Actualizado al 1/3/2014 9:34

Anuncio

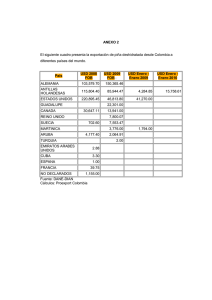

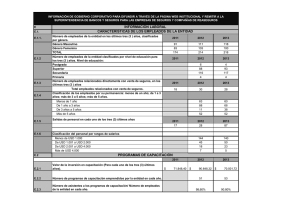

Actualizado al 1/3/2014 9:34 Contratos de Entrega a Plazo Materias Primas Unidad WTI Oil Price usd/bbl. Precio Spot 3 Mes 95.22 Brent Oil usd/bbl. Ethanol usd/gal. 1.95 usd/MMBtu 4.26 Natural Gas 107.73 6 Mes 95.30 107.21 4.14 9 Mes 91.86 Today -0.23 104.85 2 days -3.25 5 days -4.35 Week -5.08 -1.09 93.90 106.28 WTI cambios porcentuales en el precio spot 4.18 4.20 Sugar usd/MT 445 1 Month Gasoil usd/MT 918 1 Year Coal (API 2) usd/MT 81 usd/MT 73 usd/barrel 91 Coal (FOB Bolivar) Bunker C 1.94 1 Year 1 Month Economic Calendar Evento Week Mercado Organismo Resultado Previo Inventarios de Petróleo Estados Unidos Departamento de Energía (4731.00) (4731.00) 5 days Inventarios de Gasolina Estados Unidos Departamento de Energía (614.00) (614.00) 2 days Utilización de Refineria Estados Unidos Departamento de Energía 1.20% 1.20% Today News VENEZUELA - Venezuela Oil Output Declines on Lack of Funds - -6.00 Venezuela’s oil production slid for an eighth consecutive month in December, a Bloomberg survey showed, as delays obtaining external financing hamper efforts by Petroleos de Venezuela SA to arrest production declines. Venezuela produced 2.45 million barrels a day in December, down 235,000 barrels from November, according to a Bloomberg survey of oil companies, producers and analysts. Monthly output has been falling since April, the survey showed. PDVSA’s ability to offset output declines at mature fields and invest in new developments is slowed by the producer’s increasing financial commitments to the Venezuelan government, coupled with delays obtaining financing, said Carlos Rossi, president of EnergyNomics. “The economic situation in Venezuela is very bad and the non-petroleum sector is in desperate need of dollars, causing PDVSA to have to dedicate more money to the Venezuelan Central Bank,” said Rossi. -5.00 BRENT CRUDE - -4.00 -3.00 -2.00 -1.00 0.00 1.00 2.00 3.00 Brent falls from a gain of as much as 86c earlier today on ICE Futures Europe exchange. • Feb. WTI crude also reverses earlier gain; trades 25c down at $95.19/b on Nymex • U.S. oil inventory data scheduled for release by Energy Information Administration at 11am Washington time today • U.S. crude stockpiles probably fell 2.83m bbl last wk: Bloomberg survey DOE<GO> • Iraq starts fixing oil pipeline damaged by bomb NSN MYTJS26S972P <GO> • 4 of Libya’s 6 main oil ports remain closed even as Al Sharara field poised to resume • U.S. east coast faces blizzard CURVA FAIR VALUE - WTI AND VENEZUELA OIL PRODUCTION La curva CCRV identifica como el mercado cotiza los contratos futuros y los forward de los comodities, en este caso, del WTI. La tendencia representa una reducción en los precios impulsados principalmente por el programa de recortes a la compra de los bonos de los Estados Unidos. A mediados del año 2014 se espera una caida de al menos USD 1 por barril comparativamente a los niveles spot actualmente. Se espera para la próxima semana un fuerte declinio en el precio spot debido a la gran especulación de que el crecimiento económico reducirá este programa de incentivos. De los 22 analistas entrevistados, 59% opina que el crudo se reduciará en Enero 10, solo 4 correspondiente al 18% opina un aumento y 5 espera que habrá pocos cambios. La semana pasada 73% de los entrevistados opinaron de una reducción en el precio.