IR SEN SA C IÓN D E V IV IR B OIN G GUERR A DE SESOS SEN SA C IÓN D E V IV IR +7 SEN SA C IÓN D E V IV IR +7 M AS QU E COCHES IN SPEC T OR W OLF F SEN SA C IÓN D E V IV IR +7 +7 +7 IN SPEC TOR W OLF F IN SPEC T OR W OLF F +7 POLIC IA C R IM IN A L +7 ® DEM OLICIÓN ( NUEV OS) +13 IN SPEC T ORAW B RICOM NÍOLF A F D ECOGA RDEN GRA N HERM ANO D IA RIO ® ® B OIN G B en 10 B en 10 A ct ivo s y A nimad o s A ct ivo s y A nimado s +7 POLIC IA C R IM IN A L POLIC IA C R IM IN A L E CQUE OLON IA T ÚDSÍ V ALES 29® D E C OLON IA D E C OLON IA D E C OLON IA ED EL & ST A R C K ED EL & STA R C K ED EL & ST A R C K ED EL & ST A R C K +13 +13 +13 (ESTR ENO) +13 M QC GT B en 10 D ig imo n B akug an B akugan B akug an B akugan DEM OLICIÓN GRAN HERM AN O D IA RIO ® GRAN HERM AN O B en 10 A lien F or ce B en 10 A lien F or ce B en 10 A lien F or ce LA C ASA EN D IR ECT O LA CASA EN DIRECTO T it euf T it euf T it euf Sup ernenas Sup er nenas Sup ernenas Sup er nenas GR AN HERM ANO DIARIO B en 10 A lien F o rce T it euf M UJERES Y HOM B RES Y V ICEV ER SA DOM INGO 0 1 GRAN HERM AN O DIARIO ® B en 10 POLIC Í A C R IN IN A L POLIC IA C R IM IN A L D E C OLON IA SA BADO 3 1 +13 EL T IEM PO / R EPORTEROSEL TIEM PO / REPOR TER OS GRAN HERM A NO DIAR IO ® B akug an SEN SA C IÓN D E EL R EV IEN TAPR ECIOS +7 V IERNES 3 0 GR AN HERM ANO DIARIO ® A L SA LIR D E C LA SE Po kemo n X SENSA CIÓN DE V IV IR SEN SA C IÓN D E V IV IR V IV IR 73 +7 IN SPEC T OR I LOV E WTVOLF F JU EV ES 2 9 LA C ASA EN D IR ECT O (+13 ) Las Sup ernenas EL PROGRAM A D E A NA R OSA M IER COLES 2 8 EL TIEM PO / REPORT EROS GRA N HERM ANO C mp ament o Laz lo U n mo no en mi clase HI HI PUFF SU PERN ENA S B EN 10 TITEU F II AN GEL' S FRIEND S POKEM ON X SEN SA C IÓN D E SEN SA C IÓN D E BA V IV IR KUGAN II V IV IR BEN 10 ALIEN FOR CE 1.70 M ART ES 2 7 B OIN G BOIN G A ng els f riend s A ng els f riend s A ct ivo s y A nimad o s A ct ivo s y A nimado s B en 10 D ig imo n DIARIO ® LA C ASA EN DIR ECT O LA CASA EN DIRECTO LA C ASA EN DIR ECT O ® +13 LA CA SA EN DIRECTO +13 LA CASA EN DIREC TO EL BU SCA DOR D E HISTOR IAS KA RLOS A RGU IÑ ANO: EN TU C OC IN A DE BUENA LEY +7 A LIA S INFORM ATIV OS T ELECINC O +7 A LIA S INF ORM A TIV OS+7TELEC IN CO 7 V ID A S +7 A LIA S +7 7 V ID A S +7 A LIA S +7 7 V ID A S +7 A LIA S +7 7 V ID A S C OLEC C ION IST A +7 GRA N HERM ANO GR AN HERM ANO D IA RIO DIARIO ® ® 7 V ID A S GRAN HERM A NO GRAN HERM AN O GRA N HERM ANO D IAR IO DIARIO D IA RIO ® ® ® LASIET E NOT IC IAS +7 A well performing medium/long term strategy C IN E ON SÁLV A M E D IA RIO +7 7 V ID A S CINE ON M ED IC O D E F A M ILIA +7 7 V ID A S V oces Phenomenon 84' +7 7 V ID A S 114 ' +7 7 V ID A S M ÉD IC O D E F A M ILIA +13 LA C ASA EN DIR ECT O +7 M UJERES Y HOM BRES Y V ICEV ERSA 7 V ID A S Y V ICEV ER SA Y V ICEV ERSA Y V IC EV ERSA M UJERES Y HOM BRES Y V ICEV ERSA GRA N HERM ANO M UJERES Y HOM BR ES M U JER ES Y HOM BRES M UJERES Y HOM BR ES C OLEC C ION IST A B OIN G LOS SER R A N O Est reno 1.60 U EFA EU ROPA LEAGU E 3 er PAR TID O S.S. Lazio Villareal CF TOM A C ERO Y A JU GA R (Especial pro grama 70 0 ) PASA PALA BRA T OM A CER O Y A JUGA R LOS SER R A N O GRA N HERM ANO Ed , Ed d & Ed d y ¿DÓN DE EST Á M AR ISOL? PREV IO M I FAM ILIA C ONTR A TODOS 4 GR AN HERM ANO GRAN HERM A NO GRAN HERM AN O D IA RIO DIARIO D IAR IO DIARIO ® ® ® ® ® SÁLV AM E PIR ATA SÁ LV A M E PIRAT A Po kemo n X B akug an C OLEC C ION IST A B en 10 (EST RENO) B en 10 ( M º Teresa Campo s) SÁLV AM E DIA RIO N ar ut o IV PASA PALA BR A D IA RIO C OLEC C ION IST A D IST R IT O D E POLIC Í A D IST R IT O D E POLIC Í A D IST R IT O D E POLIC Í A D IST R IT O D E POLIC Í A PASA PALA BRA +13 C A SI Á N GELES EL FRONTON INF ORM AT IV OS TELEC IN CO C Á M ER A C A F É +7 G- 2 0 +7 G- 2 0 +7 +13 +13 G-2 0 +13 C Á M ER A C A F É CSI M IAM I V II 14 9 TÚ SÍ QUE V ALES +13 DE R EPENT E LOS GÓM EZ 2 31 LA NOR IA 9M09 SU E T HOM A S +7 A ID A 38 01:11:37 +13 +18 M IENTR AS DU ERM ES 3 +7 +7 A ID A 7 V ID A S 39 19 0 +7 +7 1 +13 C .S.I. +13 C .S.I. N .Y . A R M Y W IV ES +13 +7 +7 +13 G.H:LA CA SA EN DIRECTO 8 40 +7 GRAN HERM AN O: +13 IC HOE ELJER DEBAT 7 18 8 +13 GALA +13 4 16 +13 18 0 SÁ LV A M E D ELUX E HARPER' S ISLA ND T Ú SÍ QUE V ALES ® +13 +7 +13 F EAR FA CTOR HARPER' S ISLA ND A LEY EN DA DEL BUSC ADOR ® +13 +7 G-2 0 +13 F EAR FA CTOR +13 AGITA CIÓN + IV A EL JU EGO GRAN HERM AN O DE TU V ID A DIARIO ® ® +7 EL C OLEC C ION IST A D E IM Á GEN ES C .S.I. +13 G- 2 0 +13 LA CA SA EN DIRECTO +13 +13 LA C ASA EN DIR ECT O DE TU V ID A LA CASA EN DIRECTO G- 2 0 (+7) ® LA CASA EN DIREC TO ( +13 ) Source: TNS and Publiespaña TL5 multichannel grid during the week October 16-25 2009 Building a competitive multichannel edge +13 EL JU EGO LA CASA EN DIRECTO LA S V EGA S ® 18 1 D IA RIO +13 DEBATE GR AN HERM ANO +13 LA S V EGA S ® BEC ARIOS REPOR TER OS + EL TIEM PO GRA N HERM ANO ( Est reno ) 10 0 +13 A R M Y W IV ES +7 A LEY EN DA DEL BUSC ADOR D IAR IO +18 C .S.I. LA QU E SE A V EC IN A Q.R. +13 LASIET E NOT IC IA S + EL T IEM PO GRAN HERM A NO GR AN HERM ANO DIARIO EL A SESIN O D ELGRAN PA R HERM KIN G A NO 150 +13 LA CASA EN DIRECTO 19 2 GRA N HERM ANO M IA M I 15 A LIA S ( QR ) A ID A 37 +7 7 V ID A S D IA RIO SIN T ETAS NO HAY 7 V ID A S A L D ESC U B IER T O PA RA Í SO 18 9 E R EPEN T E LOS GÓM ELA QU E SE A V EC IN A 8 01:16:09 ( EST R EN O) 10 7( 3 5) +7 FEA R F ACT OR Q.R. BECARIOS +7 19 1 +13 R OJO Y NEGRO 9M09 C Á M ER A C A F É SU E T HOM A S +13 8 29 +13 CSI LAS V EGAS V III ® 178 +13 CSI LAS V EGAS V III ® 179 C Á M ER A C A F É SU E T HOM A S 7 V ID A S SU E T HOM A S +7 SÁ LV AM E DELUX E CSI NY ORK V 99 C Á M ER A C A F É FIB RILAN DO SU E T HOM A S GRAN HERM AN O +13 +13 FEAR FAC TOR 16 BROADCASTING New Audiovisual Law Current Situation TV Licences Advertising time Product Placement Pay DTT 5% Obligation New Audiovisual Law 10 years 15 years automatically renewed 12min/h advertising with limitation in number of breaks per hour + 5min/h of other forms of advertising 12min/h advertising without limitation in number of breaks per hour + 2min/h of telepromotion Not permitted Permitted One channel per multiplex Up to 50% of the multiplex capacity Obligation to invest 5% of annual revenues in Spanish (60%) and European (40%) movies Obligation to invest 5% of annual revenues in movies (60%) and TV Series (40%) New audiovisual law, approved by the Spanish parliament in January 2010 to be ratified by the Senate Sources: SOFRES 17 18 FINANCIAL RESULTS 9M09 9M08 VAR % TOTAL NET REVENUES 432.2 734.9 -41.2% TOTAL COSTS 349.8 410.6 -14.8% 59.3 63.3 -6.3% Operating Costs 182.9 238.1 -23.2% Amortizations & Depretiations 107.6 109.2 -1.5% EBITDA (1) 89.0 329.4 -73.0% EBIT 82.5 324.3 -74.6% Pre-Tax Profit 58.5 292.4 -80.0% Net Profit Reported 62.2 228.4 -72.8% Net Profit Adjusted (2) 78.5 242.4 -67.6% Personnel EBITDA/ NET REVENUES EBIT/ NET REVENUES NET PROFIT Reported/ NET REVENUES NET PROFIT Adjusted/ NET REVENUES 20.6% 19.1% 14.4% 18.2% 44.8% 44.1% 31.1% 33.0% (1) Post-rights amortization Consolidated Financial Results (2) Excluding the net impact of the amortization of the intangibles related to the PPA of Endemol (€million) 19 FINANCIAL RESULTS 9M09 9M08 FX Effect in € Organic Growth in € Net Consolidated Revenues 862.7 948.3 -8.7 -76.9 Gross Margin 241.6 277.2 -4.5 -31.1 EBITDA 209.9 162.1 -2.5 50.3 Net Profit* -34.0 -90.1 -2.5 58.6 € millions * Net Profit includes an amortization charge of €-102m (€-72m net of tax credits) in relation to PPA intangible assets Edam Group 9M09, P&L Highlights 20 FINANCIAL RESULTS 9M09 9M08 Diff. in € million Initial Cash Position -25.9 13.2 -39.0 Free Cash Flow 70.0 283.6 -213.6 Cash Flow from Operations 195.4 355.0 -159.5 Net Investments -135.8 -159.7 23.9 10.4 88.4 -78.0 Change in Equity -2.8 -8.6 5.8 Financial Investments -9.8 -23.4 13.6 Dividends received 1.8 1.6 0.2 Dividend payments -210.3 -317.6 107.3 Total Net Cash Flow -151.1 -64.3 -86.8 Final Cash Position -176.9 -51.1 -125.8 Free Cash Flow/Total Net Revenues 16.2% 38.6% Change in Net Working Capital Consolidated Cash Flow statement (€million) 21 FINANCIAL RESULTS EBITDA (in million €) EBITDA/ NET REVENUES (in %) 366.2 NET PROFIT (in million €) NET PROFIT/NET REVENUES (in %) 262.8 329.4 242.4 78.5 89.0 47.5% 44.8% 20.6% 9M07 9M08 9M09 34.1% 33.0% 18.2% 9M07 9M08 * 9M09 * * Adjusted Net Profit: excludes the accounting impact (after taxes) of the amortization of the intangibles resulting from the PPA of the Endemol acquisition. (€million) Margins 22 FINANCIAL RESULTS FREE CASH FLOW (€ million) 139.5% 89.2% 117.0% 366.5 262.8 FCF / NET REVENUES (in %) 47.5% 283.6 242.4 16.2% 38.6% 78.5 70.0 9M07 FCF FCF generation 9M08 Net Profit Adjusted 9M09 FCF Conversion / NP Adjusted (€million) 23 FINANCIAL RESULTS Financial Position Group Net Financial Position at 09/30/09: -€176.9 Net Financial Position*: -€117.0 Use of the available credit lines %: 39.6% Average use of credit lines in the year%: 23.5% Debt ratio over Equity 0.37x 311.0 117.0 Equity Strong financial position DEBT (€ millions) *excluding intercompany long term loans 24 FINANCIAL RESULTS € 135.8 million 5.4 € 159.7 million 3.2 4.4 42.2 40.3 53.2 9M09 9M08 74.0 72.9 TV Rights TV Rights Co-production Tangible & non-Fiction Fiction Distribution Intangible Fixed Assets Net Investments 25 Back Up slides 26 FINANCIAL RESULTS 9M09 9M08 VAR % Gross Adv. Revenues - Television - Other Discounts Net Advertising Revenues Other Revenues 414.5 406.5 8.0 -19.8 394.6 37.6 703.7 695.8 7.9 -32.9 670.8 64.1 -41.1% -41.6% 1.1% -39.7% -41.2% -41.3% TOTAL NET REVENUES 432.2 734.9 -41.2% Personnel Rights Amortization Other Operating Costs Total Costs 59.3 101.1 182.9** 343.3 63.3 104.1 238.1*** 405.5 -6.3% -2.8% -23.2% -15.3% 329.4 -73.0% EBITDA adj* ** Including the reversal of a provision for €34 million *** Including the reversal of a provision for €5 million Consolidated Profit & Loss Account (I) 89.0 * Post-rights amortisation (€million) 27 FINANCIAL RESULTS 9M09 9M08 VAR % EBITDA adj* 89.0 329.4 -73.0% Other Amortization & Depreciation -6.5 -5.1 25.7% EBIT 82.5 324.3 -74.6% Equity Consolidated Results -26.4 -30.0 -12.0% Financial Results 2.3 -1.9 n.a. EBT 58.5 292.4 -80.0% Income taxes 0.0 -73.3 n.a. Minority Interests 3.7 9.3 -60.2% Net Profit reported 62.2 228.4 -72.8% Net Profit adjusted** 78.5 242.4 -67.6% *Post-rights amortisation **Excluding the net impact of the Amortization of the intangibles related to the PPA of Endemol Consolidated Profit & Loss Account (II) (€million) 28 FINANCIAL RESULTS 9M09 9M08 2008 Fixed assets -Financial -Non Financial Audiovisual Rights and Pre-payments -TV, Third Party Rights -TV, Spanish Fiction Rights -Co-production / distribution Pre-paid taxes 306.0 252.4 53.6 221.4 123.1 31.1 67.2 81.3 521.7 464.4 57.3 236.3 116.3 33.3 86.7 16.2 323.6 264.5 59.1 190.7 96.6 27.3 66.9 26.3 TOTAL NON-CURRENT ASSETS Current assets Financial investments and cash TOTAL CURRENT ASSETS 608.7 124.8 12.3 137.1 774.1 175.4 10.7 186.0 540.7 251.8 35.1 286.9 TOTAL ASSETS 745.8 960.1 827.6 Shareholders' equity Non-current provisions Non-current payables Non-current financial liabilities TOTAL NON-CURRENT LIABILITIES 311.0 45.2 0.4 75.9 121.5 564.7 73.4 1.0 60.7 135.1 461.5 43.8 0.2 59.8 103.8 Current payables Current financial liabilities TOTAL CURRENT LIABILITIES 199.9 113.3 313.3 259.2 1.1 260.3 261.1 1.2 262.3 TOTAL LIABILITIES 745.8 960.1 827.6 Consolidated Balance Sheet (€million) 29 BROADCASTING 9M08 49.0 % 9M09 Programming Mix in 1H09; January 1st – September 30th 2009 In-House Production vs. Library in terms of broadcasting hours 51.0 % 46.7% Live 53.3% Recorded 47.6% Productions with Independent Companies In-house production 85.6% 84.6% 27.9% 24.5% 14.4% 15.4% Produced by Atlas & Telecinco Productions with Participating Companies Endemol La fábrica de la Tele Mandarina 9M08 Third party rights 9M09 In House production TL5 programming mix shows a stable performance of in-house production. Alba Adriatica 30 Investor Relations Department Phone: +34 91 396 67 83 Fax: + 34 91 396 66 92 Email: [email protected] WEB: http://www. telecinco.es/inversores/en DISCLAIMER Statements contained in this document, particularly the ones regarding any Telecinco possible or assumed future performance, are or may be forward looking statements and in this respect they involve some risks and uncertainties. Telecinco actual results and developments may differ materially from the ones expressed or implied by the above statements depending on a variety of factors. Any reference to past performance of Telecinco shall not be taken as an indication of future performance. The content of this document is not, and shall not be considered as, an offer document or an offer or solicitation to buy or sell any stock. 31 GESTEVISION TELECINCO S.A. VII Seminario de Media 19 de enero de 2010 www.telecinco.es/inversores/en/ 32