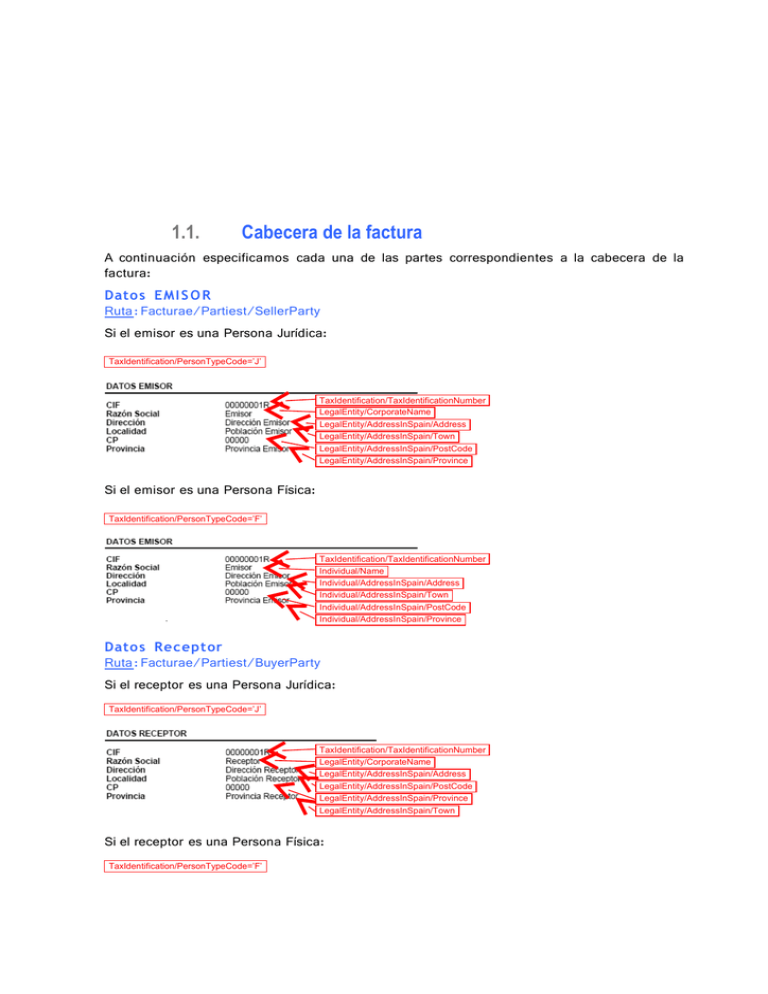

1.1. Cabecera de la factura

Anuncio

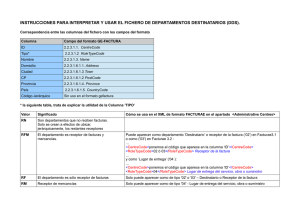

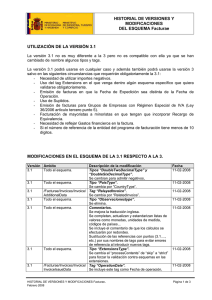

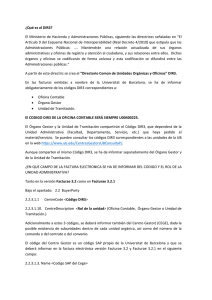

1.1. Cabecera de la factura A continuación especificamos cada una de las partes correspondientes a la cabecera de la factura: Datos EMI S O R Ruta: Facturae/Partiest/SellerParty Si el emisor es una Persona Jurídica: TaxIdentification/PersonTypeCode=’J’ TaxIdentification/TaxIdentificationNumber LegalEntity/CorporateName LegalEntity/AddressInSpain/Address LegalEntity/AddressInSpain/Town LegalEntity/AddressInSpain/PostCode LegalEntity/AddressInSpain/Province Si el emisor es una Persona Física: TaxIdentification/PersonTypeCode=’F’ TaxIdentification/TaxIdentificationNumber Individual/Name Individual/AddressInSpain/Address Individual/AddressInSpain/Town Individual/AddressInSpain/PostCode Individual/AddressInSpain/Province Datos Receptor Ruta: Facturae/Partiest/BuyerParty Si el receptor es una Persona Jurídica: TaxIdentification/PersonTypeCode=’J’ TaxIdentification/TaxIdentificationNumber LegalEntity/CorporateName LegalEntity/AddressInSpain/Address LegalEntity/AddressInSpain/PostCode LegalEntity/AddressInSpain/Province LegalEntity/AddressInSpain/Town Si el receptor es una Persona Física: TaxIdentification/PersonTypeCode=’F’ TaxIdentification/TaxIdentificationNumber Individual/Name Individual/AddressInSpain/Address Individual/AddressInSpain/Town Individual/AddressInSpain/PostCode Individual/AddressInSpain/Province Datos FACT U R A Ruta: Facturae/Invoices/Invoice/InvoiceHeader InvoiceDocumentType InvoiceNumber InvoiceIssueData/IssueDate InvoiceIssueData/InvoiceCurrencyCode Datos AGE N C I A Ruta: Facturae/Invoices/Invoice/AdditionalData/Extensions/st:AgenciesData Type=’AV’ AgentName VATNumber AgencyCode AgencyName AgencyAddress/Address AgencyAddress/Town AgencyAddress/PostCode AgencyAddress/Province AgencyAddress/CountryCode REFE R E N C I A S y SE R V I C I O S Ruta: Facturae/Invoices/Invoice/AdditionalData/Extensions st:References/Voucher st:References/Locator st:Service/BasicDataService/Paxes/PaxLeader 1.2. Pie de la factura A continuación especificamos cada una de las partes correspondientes al pie de la factura: IMP U E S T O S Ruta: Facturae/Invoices/Invoice/TaxesOutputs/Tax[i] TaxableBase/TotalAmount TaxTypeCode TaxRate TaxAmount/TotalAmount VE N C I M I E N T O S Ruta: Facturae/Invoices/Invoice/PaymentDetails/Installment[i] PaymentMeans InstallmentDueDate InstallmentAmount CO MI S I O N E S Ruta: Facturae/Invoices/Invoice/AdditionalData/Extensions/st:Commissions Commission/BeforeTaxCommision Commission/RateCommission Commission/TaxRateCommission Commission/TaxTypeCommission Commission/TaxAmountCommission Amounts/ComissionableAmount Amounts/NoCommissionableAmount Commision/TotalCommission TOTAL E S Ruta: Facturae/Invoices/Invoice/InvoiceTotals TotalGrossAmount TotalGeneralSurcharges TotalGrossAmountBeforeTaxes TotalGeneralDiscounts TotalTaxOutputs TotalOutstandingAmount 1.3. Detalle de la factura A continuación especificamos cada una de las partes correspondientes al detalle de la factura: CON C E P T O S Ruta: Facturae/Invoices/Invoice/Items/InvoiceLine[i] Extensions/st:Service/BasicDataService/Dates/StartDate Extensions/st:Service/BasicDataService/Dates/EndDate Extensions/st:ServiceDetails/Hotel/HotelDetails/HotelName Extensions/st:ServiceDetails/Hotel/Bookings/Booking[i]/Nights Extensions/bsf:BSFExtension/Extension/@nombre=’Habitaciones’ Extensions/st:ServiceDetails/Hotel/Bookings/Booking[i]/Room/Number Extensions/st:ServiceDetails/Hotel/Bookings/Booking[i]/Room/RoomClass Extensions/st:ServiceDetails/Hotel/Bookings/Booking[i]/Board/Codes GrossAmount 1. E j e m p l o f a c t u r a e l e c t r ó n i c a Para consultar un ejemplo de factura electrónica en formato facturae con especialización del sector turístico que se ajuste al modelo de visualización detallado vea el fichero XML ST+multiservicio (facturae).xml.